Noticias del mercado

-

22:01

U.S.: Net Long-term TIC Flows , May 93.0

-

22:00

U.S.: Total Net TIC Flows, May 115

-

20:01

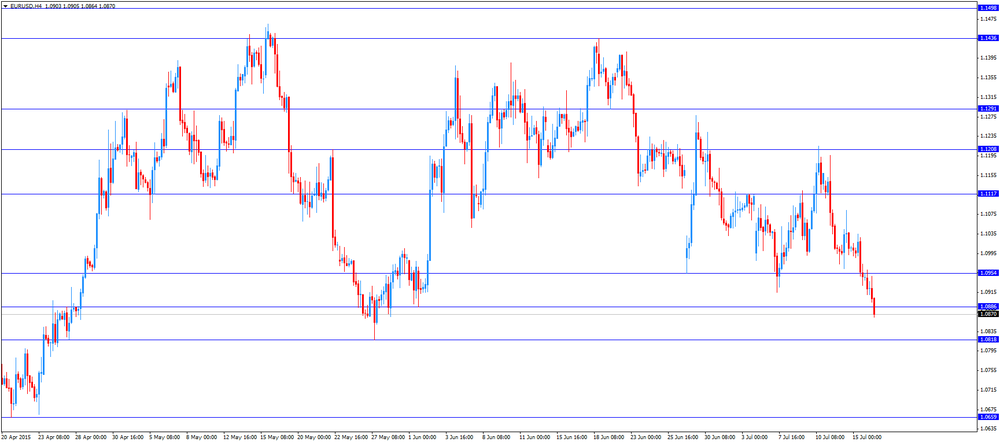

American focus: the dollar continued to appreciate against most major currencies

The euro fell against the dollar, approaching to a minimum on May 27 against Draghi's speech at the press conference that followed the decision to leave policy unchanged. Recall, the lending rate was left at 0.05%, deposit rate - at 0.2%. During the press conference after the announcement of the rate decision Draghi said that the ECB is expected to strengthen the euro-zone economic recovery, despite the uncertainty in the financial markets. "GDP growth in the eurozone in the first quarter of 2015 was confirmed at 0.4%, it was supported by private consumption and investment. We expect further expansion of economic recovery of the eurozone in the future" - said Draghi. The head of the ECB noted that the situation in the financial markets, including the factor of uncertainty assessment has not changed the economic recovery in the eurozone. He noted that evidence obtained since the previous meeting in June, largely in line with forecasts. Downside risks to the economic outlook for the euro area as a whole are constrained due to the monetary policy of the ECB, oil prices and the dynamics of the currency market, Draghi said. He added that the full implementation of all the measures of monetary policy will provide the necessary support for economic recovery and sustainable return will cause inflation to the target level of 2% in the medium term.

The Swiss franc depreciated significantly against the dollar, reaching the lowest level since April 28 against the backdrop of a weak report on retail sales in Switzerland and the positive statistics on the US labor market. Recall, the preliminary results from the Federal Statistical Office showed that retail sales in Switzerland declined in May. In real terms, retail sales decreased by 1.8 percent in May compared to the previous year, after falling 0.1 percent in April. It was the fifth consecutive month of decline. Excluding fuel, retail sales fell by 1.6 per cent per annum, as opposed to the 0.4 percent increase in April. On a monthly basis, retail sales were down 1.4 percent in May, reversing an increase of 0.9 percent in April. Sales excluding fuel fell 1.5 percent after increasing 0.7 percent a month ago. In nominal terms, total retail trade turnover decreased by 3.9 percent per annum and by 1.6 percent on a monthly basis.

