Noticias del mercado

-

22:01

U.S.: Net Long-term TIC Flows , July 103.9 (forecast 30.2)

-

22:00

U.S.: Total Net TIC Flows, July 140.6

-

16:31

-

16:09

US consumer sentiment little changed in September. The dollar continue to rise

Confidence was unchanged in early September from the August final and barely different from the July reading. Small and offsetting changes have taken place in the third quarter 2016 surveys: modest gains in the outlook for the national economy have been offset by small declines in income prospects as well as buying plans.

While income gains expected during the year ahead have edged upward, declines in inflation expectations were the main reasons future financial prospects improved, as both near and long term inflation expectations fell to near record lows. Nonetheless, buying plans suffered from the perception that no additional price discounts would be offered.

Even the more optimistic outlook for the economy had little if any impact on the expected growth rate in new jobs. Importantly, all of these changes were relatively minor. Overall, consumers remain reasonably optimistic about their economic prospects. Real personal consumption expenditures can be expected to grow by 2.6% through mid 2017.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, September 89.8 (forecast 90.8)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.11bln) 1.1200 (526m) 1.1230-35 (1.75bln) 1.1275-80 (382m)1.1300 (473m) 1.1320 (660m)

USD/JPY: 100.00-05 (1.06bln) 101.00 (464m) 101.50 (310m) 102.00 (291m) 102.50 (410m) 102.70-75 (910m) 103.00 (407m) 103.50 (246m) 104.00 (1.53bln)

GBP/USD 1.3250 (756m) 1.3350 (565m) 1.3450 (245m)

AUD/USD: 0.7345-50 (AUD 256m) 0.7600 (553m)0.7530 (250m) 0.7650 (485m)

USD/CAD: 1.2800 (280m) 1.2855 (280m) 1.2870 (280m) 1.3000 (916m) 1.3100 (336m)1.3400 (220m)

AUD/JPY 75.00 (AUD 249m)) 76.25 (250m) 77.25 (228m)

AUD/NZD 1.0440 (AUD 280m)

-

14:41

Foreign investment in Canadian securities slowed for a fourth straight month

Foreign investment in Canadian securities slowed for a fourth straight month to $5.2 billion in July. At the same time, Canadian investors continued to invest in foreign securities by adding $4.6 billion to their holdings.

Foreign investment in Canadian securities slowed for a fourth straight month to $5.2 billion in July. Non-resident investors resumed their acquisitions of Canadian debt securities, but purchased equities at a much slower pace. Despite the lower activity in July, foreign investment in Canadian securities from January to July was strong, totalling $85.7 billion, compared with $65.9 billion for the same period in 2015.

Foreign investors acquired $6.2 billion of Canadian bonds in July, mainly secondary market purchases of government instruments denominated in Canadian dollars. Foreign investment was led by a $4.8 billion acquisition of federal government bonds, following a divestment of $8.1 billion in June. On the other hand, non-resident investors reduced their exposure to private corporate bonds for the first time since October 2015, as retirements exceeded new issues. In July, Canadian long-term interest rates were down by five basis points and the Canadian dollar depreciated by 0.8 US cent against its US counterpart.

-

14:39

Canadian manufacturing sales edged up 0.1% in July

Manufacturing sales edged up 0.1% in July to $50.7 billion. Higher sales in the food, petroleum and coal products, and primary metals industries were largely offset by a decrease in the production of aerospace product and parts, and by lower machinery sales.

Overall, sales were up in 9 of 21 industries, representing about 54% of the manufacturing sector. Non-durable goods rose 1.0% to $23.6 billion, while durable goods decreased 0.7% to $27.0 billion.

Constant dollar sales increased 0.6%, indicating that a higher volume of goods was sold in July.

-

14:37

US CPI better than forecast up 1.1% y/y

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistic reported today. Over the last 12 months, the all items index rose 1.1 percent before seasonal adjustment.

