Noticias del mercado

-

22:09

Major US stock indexes finished trading in negative territory

The main US stock indices dropped significantly amid rumors about the departure of Gary Cohn, the head of the National Economic Council, an American investment banker who for over a quarter of a century worked in the investment and financial conglomerate Goldman Sachs Group.

In addition, the number of Americans applying for unemployment benefits fell to a six-month low last week, indicating a further strengthening of the labor market that could prompt the Federal Reserve to develop a plan to begin winding down its bond portfolio. Primary applications for unemployment benefits fell by 12,000 to 232,000 people for the week ending August 12, the Ministry of Labor said.

However, the report submitted by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the manufacturing sector fell slightly in August, reaching a level of 18.9 points compared to 19.5 points in July. Economists had expected the decline to 18.5 points.

The index of leading indicators from the Conference Board (LEI) for the US increased by 0.3 percent in July to 128.3 (2010 = 100), after an increase of 0.6 percent in June and 0.3 percent in May. The index of coinciding indicators increased by 0.3 percent to 115.7 (2010 = 100), after an increase of 0.1 percent in June and 0.3 percent in May. The index of lagging indicators increased by 0.1 percent in July to 124.8 (2010 = 100), after an increase of 0.2 percent in June and 0.2 percent in May.

All components of the DOW index recorded a decline (30 out of 30). Outsider were the shares of Cisco Systems, Inc. (CSCO, -4.11%).

All sectors of the S & P index showed a drop. The greatest decrease was shown by the technological sector (-1.7%).

At closing:

DJIA -1.24% 21,750.94 -273.93

Nasdaq -1.94% 6,221.91 -123.20

S & P -1.54% 2,430.01 -38.10

-

21:00

DJIA -0.86% 21,835.11 -189.76 Nasdaq -1.46% 6,252.70 -92.41 S&P -1.10% 2,440.93 -27.18

-

16:02

U.S.: Leading Indicators , July 0.3% (forecast 0.3%)

-

15:56

Russia calls for all sides involved in N.Korea situation to show restraint, avoid reaching "point of no return" - Formin spokeswoman

-

15:47

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1650 (EUR 1.15 млрд) 1.1700 (1.08 млрд) 1.1795 (1.4 млрд) 1.1800 (1.2 млрд) 1.1850-55 (1.35 млрд) 1.1875 (1.38 млрд)

USDJPY: 109.95-00 (USD 1.86 млрд) 110.75-80 (1.3 млрд) 111.60-70 (1.15 млрд)

AUDUSD: 0.7875 (AUD 915 млн) 0.7975 (1.1 млрд)

-

15:31

U.S. Stocks open: Dow -0.24%, Nasdaq -0.41%, S&P -0.31%

-

15:23

U.S.: Industrial Production YoY , July 2.2%

-

15:21

U.S.: Industrial Production (MoM), July 0.2% (forecast 0.3%)

-

15:20

U.S.: Capacity Utilization, July 76.7% (forecast 76.7%)

-

15:14

US industrial production rose 0.2 percent in July following an increase of 0.4 percent in June

In July, manufacturing output edged down 0.1 percent; the production of motor vehicles and parts fell substantially, but that decrease was mostly offset by a net gain of 0.2 percent for other manufacturing industries. Following a six-month string of increases beginning in September 2016, factory output was little changed, on net, between February and July. The indexes for mining and utilities in July rose 0.5 percent and 1.6 percent, respectively. At 105.5 percent of its 2012 average, total industrial production was 2.2 percent above its year-earlier level.

Capacity utilization for the industrial sector was unchanged in July at 76.7 percent, a rate that is 3.2 percentage points below its long-run (1972-2016) average.

-

15:13

Before the bell: S&P futures -0.24%, NASDAQ futures -0.47%

U.S. stock-index futures fell on Thursday. The focus remained on the minutes from the latest meeting of the Federal Open Market Committee (FOMC) meeting, which were released yesterday afternoon and showed members were split on the inflation outlook. Along with the Fed minutes, the sentiment was also negatively impacted by the U.S. President Donald Trump's decision to disband two business councils after a number of members quit in protest over his comments on white nationalists.

