Noticias del mercado

-

23:58

Schedule for today, Tuesday, Mar 22’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia House Price Index (QoQ) Quarter IV 2.0% 0.0%

02:00 Japan Manufacturing PMI (Preliminary) March 50.1

04:30 Japan All Industry Activity Index, m/m January -0.9% 1.9%

05:35 Australia RBA's Governor Glenn Stevens Speech

07:00 Switzerland Trade Balance February 3.513

08:00 France Services PMI (Preliminary) March 49.2 49.5

08:00 France Manufacturing PMI (Preliminary) March 50.2 50.2

08:30 Germany Services PMI (Preliminary) March 55.3 55

08:30 Germany Manufacturing PMI (Preliminary) March 50.5 50.8

09:00 Eurozone Manufacturing PMI (Preliminary) March 51.2 51.3

09:00 Eurozone Services PMI (Preliminary) March 53.3 53.3

09:00 Germany IFO - Expectations March 98.8 99.5

09:00 Germany IFO - Current Assessment March 112.9 112.6

09:00 Germany IFO - Business Climate March 105.7 105.8

09:30 United Kingdom PSNB, bln February 11.81

09:30 United Kingdom Producer Price Index - Input (MoM) February -0.7% 0.6%

09:30 United Kingdom Producer Price Index - Output (MoM) February -0.1% -0.1%

09:30 United Kingdom Producer Price Index - Input (YoY) February -7.6% -7.3%

09:30 United Kingdom Retail prices, Y/Y February 1.3% 1.3%

09:30 United Kingdom Retail Price Index, m/m February -0.7% 0.5%

09:30 United Kingdom Producer Price Index - Output (YoY) February -1.0% -1.2%

09:30 United Kingdom HICP, m/m February -0.8% 0.4%

09:30 United Kingdom HICP, Y/Y February 0.3% 0.4%

09:30 United Kingdom HICP ex EFAT, Y/Y February 1.2% 1.2%

10:00 Eurozone ZEW Economic Sentiment March 13.6 8.2

10:00 Germany ZEW Survey - Economic Sentiment March 1 5

13:00 U.S. Housing Price Index, m/m January 0.4% 0.5%

13:45 U.S. Manufacturing PMI (Preliminary) March 51.3 51.8

14:00 U.S. Richmond Fed Manufacturing Index March -4 -1

20:00 Canada Annual Budget

-

20:00

Dow +0.19% 17,636.09 +33.79 Nasdaq +0.32% 4,810.97 +15.32 S&P +0.18% 2,053.32 +3.75

-

19:20

American focus: The US dollar strengthened against most major currencies

The dollar rose modestly against the euro, supported by statements by the Fed and the profit-taking by some investors. Recall, market participants began to actively sell the US currency last week after the Federal Reserve lowered its forecast for the number of rate increases in 2016. Analysts say that in the medium term the dollar will affect the signals that the Fed plans to tighten monetary policy. If politicians continue to hint that June is still possible date of the next interest rate increase, it should support the dollar.

Earlier today, the head of the Federal Reserve Bank of San Francisco John Williams said that the Central Bank may still raise rates in April and June, when economic data will provide the foundation for such a decision. "All things being equal, if we assume that all other factors remain unchanged, but the incoming data will conform to my expectations and hopes, that in April or June definitely have the potential to raise rates", - the politician said. It is worth emphasizing now traders estimate the probability of a rate hike in June of 38%.

Meanwhile, the president of the Richmond Fed Jeffrey Lacker said that inflation in the US is likely to accelerate in the coming years and will move to the target of 2% after the oil price reached the lower limit. "Inflation has recently remained weak influenced by two factors:. Lower oil and rising dollar prices, however, probably none of these factors will not always put pressure on inflation, I believe that overall inflation will increase significantly when the complete price drop. . oil Stability of the dollar will also support the further growth of inflation ", - said Lacker.

In addition, the Federal Reserve Bank of Atlanta President Dennis Lockhart said that economic data justifies the Fed's next move may already be at the April meeting. "The economy may justify a rate hike later this year, and perhaps quite soon, however, the planned course or specific yes for decisions on interest rates there.", - The politician said. He added that the economy is largely supported by growth in consumer spending, and some indicators point to the fact that inflation is moving forward at a healthy pace. In addition, he expressed confidence that economic growth in the 1st quarter rebound after a relatively weak Q4. Lockhart expects that this year the rate of increase in GDP of 2% -2.5%.

