Noticias del mercado

-

21:00

Dow +0.47% 17,816.03 +83.28 Nasdaq +0.54% 5,101.20 +27.56 S&P +0.31% 2087.71 +6.47

-

18:09

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Friday, with the S&P 500 on track for its best week in a year, as healthcare and consumer stocks rose.

The Dow Jones industrial average turned positive for the year, led by a 4.6% rise in Nike (NKE) which announced a $12 billion share buyback and share split.

Healthcare was the top gainer among the 10 major S&P sectors, led by Allergan's (AGN) 3.3% increase. The drugmaker rose on reports that the U.S. Treasury's new tax inversion rules were unlikely to thwart its proposed deal with Pfizer (PFE).

Most of Dow stocks in positive area (22 of 30). Top looser - Chevron Corporation (CVX, -0.97%). Top gainer - NIKE, Inc. (NKE +4.31%).

Most of S&P index sectors also in positive area. Top looser - Basic Materials (-0.6%). Top gainer - Conglomerates (+1,6%).

At the moment:

Dow 17804.00 +97.00 +0.55%

S&P 500 2087.75 +8.50 +0.41%

Nasdaq 100 4678.75 +18.75 +0.40%

Oil 41.77 +0.05 +0.12%

Gold 1077.20 -0.70 -0.06%

U.S. 10yr 2.24 -0.01

-

18:00

European stocks closed: FTSE 100 6,334.63 +4.70 +0.07% CAC 40 4,910.97 -4.13 -0.08% DAX 11,119.83 +34.39 +0.31%

-

18:00

European stocks close: stocks closed mixed on speeches by the European Central Bank (ECB) officials

Stock indices closed mixed on speeches by the European Central Bank (ECB) officials. The ECB President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

The ECB Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices. He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

Meanwhile, the economic data from the Eurozone was positive. The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index increased to -6.0 in November from -7.6 in October, beating expectations for a rise to -7.5%. October's figure was revised up from -7.7%.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,334.63 +4.70 +0.07 %

