Noticias del mercado

-

23:00

New Zealand: RBNZ Interest Rate Decision, 2% (forecast 2%)

-

21:01

DJIA 18212.07 82.11 0.45%, NASDAQ 5272.88 31.52 0.60%, S&P 500 2152.82 13.06 0.61%

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

18:01

European stocks closed: FTSE 6834.77 3.98 0.06%, DAX 10436.49 42.63 0.41%, CAC 4409.55 20.95 0.48%

-

17:59

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday, helped by gains in technology and energy stocks, ahead of the Federal Reserve's decision later in the day. The Fed is scheduled to release, followed by Chair Janet Yellen's press conference. While the chances of a hike are marginal this time, investors will comb the central bank's statements for clues about a December hike.

Most of Dow stocks in positive area (21 of 30). Top gainer - Caterpillar Inc. (CAT, +1.11%). Top loser - The Walt Disney Company (DIS, -0.97%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.4%). Top loser - Conglomerates (-0.4%).

At the moment:

Dow 18088.00 +41.00 +0.23%

S&P 500 2137.75 +6.75 +0.32%

Nasdaq 100 4805.75 +7.25 +0.15%

Oil 45.20 +1.15 +2.61%

Gold 1330.50 +12.30 +0.93%

U.S. 10yr 1.71 +0.02

-

17:44

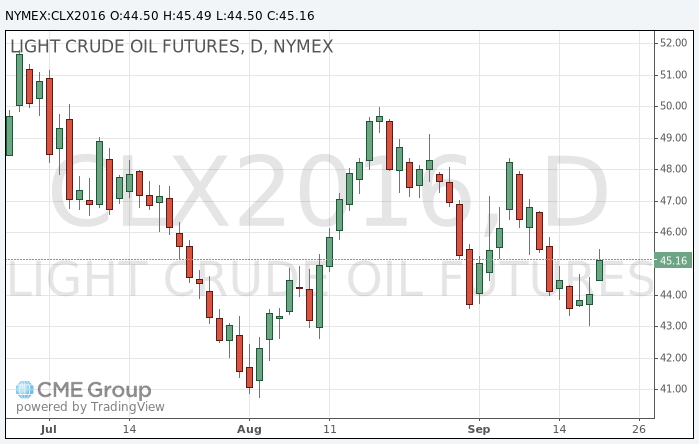

Oil continue to rise

Oil prices are relatively stable after the Energy Information Administration reported an unexpected drop of oil reserves last week. Before the release of the data, oil prices rose. However, the Ministry of Energy also reported an increase in production in the United States for the second week in a row, and a slight decrease in refinery utilization.

Commercial US crude stocks last week fell by 6,200 thousand barrels -. to 504.598 million barrels, according to the weekly US Department of Energy report.

Commercial gasoline inventories decreased by 3204 thousand barrels and totaled 225.156 million barrels.

Commercial stocks of distillates rose to 2238 thousand barrels, reaching 164.992 million barrels.

Experts interviewed by Bloomberg, expected an increase in oil reserves by 3250 thousand barrels, a decline in gasoline inventories by 1,400 th. barrels and distillate stocks to increase by 200 thousand barrels.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 45.49 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 47.11 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:34

WSE: Session Results

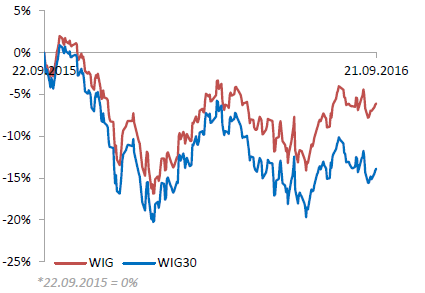

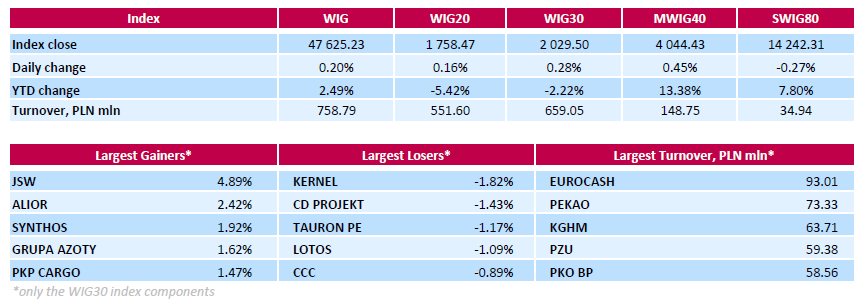

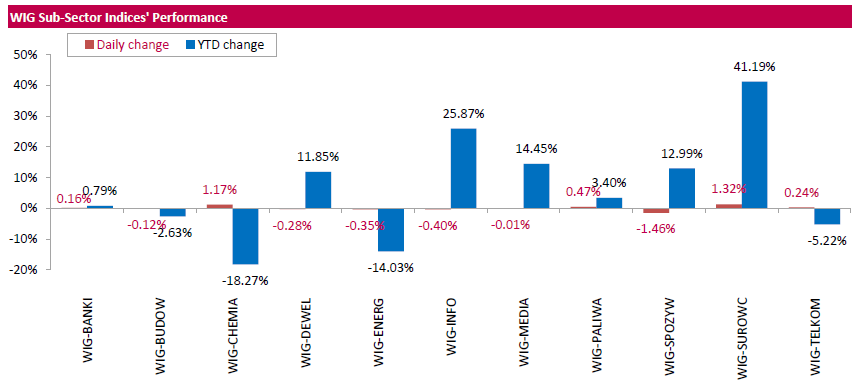

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, surged by 0.20%. Sector performance within the WIG Index was mixed. Materials (+1.32%) outperformed, while food sector (-1.46%) lagged behind.

The large-cap stocks gained 0.28%, as measured by the WIG30 Index, with the way up led by coking coal producer JSW (WSE: JSW), jumping by 4.89%. Among the other major advancers were banking name ALIOR (WSE: ALR) and two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), adding 2.42%, 1.92% and 1.62% respectively. On the other side of the ledger, agricultural producer KERNEL (WSE: KER), videogame developer CD PROJEKT (WSE: CDR), genco TAURON PE (WSE: TPE) and oil refiner LOTOS (WSE: LTS) were the biggest decliners, losing between 1.09% and 1.82%.

-

17:24

The price of gold rose markedly

Gold prices rose to more than one-week high, as investors expect the Federal Reserve;s meeting outcome later in the session.

It is expected that at 18:00 GMT the Federal Reserve will leave unchanged its policy rate at the end of the two-day meeting.