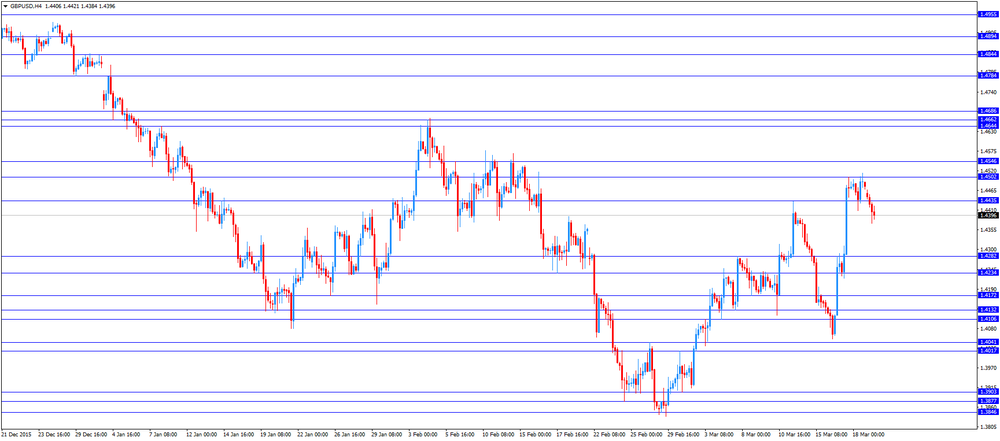

The British pound fell against 100 pips against the US dollar, updating the minimum on Friday and dropping below $ 1.4400. Initially, the pressure on the pair had the news that the British Minister for Labour Affairs and Pensions Iain Duncan Smith resigned after Britain's finance minister Osborne proposed to reduce disability. Investors believe that now Smith will take an active part in the campaign for the withdrawal from the EU, which may adversely affect the course of the pound. Also negatively affected by the data on the balance of industrial orders. In the UK, manufacturing output fell the most in six and a half years - the production volume balance fell to -15 in the three months to March. Was the lowest level since September 2009. However, enterprises expect a significant growth in the coming quarter and the corresponding survey balance was 23, the highest rate in 13 months. orders balance rose to -14 from -17 in February, in line with expectations. The balance of export orders has remained steady at -19. The survey also showed that average sales prices are likely to decline slightly in the next three months.

Reducing pairs it is also associated with increased demand for the dollar against the backdrop of statements by Fed officials for improving the Fed rate outlook.

-

18:00

European stocks closed: FTSE 100 6,184.58 -5.06 -0.08% CAC 40 4,427.8 -34.71 -0.78% DAX 9,948.64 -2.16 -0.02%

-

18:00

European stocks close: stocks closed lower on the economic data from the Eurozone

Stock indices closed lower on the economic data from the Eurozone. The European Central Bank (ECB) released its current account on Monday. Eurozone's current account surplus declined to a seasonally adjusted €25.4 billion in January from €28.6 billion in December. December's figure was revised up from a surplus of €25.5 billion.

The trade surplus rose to €27.6 billion in January from €27.2 billion in December.

The surplus on services decreased to €3.6 billion in January from €4.9 billion in December.

Eurozone's unadjusted current account surplus dropped to €6.3 billion in January from €44.8 billion in December. December's figure was revised up from a surplus of €41.4 billion.

ECB Executive Board Member Benoit Coeure said in a speech Monday that the central bank's latest stimulus measures should help to boost lending to households and businesses and to support the recovery, noting that there was "no shortage of tools".

He also said that the ECB's stimulus measures supported demand for goods and services in the Eurozone and improved financing conditions.

The Bundesbank released its monthly report on Monday. The central bank said that it expected the German economy to expand in the first quarter of 2016 at least as strong as in the second half of 2015, while the economic growth is expected to slow in the second quarter of 2016. The German economy grew 0.3% in the third and fourth quarters of 2015.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,184.58 -5.06 -0.08 %

DAX 9,948.64 -2.16 -0.02 %

CAC 40 4,427.8 -34.71 -0.78 %

-

17:56

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday as losses in energy and materials stocks were offset by gains in healthcare and telecom shares. Crude prices edged up despite uncertainty about a plan to freeze production and signs of U.S. producers increasing drilling activity. A report showed U.S. existing home sales fell 7,1% in February, widely missing the 2,2% drop expected, in a troubling sign for an economy which has otherwise looked resilient to the global economic slowdown.

Dow stocks mixed (15 vs 15). Top looser - Chevron Corporation (CVX, -1,55%). Top gainer - NIKE, Inc. (NKE, +3,11%).

S&P sectors also mixed. Top looser - Basic Materials (-0,9%). Top gainer - Healthcare (+0,4%).

At the moment:

Dow 17504.00 +12.00 +0.07%

S&P 500 2037.25 -0.25 -0.01%

Nasdaq 100 4401.25 +6.50 +0.15%

Oil 41.31 +0.17 +0.41%

Gold 1244.50 -9.80 -0.78%

U.S. 10yr 1.90 +0.03

-

17:49

Confederation of British Industry: potential costs of Britain’s exit from the European Union could be £100 billion (5% of GDP) and 950,000 jobs by 2020

The Confederation of British Industry (CBI) said on Sunday that according to PwC study, potential costs of Britain's exit from the European Union could be £100 billion (5% of GDP) and 950,000 jobs by 2020.

"This analysis shows very clearly why leaving the European Union would be a real blow for living standards, jobs and growth," CBI Director-General, Carolyn Fairbairn, said.

"The findings from PwC's independent study also explain why the majority of UK businesses are in favour of remaining within the European Union. Even under optimistic assumptions, an exit triggers serious economic disruption," she added.

-

17:45

Oil prices rose modestly today

Prices of oil futures rose modestly Monday as market participants continued to analyze the news of a modest increase in the number of US rigs.

Brent crude, which in March has risen by about 15 percent, still shows the highest monthly increase since April last year.

On Friday, Baker Hughes reported that the result of the week the number of drilling rigs in the US fell by 4 units ended March 18 to 476 units. In annual terms, a decline of 593 units or 55.47%. The number of oil rigs increased by 1 unit to 387 units. Thus, the tendency to reduce the index, which lasted for three months. The number of gas-producing plants has decreased by 5 units to 89 units. "The growing number of oil rigs 1 unit does not matter much, but it was a turning point and slightly affects the mood," - said an analyst at Price Futures Group Phil Flynn. Commerzbank analysts said that oil production in the United States still seemed quite high, partly due to special factors such as the temporary increase in performance and price hedging strategies of manufacturers. "Therefore, we still expect that the oil production in the US will fall sharply in the coming weeks and months", - experts said.