The seasonally adjusted increase in the all items index was caused by a rise in the index for all items less food and energy. It increased 0.3 percent in August, as the indexes for shelter and medical care advanced.

The energy and food indexes were both unchanged in August. Major energy component indexes were mixed, with increases in the indexes for natural gas and electricity offsetting declines in the gasoline and fuel oil indexes. The food at home index declined for the fourth month in a row, offsetting an

increase in the index for food away from home.

The 0.3-percent increase in the index for all items less food and energy was the largest rise since February 2016. Along with shelter and medical care, the indexes for motor vehicle insurance, apparel, communication, and tobacco all increased. In contrast, the indexes for used cars and trucks, household furnishings and operations, recreation, and airline fares all declined in August. -

14:30

Canada: Manufacturing Shipments (MoM), July 0.1% (forecast 1%)

-

14:30

U.S.: CPI, Y/Y, August 1.1% (forecast 1%)

-

14:30

Canada: Foreign Securities Purchases, July 5.23 (forecast 10.12)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, August 2.3% (forecast 2.2%)

-

14:30

U.S.: CPI, m/m , August 0.2% (forecast 0.1%)

-

14:30

U.S.: CPI excluding food and energy, m/m, August 0.3% (forecast 0.2%)

-

14:21

European session review: US dollar rose against major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

-----

The US dollar rose against other major currencies, but gains are limited as investors remain cautious ahead of today's US data and the Federal Reserve meeting next week.

The Commerce Department reported that retail sales in the US fell by 0.3% compared with the previous month, more than the projected decline of 0.1%. The decline was the first in five months.

Meanwhile, the Ministry of Labor said that the number of initial unemployment claims in the US rose last week, less than expected, indicating improvement in the labor market.

Labor Department also reported that the index of producer prices in the US remained unchanged in August.

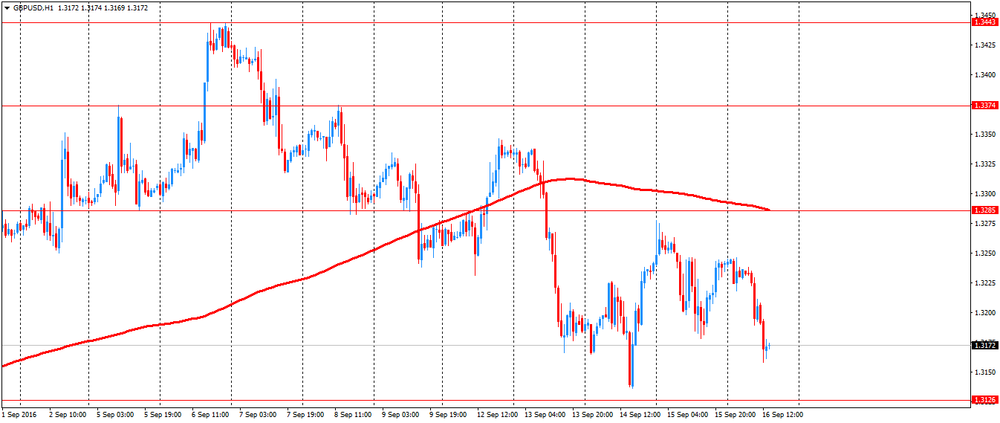

The pound fell against the dollar, while taking into account the fact that the British economic calendar for today is empty, investors will focus on the changes in risk appetite and US statistics. In addition, there may be some adjustment of positions before the weekend.

Market participants also continue to analyze the results of yesterday's meeting of the Bank of England. Recall, the Bank of England kept interest rates and quantitative easing unchanged at 0.25% and 425 billion pounds, respectively..

All nine members of the MPC voted unanimously for keeping the key rate. However, the statement was ambiguous, because the leaders of the Central Bank recognized that a number of short-term economic indicators in some ways turned out to be stronger than expected.