Global Stocks:

Nikkei 19,702.63 -26.65 -0.14%

Hang Seng 27,344.22 -64.85 -0.24%

Shanghai 3,268.62 +22.17 +0.68%

S&P/ASX 5,779.21 -5.89 -0.10%

FTSE 7,403.39 -29.64 -0.40%

CAC 5,163.51 -13.10 -0.25%

DAX 12,248.63 -15.23 -0.12%

Crude $46.56 (-0.47%)

Gold $1,290.80 (+0.62%)

-

14:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

974.5

-3.68(-0.38%)

6787

American Express Co

AXP

87.11

-0.28(-0.32%)

301

Apple Inc.

AAPL

160.52

-0.43(-0.27%)

58555

AT&T Inc

T

38.08

-0.15(-0.39%)

1850

Barrick Gold Corporation, NYSE

ABX

16.99

0.08(0.47%)

23321

Boeing Co

BA

236.75

-0.84(-0.35%)

1826

Caterpillar Inc

CAT

114.07

-0.05(-0.04%)

1462

Cisco Systems Inc

CSCO

31.4

-0.94(-2.91%)

74151

Citigroup Inc., NYSE

C

67.45

-0.26(-0.38%)

10499

Exxon Mobil Corp

XOM

77.33

-0.14(-0.18%)

1200

Facebook, Inc.

FB

169.5

-0.50(-0.29%)

45147

Ford Motor Co.

F

10.78

-0.02(-0.19%)

10288

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.65

-0.12(-0.81%)

86581

General Electric Co

GE

25.04

-0.06(-0.24%)

7016

Goldman Sachs

GS

224

-1.61(-0.71%)

1673

Google Inc.

GOOG

925.1

-1.86(-0.20%)

813

Home Depot Inc

HD

151.62

-0.63(-0.41%)

1150

Intel Corp

INTC

35.65

-0.16(-0.45%)

5893

JPMorgan Chase and Co

JPM

91.7

-0.39(-0.42%)

6046

Merck & Co Inc

MRK

62.38

-0.32(-0.51%)

793

Microsoft Corp

MSFT

73.4

-0.25(-0.34%)

5666

Starbucks Corporation, NASDAQ

SBUX

53.3

-0.20(-0.37%)

1094

Tesla Motors, Inc., NASDAQ

TSLA

360.84

-2.07(-0.57%)

31994

Twitter, Inc., NYSE

TWTR

16.05

-0.11(-0.68%)

2906

Visa

V

103

-0.32(-0.31%)

1789

Wal-Mart Stores Inc

WMT

78.8

-2.18(-2.69%)

457698

Walt Disney Co

DIS

102.02

-0.18(-0.18%)

1382

Yandex N.V., NASDAQ

YNDX

30.92

-0.03(-0.10%)

660

-

14:41

Manufacturing conditions in the Philadelphia region continued to advance in August

Manufacturing conditions in the region continued to advance in August, according to firms responding to this month's Manufacturing Business Outlook Survey. The diffusion index for general activity fell slightly but continued to reflect growth.

There was a notable improvement in the new orders and shipments indexes, and overall employment expansion continued among the reporting firms. The survey's indexes of future activity indicate that firms expect a continuation of growth in the region's manufacturing sector over the next six months.

-

14:40

US initial jobless claims declined the previous week

In the week ending August 12, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 12,000 from the previous week's unrevised level of 244,000. The 4-week moving average was 240,500, a decrease of 500 from the previous week's unrevised average of 241,000.

The advance seasonally adjusted insured unemployment rate was 1.4 percent for the week ending August 5, unchanged from the previous week's unrevised rate.

-

14:33

Canadian manufacturing sales fell 1.8% to $53.9 billion in June

Manufacturing sales fell 1.8% to $53.9 billion in June, following three consecutive monthly gains. The declines were mainly due to lower sales in the petroleum and coal product, transportation equipment, and chemical industries.

Sales were down in 15 of 21 industries, representing 72.1% of the manufacturing sector in Canada. Sales of non-durable goods declined 2.2%, while sales of durable goods were down 1.5%.