DAX 11,119.83 +34.39 +0.31 %

CAC 40 4,910.97 -4.13 -0.08 %

-

17:50

WSE: Session Results

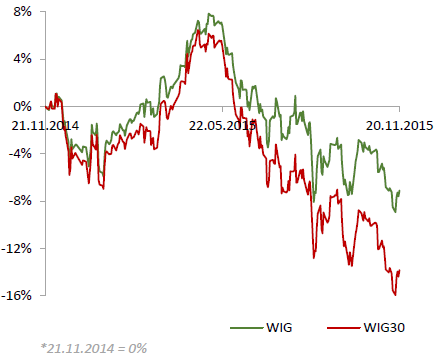

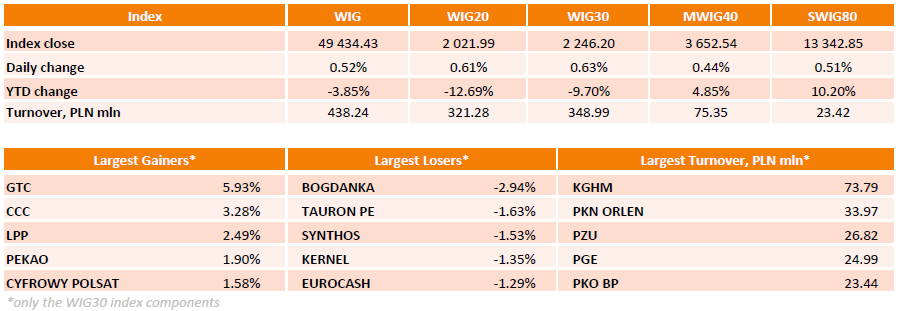

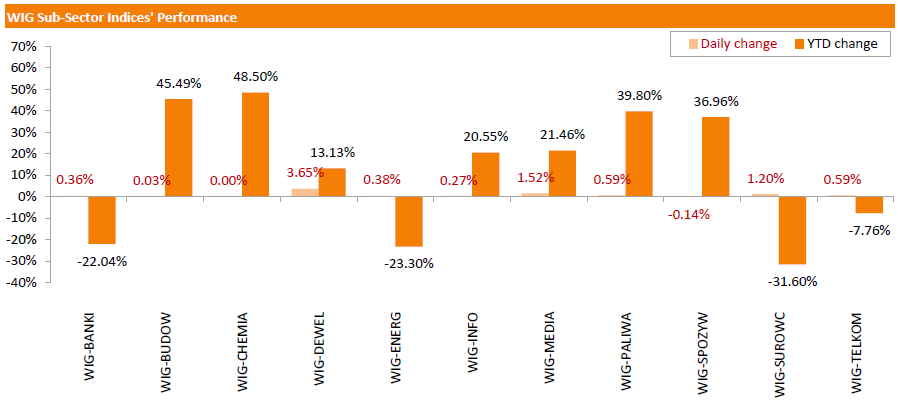

Polish equity market closed higher on Friday. The broad market measure, the WIG index, advanced 0.52%. All sectors, but for food sector (-0.14%), did well with developers sector (+3.65%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 0.63%. In the index basket, developer GTC (WSE: GTC) generated the biggest positive return, soaring by 5.93% on news the company bought property in Budapest for EUR 52 mln. Retailers CCC (WSE: CCC) and LPP (WSE: LPP) also were among top performers, adding 3.28% and 2.49% respectively. On the other side of the ledger, coal miner BOGDANKA (WSE: LWB) led the decliners with a 2.94% drop, followed by utilities name TAURON PE (WSE: TPE) and chemicals name SYNTHOS (WSE: SNS), falling by 1.63% and 1.53% respectively.

-

17:48

Oil prices trade mixed

Oil prices traded mixed. The possible interest rate hike by the Fed, a stronger U.S. dollar and concerns over the global oil oversupply weighed on oil prices.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs increased by 2 rigs to 574 last week. It was the first rise in 11 weeks.

WTI crude oil for December delivery dropped to $40.21 a barrel on the New York Mercantile Exchange.

Brent crude oil for December rose to $44.57 a barrel on ICE Futures Europe.

-

17:35

St. Louis Fed President James Bullard: the U.S. inflation will reach 2% target by the end of 2016

St. Louis Fed President James Bullard said in a speech on Friday that the U.S. inflation will reach 2% target by the end of 2016.

"Let's suppose that oil prices stabilize at the current level and stay around that level for several years. Let's further suppose that all other prices continue to increase at the same pace as they have during 2015 so far. Under such a scenario, the headline consumer price index inflation rate at the end of 2016 would be more than 2%," he said.

Bullard also said that the probability of a hard landing in China is low now, and that the U.S. labour market "largely normalized".

-

17:26

Gold price falls on a stronger U.S. dollar

Gold price declined on a stronger U.S. dollar. The greenback rose against other currencies on speculation that the Fed will start raising its interest rate next month. Yesterday's speeches by the Atlanta Fed President Dennis Lockhart and the Fed Vice Chairman Stanley Fischer added to this speculation.

Atlanta Fed President Dennis Lockhart said on Thursday that the Fed should raise its interest rate soon.

The Fed Vice Chairman Stanley Fischer said on Thursday that the Fed has done everything to prepare markets for the possible interest rate hike.

December futures for gold on the COMEX today fell to 1078.00 dollars per ounce.

-

16:47

China’s leading economic index climbs 0.6% in October

The Conference Board released its leading economic index (LEI) for China on Thursday. The leading economic index climb 0.6% in October, after a 1.6% gain in September.

The index was mainly driven by total loans issued by financial institutions.

The coincident economic index rose 2.0% in October, after a 1.5% drop in September.

-

16:32

Eurozone’s preliminary consumer confidence index increases to -6.0 in November

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index increased to -6.0 in November from -7.6 in October, beating expectations for a rise to -7.5%. October's figure was revised up from -7.7%.

European Union's consumer confidence index climbed by 1.3 points to -4.4 in November.

-

16:12

Greece’s current account surplus falls to €0.84 billion in September

The Bank of Greece released its current account data on Friday. Greece's current account surplus fell to €0.84 billion in September from €2.09 billion in September last year.

The Greek deficit on trade in goods declined to €1.4 billion in September from €2.1 billion in September last year, while the services surplus fell to €2.3 billion from €2.8 billion.

The surplus on primary income increased to €55.8 million in September from €2.8 million in September last year, while the deficit on secondary income declined to €37.1 million from €50.0 million last year.

The capital account surplus rose to €61.2 in September from 56.7 last year.

-

16:02

Eurozone: Consumer Confidence, November -6 (forecast -7.5)

-

15:34

U.S. Stocks open: Dow +0.52%, Nasdaq +0.44%, S&P +0.39%

-

15:24

Before the bell: S&P futures +0.35%, NASDAQ futures +0.31%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 19,879.81 +20.00 +0.10%

Hang Seng 22,754.72 +254.50 +1.13%

Shanghai Composite 3,630.82 +13.76 +0.38%

FTSE 6,348.31 +18.38 +0.29%

CAC 4,919.23 +4.13 +0.08%

DAX 11,132.37 +46.93 +0.42%

Crude oil $40.11 (-1.06%)

Gold $1080.90 (+0.28%)

-

15:02

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

131.28

4.37%

42.8K

ALCOA INC.

AA

8.86

1.14%

40.5K

Twitter, Inc., NYSE

TWTR

26.55

0.87%

9.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.48

0.83%

5.7K

Barrick Gold Corporation, NYSE

ABX

7.60

0.80%

23.6K

Walt Disney Co

DIS

119.37

0.56%

6.0K

Tesla Motors, Inc., NASDAQ

TSLA

223.05

0.56%

3.3K

International Business Machines Co...

