Noticias del mercado

-

21:00

DJIA 18292.20 -100.26 -0.55%, NASDAQ 5311.10 -28.43 -0.53%, S&P 500 2167.59 -9.59 -0.44%

-

18:22

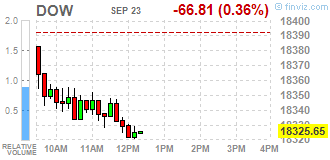

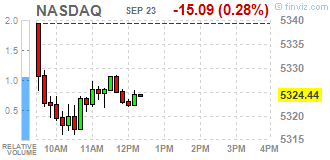

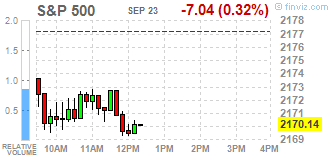

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower in late morning trading on Friday as investors assess valuations after a three-day rally spurred by optimism that the Federal Reserve will hold off from raising interest rates in the near term.

Almost all of Dow stocks in negative area (20 of 30). Top gainer - NIKE, Inc. (NKE, +0.47%). Top loser The Procter & Gamble Company (PG, -1.22%).

All S&P sectors also in negative area. Top loser - Basic Materials (-0.8%).

At the moment:

Dow 18235.00 -64.00 -0.35%

S&P 500 2161.75 -6.50 -0.30%

Nasdaq 100 4872.75 -13.50 -0.28%

Oil 44.96 -1.36 -2.94%

Gold 1341.30 -3.40 -0.25%

U.S. 10yr 1.62 -0.01

-

18:00

European stocks closed: FTSE 6909.43 -1.97 -0.03%, DAX 10626.97 -47.21 -0.44%, CAC 4488.69 -21.13 -0.47%

-

17:53

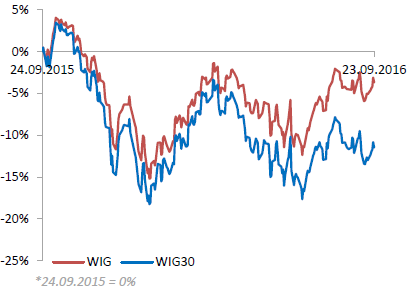

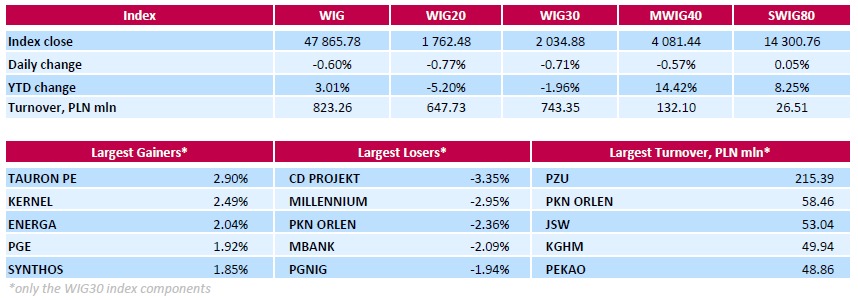

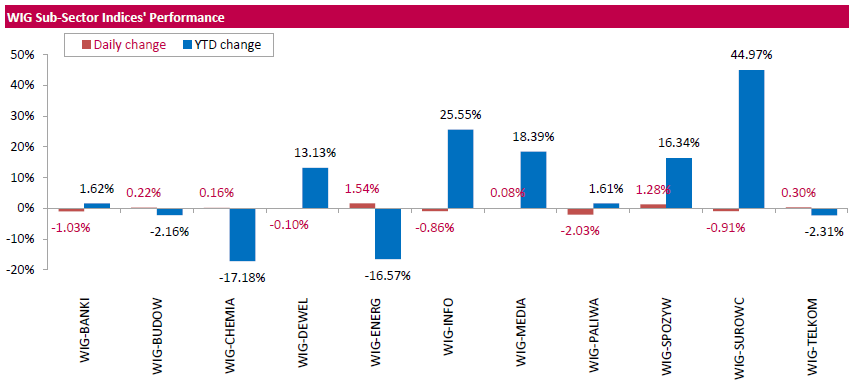

WSE: Session Results

Polish equity market closed lower on Friday. The broad market benchmark, the WIG Index, fell by 0.6%. Sector performance in the WIG Index was mixed. Utilities (+1.54%) recorded the biggest gains, while oil and0gas sector (-2.03%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, lost 0.71%. In the index basket, videogame developer CD PROJEKT (WSE: CDR) tumbled the most, down 3.35%. Other major decliners were two banking sector names MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK) as well as two oil and gas sector stocks PKN ORLEN (WSE: PKN) and PGNIG (WSE: PGN), dropping by 1.94%-2.95%. On the other side of the ledger, genco TAURON PE (WSE: TPE) led the gainers with a 2.9% advance, followed by agricultural producer KERNEL (WSE: KER), surging by 2.49%.

