Noticias del mercado

-

16:02

US new home sales up slightly in August

Sales of new single-family houses in August 2016 were at a seasonally adjusted annual rate of 609,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.6 percent (±10.7%)* below the revised July rate of 659,000, but is 20.6 percent (±14.8%) above the August 2015 estimate of 505,000.

The median sales price of new houses sold in August 2016 was $284,000; the average sales price was $353,600. The seasonally adjusted estimate of new houses for sale at the end of August was 235,000. This represents a supply of 4.6 months at the current sales rate.

-

16:00

U.S.: New Home Sales, August 609 (forecast 597)

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1170 (367m) 1.1250 (224m) 1.1325 (207m)

USD/JPY: 99.00 (USD 610m) 99.80-81 (640m) 100.00 (627m) 100.50-60 (USD 220m) 101.00 (411m) 102.00 (262m) 102.21 (360m)

AUD/USD 0.7500 (AUD 610m)

NZD/USD 0.7300 (248m) 0.7335-41 (249m)

USD/CAD 1.3300 (USD 590m)

EUR/JPY 113.15 (798m)

AUD/JPY 75.50-60 (531m)

-

15:08

FOMC, Lacker: I thought the case was strong this past week for another increase

"I thought the case was strong this past week for another increase. Given how tight labor markets are, given how close we are to our inflation target, our benchmarks point to interest rates that are substantially higher than they are now and I think we need to get on with it."

-

15:05

Shares of Deutsche Bank (DB) in premarket trading dropped to 20-year low

Deutsche Bank shares recorded a decline of 6.5%, reaching the lowest value in more than 20 years. According to the information by CNNMoney, the cause of the collapse was the message of the German government that will not interfere in the dispute with the United States Department of Justice, which requires from Deutsche Bank (DB) compensation in the amount of $ 14 billion, for dubious operations of mortgage loans, which led to the housing market crisis and the fall of 2008.

The German government refused to comment on the information.

DB's shares fell in premarket trading to $ 12.00 (-5.88%).

-

13:53

Orders

EUR/USD

Offers : 1.1250-55 1.1280 1.1300 1.1320 1.1350

Bids : 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers : 1.2950 1.2980-85 1.3000 1.3020-251.3050-55 1.3080-85 1.3100