IBM

137.49

0.55%

3.6K

Facebook, Inc.

FB

106.82

0.53%

70.0K

Intel Corp

INTC

34.48

0.52%

29.4K

Pfizer Inc

PFE

32.45

0.50%

1.2K

Google Inc.

GOOG

742.00

0.49%

9.8K

Ford Motor Co.

F

14.64

0.48%

9.7K

Home Depot Inc

HD

127.44

0.46%

1.6K

General Electric Co

GE

30.40

0.43%

37.6K

ALTRIA GROUP INC.

MO

57.70

0.42%

2.2K

JPMorgan Chase and Co

JPM

67.94

0.41%

25.1K

Starbucks Corporation, NASDAQ

SBUX

61.70

0.39%

4.2K

AT&T Inc

T

33.74

0.36%

1.9K

Amazon.com Inc., NASDAQ

AMZN

663.56

0.35%

7.5K

UnitedHealth Group Inc

UNH

111.00

0.33%

1.5K

Microsoft Corp

MSFT

54.12

0.33%

10.0K

Wal-Mart Stores Inc

WMT

60.90

0.33%

0.3K

Exxon Mobil Corp

XOM

80.55

0.31%

3.7K

Cisco Systems Inc

CSCO

27.45

0.29%

1.7K

Yahoo! Inc., NASDAQ

YHOO

32.72

0.29%

4.3K

Visa

V

80.36

0.26%

1.2K

Citigroup Inc., NYSE

C

55.20

0.25%

48.0K

The Coca-Cola Co

KO

43.20

0.21%

2.7K

Verizon Communications Inc

VZ

45.85

0.20%

3.2K

Chevron Corp

CVX

90.99

0.18%

6.8K

Boeing Co

BA

149.50

0.17%

10.5K

Apple Inc.

AAPL

118.96

0.15%

82.0K

Deere & Company, NYSE

DE

75.05

0.15%

1.0K

Caterpillar Inc

CAT

70.08

0.09%

0.5K

Hewlett-Packard Co.

HPQ

13.70

-0.65%

0.2K

-

14:52

Canadian retail sales slide by 0.5% in September

Statistics Canada released retail sales data on Friday. Canadian retail sales plunged by 0.5% in September, missing expectations for a 0.2% gain, after a 0.5% increase in August.

The decline was mainly driven by lower sales at gasoline stations. Sales at gasoline stations declined 3.7% in September.

Motor vehicle and parts sales decreased 0.5% in September, while sales at furniture and home furnishings stores were down 1.2%.

Sales at food and beverage stores were up 0.1% in September.

Sales fell in 8 of 11 subsectors.

Canadian retail sales excluding automobiles dropped 0.5% in September, missing expectations for a 0.2% decline, after a flat reading in August.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 436m) 123.50 (485m) 124.00 (1.67bln)

EUR/USD 1.0600 (EUR 2.3bln) 1.0700 (1.3bln) 1.0735 (1.4bln) 1.0750 (421m) 1.0765 (1.1bln) 1.0815 (1.6bln)

AUD/USD 0.7050 (AUD 530m) 0.7075 (202m) 0.7150 (260m)

NZD/USD 0.6400 (NZD 695m)

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Market Outperform from Market Perform at JMP Securities

Downgrades:

Other:

UnitedHealth (UNH) target lowered to $131 from $155 at Mizuho

Intel (INTC) target raised to $38 from $36 at Topeka Capital Markets

Intel (INTC) target raised to $35 from $34 at RBC Capital Markets

IBM (IBM) initiated with a Market Outperform at JMP Securities; target $167

-

14:42

Canadian consumer price inflation rises 0.1% in October

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.1% in October, in line with expectations, after a 0.2% decline in September.

The monthly increase was mainly driven by a rise in clothing and footwear prices, which climbed 1.0% in October.

On a yearly basis, the consumer price index remained unchanged at 1.0% in October, in line with expectations.

The consumer price index was partly driven by higher food prices. Food prices climbed 4.1% year-on-year in October, while transportation prices decreased 3.2%.

The index for recreation, education and reading climbed by 1.9% in October from the same month a year earlier, the shelter index gained 1.1%, while gasoline prices dropped 17.1%.

The Canadian core consumer price index, which excludes some volatile goods, rose 0.3% in October, after a 0.2% gain in September.

On a yearly basis, core consumer price index in Canada remained unchanged at 2.1% in October, in beating expectations for a fall to 2.0%.

The Bank of Canada's inflation target is 2.0%.

