Noticias del mercado

-

21:03

DJIA 18405.81 112.11 0.61%, NASDAQ 5337.04 41.86 0.79%, S&P 500 2177.60 14.48 0.67%

-

19:24

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday, with the Nasdaq hitting a record intraday high, a day after the Federal Reserve stood pat on interest rates. While the Fed said the risks to economic outlook were roughly "balanced", it left rates unchanged as inflation continued to run below its 2% target and members saw room for improvement in the labor market.

Almost all of Dow stocks in positive area (29 of 30). Top gainer - United Technologies Corporation (UTX, +1.23%). Top loser - Pfizer Inc. (PFE, -0.12%).

All S&P sectors also in positive area. Top gainer - Utilities (+1.1%).

At the moment:

Dow 18333.00 +115.00 +0.63%

S&P 500 2170.75 +14.50 +0.67%

Nasdaq 100 4890.25 +40.25 +0.83%

Oil 46.32 +0.98 +2.16%

Gold 1344.60 +13.20 +0.99%

U.S. 10yr 1.61 -0.06

-

18:00

European stocks closed: FTSE 6911.40 76.63 1.12%, DAX 10674.18 237.69 2.28%, CAC 4509.82 100.27 2.27%

-

17:58

WSE: Session Results

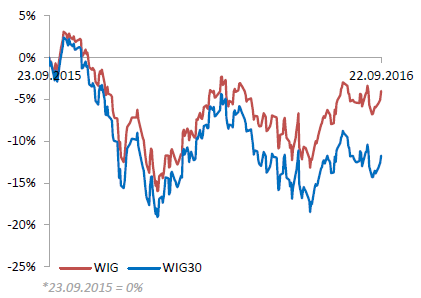

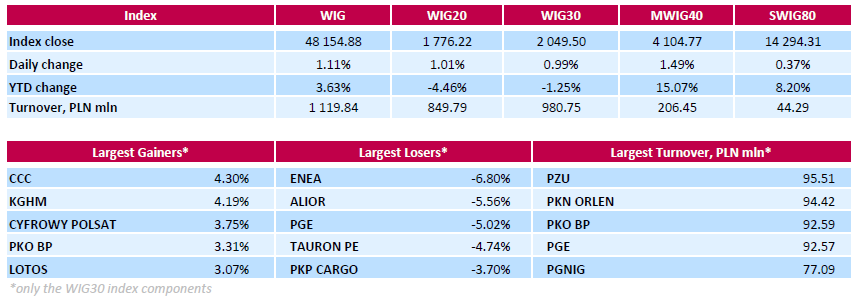

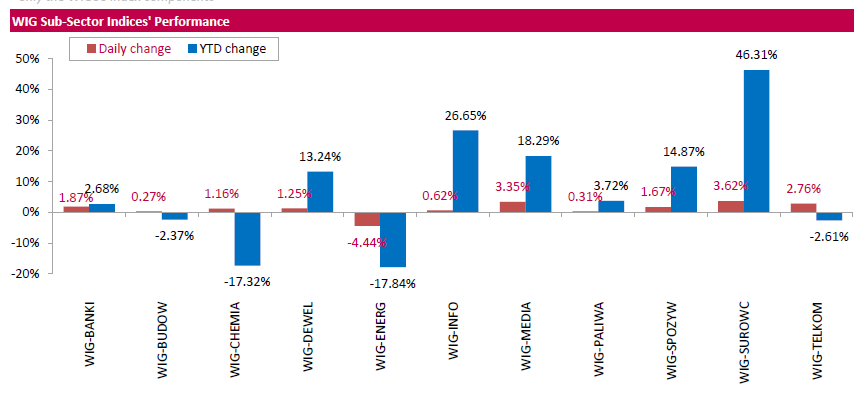

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 1.11%. Almost all sectors in the WIG generated positive returns. The only exception was utilities sector (-4.44%), dragged down by the announcement Poland's government intends to claim extra taxes from state-run utilities from 2017, in a move that is expected to hurt minority shareholders. The government's plan involves raising capital by increasing the nominal value of the utilities' shares, and not issuing new shares. As a result, the utilities will be obliged to flat-rate income tax of 19 percent on the increased nominal value.