Support for oil also have hopes that the major oil producers limit production growth. Major producers, including OPEC, should discuss freezing production in the January lows at the meeting scheduled for April 17 in Qatar. But Iran has repeatedly stated that he will not participate in the agreement, while oil production in the country will not reach 4 million barrels per day, down 1 million barrels higher than the January level.

In addition, the CFTC data showed that a week before March 15, large speculators increased their net long positions in WTI crude oil at 25,604 contracts (+ 10%, to 269,856 contracts).

WTI for delivery in May rose to $41.44 a barrel. Brent for April rose to $41.30 a barrel.

-

17:44

WSE: Session Results

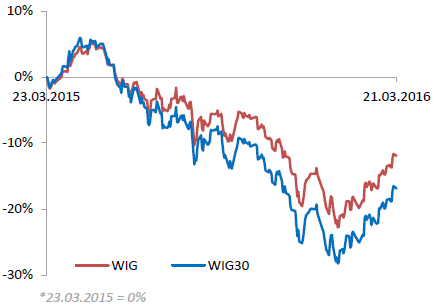

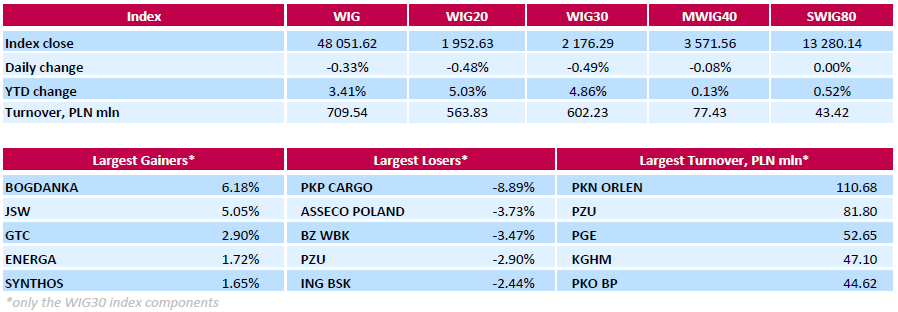

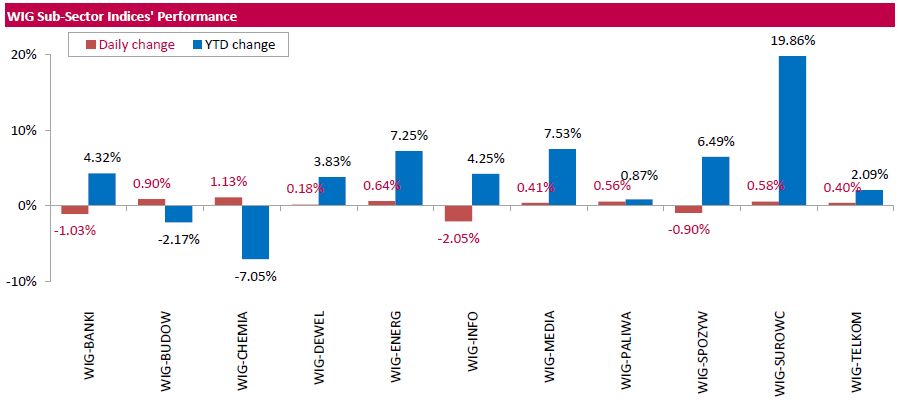

Polish equity market closed lower on Monday. The broad market benchmark, the WIG Index, lost 0.33%. Sector-wise, informational technology sector (-2.05%) was the worst-performing group, while chemicals (+1.13%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 0.49%. Within the index components, railway freight transport operator PKP CARGO (WSE: PKP) recorded the biggest drop, down 8.89%. Other major decliners were IT-company ASSECO POLAND (WSE: ACP), bank BZ WBK (WSE: BZW) and insurer PZU (WSE: PZU), plunging by 3.73%, 3.47% and 2.9% respectively. On the other side of the ledger, two coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW), became the session's best performers, gaining 6.18% and 5.05% respectively.

-

17:30

European Central Bank (ECB) Executive Board Member Benoit Coeure: the central bank’s latest stimulus measures should help to boost lending to households and businesses and to support the recovery

European Central Bank (ECB) Executive Board Member Benoit Coeure said in a speech Monday that the central bank's latest stimulus measures should help to boost lending to households and businesses and to support the recovery, noting that there was "no shortage of tools".

He also said that the ECB's stimulus measures supported demand for goods and services in the Eurozone and improved financing conditions.

Coeure pointed out that economic and fiscal policies were needed to support the monetary policy.

-

17:22

Gold has fallen in price during today's trading

Gold prices declined moderately today, recording the third-session drop in a row, helped by a stronger dollar and the statements of representatives of the Federal Reserve.

"We had quite a lot of news in the last week, while this week's economic calendar will be less intense. Against this background, the trading volume may be lower, and therefore prices will have little momentum. In addition, the US dollar strengthened slightly. But we believe that the recent decline in prices -. it's just a short-term phenomenon may have some investors decided to take profits reasons to invest in gold remain unchanged, mainly inflation expectations and inflationary pressures, "-. said Capital Economics analyst Simon Gambarini.