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, October 2.1% (forecast 2%)

-

14:30

Canada: Retail Sales, m/m, September -0.5% (forecast 0.2%)

-

14:30

Canada: Consumer price index, y/y, October 1.0% (forecast 1%)

-

14:30

Canada: Consumer Price Index m / m, October 0.1% (forecast 0.1%)

-

14:30

Canada: Retail Sales ex Autos, m/m, September -0.5% (forecast -0.2%)

-

14:30

Canada: Retail Sales YoY, September 1.2%

-

14:12

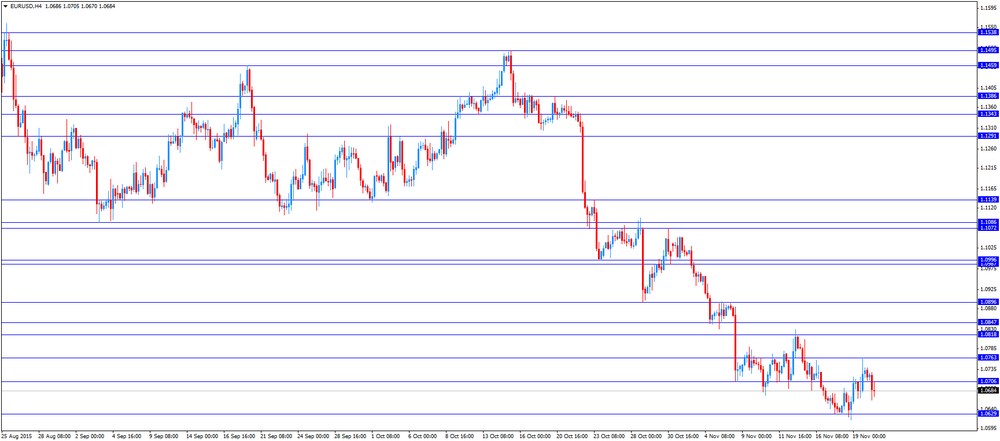

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (YoY) October -2.1% -2% -2.3%

07:00 Germany Producer Price Index (MoM) October -0.4% -0.2% -0.4%

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October 8.33 Revised From 8.63 5.5 7.47

10:15 Eurozone ECB's Jens Weidmann Speaks

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

The ECB Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices. He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

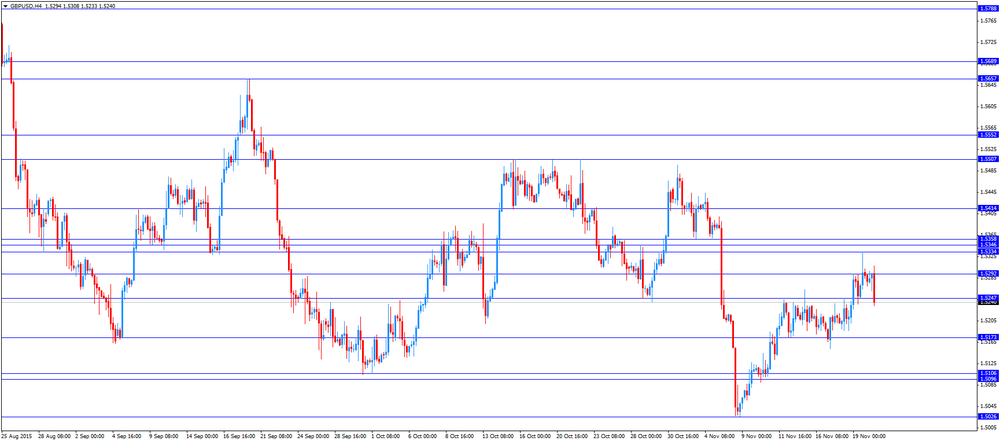

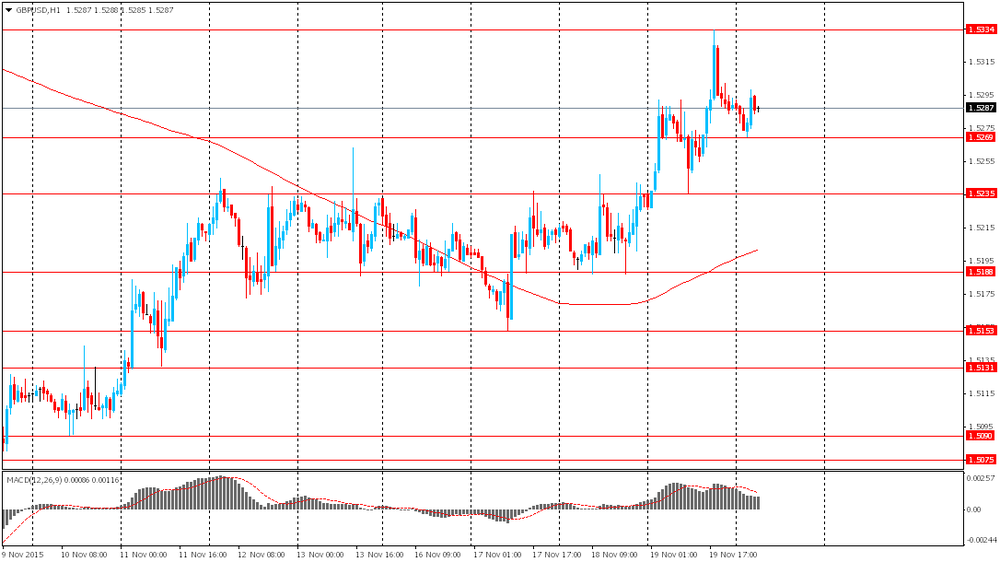

The British pound traded lower against the U.S. dollar. The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the economic data from Canada. The consumer price index in Canada is expected to remain unchanged at 1.0% year-on-year in October.

