Noticias del mercado

-

17:07

ECB leaning towards QE tweak, no radical changes - RTRS

-

16:30

Fed's Rosengren: Not Raising Rates Now Puts Economic Recovery at Risk

Federal Reserve Bank of Boston President Eric Rosengren said Friday that not raising interest rates now could put the economic expansion at risk by generating "significant imbalances" that could lead to a recession.

Mr. Rosengren was one of three Fed officials who cast dissenting votes at the Fed's policy meeting Wednesday, preferring to raise rates by a quarter percentage point rather than keep them steady.

-

15:54

Option expiries for today's 10:00 ET NY cut

EURUSD:1.1100 (EUR 2.0bln) 1.1150 (994m) 1.1175 (514m) 1.1200 (2.21bln) 1.1205 (297m) 1.1225-30 (443m) 1.1250 (1.96bln) 1.1400 (538m)

USDJPY: 99.50 (USD 275m) 99.99 (320m) 100.50 (USD 325m) 101.00 (980m) 101.80 250m) 103.00 (1.43bln)

AUDUSD 0.7545-55 (AUD 225m) 0.7650 (299m)

NZDUSD 0.7350 (197m)

USDCAD 1.3000-10 (USD 598m) 1.3050 (431m) 1.3150 (463m) 1.3250 (361m) 1.3300 (1.1bln)

-

15:49

US Manufacturing growth eases again in September - Markit

September data highlighted a further upturn in U.S. manufacturing output, but the rate of expansion was modest and only slightly faster than seen on average during the first half of 2016. The latest survey also pointed to a lack of momentum in terms of incoming new orders, especially from export clients.

Manufacturers indicated the slowest overall rise in new business intakes so far this year, which contributed to relatively subdued job hiring and ongoing efforts to reduce inventory levels. Meanwhile, factory gate charges were reduced slightly in September, despite another marginal increase in input costs at manufacturing firms.

At 51.4 in September, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™ ) 1 was down from 52.0 in August and pointed to the weakest improvement in overall business conditions since June. The latest PMI reading marked seven years of continuous growth across the manufacturing sector. However, the headline index was below the average seen over this period (54.0) and remained close to the post-crisis low recorded in May (50.7).

Softer rates of output and new business growth were the main factors weighing on the headline PMI during September. Moreover, the latest expansion of manufacturing production was the weakest for three months. Survey respondents suggested that relatively subdued economic conditions had acted as a brake on new order volumes, while there were also reports that the strong dollar had dampened export sales. Reflecting this, latest data signalled that new work rose at the slowest pace since December 2015, while export orders dropped for the first time in four months.

-

15:45

U.S.: Manufacturing PMI, September 51.4 (forecast 51.9)

-

14:59

Belgium: Business Climate, September -2.2 (forecast -2.4)

-

14:40

-

14:37

Canadian retail sales were relatively unchanged for the third consecutive month, edging down 0.1%

Retail sales were relatively unchanged for the third consecutive month in July, edging down 0.1% to $44.1 billion.

Sales were down in 5 of 11 subsectors. Excluding gasoline stations, retail sales increased 0.2%.

After removing the effects of price changes, retail sales in volume terms were up 0.3% in July.

Lower gas prices contribute to weaker sales at gasoline stations

Receipts at gasoline stations (-3.0%) fell for the first time in four months, with weaker sales recorded in every province. This decline reflected lower prices at the pump. According to the Consumer Price Index, the price of gasoline was down 5.6% on an unadjusted monthly basis in July.

Sales at furniture and home furnishings stores decreased 1.4%, as both furniture stores and home furnishings stores reported 1.4% declines.

Motor vehicle and parts dealers (-0.2%) recorded their fourth decline in five months. Within the subsector, sales at other motor vehicle dealers fell 4.1%. Sales at automotive parts, accessories and tire stores decreased 1.6%. Sales at new car dealers (+0.2%) were up for the second month in a row. Following four months of declines, used car dealers posted a 0.3% gain in July.

