Noticias del mercado

-

21:00

Dow -0.28% 18,070.11 -50.14 Nasdaq +0.73% 5,200.67 +37.49 S&P +0.00% 2,124.34 +0.05

-

20:20

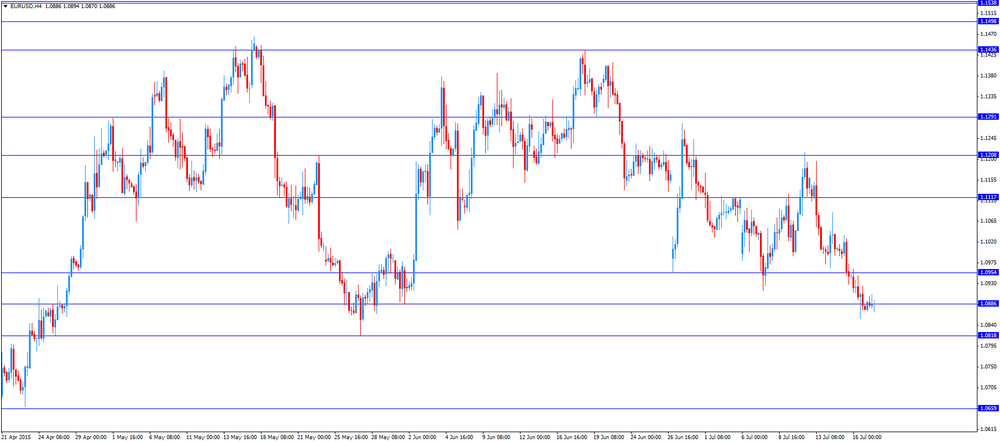

American focus: the dollar continued to strengthen against the euro

The euro depreciated significantly against the US dollar, reaching thus the new eight-week low, which was associated with the publication of positive statistics on the US. As previously reported, the consumer price index rose a seasonally adjusted 0.3% in June compared with a month earlier. Prices for gasoline, food and accommodation have increased in the last month. With the exception of volatile prices for food and energy, so-called core prices increased 0.2%. Both measures are consistent with the forecast of economists. Compared with a year earlier, as a whole, prices rose by 0.1%, which was the first annual increase since December. Basic prices increased by 1.8% compared with a year earlier. Accommodation prices rose 0.3% last month and 3% from a year earlier. Food prices rose 0.3% last month. Food costs rose by 1.8% compared with a year earlier. Energy prices rose 1.7% last month, but still 15% lower compared with a year earlier. Gasoline prices rose 3.4% on a seasonally adjusted basis in June. Gasoline prices are still 23.3% below the levels of last year.

Meanwhile, another report showed that the establishment of new homes in the US rose by 9.8% compared to the previous month and reached a seasonally adjusted annual rate of 1.17 million in June. Amplification was due solely to the construction of multifamily housing, including apartments and condominiums, which increased by 29.4%. Meanwhile, single-family units favorites that make up nearly two-thirds of the market, fell by 0.9%. New applications for building permits, which will determine the pace of construction in the coming months, rose 7.4% to 1.34 million. Performance of construction of new homes remain historically low, although there are signs of a healthy recovery in activity. Bookmarks were 26.6% higher than in June year ago, and resolution were higher by 30%.

The Canadian dollar fell modestly against the US dollar, reaching at the same level CAD1.3000. In the course of trade affected data on CPI Canada. As it became known, the consumer price index (CPI) rose by 1.0% during the 12 months to June, after increasing 0.9% in May. The decline in energy prices is still restrained the annual CPI increase, however, the effect was less pronounced than in April and May. Excluding energy, the CPI rose by 2.1% in the 12 months to June, after increasing 2.2% in May. Falling energy index was led by gasoline prices, which fell by 14.1% in June compared with the same month a year earlier. This decline followed a decline of 17.4% compared with a year earlier in May. On a monthly basis, gasoline prices rose 6.0% in June, after rising 5.5% in May. Gasoline prices rose in four of the last five months, after consecutive decline from July 2014 to January 2015. The index of natural gas decreased by 10.9% during the 12 months to June, after falling 14.4% in the previous month. In addition, oil prices fell by 17.8% year on year in June, followed by a decline to 18.6% in the previous month.

-

18:00

European stocks closed: FTSE 100 6,775.08 -21.37 -0.31% CAC 40 5,124.39 +2.89 +0.06% DAX 11,673.42 -43.34 -0.37%

-

18:00

European stocks close: stocks closed mixed despite news that the German parliament voted for negotiations on the Greek bailout programme

Stock indices closed mixed despite news that the German parliament voted for negotiations on the Greek bailout programme.

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

European Commission Vice President Valdis Dombrovskis said on Friday that he hoped that a new Greek bailout programme could be reached within a few weeks. He added that talks will include debt restructuring.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,775.08 -21.37 -0.31 %

DAX 11,673.42 -43.34 -0.37 %

CAC 40 5,124.39 +2.89 +0.06 %

-

17:51

WSE: Session Results

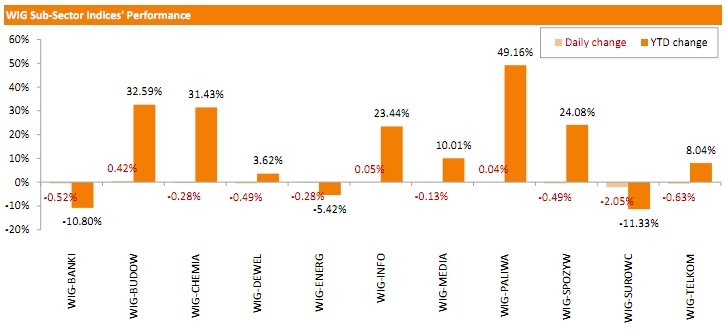

Polish equity market retreated on Friday. The broad market measure, the WIG Index, declined by 0.30%. Sector-wise, constructions (+0.42%), technologies (+0.05%) and oil and gas industry (+0.04%) were the only sectors, which posted positive results. At the same time, materials (-2.05%) recorded the sharpest drop.