After 30 minutes Chairman Janet Yellen will hold a long-awaited press conference. Investors will closely monitor any changes in the tone of the head of the Central Bank in relation to the economy and look for any hints on the timing of rate increases.

In the currency market, USD index, which tracks the greenback against a trade-weighted basket of six major rivals, is trading at 95.80, after rising to 96.29 earlier, the highest level since 9 August.

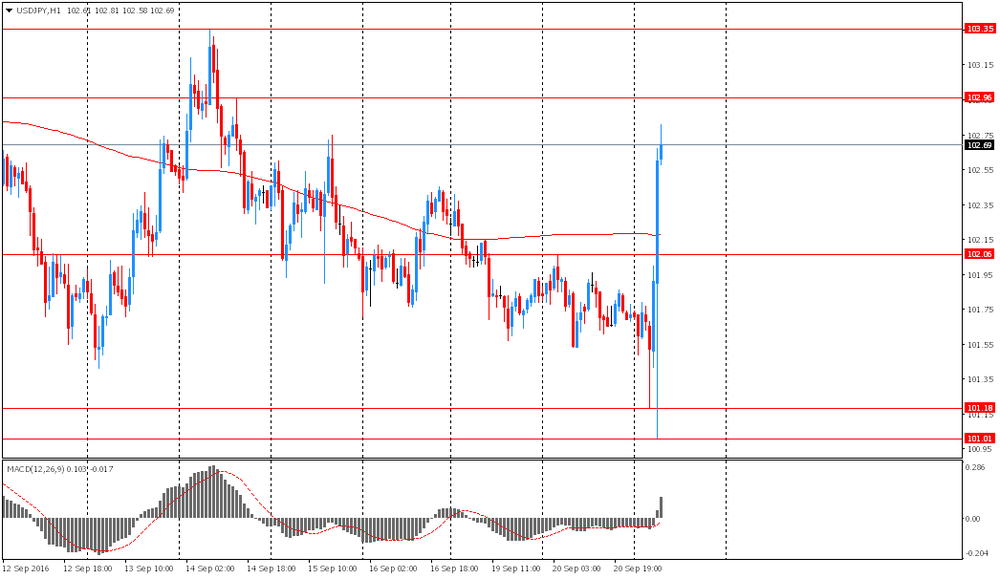

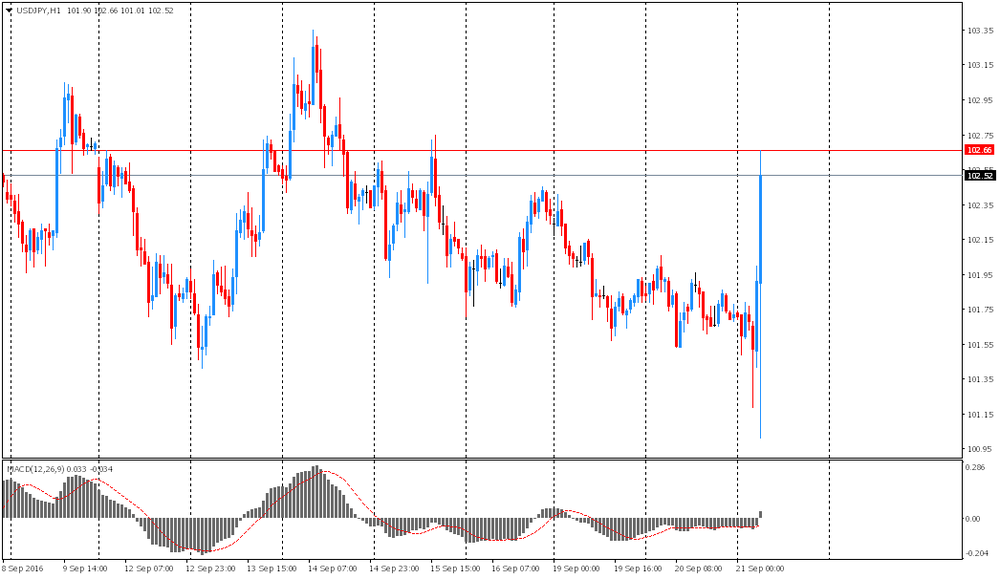

Against the yen, the dollar fell 1% to 100.57 after a session high of 102.78, due to views that the recent changes in the monetary policy of the Bank of Japan are not enough to stimulate the growth of inflation.

A strong US dollar, as a rule, is putting pressure on gold, as it reduces the metal's appeal as an alternative asset and increases the price of dollar-denominated commodities for holders of other currencies.

The cost of the October futures for gold on COMEX rose to $ 1329.2 per ounce.

-

16:36

Better US crude inventories, limited oil prices reaction

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.2 million barrels from the previous week. At 504.6 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 3.2 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories increased by 2.2 million barrels last week and are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.7 million barrels last week and are above the upper limit of the average range. Total commercial petroleum inventories decreased by 6.0 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, September -6.2 (forecast 2.25)

-

16:19

Chinese Premier, Li: the relationship with the United States will develop regardless of who wins the election

"China and the United States will continue to develop a positive relation no matter who wins the US presidential election," - said Chinese Premier Li Keqiang at the economic forum in New York, at the same time refusing to name the candidate he supports. Republican Donald Trump threatened to raise tariffs on Chinese goods, and to insist on more stringent trade talks if elected. His Democratic rival Hillary Clinton changed tactics on trade, spoke out against the Pacific Trade Agreement, which it had previously approved of.

Li Keqiang, who attended the UN General Assembly in New York, said that the US elections are an internal matter. "No matter who will be elected, I believe that the Chinese-US relations will continue to grow steadily and in a positive direction." In addition, Li Keqiang responded to complaints from foreign business leaders about the limited access to the Chinese market, saying that China was open to foreign investment, although some sectors of the economy have not yet "matured".

-

15:55

WSE: After start on Wall Street

The American market started trading with a slight, expected rise. It did not make any impression on investors in Warsaw, where the index of the largest companies remain in consolidation around the opening level.

An hour before the close of trading the WIG20 index was at the level of 1,758 points (+ 0.16%) with the turnover of slightly over PLN 400 million.

-

15:53

Swiss National Bank leaves expansionary monetary policy unchanged - Quarterly Bulletin

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at - 0.75% and the target range for the three-month Libor is unchanged at between - 1.25% and - 0.25%. At the same time, the SNB will remain active in the foreign exchange market, as necessary. The negative interest rate and the SNB's willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing upward pressure on the currency. The Swiss franc is still significantly overvalued. The SNB's expansionary monetary policy is aimed at stabilising price developments and supporting economic activity.