The large-cap benchmark, the WIG30 Index, rose by 0.99%. Within the index components, footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH) led the gainers, climbing by 4.3% and 4.19% respectively. Other major advancers were media group CYFROWY POLSAT (WSE: CPS), bank PKO BP (WSE: PKO) and oil refiner LOTOS (WSE: LTS), gaining between 3.07% and 3.75%. On the other side of the ledger, all four utilities names TAURON (WSE: TPE), PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG) were among the day's weakest performers, losing between 3.42% and 6.8%. Elsewhere, banking name ALIOR (WSE: ALR) fell by 5.56% on fears the bank may issue new shares to finance the purchase of Raiffeisen Bank Polska. ALIOR reportedly started exclusive negotiations with Austria's Raiffeisen Bank International to buy its Polish core banking business.

-

15:52

WSE: After start on Wall Street

The afternoon part of session brought the light rebuild of the Warsaw market. Bulls managed to return to the levels from the opening, which also means a return to cosmetics growth. Negative sentiment to energy companies, of course, still remains, so a return to growth allows visible gain to the non-energy values, mainly on KGHM. It looks like capital fleeing the energy flow in the direction of the remaining shares.

Behind us strong data from the US labor market. This is the best reading since April 16. The market in the US is back to levels before the bond confusion. So in short, we may specify the achievements of yesterday's session and a positive beginning today. We should, however, realize that now control over market may slowly take over unrolling election campaign in the US. On Monday it will take place the first TV debate of two main candidates, none of which seems to be particularly advantageous from the investors point of view.

An hour before the close of trading the WIG20 index reached the level of 1,772 points (+0,78%).

-

15:32

U.S. Stocks open: Dow +0.43%, Nasdaq +0.53%, S&P +0.48%

-

15:21

Before the bell: S&P futures +0.43%, NASDAQ futures +0.52%

U.S. stock-index futures rose, with equities poised to add to a rally yesterday prompted by the Federal Reserve's decision to leave interest rates unchanged.

Global Stocks:

Nikkei Closed

Hang Seng 23,759.80 +89.90 +0.38%

Shanghai 3,042.69 +16.81 +0.56%

FTSE 6,929.72 +94.95 +1.39%

CAC 4,515.35 +105.80 +2.40%

DAX 10,671.00 +234.51 +2.25%

Crude $46.16 (+1.81%)

Gold $1340.20 (+0.66%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

180.1

0.51(0.284%)

290

ALCOA INC.

AA

9.77

0.10(1.0341%)

52100

ALTRIA GROUP INC.

MO

63.71

0.21(0.3307%)

4186

Amazon.com Inc., NASDAQ

AMZN

793.38

3.64(0.4609%)

41942

American Express Co

AXP

64.3

0.02(0.0311%)

697

Apple Inc.

AAPL

114.08

0.53(0.4668%)

122491

AT&T Inc

T

40.74

0.17(0.419%)

550

Barrick Gold Corporation, NYSE

ABX

18.84

0.15(0.8026%)

245998

Boeing Co

BA

131.26

0.70(0.5361%)

1062

Caterpillar Inc

CAT

83.7

0.23(0.2755%)

5790

Chevron Corp

CVX

100.33

0.70(0.7026%)

9981

Cisco Systems Inc

CSCO

31.58

0.22(0.7015%)

13144

Citigroup Inc., NYSE

C

47.19

0.29(0.6183%)

500

Exxon Mobil Corp

XOM

83.92

0.62(0.7443%)

6925

Facebook, Inc.

FB

130.33

0.39(0.3001%)

67783

FedEx Corporation, NYSE

FDX

174.4

0.54(0.3106%)

4439

Ford Motor Co.

F

12.16

0.07(0.579%)

47320

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.91

0.37(3.5104%)

100606

General Electric Co

GE

29.9

0.05(0.1675%)

7900

General Motors Company, NYSE

GM

32.33

0.22(0.6852%)

17197

Google Inc.

GOOG

779

2.78(0.3581%)

1039

Home Depot Inc

HD

129

0.89(0.6947%)

255

Intel Corp

INTC

37.41

-0.04(-0.1068%)

1750

International Business Machines Co...