They also indicated that they expect at least a significant slowdown in economic growth in the second half of the year. At the same time, the Central Bank has signaled its readiness to lower the rate again if economic growth continues to slow in line with expectations.

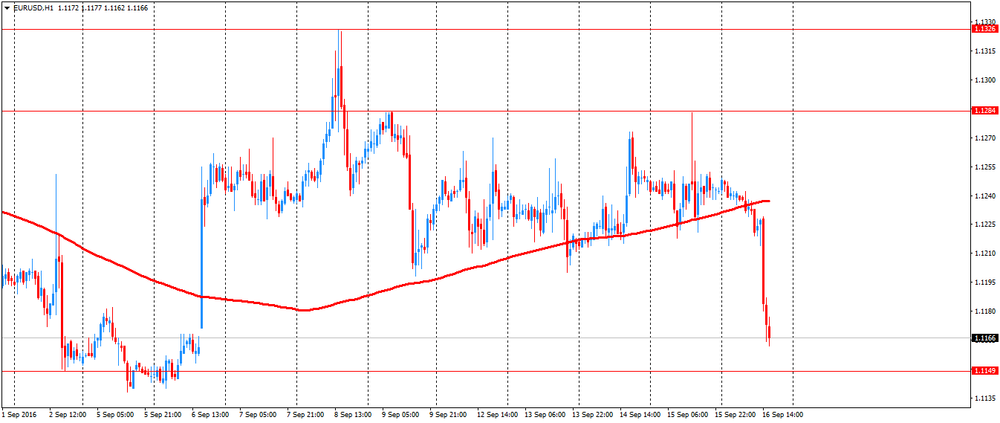

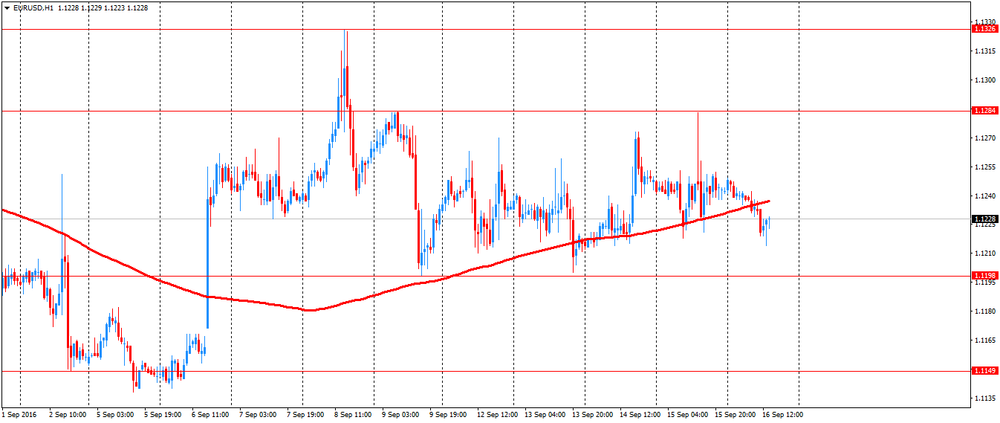

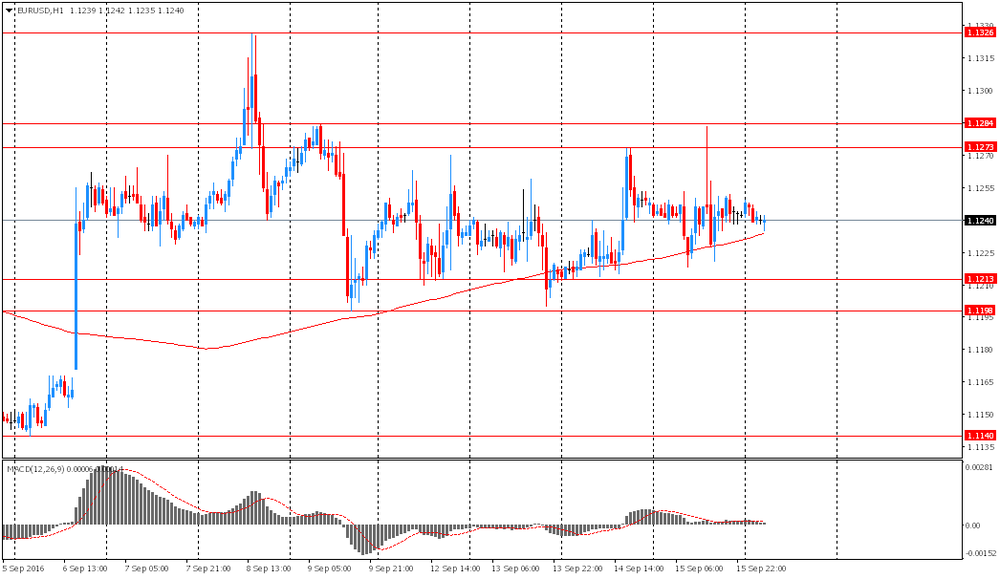

EUR / USD: during the European session, the pair fell to $ 1.1214

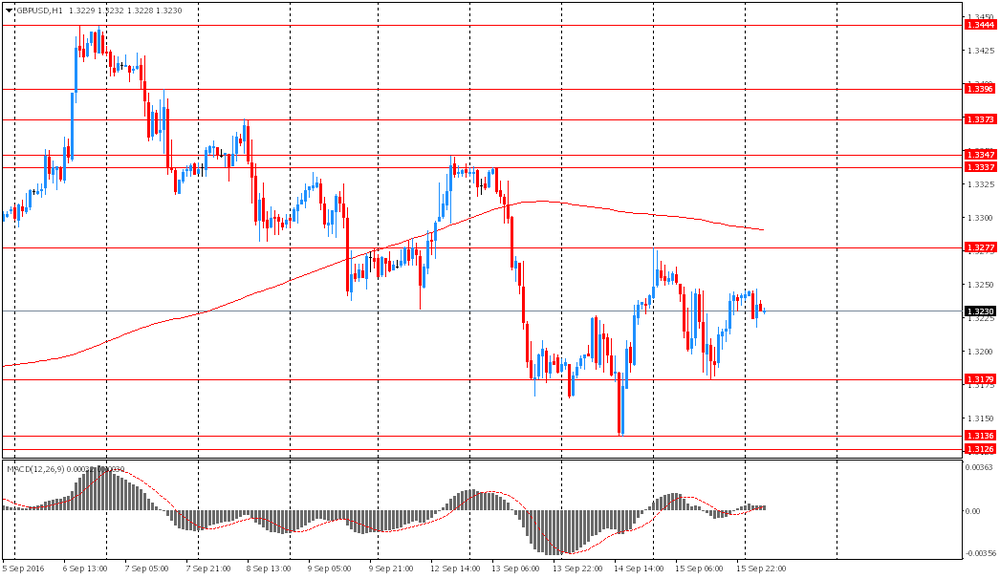

GBP / USD: during the European session, the pair fell to $ 1.3158

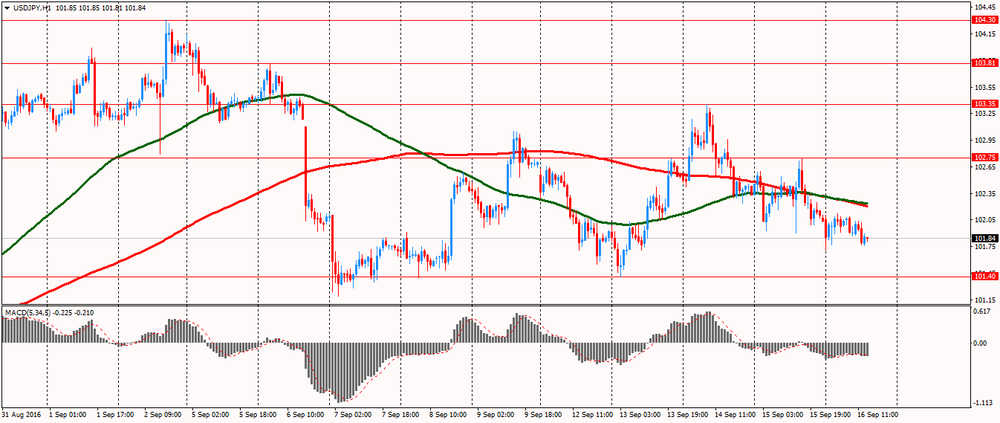

USD / JPY: during the European session, the pair is trading flat

-

12:50

USD/JPY: Preparing For Another Disappointing BoJ Meeting - Credit Suisse

"The BoJ meeting on 20-21 September appears to be attracting more market attention than the Fed meeting also taking place on 21 September. Option markets show a clear premium in USDJPY vol vs. the rest of G10 vol around the two-week tenor coinciding with the BoJ meeting

Indications of strong market interest in JPY abound across the vol space. The divergence in implied correlations, with JPY correlation drifting higher suggests markets are looking at the JPY as a potential driver for FX volatility (Figure 6). At the same time, the front-end tenor USDJPY risk reversal skew has moved close to zero over the course of the past few weeks, pricing USDJPY calls at a near flat premium to USDJPY puts