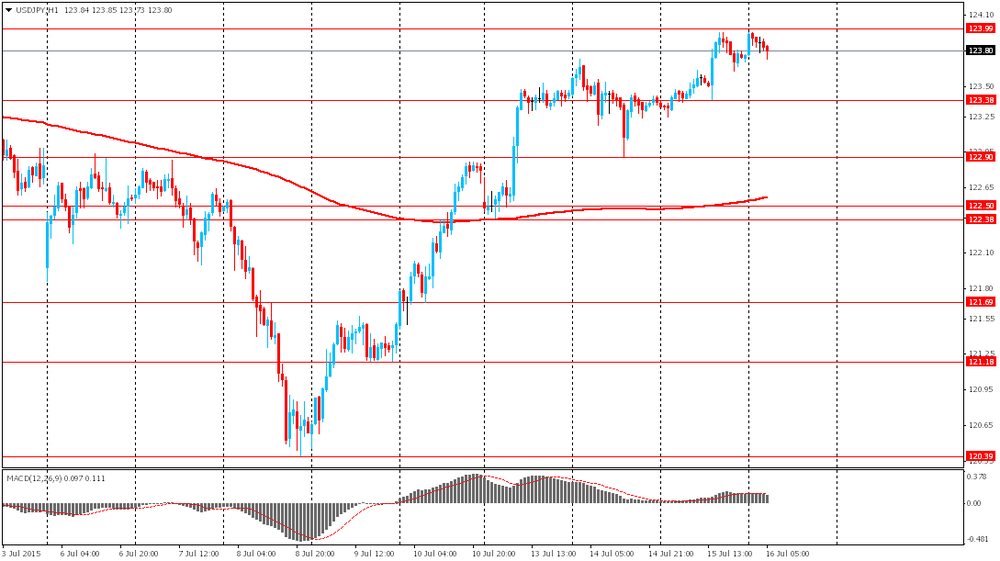

The yen fell against the US currency, reaching the lowest level since June 24, which was associated with the publication of data on the US labor market, and expectations of Fed Yellen speech. The Labor Department said initial applications for unemployment benefits fell by 15,000 and reached a seasonally adjusted 281,000 in the week ended July 11th. Economists expected 285,000 initial claims. The moving average of four weeks, designed to smooth out weekly changes, rose by 3250 to 282 500. The report on Thursday showed that the 296,000 initial claims were filed in the week ended July 4th, which was revised down from the earlier estimate of 297000. In addition The number of people continuing to receive unemployment benefits fell by 112,000 to 2.215 million in the week ended July 4th. Repeated applications communicate with one week delay.

-

17:09

Employment rate in the OECD area increases to 66.1% in the first quarter

The Organization for Economic Co-operation and Development (OECD) released its employment rate for the first quarter on Thursday. The employment rate in the OECD area increased to 66.1% in the first quarter from 65.9% in the fourth quarter.

The employment rate in the Eurozone was up 0.2% to 64.2% in the first quarter, the employment rate in the United Kingdom rose by 0.4% to 72.6%, while the rate in the United States climbed 0.1% to 68.6%.

-

17:01

Greek banks will reopen on Monday

According to a senior banker, Greek banks will reopen on Monday.

Greek banks have been closed since June 29.

The European Central Bank (ECB) raised the amount of emergency funding (ELA) to Greek banks by €900 million for one week.

-

16:52

European Commission President Jean-Claude Juncker: European Union finance ministers agreed to provide a €7 billion bridge loan to Greece

European Commission President Jean-Claude Juncker said on Thursday that European Union finance ministers agreed to provide a €7 billion bridge loan to Greece until the third Greek bailout programme will be set up. The bridge loan would come from the European Financial Stabilization Mechanism.

-

16:42

Philadelphia Federal Reserve Bank’s manufacturing index plunges to 5.7 in July

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to 5.7 in July from 15.2 in June, missing expectations for a decline to 12.0.

A reading above zero indicates expansion.

The decline was driven by lower demand for manufactured goods. The new orders index slid to 7.1 in July from 15.2 in June.

The shipments index plunged to 4.4 in July from 14.3 in June.

The prices paid index climbed to 20.2 in July from 17.2 in June, while the prices received index were down to 1.7 from 4.8.

The number of employees index declined to -0.4 in July from 4.8 last month.

According to the report, the future general activity index rose to 41.5 in July from 39.7 in June. It was the highest level since January.