The new conditional inflation forecast has been revised slightly downwards compared to the June forecast. Up to the first quarter of 2017, the path of inflation remains almost the same. Thereafter, the slightly less favourable global economic outlook dampens inflation in Switzerland. For 2016, the inflation forecast remains unchanged at - 0.4%. For 2017, the SNB expects inflation of 0.2%, compared to 0.3% forecast in the last quarter, while for 2018, the forecast has fallen from 0.9% to 0.6%. The conditional inflation forecast is based on the assumption that the three-month Libor remains at - 0.75% over the entire forecast horizon.

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1200 (EUR 250 M), 1.1235-1.1240 (EUR 269 M), 1.1260-1.1265 (EUR 419 M)

USDJPY: 100.00 (USD 1,150 M), 100.50-100.58 (USD 320 M), 101.25-101.40 (USD 266 M), 101.60-101.75 (USD 410 M), 102.00 (USD 230 M), 102.50-102.65 (USD 255 M), 103.00-103.15 (USD 298 M)

GBPUSD: 1.2800 (GBP 301 M), 1.3128-1.3130 (GBP 194 M), 1.3150 (GBP 444 M)

AUDUSD: 0.7450-0.7455 (AUD 256 M), 0.7525 (AUD 249 M), 0.7680 (AUD 380 M)

USDCAD: 1.3035-1.3050 (USD 637 M), 1.3185-1.3200 (USD 439 M), 1.3250 (USD 832 M), 1.3300 (USD 437 M)

-

15:44

-

15:38

test

-

15:31

U.S. Stocks open: Dow +0.44%, Nasdaq +0.42%, S&P +0.34%

-

15:00

Before the bell: S&P futures +0.28%, NASDAQ futures +0.39%

U.S. stock-index futures rose before the Federal Reserve's policy decision, with the Bank of Japan reinforcing optimism that central banks will continue to support global growth.

Global Stocks:

Nikkei 16,807.62 +315.47 +1.91%

Hang Seng 23,669.90 +139.04 +0.59%

Shanghai 25.48 +2.48 +0.08%

FTSE 6,846.74 +15.95 +0.23%

CAC 4,426.32 +37.72 +0.86%

DAX 10,484.18 +90.32 +0.87%

Crude $44.90 (+1.93%)

Gold $1331.00 (+0.97%)

-

14:48

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.53

0.09(0.9534%)

54029

Amazon.com Inc., NASDAQ

AMZN

782.65

2.43(0.3115%)

8188

Apple Inc.

AAPL

114.15

0.58(0.5107%)

122360

AT&T Inc

T

40.11

0.15(0.3754%)

3387

Barrick Gold Corporation, NYSE

ABX

17.6

0.40(2.3256%)

56538

Chevron Corp

CVX

98.39

0.69(0.7062%)

400

Cisco Systems Inc

CSCO

31.15

0.05(0.1608%)

100

Citigroup Inc., NYSE

C

46.85

0.31(0.6661%)

30323

Exxon Mobil Corp

XOM

83.02

0.48(0.5815%)

857

Facebook, Inc.

FB

128.96

0.32(0.2488%)

74425

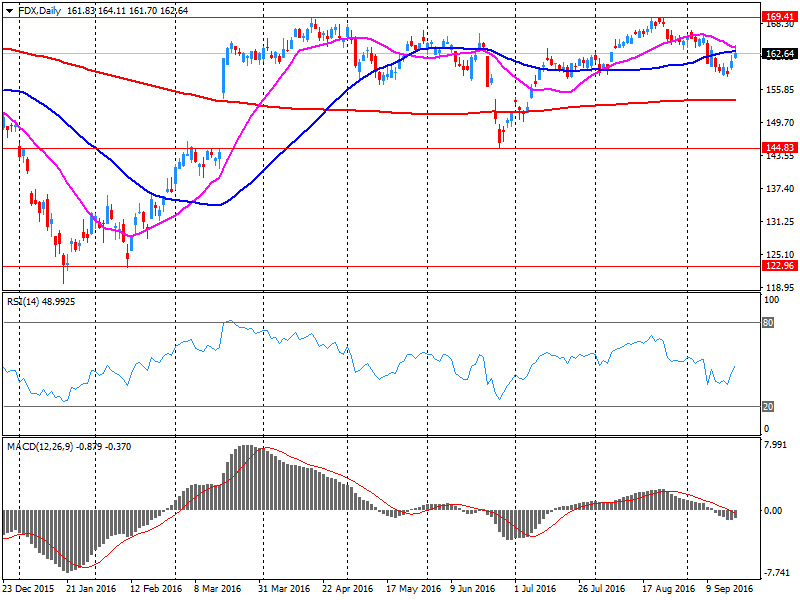

FedEx Corporation, NYSE

FDX

168.84

6.19(3.8057%)

8417

Ford Motor Co.

F

12.05

0.05(0.4167%)

40418

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.11

0.16(1.608%)

54149

General Electric Co

GE

29.83

0.16(0.5393%)

5468

General Motors Company, NYSE

GM

31.73

0.08(0.2528%)

10309

Google Inc.

GOOG

774

2.59(0.3357%)

626

Hewlett-Packard Co.

HPQ

14.55

0.01(0.0688%)

600

Intel Corp

INTC

37.25

0.11(0.2962%)

543

JPMorgan Chase and Co

JPM

66.79

0.33(0.4965%)

3839

Microsoft Corp

MSFT

57.55

0.74(1.3026%)

114988

Nike

NKE

55.07

0.20(0.3645%)

1813

Procter & Gamble Co

PG

88.62

0.04(0.0452%)

13346

Starbucks Corporation, NASDAQ

SBUX

53.75

0.45(0.8443%)

2059

Tesla Motors, Inc., NASDAQ

TSLA

205.1

0.46(0.2248%)

534

The Coca-Cola Co

KO

42.4

0.06(0.1417%)

28011

Wal-Mart Stores Inc

WMT

72.07

0.10(0.1389%)

8560

Walt Disney Co

DIS

93.3

0.35(0.3765%)

746

Yahoo! Inc., NASDAQ

YHOO

43.01

0.22(0.5141%)

500

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Altria (MO) initiated with a Hold at Jefferies; target $70

Starbucks (SBUX) initiated with a Buy at Longbow

FedEx (FDX) target raised to $186 from $179 at Stifel

-

14:33

Canadian wholesale sales increased for a fourth consecutive month

Wholesale sales rose 0.3% to $56.5 billion in July, a fourth consecutive monthly gain. Increases were recorded in five of seven subsectors, led by the motor vehicle and parts subsector and the food, beverage and tobacco subsector.