This sharp increase in demand for optionality around the BoJ meeting and the shift in relative pricing for USDJPY calls vs. puts to the highest point in almost a year suggests the market is approaching the upcoming BoJ meeting with high expectations for a dovish outcome, one that would likely drive spot USDJPY higher. We think these expectations will once again be disappointed.

Our economists are in fact expecting little to no change in policy from the BoJ at the upcoming meeting. Specifically, the spotlight next week is expected to be on the BoJ's "comprehensive assessment" of its NIRP+QQE policies. Our economics team believes this assessment will be broadly positive, pointing to improved borrowing and investment data as proof of its policies' success. In absence of a considerable change in how BoJ officials view their own policies, a significant change in said measures is unlikely.

If anything, our team believes there is a small possibility of a cut in the tier 3 IOER rate from -0.1% to -0.2%, or of a slight upgrade in JGB purchase targets from JPY80tn to JPY80-90tn.

In light of the large and rapid shift in expectations, we are not convinced that such changes are likely to be viewed as satisfactory relative to market pricing, especially at a time when much more aggressive policy options (e.g., direct financing of government spending on infrastructure) are being weighed in the financial press. As such, we see high potential for disappointment and continue to target USDJPY at 95 in three months.

As a technical-based trade, Credit Suisse maintains a short USD/JPY trade from 103.90 targeting 100".

Copyright © 2016 Credit Suisse, eFXnews™

-

12:17

BOE's Forbes: Pounds depreciation since the vote should improve the UK's net foreign asset position by over 20% of GDP

-

Sterling depreciation since Brexit vote is leading to some automatic adjustments in the UK current account balance

-

Depreciation since the vote should improve the UK's net foreign asset position by over 20% of GDP

-

Improvement in the UK's net international asset position should alleviate investor concerns

*via forexlive -

-

11:06

Wages in eurozone rose 0.9% in Q2

Hourly labour costs rose by 1.0% in the euro area (EA19) and by 1.4% the EU28 in the second quarter of 2016, compared with the same quarter of the previous year. In the first quarter of 2016, hourly labour costs increased by 1.6% in both zones. These figures are published by Eurostat, the statistical office of the European Union. The two main components of labour costs are wages & salaries and non-wage costs.