-

16:29

NAHB housing market index remains unchanged at 60 in July, the highest level since November 2005

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Thursday. The NAHB housing market index remained unchanged at 60 in July, in line with expectations. It was the highest level since November 2005.

June's figure was revised up from 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The increase was driven by a rise in two of three components of the index. The current sales conditions subindex rose one point to 66 in June, the subindex measuring sales expectations in the next six months climbed two points to 71, while the buyer traffic subindex was down one point to 43.

"The fact that builder confidence has returned to levels not seen since 2005 shows that housing continues to improve at a steady pace, " the NAHB Chairman Tom Woods said. He added that housing market is expected to continue to recover in the second half of the year.

The NAHB Chief Economist David Crowe noted that the current reading was driven by "stronger sales in both the new and existing home markets" and by continued job growth.

-

16:04

Italy’ trade surplus climbs to €4.27 billion in May

The Italian statistical office Istat released its trade data for Italy on Thursday. Italy' trade surplus rose to a seasonally adjusted €4.27 billion in May from €3.63 billion in April.

Exports climbed 1.5% in May, while imports fell 0.3%.

On a yearly basis, exports climbed 2.0% in May, while imports rose 0.5%.

The trade surplus with the EU was a seasonally adjusted €1.29 billion in May, while the trade surplus with non-EU countries was €2.98 billion.

-

16:00

U.S.: NAHB Housing Market Index, July 60 (forecast 60)

-

16:00

U.S.: Philadelphia Fed Manufacturing Survey, July 5.7 (forecast 12.0)

-

15:55

European Central Bank President Mario Draghi: liquidity provision to Greece was never meant to be unlimited and unconditional

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- The central bank will continue its bond-buying programme until September 2016 or until 2% inflation target will be reached;

- Quantitative easing continues "to proceed smoothly";

- Lower oil prices should support disposable incomes in Europe;

- The slowdown in emerging markets weighs on recovery in the Eurozone;

- Demand for loans from companies rose;

- Governments should implement structural reforms;

- The central bank continues to act on the assumption Greece is and will continue to remain in the Eurozone;

- Liquidity provision to Greece was never meant to be unlimited and unconditional;

- The Eurosystem of central banks' total exposure to Greece is €130 billion;

- Greece will repay ECB loans by July 20.

- The central bank will continue its bond-buying programme until September 2016 or until 2% inflation target will be reached;

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E413mn), $1.0925(E342mn), $1.1000(E824mn), $1.1075(E446mn), $1.1100(E1.0bn)

USD/JPY: Y122.00($1.19bn), Y123.00($500mn), Y123.50($722mn), Y124.00($1.35bn)

GBP/USD: $1.5550(Gbp406mn)

USD/CHF: Chf0.9425($285mn)

AUD/USD: $0.7300(A$3.83bn), $0.7400(A$1.8bn), $0.7500(A$6.34bn)

NZD/USD: $0.6750(NZ$207mn)

USD/CAD: C$1.2600($1.1bn), C$1.2750-55($1.3bn), C$1.2800($355mn), C$1.2900($230mn)

-

15:31

European Central Bank raises the amount of emergency funding (ELA) to Greek banks by €900 million over one week

The European Central Bank (ECB) raised the amount of emergency funding (ELA) to Greek banks by €900 million over one week on Thursday, the ECB President Mario Draghi said at a press conference.

The amount the Greek central bank can lend its banks totals around €89.5 billion.

-

15:14

Spain's trade deficit narrows to €1.65 billion in May

Spain's Economy Ministry released its trade data on Thursday. Spain's trade deficit narrowed to €1.65 billion in May from €1.75 billion in April.

Exports climbed at an annual rate of 1.9% in May, while imports rose 1.3%.

-

15:03

Foreign investors reduce C$5.45 billion of Canadian securities in May

Statistics Canada released foreign investment figures on Thursday. Foreign investors reduced C$5.45 billion of Canadian securities in May, after a purchase of C$16.73 billion in April.

April's figure was revised up from a purchase of C$12.94 billion.