The core consumer price index in Canada is expected to decline to 2.0% year-on-year in October from 2.1% in September.

Canadian retail sales are expected to increase 0.2% in September, after a 0.5% rise in August.

EUR/USD: the currency pair decreased to $1.0663

GBP/USD: the currency pair fell to $1.5233

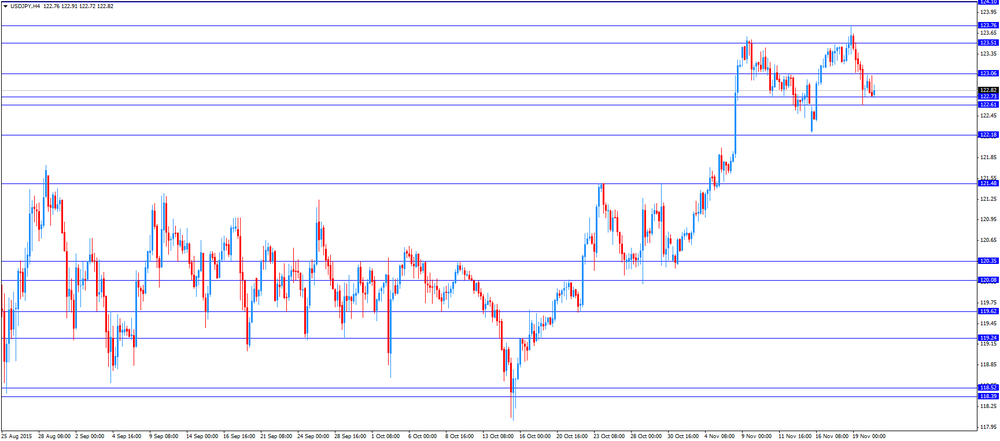

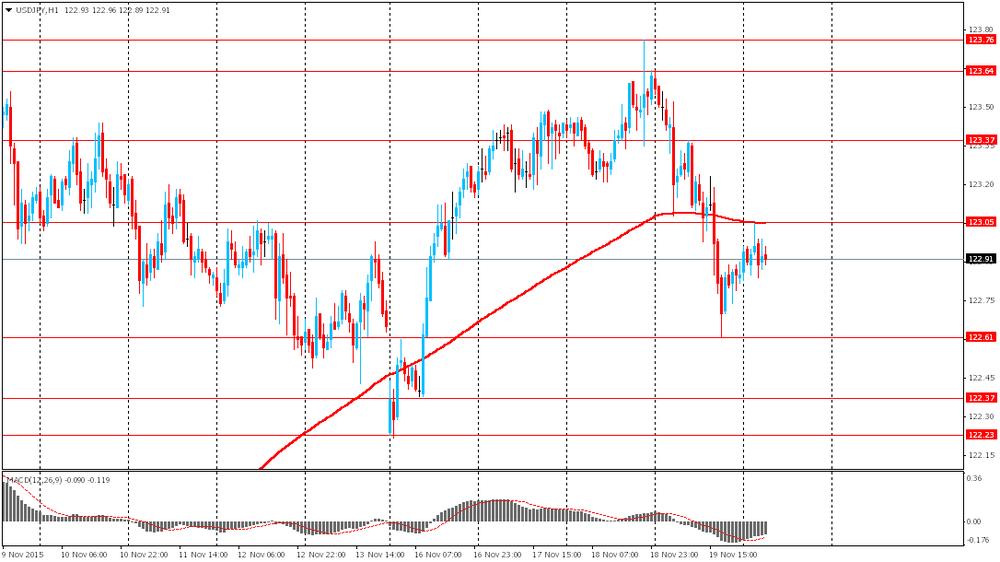

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m September 0.5% 0.2%

13:30 Canada Retail Sales YoY September 2.8%

13:30 Canada Retail Sales ex Autos, m/m September 0% -0.2%

13:30 Canada Consumer Price Index m / m October -0.2% 0.1%

13:30 Canada Consumer price index, y/y October 1.0% 1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October 2.1% 2%

15:00 Eurozone Consumer Confidence (Preliminary) November -7.7 -7.5

16:15 U.S. FOMC Member Dudley Speak

-

13:50

Orders

EUR/USD

Offers 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800 1.0830 1.08500

Bids 1.0680-85 1.0665 1.0650 1.0630-35 1.0620 1.0600 1.0580 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5300 1.5325-30 1.5350 1.5380 1.5400 1.5420 1.5435 1.5450