-

14:35

Canadian CPI down 0.2% in August. Canadian dollar sold hard

The Consumer Price Index (CPI) rose 1.1% on a year-over-year basis in August, following a 1.3% gain in July.

Excluding gasoline, the CPI was up 1.7% year over year in August, after posting a 1.9% increase in July.

Prices were up in seven of the eight major components in the 12 months to August, with the shelter index contributing the most to the year-over-year rise in the CPI. Smaller year-over-year gains in the food index and the recreation, education and reading index contributed the most to the deceleration in the year-over-year increase in consumer prices.

Consumer prices increase in seven of the eight major components

Food prices were up 1.1% year over year in August, after rising 1.6% in July. Prices for food purchased from stores recorded their smallest year-over-year gain since June 2010, up 0.4% in August. On a year-over-year basis, the meat index decreased in August, after increasing in July, and the fresh fruit index posted its first decline since December 2013. Prices for food purchased from restaurants rose 2.5% year over year in August, following a 2.7% gain in July.

The recreation, education and reading index was up 1.1% on a year-over-year basis in August, after posting a 1.9% gain in July. This deceleration was partly attributable to the travel tours index, which declined 5.6% in the 12 months to August, following a 0.4% rise in July. The traveller accommodation index was unchanged on a year-over-year basis in August, following a 0.7% increase in July.

-

14:31

Canada: Retail Sales YoY, July 2.3%

-

14:30

Canada: Retail Sales, m/m, July -0.1% (forecast 0.1%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, August 1.8% (forecast 2%)

-

14:30

Canada: Consumer Price Index m / m, August -0.2% (forecast 0.1%)

-

14:30

Canada: Retail Sales ex Autos, m/m, July -0.1% (forecast 0.5)

-

14:30

Canada: Consumer price index, y/y, August 1.1% (forecast 1.4%)

-

14:18

Saudis Ready To Lower Output If Iran Agrees To Production Freeze At Current Levels Of 3.6 Mln Bpd – RTRS Sources