Canadian investors purchased C$5.6 billion of foreign securities in May, mainly corporate securities.

-

14:44

Initial jobless claims fall by 15,000 to 281,000 in the week ending July 11

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending July 11 in the U.S. fell by 15,000 to 281,000 from 296,000 in the previous week. The previous week's reading was revised up from 297,000.

Analysts had expected the number of initial jobless claims to be 285,000.

Jobless claims remained below 300,000 the 15th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 112,000 to 2,215,000 in the week ended July 04.

-

14:30

U.S.: Initial Jobless Claims, July 281 (forecast 285)

-

14:30

U.S.: Continuing Jobless Claims, 2215 (forecast 2295)

-

14:30

Canada: Foreign Securities Purchases, May -5.45

-

14:19

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the European Central Bank’s decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation July 3% 3.4%

04:00 Japan BoJ monthly economic report

07:15 Switzerland Retail Sales Y/Y May 1.6% -1.8%

07:16 Switzerland Retail Sales (MoM) May 2.1% -1.4%

09:00 Eurozone Trade balance unadjusted May 24.9 18.8

09:00 Eurozone Harmonized CPI June 0.2% 0% 0.0%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June 0.3% 0.2% 0.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) June 0.9% 0.8% 0.8%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded higher against the most major currencies ahead the release of the U.S. economic data. The NAHB housing market index is expected to climb to 60 in July from 59 in June.

The number of initial jobless claims in the U.S. is expected to decline by 12,000 to 285,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to fall to 12.0 in July from 15.2 in June.

The Fed Chair Janet Yellen will testify at 14:00 GMT.

The greenback remained supported by yesterday's comments by Fed Chair Janet Yellen. She said that she expects the U.S. economy to strengthen in the rest of the year. Yellen pointed out that the Fed could raise its interest rate "at some point this year".

The euro traded lower against the U.S. dollar after the European Central Bank's (ECB) decision. The central bank kept its interest rate unchanged at 0.05%.

The Greek parliament has approved reforms demanded by Greece's creditors in return for the third bailout programme on Wednesday. 32 Syriza members, including former finance minister Yanis Varoufakis, voted against new reforms.

Greek Prime Minster Alexis Tsipras said before the parliament that there is no alternative.

The ECB Governing Council will meet in Frankfurt on Thursday, and the German parliament on Friday votes on the resumption of talks on financial aid to Greece.

The European Central Bank will release its interest rate decision today. It is unlikely that there will be changes in the monetary policy. Market participants will closely monitor the press conference, looking for new details regarding Greece.

Meanwhile, the economic data from the Eurozone showed some weakness. Eurozone's final consumer price index was flat in June, in line with the previous estimate, after a 0.2% increase in May.

On a yearly basis, Eurozone's final consumer price inflation fell to 0.2% in June from 0.3% in May, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.8% in June from 0.9% in May, in line with the previous estimate.

Eurozone's unadjusted trade surplus slid to €18.8 billion in May from €24.9 billion in April.

Exports rose at an annual rate of 3.0% in May, while imports were flat.

The British pound traded lower against the U.S. dollar in the absence of any major economic report from the U.K.

The Bank of England Governor Mark Carney will speak at 18:00 GMT.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data.

The Swiss franc traded lower against the U.S. dollar. Retail sales in Switzerland dropped at an annual rate of 1.8% in May, after a 1.6% increase in April.

Sales of food, beverages and tobacco fell at an annual rate of 0.5% in May, while non-food sales plunged 2.2%.

On a monthly basis, retail sales fell by 1.4% in May, after a 2.1% increase in April.

Sales of food, beverages and tobacco were down 1.2% in May, while non-food sales dropped 2.1%.