Bids 1.5250-60 1.5220-25 1.5200 1.5185 1.5150 1.5125-30 1.5100

EUR/GBP

Offers 0.7020 0.7035 0.7050 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7000 0.6980-85 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 131.85 132.00 132.40 132.60 132.75-80 133.00

Bids 131.50 131.20 131.00 130.80 130.50 130.25-30 130.00

USD/JPY

Offers 122.85-90 123.00 123.20 123.35 123.50 123.65.70 123.85 124.00

Bids 122.65-70 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7220 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7185-90 0.7165 0.7150 0.7120-25 0.7100 0.7085 0.7065 0.7050

-

12:04

European stock markets mid session: stocks traded little changed on speeches by the European Central Bank officials

Stock indices traded little changed on speeches by the European Central Bank (ECB) officials. The ECB President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

The ECB Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices. He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

Current figures:

Name Price Change Change %

FTSE 100 6,329.25 -0.68 -0.01 %

DAX 11,085.92 +0.48 0.00%

CAC 40 4,890.58 -24.52 -0.50 %

-

12:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 436m) 123.50 (485m) 124.00 (1.67bln)

EUR/USD 1.0600 (EUR 2.3bln) 1.0700 (1.3bln) 1.0735 (1.4bln) 1.0750 (421m) 1.0765 (1.1bln) 1.0815 (1.6bln)

AUD/USD 0.7050 (AUD 530m) 0.7075 (202m) 0.7150 (260m)

NZD/USD 0.6400 (NZD 695m)

-

11:58

European Central Bank Governing Council member Jens Weidmann: the low inflation in the Eurozone was driven by lower energy prices

The European Central Bank (ECB) Governing Council member Jens Weidmann said in a speech in Frankfurt on Friday that the low inflation in the Eurozone was driven by lower energy prices.

"At the moment, the sharp fall in energy prices is what is mainly driving the low rates. This drop has pushed down headline inflation by about one percentage point. Correspondingly, the core inflation rate stands at 1% and should gradually increase towards our definition of price stability, which is - let me remind you - a medium-term concept," he said.

"Crucially, the decline in oil prices is more of an economic stimulus for the euro area than a harbinger of deflation. Lower oil prices reduce energy bills for both households and firms," Weidmann added.

He pointed out that the ultra-loose monetary policy could lead to risks.

"We need to be aware that the longer we stay in ultra-loose monetary policy mode, the less effective this policy will become and the more the attendant risks and side-effects will come into play," Weidmann said.

-

11:38

European Central Bank President Mario Draghi: the central bank is ready to use “all the instruments” to boost inflation in the Eurozone

The European Central Bank (ECB) President Mario Draghi said in a speech in Frankfurt on Friday that the central bank is ready to use "all the instruments" to boost inflation in the Eurozone.

"If we conclude that the balance of risks to our medium-term price stability objective is skewed to the downside, we will act by using all the instruments available within our mandate," he said.

"If we decide that the current trajectory of our policy is not sufficient to achieve our objective, we will do what we must to raise inflation as quickly as possible," Draghi added.

The ECB president pointed out that there are downside risks to the central bank's scenario.

"The downside risks to our baseline scenario for the euro area economy have increased in recent months due to the deterioration of the external environment. The outlook for global demand, especially in emerging markets, has notably worsened, while uncertainty in financial markets has increased," he noted.

-

11:29

Public sector net borrowing in the U.K. declines to £7.47 billion in October

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £7.47 billion in October from £8.33 billion in September. September's figure was revised down from £8.63 billion.

Analysts had expected a decrease to £5.5 billion.

Public sector net borrowing excluding public sector banks increased to £8.2 billion in October from £7.1 billion in October 2014.

-

11:17

German producer prices drop 0.4% in October

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.4% in October, missing expectations for a 0.2% fall, after a 0.4% drop in September.

On a yearly basis, German PPI dropped 2.3% in October, missing expectations for a 2.0% decrease, after a 2.1% fall in September.

PPI excluding energy sector fell by 0.7% year-on-year in October.

Energy prices were down 6.5% year-on-year in October.

Consumer non-durable goods prices fell 0.5% year-on-year in October, intermediate goods sector prices decreased by 1.9%, while capital goods prices increased 0.6% and durable consumer goods sector prices rose 1.3%.

-

11:02

Fed Vice Chairman Stanley Fischer: some central bank could raise its interest rates in the near future

The Fed Vice Chairman Stanley Fischer said on Thursday that some central bank could raise its interest rates in the near future.

"In the relatively near future probably some major central banks will begin gradually moving away from near-zero interest rates," he said.

Fischer also said that the Fed has done everything to prepare markets for the possible interest rate hike.

"While we continue to scrutinize incoming data, and no final decisions have been made, we have done everything we can to avoid surprising the markets and governments when we move," the Fed vice president noted.