In volume terms, wholesale sales were unchanged in July.

Sales rose in five of seven subsectors, representing 72% of total wholesale sales. The motor vehicle and parts subsector recorded the largest increase in dollar terms in July, up 2.0% to $11.1 billion. This was the subsector's fourth consecutive monthly gain. Sales in the motor vehicle industry (+3.0%) rose to a record high, and accounted for most of the advance in the subsector. Excluding this subsector, wholesale sales were down 0.1% in July.

Sales in the food, beverage and tobacco subsector rose 1.2% to $11.0 billion in July. While sales increased in all of the subsector's industries, the food industry (+1.3%) contributed the most to the gain.

In the machinery, equipment and supplies subsector, sales rose 0.6% to $11.2 billion in July, the highest level since January 2016. Three of the four industries in the subsector contributed to the increase, led by the construction, forestry, mining, and industrial machinery, equipment and supplies industry (+2.6%).

Following two consecutive declines, sales in the miscellaneous subsector rose 0.9% to $7.0 billion, led by the agricultural supplies industry (+3.9%).

Following five consecutive increases, the personal and household goods subsector was down 2.0% to $8.1 billion. Declines in the pharmaceuticals and pharmacy supplies industry (-3.5%) accounted for most of the sales decrease. Imports and exports of pharmaceutical and medicinal products were also lower in July.

-

14:31

European session review: the US dollar significantly lower against the yen

The following data was published:

(Time / country / index / period / previous value / forecast)

6:30 Japan Press Conference of the Bank of Japan

8:30 UK net borrowing state. sector billion. August 2.43 -10.3 -10.05

The Japanese yen has strengthened considerably against the dollar, recovering all the ground lost after the announcement of the Bank of Japan. The catalyst for the growth of the yen were the statements of the Bank of Japan's governor Haruhiko Kuroda. He noted that the Japanese economy emerged from a state of deflation, which lasted 15 years. "The Bank of Japan will continue to pursue a flexible monetary policy and did not hesitate to implement additional stimulus measures if needed to achieve the inflation target as soon as possible and is still a priority for the Central Bank." - Said Kuroda, adding that now the Central Bank is focused on targeting bond yields and ready to reduce the volume of purchases of bonds. Kuroda also said that the recent changes in the policy framework were 50% due to fears that the combination of negative interest rates and quantitative easing has a very negative impact on banks' profits and consumer sentiment.

Recall, at the end of the two-day meeting, the Bank of Japan left interest rates on deposits at the level of -0.1%. The Board also left unchanged the target volume of purchases of government bonds - at 80 trillion yen per year. However, the Central Bank unexpectedly introduced a target rate of return on 10-year government bonds at 0% within the framework of strengthening the fight against deflation. This measure was taken after the assessment of existing measures that do not yield results. The Bank of Japan first introduced the target level for the long-term rates, and it happened at a time when other central banks have difficulty in finding ways of accelerating inflation. "Investors reacted positively to the decision, considering that the Central Bank will make every effort to overcome deflation," - said Kengo Suzuki analyst at Mizuho Securities.

The British pound rose moderately against the US dollar, as investors adjusted their positions ahead of Fed's decision on rates. Investors' attention is also drawn by the British data. Office for National Statistics reported that the results of last month's budget deficit was lower than in the same period of 2015. Net borrowing of the public sector decreased by 0.9 billion pounds compared to August 2015 and amounted to 10.5 billion pounds.

Also in focus were revised forecasts from the Organisation for Economic Cooperation and Development. The OECD lowered the forecast for world GDP in 2016 to 2.9%. In June, the OECD expected an increase of 3%. Global GDP in 2017 deteriorated to 3.2% from 3.3%. A slight decrease reflects the weakening of forecasts of major economies of the world, especially in Britain, in 2017, partially offset by the gradual improvement of the situation in the main emerging markets. Also, the OECD pointed out the very weak growth in trade. The rate of increase in world trade slowed down approximately double compared to pre-crisis levels.

The US dollar fell slightly against the euro, returning to the opening level due to investors caution before the announcement of the Fed meeting outcome. The median estimate of more than 100 economists polled to Reuters show that rates will increase to 0.50-0.75 percent in the fourth quarter, and, most likely, in December (average probability of 70 percent). Recall that in a survey last month, the chances of a hike in December were at 57.5 percent.

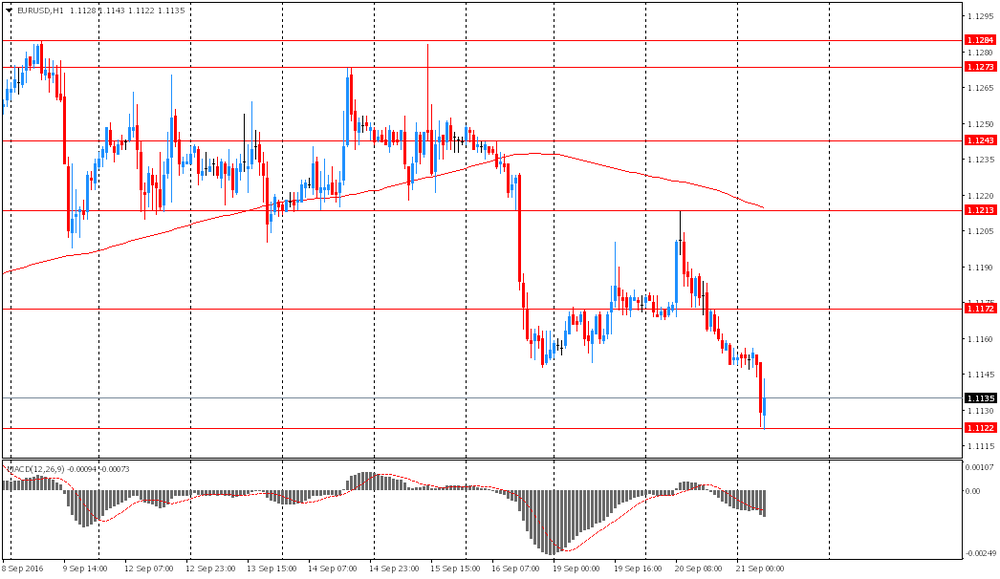

EUR / USD: during the European session, the pair fell to $ 1.1122, but then went back to $ 1.1160