The large-cap stocks lost 0.50%, as measured by the WIG30 Index. Within the index components, KGHM (WSE: KGH) led the decliners with a 2.49% drop. It was followed by ORANGE POLSKA (WSE: OPL) and ENERGA (WSE: ENG), plunging 1.52% and 1.41% respectively. On the other side of the ledger, CCC (WSE: CCC) became the best-performer, advancing 2.37%. Other noticeable gainers included PGNIG (WSE: PGN), SYNTHOS (WSE: SNS) and ENEA (WSE: ENA), which added over 1% each.

-

17:41

Oil prices decrease on concerns over the global oil oversupply

Oil prices decreased on concerns over the global oil oversupply. Analysts expect that additional Iranian oil will lead to lower oil prices.

The increase in crude stocks at the Cushing, Oklahoma, last week still weighed on oil prices. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.346 million barrels to 461.4 million in the week to July 10.

Crude stocks at the Cushing, Oklahoma, increased by 438,000 barrels to 57.1 million barrels.

Losses were limited due to a power outage shut production at Buzzard, the UK's largest oilfield.

Buzzard oilfield normally pumps 170,000 to 180,000 barrels per day.

WTI crude oil for August delivery decreased to $50.38 a barrel on the New York Mercantile Exchange.

Brent crude oil for August fell to $56.75 a barrel on ICE Futures Europe.

-

17:38

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes are mixed. The Nasdaq composite index opened at a record high on Friday on strong results from Google (GOOGL, GOOG), while Boeing (BA) kept a check on the Dow. Strong consumer price index data, rebounding housing starts numbers and surging building permits could give the Federal Reserve confidence that inflation will gradually rise toward its 2 percent target. Google jumped as much as 14.5 percent to a record high of $688.81, a day after its profit beat forecasts for the first time in six quarters and the company said it would be more disciplined on spending.

Most of Dow stocks in negative area (26 of 30). Top looser - Intel Corporation (INTC, -2.46%). Top gainer - Apple Inc. (AAPL, +0.61).

Almost all S&P index sectors in negative area. Top gainer - Basic materials (-1.3%). Top gainer - Technology (+1.7%).

At the moment:

Dow 17965.00 -55.00 -0.31%

S&P 500 2115.25 -1.75 -0.08%

Nasdaq 100 4633.25 +35.50 +0.77%

10 Year yield 2,34% -0,01

Oil 50.68 -0.56 -1.09%

Gold 1131.10 -12.80 -1.12%

-

17:22

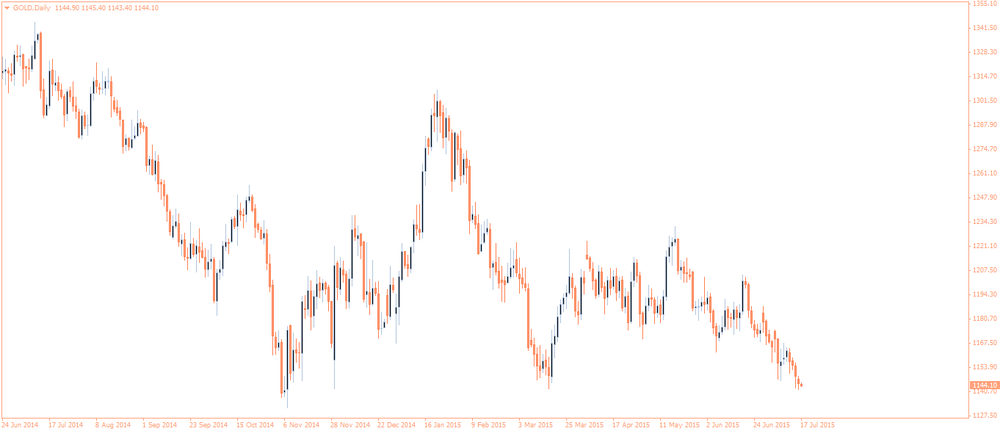

Gold price declines on a stronger U.S. dollar

Gold price declined on a stronger U.S. dollar. The greenback rose on the better-than-expected U.S. economic data. The U.S. consumer price inflation rose 0.3% in June, in line with expectations, after a 0.4% gain in May.

The increase was partly driven by higher gasoline prices, which climbed 3.4% in June.

On a yearly basis, the U.S. consumer price index increased to 0.1% in June from 0.0% in May, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.2% in June, in line with expectations, after a 0.1% rise in May.

On a yearly basis, the U.S. consumer price index excluding food and energy remained rose to 1.8% in June from 1.7% in May, in line with expectations.

Food prices increased 0.3% in June, the largest rise since September 2014.