IBM

156

0.47(0.3022%)

653

Johnson & Johnson

JNJ

119.18

0.27(0.2271%)

1254

Microsoft Corp

MSFT

57.94

0.18(0.3116%)

6155

Nike

NKE

55.47

0.13(0.2349%)

1770

Pfizer Inc

PFE

34.4

0.12(0.3501%)

4900

Procter & Gamble Co

PG

88

0.20(0.2278%)

814

Starbucks Corporation, NASDAQ

SBUX

54.22

0.24(0.4446%)

3404

Tesla Motors, Inc., NASDAQ

TSLA

206

0.78(0.3801%)

5670

The Coca-Cola Co

KO

42.69

0.16(0.3762%)

1995

Twitter, Inc., NYSE

TWTR

18.54

0.05(0.2704%)

68968

Verizon Communications Inc

VZ

52.1

0.23(0.4434%)

538

Visa

V

83.89

0.67(0.8051%)

1023

Walt Disney Co

DIS

92.7

0.31(0.3355%)

2769

Yahoo! Inc., NASDAQ

YHOO

44.46

0.32(0.725%)

756150

Yandex N.V., NASDAQ

YNDX

21.61

0.07(0.325%)

400

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Amazon (AMZN) upgraded to Buy from Hold at Argus

Downgrades:

Other:

Intl Paper (IP) initiated with a Neutral at Goldman

Apple (AAPL) target raised to $125 from $120 at RBC Capital Mkts

Apple (AAPL) target raised to $135 from $120 at Nomura

-

13:19

Major European stock indices trading in the green zone

European stock markets are showing strong gains after the Federal Reserve refrained from raising interest rates and said it needed more evidence of economic improvement before continuing tightening.

Recall, the US Federal Reserve decided to leave the interest rate at the target range of 0.25-0.50%. The decision of the Central Bank is in line with expectations. Fed Chairwomen made it clear that the central bank still intends to raise the rate this year, but did not specify the terms of such a step. "I expect to see it, if the current process in the labor market will continue and will not be any significant new risks", - she noted. In addition, the Fed reduced its forecast for the hikes for in the next year to two (three). Yellen said that divisions within the FOMC basically boiled down to the terms of a rate hike. According to the futures market, the likelihood of tighter monetary in December is 58.4%.

Traders in Europe and the UK are closely monitoring the changes in the interest rate in the United States, since it is the main driving force for the global economy and foreign exchange markets. "Despite the fact that Fed's monetary policy decision was seen as a" dove ", three of the ten FOMC members with voting rights did not agree with the final decision, and called for an immediate increase in interest rates. In general, this situation increases the likelihood that interest rates will be reviewed in December, "- said Hussain Sayed, chief market strategist at FXTM.

Shares of mining and oil companies, led the increase, receiving support from a weaker dollar after the Fed decision. The positive dynamics of the oil market against the background of data on US oil inventories also supported stocks. US Department of Energy announced that crude oil reserves in the country for the week ended 16 September fell by 6.2 million barrels to 504.6 million barrels. Analysts, on the other hand, expected growth by 2.25 million barrels.

Quotes of BHP Billiton PLC rose by 4,57%, Boliden AB +4.34%, and Randgold Resources Ltd. +3.65%. Among oil companies, Eni SpA shares rose 1,44%, Total SA +2.46%, while BP PLC added 2.5%.

Shares A.P. Moeller-Maersk AS have increased by 0.96% after the Danish company said it would split into two companies - the oil unit and transportation and logistics.

Capitalization of Rocket Internet SE jumped 9.64%, as the German engineering company reported that the largest companies in its portfolio have reduced their combined loss in the first half of the year.

Shares of Ericsson AB climbed 1.81% after media reports that the mobile telecommunications equipment manufacturer plans to close its last manufacturing site in Sweden and cut about 3,000 jobs.

The cost of Electricite de France SA fell 0.74% after late in the evening the service company lowered its forecast for profit.

At the moment:

FTSE 100 +80.16 6914.93 + 1.17%

DAX +206.92 10643.41 + 1.98%

CAC 40 +85.42 4494.97 + 1.94%

-

13:09

WSE: Mid session comment

Minister of Energy said in parliament that over several years, the nominal value of the shares of energy companies could increase by more than PLN 50 billion.

This statement has brought an unexpected slump on all qualities in energy sector, which drew the WIG20 by more than 20 points into session lows. The sell-off in PGE and Tauron (WSE: TPE) forced even course balancing.

Same design is not new, as it had already informed the newspaper. Concerns may be the amount that gave the minister because it would mean that companies would be forced to pay taxes in the amount of approx. PLN 10 billion.

Thus it is not surprising the relative weakness of the Warsaw market. As a result, during only today's session the DAX grow by 1.8 per cent. and the WIG20 after another blow received from "above" lost 0.6 percent.