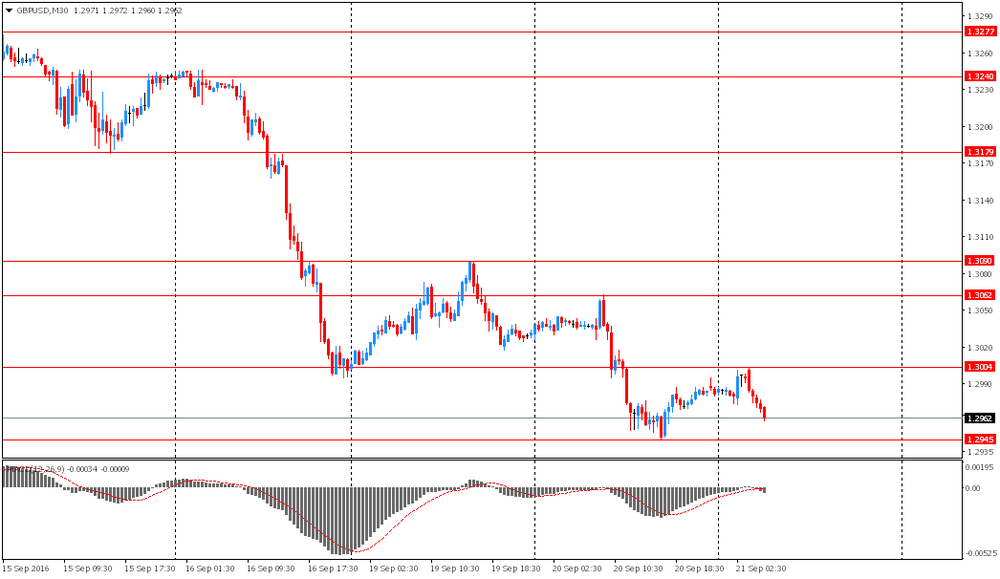

GBP / USD: during the European session, the pair rose to $ 1.3005 from $ 1.2944

USD / JPY: during the European session, the pair has collapsed to Y100.94 from Y102.79

-

14:30

Canada: Wholesale Sales, m/m, July 0.3% (forecast 0.2%)

-

14:03

Why We Still See EUR/USD Reaching 1.20 Before It Reaches 1.00 - Danske

"We keep our EUR/USD forecasts unchanged and still expect EUR/USD to continue to trade in the 'post-Brexit' range of 1.10- 1.14 in coming months. We target EUR/USD at 1.12 in 1-3M.

While we believe that there will be some slowdown in the Eurozone in coming months, we still do not expect the ECB to cut rates. Political uncertainty is likely to increase as the US presidential elections are moving closer.

However, political uncertainty could weigh on both the EUR and the USD and thus uncertainty is more likely to be source of increased volatility rather than a directional risk. Longer term, we maintain our long-held view that the undervaluation of the EUR and the wide eurozone-US current account differential are longer-term EUR positives.

Hence, EUR/USD will reach 1.20 before it reaches 1.00, in our view. We target 1.14 in 6M and 1.18 in 12M".

Copyright © 2016 Danske, eFXnews™

-

14:00

Orders

EUR/USD

Offers 1.1160-65 1.1180 1.1200 1.1220-25 1.1245-50 1.1280 1.1300

Bids 1.1130 1.1100 1.1080 1.1050 1.1025-30 1.1000

GBP/USD

Offers 1.3000-05 1.3020 1.3050 1.3070 1.3085 1.3100 1.3125-30 1.3150

Bids 1.2965 1.2940-50 1.2900 1.2880 1.2850 1.2830 1.2800

EUR/GBP

Offers 0.8600 0.8625-30 0.8650 08685 0.8700

Bids 0.8565 0.8540 0.8520 0.8500 0.8485 0.8450

EUR/JPY

Offers 113.85 114.00 114.20 114.50 114.80-85 115.00 115.25 115.50

Bids 113.20 113.00 112.50-55 112.35 112.00 111.80 111.50

USD/JPY

Offers 102.25 102.45-50 102.80 103.00 103.30 103.50

Bids 101.80 101.50 101.20 101.00 100.80 100.50 100.30 100.00

AUD/USD

Offers 0.7600 0.7620 0.7660-65 0.7685 0.7700

Bids 0.7565 0.7550 0.7530-35 0.7500 0.7485 0.7465 0.7445-50

-

13:16

Company News: FedEx (FDX) quarterly results beat analysts’ estimates

FedEx reported Q1 FY 2017 earnings of $2.90 per share (versus $2.42 in Q1 FY 2016), beating analysts' consensus estimate of $2.78.

The company's quarterly revenues amounted to $14.700 bln (+19.5% y/y), beating analysts' consensus estimate of $14.441 bln.

FedEx also improved guidance for FY 2017, increasing EPS to $11.85-12.35 from $11.75-12.25 versus analysts' consensus estimate of $11.88.

FDX rose to $168.00 (+3.29%) in pre-market trading.

-

13:04

WSE: Mid session comment

The first half of trading on European markets brought stabilization after high openings and the DAX and the CAC indices are gaining about 1 percent.

In the Warsaw we do not see much enthusiasm and WIG20 index hovering around the level of yesterday's closing auction. Relatively weak behavior is in other emerging markets. The next hours will shift attention to Wall Street and today's FOMC decision, which carries risks for emerging markets and for this reason the Warsaw Stock Exchange may maintain a distance in relation to the developed markets. The market activity improves today, however, the variability remains a sensitive subject, and in the first half of the session was a mere 6 points. At the halfway point of today's session the WIG20 index was at the level of 1,747 points (-0,12%).

-

13:03

Major European stock indices trading in the green zone

European stock indices show an increase for the second time in three days on optimism that the policy of the world's central banks will continue to support growth.

At the end of the two-day meeting, the Bank of Japan left interest rates on deposits at the level of -0.1%. The Board also left unchanged the target volume of purchases of government bonds - at 80 trillion yen per year. However, the Central Bank unexpectedly introduced a target rate of return on 10-year government bonds at 0% within the framework of strengthening the fight against deflation. This measure was taken after the assessment of existing measures that do not yield results. The Bank of Japan first introduced the target level for the long-term rates, and it happened at a time when other central banks have difficulty in finding ways of accelerating inflation. "Investors reacted positively to the decision, considering that the Central Bank will make every effort to overcome deflation," - said Kengo Suzuki analyst at Mizuho Securities.

In the last session, European stocks fluctuated between gains and losses, in response to mixed economic data and fears that central banks may be less willing to strengthen measures to stimulate the economy.