Sales in the petroleum and coal product industry decreased 7.1% to $4.6 billion in June, following a 3.0% decline in May. Lower prices for petroleum and coal products (-4.1%) and lower volumes, particularly in eastern refineries, contributed to the decline in June. Constant dollar sales of petroleum and coal products fell 3.5%.

-

14:30

U.S.: Philadelphia Fed Manufacturing Survey, August 18.9 (forecast 18.5)

-

14:30

U.S.: Continuing Jobless Claims, 1953 (forecast 1953)

-

14:30

Canada: Manufacturing Shipments (MoM), June -1.8% (forecast -1%)

-

14:30

U.S.: Initial Jobless Claims, 232 (forecast 240)

-

14:09

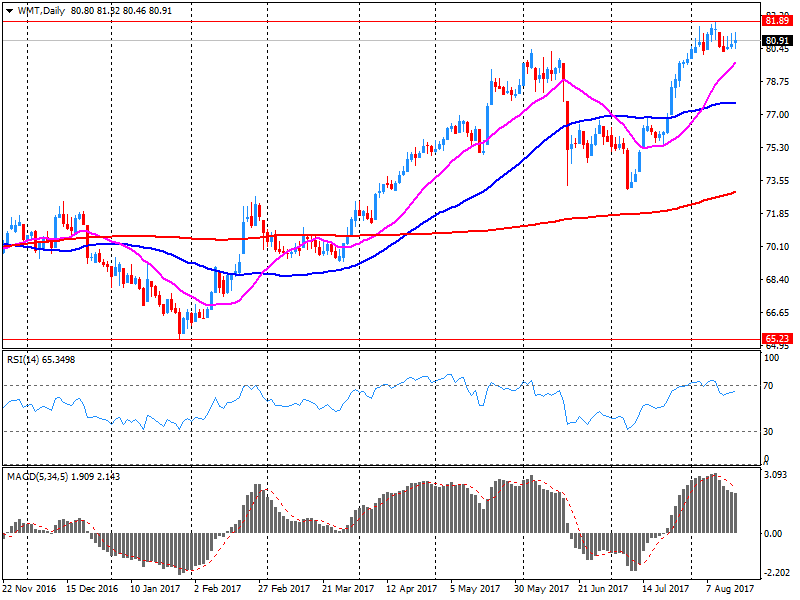

Company News: Walmart (WMT) Q2 EPS beat analysts’ estimate

Walmart (WMT) reported Q2 FY 2018 earnings of $1.08 per share (versus $1.07 in Q2 FY 2017), beating analysts' consensus estimate of $1.07.

The company's quarterly revenues amounted to $121.949 bln (+2.1% y/y), generally in-line analysts' consensus estimate of $121.858 bln.

WMT fell to $78.66 (-2.86%) in pre-market trading.

-

14:00

ECB says more favourable growth outlook increases confidence that inflation will gradually converge to target

-

Core inflation shows tentative signs of pick-up, still needs conclusive evidence of upward trend

-

A suggestion was made that consideration be given to adjustment in language

-

It was generally judged paramount to avoid signals that might prove premature, be prone to over-interpreation

-

A remark was made that expansion was increasingly self-sustaining

-

It needs to gain more space and flexibility to adjust policy and accommodation in either direction if needed

-

Still favourable financing conditions could not be taken for granted, relied to great extent on policy

