Noticias del mercado

-

16:02

US consumer confidence improved further in September

The Conference Board Consumer Confidence Index®, which had increased in August, improved further in September. The Index now stands at 104.1 (1985=100), up from 101.8 in August. The Present Situation Index rose from 125.3 to 128.5, while the Expectations Index improved from 86.1 last month to 87.8.

"Consumer confidence increased in September for a second consecutive month and is now at its highest level since the recession," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers' assessment of present-day conditions improved, primarily the result of a more positive view of the labor market. Looking ahead, consumers are more upbeat about the short-term employment outlook, but somewhat neutral about business conditions and income prospects. Overall, consumers continue to rate current conditions favorably and foresee moderate economic expansion in the months ahead."

-

16:00

U.S.: Consumer confidence , September 104.1 (forecast 99)

-

16:00

U.S.: Richmond Fed Manufacturing Index, September -8 (forecast -2)

-

15:52

US: Faster rise in services activity, but new orders and jobs growth eases - Markit

The rate of expansion in business activity at U.S. service providers picked up for the first time in three months during September, but remained relatively modest. Meanwhile, growth of new orders eased to a four-month low and companies reacted to modest inflows of new work by reducing their rate of hiring. There was no sign of inflationary pressures building during the month as both input costs and output prices rose at weaker rates than in August. A dip in confidence was also registered in the latest survey period.

Adjusted for seasonal influences, the Markit Flash U.S. Services PMI™ Business Activity Index1 1 Please note that Markit's PMI data, flash and final, are derived from information collected by Markit from a different panel of companies to those that participate in the ISM Non-Manufacturing Report on Business. No information from the ISM survey is used in the production of Markit's PMI. rose to 51.9 in September from the previous month's final reading of 51.0. This signalled the fastest monthly rise in activity since April, albeit one that was still relatively modest. Activity has now increased in each of the past seven months. Where higher activity was recorded, this was widely linked by panellists to ongoing new business growth.

However, although continuing to increase during September, new business was up only modestly compared to August. In fact, the rate of growth eased to a four-month low. The pace of accumulation in backlogs of work also eased and was the slowest in the current three-month sequence of rising outstanding business.

-

15:45

U.S.: Services PMI, September 51.9 (forecast 51.1)

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1170 (367m) 1.1250 (224m) 1.1325 (207m)

USD/JPY: 99.00 (USD 610m) 99.80-81 (640m) 100.00 (627m) 100.50-60 (USD 220m) 101.00 (411m) 102.00 (262m) 102.21 (360m)

AUD/USD 0.7500 (AUD 610m)

NZD/USD 0.7300 (248m) 0.7335-41 (249m)

USD/CAD 1.3300 (USD 590m)

EUR/JPY 113.15 (798m)

AUD/JPY 75.50-60 (531m)

-

15:10

S&P Case-Shiller U.S. National Home Prices rose 0.7% in July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.1% annual gain in July, up from 5.0% last month. The 10-City Composite posted a 4.2% annual increase, down from 4.3% the previous month.The 20-City Composite reported a year-over-year gain of 5.0%, down from 5.1% in June.

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.7% in July. The 10-City Composite recorded a 0.5% month-over-month increase while the 20-City Composite posted a 0.6% increase in July. After seasonal adjustment, the National Index recorded a 0.4% month-overmonth increase, the 10-City Composite posted a 0.1% decrease, and the 20-City Composite remains unchanged. After seasonal adjustment, 12 cities saw prices rise, two cities were unchanged, and six cities experienced negative monthly prices changes.

"Both the housing sector and the economy continue to expand with home prices continuing to rise at about a 5% annual rate," says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. "The statement issued last week by the Fed after its policy meeting confirms the central bank's view that the economy will see further gains. Most analysts now expect the Fed to raise interest rates in December. After such Fed action, mortgage rates would still be at historically low levels and would not be a major negative for house prices"

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, July 5% (forecast 5.1%)

