Noticias del mercado

-

21:03

DJIA 18405.81 112.11 0.61%, NASDAQ 5337.04 41.86 0.79%, S&P 500 2177.60 14.48 0.67%

-

19:24

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday, with the Nasdaq hitting a record intraday high, a day after the Federal Reserve stood pat on interest rates. While the Fed said the risks to economic outlook were roughly "balanced", it left rates unchanged as inflation continued to run below its 2% target and members saw room for improvement in the labor market.

Almost all of Dow stocks in positive area (29 of 30). Top gainer - United Technologies Corporation (UTX, +1.23%). Top loser - Pfizer Inc. (PFE, -0.12%).

All S&P sectors also in positive area. Top gainer - Utilities (+1.1%).

At the moment:

Dow 18333.00 +115.00 +0.63%

S&P 500 2170.75 +14.50 +0.67%

Nasdaq 100 4890.25 +40.25 +0.83%

Oil 46.32 +0.98 +2.16%

Gold 1344.60 +13.20 +0.99%

U.S. 10yr 1.61 -0.06

-

18:00

European stocks closed: FTSE 6911.40 76.63 1.12%, DAX 10674.18 237.69 2.28%, CAC 4509.82 100.27 2.27%

-

17:58

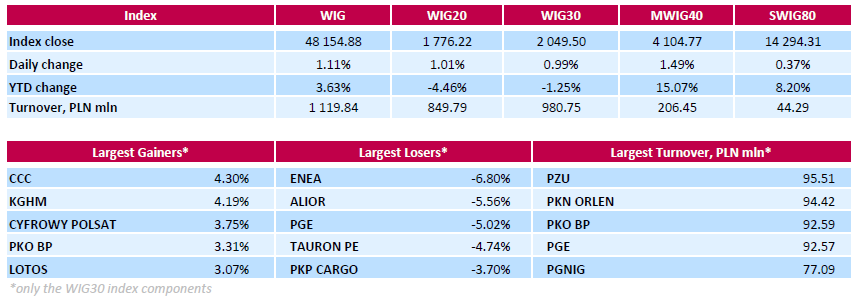

WSE: Session Results

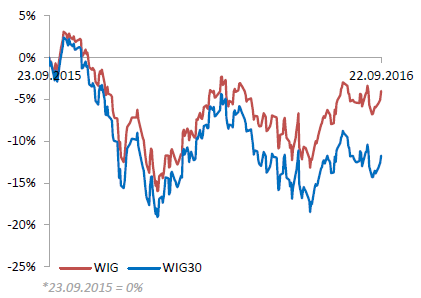

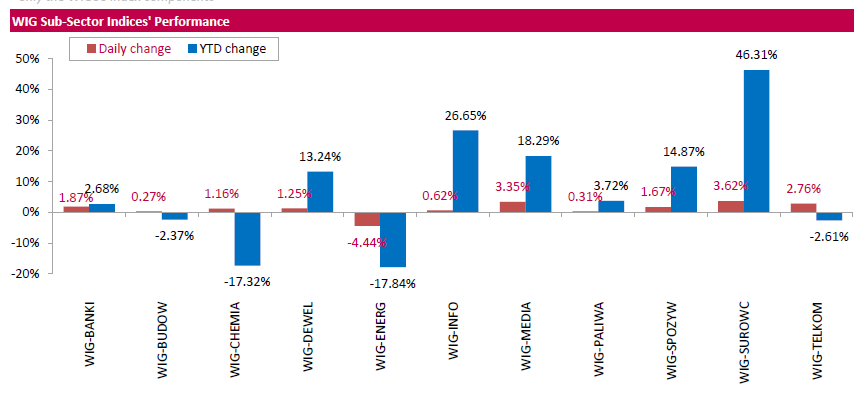

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 1.11%. Almost all sectors in the WIG generated positive returns. The only exception was utilities sector (-4.44%), dragged down by the announcement Poland's government intends to claim extra taxes from state-run utilities from 2017, in a move that is expected to hurt minority shareholders. The government's plan involves raising capital by increasing the nominal value of the utilities' shares, and not issuing new shares. As a result, the utilities will be obliged to flat-rate income tax of 19 percent on the increased nominal value.

The large-cap benchmark, the WIG30 Index, rose by 0.99%. Within the index components, footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH) led the gainers, climbing by 4.3% and 4.19% respectively. Other major advancers were media group CYFROWY POLSAT (WSE: CPS), bank PKO BP (WSE: PKO) and oil refiner LOTOS (WSE: LTS), gaining between 3.07% and 3.75%. On the other side of the ledger, all four utilities names TAURON (WSE: TPE), PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG) were among the day's weakest performers, losing between 3.42% and 6.8%. Elsewhere, banking name ALIOR (WSE: ALR) fell by 5.56% on fears the bank may issue new shares to finance the purchase of Raiffeisen Bank Polska. ALIOR reportedly started exclusive negotiations with Austria's Raiffeisen Bank International to buy its Polish core banking business.

-

17:47

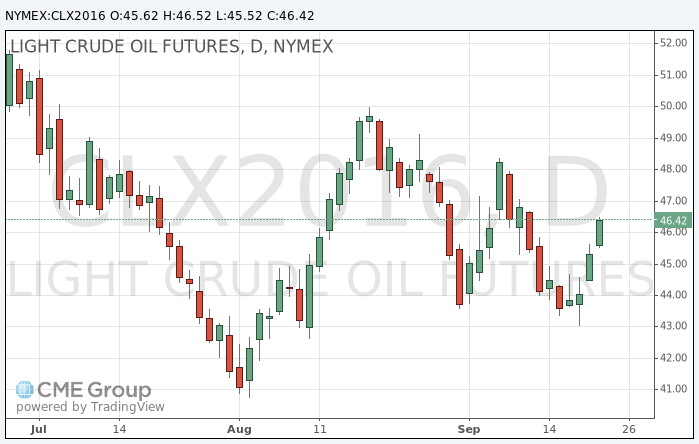

Oil continue to strengthen helped by inventories and lower USD

Oil prices continue to strengthened on weaker US dollar and a reduction in US stocks.

The weak US dollar has been supporting raw materials, as denominated in the US currency, oil futures become cheaper for investors using other currencies.

In addition, quotes are supported by a strike in the Norwegian oil industry, threatening production in the North Sea.

US Energy Information Administration reported that crude oil inventories tumbled by 6.2 million barrels last week to 504.6 million, which was a surprise to market analysts that forecasted an increase of 3.35 million barrels.

The report also showed that gasoline stocks fell by 3.204 million barrels, compared with expectations of a decline by 0.567 million barrels, while distillate stocks rose by 2.238 million barrels.

Traders continue to assess the likelihood that major oil-producing countries will be able to agree on the level of production in order to stabilize the market.