-

-

13:59

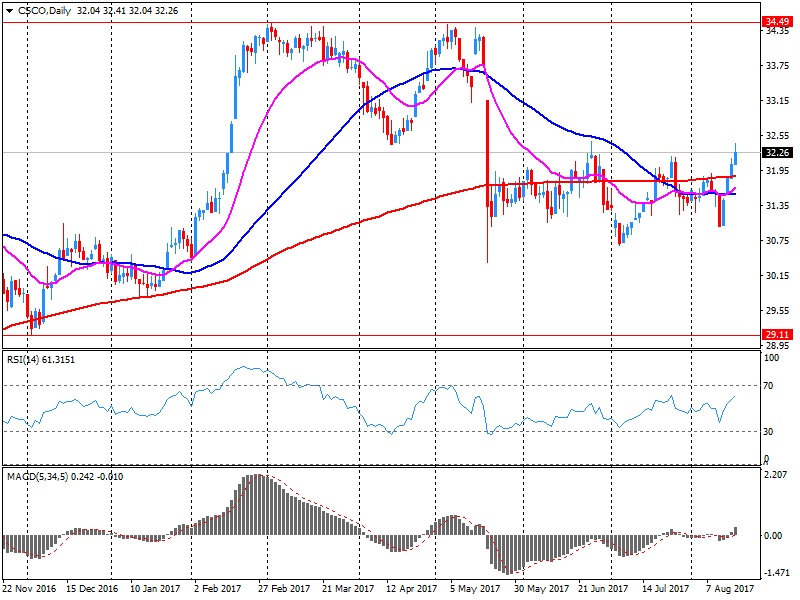

Company News: Cisco (CSCO) posts Q4 financials in line with analysts' estimates

Cisco (CSCO) reported Q4 FY 2017 earnings of $0.61 per share (versus $0.63 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $12.133 bln (-4% y/y), generally in-line analysts' consensus estimate of $12.065 bln.

CSCO fell to $31.55 (-2.44%) in pre-market trading.

-

13:58

ECB says headline inflation slightly lower than previously expected due to oil, exchange rates

-

12:15

New US ambassador to Japan says US ability to defend self and allies against North Korea is beyond question

-

11:13

Euro area trade balance surplus rose more than expected in June

The first estimate for euro area (EA19) exports of goods to the rest of the world in June 2017 was €187.2 billion, an increase of 3.9% compared with June 2016 (€180.2 bn). Imports from the rest of the world stood at €160.7 bn, a rise of 6.2% compared with June 2016 (€151.3 bn). As a result, the euro area recorded a €26.6 bn surplus in trade in goods with the rest of the world in June 2017, compared with +€28.9 bn in June 2016. Intra-euro area trade rose to €157.5 bn in June 2017, up by 3.5% compared with June 2016. These data are released by Eurostat, the statistical office of the European Union.

-

11:12

Euro area annual inflation was 1.3% in July, stable compared with June

Euro area annual inflation was 1.3% in July 2017, stable compared with June 2017. In July 2016 the rate was 0.2%. European Union annual inflation was 1.5% in July 2017, also stable compared to June 2017. A year earlier the rate was 0.2%. These figures come from Eurostat, the statistical office of the European Union. The lowest annual rates were registered in Ireland (-0.2%), Cyprus (-0.1%), Bulgaria and Finland (both 0.6%). The highest annual rates were recorded in Lithuania (4.1%), Estonia (3.9%), Latvia and the United Kingdom (both 2.6%). Compared with June 2017, annual inflation fell in four Member States, remained stable in eight and rose in sixteen. The largest upward impacts to the euro area annual inflation came from accommodation services (+0.10 percentage points), package holidays (+0.06 pp) and air transport (+0.05 pp), while telecommunication (-0.11 pp), vegetables (-0.05 pp) and fruit (-0.04 pp) had the biggest downward impacts.

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, July 1.2% (forecast 1.2%)

-

11:00

Eurozone: Trade balance unadjusted, June 26.6 (forecast 22.9)

-

11:00

Eurozone: Harmonized CPI, July -0.5% (forecast -0.5%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, July 1.3% (forecast 1.3%)

-

10:39

UK retail sales rose a little more than expected in July. GBP/USD retreat

In July 2017, the quantity bought (volume) in retail sales increased by 0.3% compared with the previous month, due to strong sales in food stores at 1.5%; recovering from a fall of 1.1% in June 2017.

All other sectors except food and household goods stores declined on the month for the quantity bought in retail sales.

The underlying pattern in the quantity bought, measured by the 3 month on 3 month estimate, shows an increase of 0.6%.

The quantity bought increased by 1.3% compared with July 2016; the 51st consecutive year-on-year increase in retail sales since April 2013.

Online sales increased year-on-year by 15.1% and by 0.3% on the month, accounting for approximately 16.0% of all retail spending.