-

14:00

Orders

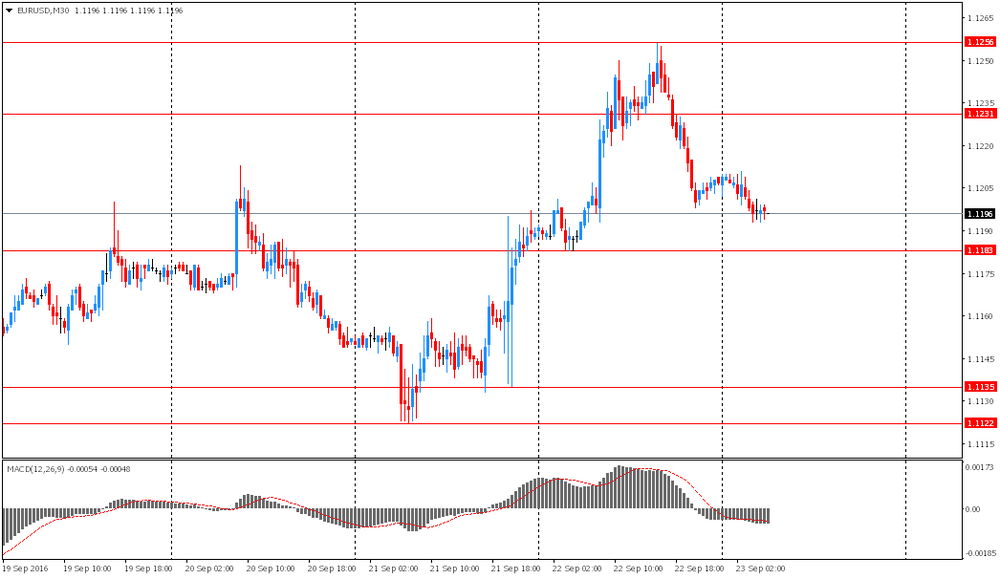

EUR/USD

Offers 1.1220-25 1.1245-50 1.1280 1.1300 1.1320 1.1350

Bids 1.1200 1.1185 1.1150 1.1130 1.1100 1.1080 1.1050

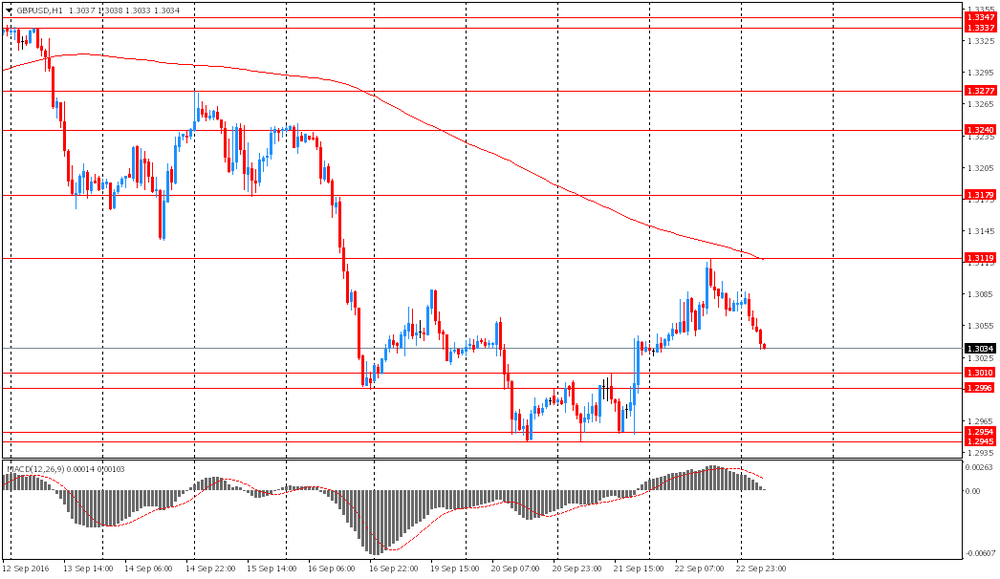

GBP/USD

Offers 1.3030 1.3050-55 1.3080-851.3100 1.3125-30 1.3150 1.3175-80 1.3200

Bids 1.3000 1.2985 1.2965 1.2940-50 1.2900

EUR/GBP

Offers 0.8625-30 0.8650 0.8685 0.8700

Bids 0.8600 0.8580 0.8565 0.8540 0.8520 0.8500 0.8485 0.8450

EUR/JPY

Offers 113.30 113.50 113.85 114.00 114.20 114.50 114.80-85 115.00

Bids 113.00 112.80-85 112.50 112.35 112.00 111.80 111.50

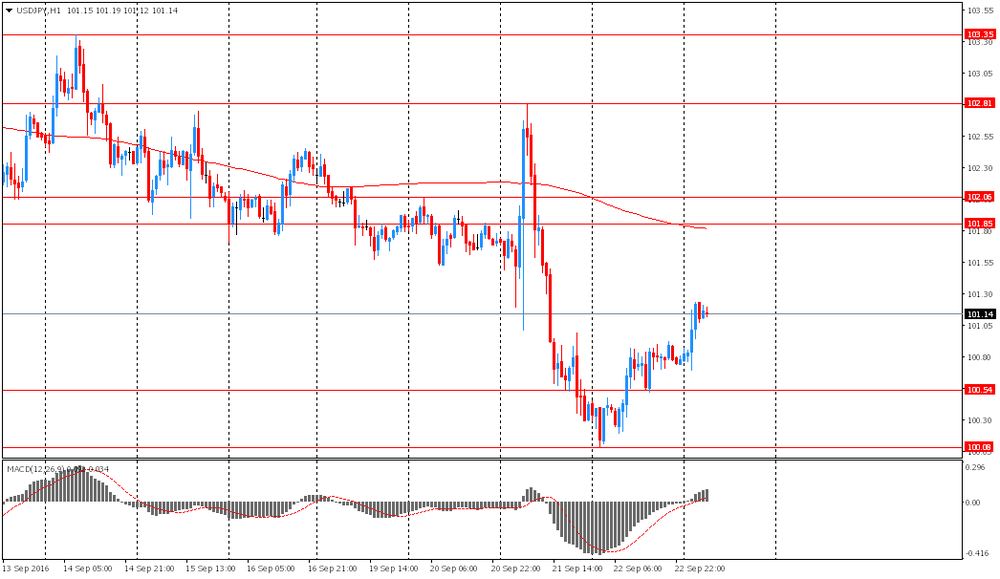

USD/JPY

Offers 101.25-30 101.50 101.80 102.00 102.25 102.45-50

Bids 100.70 100.45-50 100.20 100.00 99.8099.65 99.50

AUD/USD

Offers 0.7650-55 0.7680 0.7700 0.7725-30 0.7750 0.7765 0.7800

Bids 0.7620-25 0.7600 0.7565 0.7550 0.7530-35 0.7500

-

13:40

-

11:46

Distribution confirmed on USD/CAD. Canadian CPI and retail sales to spark a new sharp down move?

-

11:43

China to Start Direct Trading Between Yuan and Saudi Riyals

-

11:42

ECB's Constancio Says Governments Can Do More to Boost Growth

-

11:05

BoJ Buys Time; Sticking To Our USD/JPY Forecast - Morgan Stanley

"Yesterday's BoJ decision contained many changes to their framework but has not materially changed the near-term outlook.The BoJ's yield curve targeting still keeps NIRP in place as well as low long term interest rates, just by a different mechanism than before. The new framework does help the BoJ's dilemma by giving them more flexibility around QE purchases and the yield curve and the new commitment to inflation overshoot reinforces the BoJ's commitment to weaker policy but they don't have near term weakening implications on JPY. For that reason, in addition to our bearish USD view, we think USDJPY can trade lower for now towards our target of 97.

We have been bullish on the JPY for the past year and are now looking for a bottom in this pair, expected between 97 and 100, before it heads back up to 107 in 2017.