Increasing inflation could support the Fed's decision to start raising interest rates this year.

Housing starts in the U.S. rose 9.8% to 1,174 million annualized rate in June from a 1,069 million pace in May, missing expectations for a rise to 1.110 million. May's figure was revised up from 1,036 million units.

The increase was driven by an increase in starts of multi-family homes.

Building permits in the U.S. climbed 7.4% to 1.343 million annualized rate in June from a 1.250 million pace in May. May's figure was revised down from 1.275 million. It was the highest level since July 2007.

Analysts had expected building permits to decline to 1.150 million units.

August futures for gold on the COMEX today declined to 1132.70 dollars per ounce.

-

17:01

European Commission Vice President Valdis Dombrovskis hopes a new Greek bailout programme could be reached within a few weeks

European Commission Vice President Valdis Dombrovskis said on Friday that he hoped that a new Greek bailout programme could be reached within a few weeks. He added that talks will include debt restructuring.

"On debt I would expect this being a part of negotiations, because this is also something the IMF insists on. There is also a clear conclusion of the Euro Summit that the IMF should be a part of the third programme. It means certainly also that debt sustainability issue is going to be a part of negotiations," Dombrovskis said.

-

16:44

Bank of Italy upgrades its economic growth forecast for 2015

The Bank of Italy upgraded its economic growth forecast for 2015 on Friday. Italy's economy is expected to expand 0.7% this year, up from the previous forecast of a 0.5% growth.

The upward revision was driven by low oil prices, a weaker euro and "a more positive evolution of the external context, in large part attributable to the effects of monetary policy".

Growth forecast for 2016 remained unchanged at 1.5%.

-

16:18

Thomson Reuters/University of Michigan preliminary consumer sentiment index drops to 93.3 in July

The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 93.3 in July from a final reading of 96.1 in June, missing expectations for an increase to 96.4.

"Consumer confidence continued to meander sidewards with no indication of a potential break in the prevailing positive trend in sentiment. The small loss in early July reflected a slight rise in concerns about international developments which was partially offset by continued news of job gains," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The drop in the index was mainly driven by declines in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions declined to 106.0 in July from 108.9 in June, while the index of consumer expectations decreased to 85.2 from 87.2.

The one-year inflation expectations in July was up to 2.8% from 2.7% in May.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, July 93.3 (forecast 96.4)

-

15:57

Eurozone’s inflation forecast for 2015 is upgraded to 0.2%

The European Central Bank (ECB) released its Survey of Professional Forecasters on Friday. Respondents expect the inflation in the Eurozone to rise 0.2% in 2015, up from the previous quarter's estimate of a 0.1% gain.

Inflation in 2016 is expected to increase 1.3%, up from the previous estimate of a 1.2% rise.

The upward revision was driven by the impact of quantitative easing.

GDP forecast for 2015 remained unchanged at 1.4%, while the forecast for 2016 was upgraded to 1.8% from the previous estimate of 1.7%.

The unemployment rate is expected to be 11% in 2015, 10.5% in 2016, and 10% in 2017.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.3bn), $1.0850(E807mn), $1.0900(E1.2bn), $1.0925-30(E900mn), $1.1000(E2.2bn)

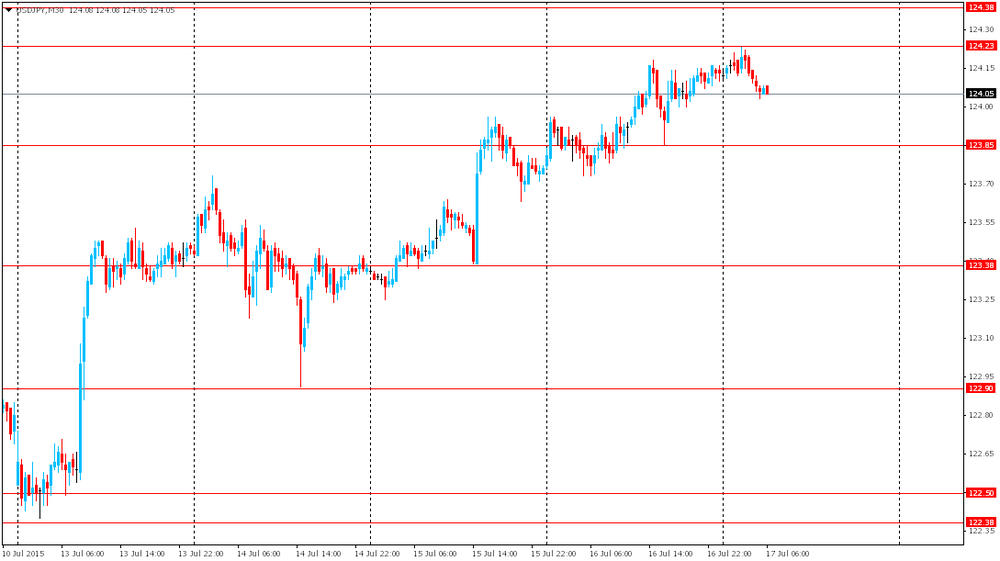

USD/JPY: Y122.00($1.18bn), Y123.00($642mn), Y124.25($250mn)

GBP/USD: $1.5700(Gbp301mn)

EUR/GBP: Gbp0.7100(E324mn)

AUD/USD: $0.7490(A$213mn)

NZD/USD: $0.6475(NZ$309mn), $0.6595(NZ$303mn)

USD/CAD: C$1.2975($365mn)

-

15:41

New orders in Spain rise a seasonally adjusted 3.3% in May

The Spanish statistical office INE released its new orders data on Friday. New orders in Spain rose a seasonally adjusted 3.3% in May, after a flat reading in April.