EUR/USD: the currency pair fell to $1.0864

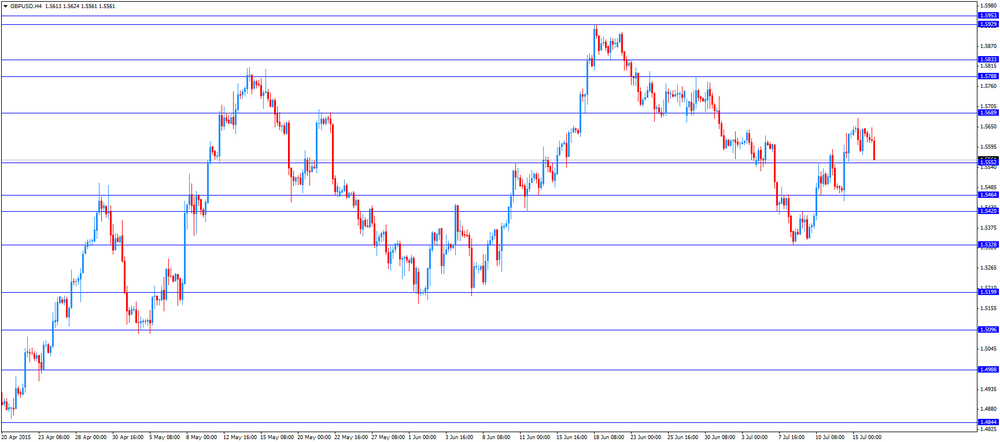

GBP/USD: the currency pair declined to $1.5560

USD/JPY: the currency pair rose to Y124.15

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Foreign Securities Purchases May 12.94

12:30 U.S. Initial Jobless Claims July 297 285

14:00 U.S. NAHB Housing Market Index July 59 60

14:00 U.S. Philadelphia Fed Manufacturing Survey July 15.2 12.0

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:00 United Kingdom BOE Gov Mark Carney Speaks

20:00 U.S. Net Long-term TIC Flows May 53.9

-

14:00

Orders

EUR/USD

Offers 1.1100 1.1080/90

Bids 1.0885

GBP/USD

Offers 1.57200 1.5700 1.5650

Bids 1.5500

EUR/GBP

Offers

Bids 0.6980 0.6950/45

EUR/JPY

Offers 136.80/00

Bids 135.00 134.50 134.00 133.00

USD/JPY

Offers 125.00 124.50 124.00

Bids 123.05/00 122.55/50

AUD/USD

Offers 0.7500

Bids 0.7350 0.7300 0.7250

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

11:41

Eurozone's final consumer price index is flat in June

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's final consumer price index was flat in June, in line with the previous estimate, after a 0.2% increase in May.

On a yearly basis, Eurozone's final consumer price inflation fell to 0.2% in June from 0.3% in May, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.8% in June from 0.9% in May, in line with the previous estimate.

-

11:31

Eurozone's unadjusted trade surplus drops to €18.8 billion in May

Eurostat released its trade data for the Eurozone on Thursday. Eurozone's unadjusted trade surplus slid to €18.8 billion in May from €24.9 billion in April.

Exports rose at an annual rate of 3.0% in May, while imports were flat.

-

11:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E413mn), $1.0925(E342mn), $1.1000(E824mn), $1.1075(E446mn), $1.1100(E1.0bn)

USD/JPY: Y122.00($1.19bn), Y123.00($500mn), Y123.50($722mn), Y124.00($1.35bn)

GBP/USD: $1.5550(Gbp406mn)

USD/CHF: Chf0.9425($285mn)

AUD/USD: $0.7300(A$3.83bn), $0.7400(A$1.8bn), $0.7500(A$6.34bn)

NZD/USD: $0.6750(NZ$207mn)

USD/CAD: C$1.2600($1.1bn), C$1.2750-55($1.3bn), C$1.2800($355mn), C$1.2900($230mn)

-

11:18

Swiss retail sales drops 1.4% in May

The Federal Statistical Office released its retail sales data for Switzerland on Thursday. Retail sales in Switzerland dropped at an annual rate of 1.8% in May, after a 1.6% increase in April.

Sales of food, beverages and tobacco fell at an annual rate of 0.5% in May, while non-food sales plunged 2.2%.

On a monthly basis, retail sales fell by 1.4% in May, after a 2.1% increase in April. Sales of food, beverages and tobacco were down 1.2% in May, while non-food sales dropped 2.1%.