We think changing inflation expectations would drive a weaker JPY. There are three ways Japan could see higher inflation. First,domestically generated,via the success of Abenomics feeding through into economic data and stronger wages. Second,internationally generated,via higher commodity prices or an improved growth and trade outlook. Third would be an expansion of government spending, the measure that could speed up the rise of inflation expectations. If this spending is debt funded and causes a steeper yield curve together with higher inflation expectations, then this would cause the quickest JPY weakness and be the most bearish scenario. Our base case assumes a slow rise of USDJPY over the coming quarters".

Copyright © 2016 Morgan Stanley, eFXnews

-

10:59

Option expiries for today's 10:00 ET NY cut

EUR/USD:1.1100 (EUR 2.0bln) 1.1150 (994m) 1.1175 (514m) 1.1200 (2.21bln) 1.1205 (297m) 1.1225-30 (443m) 1.1250 (1.96bln) 1.1400 (538m)

USD/JPY: 99.50 (USD 275m) 99.99 (320m) 100.50 (USD 325m) 101.00 (980m) 101.80 250m) 103.00 (1.43bln)

AUD/USD 0.7545-55 (AUD 225m) 0.7650 (299m)

NZD/USD 0.7350 (197m)

USD/CAD 1.3000-10 (USD 598m) 1.3050 (431m) 1.3150 (463m) 1.3250 (361m) 1.3300 (1.1bln)

-

10:12

ECB vice-president Constancio talking against long period of low intrest rates

-

low rates for long periods pose risks to financial stability

-

could increase long term rates if supply of safe assets increases

-

some models show EZ equilibrium rate is neg

-

hoped for faster economic reaction to expansionary mon pol

-

seeing softer than expected recovery

-

conviction in markets that long period of low growth is ahead of us

*via forexlive -

-

10:10

Further easing in the rate of eurozone economic expansion - Markit

The end of the third quarter saw a further easing in the rate of eurozone economic expansion. September saw combined output across the manufacturing and service sectors rise at the slowest pace since January 2015.