OPEC members will discuss potential limitation of production in the course of an informal meeting on the sidelines of the International Energy Conference in Algiers on 26-28 September.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 46.52 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 47.83 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:26

Gold continue to rise

Gold prices continue to rise and reached a fresh two-week high, as the US dollar fell to the Federal Reserve's decision to refrain from raising interest rates and reducing the forecast for the expected number of rate hikes next year.

On Wednesday, the Federal Reserve left interest rates unchanged. In addition, the Fed reduced the number of expected rate increases this year from two to one and predict the less aggressive growth of the interest rate for the next two years.

Nevertheless, the US central bank signaled that might tighten monetary policy until the end of the year, if the labor market continues to improve.

The next Fed meeting is scheduled for early November and mid-December. Economists believe that the bank officials will be able to avoid raising interest rates in November, partly because the meeting will take place just a few days before the US presidential election.

According Fed funds futures the estimated probability of a hike in November is 15% and 60% in December.

The gradual increase of the rate shall be less of a threat to the gold price

In the currency market, the USD index which tracks the greenback against a basket of six majors, fell by 0.45% to 95.05 from a six-week high in the previous session, 96.29.

Weak US dollar usually supports gold, as it boosts the metal's appeal as an alternative asset and decrease the price of dollar-denominated commodities for holders of other currencies.

The cost of the October futures for gold on COMEX rose to $ 1340.3 per ounce.

-

16:47

Iran says oil production close to pre-sanction levels

-

16:08

Eurozone consumer confidence increased in August

In September 2016, the DG ECFIN flash estimate of the consumer confidence indicator increased markedly in the EU (by 1.3 points to -6.4) compared to August. In the euro area it edged up by 0.3 points to -8.2.

-

16:05

US existing home sales declined in August

Slowed by frustratingly low inventory levels in many parts of the country, existing-home sales lost momentum in July and decreased year-over-year for the first time since November 2015, according to the National Association of Realtors®. Only the West region saw a monthly increase in closings in July.

Total existing-home sales 1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 3.2 percent to a seasonally adjusted annual rate of 5.39 million in July from 5.57 million in June. For only the second time in the last 21 months 2, sales are now below (1.6 percent) a year ago (5.48 million).

Lawrence Yun, NAR chief economist, says existing sales fell off track in July after steadily climbing the last four months. "Severely restrained inventory and the tightening grip it's putting on affordability is the primary culprit for the considerable sales slump throughout much of the country last month," he said. "Realtors® are reporting diminished buyer traffic because of the scarce number of affordable homes on the market, and the lack of supply is stifling the efforts of many prospective buyers attempting to purchase while mortgage rates hover at historical lows."

-

16:01

U.S.: Leading Indicators , August -0.2% (forecast 0.1%)

-

16:00

Eurozone: Consumer Confidence, September -8.2 (forecast -8.2)

-

16:00

U.S.: Existing Home Sales , August 5.33 (forecast 5.45)

-

15:52

WSE: After start on Wall Street

The afternoon part of session brought the light rebuild of the Warsaw market. Bulls managed to return to the levels from the opening, which also means a return to cosmetics growth. Negative sentiment to energy companies, of course, still remains, so a return to growth allows visible gain to the non-energy values, mainly on KGHM. It looks like capital fleeing the energy flow in the direction of the remaining shares.

Behind us strong data from the US labor market. This is the best reading since April 16. The market in the US is back to levels before the bond confusion. So in short, we may specify the achievements of yesterday's session and a positive beginning today. We should, however, realize that now control over market may slowly take over unrolling election campaign in the US. On Monday it will take place the first TV debate of two main candidates, none of which seems to be particularly advantageous from the investors point of view.

An hour before the close of trading the WIG20 index reached the level of 1,772 points (+0,78%).

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1000 (EUR 1.46bln) 1.1050-60 (414m) 1.1100 (1.53bln) 1.1150 (994m)1.1200 (577m) 1.1300 (897m)

USDJPY: 99.90-95 (USD 615m) 100.45 (USD 390m) 101.00 (535m) 101.20-35 (515m) 102.00 (402m)

GBPUSD 1.3000 (GBP 290m) 1.3200 (269m)

AUDUSD 0.7555 (AUD 212m) 0.7620 (284m)

USDCAD 1.3150 (USD 590m) 1.3200 (480m) 1.3300 (279m)

-

15:42

-

15:32

U.S. Stocks open: Dow +0.43%, Nasdaq +0.53%, S&P +0.48%

-

15:26

Draghi says banks play a vital role in financing SME's

-

Overbanking is a factor in the low levels of bank profitability

-

Overcapacity also means the sector is not efficient

-

Life insurers face weak profitability unless they reform their business models

*via forexlive -

-

15:21

Before the bell: S&P futures +0.43%, NASDAQ futures +0.52%

U.S. stock-index futures rose, with equities poised to add to a rally yesterday prompted by the Federal Reserve's decision to leave interest rates unchanged.

Global Stocks:

Nikkei Closed

Hang Seng 23,759.80 +89.90 +0.38%

Shanghai 3,042.69 +16.81 +0.56%

FTSE 6,929.72 +94.95 +1.39%

CAC 4,515.35 +105.80 +2.40%

DAX 10,671.00 +234.51 +2.25%

Crude $46.16 (+1.81%)

Gold $1340.20 (+0.66%)

-

15:09

Russian oil minister, Novak: Production freeze under discussion, cut not discussed

-

15:08

-

15:04

US house price index up 0.5% in July

Washington, D.C. - U.S. house prices rose in July, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.2 percent increase in June was revised upward to reflect a 0.3 percent increase.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From July 2015 to July 2016, house prices were up 5.8 percent.

For the nine census divisions, seasonally adjusted monthly price changes from June 2016 to July 2016 ranged from +0.2 percent in the Middle Atlantic division to +1.0 percent in the East South Central division. The 12-month changes were also all positive, ranging from+2.6 percent in the Middle Atlantic division to +7.7 percent in the Pacific division.

-

15:00

U.S.: Housing Price Index, m/m, July 0.5% (forecast 0.3%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

180.1

0.51(0.284%)

290

ALCOA INC.

AA

9.77

0.10(1.0341%)

52100

ALTRIA GROUP INC.

MO

63.71

0.21(0.3307%)

4186

Amazon.com Inc., NASDAQ

AMZN

793.38

3.64(0.4609%)

41942

American Express Co

AXP

64.3

0.02(0.0311%)

697

Apple Inc.