Bids : 1.2915 1.2900 1.2880 1.2865 1.2850 1.2830 1.2800

EUR/GBP

Offers : 0.8700 0.8720-25 0.8750 0.8765 0.8785 0.8800

Bids : 0.8680 0.8665 0.8645-50 0.8630 0.8600 0.8580 0.8565 0.8540 0.8520 0.8500

EUR/JPY

Offers : 113.30 113.50 113.85 114.00 114.20 114.50 114.80-85 115.00

Bids : 112.80-85 112.50 112.35 112.00 111.80 111.50 111.30 111.00

USD/JPY

Offers : 100.85 101.00 101.25-30 101.50 101.80 102.00

Bids : 100.45-50 100.20 100.00 99.80 99.65 99.50-55 99.30 99.00

AUD/USD

Offers : 0.7630 0.7650-55 0.7680 0.7700 0.7725-30 0.7750

Bids : 0.7600 0.7585 0.7565 0.7550 0.7530-35 0.7500

-

13:47

This Can Trigger A Sharp EUR Rally Next Year; How To Position? - SocGen

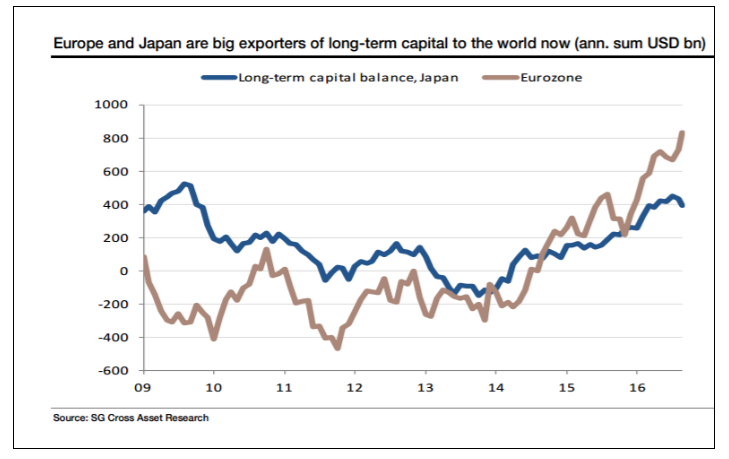

"The chart below shows net annual long-term (direct and portfolio investment) capital outflows from Japan, in US dollars. The switch from net importer of capital to exporter in 2014 helped weaken the Yen and the Euro. It still provides a lot of fuel for risk assets everywhere.

But if massive capital outflows merely keep EUR/USD in a stifling range, isn't the risk at some point in the next year, that any hiccup in those flows triggers a sharp Euro rally?

A Euro surge would catch just as many people off guard as the yen move did. The best way to position for this is to be long EUR/GBP".

Copyright © 2016 Societe Generale, eFXnews™

-

13:07

Major European stock indices trading in the red zone

European stock markets started trading with a negative dynamic, since the reduction in the shares of major banks and energy companies weighed on the stock exchange in the region.

Investors evaluate data on German business climate, as well as the expected long-awaited presidential debate in the United States.

According to Ifo institute IFO the index of confidence of German businessmen rose to 109.5 points - the highest level since May 2014 - as compared with 106.3 points a month earlier.

Tonight at Hofstra University in New York will be the first debate of the US presidential candidates Hillary Clinton and Donald Trump.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading on 1,5% - to 340.29 points.

Shares of Deutsche Bank collapsed in price to a record low of 10.65 euros, to the 08:40 GMT decrease their value exceeded 5%.

Earlier, the German magazine Focus reported that German Chancellor Angela Merkel ruled out the possibility of granting state aid to Deutsche Bank, from which US regulators require the payment of $ 14 billion as part of the settlement of claims in the case of manipulating prices for mortgage securities in the period before the 2008 crisis.

On Friday, ratings agency Fitch said that the key risks for the banking sector in Germany are ultra-low interest rates, putting pressure on the profits of banks, as well as regulatory pressures and stiff competition.

In the case of Deutsche Bank agency also noted the problems associated with significant costs and expenses.

Shares of other European banks also fell today. Quotes Commerzbank Securities, BNP Paribas and Lloyds Banking Group fell by 4.5%, 4.3% and 3.1%.

Shares of oil companies are also cheaper in the course of trading on the background of the high volatility of oil prices before the upcoming meeting of oil producing countries in Algiers.

The cost of BP shares fell to 1,6%, Royal Dutch Shell - by 1.6%.

Oil prices, which rose in the morning about 1%, sharply reduced growth during the session amid experts doubt the success of the upcoming talks between the oil-producing countries.

"We are skeptical about the possibility of reaching an agreement this week", - said a senior analyst at IronFX Global Charalambos Pissuros.

German Lanxess shares rose 7.9%. German specialty chemicals group announced the purchase of its US Chemtura Corp., the transaction amount will be about 2.4 billion euros ($ 2.7 billion).

At the moment:

FTSE 6838.24 -71.19 -1.03%

DAX 10479.33 -147.64 -1.39%

CAC 4418.23 -70.46 -1.57%

-

11:45

Jordan: Financial market infrastructures: Walking the line between stability and innovation

"Financial market infrastructures are vital for various Swiss National Bank (SNB) activities, including the implementation of monetary policy. This part of the financial sector also stands to be affected by the rapid changes currently taking place in financial technology. Technological innovations are thus highly relevant for the SNB. The SNB's task is to strike the right balance between maintaining stable conditions and promoting useful innovation.