New orders in the capital goods sector jumped 10.4% in May, orders in the energy sector rose by 4.5%, durable consumer goods sector declined 0.9%.

On a yearly basis, industrial new orders climbed a seasonally adjusted 5.6% in May, after a 0.5% increase in April.

-

15:36

U.S. Stocks open: Dow -0.29%, Nasdaq +0.56%, S&P -0.02%

-

15:28

Before the bell: S&P futures +0.05%, NASDAQ futures +0.46%

U.S. stock-index futures rose thanks to upbeat earnings from Google (GOOG).Nikkei 20,650.92 +50.80 +0.25%

Hang Seng 25,415.27 +252.49 +1.00%

Shanghai Composite 3,957.35 +134.18 +3.51%

FTSE 6,779.98 -16.47 -0.24%

CAC 5,131.78 +10.28 +0.20%

DAX 11,704.16 -12.60 -0.11%

Crude oil $50.31 (-1.18%)

Gold $1138.60 (-0.42%) -

15:22

U.S. consumer price inflation rises 0.3% in June

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation rose 0.3% in June, in line with expectations, after a 0.4% gain in May.

The increase was partly driven by higher gasoline prices, which climbed 3.4% in June.

On a yearly basis, the U.S. consumer price index increased to 0.1% in June from 0.0% in May, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.2% in June, in line with expectations, after a 0.1% rise in May.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.8% in June from 1.7% in May, in line with expectations.

Food prices increased 0.3% in June, the largest rise since September 2014.

Increasing inflation could support the Fed's decision to start raising interest rates this year.

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

211.20

+0.01%

1.6K

United Technologies Corp

UTX

111.27

+0.01%

0.6K

ALCOA INC.

AA

10.52

+0.10%

2.3K

JPMorgan Chase and Co

JPM

69.66

+0.14%

1.1K

Citigroup Inc., NYSE

C

58.68

+0.15%

6.9K

Ford Motor Co.

F

14.61

+0.27%

3.2K

Walt Disney Co

DIS

119.49

+0.35%

11.5K

UnitedHealth Group Inc

UNH

125.50

+0.46%

1.8K

General Motors Company, NYSE

GM

30.75

+0.46%

1.2K

Apple Inc.

AAPL

129.12

+0.47%

284.3K

Amazon.com Inc., NASDAQ

AMZN

478.78

+0.69%

17.1K

Yahoo! Inc., NASDAQ

YHOO

39.30

+1.00%

9.7K

Twitter, Inc., NYSE

TWTR

36.55

+1.25%

22.5K

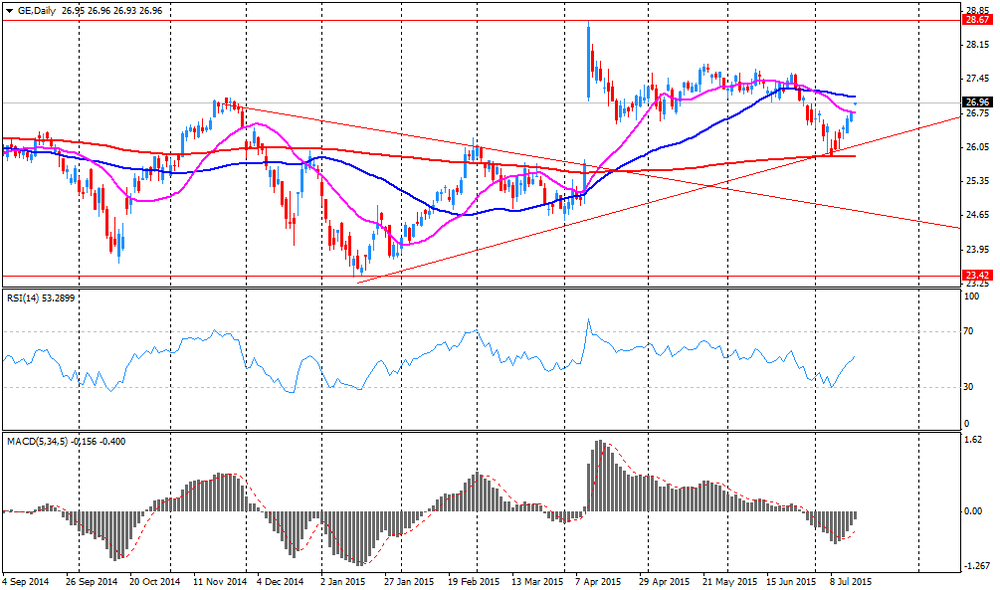

General Electric Co

GE

27.41

+1.37%

398.6K

Yandex N.V., NASDAQ

YNDX

15.71

+1.68%

0.6K

HONEYWELL INTERNATIONAL INC.

HON

105.45

+1.82%

20.5K

Facebook, Inc.

FB

92.63

+1.96%

390.4K

Google Inc.

GOOG

653.25

+12.66%

216.6K

Tesla Motors, Inc., NASDAQ

TSLA

272.85

+2.31%

27.3K

Johnson & Johnson

JNJ

101.11

0.00%

0.1K

AT&T Inc

T

35.15

-0.03%

11.5K

ALTRIA GROUP INC.