AAPL

114.08

0.53(0.4668%)

122491

AT&T Inc

T

40.74

0.17(0.419%)

550

Barrick Gold Corporation, NYSE

ABX

18.84

0.15(0.8026%)

245998

Boeing Co

BA

131.26

0.70(0.5361%)

1062

Caterpillar Inc

CAT

83.7

0.23(0.2755%)

5790

Chevron Corp

CVX

100.33

0.70(0.7026%)

9981

Cisco Systems Inc

CSCO

31.58

0.22(0.7015%)

13144

Citigroup Inc., NYSE

C

47.19

0.29(0.6183%)

500

Exxon Mobil Corp

XOM

83.92

0.62(0.7443%)

6925

Facebook, Inc.

FB

130.33

0.39(0.3001%)

67783

FedEx Corporation, NYSE

FDX

174.4

0.54(0.3106%)

4439

Ford Motor Co.

F

12.16

0.07(0.579%)

47320

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.91

0.37(3.5104%)

100606

General Electric Co

GE

29.9

0.05(0.1675%)

7900

General Motors Company, NYSE

GM

32.33

0.22(0.6852%)

17197

Google Inc.

GOOG

779

2.78(0.3581%)

1039

Home Depot Inc

HD

129

0.89(0.6947%)

255

Intel Corp

INTC

37.41

-0.04(-0.1068%)

1750

International Business Machines Co...

IBM

156

0.47(0.3022%)

653

Johnson & Johnson

JNJ

119.18

0.27(0.2271%)

1254

Microsoft Corp

MSFT

57.94

0.18(0.3116%)

6155

Nike

NKE

55.47

0.13(0.2349%)

1770

Pfizer Inc

PFE

34.4

0.12(0.3501%)

4900

Procter & Gamble Co

PG

88

0.20(0.2278%)

814

Starbucks Corporation, NASDAQ

SBUX

54.22

0.24(0.4446%)

3404

Tesla Motors, Inc., NASDAQ

TSLA

206

0.78(0.3801%)

5670

The Coca-Cola Co

KO

42.69

0.16(0.3762%)

1995

Twitter, Inc., NYSE

TWTR

18.54

0.05(0.2704%)

68968

Verizon Communications Inc

VZ

52.1

0.23(0.4434%)

538

Visa

V

83.89

0.67(0.8051%)

1023

Walt Disney Co

DIS

92.7

0.31(0.3355%)

2769

Yahoo! Inc., NASDAQ

YHOO

44.46

0.32(0.725%)

756150

Yandex N.V., NASDAQ

YNDX

21.61

0.07(0.325%)

400

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded to Buy from Hold at Argus

Downgrades:

Other:

Intl Paper (IP) initiated with a Neutral at Goldman

Apple (AAPL) target raised to $125 from $120 at RBC Capital Mkts

Apple (AAPL) target raised to $135 from $120 at Nomura

-

14:40

US initial unemployment claims continue to decline

In the week ending September 17, the advance figure for seasonally adjusted initial claims was 252,000, a decrease of 8,000 from the previous week's unrevised level of 260,000. The 4-week moving average was 258,500, a decrease of 2,250 from the previous week's unrevised average of 260,750.

There were no special factors impacting this week's initial claims. This marks 81 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:30

U.S.: Initial Jobless Claims, 252 (forecast 262)

-

14:30

U.S.: Continuing Jobless Claims, 2113 (forecast 2143)

-

14:22

European session review: the US dollar continued to fall against most major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Eurozone Economic ECB bulletin

10:00 UK Balance industrial orders Confederation of British Industry in September -5 -5 -5

The British pound rose moderately against the dollar, reaching the 19 Septemhber hig, but then lost some positions, which was associated with a partial profit-taking and expectations of the performance of the Bank of England. Pressure on the currency has also provided a report of the Committee on the financial policy of the Bank of England, which reported that the country will face a period of uncertainty. "The prospects of financial stability are problematic.

The results of a survey by the Confederation of British Industry (CBI) showed that manufacturers expect a sharp acceleration in production in the coming months. In September, 18 percent of enterprises reported that total orders to be above normal, and 22 percent said that the orders were below normal. As a result, the balance of orders amounted to -5, in line with expectations and the index for August. Meanwhile, the production volume amounted to 11 percent. The survey also revealed that production growth is likely to accelerate in the next three months. About 37 percent of companies forecast an increase, and 15 percent are waiting for a fall, bringing the balance to 22. The average price is forecast to decrease slightly over the next quarter. "The fall of the pound has increased the international competitiveness of many enterprises and export orders volume remained much higher than the average, but in the future, manufacturers expect a lot of problems, because they need to adapt to new relations with the EU and the rest of the world..", - Said Raine Newton-Smith, Chief Economist CBI.

The euro has appreciated considerably against the US dollar, reaching the 16 September high. Experts point out that the US currency remains under pressure against the background of yesterday's Fed decision. Appreciation of the euro also contributed to the strong growth of stock indices in Europe.

Recall, the US Federal Reserve decided to leave the interest rate at the target range of 0.25-0.50%. The decision of the Central Bank is in line with expectations. Fed Chairwomen made it clear that the central bank still intends to raise the rate this year, but did not specify the terms of such a step. "I expect to see it, if the current process in the labor market will continue and will not be any significant new risks", - she noted. In addition, the Fed reduced its forecast for the hikes for in the next year to two (three). Yellen said that divisions within the FOMC basically boiled down to the terms of a rate hike. According to the futures market, the likelihood of tighter monetary in December is 58.4%.