Although the financial industry's core functions - funding new investments, offering investment and asset protection strategies, and executing payments - will remain largely unchanged, the technologies and channels by which it delivers these services are changing. The challenge for regulators and central banks is to make sure they fully understand the effects - and side-effects - of these new mechanisms at an early stage. Central banks and regulators have a duty to protect the safety of financial market infrastructures, but they also have a duty to ensure that they operate efficiently.

Until recently, financial market infrastructures had been moving towards centralisation. However, technological progress could reverse this trend, making decentralisation the new paradigm. The keywords here are 'distributed ledger' and 'blockchain'. There will nevertheless continue to be a role for centralised infrastructures, which already operate at low cost and meet high safety standards. It is, however, possible that we will see conventional and new technologies co-existing or even blending in the future. Such new technology is particularly relevant for central banks in the context of the ongoing debate about central bank money potentially being issued via a distributed ledger. This issue raises a host of central bank-specific questions that will need to be examined in more detail. The SNB is following and analysing developments in this arena closely and is actively involved in discussions with market participants, regulators and other central banks.

Certain other developments are already having a tangible effect on financial market infrastructures - for instance on cashless payment systems - and, this, in turn, has ramifications for the SNB. According to its mandate, the SNB is obliged to facilitate and secure the operation of such systems. In April of this year, the latest generation of the Swiss Interbank Clearing (SIC) system, which operates under the strategic guidance of the SNB, was launched. Support for emerging messaging standards and plans to extend SIC's operating hours next year will set the stage for cashless payment innovations which will ultimately benefit companies as well as private customers.

For financial market infrastructure innovations to be successful, market participants, regulators and central banks must all be convinced they are both safe and efficient. It is therefore essential that these parties maintain an active dialogue".

-

11:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1170 (367m) 1.1250 (224m) 1.1325 (207m)

USD/JPY: 99.00 (USD 610m) 99.80-81 (640m) 100.00 (627m) 100.50-60 (USD 220m) 101.00 (411m) 102.00 (262m) 102.21 (360m)

AUD/USD 0.7500 (AUD 610m)

NZD/USD 0.7300 (248m) 0.7335-41 (249m)

USD/CAD 1.3300 (USD 590m)

EUR/JPY 113.15 (798m)

AUD/JPY 75.50-60 (531m)

-

10:45

German business confidence improved in September

According to rttnews, German business confidence improved in September, reports said citing survey data from Ifo institute on Monday.

The business sentiment index rose to 109.5 in September, while the score was forecast to remain unchanged at August's initially estimated value of 106.2.

The current conditions index came in at 114.7 versus 112.8 a month ago. The reading was forecast to rise to 113.

The expectations indicator climbed to 104.5 from 100.1 in August. The expected reading was 100.0.

-

10:44

UK mortgage approvals down slightly

-

Gross mortgage borrowing of £12.4bn in the month was 1% higher than in August 2015.

-

Net mortgage borrowing is just under 3% higher than a year ago.

-

Consumer credit continues to show annual growth of over 6% reflecting fairly strong retail sales and in the case of personal loans and overdrafts favourable interest rates.

Dr Rebecca Harding, Chief Economist at the BBA, said:

"The High Street Banking statistics published today point to a softer housing market, strong consumer credit and slightly weaker business borrowing in August. The data was collected before the Bank of England reduced interest rates to 0.25% and so give an indication of some of the underlying pressures that the MPC was responding to when it made this decision.

"Mortgage borrowing is growing at a slower pace than it has for the last few months reflecting both the slowdown in housing market growth after the April spike and broader trends in the sector".

