Noticias del mercado

-

22:09

Major US stock indexes finished trading in negative territory

The main US stock indices dropped significantly amid rumors about the departure of Gary Cohn, the head of the National Economic Council, an American investment banker who for over a quarter of a century worked in the investment and financial conglomerate Goldman Sachs Group.

In addition, the number of Americans applying for unemployment benefits fell to a six-month low last week, indicating a further strengthening of the labor market that could prompt the Federal Reserve to develop a plan to begin winding down its bond portfolio. Primary applications for unemployment benefits fell by 12,000 to 232,000 people for the week ending August 12, the Ministry of Labor said.

However, the report submitted by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the manufacturing sector fell slightly in August, reaching a level of 18.9 points compared to 19.5 points in July. Economists had expected the decline to 18.5 points.

The index of leading indicators from the Conference Board (LEI) for the US increased by 0.3 percent in July to 128.3 (2010 = 100), after an increase of 0.6 percent in June and 0.3 percent in May. The index of coinciding indicators increased by 0.3 percent to 115.7 (2010 = 100), after an increase of 0.1 percent in June and 0.3 percent in May. The index of lagging indicators increased by 0.1 percent in July to 124.8 (2010 = 100), after an increase of 0.2 percent in June and 0.2 percent in May.

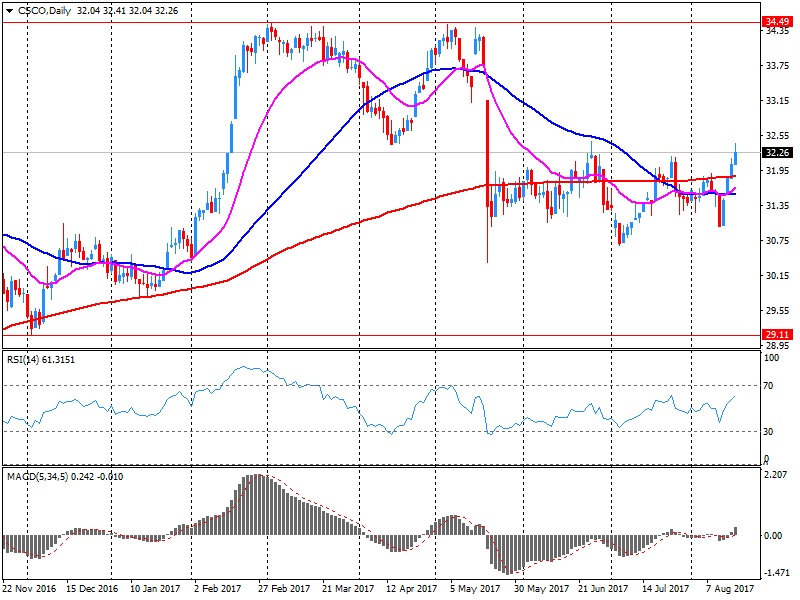

All components of the DOW index recorded a decline (30 out of 30). Outsider were the shares of Cisco Systems, Inc. (CSCO, -4.11%).

All sectors of the S & P index showed a drop. The greatest decrease was shown by the technological sector (-1.7%).

At closing:

DJIA -1.24% 21,750.94 -273.93

Nasdaq -1.94% 6,221.91 -123.20

S & P -1.54% 2,430.01 -38.10

-

21:00

DJIA -0.86% 21,835.11 -189.76 Nasdaq -1.46% 6,252.70 -92.41 S&P -1.10% 2,440.93 -27.18

-

15:31

U.S. Stocks open: Dow -0.24%, Nasdaq -0.41%, S&P -0.31%

-

15:13

Before the bell: S&P futures -0.24%, NASDAQ futures -0.47%

U.S. stock-index futures fell on Thursday. The focus remained on the minutes from the latest meeting of the Federal Open Market Committee (FOMC) meeting, which were released yesterday afternoon and showed members were split on the inflation outlook. Along with the Fed minutes, the sentiment was also negatively impacted by the U.S. President Donald Trump's decision to disband two business councils after a number of members quit in protest over his comments on white nationalists.

Global Stocks:

Nikkei 19,702.63 -26.65 -0.14%

Hang Seng 27,344.22 -64.85 -0.24%

Shanghai 3,268.62 +22.17 +0.68%

S&P/ASX 5,779.21 -5.89 -0.10%

FTSE 7,403.39 -29.64 -0.40%

CAC 5,163.51 -13.10 -0.25%

DAX 12,248.63 -15.23 -0.12%

Crude $46.56 (-0.47%)

Gold $1,290.80 (+0.62%)

-

14:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

974.5

-3.68(-0.38%)

6787

American Express Co

AXP

87.11

-0.28(-0.32%)

301

Apple Inc.

AAPL

160.52

-0.43(-0.27%)

58555

AT&T Inc

T

38.08

-0.15(-0.39%)

1850

Barrick Gold Corporation, NYSE

ABX

16.99

0.08(0.47%)

23321

Boeing Co

BA

236.75

-0.84(-0.35%)

1826

Caterpillar Inc

CAT

114.07

-0.05(-0.04%)

1462

Cisco Systems Inc

CSCO

31.4

-0.94(-2.91%)

74151

Citigroup Inc., NYSE

C

67.45

-0.26(-0.38%)

10499

Exxon Mobil Corp

XOM

77.33

-0.14(-0.18%)

1200

Facebook, Inc.

FB

169.5

-0.50(-0.29%)

45147

Ford Motor Co.

F

10.78

-0.02(-0.19%)

10288

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.65

-0.12(-0.81%)

86581

General Electric Co

GE

25.04

-0.06(-0.24%)

7016

Goldman Sachs

GS

224

-1.61(-0.71%)

1673

Google Inc.