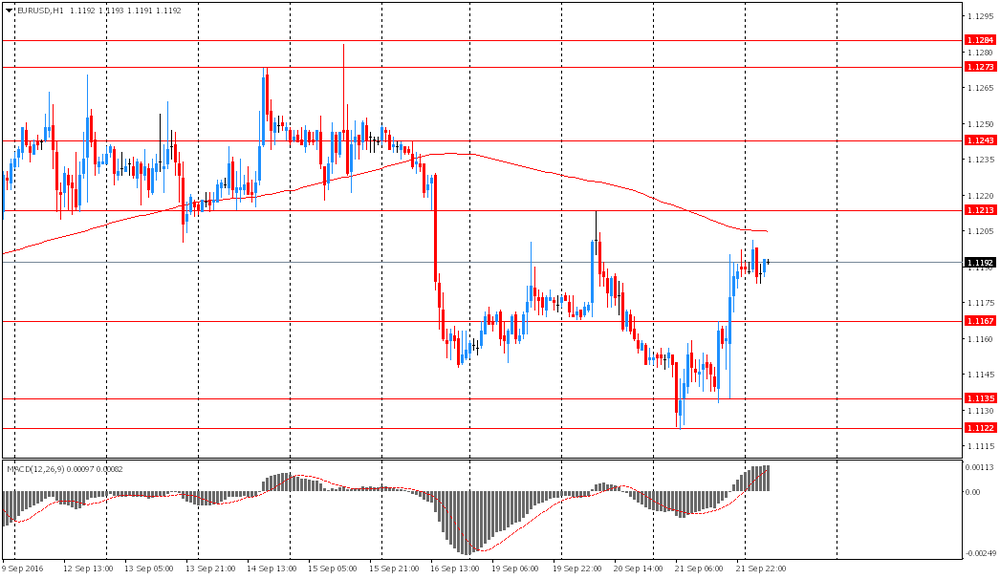

EUR / USD: during the European session, the pair rose to $ 1.1250

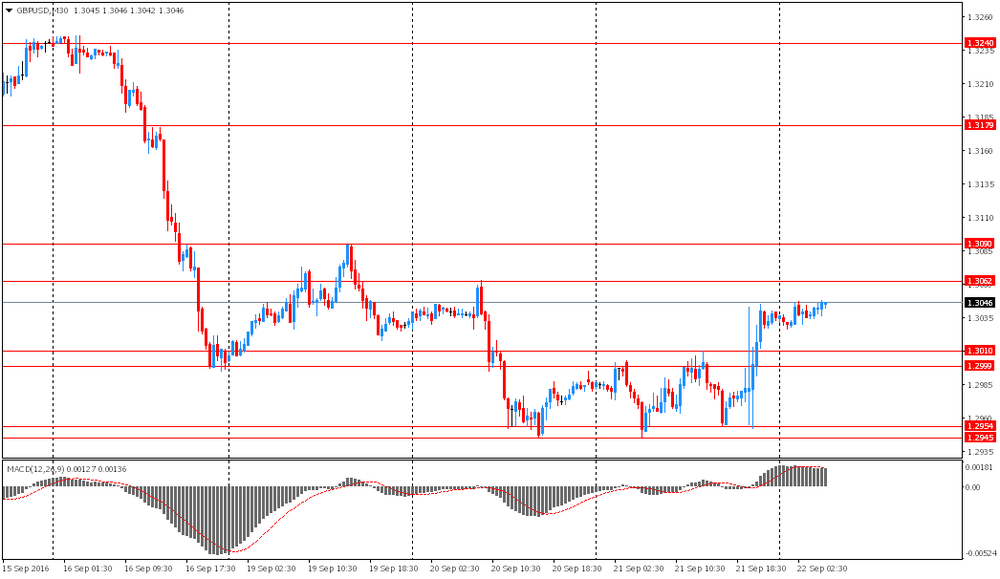

GBP / USD: during the European session, the pair has risen to $ 1.3082, but then went back up to $ 1.3045

USD / JPY: during the European session, the pair has recovered to Y100.87 from Y100.08

-

14:01

Orders

EUR/USD

Offers 1.1245-50 1.1280 1.1300 1.1320 1.1350

Bids 1.1220 1.1200 1.1180 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers 1.3080-85 1.3100 1.3125-30 1.3150 1.3175-80 1.3200

Bids 1.3050 1.3030 1.3000 1.2980 1.2965 1.2940-50 1.2900

EUR/GBP

Offers 0.8625-30 0.8650 08685 0.8700

Bids 0.8580 0.8565 0.8540 0.8520 0.8500 0.8485 0.8450

EUR/JPY

Offers 113.30 113.50 113.85 114.00 114.20 114.50 114.80-85 115.00

Bids 112.80 112.50 112.35 112.00 111.80 111.50

USD/JPY

Offers 100.80 101.00 101.30 101.50 101.80 102.00 102.25 102.45-50

Bids 100.45-50 100.20 100.00 99.8099.65 99.50 99.00 98.50

AUD/USD

Offers 0.7685 0.7700 0.7725-30 0.7750 0.7765 0.7800

Bids 0.7630 0.7600 0.7565 0.7550 0.7530-35 0.7500

-

13:19

Major European stock indices trading in the green zone

European stock markets are showing strong gains after the Federal Reserve refrained from raising interest rates and said it needed more evidence of economic improvement before continuing tightening.

Recall, the US Federal Reserve decided to leave the interest rate at the target range of 0.25-0.50%. The decision of the Central Bank is in line with expectations. Fed Chairwomen made it clear that the central bank still intends to raise the rate this year, but did not specify the terms of such a step. "I expect to see it, if the current process in the labor market will continue and will not be any significant new risks", - she noted. In addition, the Fed reduced its forecast for the hikes for in the next year to two (three). Yellen said that divisions within the FOMC basically boiled down to the terms of a rate hike. According to the futures market, the likelihood of tighter monetary in December is 58.4%.

Traders in Europe and the UK are closely monitoring the changes in the interest rate in the United States, since it is the main driving force for the global economy and foreign exchange markets. "Despite the fact that Fed's monetary policy decision was seen as a" dove ", three of the ten FOMC members with voting rights did not agree with the final decision, and called for an immediate increase in interest rates. In general, this situation increases the likelihood that interest rates will be reviewed in December, "- said Hussain Sayed, chief market strategist at FXTM.

Shares of mining and oil companies, led the increase, receiving support from a weaker dollar after the Fed decision. The positive dynamics of the oil market against the background of data on US oil inventories also supported stocks. US Department of Energy announced that crude oil reserves in the country for the week ended 16 September fell by 6.2 million barrels to 504.6 million barrels. Analysts, on the other hand, expected growth by 2.25 million barrels.

Quotes of BHP Billiton PLC rose by 4,57%, Boliden AB +4.34%, and Randgold Resources Ltd. +3.65%. Among oil companies, Eni SpA shares rose 1,44%, Total SA +2.46%, while BP PLC added 2.5%.

Shares A.P. Moeller-Maersk AS have increased by 0.96% after the Danish company said it would split into two companies - the oil unit and transportation and logistics.

Capitalization of Rocket Internet SE jumped 9.64%, as the German engineering company reported that the largest companies in its portfolio have reduced their combined loss in the first half of the year.

Shares of Ericsson AB climbed 1.81% after media reports that the mobile telecommunications equipment manufacturer plans to close its last manufacturing site in Sweden and cut about 3,000 jobs.

The cost of Electricite de France SA fell 0.74% after late in the evening the service company lowered its forecast for profit.

At the moment:

FTSE 100 +80.16 6914.93 + 1.17%

DAX +206.92 10643.41 + 1.98%

CAC 40 +85.42 4494.97 + 1.94%

-

13:09

WSE: Mid session comment

Minister of Energy said in parliament that over several years, the nominal value of the shares of energy companies could increase by more than PLN 50 billion.

This statement has brought an unexpected slump on all qualities in energy sector, which drew the WIG20 by more than 20 points into session lows. The sell-off in PGE and Tauron (WSE: TPE) forced even course balancing.

Same design is not new, as it had already informed the newspaper. Concerns may be the amount that gave the minister because it would mean that companies would be forced to pay taxes in the amount of approx. PLN 10 billion.