To the growth also contributes the situation on the oil market. Quotes of oil rose by about 2 per cent due to a report from the American Petroleum Institute, which pointed to a significant reduction in US oil inventories. According to API, oil reserves in the previous week fell by 7.5 million barrels, while analysts had expected an increase. Later today iUS Department of Energy data will be published. It is estimated that crude oil inventories rose by 2.25 million barrels to 513.05 million barrels.

Also in focus were revised forecasts from the Organisation for Economic Cooperation and Development. The OECD lowered the forecast for world GDP in 2016 to 2.9%. In June, the OECD expected an increase of 3%. Global GDP in 2017 deteriorated to 3.2% from 3.3%. A slight decrease reflects the weakening of forecasts of major economies of the world, especially in Britain, in 2017, partially offset by the gradual improvement of the situation in the main emerging markets. Also, the OECD pointed out the very weak growth in trade. The rate of increase in world trade slowed down approximately double compared to pre-crisis levels.

The composite index of the largest companies in the regios Stoxx Europe 600 grew by 0.9 percent. Shares of banks and insurance companies show the most gains, which is associated with the decision of the Bank of Japan, and the expectation of the Fed's meeting today. It is unlikely that the Fed will raise rates in September, but investors will be closely watching the press conference and forecasts looking for indications that a decision may be taken in December.

Capitalization of Banco Santander SA rose 3.4 percent after reports that the lender has completed negotiations with the Royal Bank of Scotland, to buy Williams & Glyn.

Shares of Inditex SA rose 0.9 percent after the world's largest clothing retailer reported that earnings exceeded analysts' expectations.

The cost of Eurofins Scientific SE has increased by 3.9 percent, as the company raised its earnings forecast for the current year and said it remains on track to achieve its objectives for 2020.

At the moment:

FTSE 100 6854.75 +23.96 + 0.35%

DAX +113.99 10507.85 + 1.10%

CAC 40 +53.45 4442.05 + 1.22%

-

12:35

Record daily oil production from Russia in September

TYUMEN, September 21. / TASS /. Russia set a new record for average daily oil production in the country, on September 8, will exceed 11 million barrels. This was stated during the Tyumen Oil and Gas Innovation Forum by the Deputy Energy Minister.

"The Russian Federation reached on September 8 a historic high. We produced more than 11 million barrels" - he said.

Oil production is growing for several years in a row in Russia. In 2015 the average oil extracted was 10,726,000 barrels of oil and condensate per day. Total for the year was more than 534 million tons, which is 1.4% more than in the previous year.

According to Rosstat, in June 2016. Russian extracted 10.136 million barrels of oil per day.

-

12:10

AUD The Most Vulnerable Vs USD If The Fed Hikes Today As We Expect - BNPP

"The minutes from the Reserve Bank of Australia's September meeting signalled that the RBA is in no hurry to make any changes to current settings, consistent with the view from our economists that they are unlikely to cut rates further, and consistent with AUD rates market pricing for minimal easing over the next 12 months. We do not think RBA rate cuts are required for AUDUSD to weaken.

BNP Paribas STEER, our short-term fair value model, signals the key driver of AUDUSD is global equities: a 5% decline in MSCI world corresponds with a 3.5% decline in AUDUSD's STEER.

Given our economists' expectations for a Fed rate hike at tomorrow's meeting, we see the risk environment as vulnerable and continue to recommend short AUDUSD through options".

Copyright © 2016 BNP Paribas™, eFXnews™

-

11:24

OECD dowgrades global economic outlook due to downgrades in major advanced economies

The OECD projects that the global economy will grow by 2.9 percent this year and 3.2 percent in 2017, which is well below long-run averages of around 3¾ percent.

The small downgrade in the global outlook since the previous Economic Outlook in June 2016 reflects downgrades in major advanced economies, notably the United Kingdom for 2017, offset by a gradual improvement in major emerging-market commodity producers.

Growth among the major advanced economies will be subdued. In the United States, where solid consumption and job growth is countered by weak investment, growth is estimated at 1.4 percent this year and 2.1 percent in 2017. The euro area is projected to grow at a 1.5 percent rate in 2016 and a 1.4 percent pace in 2017. Germany is forecast to grow by 1.8 percent in 2016 and 1.5 percent in 2017, France by 1.3 percent in both 2016 and 2017, while Italy will see a 0.8 percent growth rate this year and next.

-

10:42

Oil is gaining in early trading

This morning, New York crude oil futures for WTI rose 2.22% to $ 45.03 and Brent crude oil futures rose in price by 1.77% to $ 46.69 per barrel. Thus, the black gold is trading higher, amid the release of data on the reduction of inventories in the United States and the good performance of the Japanese imports. Data from the American Petroleum Institute showed that US crude stocks fell by 7.5 million barrels to 507.2 million, while analysts had expected a growth of oil reserves by 3.4 million barrels. Energy Information Administration will release official data on US inventories later on Wednesday and experts said they are also waiting for the outcome of the meeting of the US Federal Reserve Open Market Committee. Oil imports grew by 0.5% in Japan in August compared with the same period last year, reported the Ministry of Finance. Also Japan, the fourth-largest buyer of oil in the world, imported 3.38 million barrels per day last month, data showed.

-

10:39

BOE Agents' Summary of Business Conditions, 2016 Q3

-

The annual rate of activity growth had slowed overall as uncertainty rose following the EU referendum, although it remained positive. However, business sentiment improved slightly in August following a marked dip in the immediate aftermath of the referendum.

-

Consumer spending growth and confidence had been more resilient. Although housing market activity had fallen markedly in London and in parts of the surrounding area, it had held up relatively well in other parts of the United Kingdom.

-

Companies' investment and employment intentions had fallen, and were consistent with broadly flat levels of capital spending and employment over the coming six to twelve months.

-

-

10:38

UK public sector net borrowing improves in August

-

The data in this bulletin presents the latest fiscal position of the UK public sector as at 31 August 2016 and so includes 2 months of post-EU referendum data. However, estimates for the latest period always contain a substantial forecast element and the figures have to be considered in this light.

-

Public sector net borrowing (excluding public sector banks) decreased by £4.9 billion to £33.8 billion in the current financial year-to-date (April to August 2016), compared with the same period in 2015.

-

Public sector net borrowing (excluding public sector banks) decreased by £0.9 billion to £10.5 billion in August 2016, compared with August 2015.

-

Public sector net debt (excluding public sector banks) at the end of August 2016 was £1,621.5 billion, equivalent to 83.6% of gross domestic product (GDP); an increase of £52.0 billion compared with August 2015.