Today the head of the Federal Reserve Bank of San Francisco John Williams said that the central bank could still raise rates in April and June, when economic data will provide the foundation for a political solution. Meanwhile, the president of the Richmond Fed Jeffrey Lacker said that inflation in the US is likely to accelerate in the coming years and will move to the target of 2% after the oil price reached the lower limit.

In focus were also data on the US housing market. The National Association of Realtors reported that after rising to its highest annual level in six months in January, housing sales in the secondary market dropped in February against the background of a stable low level of supply and stable prices in some parts of the country. home sales in the secondary market decreased by 7.1 percent to a seasonally adjusted annual rate reached 5.08 million compared to 5.47 million in January. Despite the fact that the last month was a significant reduction in sales for another 2.2 percent higher than a year ago. Lawrence Yun, the NAR chief economist, said that sales in the secondary market in February, disappointing and run counter to a strong start of the year. The average house price in the secondary market for all types of housing in February was $ 210,800, up 4.4 per cent per annum above. Stocks of housing in the end of February increased by 3.3 percent to 1.88 million homes.

Support for the precious metal has the approach of the Easter holidays in Europe at the end of the week, as well as expectations that the ultra-low rates will continue. Some economists fear that the ultra-low interest rates around the world will eventually have a negative impact on inflation rates. Gold does not generate revenue, and it is difficult to compete with the profitable assets, such as Treasury bonds when interest rates are near zero. If in the future rates will remain unchanged, then gold will go up amid falling US currency. This year, gold rose in price by almost 16%, as investors seek refuge in conditions of instability in the financial markets and on concerns about the global economic downturn.

In addition, it became known that the gold reserves in the largest gold ETF-fund SPDR Gold Trust rose on Friday to 11.9 tonnes, bringing the total inflow for the year increased to 176.6 tonnes compared to 40.8 tonnes for a same period last year.

April futures price of gold on COMEX today fell to $ 1246.90 per ounce.

-

17:10

Australia’s leading economic index falls 0.4% in January

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) fell 0.4% in January, after a 0.3% decline in December.

The coincident index was flat in January, after a 0.1% gain in December.

-

16:42

European Central Bank (ECB) Governing Council member Erkki Liikanen: the ECB could expand its stimulus measures further

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Monday that the ECB could expand its stimulus measures further if needed.

"If the outlook or financing conditions deteriorate, the ECB still has capacity to boost inflation and growth," he said.

Liikanen pointed out that the central bank would keep its interest rates at present or lower levels for a longer period.

-

16:34

European Central Bank purchases €12.4 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.4 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.8 billion of covered bonds, and €100 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:28

Bundesbank expects the German economic growth to slow in the second quarter of 2016

The Bundesbank released its monthly report on Monday. The central bank said that it expected the German economy to expand in the first quarter of 2016 at least as strong as in the second half of 2015, while the economic growth is expected to slow in the second quarter of 2016.

The German economy grew 0.3% in the third and fourth quarters of 2015.

The central bank said that industry and construction rose sharply in January. But the Bundesbank pointed to "a stagnation in the new orders received by industry and the further deterioration in business expectations according to the Ifo business climate index, which has, moreover, been accompanied by a marked decline in previously stable and expansionary output and export expectations".

Consumer sentiment remained very confident, according to the central bank.

-

16:13

Eurozone’s preliminary consumer confidence index falls to -9.7 in March

The European Commission released its preliminary consumer confidence figures for the Eurozone on Monday. Eurozone's preliminary consumer confidence index fell to -9.7 in March from -8.8 in February. Analysts had expected the index to rise to -8.5.

European Union's consumer confidence index decreased by 0.7 points to -7.3 in March.

-

16:01

Eurozone: Consumer Confidence, March -9.7 (forecast -8.5)

-

15:47

San Francisco Fed President John Williams: the Fed could hike its interest rate in April or June

San Francisco Fed President John Williams said in an interview with Market News International on Monday that the Fed could hike its interest rate in April or June if the U.S. economic data remains strong.

"All else equal, assuming everything else is basically the same and the data flow continues the way I hope and expect, then April or June would definitely be potential times to have an increase in interest rates," he said.

Williams noted that there were still global economic and financial risks but the U.S. economy managed to withstand headwinds from abroad.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:08

U.S. existing homes sales slides 7.1% in February

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes slid 7.1% to a seasonally adjusted annual rate of 5.08 million in February from 5.47 in January. Analysts had expected a decrease to 5.31 million units.

"Sales took a considerable step back in most of the country last month, and especially in the Northeast and Midwest," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers remained dropped to 30% in February from 32% in January.

"The overall demand for buying is still solid entering the busy spring season, but home prices and rents outpacing wages and anxiety about the health of the economy are holding back a segment of would-be buyers," Yun said.

-

15:00

U.S.: Existing Home Sales , February 5.08 (forecast 5.31)

-

14:57

Spain’s trade deficit widened to €2.39 billion in January

Spain's Economy Ministry released its trade data on Monday. The trade deficit widened to €2.39 billion in January from €1.79 billion in December.

Exports rose at an annual rate of 2.1% year-on-year in January, while imports climbed 0.8%.

-

14:57

WSE: After start on Wall Street

US markets opened with a slight decline, fully in line with what we would expect from the morning. The short-term trend remains pointed upward, but profit-taking steps taken by market participants are natural, especially that the most important market events are already behind us.

On the Warsaw Exchange the biggest obstacle to the bulls is banking sector. Throughout the sector, heaviest losses are borne by holders of shares of BZ WBK, which lost more than 4 percent. Similarly, in the second line, ING BSK and Bank Millennium are negatively affecting the market. The supply is also active on other companies of the banking sector. As a result the decline of the WIG20 index is almost 1 percent.