-

14:08

Novak: Oil market would balance quicker with producer cooperation

-

14:01

Orders

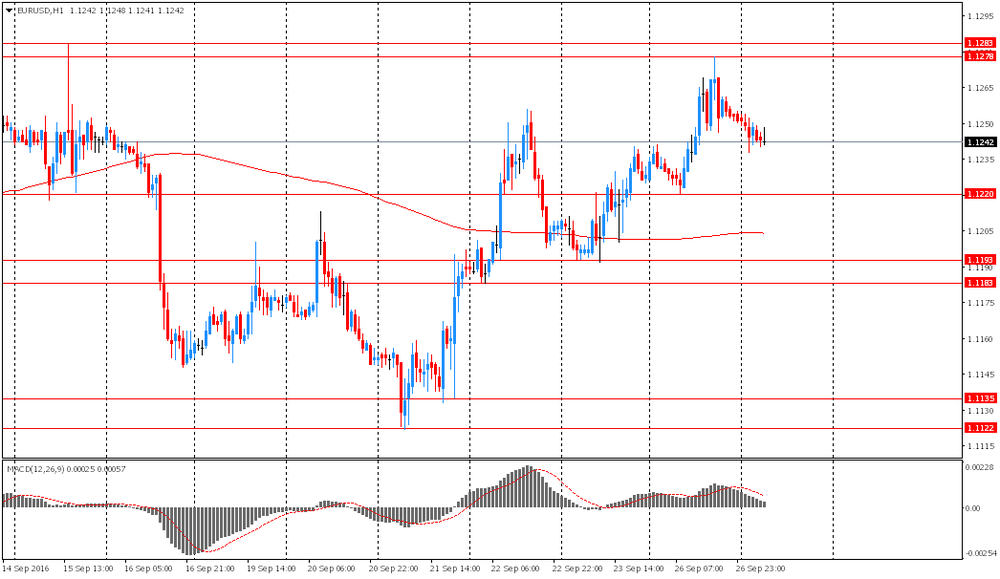

EUR/USD

Offers : 1.1280 1.1300 1.1320 1.1350

Bids : 1.1240 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100

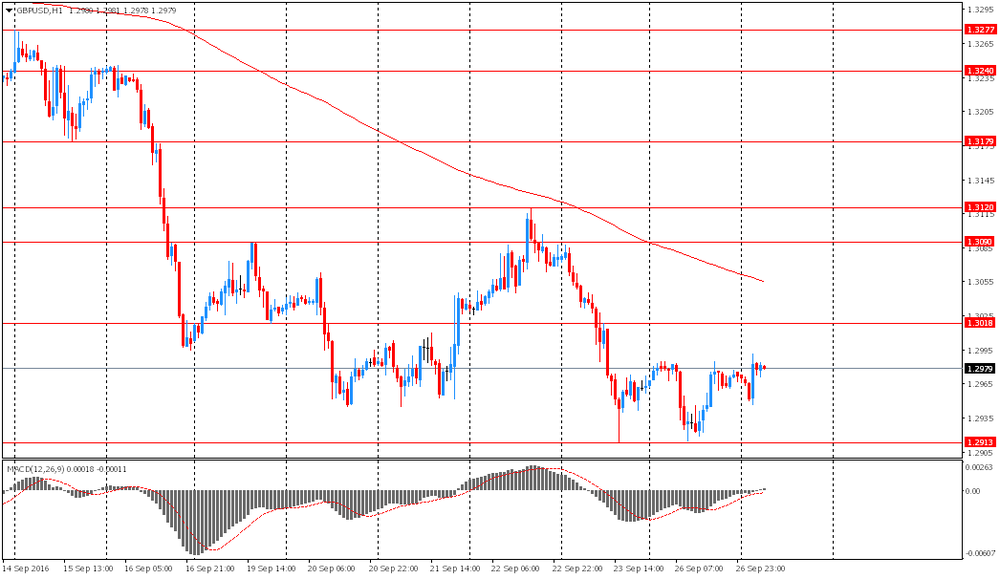

GBP/USD

Offers : 1.3020-25 1.3050-55 1.3080-85 1.3100 1.3120 1.3150

Bids : 1.2950 1.2935 1.2915 1.2900 1.2880 1.2865 1.2850

EUR/GBP

Offers : 0.8685 0.8700 0.8720-25 0.8750 0.8765 0.8785 0.8800

Bids : 0.8645-50 0.8630 0.8600 0.8580 0.8565 0.8540 0.8520 0.8500

EUR/JPY

Offers : 113.30 113.50 113.85 114.00 114.20 114.50 114.80-85 115.00

Bids : 113.00 112.80-85 112.50 112.35 112.00 111.80 111.50 111.30 111.00

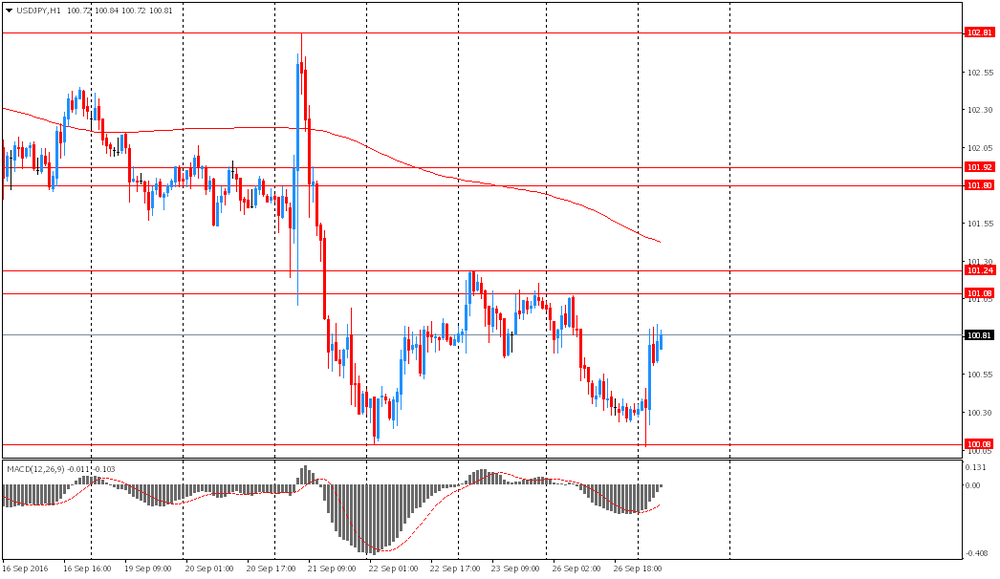

USD/JPY

Offers : 100.85 101.00 101.25-30 101.50 101.80 102.00

Bids : 100.40 100.25 100.00 99.80 99.65 99.50-55 99.30 99.00

AUD/USD

Offers : 0.7700 0.7725-30 0.7750 0.7765 0.7800

Bids : 0.7650 0.7630 0.7600 0.7585 0.7565 0.7550

-

12:39

Major European stock indices trading in the red zone

After rising at the opening the European stock indices decline on fears for the economy of the region and especially the banking sector.

In early trading the main positive factor for the global stock markets were the results of the first televised US presidency debate.

In the opinion of many market participants, Clinton seemed preferable. According to a CNN poll, 62% of viewers gave the victory in the first round to her. Democratic candidate Donald Trump managed to get on the defensive during the greater part of the discussion.

Investors also evaluated by statistical data for the euro area. Eurozone money supply growth accelerated in August, and the lending of households increased at a steady pace, said the European Central Bank.