In the second half of trading we enter with the index of the largest companies on the level of 1,757 points (-0,04%).

-

09:32

Major stock exchanges trading in the green zone: FTSE + 0.6%, DAX + 0.8%, CAC40 + 0.8%, FTMIB + 0.9%, IBEX + 0.9%

-

09:13

WSE: After opening

WIG20 index opened at 1762.09 points (+0.21%)*

WIG 47854.67 0.48%

WIG30 2038.42 0.44%

mWIG40 4062.71 0.45%

*/ - change to previous close

The WIG20 futures took off 10 points above yesterday's close, which in percentage terms represents an increase of 0.5 percent.

The cash market opens with fairly modest rise 1,762 points, with good, compare to the recent low standards of turnover, though focused on the shares of KGHM. Milder start gives us a buffer to increase the scale of increases during continuous trading, as we indeed observe.

Negatively distinguished is only Alior (WSE: ALR), but this is understandable due to the previous information.

-

08:28

WSE: Before opening

The highlight of Wednesday for the markets was the decision of the US Federal Reserve. The Fed decided to leave the main federal funds rate unchanged at 0.25-0.50 percent. After the Fed's decision the US indices recorded gains. Earlier, the market received a positive morning decision of the BoJ to continue easing of monetary policy. The image of the US economy after the FOMC conference is not necessarily beneficial. It is true that the rate hike was avoided, what part of the market had feared, however, the downward projections for this year for the US economy have been adjusted, so the unemployment rate up, while inflation and GDP down.

From the point of view of equity markets this picture is not so optimistic. Equity markets in the long run more likely to reflect the condition of the real economy, rather than interest rates.

Today's session will be a response to a message sent last night by the Federal Open Market Committee. In the morning, Asian stock markets react positively, but excluding Japan, where the stock market is not working because of the holidays.

On the Warsaw market we must pay attention to the deduction of dividends on shares of PGE (PLN 0.25 per share). This will reduce the WIG20 index by approx. 0.12%. We recommend also to be focused on the behavior of Alior (WSE: ALR) and PKO BP (WSE: PKO). The first announced for exclusive negotiations with Raiffeisen Bank International on the acquisition of core banking Raiffeisen Bank Poland. The success means a subsequent issue of shares. In turn, the PKO BP entered into an agreement to conduct negotiations on an exclusive basis on the acquisition of the company Raiffeisen-Leasing Poland of Raiffeisen Bank International. The Bank also announced that the conclusion of this transaction will mean a lack of dividend payment.

-

06:46

Global Stocks

Stocks across Europe bounded higher Wednesday, bolstered by rises in financial shares after the Bank of Japan tweaked monetary policy in a way that should help yield-dependent businesses. Stocks rose after the BOJ unexpectedly said it would start targeting 10-year interest rates, committing to keep them around zero as part of a new policy framework aimed at bolstering inflation. The central bank will maintain quantitative easing until its inflation target of 2% is overshot, and it kept its main interest rates unchanged.

U.S. stocks rallied Wednesday, with the Nasdaq Composite closing at a record, after the Federal Reserve opted to keep interest rates unchanged as it sought further evidence of economic strength. The policy-setting Federal Open Market Committee, in a 7-to-3 vote, opted to keep rates steady in what Chairwoman Janet Yellen described as a "new normal" as central banks elsewhere around the globe embark upon quantitative-easing measures. Yellen also said she is "pleased with" the health of the economy.

Asian stocks shot higher across the board Thursday, buoyed by the U.S. Federal Reserve's decision to stick to the status quo, as well as rising commodity prices. Overnight, the Federal Reserve opted to hold its key short-term interest rate steady. Asia-based traders welcomed the news as a rate rise would have pulled money out of emerging markets.

-

00:29

Stocks. Daily history for Sep 21’2016:

(index / closing price / change items /% change)

Nikkei 225 16,807.62 +315.47 +1.91%

Shanghai Composite 3,025.48 +2.48 +0.08%

S&P/ASX 200 5,339.56 +36.03 +0.68%

FTSE 100 6,834.77 +3.98 +0.06%

CAC 40 4,409.55 +20.95 +0.48%

Xetra DAX 10,436.49 +42.63 +0.41%

S&P 500 2,163.12 +23.36 +1.09%

Dow Jones Industrial Average 18,293.70 +163.74 +0.90%

S&P/TSX Composite 14,710.82 +188.84 +1.30%

-