-

14:46

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.75, 112.00 (539m), 112.50, 112.97, 113.50

EUR/USD 1.1000, 1.1098, 1.1100, 1.1115, 1.1285, 1.1300, 1.1350, 1.1400

AUD/USD 0.7465, 0.7500, 0.7525, 0.7550, 0.7600 (524m)

AUD/JPY 82.50, 82.85

USD/CHF 0.9695/0.9700 (220m)

-

14:35

U.S. Stocks open: Dow -0.06%, Nasdaq -0.09%, S&P -0.10%

-

14:27

Before the bell: S&P futures -0.09%, NASDAQ futures -0.05%

U.S. stock-index were little changed.

Global Stocks:

Nikkei Closed

Hang Seng 20,684.15 +12.52 +0.06%

Shanghai Composite 3,020.12 +64.97 +2.20%

FTSE 6,172.31 -17.33 -0.28%

CAC 4,433.66 -28.85 -0.65%

DAX 9,930.5 -20.30 -0.20%

Crude oil $41.27 (+0.32%)

Gold $1244.00 (-0.82%)

-

14:25

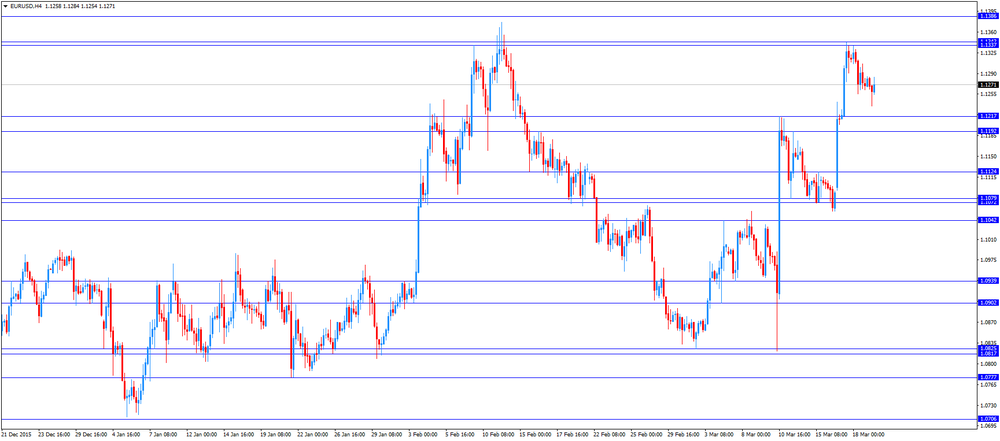

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the current account data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:00 Eurozone Current account, unadjusted, bln January 44.8 Revised From 41.4 6.3

11:00 United Kingdom CBI industrial order books balance March -17 -14 -14

11:00 Germany Bundesbank Monthly Report

The U.S. dollar traded mixed against the most major currencies ahead the release of the existing home sales data. The existing home sales in the U.S. are expected to fall to 5.31 million units in February from 5.47 million units in January.

The euro traded higher against the U.S. dollar after the release of the current account data from the Eurozone. The European Central Bank (ECB) released its current account on Monday. Eurozone's current account surplus declined to a seasonally adjusted €25.4 billion in January from €28.6 billion in December. December's figure was revised up from a surplus of €25.5 billion.

The trade surplus rose to €27.6 billion in January from €27.2 billion in December.

The surplus on services decreased to €3.6 billion in January from €4.9 billion in December.

Eurozone's unadjusted current account surplus dropped to €6.3 billion in January from €44.8 billion in December. December's figure was revised up from a surplus of €41.4 billion.

The British pound traded mixed against the U.S. dollar. The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to -14 in March from-17 in February, in line with expectations. The index reflected weakness in the food and drink sector. Export orders remained unchanged in March.

EUR/USD: the currency pair rose to $1.1284

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y111.81

The most important news that are expected (GMT0):

14:00 U.S. Existing Home Sales February 5.47 5.31

15:00 Eurozone Consumer Confidence (Preliminary) March -9 -8.5

-

14:18

CBI industrial order books balance rises to -14 in March

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to -14 in March from-17 in February, in line with expectations.

The index reflected weakness in the food and drink sector.

Export orders remained unchanged in March.

"March has been a mixed month for the UK's manufacturers. Whilst total order and export books remained steady, a drop in output reflected some volatility in the food and drink sector. Reassuringly, manufacturers expect a swift turnaround in activity," the CBI director of economics Rain Newton-Smith said.

"While the Budget included several policies that should drive growth, the absence of further measures to support innovation, and research and development, was a missed opportunity to boost investment," she added.

-

14:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Tesla Motors, Inc., NASDAQ

TSLA

235.05

0.97%

56612

Nike

NKE

63.40

0.64%

29491

General Motors Company, NYSE

GM

32.15

0.59%

3012

AT&T Inc

T

38.70

0.36%

7696

Johnson & Johnson

JNJ

107.79

0.27%

1251

United Technologies Corp

UTX

99.19

0.14%

202

Pfizer Inc

PFE

29.48

0.10%

12646

Starbucks Corporation, NASDAQ

SBUX

59.75

0.08%

1200

Google Inc.

GOOG

738.00

0.05%

1225

Apple Inc.