-

10:49

Atlanta Fed President Dennis Lockhart: the pace of interest rate hikes will be slow once the Fed starts raising its interest rate

Atlanta Fed President Dennis Lockhart said on Thursday that the pace of interest rate hikes will be slow once the Fed starts raising its interest rate.

"The pace of increases may be somewhat slow and possibly more halting than historic episodes of rising rates. Moreover, to the extent the evolving economic picture allows a process leading to a "resting place" (a neutral or equilibrium rate), that point might be lower than in the past, as implied by a somewhat lower trend rate of economic growth," he said.

Lockhart noted that the Fed should raise its interest rate soon.

"I'm comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions. Given my reading of current conditions and my outlook views, I believe it will soon be appropriate to begin a new policy phase," Atlanta Fed president said.

-

10:38

Iran's Deputy Trade Minister Mojtaba Khosrowtaj: Iran could double its oil exports within three months after the lift-off of sanctions

Iran's Deputy Trade Minister Mojtaba Khosrowtaj said on Thursday that the country could double its oil exports within three months after the lift-off of sanctions.

"Earlier, before sanctions, we produced 1.8 million barrels of oil per day for domestic use and 2.5 for export. Currently, we export almost one million barrels per day, and we are fully prepared to add another 500,000 barrels of oil to our exports immediately after sanctions are lifted. And within a few months, maybe three, we can add another 500,000 barrels per day," he said.

-

10:32

United Kingdom: PSNB, bln, October -7.47 (forecast -5.5)

-

10:21

Bank of Japan‘s monthly report: the slowdown in emerging economies weighed on exports

The Bank of Japan (BoJ) released its monthly report on Friday. The central bank said that Japan's economy continued to recover moderately. The slowdown in emerging economies weighed on exports, the central bank added.

"Exports are expected to remain more or less flat for the time being, but after that, they are likely to increase moderately, as emerging economies move out of their deceleration phase," the BoJ noted.

Private consumption is expected to remain resilient, according to the BoJ.

Producer price inflation declined due to lower commodity prices, the central bank said.

-

10:16

Goldman Sachs: oil price could decline to $20 a barrel

Goldman Sachs said that oil price could drop to $20 a barrel due to increasing global oil oversupply and mild weather.

"Risks of a sharp leg lower remain elevated," the investment bank said.

-

08:30

Options levels on friday, November 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0861 (2019)

$1.0798 (946)

$1.0754 (200)

Price at time of writing this review: $1.0706

Support levels (open interest**, contracts):

$1.0647 (5393)

$1.0599 (7461)

$1.0570 (3495)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 90984 contracts, with the maximum number of contracts with strike price $1,1200 (5553);

- Overall open interest on the PUT options with the expiration date December, 4 is 115837 contracts, with the maximum number of contracts with strike price $1,0500 (8190);

- The ratio of PUT/CALL was 1.27 versus 1.27 from the previous trading day according to data from November, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5502 (1002)

$1.5404 (1873)

$1.5308 (2632)

Price at time of writing this review: $1.5276

Support levels (open interest**, contracts):

$1.5195 (2213)

$1.5098 (2597)

$1.4999 (2897)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28403 contracts, with the maximum number of contracts with strike price $1,5600 (3583);

- Overall open interest on the PUT options with the expiration date December, 4 is 32435 contracts, with the maximum number of contracts with strike price $1,5050 (4995);

- The ratio of PUT/CALL was 1.14 versus 1.15 from the previous trading day according to data from November, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Producer Price Index (MoM), October -0.4% (forecast -0.2%)

-

08:01

Germany: Producer Price Index (YoY), October -2.3% (forecast -2%)

-

07:55

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan BoJ monthly economic report

The euro was quite stable ahead of today's speech by European Central Bank President Mario Draghi. Bundesbank President Jens Weidmann is also scheduled to speak today. Yesterday Greece's Parliament voted in favor of economic reforms demanded by the country's international lenders.

On Thursday Atlanta Fed President Dennis Lockhart said in prepared remarks that volatility in financial markets has declined and he would be comfortable if the central bank raised its benchmark interest rate "soon".

The U.S. dollar fell against the yen amid Bank of Japan's decision not leave its monetary policy unchanged. The decision was made at the bank's meeting yesterday. The BOJ reiterated that inflation expectations were growing on the whole. BOJ officials used to say that declines in oil prices are in the way of inflation growth. However the tone of the bank's statement signaled that risks for the 2% inflation target had grown.

EUR/USD: the pair fell to $1.0710 in Asian trade

USD/JPY: the pair traded within Y122.85-05

GBP/USD: the pair traded within $1.5270-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Producer Price Index (YoY) October -2.1% -2%

07:00 Germany Producer Price Index (MoM) October -0.4% -0.2%

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October -8.63 -5.5

13:30 Canada Retail Sales, m/m September 0.5% 0.2%

13:30 Canada Retail Sales YoY September 2.8%

13:30 Canada Retail Sales ex Autos, m/m September 0% -0.2%

13:30 Canada Consumer Price Index m / m October -0.2% 0.1%

13:30 Canada Consumer price index, y/y October 1.0% 1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October 2.1% 2%

15:00 Eurozone Consumer Confidence (Preliminary) November -7.7 -7.5

16:15 U.S. FOMC Member Dudley Speak

-

07:33

Oil prices edged up

West Texas Intermediate futures for December delivery is currently at $41.92 (+0.48%), while Brent crude is at $44.26 (+0.18%). Prices remain under pressure despite these minor gains as fundamentals are weak. The global supply glut persists and Iran is preparing to add more crude.