MO

52.89

-0.04%

2.4K

International Business Machines Co...

IBM

170.90

-0.06%

1.1K

3M Co

MMM

157.06

-0.07%

0.6K

Visa

V

70.52

-0.07%

4.3K

American Express Co

AXP

78.86

-0.08%

1.8K

Home Depot Inc

HD

114.60

-0.11%

16.6K

Pfizer Inc

PFE

35.06

-0.11%

2.2K

Nike

NKE

112.16

-0.16%

0.1K

The Coca-Cola Co

KO

41.41

-0.17%

0.4K

Cisco Systems Inc

CSCO

28.27

-0.18%

9.7K

Chevron Corp

CVX

94.25

-0.24%

14.6K

Procter & Gamble Co

PG

82.07

-0.28%

3.4K

Verizon Communications Inc

VZ

47.69

-0.29%

1.3K

Caterpillar Inc

CAT

83.50

-0.31%

0.9K

Exxon Mobil Corp

XOM

82.60

-0.37%

3.9K

McDonald's Corp

MCD

97.50

-0.37%

0.9K

Intel Corp

INTC

29.75

-0.50%

22.5K

Microsoft Corp

MSFT

46.42

-0.51%

27.7K

Travelers Companies Inc

TRV

102.74

-0.53%

0.6K

Starbucks Corporation, NASDAQ

SBUX

55.35

-0.70%

6.4K

Barrick Gold Corporation, NYSE

ABX

09.17

-0.76%

6.5K

Boeing Co

BA

147.20

-0.87%

2.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.15

-0.92%

5.1K

-

15:05

U.S. housing market rises better than expected in June

The U.S. Commerce Department released the housing market data on Friday. Housing starts in the U.S. rose 9.8% to 1.174 million annualized rate in June from a 1.069 million pace in May, missing expectations for a rise to 1.110 million. May's figure was revised up from 1.036 million units.

The increase was driven by an increase in starts of multi-family homes.

Building permits in the U.S. climbed 7.4% to 1.343 million annualized rate in June from a 1.250 million pace in May. May's figure was revised down from 1.275 million. It was the highest level since July 2007.

Analysts had expected building permits to decline to 1.150 million units.

Starts of single-family homes rose 0.9% in June. Building permits for single-family homes rose 0.9%.

Starts of multifamily buildings jumped 29.4% in June. Permits for multi-family housing soared 15.3%.

Housing market activity may accelerate this year due to the improvements in the labour market.

-

15:05

Upgrades and downgrades before the market open

Upgrades:

Google (GOOGL) upgraded from Hold to Buy at Axiom Capital, target raised from $615 to $850

Downgrades:

Other:

Travelers (TRV) initiated at Neutral at Piper Jaffray

UnitedHealth (UNH) initiated at Buy at Mizuho, target $150

Google (GOOG) target raised from $700 to $750 at Credit Suisse, from $675 to $740 at Needham, from $625 to $720 at Cantor Fitzgerald, from $631 to $723 at Piper Jaffray, from $672 to $749 at FBR Capital, from $640 to $750 at RBC Capital Mkts, from $595 to $715 at Mizuho

-

14:45

Canadian consumer price inflation rises 0.2% in June

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.2% in June, in line with expectations, after a 0.6% gain in May.

On a yearly basis, the consumer price index rose to 1.0% in June from 0.9% in April, in line with expectations.

The consumer price index was partly driven by higher food prices, which climbed 3.4% in June.

The energy index plunged 9.0% in June from the same month a year earlier as gasoline price dropped 14.1% in June from the same month a year earlier.

Canadian core consumer price index, which excludes some volatile goods, was flat in June, after a 0.4% gain in May.

On a yearly basis, core consumer price index in Canada was up to 2.3% in June from 2.2% in May. Analysts had expected the index to remain unchanged at 2.2%.

The Bank of Canada's inflation target is 2.0%.

-

14:30

Canada: Consumer price index, y/y, June 1% (forecast 1.0%)

-

14:30

U.S.: CPI excluding food and energy, m/m, June 0.2% (forecast 0.2%)

-

14:30

U.S.: CPI, Y/Y, June 0.1% (forecast 0.1%)

-

14:30

U.S.: Housing Starts, June 1174 (forecast 1110)

-

14:30

Canada: Consumer Price Index m / m, June 0.2% (forecast 0.2%)

-

14:30

U.S.: CPI, m/m , June 0.3% (forecast 0.3%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, June 2.3% (forecast 2.2%)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, June 1.8% (forecast 1.8%)

-

14:30

U.S.: Building Permits, June 1343 (forecast 1150)

-

14:29

-

14:28

Construction production in the Eurozone drops 0.6% in May

The Italian statistical office Istat released its construction production data for Italy on Friday. Construction production in Italy decreased 0.6% in May, after a flat reading in April.

On a yearly basis, construction output plunged 2.5% in May, after a 2.8% drop in April.

-

14:24

Construction production in the Eurozone rises 0.3% in May

The Eurostat released its construction production data for the Eurozone on Friday. Construction production in the Eurozone increased 0.3% in May, after a 0.2% decline in April. April's figure was revised down from a 0.3% gain.

Civil engineering output climbed 1.3% in May, while production in the building sector was up 0.2%.