Broad money M3 increased by 5.1 percent year on year in August, faster than the growth of 4.9 percent in July.

Economists had forecast that the growth rate will accelerate to 4.9 percent compared to the initially estimated rise in July of 4.8 percent.

Similarly, M1 aggregate, which includes cash in circulation and overnight deposits, increased by 8.9 percent in August after rising 8.4 percent in July.

Deposits placed by households increased by 5.2 per cent and deposits from non-financial corporations rose by 7.1 per cent.

The data showed that the annual rate of credit growth in the private sector amounted to 1.5 percent in August, compared with 1.4 percent in July.

Loans to the private sector increased by 1.7 percent in August, the same rate as in July. In addition, household loans grew at a steady pace of 1.8 percent, and loans to non-financial corporations rose by 1.9 per cent.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,6% - to 338.05 points.

The energy sector was mixed, as market participants are preparing for the informal meeting of OPEC members this week, which should be discussed a production freeze.

French oil and gas giant Total SA gained 0.5%, the Italian ENI rose 0.6%, while the Norwegian Statoil fell by 0.2%.

The financial sector as a whole grew, as French lenders BNP Paribas and Societe Generale rose 0.3% and 0.4%, while Germany's Deutsche Bank up 1.6% after the collapse of more than 6% on Monday amid reports that the German government will not provide state aid to the bank.

Shares of Commerzbank, on the other hand, fell by 0.6% on news that the lender plans to cut about 9,000 jobs in the coming years.

Shares of French telecom group Orange SA jumped 2.1% after Credit Suisse analysts raised their rating to "outperform."

Carnival shares rose 2.5% after the company raised its profit forecast and announced its increase of 17% in the last quarter.