The flash estimate of Markit's Eurozone PMI® Composite Output Index slipped to 52.6, down from 52.9 in August, a 20-month low.

The average index reading over the third quarter (52.9) is below that of quarter two (53.1), also suggesting that the economy is losing, rather than gaining, momentum. Looking beneath the headline figure highlighted contrasting growth trends at manufacturers and service providers. Service sector business activity increased at the weakest rate since the end of 2014, whereas manufacturing production expanded at the quickest pace since December of last year.

Manufacturers benefitted from faster growth of both total new orders (three-month high) and new export business. The gain in new export orders was the steepest in two-and-a-half years. Service sector order books meanwhile rose at a pace unchanged from August's 19-month low. The outlook for the service economy also weakened, with optimism regarding levels of activity in 12 months' time dipping to a 21-month low.

-

10:00

Eurozone: Services PMI, September 52.6 (forecast 52.8)

-

10:00

Eurozone: Manufacturing PMI, September 52.6 (forecast 51.5)

-

09:34

Germany saw the slowest rise in output for 16 months as service sector activity edges closer to stagnation - Markit

Output growth at German private sector firms slowed further at the end of the third quarter. The Markit Flash Germany Composite Output Index fell from August's 53.3 to 52.7 and therefore signalled the weakest expansion in activity in almost one-and-a-half years. While service providers reported a near-stagnation of output during the month, manufacturers recorded ongoing solid growth.

September data signalled a further rise in new order intakes, which companies generally linked to a combination of better marketing initiatives and strong demand from foreign markets. The rate at which new business increased remained below levels seen during the first half of the year, however. That said, manufacturers signalled the strongest rise in new export orders since the beginning of 2014, with Asia and the US mentioned specifically as sources of growth.

Business outstanding rose only marginally during the month as some companies were able to process backlogs amid subdued new order growth. A decline in work-in-hand at service providers contrasted with a solid increase at manufacturers.

Latest survey results pointed to a further solid rise in private sector employment, with the rate of job creation little-changed from that seen in August. The current period of continuous employment growth now stretches to just under three years. Input costs rose for the fifth consecutive month in September, in part driven by higher wages and increased raw material prices. The rate of cost inflation accelerated since August and was among the strongest recorded for over a year.

Some clients passed higher input costs on to their clients in the form of higher charges. The rate of output price inflation was the most marked since January 2014, with both manufacturers and service providers raising their charges.

-

09:30

Germany: Manufacturing PMI, September 54.3 (forecast 53.1)

-

09:30

Germany: Services PMI, September 50.6 (forecast 52.1)

-

09:09

French services and manufacturing improves in September

The latest flash France PMI® data signalled that private sector output rose at the strongest rate in 15 months during September. The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 53.3, up from 51.9 in the preceding survey period.

The latest reading was the jointhighest since August 2011. Driving the pick-up in growth was a faster expansion of service sector activity, which increased at the sharpest rate since June 2015. Manufacturing output on the other hand remained unchanged since August.

New business received by French private sector firms increased for a third successive month in September. The rate of growth was solid, having accelerated to a 15-month high. Whereas service providers reported a faster rise in new business, manufacturers noted a further decline (albeit the slowest in the current nine-month period of contraction). Manufacturers' new export orders fell for the second month running, albeit marginally.

Employment across the French private sector rose for the second time in the past three months during September. That said, the rate of job creation was marginal overall. Staffing levels increased in the service sector, but were cut further by manufacturers. Outstanding business in the French private sector rose for a seventh consecutive month in September. Moreover, the rate of growth quickened to a 15-month high. Faster increases in backlogs were signalled by both service providers and manufacturers, with the former noting the sharper increase.