On a yearly basis, construction output increased 0.3% in May, after a 1.1% drop in April. April's figure was revised down from a flat reading.

-

14:17

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the results of the German parliament's vote on a new Greek bailout programme

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index May -0.3% 0.2%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The U.S. consumer price inflation is expected to rise to 0.1% in June from 0.0% in May.

The U.S. consumer price index excluding food and energy is expected to increase to 1.8% in June from 1.7% in May.

Housing starts in the U.S. are expected to climb to 1.110 million units in June from 1.036 million units in May.

The number of building permits is expected to fall to 1.150 million units in June from 1.275 million units in May.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to climb to 96.4 in July from a final reading of 96.1 in June.

The greenback remained supported by yesterday's comments by Fed Chair Janet Yellen. She repeated that the Fed could raise its interest rate "at some point this year".

The euro traded lower against the U.S. dollar after the results of the German parliament's vote on a new Greek bailout programme. The German parliament voted for negotiations on the Greek bailout programme.

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

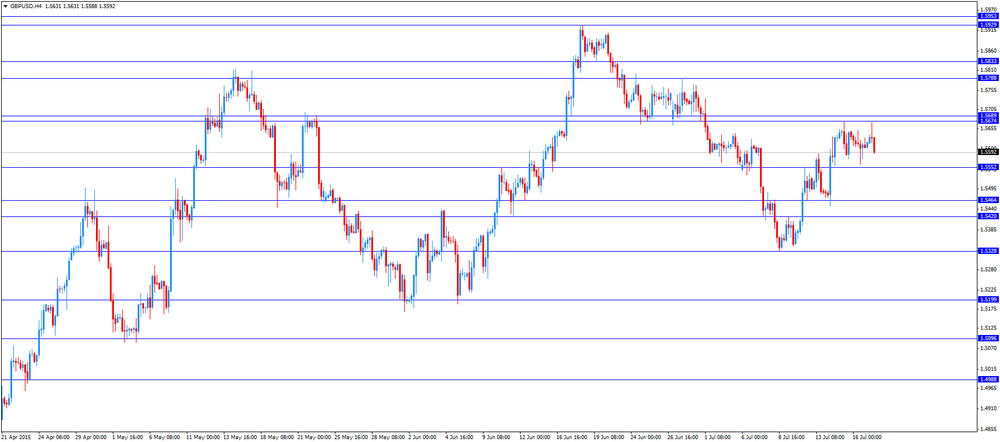

The British pound traded lower against the U.S. dollar in the absence of any major economic report from the U.K.

The Bank of England (BoE) Governor Mark Carney said on Thursday that the central bank could start raising its interest rate by the end of the year. He expects the interest rate to increase to about 2.0% over the next three years.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian consumer price inflation data. The consumer price index in Canada is expected to rise to 1.0% in June from 0.9% in May.

The core consumer price index in Canada is expected to remain unchanged at 2.2% in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5588

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m June 0.6% 0.2%

12:30 Canada Consumer price index, y/y June 0.9% 1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June 2.2% 2.2%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June 0.4%

12:30 U.S. Housing Starts June 1036 1110

12:30 U.S. Building Permits June 1275 1150

12:30 U.S. CPI excluding food and energy, m/m June 0.1% 0.2%

12:30 U.S. CPI, m/m June 0.4% 0.3%

12:30 U.S. CPI, Y/Y June 0.0% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y June 1.7% 1.8%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 96.1 96.4

14:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

14:03

Orders

EUR/USD

Offers 1.0930

Bids 1.0850

GBP/USD

Offers 1.5750 1.5720 1.5700

Bids 1.5500 1.5410/00

EUR/GBP

Offers 0.7020

Bids

EUR/JPY

Offers 136.80/00 136.00/10

Bids 134.50 134.00

USD/JPY

Offers 125.00 124.30/50

Bids 123.90 123.60/50 123.06/00 122.55/50

AUD/USD

Offers 0.7500

Bids 0.7300 0.7250

-

12:02

European stock markets mid session: stocks traded slightly lower ahead the German parliament's vote on a new Greek bailout programme

Stock indices traded slightly lower ahead the German parliament's vote on a new Greek bailout programme.

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

Current figures:

Name Price Change Change %

FTSE 100 6,783.12 -13.33 -0.20 %

DAX 11,674.18 -42.58 -0.36 %

CAC 40 5,120.37 -1.13 -0.02 %

-

11:39

International Monetary Fund (IMF) Managing Director Christine Lagarde: the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

"This complete package has two legs, a Greek leg that entails an in-depth reform of the Greek economy. That means holding a budgetary position that is sound and gives the country solidity; and the second leg is that of the lenders, which entails supplying financing and restructuring the debt to ease its burden," she said.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

-

11:22

Eurozone finance ministers agreed to provide a third bailout programme to Greece

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

"The Eurogroup welcomes the adoption by the Greek Parliament of all the commitments specified in the Euro Summit statement of 12 July. We reached today a decision to grant in principle a 3-year ESM stability support to Greece, subject to the completion of relevant national procedures," the Eurogroup said in its statement.

-

11:11

Bank of England Governor Mark Carney said on Thursday: the central bank could start raising its interest rate by the end of the year

The Bank of England (BoE) Governor Mark Carney said on Thursday that the central bank could start raising its interest rate by the end of the year. He expects the interest rate to increase to about 2.0% over the next three years.