-

-

10:30

United Kingdom: PSNB, bln, August -10.05 (forecast -10.3)

-

10:21

Japan's Ishihara: Abenomics will be accelerated in conjunction with BOJ

-

govt welcomes BOJ commitment to achieving 2% inflation target

-

important for BOJ to communicate with market

*via forexlive -

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 500m) 1.1030 (1.17bln) 1.1200 (728m) 1.1250 (493m) 1.1300 (297m)

USD/JPY: 100.00 (USD 433m) 100.75 (500m) 101.30 (250m) 101.50 (455m) 102.00 (412m) 102.40-50 (640m) 103.00 (1.27bln)

NZD/USD 0.7300 (NZD 240m) 0.7315 (181m) 0.7330-50 (350m)

-

09:37

Major stock exchanges trading in the green zone: FTSE + 0.6%, DAX + 1.0%, CAC40 + 1.2%, FTMIB + 1.1%, IBEX + 1.4%

-

09:09

Today’s events

At 11:00 GMT the Bank of England's Quarterly Bulletin

At 13:00 GMT quarterly inflation report from the SNB

At 18:00 GMT Economic Outlook from the FOMC, FOMC decision on the nterest rate and the accompanying FOMC statement

In the 18:30 GMT FOMC Press Conference

At 21:00 GMT RBNZ decision on interest rate and the accompanying RBNZ statement

Also today, Japan celebrates the autumn equinox

-

08:48

Expected positive start of trading on the major stock exchanges in Europe: DAX futures + 0.4%, CAC40 + 0.7%, FTSE + 0.3%

-

08:47

Asian session review: The Bank of Japan took measures that even the market can’t fully understand

The yen has fallen by updating the session low despite the fact that BoJ did not change the intrest rate level, the regulator said that it will continue to increase monetary base, while inflation stabilizes above 2%. In addition, the Bank of Japan made a surprise move, targeting a level for the 10-year interest rates in order to strengthen the fight against deflation. This measure was adopted after the Bank management's assessment of existing measures which have not led to the achievement of inflation target of 2% for two years, as it was planned earlier. Also, traditionally the Bank of Japan announced its readiness to further reduce the negative interest rates on deposits.

Earlier today data on the trade balance of Japan was published. According to the report of the Ministry of Finance of Japan, the foreign trade deficit amounted to Y19,0 billion in August, but the forecast indicated a surplus of Y202,3 billion. In July, the trade surplus was Y513,2. Japan's exports fell by -9.6% compared to the same period of the previous year. Economists had expected a fall to -4.8%. Reduced exports continues the eleventh consecutive month. Exports to Europe decreased by 0.7% in the US to 14.5%, while in China -8.9%. Year-on-year imports fell by -17.3% compared to August of the previous year.

Today, a key event for markets will be the announcement of the Fed's decision on monetary policy. Mixed US data recently clouded the prospects of a Fed hike. Judging by the futures market, investors assess the probability of a hike at this meeting at only 18%.

EUR / USD: during the Asian session the pair fell to $ 1.1120

GBP / USD: during the Asian session the pair fell to $ 1.2945

USD / JPY: rose to Y102.80 in the Asian session

-

08:38

BOJ's Kuroda says Japanese economy no longer in deflation

-

08:36

USD Into FOMC: Will This Be The Start Of A New Trend? - BofA Merrill

"Fed may send conditional hints of upcoming hike:

The Federal Reserve meeting on September, 21 is likely to be eventful. While the FOMC is unlikely to deliver a rate hike, we think the committee will have to communicate that a hike is still likely before year-end. This means that the communication would have to sound cautiously hawkish, which is not an easy task.

We expect the FOMC to note that the balance of risks are nearly balanced and for the dots to shift down by 25bp across the curve. In our view, Fed Chair Yellen is likely to make the case for a hike before year-end in the press conference, but with an emphasis on the fact that it is dependent on continued improvement in the data.

FX Implications: Start of A New Trend?

The "cautiously hawkish" tone that we expect from the FOMC meeting is likely to be mildly USD-supportive, but we doubt it is the start of a new trend.

An upbeat economic assessment and nearly-balanced economic risks would support market pricing for a December hike, limiting USD downside, in our view. However, with the market pricing just over one hike between now and end-2017, we believe a necessary condition for the USD to rally is a consistent pattern of better US data allowing the market to price a meaningful pace of hikes in 2017 and 2018. Until then, the USD is likely to be range bound. That said, a residual expectation for Fed hikes is likely enough to limit significant USD downside given most G10 central banks are easing, but the dollar is unlikely to rally either.

Additionally, the recent shift by our US Rates Team's to a short real rates stance also suggests USD risks are more on the upside than the downside. The USD has benefitted over the past week as US real yields have risen between 6 and 18 basis points, driving a steepening of the rates curve. While the USD is typically negatively correlated with the shape of the yield curve, it has rallied because the curve steepening has been driven by real yields a relationship we have highlighted on many occasions. Should a real rate-led steepening of the curve continue, we would expect the USD to benefit. Indeed, the dollar continues to look undervalued relative to real yield differentials as we have noted recently.

However, we believe there are two risks around real yields for the dollar.

First, if the Fed were to more explicitly (through its Sep forecasts or communications) signal it will strategically overshoot its inflation target, real yields will fall, breakevens will rise and the USD will suffer. Our base case does not see this as a possibility for the September meeting, but Ethan Harris has argued the Fed could adopt this strategy to extend the business cycle allowing more room for rates to rise. Some belief that the Fed would stay 'behind the curve' on inflation earlier this year was a key reason for the USD selloff.

Second, if the BoJ focuses, as we expect, on maintaining policy flexibility as opposed to implementing significant new stimulus, the market could again interpret this as a policy constraint, pushing Japanese real yields higher, equities lower, and leading to a stronger Yen. This sentiment could spread to the ECB suggesting the USD would likely struggle against its G3 counterparts. This is why the BoJ meeting (happening hours before the Fed next Wednesday) is likely to be more consequential for FX markets than the FOMC".

Copyright © 2016 BofAML, eFXnews™

-

08:34

ECB Board Member, Praet: French economic performance "surprisingly weak"

ECB's chief economist, Peter Praet gave an interview to the famous French business publication L'opinion. The official said that recent economic indicators for France, seemed "surprisingly weak" and the main problem he sees is the labor market. Praet also promised to promote the expansion of Franco-German relations. With regard to the policy of the European Central Bank, confirmed willingness to maintain a very high level of financial support to the region and called for European banks to adapt to the negative interest rates.

