Noticias del mercado

-

17:41

Oil prices traded mixed

Oil prices traded mixed. Brent crude oil rose after a power outage shut production at Buzzard, the UK's largest oilfield, and as expiration of the August contract is approaching.

Buzzard oilfield normally pumps 170,000 to 180,000 barrels per day.

WTI crude oil declines as crude stocks at the Cushing, Oklahoma, increased last week. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.346 million barrels to 461.4 million in the week to July 10.

Crude stocks at the Cushing, Oklahoma, increased by 438,000 barrels to 57.1 million barrels.

The results of the Greek parliament's vote supported oil prices. The Greek parliament has approved reforms demanded by Greece's creditors in return for the third bailout programme on Wednesday. 32 Syriza members, including former finance minister Yanis Varoufakis, voted against new reforms.

European Commission President Jean-Claude Juncker said on Thursday that European Union finance ministers agreed to provide a €7 billion bridge loan to Greece until the third Greek bailout programme will be set up. The bridge loan would come from the European Financial Stabilization Mechanism.

Greece could use the bridge loan to repay ECB and IMF loans.

WTI crude oil for August delivery decreased to $51.50 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $57.87 a barrel on ICE Futures Europe.

-

17:25

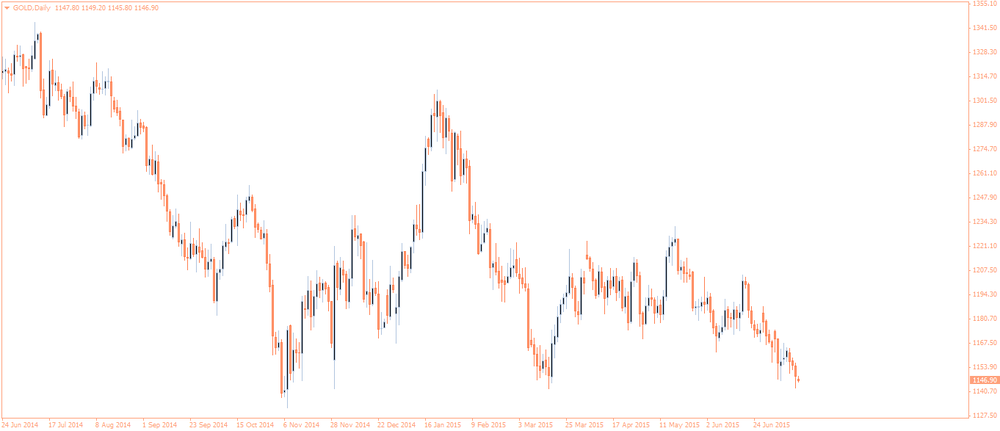

Gold price declines on a stronger U.S. dollar

Gold price declined on a stronger U.S. dollar. The greenback rose on comments by the Fed Chair Janet Yellen. She testified for a second day before the Senate Banking Committee. Yellen repeated that she expects the U.S. economy to strengthen in the rest of the year, and that the Fed could raise its interest rate "at some point this year".

Increase in European stock markets also weighed on gold price. European stock markets rose as the Greek parliament has approved reforms demanded by Greece's creditors in return for the third bailout programme on Wednesday.

European Commission President Jean-Claude Juncker said on Thursday that European Union finance ministers agreed to provide a €7 billion bridge loan to Greece until the third Greek bailout programme will be set up. The bridge loan would come from the European Financial Stabilization Mechanism.

Greece could use the bridge loan to repay ECB and IMF loans.

August futures for gold on the COMEX today declined to 1143.10 dollars per ounce.

-

09:35

Oil price advanced amid U.S. crude inventories data

West Texas Intermediate futures for August delivery climbed to $51.71 (+0.58%); Brent crude advanced to $57.26 (+0.25%) after data from the Energy Information Administration showed that U.S. crude inventories fell 4.3 million barrels in the week ended July 10. Total commercial stockpiles of crude oil and petroleum products, including gasoline and diesel fuel, rose by 2.8 million barrels to a record high of 1.27 billion barrels.

Although U.S. crude inventories dropped last week and Iran needs several months to boost exports for operational reasons, the outlook remains bearish as markets are already oversupplied.

-

09:22

Gold declined amid prospects of a rate hike in the U.S.

Gold is currently near a four-month low at $1,146.30 (-0.10%) an ounce as the Federal Reserve is preparing to raise its key interest rate from the current level of 0.25% within this year. Yesterday Fed Chair Yellen said that labor markets were expected to steadily improve and turmoil abroad unlikely to harm the U.S. economy.

HSBC analyst James Steel marked that a potential U.S. rate hike had been discussed by market participants as early as 2013, and gold has already fallen on this speculation. "This leads us to conclude that most of gold's declines based on a rate rise have already occurred, and that gold's reaction to the rate hike - whenever it comes - and subsequent hikes, may be muted or short-lived," Steel said.

Physical demand remains sluggish. India's trade ministry reported that imports to this country (second-biggest consumer of gold after China) fell 37% in June compared to a year earlier.

-

01:03

Commodities. Daily history for Jul 15’2015:

(raw materials / closing price /% change)

Oil 51.62 +0.41%

Gold 1,146.70 -0.06%

-