-

15:52

WSE: After start on Wall Street

The US market started slightly lower than could be estimated based on previous contracts trading. The S&P500 lost at the opening 0.3 percent and was close to the yesterday session minimum. It does not help, of course, for the demand side on the Warsaw Stock Exchange. Additionally, in afternoon trading phase, the German DAX cosmetic downside at 0.25 percent was doubled. The scale of depreciation on the Warsaw Stock Exchange is much higher, an hour before the close of trading WIG20 index lost 1.48% reaching the level of 1,750 points.

-

15:33

U.S. Stocks open: Dow -0.17%, Nasdaq -0.24%, S&P -0.25%

-

15:25

Before the bell: S&P futures -0.07%, NASDAQ futures -0.09%

U.S. stock-index futures were little changed as investors assessed a rally spurred by central-bank optimism.

Global Stocks:

Nikkei 16,754.02 -53.60 -0.32%

Hang Seng 23,686.48 -73.32 -0.31%

Shanghai 3,033.79 -8.52 -0.28%

FTSE 6,903.96 -7.44 -0.11%

CAC 4,484.10 -25.72 -0.57%

DAX 10,633.26 -40.92 -0.38%

Crude $46.22 (-0.22%)

Gold $1343.70 (-0.07%)

-

15:10

Twitter shares jump 15% on sale rumors

-

15:06

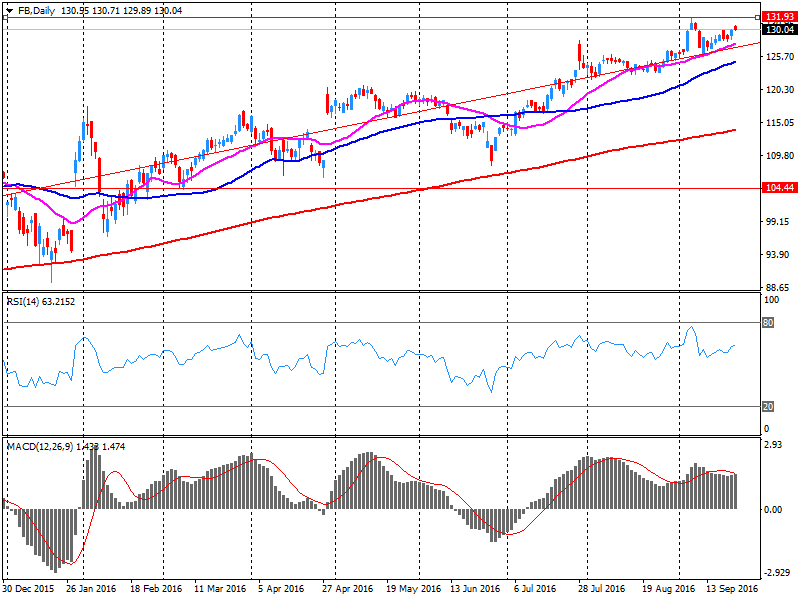

WSJ: Facebook (FB) overstated ad figures on the network for two years

According to the WSJ, citing sources familiar with the situation, large advertisers and sellers of advertising space are disappointed after learning that FB significantly overestimated the average duration of video viewing on its platform, in the last two years.

A few weeks ago, reports surfaced that the rate of content was artificially inflated because it took into account only those videos that have been viewed by more than three seconds. The company also announced that it is introducing a new calculation criteria, to solve this problem.

Directors of some companies, which Facebook has notified about the changes, requested more details on the calculations, the sources said.

It is thought that the previous method of calculation inflated figures by 60-80%.

The news is negative for Facebook, which is "praising" the rapid growth of "consumer" video through its platform in recent years.

FB shares fell in premarket trading to $ 126.92 (-2.43%).

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.72

-0.06(-0.6135%)

4500

Amazon.com Inc., NASDAQ

AMZN

804

-0.70(-0.087%)

9958

Apple Inc.

AAPL

114.5

-0.12(-0.1047%)

77984

Barrick Gold Corporation, NYSE

ABX

18.7

0.17(0.9174%)

55450

Boeing Co

BA

131.8

-0.07(-0.0531%)

642

Citigroup Inc., NYSE

C

47.05

-0.06(-0.1274%)

3327

Exxon Mobil Corp

XOM

83.6

0.06(0.0718%)

6802

Facebook, Inc.