-

09:00

France: Manufacturing PMI, September 49.5 (forecast 48.4)

-

09:00

France: Services PMI, September 54.1 (forecast 52)

-

08:54

Japan ‘s Minister of Finance, Taro Aso: The Government does not intend to impose on the Bank of Japan all the responsibility to combat deflation

Today, after a cabinet meeting, Finance Minister Taro Aso talked with reporters and answered a few questions. In particular, the official said that the Cabinet does not intend to sit back and lay on the Bank of Japan all the responsibility for the fight against deflation. "The government and the Bank of Japan should work together to solve the structural problems, because the inflation outlook in Japan is still unclear, "- said Aso.

Aso also said that the government intends to promptly take additional economic stimulus package amounting to 28 trillion yen (277 billion dollars), when parliament will hold an extraordinary session on 26 September.

-

08:42

Asian session review: NZD declines

The New Zealand dollar has fallen against the US dollar as investors continue to assess the likelihood of a intrest rate change by the Reserve Bank of New Zealand in the coming months. Earlier, the Central Bank made it clear that the NZD / USD is expected to decline, and that the regulator intends to continue to lower interest rates. Most economists expect RBNZ to cut rates in November. The greatest decrease in the New Zealand Dollar was vs AUD.

The yen fell against the dollar amid wariness of investors about the possible reaction of the Japanese government. Earlier, the yen has increased significantly on the Bank of Japan'smeeting outcome, as the central bank announced new measures by introducing the target level for the 10-year interest rates. Many investors have regarded this step as the Bank of Japan's waiver policy, which allows to control the exchange rate of the yen over the years.

Japanese data was better tha forecast. In September manufacturing PMI was 50.3 points higher than the previous value of 49.5 and economists' expectations of 49.3. Nikkei PMI provides a preliminary assessment of the health of the manufacturing sector in Japan.

Nikkei / Markit report says that the current rate of groth was the most significant in the last 7 months and is a positive sign for the Japanese production. Growth in the sector is mainly due to the increase in export orders, which previously rose to the final value of 47.2.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1195-10 range

GBP / USD: during the Asian session the pair fell to $ 1.3030

USD / JPY: rose to Y101.25

-

08:30

Options levels on friday, September 23, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1335 (2475)

$1.1306 (2701)

$1.1269 (1029)

Price at time of writing this review: $1.1201

Support levels (open interest**, contracts):

$1.1157 (3855)

$1.1122 (3204)

$1.1082 (6315)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 36952 contracts, with the maximum number of contracts with strike price $1,1400 (4956);

- Overall open interest on the PUT options with the expiration date October, 7 is 38876 contracts, with the maximum number of contracts with strike price $1,1100 (6315);

- The ratio of PUT/CALL was 1.05 versus 1.12 from the previous trading day according to data from September, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.3302 (2609)

$1.3205 (1334)

$1.3109 (995)

Price at time of writing this review: $1.3034

Support levels (open interest**, contracts):

$1.2994 (3593)

$1.2897 (848)

$1.2798 (1756)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 26084 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22263 contracts, with the maximum number of contracts with strike price $1,3000 (3593);

- The ratio of PUT/CALL was 0.85 versus 0.87 from the previous trading day according to data from September, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

3 Reasons To Stay Bearish GBP - BNPP

"We expect the GBP to continue weakening for three main reasons

.First, stronger than expected UK data over the past month and a squeeze of short GBP positions have, according BNP Paribas STEER, driven the GBP above its its fair value implied by rates and equity markets - short-term fair value currently stands at 1.2890.

Second, the GBP remains vulnerable to political uncertainty which we think is likely to remain high near term.

Finally, our economists continue to forecast a 15bp rate cut at the Bank of England's November meeting - considerably more than the market is pricing in".