"It would not seem unreasonable to me to expect that once normalisation begins, interest rate increases would proceed slowly and rise to a level in the medium term that is perhaps about half as high as historic averages," Carney said.

The BoE governor noted that the central bank could change the timing and the size of any interest rate hike if there are shocks to the U.K. economy.

Carney added that skills shortages will lead to higher wage inflation.

-

11:05

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E1.3bn), $1.0850(E807mn), $1.0900(E1.2bn), $1.0925-30(E900mn), $1.1000(E2.2bn)

USD/JPY: Y122.00($1.18bn), Y123.00($642mn), Y124.25($250mn)

GBP/USD: $1.5700(Gbp301mn)

EUR/GBP: Gbp0.7100(E324mn)

AUD/USD: $0.7490(A$213mn)

NZD/USD: $0.6475(NZ$309mn), $0.6595(NZ$303mn)

USD/CAD: C$1.2975($365mn)

-

10:51

Greek Deputy Finance Minister Dimitris Mardas: Greek banks will reopen on Monday

Greek Deputy Finance Minister Dimitris Mardas said that Greek banks will reopen on Monday.

"From Monday, the services offered will be widened. All the banks everywhere will be open. There might be a weekly limit on withdrawals, rather than a daily one. This is a proposal we are processing and we think it's technically possible," he said.

-

10:42

The Wall Street Journal survey: about 82% of economists expect the Fed to start raising its interest rate in September

According to The Wall Street Journal survey, about 82% of economists expect the Fed to start raising its interest rate in September. 15% expect that the Fed would wait until December.

72% of economists expected last month that the Fed to start raising its interest rate in September, while 9% expected the first interest rate hike in December.

"The Federal Reserve continues to message that it intends to normalize rates this year, and with rebounding activity in the coming months, September continues to be the leading candidate," National Association of Manufacturers chief economist Chad Moutray said.

-

10:32

Corporate loans in Japan increase in July

The Bank of Japan (BoJ) released its Senior Loan Officer Opinion Survey on Friday. The balance of demand for loans from companies increased to 2 in July from 1 in April.

Demand for loans from large companies climbed to 6 in July from zero in April, while demand for loans from medium-sized companies and small companies remained unchanged at 1.

-

10:18

Australian leading economic index rises 0.2% in May

The Conference Board (CB) released its leading economic index for Australia on Friday. The leading economic index increased 0.2% in May, after a 0.3% fall in April.

The increase was driven by higher inventory sales, rural goods exports, yield spread, building approvals and gross operating surplus.

The coincident index was up 0.3% in May, after a 0.1% gain in April.

The rise was driven by employment, household disposable income and industrial production.

-

10:12

U.K. leading economic index falls 0.4% in May

The Conference Board (CB) released its leading economic index for the U.K. on Thursday. The leading economic index decreased 0.4% in May, after a 0.3% rise in April. Three of seven subindexes were positive.

The coincident index was up 0.1% in May, after a 0.2% gain in April. All four subindexes climbed. The CB said that the index indicates that the U.K. economy is likely to expand in the near term.

-

08:50

Oil price advanced despite the first oil tanker coming from Iran

West Texas Intermediate futures for August delivery climbed to $51.29 (+0.75%); Brent crude advanced to $57.06 (+0.25%) due to a power outage at Britain's largest oilfield. Positive progress in Greece helped improve risk sentiment. Nevertheless markets are oversupplied and Iran is set to add to this issue now that the nuclear deal is reached.

It will take time for Iran to raise output; however sources claim that it has millions of barrels of oil in store (51.4 million barrels as estimated by Windward, a Tel Aviv operated maritime data and analytics company) and that an Iranian supertanker with two million barrels of oil sailed to Asia after sitting in Iranian waters for months.

-

08:42

Gold is weighed by the dollar

Gold is currently at $1,143.60 (-0.03%) an ounce. The metal is basically flat this morning as investors are waiting for U.S. economic data to assess strength of the dollar.

Physical demand in key consumers China and India remained sluggish despite low prices. Strong U.S. dollar draws Chinese investors away from bullion and they favor stocks. Indian jewelers sell gold at a discount and prefer to get rid of old stocks instead of preparing new items.

-

08:40

Global Stocks: indices improved worldwide

U.S. stock indices advanced with the Nasdaq leading the gains amid earnings reports from various companies. Shares of Netflix Inc. rose 18% and eBay Inc. shares jumped 3.4% on better-than-expected reports.

Investor confidence advanced after Greece's parliament voted for austerity reforms.

The U.S. Department of Labor reported Thursday that the number of initial jobless claims fell for the first time in three weeks. The seasonally adjusted index fell by 15,000 to 281,000 in a week ended July 11. Economists expected 285,000 claims.

The Dow Jones Industrial Average gained 70.08 points, or 0.4%, to 18120.25. The S&P 500 added 16.89 points, or 0.8%, to 2124.29. The Nasdaq Composite Index rose 64.24 points, or 1.3%, to 5163.18.

In Asia this morning Hong Kong Hang Seng rose 0.98%, or 246.31 points, to 25,409.09. China Shanghai Composite Index rose 1.57%, or 60.01 points, to 3,883.18. Meanwhile the Nikkei advanced by 0.17%, or 34.01 points, to 20,634.13.