FB

127.55

-2.53(-1.945%)

2147387

Ford Motor Co.

F

12.16

-0.02(-0.1642%)

12528

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11

0.02(0.1821%)

61740

Google Inc.

GOOG

785

-2.21(-0.2807%)

1047

Johnson & Johnson

JNJ

119.5

0.04(0.0335%)

1415

JPMorgan Chase and Co

JPM

67.1

-0.29(-0.4303%)

1792

Microsoft Corp

MSFT

57.8

-0.02(-0.0346%)

2888

Nike

NKE

55.3

-0.11(-0.1985%)

1049

Tesla Motors, Inc., NASDAQ

TSLA

205.51

-0.92(-0.4457%)

2476

Twitter, Inc., NYSE

TWTR

17.95

-0.68(-3.65%)

549292

Wal-Mart Stores Inc

WMT

72.88

0.61(0.8441%)

6305

Yahoo! Inc., NASDAQ

YHOO

43.41

-0.74(-1.6761%)

58889

Yandex N.V., NASDAQ

YNDX

21.97

-0.10(-0.4531%)

1400

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Wal-Mart (WMT) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Twitter (TWTR) downgraded to Underperform at RBC Capital Mkts; target lowered to $14 from $17

Other:

Twitter (TWTR) initiated with a Hold at Loop Capital; target $18

Facebook (FB) initiated with a Buy at Loop Capital; target $165

UnitedHealth (UNH) initiated with a Buy at Evercore ISI

Amazon (AMZN) target raised to $950 from $855 at Mizuho

-

13:15

WSE: Mid session comment

The first half of today's trading on the Warsaw market was held under the sign of discounts, however a surprise may be the scale of the sell-off. It is noteworthy attempt to rebound of the energy sector companies, which yesterday lost heavily and cast a shadow on the outcome of the session. Tauron (WSE: TPE) and Energa (WSE: ENG) grow more than one percent. On the line of increases balances Enea (WSE: ENA), so this is the segment that can assume the role of locomotive reducing decline in the WIG20.

The leader of discounts today is PKN Orlen, which lost 2.8 percent. although decline has reached 3.3 percent. The reason is obvious. Recommendation "underweight" from JP Morgan with a target price of PLN 58.

In the second half of the session we entered with the WIG20 index at 1,754 points (-1.23%) and with a turnover of PLN 200 million.

-

12:42

Major European stock indices traded in the red zone

European stocks resumed the decline after a 4 day rally, reducing its biggest weekly gain in two months.

A certain pressure on the indexes had statistical data for the euro area. In a preliminary report, Markit Economics reported that business activity expanded in September at the slowest pace in 20 months. The composite PMI index fell to 52.6 points in September from 52.9 points in August. However, the index above 50 indicates that the expansion continues. Economists had expected the index to deteriorate to only 52.8 points. The average value of the index for the third quarter amounted to 52.9 points, which was lower than in the second quarter (53.1 points). In addition, the report showed that the index of business activity in the manufacturing sector improved to 52.6 points from 51.7 points in August. It was expected that the rate will drop to 51.5 points. At the same time, the PMI index for the services sector fell to 52.1 points from 52.8 points last month. It was the lowest reading in 21 months. Analysts had expected the index to remain at the level of 52.8 points. "While the main picture shows the continuation of weak growth (about 0.3 percent for the quarter), is still clear that the economic recovery is fragile and do not expect any real acceleration", - said Rob Dobson, senior economist at HS Markit.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0.6 percent. However, despite a significant increase in European stocks this week, market participants remain skeptical about the effectiveness of the ECB's stimulus measures, taking into account the slowdown in profit growth and recent economic data, which are not up to expectations. Previously, investors have ignored these concerns and focused on the policies of other central banks. Recall, the Fed decided to keep interest rates unchanged, while the Bank of Japan said it will adjust the purchase of assets to control bond yields.

The capitalization of Polymetal International Plc decreased by 8.6 per cent, triggering a decrease in shares of mining companies. The reason for this was the statements of the two investors that they plan to sell 13 million shares.

The cost of Moncler, the Italian manufacturer of luxury ski equipment, fell 2.6 percent, while the price of Scout24, a German operator of online ads fell by 4.1 per cent, which was due to the sale of shares by shareholders.

CaixaBank shares fell by 3.7 percent. The bank said it sold part of the shares to fund the takeover of Portuguese Banco BPI.

Securities of pharmaceutical company H. Lundbeck has decreased by 14 percent, the highest since December 2012. The company said that the first of three major studies on the treatment of Alzheimer's disease have not yielded results.