-

10:30

United Kingdom: Retail Sales (YoY) , July 1.3% (forecast 1.4%)

-

10:30

United Kingdom: Retail Sales (MoM), July 0.3% (forecast 0.2%)

-

10:17

New US ambassador to Japan says all options in dealing with North Korea remain on the table

-

Looks forward to seeing North Korea dial back its rhetoric

-

-

09:45

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1650 (EUR 1.15bln) 1.1700 (1.08bln) 1.1795 (1.4bln) 1.1800 (1.2bln) 1.1850-55 (1.35bln) 1.1875 (1.38bln)

USDJPY: 109.95-00 (USD 1.86bln) 110.75-80 (1.3bln) 111.60-70 (1.15bln)

AUDUSD: 0.7875 (AUD 915m) 0.7975 (1.1bln)

-

09:43

U.S. 10-year treasuries yield at 2.234 percent vs U.S. close of 2.225 percent on wednesday

-

09:43

Britain is confident that it will make sufficient progress in Brexit talks with the EU by october to move to next phase - Brexit department

-

09:41

Major European stock exchanges trading in the red zone: FTSE 7419.00 -14.03 -0.19%, DAX 12228.01 -35.85 -0.29%, CAC 5163.71 -12.90 -0.25%

-

08:47

Negative start of trading expected on the main European stock markets: DAX -0.2%, CAC 40 without change, FTSE 100 + 0.1%

-

08:32

S.Korea, U.S. discuss possible revision to missile pact @zerohedge

-

08:31

UK is said to allow EU Migrants into UK Post-brexit: Times

-

08:30

Australian unemployment rate stable at 5.6% in July

-

Employment increased 26,000 to 12,196,900.

-

Unemployment decreased 1,800 to 726,000.

-

Unemployment rate remained steady at 5.6%.

-

Participation rate increased by less than 0.1 pts, but remained at 65.0% in rounded terms.

-

Monthly hours worked in all jobs increased 5.2 million hours (0.3%) to 1,696.4 million hours.

Seasonally adjusted estimates (monthly change)

-

Employment increased 27,900 to 12,201,400. Full-time employment decreased 20,300 to 8,342,300 and part-time employment increased 48,200 to 3,859,100.

-

Unemployment increased 1,100 to 730,600. The number of unemployed persons looking for full-time work decreased 3,800 to 496,400 and the number of unemployed persons only looking for part-time work increased 4,900 to 234,200.

-

Unemployment rate decreased by less than 0.1 pts to 5.6%

-

Participation rate increased by 0.1 pts to 65.1%.

-

Monthly hours worked in all jobs decreased 14.4 million hours (0.8%) to 1,690.4 million hours.

-

-

08:27

Fed policymakers held wide-ranging debates over inflation outlook, stock prices and financial stability - july 25-26 policy meeting minutes

-

Policymakers disagreed on whether inflation expectations were well-anchored

-

Agreed a fall in longer-term inflation expectations would be undesirable

-

Voting policymakers were concerned about slowdown in inflation and agreed to monitor prices closely

-

Some voting policymakers said further interest rate hikes should wait until there were signs inflation would rise to fed's 2 pct target

-

Several policymakers noted rising stock prices had eased financial conditions

-

A couple policymakers said high stock prices might not pose big risks to financial stability

-

A couple policymakers saw pace of price gains in multi-family real estate and lending activity of certain government-sponsored firms as possible sources of financial instability

-

-

08:22

Options levels on thursday, August 17, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1893 (3139)

$1.1869 (1958)

$1.1833 (1683)

Price at time of writing this review: $1.1772

Support levels (open interest**, contracts):

$1.1718 (1393)

$1.1696 (2485)

$1.1670 (3198)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 8 is 126329 contracts (according to data from August, 16) with the maximum number of contracts with strike price $1,1600 (5046);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3085 (1518)

$1.3049 (3163)

$1.2990 (1073)

Price at time of writing this review: $1.2897

Support levels (open interest**, contracts):

$1.2808 (2045)

$1.2781 (2695)

$1.2748 (1965)

Comments:

- Overall open interest on the CALL options with the expiration date September, 8 is 31714 contracts, with the maximum number of contracts with strike price $1,3150 (3206);

- Overall open interest on the PUT options with the expiration date September, 8 is 27068 contracts, with the maximum number of contracts with strike price $1,2850 (2695);

- The ratio of PUT/CALL was 0.85 versus 0.86 from the previous trading day according to data from August, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:39

Global Stocks

Equities extended this week's gains a bit further early Thursday as minutes of the Federal Reserve's meeting revealed a deeper-than-expected divide on the timing of the next interest rate increase. The prospect of a slower pace of additional rate increases pressured the dollar in Wednesday afternoon U.S. trading, and the subsequent gain in the yen weighed on Japanese stocks early Thursday.