-

11:07

Federal Reserve Bank of Cleveland President Loretta Mester: the Fed could start raising its interest rate right now

Federal Reserve Bank of Cleveland President Loretta Mester said on Wednesday that the Fed could start raising its interest rate right now.

"The economy can handle an increase in the fed funds rate. A small increase in interest rates from zero is not tight monetary policy, and with the economic progress we've made and that I expect to continue, monetary policy can take a step back from the emergency measure of zero interest rates," she said.

Mester expects the U.S. economy to expand 2.75-3% by the rest of this year and next year. She added that the situation in China and Greece should have a "limited impact on the U.S. economy because our direct exposure via trade and banking is limited".

Mester is not a voting member of the Federal Open Market Committee this year.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, June 0.8% (forecast 0.8%)

-

11:00

Eurozone: Trade balance unadjusted, May 18.8

-

11:00

Eurozone: Harmonized CPI, June 0.0% (forecast 0%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, June 0.2% (forecast 0.2%)

-

10:55

Federal Reserve Bank of San Francisco President John Williams: the Fed could start to raise its interest rate this year

Federal Reserve Bank of San Francisco President John Williams reiterated Wednesday that the Fed could start to raise its interest rate this year as the U.S. economy continued to expand.

"I still believe this will be the year for lift-off, and I still believe that waiting too long to raise rates poses its own risks," he said.

But he added that he cannot tell the date.

San Francisco Fed president said that he does not expect the situation in China and Greece will have a negative impact on the U.S. economy.

Williams pointed out that lower oil prices had less of a positive impact on the U.S. economy, and the reasons are unclear.

Williams is a voting member of the Federal Open Market Committee this year.

-

10:44

Greek parliament approves reforms demanded by Greece’s creditors

The Greek parliament has approved reforms demanded by Greece's creditors in return for the third bailout programme on Wednesday. 32 Syriza members, including former finance minister Yanis Varoufakis, voted against new reforms.

Greek Prime Minster Alexis Tsipras said before the parliament that there is no alternative.

The ECB Governing Council will meet in Frankfurt on Thursday, and the German parliament on Friday votes on the resumption of talks on financial aid to Greece.

-

10:35

Beige Book: the Fed is optimistic that the U.S. economy is on right track

The Federal Reserve released its Beige Book on Wednesday. The Fed was optimistic that the U.S. economy is on right track.

According to the report, economic activity expanded in all regions.

Manufacturing activity was uneven.

Consumer spending rose, housing market was steady, while lending activity increased.

Employment was improving in each of the Fed's 12 districts, while wage pressure remained "modest".

-

10:18

International Monetary Fund urges Germany to boost its investment in its public infrastructure

The International Monetary Fund (IMF) on Wednesday urged Germany to boost its investment in its public infrastructure.

"Boosting public investment, women's employment, and competition in the services sector now would help face the challenges that loom further ahead," IMF mission chief for Germany, Enrica Detragiache, said.

The IMF expects Germany's economy to expand 1.6% in 2015 and 1.7% in 2016 due to a weaker euro and lower energy prices.

The lender forecast the German current account surplus to rise to 8.4% of gross domestic product (GDP) this year from 7.6% of GDP in 2014, caused by weak domestic demand and saving in the economy.

-

10:11

Consumer prices in New Zealand rise 0.4% in the second quarter

The Reserve Bank of New Zealand (RBNZ) released its consumer price inflation data on late Wednesday. Consumer prices in New Zealand rose 0.4% in the second quarter, missing expectations for a 0.6% gain, after a 0.3% decline in the first quarter.

On a yearly basis, consumer price inflation increased 0.3% in the second quarter, missing forecasts of the 0.4% rise, after a 0.1% gain in the first quarter.

Consumer prices slightly rose but remained below the central bank's target range of 1%-3% as prices for petrol and for international airfares remained low.

The increase in consumer price inflation was driven by higher cigarettes and tobacco prices, caused by the rise in excise duty in January.