Some traders are getting ready for further declines as analysts expect crude prices to stay low at least throughout the beginning of 2016. Expectations for a relatively warm winter add to this speculation.

-

07:15

Gold advanced slightly

Gold climbed to $1,083.00 (+0.47%) however it's on track to post another weekly decline as a looming FOMC meeting keeps pressure on this metal. Higher interest rates would impact demand for the non-interest-paying bullion.

Sources familiar with the matter said that Chinese banks got more cautious about lending to jewellery manufacturers because of a growing number of defaults. This news makes investors more cautious as well.

-

07:13

Global Stocks: U.S. stock indices little changed

U.S. stock indices closed flat on Thursday as gains in consumer sector offset declines in health-care stocks.

The Dow Jones Industrial Average edged down 4.34 points, or 0.02%, to 17,732.82. The S&P 500 declined 2.35 points, or 0.11%, to 2,081.23. The Nasdaq Composite slid 1.56 points, or 0.03%, to 5,073.64.

Stocks of UnitedHealth Group Incorporated plunged 5.78% after the company cut its earnings forecast.

Atlanta Fed President Dennis Lockhart said in prepared remarks that volatility in financial markets has declined and he would be comfortable if the central bank raised its benchmark interest rate "soon". Lockhart did not say how he intends to vote when the Federal Open Market Committee meets in December and refused to try to predict the outcome of this meeting.

This morning in Asia Hong Kong Hang Seng declined 0.23%, or 52.83, to 22,447.39. China Shanghai Composite Index gained 0.28%, or 10.03, to 3.627.10. The Nikkei 225 lost 0.37%, or 73.89, to 19,785.92.

Asian indices traded mixed.

Japanese stocks declined amid profit taking after several days of growth. A stronger yen weighed on stocks too.

November BOJ economic report released today showed that exports and production had been influenced by slowdown in emerging markets. The report also noted that "producer prices are declining relative to three months earlier, mainly due to the fall in international commodity prices" and "inflation expectations appear to be rising on the whole from a somewhat longer-term perspective".

-

03:33

Nikkei 225 19,769.39 -90.42 -0.46 %, Hang Seng 22,482.1 -18.12 -0.08 %, Shanghai Composite 3,628.19 +11.13 +0.31 %

-

01:06

Commodities. Daily history for Nov 19’2015:

(raw materials / closing price /% change)

Oil 40.58 +0.10%

Gold 1,081.40 +0.32%

-

01:04

Stocks. Daily history for Sep Nov 19’2015:

(index / closing price / change items /% change)

HANG SENG 22,494.57 +306.31 +1.38%

S&P/ASX 200 5,242.57 +109.45 +2.13%

TOPIX 1,600.38 +13.85 +0.87%

SHANGHAI COMP 3,617.85 +49.38 +1.38%

FTSE 100 6,329.93 +50.96 +0.81 %

CAC 40 4,915.1 +8.38 +0.17 %

Xetra DAX 11,085.44 +125.49 +1.14 %

S&P 500 2,081.24 -2.34 -0.11 %

NASDAQ Composite 5,073.64 -1.56 -0.03 %

Dow Jones Industrial Average 17,732.75 -4.41 -0.02 %

-

01:01

Currencies. Daily history for Nov 19’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0733 +0,69%

GBP/USD $1,5289 +0,36%

USD/CHF Chf1,0126 -0,70%

USD/JPY Y122,85 -0,63%

EUR/JPY Y131,87 +0,08%

GBP/JPY Y187,84 -0,27%

AUD/USD $0,7192 +1,15%

NZD/USD $0,6554 +1,28%

USD/CAD C$1,3282 -0,14%

-

00:02

Schedule for today,Friday, Nov 20’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (YoY) October -2.1% -2%

07:00 Germany Producer Price Index (MoM) October -0.4% -0.2%

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October -8.63

13:30 Canada Retail Sales, m/m September 0.5% 0.2%

13:30 Canada Retail Sales YoY September 2.8%

13:30 Canada Retail Sales ex Autos, m/m September 0% -0.2%

13:30 Canada Consumer Price Index m / m October -0.2% 0.1%

13:30 Canada Consumer price index, y/y October 1.0% 1%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October 2.1% 2%

15:00 Eurozone Consumer Confidence (Preliminary) November -7.7 -7.5

16:15 U.S. FOMC Member Dudley Speak

-