AAPL

105.96

0.04%

79662

Visa

V

73.78

0.00%

1529

Merck & Co Inc

MRK

52.25

0.00%

1800

Ford Motor Co.

F

13.64

0.00%

3038

Wal-Mart Stores Inc

WMT

66.92

-0.04%

2846

Amazon.com Inc., NASDAQ

AMZN

551.75

-0.06%

10390

Facebook, Inc.

FB

111.37

-0.07%

78253

3M Co

MMM

165.21

-0.07%

300

Verizon Communications Inc

VZ

53.20

-0.08%

4757

FedEx Corporation, NYSE

FDX

163.57

-0.09%

410

Walt Disney Co

DIS

99.10

-0.10%

864

Cisco Systems Inc

CSCO

28.30

-0.11%

2512

Exxon Mobil Corp

XOM

84.10

-0.12%

3265

General Electric Co

GE

30.88

-0.13%

6046

Yahoo! Inc., NASDAQ

YHOO

35.10

-0.20%

13420

Goldman Sachs

GS

157.28

-0.20%

2551

JPMorgan Chase and Co

JPM

60.35

-0.22%

2303

The Coca-Cola Co

KO

45.50

-0.22%

4873

Home Depot Inc

HD

131.00

-0.27%

355

Twitter, Inc., NYSE

TWTR

16.80

-0.30%

23640

Chevron Corp

CVX

97.40

-0.30%

2397

Caterpillar Inc

CAT

75.22

-0.33%

1625

Microsoft Corp

MSFT

53.27

-0.41%

9617

Citigroup Inc., NYSE

C

43.33

-0.49%

4018

ALCOA INC.

AA

9.98

-0.50%

9257

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.64

-1.14%

130155

Barrick Gold Corporation, NYSE

ABX

14.56

-1.25%

68536

Intel Corp

INTC

32.21

-1.48%

76503

-

14:00

Orders

EUR/USD

Offers: 1.1320 1.1340-50 1.1375 1.1400 1.1430 1.1450 1.1480 1.1500

Bids: 1.1270-75 1.1250 1.1220 1.1200 1.1175 1.1150 1.1130 1.1100

GBP/USD

Offers: 1.4485 1.4500 1.4530 1.4550 1.4575 1.4600 1.4660 1.4700

Bids: 1.4435 1.4420 1.4400 1.4375-80 1.4350 1.4330 1.4300 1.4280 1.4265 1.4250

EUR/JPY

Offers: 125.80 126.00 126.20 126.50 126.80 127.00 127.30 127.50

Bids: 125.20 125.00 124.50 124.20 124.00

EUR/GBP

Offers: 0.7830 0.7850 0.7880 0.7900-10 0.7925 0.7950

Bids: 0.7800 0.7785 0.7770 0.7750 0.7730 0.7700 0.7675 0.7650

USD/JPY

Offers: 111.90 112.00 112.50 113.00

Bids: 111.20 111.00/05 110.50 110.20/25

AUD/USD

Offers: 0.7650 0.7700 0.7750

Bids: 0.7570 0.7510 0.7500

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Tesla Motors (TSLA) upgraded to Buy from Hold at Argus

Hewlett Packard Enterprise (HPE) upgraded to Outperform from Neutral at Macquarie

Downgrades:

Intel (INTC) downgraded to Underperform from Market Perform at Bernstein; target $26

Other:

-

12:48

WSE: Mid session comment

The WIG 20 index defended the level of 1,943 points, and is likely to get subjected to another round of downward pressure stemming from a wave of moderate profit-taking. What seemed as a very weak beginning of trading in Euroland turned into a relatively flat session. The German DAX, after an initial decline of 0.9 percent reverted to its equilibrium level. This improvement in relation to the morning's quotations did not affect the listing on the Warsaw Stock Exchange, which remains under the bearish pressure.

-

12:03

European stock markets mid session: stocks traded higher on the economic data from the Eurozone

Stock indices traded higher on the economic data from the Eurozone. The European Central Bank (ECB) released its current account on Monday. Eurozone's current account surplus declined to a seasonally adjusted €25.4 billion in January from €28.6 billion in December. December's figure was revised up from a surplus of €25.5 billion.

The trade surplus rose to €27.6 billion in January from €27.2 billion in December.

The surplus on services decreased to €3.6 billion in January from €4.9 billion in December.

Eurozone's unadjusted current account surplus dropped to €6.3 billion in January from €44.8 billion in December. December's figure was revised up from a surplus of €41.4 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,194.37 +4.73 +0.08 %

DAX 10,025.5 +74.70 +0.75 %

CAC 40 4,462.88 +0.37 +0.01 %

-

12:00

United Kingdom: CBI industrial order books balance, March -14 (forecast -14)

-

11:59

Italy’s current account deficit is €1.07 billion in January

The Bank of Italy released its current account on Monday. Italy's current account surplus turned into a deficit of €1.07 billion in January from a surplus of €6.3 billion in December.

The trade surplus rose to €1.04 billion in January from €742 million in January last year.

The deficit on services decreased to €651 million in January from €720 million in January last year.

The primary income surplus was €186 million in January, while the secondary income deficit was €1.64 billion.

-

11:49

Richmond Fed President Jeffrey Lacker: inflation in the U.S. is likely to rise in coming years

Richmond Fed President Jeffrey Lacker said on Monday that inflation was likely to rise in coming years.

"I am reasonably confident that, barring subsequent shocks, inflation will move back to the FOMC's 2 percent objective over the medium term," he said.