Asian stock indices advanced amid gains in U.S. stock markets. Investors are less worried about Chinese stocks and Greece's debt situation. A weaker yen supported Japanese stocks as it is favorable for exporters.

-

08:36

Foreign exchange market. Asian session: the euro remains under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 Australia Conference Board Australia Leading Index May -0.3% 0.2%

The euro remained under pressure despite positive news from Athens. Yesterday EU finance ministers agreed to provide Greece with financial aid in the coming three years. The final decision will be made today. Improvements in political and financial situations boost demand for European stocks and undermine the single currency.

The Australian dollar little changed although the Conference Board released some favorable data. Australia leading index rose by 0.2% in May compared to -0.3% reported previously. Five out seven components of the index contributed in a positive way (sales to inventories ratio, rural goods exports, yield spread, building approvals, and gross operating surplus). Money supply and share prices declined in May.

EUR/USD: the pair climbed to $1.0900 in Asian trade

USD/JPY: the pair traded around Y124.10

GBP/USD: the pair advanced to $1.5635

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

14:30 Canada Consumer Price Index m / m June 0.6% 0.2%

14:30 Canada Consumer price index, y/y June 0.9% 1.0%

14:30 Canada Bank of Canada Consumer Price Index Core, y/y June 2.2% 2.2%

14:30 Canada Bank of Canada Consumer Price Index Core, m/m June 0.4%

14:30 U.S. Housing Starts June 1036 1110

14:30 U.S. Building Permits June 1275 1150

14:30 U.S. CPI excluding food and energy, m/m June 0.1% 0.2%

14:30 U.S. CPI, m/m June 0.4% 0.3%

14:30 U.S. CPI, Y/Y June 0.0% 0.1%

14:30 U.S. CPI excluding food and energy, Y/Y June 1.7% 1.8%

16:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 96.1 96.4

16:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

08:15

Options levels on friday, July 17, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1068 (1006)

$1.1010 (550)

$1.0966 (242)

Price at time of writing this review: $1.0888

Support levels (open interest**, contracts):

$1.0854 (1113)

$1.0815 (4585)

$1.0773 (5913)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 47594 contracts, with the maximum number of contracts with strike price $1,1400 (3370);

- Overall open interest on the PUT options with the expiration date August, 7 is 62000 contracts, with the maximum number of contracts with strike price $1,0800 (6286);

- The ratio of PUT/CALL was 1.30 versus 1.32 from the previous trading day according to data from July, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1164)

$1.5804 (1946)

$1.5707 (928)

Price at time of writing this review: $1.5641

Support levels (open interest**, contracts):

$1.5588 (1535)

$1.5492 (1352)

$1.5395 (1347)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20404 contracts, with the maximum number of contracts with strike price $1,5750 (2595);

- Overall open interest on the PUT options with the expiration date August, 7 is 22479 contracts, with the maximum number of contracts with strike price $1,5250 (2054);

- The ratio of PUT/CALL was 1.10 versus 1.07 from the previous trading day according to data from July, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:06

Nikkei 225 20,631.08 +30.96 +0.15 %, Hang Seng 25,416.45 +253.67 +1.01 %, Shanghai Composite 3,881.68 +58.51 +1.53 %

-

02:02

Australia: Conference Board Australia Leading Index, May 0.2%

-

00:34

Commodities. Daily history for Jul 16’2015:

(raw materials / closing price /% change)

Oil 50.92 +0.02%

Gold 1,143.80 -0.01%

-

00:33

Stocks. Daily history for Jul 16’2015:

(index / closing price / change items /% change)

Nikkei 225 20,600.12 +136.79 +0.67 %

Hang Seng 25,162.78 +107.02 +0.43 %

S&P/ASX 200 5,669.61 +33.38 +0.59 %

Shanghai Composite 3,824.19 +18.49 +0.49 %

FTSE 100 6,796.45 +42.70 +0.63 %

CAC 40 5,121.5 +74.26 +1.47 %

Xetra DAX 11,716.76 +177.10 +1.53 %

S&P 500 2,124.29 +16.89 +0.80 %

NASDAQ Composite 5,163.18 +64.24 +1.26 %

Dow Jones 18,120.25 +70.08 +0.39 %

-

00:32

Currencies. Daily history for Jul 16’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0875 -0,65%

GBP/USD $1,5604 -0,19%

USD/CHF Chf0,9574 +0,58%

USD/JPY Y124,13 +0,30%

EUR/JPY Y134,99 -0,36%

GBP/JPY Y193,69 +0,12%

AUD/USD $0,7404 +0,34%

NZD/USD $0,6510 -2,83%

USD/CAD C$1,2957 +0,33%

-

00:01

Schedule for today, Friday, Jul 17’2015:

(time / country / index / period / previous value / forecast)

00:00 China New Loans June 900.8 1050

00:00 Australia Conference Board Australia Leading Index May -0.3%

12:30 Canada Consumer Price Index m / m June 0.6% 0.2%

12:30 Canada Consumer price index, y/y June 0.9% 1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June 2.2% 2.2%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June 0.4%

12:30 U.S. Housing Starts June 1036 1114

12:30 U.S. Building Permits June 1275 1150

12:30 U.S. CPI excluding food and energy, m/m June 0.1% 0.2%

12:30 U.S. CPI, m/m June 0.4% 0.3%

12:30 U.S. CPI, Y/Y June 0.0% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y June 1.7% 1.8%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 96.1 96.4

14:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-