In the euro area, wages & salaries per hour worked grew by 0.9% and the non-wage component by 1.4%, in the second quarter of 2016 compared with the same quarter of the previous year. In the first quarter of 2016, the annual changes were +1.7% and +1.5% respectively. In the EU28, hourly wages & salaries rose by 1.3% and the non-wage component by 1.6% in the second quarter of 2016. In the first quarter of 2016, annual changes were +1.6% for both components.

-

10:39

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.11bln) 1.1200 (526m) 1.1230-35 (1.75bln) 1.1275-80 (382m)1.1300 (473m) 1.1320 (660m)

USD/JPY: 100.00-05 (1.06bln) 101.00 (464m) 101.50 (310m) 102.00 (291m) 102.50 (410m) 102.70-75 (910m) 103.00 (407m) 103.50 (246m) 104.00 (1.53bln)

GBP/USD 1.3250 (756m) 1.3350 (565m) 1.3450 (245m)

AUD/USD: 0.7345-50 (AUD 256m) 0.7600 (553m)0.7530 (250m) 0.7650 (485m)

USD/CAD: 1.2800 (280m) 1.2855 (280m) 1.2870 (280m) 1.3000 (916m) 1.3100 (336m)1.3400 (220m)

AUD/JPY 75.00 (AUD 249m)) 76.25 (250m) 77.25 (228m)

AUD/NZD 1.0440 (AUD 280m)

-

09:58

EU economic summit ongoing. On the agenda Brexit consequences

EU leaders meet today in Bratislava.

France President Hollande:

-

EU leaders will talk security, economy.

-

EU needs to give hope to young generation.

Merkel:

-

EU in critical situation.

-

need to tackle security, defence, protect EU borders.

-

seeks concrete steps at meeting.

-

-

08:38

US CPI expected to shake things up in a quiet week so far. 1% anual inflation rise expected vs +0.8% previous ( 2% Fed target)

-

08:34

New Zeeland ANZ consumer confidence index advanced 2.8%

Consumer confidence in New Zealand picked up steam in September, the latest survey from ANZ Bank revealed on Friday as its consumer confidence index advanced 2.8 percent to a reading of 121.0.

That represents an eight-month high for the index, and it follows the 0.4 percent decline in August to 117.7.

The September results shows that economic momentum is continuing at brisk clip, ANZ said in its commentary, as house price expectations hit a new high.

The index continues to flag solid to strong GDP growth in coming months, with projections hitting 4 percent - rttnews.

-

08:32

Asian session review: tight ranges before US CPI

The US dollar traded almost unchanged after yesterday's decline on weak economic data from the United States. The US Commerce Department reported that retail sales fell by 0.3% after rising 0.1% in July. Sales rose by 1.9% compared to last year. Excluding automobiles, gasoline, building materials and food services sales declined by 0.1% after falling 0.1% in July. It was expected that total sales will fall by 0.1%, while core sales to rise by 0.3%.

Meanwhile, the Labor Department said that initial applications for unemployment benefits rose by 1.000 to reach a seasonally adjusted 260,000 for the week ended September 10. Economists had forecast that claims will rise to 265 000. This was the 80 th week in a row with claims below 300 000, the longest period since 1970.

These data led investors to doubt that the US economy is strong enough to withstand a rate hike in the coming months. According to Fed futures the probability of a rate hike in December is 46% compared to slightly more than 53% a day earlier. The probability of a rate hike at the next meeting, to be held September 20-21, is only 12% compared to more than 15% on Wednesday.