-

-

10:16

Italian retail trade index decreased by 0.3% m/m

The retail trade index measures the monthly evolution of the turnover at current prices of enterprises with retail sale outlets. With effect from January 2013 the indices are calculated with reference to the base year 2010 using the Ateco 2007 classification (Italian edition of Nace Rev. 2). In July 2016 the seasonally adjusted retail trade index decreased by 0.3% with respect to June 2016 (+0.3% for food goods and -0.5% for non-food goods). The average of the last three months increased with respect to the previous three months (+0.2%). The unadjusted index decreased by 0.2% with respect to July 2015.

-

10:00

Germany: IFO - Current Assessment , September 114.7 (forecast 113)

-

10:00

Germany: IFO - Expectations , September 104.5 (forecast 100.2)

-

10:00

Germany: IFO - Business Climate, September 109.5 (forecast 106.4)

-

09:51

Today’s events

At 11:15 GMT the ECB member Yves Mersch will make a speech

At 12:30 GMT The head of the SNB, Thomas Jordan will deliver a speech

At 16:15 GMT the ECB board member Benoit Coeure deliver a speech

At 16:30 GMT FOMC member Neil Kashkari will deliver a speech

At 17:05 GMT the ECB president Mario Draghi will deliver a speech

At 18:45 GMT FOMC Member Daniel Tarullo deliver a speech

At 20:30 GMT FOMC members Robert Kaplan will deliver a speech

-

09:14

GBP 'Increasingly Unloved', Consider Long EUR/GBP Over Short GBP/USD - RBS

"GBP is feeling increasingly unloved. Downside pressure has been building just above 1.30 in GBP/USD. This week's break appears to have added to the negative sentiment as has a break up through 0.8635 in EUR/GBP. A break of 0.8676 would add to existing negative sentiment.

We believe the reality of Brexit is sinking in after a summer of less political sound-bites.

GBP has also stopped rallying on better data as the focus has turned to the longer term negatives. This week's current account data (that accompany the final estimate of Q2 GDP) will remind investors of the challenges of financing a large deficit.

We see further trade weighted losses for GBP. Currently we have a slight bias to be long EUR/GBP over short GBP/USD".

Copyright © 2016 RBS, eFXnews™

-

08:52

Markets return to normal at the end of September as the big money come back. More volatile times expected

-

08:15

Former Japan Minister of Finance, Eysuke Sakakibara: Yen slowly but surely to around Y90 in 2017

Today, the former Minister of Finance , Eysuke Sakakibara, known among traders by the nickname "Mr. Yen" gave a short interview. The official said that in his forecast of 2017, the yen will slowly but surely come to around Y90. Sakakibara said the yen to Y95-Y100 range is very favorable for the Japanese economy and can provide the necessary minimum rise of 1% of GDP. Also he supported the recent decision of the Bank of Japan, and said that the regulator is monitoring the situation on the currency market.

-

08:12

3 Reasons Why JPY Will Weaken M-Term On BoJ New Policy Framework - Nomura

"The BOJ's new policy framework aims to improve the sustainability of its easing, as the Bank acknowledges the battle to reach the price target may be more prolonged. The transformation was inevitable sooner rather than later, and the BOJ made the initial step relatively smoothly, avoiding volatility in bond and equity markets. At the same time, the decision does not necessarily add much fresh stimulus to the economy, and we judge this preparation for a prolonged fight means less frequent policy reactions going forward. Thus, we expect the immediate impact on JPY to be limited.

Nonetheless, the improved sustainability under the new policy framework will enable JPY weakness in the medium term, as 1) it avoids the danger of deterioration in risk sentiment by sudden tapering, 2) the policy rate cut will be less harmful for the financial sector, and 3) expectations for joint efforts by the BOJ and the government will continue.

As a result, when positive external developments, such as US rate hikes and a reduction in US political uncertainty, occur, Japanese investment in foreign assets with no FX hedging could accelerate more easily. Carry trade-type JPY selling should also become gradually easier. The BOJ's commitment to maintaining stability in the JGB market will be the key to success".