-

08:29

The Wall Street Journal about the Bank of Japan's measures

-

An unexpected step launching a 10-year interest rate target

-

Following an internal review of existing measures that failed to achieve 2% inflation in a promised two-year time frame

-

Bank to start targeting 10-year interest rates ... committing to keep them around zero

-

Will continue QQE until inflation "exceeds" 2%

-

-

08:27

Options levels on wednesday, September 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1300 (2530)

$1.1252 (1037)

$1.1216 (425)

Price at time of writing this review: $1.1131

Support levels (open interest**, contracts):

$1.1097 (3395)

$1.1062 (6122)

$1.1024 (3081)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 35565 contracts, with the maximum number of contracts with strike price $1,1400 (4704);

- Overall open interest on the PUT options with the expiration date October, 7 is 39270 contracts, with the maximum number of contracts with strike price $1,1100 (6122);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from September, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.3204 (1223)

$1.3107 (1115)

$1.3011 (371)

Price at time of writing this review: $1.2971

Support levels (open interest**, contracts):

$1.2893 (897)

$1.2796 (1891)

$1.2697 (1427)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 22836 contracts, with the maximum number of contracts with strike price $1,3450 (2862);

- Overall open interest on the PUT options with the expiration date October, 7 is 22964 contracts, with the maximum number of contracts with strike price $1,3000 (3707);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from September, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:26

USD / JPY rose sharply to Y102.80 after the announcement of the Bank of Japan

USD / JPY rose updating the session high despite the fact that the Central Bank did not change the intrest rate, the regulator said that it will continue to increase monetary base, while inflation stabilizes above 2%. In addition, the Bank of Japan announced its readiness to further reduce the negative interest rates on deposits.

-

08:24

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. There was no impulse yesterday, which is worth to remember and will be important during today's trading. After a month of focus on the question "what the Fed will do in September?" the stock exchanges reached the day on which the whole trade will be dominated by reactions to the actions and signals from the central banks. We may expect that opening of European markets will be a simple reaction to today's decision of the BoJ and the related conference of the BoJ head.

However, investor's attention should quickly move in the direction of Wall Street and waiting for the evening decision of the Federal Open Market Committee. In the case of the Fed's decision is a lot of uncertainty, statements of the Fed indicated that in September will raise interest rates. The data indicate rather the lack of such action.

The session on the Warsaw market will be than strongly associated with other exchanges. The Fed's decision will appear after the close of trading in Warsaw, so a serious reaction we will see tomorrow.

-

08:22

Bank of Japan holds rates, changes QQE parameters

According to rttnews, the Bank of Japan decided to modify the existing policy framework to achieve the inflation target at the earliest possible time.

"With a view to achieving the the price stability target of 2 percent at the earliest possible time, the Bank decided to introduce 'QQE with yield curve control'," the bank said Wednesday.

Accordingly, the bank will control short-term and long-term interest rates and also it will expand the monetary base until inflation exceeds 2 percent.

"With regard to the amount of JGBs to be purchased, the bank will conduct purchases more or less in line with the current pace - an annual pace of increase in the amount of outstanding of its JGB holdings at about 80 trillion yen," the bank said.

The BoJ will continue applying a negative interest rate of -0.1 percent to the policy rate balances in current accounts held by financial institutions.

-

06:54

Global Stocks

U.K. stocks gained ground Tuesday, finding support as the pound lost some of its value ahead of much anticipated decisions by the U.S. Federal Reserve and the Bank of Japan. The blue-chips benchmark had been darting in and out of positive territory Tuesday, but stepped higher as the pound GBPUSD, -0.1694% dropped below $1.30, trading below that level for the first time since mid-August.

U.S. stocks on Tuesday ended little-changed, paring modest gains into the close, as traders grew cautious on the eve of a pair of major central-bank decisions. Volatile oil prices pressured energy shares, limiting overall gains. The S&P 500 index SPX, +0.03% finished up less than a point at 2,139.76. Health care and consumer staples led winners, while energy shares lagged behind, falling 0.8%.

Japan's Nikkei stock market rose and the yen weakened immediately following the BOJ announcement. Japan's central bank announced Wednesday that it would keep its key interest rate steady at -0.1%. The Bank of Japan also said it would expand its monetary base until inflation becomes stable above 2%. The BOJ intends to abandon its monetary base target, but maintain an annual pace of government-bond buying at 80 trillion yen. Experts had been nervously awaiting the bank's move, with many concerned the BOJ would cut interest rates even deeper into negative territory.

-

06:19

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

02:32

Australia: Leading Index, August 0.0%

-

01:50

Japan: Trade Balance Total, bln, August -19 (forecast 202.3)

-

00:45

New Zealand: Visitor Arrivals, August 9%

-

00:30

Commodities. Daily history for Sep 20’2016:

(raw materials / closing price /% change)

Oil 44.43 +0.86%

Gold 1,318.00 -0.02%

-

00:29

Stocks. Daily history for Sep 20’2016:

(index / closing price / change items /% change)

Nikkei 225 16,492.15 0.00 0.00%

Shanghai Composite 3,023.30 -2.75 -0.09%

S&P/ASX 200 5,303.57 +8.77 +0.17%

FTSE 100 6,830.79 +17.24 +0.25%

CAC 40 4,388.60 -5.59 -0.13%

Xetra DAX 10,393.86 +19.99 +0.19%

S&P 500 2,139.76 +0.64 +0.03%

Dow Jones Industrial Average 18,129.96 +9.79 +0.05%

S&P/TSX Composite 14,521.98 +25.75 +0.18%

-

00:28

Currencies. Daily history for Sep 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1152 -0,20%

GBP/USD $1,2982 -0,39%

USD/CHF Chf0,9792 -0,07%

USD/JPY Y101,72 -0,11%

EUR/JPY Y113,45 -0,31%

GBP/JPY Y132,05 -0,49%

AUD/USD $0,7551 +0,19%

NZD/USD $0,7315 +0,19%

USD/CAD C$1,3192 -0,04%

-

00:00

Schedule for today, Wednesday, Sep 21’2016

00:30 Australia Leading Index August 0.1%

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

06:30 Japan BOJ Press Conference

08:30 United Kingdom PSNB, bln August 1.47 -10.3

12:30 Canada Wholesale Sales, m/m July 0.7% 0.2%

13:00 Switzerland SNB Quarterly Bulletin

14:30 U.S. Crude Oil Inventories September -0.559

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

21:00 New Zealand RBNZ Interest Rate Decision 2% 2%

21:00 New Zealand RBNZ Rate Statement

-