Today at 12:30 GMT data on the US consumer price index will be published. According to the average forecast, prices are expected rose by 0.1% after flat in July.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1235-50 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3220-45 range

USD / JPY: during the Asian session, the pair was trading in the Y101.70-10 range

-

08:29

Options levels on friday, September 16, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1374 (2333)

$1.1333 (2080)

$1.1295 (425)

Price at time of writing this review: $1.1237

Support levels (open interest**, contracts):

$1.1184 (3044)

$1.1152 (3831)

$1.1116 (3687)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 35524 contracts, with the maximum number of contracts with strike price $1,1500 (4677);

- Overall open interest on the PUT options with the expiration date October, 7 is 38828 contracts, with the maximum number of contracts with strike price $1,1100 (6199);

- The ratio of PUT/CALL was 1.09 versus 1.06 from the previous trading day according to data from September, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1779)

$1.3406 (2156)

$1.3309 (1348)

Price at time of writing this review: $1.3226

Support levels (open interest**, contracts):

$1.3191 (1904)

$1.3095 (766)

$1.2997 (3366)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 22328 contracts, with the maximum number of contracts with strike price $1,3450 (2773);

- Overall open interest on the PUT options with the expiration date October, 7 is 20742 contracts, with the maximum number of contracts with strike price $1,3000 (3366);

- The ratio of PUT/CALL was 0.93 versus 0.95 from the previous trading day according to data from September, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:12

EUR/USD, USD/JPY: Reactions If The Fed Disappoints Next Week - BNPP

"Heading into next week's FOMC meeting, markets are pricing just a 20% chance of a rate hike. We think the likelihood of a hike are considerably higher and continue to forecast the Fed delivering 25bp of tightening. Our economists expect the Fed will cushion its delivery with reassurances about gradual tightening going forward, a lower projected terminal Fed funds rate and a shift to the dot plot to signal that further tightening this year is not expected.

However, with rates markets underpriced for tightening heading into the meeting and the market short USD, we expect to see a significant, broad strengthening of the USD in response.

If the Fed does elect to leave policy unchanged, we expect the accompanying message to attempt to keep a December hike in play, but markets are likely to be sceptical, and in this scenario the USD would likely challenge the lower ends of its recent ranges vs the EUR and JPY.

In contrast to the Fed, we expect the Bank of Japan to disappoint expectations for easing this week. Our economists expect no action on the Bank's deposit rate and no significant changes to its QE program at this meeting. Surveys show about half of economists expect a move this week, but we note that our position metrics still show significant long yen positioning, suggesting that either market participants do not expect a move or they are sceptical that new action from the BoJ can weaken the yen.

We do not expect a steady policy call this week to result in sharp yen gains, particularly about 12 hours ahead of the FOMC meeting. However, if the Fed does disappoint our forecast, the combination of a steady Fed and steady BoJ policy would likely see USDJPY test back below 100".

Copyright © 2016 BNP Paribas™, eFXnews™

-

08:08

Chinese banks will be closed today in observance of the Mid-Autumn Festival

-

08:06

Japanese Finance Minister Aso: Our goal is to eradicate deflation

During his speech today, Japanese Finance Minister, Taro Aso, has once again pointed out that the most important task for his Ministry and the Bank of Japan is to eradicate deflation. However, the minister said that the policy process requires coordinated fiscal and monetary actions of the two institutions.

-

00:28

Currencies. Daily history for Sep 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1242 -0,05%

GBP/USD $1,3241 0,00%

USD/CHF Chf0,9717 -0,11%

USD/JPY Y102,04 -0,28%

EUR/JPY Y114,42 -0,61%

GBP/JPY Y135,12 -0,28%

AUD/USD $0,7516 +0,57%

NZD/USD $0,7323 +0,42%

USD/CAD C$1,3151 -0,33%

-

00:00

Schedule for today,Friday, Sep 16’2016

12:30 Canada Manufacturing Shipments (MoM) July 0.8% 1%

12:30 Canada Foreign Securities Purchases July 9.02 10.12

12:30 U.S. CPI, m/m August 0% 0.1%

12:30 U.S. CPI, Y/Y August 0.8% 1%

12:30 U.S. CPI excluding food and energy, m/m August 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y August 2.2% 2.2%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 89.8 90.8

20:00 U.S. Total Net TIC Flows July -202.8

20:00 U.S. Net Long-term TIC Flows July -3.6 30.2

-