Lacker noted that inflation was low due to low oil prices and a stronger U.S. dollar.

Lacker is not a voting member on the Federal Open Market Committee (FOMC) this year.

-

11:32

Rightmove: U.K. house prices rise 1.3% in March

According to property tracking website Rightmove, U.K. house prices rose 1.3% in March, after a 2.9% increase in February.

"While the start of 2016 has seen an encouraging but modest uptick in the number of properties coming to market, demand and momentum have combined to push prices over £300,000," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 7.6% in March, after a 7.3% increase in February.

-

11:20

Eurozone’s current account surplus falls to a seasonally adjusted €25.4 billion in January

The European Central Bank (ECB) released its current account on Monday. Eurozone's current account surplus declined to a seasonally adjusted €25.4 billion in January from €28.6 billion in December. December's figure was revised up from a surplus of €25.5 billion.

The trade surplus rose to €27.6 billion in January from €27.2 billion in December.

The surplus on services decreased to €3.6 billion in January from €4.9 billion in December.

The primary income surplus fell to €4.7 billion in January from €7.6 billion in December, while the secondary income deficit decreased to €10.5 billion from €11.0 billion.

Eurozone's unadjusted current account surplus dropped to €6.3 billion in January from €44.8 billion in December. December's figure was revised up from a surplus of €41.4 billion.

-

10:50

European Central Bank Governing Council member Jens Weidmann: there was no need for further stimulus measures by the ECB

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview over the weekend that there was no need for further stimulus measures by the ECB.

"It would make sense to pause," he said, adding that reforms were needed.

Weidmann warned about helicopter money, saying that it will weigh on the central bank's balance sheets.

-

10:33

International Monetary Fund Managing Director Christine Lagarde: the global economy would be worse without negative interest rate in Europe and Japan

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview on Friday that the global economy would be worse without negative interest rate in Europe and Japan as negative interest rates helped to support global growth and inflation.

"If we had not had those negative rates, we would be in a much worse place today, with inflation probably lower than where it is, with growth probably lower than where we have it," she said.

Lagarde noted that time was needed to analyse effects of negative interest rates.

IMF managing director pointed out that the IMF could upgrade its economic growth forecast for China.

-

10:24

WSE: BOS Bank SA

BOS Bank posted a net loss of PLN 51.12 mln in 2015 againt to PLN 65.57 mln profit a year earlier.

The result on banking operations fell 8.8% to PLN 486 mln. Net interest income fell 9.7% (totaled PLN 261.41 mln against to PLN 289.44 mln a year earlier), while fee & commission income actually increased 9.4% y/y.

Total assets of the bank amounted to PLN 20.92 billion at the end of 2015 against PLN 19.67 billion at the end of 2014.

BOS Bank is the company indirectly controlled by the Polish government.

Shares of the BOS Bank are listed since 1997 on the main market of the Warsaw Stock Exchange in Warsaw.

-

10:20

The number of active U.S. oil rigs rises by 1 rigs to 387 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. oil rigs increased by 1 rigs to 387 last week. It was the first rise in 3 months.

The number of gas rigs slid by 5 to 89.

Combined oil and gas rigs decreased by 4 to 476.

-

10:10

The People’s Bank of China injects 130 billion yuan in the financial system

The People's Bank of China (PBoC) on Monday injected 130 billion yuan ($20 billion) in the financial system by offering seven-day reverse repurchase agreements, increasing efforts to combat capital flight from the country's economy and stock markets.

The PBoC already injected 110 billion yuan in the financial system on Friday.

China's central bank set today's daily fixing at 6.4824 per U.S. dollar, down from 6.4628 on Friday.

-

10:00

Eurozone: Current account, unadjusted, bln , January 6.3

-

09:24

DAX 9,869.27 -81.53 -0.82%, FTSE 100 6,156.73 -32.91 -0.53%, CAC 40 4,423.35 -39.16 -0.88%

-

09:13

WSE: After opening

The new series of futures contracts on the WIG20 index (FW20M16) started the week with decline of 0.26% (the contract opened at 1,943 points).

In Europe, the mood in the morning are also slightly downward, but does not change the general picture of the situation.

The market is calm and we see a consolidation there.

The WIG20 index opened at 1951,90 points (-0,51% to previous close)

WIG 48029,37 -0,38%*

WIG30 2175,38 -0,53%

mWIG40 3570,29 -0,12%

*/ - change to previous close

We lose a lot from Friday's close, but we have to remember about the specifics of Friday's - expiration of futures - session. We return to the area Thursday's maximum and at the same time to the psychological level of 1,950 points.

-

09:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.75, 112.00 (539m), 112.50, 112.97, 113.50

EUR/USD 1.1000, 1.1098, 1.1100, 1.1115, 1.1285, 1.1300, 1.1350, 1.1400

AUD/USD 0.7465, 0.7500, 0.7525, 0.7550, 0.7600 (524m)

AUD/JPY 82.50, 82.85

USD/CHF 0.9695/0.9700 (220m)

-

08:29

WSE: Before opening

Today we begin shortened week (Easter holidays). In the case of global sentiment it looks to be a slight correction or gap of increases after earlier gains. Stock Exchange in Japan is closed for holidays, but outside of China in Asia we see a slight red color.

Future contracts in the US moved down, though on a small scale. From the point of view of emerging markets it is important to keep an eye on the raw materials market where we also see declines after successful last week sessions.

Monday's session should be a calmer session with possibility of a small adjustments. The Warsaw market has significantly departed from the level of 1900 points and is heading towards 2000 points. Nevertheless, according to the presented form recently, after successful sessions a rest would be natural.