-

09:15

Switzerland: Retail Sales Y/Y, May -1.8%

-

08:58

Foreign exchange market. Asian session: the euro remains under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 Australia Consumer Inflation Expectation July 3% 3.4%

04:00 Japan BoJ monthly economic report

The euro declined despite good news from Athens. Sources reported that Greece's parliament approved financial aid program from the euro zone. At the same time uncertainty persists and it weighs on the single currency. Today's ECB meeting and Mario Draghi's press-conference may put extra pressure on the euro. The central bank is expected to keep its monetary policy unchanged. There have not been any significant changes in macroeconomic statistics since the last ECB meeting. Data from France, Spain in Italy improved, while German economy got slightly weaker. Thus Draghi is likely to be very careful.

The Australian dollar rose against the New Zealand dollar amid positive data from Australia and disappointing reports from New Zealand. This month Australian consumer price expectations rose to 3.4% from 3.0% reported previously. The higher the expectations the greater their influence on probability of a rate hike by the Reserve Bank of Australia. Meanwhile dairy product prices declined in New Zealand and the consumer price index missed expectations.

EUR/USD: the pair declined to $1.0910 in Asian trade

USD/JPY: the pair traded around Y123.70-00

GBP/USD: the pair fell to $1.5610

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Retail Sales Y/Y May 1.6%

07:16 Switzerland Retail Sales (MoM) May 2.1%

09:00 Eurozone Trade balance unadjusted May 24.9

09:00 Eurozone Harmonized CPI June 0.2% 0%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June 0.3% 0.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) June 0.9% 0.8%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Foreign Securities Purchases May 12.94

12:30 U.S. Continuing Jobless Claims 2334 2295

12:30 U.S. Initial Jobless Claims July 297 285

14:00 U.S. NAHB Housing Market Index July 59 60

14:00 U.S. Philadelphia Fed Manufacturing Survey July 15.2 12.0

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:00 United Kingdom BOE Gov Mark Carney Speaks

20:00 U.S. Total Net TIC Flows May 106.6

20:00 U.S. Net Long-term TIC Flows May 53.9

-

08:21

Options levels on thursday, July 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1134 (909)

$1.1079 (322)

$1.1022 (92)

Price at time of writing this review: $1.0928

Support levels (open interest**, contracts):

$1.0891 (3114)

$1.0852 (4634)

$1.0800 (6051)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 46671 contracts, with the maximum number of contracts with strike price $1,1400 (3349);

- Overall open interest on the PUT options with the expiration date August, 7 is 61448 contracts, with the maximum number of contracts with strike price $1,0800 (6262);

- The ratio of PUT/CALL was 1.32 versus 1.29 from the previous trading day according to data from July, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1163)

$1.5805 (1791)

$1.5709 (928)

Price at time of writing this review: $1.5617

Support levels (open interest**, contracts):

$1.5589 (1570)

$1.5493 (1025)

$1.5395 (1166)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20115 contracts, with the maximum number of contracts with strike price $1,5750 (2502);

- Overall open interest on the PUT options with the expiration date August, 7 is 21619 contracts, with the maximum number of contracts with strike price $1,5250 (2050);

- The ratio of PUT/CALL was 1.07 versus 1.09 from the previous trading day according to data from July, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

Australia: Consumer Inflation Expectation, July 3.4%

-

01:00

Currencies. Daily history for Jul 15’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0946 -0,56%

GBP/USD $1,5633 +0,01%

USD/CHF Chf0,9518 +0,71%

USD/JPY Y123,76 +0,32%

EUR/JPY Y135,47 -0,24%

GBP/JPY Y193,46 +0,33%

AUD/USD $0,7379 -0,95%

NZD/USD $0,6694 -0,19%

USD/CAD C$1,2914 +1,42%

-

00:45

New Zealand: CPI, q/q , Quarter II 0.4% (forecast 0.6%)

-

00:45

New Zealand: CPI, y/y, Quarter II 0.3% (forecast 0.4%)

-

00:31

New Zealand: Business NZ PMI, June 55.2

-