Noticias del mercado

-

17:41

Oil prices decrease on concerns over the global oil oversupply

Oil prices decreased on concerns over the global oil oversupply. Analysts expect that additional Iranian oil will lead to lower oil prices.

The increase in crude stocks at the Cushing, Oklahoma, last week still weighed on oil prices. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.346 million barrels to 461.4 million in the week to July 10.

Crude stocks at the Cushing, Oklahoma, increased by 438,000 barrels to 57.1 million barrels.

Losses were limited due to a power outage shut production at Buzzard, the UK's largest oilfield.

Buzzard oilfield normally pumps 170,000 to 180,000 barrels per day.

WTI crude oil for August delivery decreased to $50.38 a barrel on the New York Mercantile Exchange.

Brent crude oil for August fell to $56.75 a barrel on ICE Futures Europe.

-

17:22

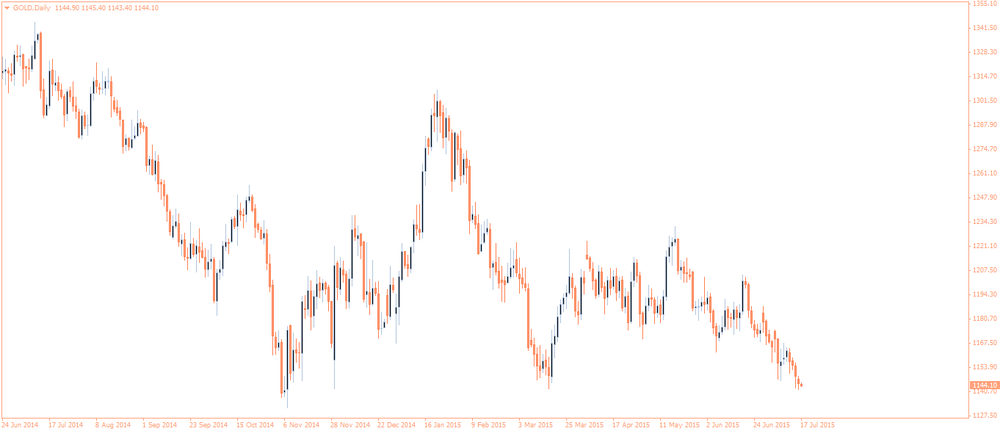

Gold price declines on a stronger U.S. dollar

Gold price declined on a stronger U.S. dollar. The greenback rose on the better-than-expected U.S. economic data. The U.S. consumer price inflation rose 0.3% in June, in line with expectations, after a 0.4% gain in May.

The increase was partly driven by higher gasoline prices, which climbed 3.4% in June.

On a yearly basis, the U.S. consumer price index increased to 0.1% in June from 0.0% in May, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.2% in June, in line with expectations, after a 0.1% rise in May.

On a yearly basis, the U.S. consumer price index excluding food and energy remained rose to 1.8% in June from 1.7% in May, in line with expectations.

Food prices increased 0.3% in June, the largest rise since September 2014.

Increasing inflation could support the Fed's decision to start raising interest rates this year.

Housing starts in the U.S. rose 9.8% to 1,174 million annualized rate in June from a 1,069 million pace in May, missing expectations for a rise to 1.110 million. May's figure was revised up from 1,036 million units.

The increase was driven by an increase in starts of multi-family homes.

Building permits in the U.S. climbed 7.4% to 1.343 million annualized rate in June from a 1.250 million pace in May. May's figure was revised down from 1.275 million. It was the highest level since July 2007.

Analysts had expected building permits to decline to 1.150 million units.

August futures for gold on the COMEX today declined to 1132.70 dollars per ounce.

-

08:50

Oil price advanced despite the first oil tanker coming from Iran

West Texas Intermediate futures for August delivery climbed to $51.29 (+0.75%); Brent crude advanced to $57.06 (+0.25%) due to a power outage at Britain's largest oilfield. Positive progress in Greece helped improve risk sentiment. Nevertheless markets are oversupplied and Iran is set to add to this issue now that the nuclear deal is reached.

It will take time for Iran to raise output; however sources claim that it has millions of barrels of oil in store (51.4 million barrels as estimated by Windward, a Tel Aviv operated maritime data and analytics company) and that an Iranian supertanker with two million barrels of oil sailed to Asia after sitting in Iranian waters for months.

-

08:42

Gold is weighed by the dollar

Gold is currently at $1,143.60 (-0.03%) an ounce. The metal is basically flat this morning as investors are waiting for U.S. economic data to assess strength of the dollar.

Physical demand in key consumers China and India remained sluggish despite low prices. Strong U.S. dollar draws Chinese investors away from bullion and they favor stocks. Indian jewelers sell gold at a discount and prefer to get rid of old stocks instead of preparing new items.

-

00:34

Commodities. Daily history for Jul 16’2015:

(raw materials / closing price /% change)

Oil 50.92 +0.02%

Gold 1,143.80 -0.01%

-