There are no meaningful data in macro calendar today.

-

08:18

Asian session: Sterling was a notable underperformer

Sterling was a notable underperformer after British Prime Minister David Cameron was forced into a hasty cabinet reshuffle on Saturday following the shock resignation of a senior minister.

Dollar bulls were hit hard after the Fed last week held interest rates steady and cut in half the number of projected quarter-point hikes to just two this year. Fed Chair Janet Yellen also sounded doubtful that a recent firming in U.S. inflation would be sustained, suggesting the central bank is in no hurry to tighten policy.

Euro bulls were not spared either. European Central Bank (ECB) chief economist Peter Praet on Friday said rates have not reached their lower limit yet. His comments came a week after ECB President Mario Draghi upset the market by saying he did not expect further rate cuts were needed after unveiling a fresh set of stimulus. That saw the euro rebound from a low around $1.0821.

The safe-haven yen was broadly firmer on Monday, particularly against its New Zealand and Australian peers, as the mood turned sour with most Asian share markets down. "It is an extension of a slightly cooler mood overall," said Sean Callow, senior currency strategist at Westpac Bank.

A public holiday in Japan and an absence of fresh drivers meant there was no conviction to push the market either way.

EUR/USD: during the Asian session the pair traded in the range of $1.1260-80

GBP/USD: during the Asian session the pair fell to $1.4420

USD/JPY: during the Asian session the pair traded in the range Y111.20-50

Based on Reuters materials

-

07:22

Global Stocks: shares rose

European stocks closed higher Friday, with an assist from further European Central Bank dovish signals. The ECB's chief economist, Peter Praet, suggested Friday that interest rates could be cut further. He also expressed openness to "helicopter money," the idea of the central bank effectively delivering money directly to the people, rather than via loans to banks or purchases of assets.

The S&P 500 and the Dow industrials rallied on Friday, buoyed by an advance in heath-care and financial stocks that helped shares notch a fifth straight week of gains. Both the S&P 500 and the Dow industrials ended in positive territory for the year, while the Dow logged six days of gains in a row-the longest winning streak since early October.

Stocks in China rose Monday after authorities signaled a loosening stance toward margin trading, the practice of using borrowed money to buy shares. Those gains came after a state-backed company called China Securities Finance Corp. published new interest rates on a range of loans that it gives to brokerages.

Based on MarketWatch materials

-

07:10

Options levels on monday, March 21, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1450 (3053)

$1.1390 (3101)

$1.1347 (2424)

Price at time of writing this review: $1.1263

Support levels (open interest**, contracts):

$1.1206 (1728)

$1.1149 (1987)

$1.1075 (2823)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 46059 contracts, with the maximum number of contracts with strike price $1,1500 (4413);

- Overall open interest on the PUT options with the expiration date April, 8 is 66782 contracts, with the maximum number of contracts with strike price $1,0900 (6152);

- The ratio of PUT/CALL was 1.45 versus 1.49 from the previous trading day according to data from March, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.4705 (1616)

$1.4608 (1093)

$1.4512 (1600)

Price at time of writing this review: $1.4418

Support levels (open interest**, contracts):

$1.4390 (687)

$1.4294 (427)

$1.4196 (626)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20030 contracts, with the maximum number of contracts with strike price $1,4400 (2034);

- Overall open interest on the PUT options with the expiration date April, 8 is 21082 contracts, with the maximum number of contracts with strike price $1,3850 (2259);

- The ratio of PUT/CALL was 1.05 versus 1.03 from the previous trading day according to data from March, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:04

Hang Seng 20,691.08 +19.45 +0.09 %, Shanghai Composite 2,978.54 +23.39 +0.79 %

-

01:03

Commodities. Daily history for Mar 18’2016:

(raw materials / closing price /% change)

Oil 41.02 -0.29%

Gold 1,255.70 +0.11%

-

01:02

Stocks. Daily history for Sep Mar 18’2016:

(index / closing price / change items /% change)

Nikkei 225 16,724.81 -211.57 -1.25%

Hang Seng 20,671.63 +167.82 +0.82%

Shanghai Composite 2,954.93 +50.10 +1.72%

FTSE 100 6,189.64 -11.48 -0.19%

CAC 40 4,462.51 +19.62 +0.44%

Xetra DAX 9,950.8 +58.60 +0.59%

S&P 500 2,049.58 +8.99 +0.44%

NASDAQ Composite 4,795.65 +20.66 +0.43%

Dow Jones 17,602.3 +120.81 +0.69%

-

01:02

Currencies. Daily history for Mar 18’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,1269 -0,40%

GBP/USD $1,4476 +0,01%

USD/CHF Chf0,9692 +0,22%

USD/JPY Y111,53 +0,10%

EUR/JPY Y125,65 -0,33%

GBP/JPY Y161,45 +0,11%

AUD/USD $0,7602 -0,46%

NZD/USD $0,6796 -0,54%

USD/CAD C$1,3003 +0,15%

-

00:01

Schedule for today, Monday, Mar 21’2016:

(time / country / index / period / previous value / forecast)

09:00 Eurozone Current account, unadjusted, bln January 41.4

11:00 United Kingdom CBI industrial order books balance March -17 -14

11:00 Germany Bundesbank Monthly Report

14:00 U.S. Existing Home Sales February 5.47 5.31

15:00 Eurozone Consumer Confidence March -9 -8.5

-