Thus it is not surprising the relative weakness of the Warsaw market. As a result, during only today's session the DAX grow by 1.8 per cent. and the WIG20 after another blow received from "above" lost 0.6 percent.

In the second half of trading we enter with the index of the largest companies on the level of 1,757 points (-0,04%).

-

12:12

UK's manufacturing output continues to expand at a solid rate

Manufacturing output continues to expand at a solid rate, according to the latest CBI monthly Industrial Trends Survey.

The survey of 481 firms found that manufacturers are expecting the rate of production to accelerate rapidly, with 11 of the 18 sub-sectors upgrading their expectations for output over the next three months.

Meanwhile, export order books weakened slightly, but remained comfortably above their long-run average. Chemical firms experienced the sharpest drop in overseas demand, contrasting with the motor vehicle and transport sector, which reported the greatest improvement. Total orders remained unchanged from the previous month, well above average levels.

Companies' near-term expectations for prices eased, with a majority of respondents anticipating no change over the next three months.

Stock adequacy climbed to the highest level since June 2013, with half of the change in the balance accounted for by chemical manufacturers, who also scaled back their output the most out of the survey respondents - CBI.

-

12:00

United Kingdom: CBI industrial order books balance, September -5 (forecast -5)

-

11:38

The Committee on the financial policy of the Bank of England: UK into a period of uncertainty, correction

-

Prospects for financial stability problematic

-

Some households may find it difficult to service their debts if the economic situation deteriorates

-

Risks to the stability of the world economy increased

-

Increased uncertainty about the short-term macroeconomic prospects and future relationship with the EU strengthens domestic risks

-

We remain committed to the implementation of sound prudential standards in the financial system of the United Kingdom

-

There is a risk of falling appetite of foreign investors and the sharp weakening of the pound's exchange rate.

-

-

11:27

Greek Prime Minister Alexis Tsipras: Greece hopes to be included in the program of QE from the ECB at the beginning of 2017

Today, the Greek Prime Minister Alexis Tsipras told Reuters in an interview that Athens hopes to be included in the program of quantitative easing from the ECB by the beginning of 2017. In addition, Tsipras and his team fully expect to return the debt in 2018, depending on the growth and debt. According to the latest forecast of economists, the Greek economy could grow by 0.2% to 0.4% in 2016. At the same time, the Prime Minister of Greece said that economic growth exceed the forecast in the case of foreign investment in the country.

-

11:12

If You Knew The US Election Result Today Would You Buy Or Sell USD? - Deutsche Bank

"On Monday we have the first of three Trump- Clinton debates. Rare is the cut and thrust of these Presidential debates decisive. Kennedy-Nixon moments are few and far between. The 'winner' of the coming debates may well be the candidate that can break the mold of 'confirmation bias' and reveal something positive and new about themselves for swing voters. One immediately relevant question is: How should markets trade the post debate poll fluctuations?

It has not felt like the market has traded the polls, but (very) superficially there has been a slight tendency for the USD to trade stronger when Trump has gone up in the poll (see Figure1). The average Real Clear Politics Trump poll correlation with the Broad USD TWI is 0.51 year to date, but almost certainly much of this correlation is spurious, especially in H1 when outside of USD/MXN, there was minimal anecdotal talk of trading off the polls.

Perhaps a more pertinent question is if you knew the election result today would you buy or sell the USD?

In so much as the current market talk has focused on the potential for a large fiscal stimulus whoever is the President and that this stimulus will encourage and complement monetary policy tightening, whoever is elected President is seen as a likely to be USD positive. Fears over a fiscal package that is too big or destabilizing are not high on the list, as there appears to be some belief in Congressional checks and balances. There is also some confidence that the election will break Washington's gridlock long enough to get some stimulus through in the new President's first year in office. The market is apt to trade off this one important strongly held belief, until it is confident that there are other policy initiatives to trade off. As an example, a USD negative allied to the election could relate to the attacks on free trade, where retaliation could easily constrain the Fed from tightening. The cult of personality will also be a factor. Who will be the next Treasury Secretary and will they use a weaker USD as a vehicle to support trade, as Lloyd Bentsen did in 1993 - 94? Nonetheless second order considerations like the above with all their uncertainties, are for the moment being dominated by positive USD fiscal arguments.

The big macro events to end 2016 may not all play out as decisively as hoped, but the skew as it relates to risks, all lean USD positive, whether it be probability for a Fed rate hike; the concerns around the Italian referendum; and soon to be most important, the prospective US election impact".

Copyright © 2016 DB, eFXnews™

-

10:31

ECB Economic Bulletin: expect real GDP to grow at a moderate but steady pace

At its monetary policy meeting on 8 September 2016, the Governing Council assessed the economic and monetary data which had become available since the July meeting and discussed the new ECB staff macroeconomic projections. The comprehensive policy measures that have been adopted continue to ensure supportive financing conditions and underpin the momentum of the euro area economic recovery. As a result, the Governing Council continues to expect real GDP to grow at a moderate but steady pace and euro area inflation to rise gradually over the coming months, in line with the path already implied in the June 2016 staff projections. Overall, while the available evidence so far suggests resilience of the euro area economy to the continuing global economic and political uncertainty, the baseline scenario remains subject to downside risks.

Moderate global growth continued in the first half of 2016. Looking ahead, global growth is expected to recover gradually. Low interest rates, improving labour markets and growing confidence support the outlook for advanced economies, although the uncertainty generated by the referendum in the United Kingdom on EU membership will weigh on demand in that country. As regards emerging market economies, economic activity in China is expected to slow, while the outlook for large commodity exporters remains subdued, despite some tentative signs of stabilisation. Risks to the outlook for global economic activity remain on the downside.

Between early June and early September euro area and global financial markets remained relatively calm, apart from the immediate period around the UK referendum. In the period leading up to the referendum on 23 June, global financial markets exhibited increasing volatility, which spiked on the day following the referendum. Since then, financial market volatility has receded and most asset classes have recovered their losses. At the same time, long-term euro area bond yields remained significantly below their pre-referendum levels, and bank equities continued to underperform the wider market index.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.46bln) 1.1050-60 (414m) 1.1100 (1.53bln) 1.1150 (994m) 1.1200 (577m) 1.1300 (897m)

USD/JPY: 99.90-95 (USD 615m) 100.45 (USD 390m) 101.00 (535m) 101.20-35 (515m) 102.00 (402m)

GBP/USD 1.3000 (GBP 290m) 1.3200 (269m)

AUD/USD 0.7555 (AUD 212m) 0.7620 (284m)

USD/CAD 1.3150 (USD 590m) 1.3200 (480m) 1.3300 (279m)

-

09:48

Oil is trading higher

This morning, New York crude oil futures for WTI rose by 1.01% to $ 45.8 and Brent crude oil futures rose in price by 0.94% to $ 47.27 per barrel. Thus, the black gold is continuing to grow after an unexpected decline in US stocks volume third consecutive week. Oil rose after the US Energy Information Administration reported that oil reserves in the United States fell for the week ending 16 September 6.20 million barrels to 504.6 million barrels. It is worth noting that the experts predicted a growth of 3.4 million barrels.