European stocks pushed higher Wednesday, with stocks continuing to recover after the flare-up in tensions between the U.S. and North Korea and big exporters getting a boost from a weaker euro. The Stoxx Europe 600 index SXXP, +0.69% picked up 0.7% to close at 379.09, logging a third straight day of gains.

U.S. stocks closed moderately higher Wednesday, restoring the Dow above the psychologically-important 22,000 mark, after Federal Reserve minutes suggested that the central bank is wrestling with sluggish inflation but eager to commence an unwind of its $4.5 trillion asset portfolio.

-

03:30

Australia: Unemployment rate, July 5.6% (forecast 5.6%)

-

03:30

Australia: Changing the number of employed, July 27.9 (forecast 20)

-

01:51

Japan: Trade Balance Total, bln, July 419 (forecast 392)

-

00:47

New Zealand: PPI Output (QoQ) , Quarter II 1.3% (forecast 0.7%)

-

00:46

New Zealand: PPI Input (QoQ), Quarter II 1.4% (forecast 0.9%)

-

00:24

Commodities. Daily history for Aug 16’2017:

(raw materials / closing price /% change)

Oil 46.77 -0.02%

Gold 1,288.80 +0.46%

-

00:22

Stocks. Daily history for Aug 16’2017:

(index / closing price / change items /% change)

Nikkei -24.03 19729.28 -0.12%

TOPIX -0.21 1616.00 -0.01%

Hang Seng +234.11 27409.07 +0.86%

CSI 300 -4.64 3701.42 -0.13%

Euro Stoxx 50 +22.66 3484.57 +0.65%

FTSE 100 +49.18 7433.03 +0.67%

DAX +86.82 12263.86 +0.71%

CAC 40 +36.36 5176.61 +0.71%

DJIA +25.88 22024.87 +0.12%

S&P 500 +3.50 2468.11 +0.14%

NASDAQ +12.10 6345.11 +0.19%

-

00:21

Currencies. Daily history for Aug 16’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1770 +0,31%

GBP/USD $1,2887 +0,14%

USD/CHF Chf0,9652 -0,70%

USD/JPY Y110,11 -0,42%

EUR/JPY Y129,61 -0,11%

GBP/JPY Y141,91 -0,27%

AUD/USD $0,7928 +1,35%

NZD/USD $0,7311 +1,00%

USD/CAD C$1,2616 -1,08%

-

00:05

Schedule for today, Thursday, Aug 17’2017 (GMT0)

01:30 Australia Unemployment rate July 5.6% 5.6%

01:30 Australia Changing the number of employed July 14.0 20

08:30 United Kingdom Retail Sales (MoM) July 0.6% 0.2%

08:30 United Kingdom Retail Sales (YoY) July 2.9% 1.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 1.1% 1.2%

09:00 Eurozone Harmonized CPI July 0% -0.5%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) July 1.3% 1.3%

09:00 Eurozone Trade balance unadjusted June 21.4 22.9

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Manufacturing Shipments (MoM) June 1.1% -1%

12:30 U.S. Continuing Jobless Claims 1951 1953

12:30 U.S. Philadelphia Fed Manufacturing Survey August 19.5 18.5

12:30 U.S. Initial Jobless Claims 244 240

13:15 U.S. Capacity Utilization July 76.6% 76.7%

13:15 U.S. Industrial Production YoY July 2%

13:15 U.S. Industrial Production (MoM) July 0.4% 0.3%

14:00 U.S. Leading Indicators July 0.6% 0.3%

16:30 U.S. FOMC Member Kaplan Speak

-