At the moment:

FTSE 6803.48 -14.56 -0.21%

DAX 10300.42 -93.29 -0.90%

CAC 4381.89 -25.96 -0.59%

-

12:34

UK: the volume of sales fell, despite expectations - CBI

The survey of 120 firms, of which 63 were retailers, showed that the volume of sales fell, despite expectations last month that sales would be largely unchanged. However, sales volumes look set to grow slightly in the year to October.

Overall, sales volumes for the time of year were considered to be above seasonal norms.

The volume of orders placed upon suppliers fell for a sixth consecutive month, disappointing expectations of a rebound in order growth.

Within the retail sector, lower sales at grocers, specialist food & drink and footwear & leather were the main drivers of the drop in overall volumes. Meanwhile, strong growth was recorded in clothing, hardware & DIY.

Growth in internet sales volumes slowed further in the year to September, although growth is set to pick up in October.

-

12:01

Informal meeting of OPEC may be held 27 or 28 September - Novak

-

12:00

United Kingdom: CBI retail sales volume balance, September -8 (forecast 7)

-

10:59

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1170 (367m) 1.1250 (224m) 1.1325 (207m)

USD/JPY: 99.00 (USD 610m) 99.80-81 (640m) 100.00 (627m) 100.50-60 (USD 220m) 101.00 (411m) 102.00 (262m) 102.21 (360m)

AUD/USD 0.7500 (AUD 610m)

NZD/USD 0.7300 (248m) 0.7335-41 (249m)

USD/CAD 1.3300 (USD 590m)

EUR/JPY 113.15 (798m)

AUD/JPY 75.50-60 (531m)

-

10:45

AUD: Overvalued For A Reason: Where To Target? - NAB

"The Fed has come and gone and the US dollar has traded softer out of the FOMC, helping keep AUD/USD firmly ensconced within a 0.7450-0.7750 range and which has contained close to 100% of the price action since the beginning of August.

AUD/USD looks set to end the quarter not too far from our earlier 0.77 forecast and we see no compelling reason at this stage to alter our end-2016 forecast of 0.75. We're not convinced the prevailing range is under any imminent threat of breaking.

That said, post-Fed and with market volatility set to stay low at least until we get much closer to the US Presidential elections, we'd have to judge the top side as currently the weaker edge.

AUD overvalued, but so what?

AUD/USD trades slightly rich relative to our short term fair value model estimate (just over 0.74) - but has done so for about two months now. It is significantly above the RBA's own view of the (real) trade weighted AUD that would be consistent with the scale of the terms of trade decline since its 2011 peak. In a chart contained within a speech from RBA Assistant Governor Chris Kent on 13 September, the estimated overvaluations looks to be about 6% as of Q2 and more like 8% currently. This is broadly in line with NAB's own estimates using our stylised RBA real TWI model".

Copyright © 2016 NAB, eFXnews™

-

10:09

Euro Zone monetary aggregate M3 increased to 5.1%

The annual growth rate of the broad monetary aggregate M3 increased to 5.1% in August 2016, from 4.9% in July, averaging 5.0% in the three months up to August. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), increased to 8.9% in August, from 8.4% in July.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) stood at -1.5% in August, compared with -1.4% in July. The annual growth rate of marketable instruments (M3-M2) decreased to 4.5% in August, from 5.0% in July. Within M3, the annual growth rate of deposits placed by households increased to 5.2% in August, from 4.8% in July, while the annual growth rate of deposits placed by non-financial corporations decreased to 7.1% in August, from 7.3% in July. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) increased to 1.5% in August, from 0.4% in July.

-

10:00

Eurozone: M3 money supply, adjusted y/y, August 5.1% (forecast 4.9%)

-

10:00

Eurozone: Private Loans, Y/Y, August 1.8% (forecast 2%)

-

09:34

Today’s events

At 13:00 GMT house price index S & P / Case-Shiller July 5.1% y / y 5.0% y / y

At 14:00 GMT Richmond Fed Index September -11 -2

At 15:15 GMT the Federal Reserve Vice Chairman Stanley Fischer will deliver a speech

-

08:38

A “big short” for USD/CAD? Will OPEC support the oil market?