-

09:32

Major stock exchanges trading in the green zone: FTSE + 0.6%, DAX + 0.8%, CAC40 + 0.8%, FTMIB + 0.9%, IBEX + 0.9%

-

09:13

WSE: After opening

WIG20 index opened at 1762.09 points (+0.21%)*

WIG 47854.67 0.48%

WIG30 2038.42 0.44%

mWIG40 4062.71 0.45%

*/ - change to previous close

The WIG20 futures took off 10 points above yesterday's close, which in percentage terms represents an increase of 0.5 percent.

The cash market opens with fairly modest rise 1,762 points, with good, compare to the recent low standards of turnover, though focused on the shares of KGHM. Milder start gives us a buffer to increase the scale of increases during continuous trading, as we indeed observe.

Negatively distinguished is only Alior (WSE: ALR), but this is understandable due to the previous information.

-

09:07

Asian session review: Fed holds, dollar lower

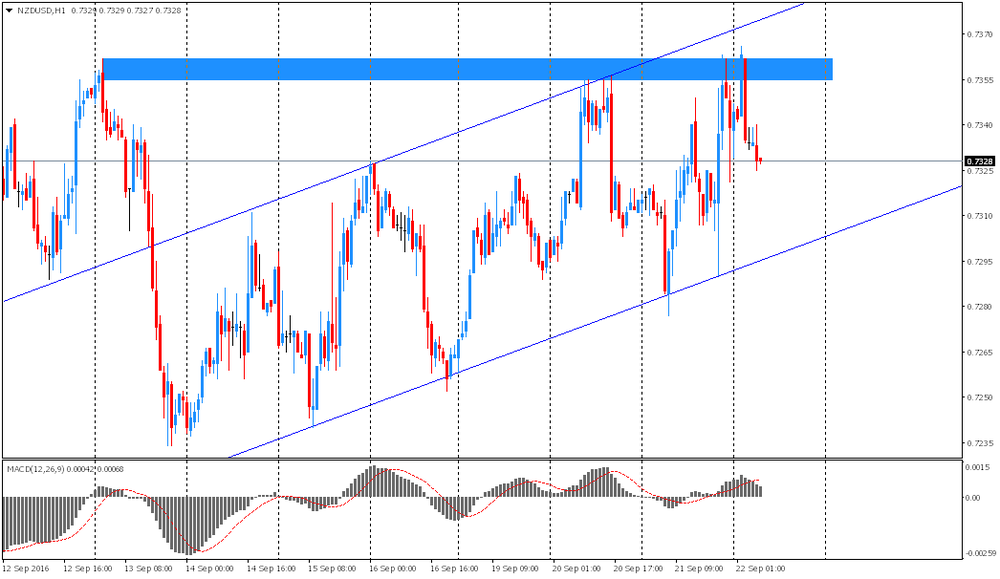

At the beginning of the trading session the New Zealand dollar rose after the Reserve Bank of New Zealand left interest rates unchanged at 2.0%, but said it would take further easing of monetary policy. " The New Zealand dollar makes difficult to achieve the inflation target. It is expected that annual CPI inflation will weaken, but long-term inflation expectations are well anchored at 2%, "- said the Central Bank. However, the later course of the pair NZD / USD was on the downside helped by declarations of the General Director of Fonterra Theo Spirings. The top manager said that the strong New Zealand dollar exchange rate hurts the company. For this reason, many analysts began to warn of possible verbal intervention on the part of central bank and governmens, to put pressure on NZD.

The dollar remained under pressure after the Federal Reserve left interest rates unchanged, but signaled that it may tighten monetary policy in the coming months. However, there are contradictions among the leaders of the central bank. One group is in favor of an immediate rate hike, while the other sees no need to tighten monetary policy later this year. "The Fed noted the emergence of more powerful arguments in favor of raising rates, but decided to wait until new evidence of further progress in achieving these goals," - said in a statement the central bank. Judging by the published forecasts of the Fed, 10 of 17 of its leaders expects a key rate hike by a quarter percentage point to 0.5% -0.75% range in December. Three members of the committee do not expect rate hikes this year, and four want rates raised more than once before the end of the year. This suggests that differences in the leadership of the central bank on further action. At the same time, futures on interest rates indicate a 55% probability of a rate hike at the December meeting. Many believe that the central bank will refrain from raising rates at its next meeting, which will end on November 2, a week before the presidential election.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1180-00 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3025-60 range

USD / JPY: during the Asian session, the pair was trading in Y110.10-50 range

-

08:29

Options levels on thursday, September 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1332 (2159)

$1.1300 (2688)

$1.1256 (1029)

Price at time of writing this review: $1.1225

Support levels (open interest**, contracts):

$1.1168 (2855)

$1.1143 (3886)

$1.1112 (3428)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 35416 contracts, with the maximum number of contracts with strike price $1,1400 (4663);

- Overall open interest on the PUT options with the expiration date October, 7 is 39564 contracts, with the maximum number of contracts with strike price $1,1100 (6222);

- The ratio of PUT/CALL was 1.12 versus 1.10 from the previous trading day according to data from September, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.3302 (2609)

$1.3204 (1240)

$1.3107 (1010)

Price at time of writing this review: $1.3072

Support levels (open interest**, contracts):

$1.2990 (3659)

$1.2894 (842)

$1.2797 (1857)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 25814 contracts, with the maximum number of contracts with strike price $1,3500 (3377);

- Overall open interest on the PUT options with the expiration date October, 7 is 22515 contracts, with the maximum number of contracts with strike price $1,3000 (3659);

- The ratio of PUT/CALL was 0.87 versus 1.00 from the previous trading day according to data from September, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:28

WSE: Before opening

The highlight of Wednesday for the markets was the decision of the US Federal Reserve. The Fed decided to leave the main federal funds rate unchanged at 0.25-0.50 percent. After the Fed's decision the US indices recorded gains. Earlier, the market received a positive morning decision of the BoJ to continue easing of monetary policy. The image of the US economy after the FOMC conference is not necessarily beneficial. It is true that the rate hike was avoided, what part of the market had feared, however, the downward projections for this year for the US economy have been adjusted, so the unemployment rate up, while inflation and GDP down.

From the point of view of equity markets this picture is not so optimistic. Equity markets in the long run more likely to reflect the condition of the real economy, rather than interest rates.