GOOG

925.1

-1.86(-0.20%)

813

Home Depot Inc

HD

151.62

-0.63(-0.41%)

1150

Intel Corp

INTC

35.65

-0.16(-0.45%)

5893

JPMorgan Chase and Co

JPM

91.7

-0.39(-0.42%)

6046

Merck & Co Inc

MRK

62.38

-0.32(-0.51%)

793

Microsoft Corp

MSFT

73.4

-0.25(-0.34%)

5666

Starbucks Corporation, NASDAQ

SBUX

53.3

-0.20(-0.37%)

1094

Tesla Motors, Inc., NASDAQ

TSLA

360.84

-2.07(-0.57%)

31994

Twitter, Inc., NYSE

TWTR

16.05

-0.11(-0.68%)

2906

Visa

V

103

-0.32(-0.31%)

1789

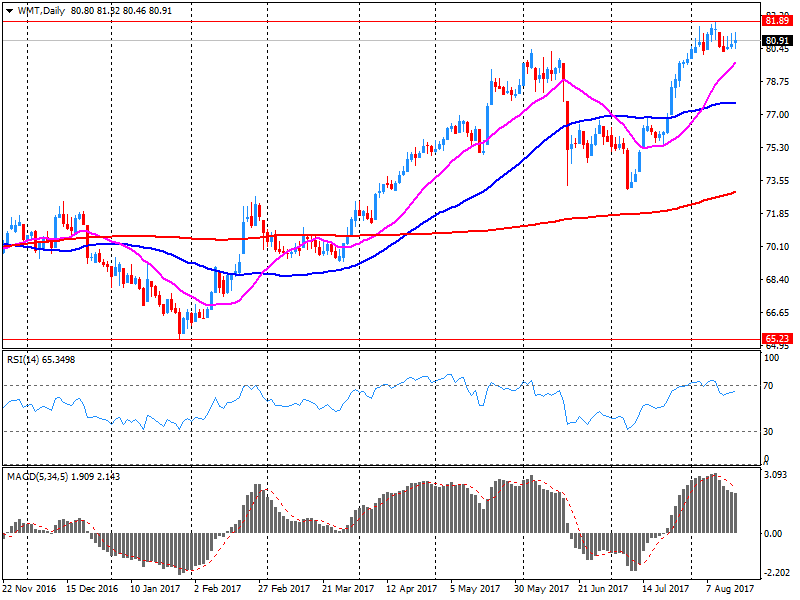

Wal-Mart Stores Inc

WMT

78.8

-2.18(-2.69%)

457698

Walt Disney Co

DIS

102.02

-0.18(-0.18%)

1382

Yandex N.V., NASDAQ

YNDX

30.92

-0.03(-0.10%)

660

-

14:09

Company News: Walmart (WMT) Q2 EPS beat analysts’ estimate

Walmart (WMT) reported Q2 FY 2018 earnings of $1.08 per share (versus $1.07 in Q2 FY 2017), beating analysts' consensus estimate of $1.07.

The company's quarterly revenues amounted to $121.949 bln (+2.1% y/y), generally in-line analysts' consensus estimate of $121.858 bln.

WMT fell to $78.66 (-2.86%) in pre-market trading.

-

13:59

Company News: Cisco (CSCO) posts Q4 financials in line with analysts' estimates

Cisco (CSCO) reported Q4 FY 2017 earnings of $0.61 per share (versus $0.63 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $12.133 bln (-4% y/y), generally in-line analysts' consensus estimate of $12.065 bln.

CSCO fell to $31.55 (-2.44%) in pre-market trading.

-

09:41

Major European stock exchanges trading in the red zone: FTSE 7419.00 -14.03 -0.19%, DAX 12228.01 -35.85 -0.29%, CAC 5163.71 -12.90 -0.25%

-

08:47

Negative start of trading expected on the main European stock markets: DAX -0.2%, CAC 40 without change, FTSE 100 + 0.1%

-

07:39

Global Stocks

Equities extended this week's gains a bit further early Thursday as minutes of the Federal Reserve's meeting revealed a deeper-than-expected divide on the timing of the next interest rate increase. The prospect of a slower pace of additional rate increases pressured the dollar in Wednesday afternoon U.S. trading, and the subsequent gain in the yen weighed on Japanese stocks early Thursday.

European stocks pushed higher Wednesday, with stocks continuing to recover after the flare-up in tensions between the U.S. and North Korea and big exporters getting a boost from a weaker euro. The Stoxx Europe 600 index SXXP, +0.69% picked up 0.7% to close at 379.09, logging a third straight day of gains.

U.S. stocks closed moderately higher Wednesday, restoring the Dow above the psychologically-important 22,000 mark, after Federal Reserve minutes suggested that the central bank is wrestling with sluggish inflation but eager to commence an unwind of its $4.5 trillion asset portfolio.

-

00:22

Stocks. Daily history for Aug 16’2017:

(index / closing price / change items /% change)

Nikkei -24.03 19729.28 -0.12%

TOPIX -0.21 1616.00 -0.01%

Hang Seng +234.11 27409.07 +0.86%

CSI 300 -4.64 3701.42 -0.13%

Euro Stoxx 50 +22.66 3484.57 +0.65%

FTSE 100 +49.18 7433.03 +0.67%

DAX +86.82 12263.86 +0.71%

CAC 40 +36.36 5176.61 +0.71%

DJIA +25.88 22024.87 +0.12%

S&P 500 +3.50 2468.11 +0.14%

NASDAQ +12.10 6345.11 +0.19%

-