Copyright © 2016 Nomura, eFXnews™

-

08:09

BOJ's Kuroda: ready to use every possible policy tool if needed

-

there's no limit to monetary policy

-

BOJ to relentlessly pursue innovation

-

can accelerate monetary base expansion if necessary along with more asset purchases

-

main tool for more easing still deepening neg rate cuts and lowering long term rate target

-

shape, locations of yield curve will broadly remain as they are at present

-

large scale monetary easing will be in place until observed CPI stays above 2% in stable manner

*via forexlive -

-

08:08

Saudis Willing to Act on ‘Critical’ Oil Market, Algeria Says - Bloomberg

-

08:07

New Zeeland's trade balance deficit increased more than expected

For August 2016 compared with August 2015:

Goods exports fell $323 million to $3.4 billion.

-

Milk powder, butter, and cheese led the fall, down $135 million (22 percent).

-

Meat and edible offal fell $111 million (26 percent), with falls in beef and lamb.

-

Logs, wood, and wood articles rose $102 million (34 percent), led by untreated logs.

Goods imports fell $148 million to $4.7 billion.

-

Capital goods led the fall in imports, down $195 million (45 percent).

-

Crude oil fell $106 million (38 percent) in value and 16 percent in quantity.

-

Excluding petroleum products and aircraft and parts, goods imports rose $182 million (4.4 percent).

The monthly trade balance was a deficit of $1.3 billion (37 percent of exports).

The trade weighted index rose 9.2 percent from August 2015.

Milk powder exports fell in August 2016 to the lowest level since August 2009, contributing to a large 8.7 percent fall in the monthly value of exports when compared with August 2015, Statistics New Zealand said today.

-

-

07:16

Japan: Coincident Index, July 112.1 (forecast 112.8)

-

07:06

Options levels on monday, September 26, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1341 (2636)

$1.1316 (2222)

$1.1288 (1073)

Price at time of writing this review: $1.1228

Support levels (open interest**, contracts):

$1.1173 (3927)

$1.1134 (3243)

$1.1090 (7019)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 36626 contracts, with the maximum number of contracts with strike price $1,1400 (4957);

- Overall open interest on the PUT options with the expiration date October, 7 is 39349 contracts, with the maximum number of contracts with strike price $1,1100 (7019);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from September, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.3202 (1398)

$1.3105 (996)

$1.3009 (542)

Price at time of writing this review: $1.2981

Support levels (open interest**, contracts):

$1.2894 (914)

$1.2797 (1761)

$1.2698 (1424)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 26547 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22321 contracts, with the maximum number of contracts with strike price $1,3000 (3590);

- The ratio of PUT/CALL was 0.84 versus 0.85 from the previous trading day according to data from September, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:02

Japan: Leading Economic Index , July 100 (forecast 100)

-

00:45

New Zealand: Trade Balance, mln, August -1265

-

00:28

Currencies. Daily history for Sep 23’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1228 +0,19%

GBP/USD $1,2963 -0,87%

USD/CHF Chf0,9703 +0,18%

USD/JPY Y100,99 +0,21%

EUR/JPY Y113,40 +0,40%

GBP/JPY Y130,92 -0,65%

AUD/USD $0,7621 -0,26%

NZD/USD $0,7243 -0,95%

USD/CAD C$1,3165 +0,90%

-

00:01

Schedule for today,Monday, Sep 26’2016

05:00 Japan Coincident Index (Finally) July 111.1 112.8

05:00 Japan Leading Economic Index (Finally) July 99.2 100

08:00 Germany IFO - Current Assessment September 112.8 113

08:00 Germany IFO - Expectations September 100.1 100.2

08:00 Germany IFO - Business Climate September 106.2 106.4

09:30 Switzerland SNB Chairman Jordan Speaks

14:00 Eurozone ECB President Mario Draghi Speaks

14:00 U.S. New Home Sales August 654 597

23:10 Canada BOC Gov Stephen Poloz Speaks

-