Today's session will be a response to a message sent last night by the Federal Open Market Committee. In the morning, Asian stock markets react positively, but excluding Japan, where the stock market is not working because of the holidays.

On the Warsaw market we must pay attention to the deduction of dividends on shares of PGE (PLN 0.25 per share). This will reduce the WIG20 index by approx. 0.12%. We recommend also to be focused on the behavior of Alior (WSE: ALR) and PKO BP (WSE: PKO). The first announced for exclusive negotiations with Raiffeisen Bank International on the acquisition of core banking Raiffeisen Bank Poland. The success means a subsequent issue of shares. In turn, the PKO BP entered into an agreement to conduct negotiations on an exclusive basis on the acquisition of the company Raiffeisen-Leasing Poland of Raiffeisen Bank International. The Bank also announced that the conclusion of this transaction will mean a lack of dividend payment.

-

08:14

Markets Post-FOMC: Views From Major Banks

"Danske (out of consensus): We Stick To Our Call For No Fed Hikes This Year

Although the more hawkish statement puts pressure on our Fed call, we stick to our view that the Fed will not hike this year, especially as we think the Fed may be too optimistic about the current economic situation given the weakness in ISM and retail sales, but it is a close call. We have outlined our view in Presentation US: 10 reasons why we believe the Fed will not hike this year, 14 September. However, incoming data will be analysed thoroughly in coming months and we may see markets react more to positive/negative data surprises. Also, in our view, one should not be fooled about the Fed's eagerness to hike as the Fed has communicated an upcoming rate hike the whole year. We still think most voting FOMC members have a dovish-to-neutral stance on monetary policy and when it comes right down to it they would rather postpone the second hike than hike prematurely. It is also worth noting that three voting hawks (George, Mester, Rosengren) all lose their voting rights next year. Markets have priced a 60% probability of a hike by year-end.

Credit Agricole: Fed To Hike In December

The FOMC, as widely expected, opted for unchanged policy at its September meeting with the Fed funds target range maintained at 0.25% to 0.50%. Market participants saw a relatively low probability for a rate hike with policymakers split over the near-term rate normalization path. We look for the FOMC to hike the Fed funds rate by 25 bps on 14- December. Chair Yellen's comment that the case for a rate hike has strengthened was echoed in the statement. Moreover, the FOMC noted that the "near-term risks to the economic outlook appear roughly balanced.". The FOMC wants to "wait for further evidence of continued progress toward its objectives." We expect real GDP growth to average over 2.5% in the second half of the year. As more evidence accumulates that the economy continues to grow above its potential rate and labor markets strengthen further with a likely acceleration in wage growth, we believe that the cautious members of the FOMC will feel more confident about meeting their policy objectives and raise rates. The FOMC continues to expect that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate. The Fed's updated dot plot put the median Fed funds projection for yearend 2016 at 0.625% and the projected rate hikes for 2017 were trimmed to 2 from 3. The longer run rate was moved down to 2.875%.

CIBC: Fed To Hike In December.

A string of weak data releases in the lead up to today's announcement likely removed any chance of a Fed rate hike. So it comes as no surprise then that the FOMC decided to keep interest rates unchanged at their September meeting. That said, with three officials dissenting, it appears that odds are starting to tilt in favour of a rate hike. The assessment of the economy contained in the statement appears to be little changed from the previous one and a sentence indicating that the case for a rate increase has strengthened was added. Together, those factors suggest that the recent spate of soft economic releases are likely viewed as more transitory than not. While the statement and dissenters argue for more near-term hawkishness from the central bank than had been expected, the SEP favours a longer-term dovish view of the economy. The median of members now only sees two rate hikes next year, while the forecast for the longer-run neutral rate came down a tick to 2.9%. We continue to view December as the most likely timing for the next rate hike, although that's contingent on a rebound in economic data. Overall, while the statement and dissents were more hawkish than expected, the dovishness contained in the SEP appear to be driving markets

Barclays: The committee More Split Than It Has Been At Any Time In Our Memory

Although we had expected a interest rate hike at this meeting, the non-hike was very close call. The language in the statement suggests that the committee was quite undecided in its view. More clearly, with three members dissenting against the decision and three, presumably different, members calling for no further rate hikes this year, the committee is more split than it has been at any time in our memory. This split in views will make FOMC communication and action increasingly difficult this year. In particular, we believe that this level of dissent will make it difficult for the committee to keep the possibility of December rate hike live in the minds of market participants and, indeed, households and businesses.

SEB: The Fed Paving The Way For December Hike

As expected the Fed decided to hold the target range for the federal funds rate unchanged at the policy meeting that concluded today. Disappointing economic data notwithstanding, the no-hike decision came with a hawkish twist as policymakers strongly suggested that rates will be lifted before long. While the case for a rate increase had strengthened according to the statement, the committee decided for the time being to wait for further evidence of continued progress towards its objectives. Every word is there for a reason and "for the time being" is clearly suggesting that the rate hike is close. The balance of risk assessment made a comeback too; near-term risks to the outlook now appear roughly balanced thus also paving the way for a 2016 hike. In addition to that, the new forecasts show a 2016 hike so all of the above is suggesting that the December meeting is in the spotlight. Not only is the election will be out of the way by then but the as opposed to November the December meeting has a press conference attached to it. The committee was unusually split with George, Mester and Rosengren dissenting in favor of a hike while three officials see no rate hike in 2016. What the latter is suggesting, however, is that a huge majority is expecting a 2016 hike since 17 officials submitted forecasts. As an aside, if memory serves us correctly not too long ago Rosegren was a dovish dissenter.

Nordea: Hawkish Signal For December

Today's FOMC statement and the new dot plot reinforce our expectation that the Fed will hike rates again in December. We continue to believe that a Fed move at the next FOMC meeting in early November is rather unlikely, just one week ahead on the presidential election on 8 November. The renewed downward revision of the Fed's estimate of the neutral rate adds to the downside risks surrounding our forecast of 3 Fed rates hikes in 2017.

ANZ: Positive For Risky Assets

The FOMC left interest rates unchanged as expected, but signalled that one increase in the Fed funds rate was likely by December. Three voters dissented on the decision to hold rates. Owing to weak growth in the first half of this year, the 2016 GDP forecast was cut to 1.8% and the FOMC now anticipates two hikes in 2017. The gradual approach to raising interest rates and prospect of only modest rises in the future against the backdrop of moderate growth and well contained inflation continues to provide a positive framework for risky assets. Accompanied by exceptionally loose monetary policy in other developed economies, Asia/Pacific markets should continue to be attractive to overseas investors especially given the improving growth backdrop in the region.