Copyright © 2016 BNP Paribas™, eFXnews™

-

08:15

Japan's all industry activity grew at a slower pace in July

According to rttnews, Japan's all industry activity grew at a slower pace in July, the Ministry of Economy, Trade and Industry said Friday.

The all industry activity index rose 0.3 percent month-on-month in July, following June's 1 percent increase. Nonetheless, this was the second consecutive rise in activity and better than the expected 0.2 percent growth.

Tertiary industry activity grew at a slower pace of 0.3 percent after rising 0.7 percent in the prior month.

Industrial output slid 0.4 percent on month, reversing a 2.3 percent rise a month ago. Meanwhile, the increase in construction activity accelerated to 2 percent from 0.1 percent.

On a yearly basis, the all industry activity index slid 0.7 percent in July in contrast to a 0.1 percent rise in June. This was the first fall in three months.

-

08:13

6.1 earthquake occurred near Off East Coast Of Honshu, Japan

-

08:12

Japan's manufacturing sector resumes expansion

Flash Japan Manufacturing PMI™ at 50.3 in September (49.5 in August). Manufacturing conditions improve marginally for the first time in seven months. Flash Japan Manufacturing Output Index at 50.7 (50.2 in August). Production increased for the second month running.

Today sees the latest public release of the Nikkei Flash Japan Manufacturing Purchasing Managers' Index™ (PMI™). Published on a monthly basis approximately one week before final PMI data are released, this makes the PMI the earliest available indicator of manufacturing sector operating conditions in Japan. The estimate is typically based on approximately 85%-90% of total PMI survey responses each month and is designed to provide an accurate indication of final PMI data.

Commenting on the Japanese Manufacturing PMI survey data, Amy Brownbill, economist at IHS Markit, which compiles the survey, said: "Manufacturing conditions in Japan improved for the first time since February at the end of Q3. Production increased for the second month running, while international demand picked up for the first time since the start of 2016. As a result, goods producers were more optimistic towards taking on additional staff, with job creation accelerating to a four-month high. Manufacturers also benefitted from lower cost burdens, with input prices declining for the ninth consecutive month."

-

06:46

Japan: All Industry Activity Index, m/m, July 0.3% (forecast 0.2%)

-

02:37

Japan: Manufacturing PMI, September 50.3

-

00:28

Currencies. Daily history for Sep 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1207 +0,16%

GBP/USD $1,3076 +0,31%

USD/CHF Chf0,9686 -0,54%

USD/JPY Y100,78 +0,36%

EUR/JPY Y112,95 +0,50%

GBP/JPY Y131,77 +0,65%

AUD/USD $0,7641 +0,13%

NZD/USD $0,7312 -0,37%

USD/CAD C$1,3047 -0,35%

-

00:00

Schedule for today, Friday, Sep 23’2016

02:00 Japan Manufacturing PMI (Preliminary) September 49.5

04:30 Japan All Industry Activity Index, m/m July 1% 0.2%

07:00 France Services PMI (Preliminary) September 52.3 52

07:00 France Manufacturing PMI (Preliminary) September 48.3 48.4

07:30 Germany Services PMI (Preliminary) September 51.7 52.1

07:30 Germany Manufacturing PMI (Preliminary) September 53.6 53.1

08:00 Eurozone Services PMI (Preliminary) September 52.8 52.8

08:00 Eurozone Manufacturing PMI (Preliminary) September 51.7 51.5

12:30 Canada Retail Sales, m/m July -0.1% 0.1%

12:30 Canada Retail Sales YoY July 2.7%

12:30 Canada Retail Sales ex Autos, m/m July -0.8% 0.5

12:30 Canada Consumer Price Index m / m August -0.2% 0.1%

12:30 Canada Consumer price index, y/y August 1.3% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August 2.1% 2%

13:00 Belgium Business Climate September -3.1 -2.4

13:45 U.S. Manufacturing PMI (Preliminary) September 52 51.9

-