Shares of construction firms Persimmon Plc and Barratt Developments Plc climbed more than 2.2 percent after Liberum experts have raised estimates of the shares sector.

Shares of Sports Direct International rose 7 percent after reports that founder Mike Ashley will take over as chief executive officer.

Capitalization of Moleskin SpA jumped 13 percent after the Belgian D'Ieteren said it will make an offer to buy the Italian company.

At the moment:

FTSE 100 6901.26 -10.14 -0.15%

DAX -12.59 10661.59 -0.12%

CAC 40 4494.25 -15.57 -0.35%

-

09:48

Major stock markets trading in the red zone: FTSE 100 6,891.07 -20.33 -0.29%, Xetra DAX 10,664.06 -10.12 -0.09%

-

09:18

WSE: After opening

WIG20 index opened at 1774.40 points (-0.10%)*

WIG 48091.47 -0.13%

WIG30 2045.76 -0.18%

mWIG40 4104.99 0.01%

*/ - change to previous close

The WIG20 futures took off 2 points above yesterday's close, which may be explained primarily an attempt to catch up with the WIG20 index, which at yesterday's final fixing gained a few extra points for the artificial draw up. For growth certainly does not convince the outside mood.

Europe started the day slightly worse than expectations. Recessive reading of the GDP of France lowered the valuation of CAC index by 0.4 percent. On the red side is also the German DAX. The WSE responded with withdrawal of most companies in the WIG20 index, which lost 0.8 percent. A positive element is the low turnover, which does not indicate a serious attack of the supply.

After fifteen minutes of trading WIG20 index was at the level of 1,760 points (-0,87%).

-

08:43

Negative start of trading expected on the major stock exchanges in Europe: DAX futures flat, CAC40 -0.3%, FTSE -0.1%

-

08:26

WSE: Before opening

Thursday's session on Wall Street ended with no surprises. Major averages recorded solidarity increases, the S&P500 index gained 0.65 percent and ended the day at levels similar to those observed after opening. Than this is a preview of neutral openings in Europe.

Today's macro calendar does not contain exciting events and from this perspective it is difficult to expect any fireworks. In the afternoon we will know the PMI index for the industry of the United States and earlier similar readings from Europe but there are not data that could have a decisive impact on the market. Markets seem to have today everything to look calm and consolidate after two days of reaction to the super-Wednesday. Moreover Europe has had four sessions of gains which may lead to profit taking.

On the Warsaw market situation is slightly different. Positive sentiment after the Fed decision, suitable for emerging markets, fighting in Warsaw with local political risk. Yesterday's decline in stock prices in the energy sector - triggered by announcements of the authorities about capital increasing, discourages foreign investors and minority shareholders to hold Polish shares and especially shares in companies owned by the Treasury. Thus, a good attitude to other emerging markets does not necessarily have to reflect with increases in the Warsaw index of the largest companies.

-

06:21

Global Stocks

European stock markets scored solid advances on Thursday after the U.S. Federal Reserve refrained from raising interest rates and said it needs more evidence of a stronger economy before it tightens policy. Mining and oil firms were among the biggest advancers, scoring a boost from a weaker dollar in the aftermath of the Fed decision, released after the European close on Wednesday.

U.S. stocks closed near session highs Thursday, with the Nasdaq Composite notching a record close, as investor enthusiasm following the Federal Reserve's most recent policy update spilled over into a second session. The Fed stood pat on interest rates on Wednesday, but Chairwoman Janet Yellen indicated a rate rise is likely by year-end as she expressed confidence in the U.S. economy. Better-than-expected weekly jobless claims data, which fell to the lowest tally since July, signaled a strong labor market and helped extend the optimistic tone on Wall Street.

Asian shares were mixed early Friday, with some markets seeing support amid easing worries that central banks globally would hike interest rates soon. Nonetheless, the currency retreated slightly against the U.S. dollar on Friday, on caution over a possible response from Japanese authorities against the yen's latest strength, after a meeting among top Japanese finance officials on Thursday.

-

00:29

Stocks. Daily history for Sep 22’2016:

(index / closing price / change items /% change)

Nikkei 225 16,807.62 +315.47 +1.91%

Shanghai Composite 3,042.69 +16.81 +0.56%

S&P/ASX 200 5,374.46 +34.90 +0.65%

FTSE 100 6,911.40 +76.63 +1.12%

CAC 40 4,509.82 +100.27 +2.27%

Xetra DAX 10,674.18 +237.69 +2.28%

S&P 500 2,177.18 +14.06 +0.65%

Dow Jones Industrial Average 18,392.46 +98.76 +0.54%

S&P/TSX Composite 14,797.18 +86.36 +0.59%

-