BofA Merrill: Fed Signals December Hike; Limited USD Downside

The FOMC clearly signaled a hike before the end of the year in both the language and the dots. The Fed made two important changes to the statement. First, the committee noted that near-term risks to the economic outlook "appear roughly balanced". This is an important step for the Fed to justify hiking rates at an upcoming meeting and is a page out of the playbook from last year. We expected the Fed to make this language change. Second, the FOMC noted that "the Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of further progress toward its objectives." This is a strong signal that the Fed is planning to hike in an upcoming meeting. It is not explicit calendar guidance, but it is a small step in that direction. USD: What's Next? The dollar was mixed in the wake of the FOMC statement. Cross-currents in the statement between three voters dissenting in favor of hikes combined risks to the outlook now being seen as nearly balanced were offset by downward revisions to the 2016-2018 dot plots. On balance, as we expected, today's meeting set the stage for a December hike, which will keep the USD supported (and downside limited)".

Copyright © 2016 eFXplus™

-

08:10

Fonterra CEO: the strong New Zealand dollar exchange rate hurts us

Today, after the meeting of the Reserve Bank of New Zealand, the New Zealand tradid again around the monthly high. Later, the CEO of the largest in the world powdered milk company Fonterra, Theo Spirings said the strong New Zealand dollar exchange rate hurts the company. Recall that milk is one of the main exports of New Zealand and Fonterra's profits directly affect the economic component of the region. For this reason, many analysts warn about possible verbal intervention on the part of central banks and governments.

-

08:08

RBA Lowe: It would be nice if the Australian dollar was lower

-

Interest rates correspond to the target level of inflation and support the growth of employment and GDP

-

The rapid rise in inflation could harm the financial stability

-

Falling commodity prices will end soon

-

Leading indicators of the labor market improved, the labor market longer underutilized than the unemployment rate indicates

-

Negative rates worldwide impact on the Australian dollar

-

Carefully observe the dynamics of the housing market. Housing prices in some segments are growing rapidly

-

-

08:06

The Reserve Bank of New Zeeland left the Official Cash Rate unchanged at 2.0 percent

Global growth is below trend despite being supported by unprecedented levels of monetary stimulus. Significant surplus capacity remains across many economies and, along with low commodity prices, is suppressing global inflation. Volatility in global markets has increased in recent weeks, with government bond yields rising and equities coming off their highs. The prospects for global growth and commodity prices remain uncertain. Political uncertainty remains.

Weak global conditions and low interest rates relative to New Zealand are placing upward pressure on the New Zealand dollar exchange rate. The trade-weighted exchange rate is higher than assumed in the August Statement. Although this may partly reflect improved export prices, the high exchange rate continues to place pressure on the export and import-competing sectors and, together with low global inflation, is causing negative inflation in the tradables sector. A decline in the exchange rate is needed.

Second quarter GDP results were consistent with the Bank's growth expectations. Domestic growth is expected to remain supported by strong net immigration, construction activity, tourism, and accommodative monetary policy. While dairy prices have firmed since early August, the outlook for the full season remains very uncertain. High net immigration is supporting strong growth in labour supply and limiting wage pressure.

-

07:46

Federal Open Market Committee opted to keep rates steady in what Chairwoman Janet Yellen described as a "new normal"

Federal Open Market Committee, in a 7-to-3 vote, opted to keep rates steady in what Chairwoman Janet Yellen described as a "new normal" as central banks elsewhere around the globe embark upon quantitative-easing measures. Yellen also said she is "pleased with" the health of the economy.

The US dollar fell after the Federal Reserve left interest rates unchanged, but signaled that it may tighten monetary policy in the coming months.

However, there are contradictions among the FOMC members. One group is in favor of an immediate rate hike, while the other sees no need to tighten monetary policy later this year.

"The Fed noted the emergence of more powerful arguments in favor of raising rates, but decided to wait until new evidence of further progress in achieving these goals,"

-

06:46

Global Stocks

Stocks across Europe bounded higher Wednesday, bolstered by rises in financial shares after the Bank of Japan tweaked monetary policy in a way that should help yield-dependent businesses. Stocks rose after the BOJ unexpectedly said it would start targeting 10-year interest rates, committing to keep them around zero as part of a new policy framework aimed at bolstering inflation. The central bank will maintain quantitative easing until its inflation target of 2% is overshot, and it kept its main interest rates unchanged.

U.S. stocks rallied Wednesday, with the Nasdaq Composite closing at a record, after the Federal Reserve opted to keep interest rates unchanged as it sought further evidence of economic strength. The policy-setting Federal Open Market Committee, in a 7-to-3 vote, opted to keep rates steady in what Chairwoman Janet Yellen described as a "new normal" as central banks elsewhere around the globe embark upon quantitative-easing measures. Yellen also said she is "pleased with" the health of the economy.

Asian stocks shot higher across the board Thursday, buoyed by the U.S. Federal Reserve's decision to stick to the status quo, as well as rising commodity prices. Overnight, the Federal Reserve opted to hold its key short-term interest rate steady. Asia-based traders welcomed the news as a rate rise would have pulled money out of emerging markets.

-

00:29

Commodities. Daily history for Sep 21’2016:

(raw materials / closing price /% change)

Oil 45.62 +0.62%

Gold 1,339.00 +0.57%

-

00:29

Stocks. Daily history for Sep 21’2016:

(index / closing price / change items /% change)

Nikkei 225 16,807.62 +315.47 +1.91%

Shanghai Composite 3,025.48 +2.48 +0.08%

S&P/ASX 200 5,339.56 +36.03 +0.68%

FTSE 100 6,834.77 +3.98 +0.06%

CAC 40 4,409.55 +20.95 +0.48%

Xetra DAX 10,436.49 +42.63 +0.41%

S&P 500 2,163.12 +23.36 +1.09%

Dow Jones Industrial Average 18,293.70 +163.74 +0.90%

S&P/TSX Composite 14,710.82 +188.84 +1.30%

-

00:28

Currencies. Daily history for Sep 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1189 +0,33%

GBP/USD $1,3035 +0,41%

USD/CHF Chf0,9738 -0,55%

USD/JPY Y100,42 -1,29%

EUR/JPY Y112,38 -0,95%

GBP/JPY Y130,91 -0,87%

AUD/USD $0,7631 +1,05%

NZD/USD $0,7339 +0,33%

USD/CAD C$1,3093 -0,76%

-

00:00

Schedule for today, Thursday, Sep 22’2016

12:30 U.S. Continuing Jobless Claims 2143 2143

12:30 U.S. Initial Jobless Claims 260 262

13:00 Eurozone ECB President Mario Draghi Speaks

13:00 U.S. Housing Price Index, m/m July 0.2% 0.3%

14:00 Eurozone Consumer Confidence (Preliminary) September -8.5 -8.2

14:00 U.S. Leading Indicators August 0.4% 0.1%

14:00 U.S. Existing Home Sales August 5.39 5.45

-