-

08:36

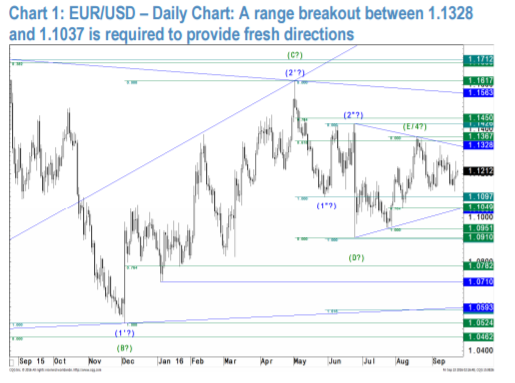

EUR/USD: Struggle Between Bulls And Bears Drags On: Levels & Targets - JP Morgan

"Since EUR/USD bottomed at 1.0462 in March 2015 it formed a broad consolidation triangle (A-B-C-D-E, green) which could be complete as the market stalled right around its projected E-wave target at 1.1347 (int. 61.8 %) five weeks ago.

Following this view, any bounce should now be capped at 1.1309/28 (minor 76.4 %/daily triangle).

Only a break above the latter would re-open the upside for an extension to the next higher T-junction at 1.1426/50 (pivot/int. 76.4 % on higher scale).

Below 1.1309/28 though, we see a negative bias prevailing and the market at risk of at least testing key-support at 1.1049/37 (int. 76.4 %/daily trend).

A break below the latter would finally challenge the key-T-zone on big scale at 1.0782/10 (int. 76.4 %/pivot).

A break below the latter would resume the long-term downtrend in favor of an extension to 1.0072 and possibly to 0.9652 and 0.9298 (wave 3 projections)".

Copyright © 2016 eFXplus™

-

08:33

Asian session review: Euro under preasure

The euro is under pressure against the background of yesterday's statement by European Central Bank President Mario Draghi, who once again invited Governments to help the eurozone and the ECB carrying out reforms aimed at growth. Thus, he stressed that the possibility of measures by central banks are close to the limits. Draghi warned of the negative side effects of prolonged interest rates at a low level and said that the measures applied by the European Central Bank "are not sufficient to ensure real, sustainable and long-term growth." He stressed that the stimulus measures taken by the ECB yield results, and the euro zone economy is still coping with the effects of the British decision to withdraw from the EU. He said the ECB will continue to "play its role", providing extra stimulation of economic growth if necessary.

The dollar rose against the yen after the end of the first of three US presidential debate between Hillary Clinton and Donald Trump. Investors felt that the Democratic candidate Hillary Clinton looks more confident than the Republican Donald Trump. According to a survey conducted by ABC and the newspaper Washington Post, Clinton is ahead in popularity by 2%. Studies have shown that if you had to choose between two candidates, 46% of respondents would vote for Clinton and 44% for Trump. Meanwhile, the latest Reuters / Ipsos poll indicated 41%% of voters supported Clinton against 37% for Trump.

Richard Grace of CBA said that the debate will cause volatility in the market, a small but real impact on the currency can only have the election on November 8. "If Trump wins the election, then, in our opinion, the US currency will rise 10%, and AUD / USD will fall by the same amount for 12 months," - Grace said.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1240-55 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2945-90 rabge

USD / JPY: rose to Y100.85 in the Asian session

-

08:26

Corporate service prices in Japan were up 0.2 percent on year

According to rttnews, corporate service prices in Japan were up 0.2 percent on year in August, the Bank of Japan said on Tuesday.

That was shy of forecasts for 0.3 percent, which would have been unchanged following the downward revision from 0.4 percent.

On a monthly basis, prices were down 0.3 percent after climbing 0.4 percent in the previous month.

Individually, prices were down for advertising, leasing and real estate, and they were up for transportation and postal activities.

-

08:24

Prime Minister of Japan, Shinzo Abe: I believe in what Kuroda and his team do

The prime minister expressed his full support for the actions of Governor of the Bank of Japan, Mr. Kuroda. "The government supports the monetary policy of the Central Bank and is ready to help in achieving the 2% inflation target and high rates of economic growth" - said Abe. At the same time, the politician said that it was too early to talk about the termination of such measures.

-

08:24

Options levels on tuesday, September 27, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1381 (4266)

$1.1331 (2238)

$1.1298 (425)

Price at time of writing this review: $1.1244

Support levels (open interest**, contracts):

$1.1179 (4181)

$1.1138 (3253)

$1.1093 (7037)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 37912 contracts, with the maximum number of contracts with strike price $1,1500 (5460);

- Overall open interest on the PUT options with the expiration date October, 7 is 39704 contracts, with the maximum number of contracts with strike price $1,1100 (7037);

- The ratio of PUT/CALL was 1.05 versus 1.07 from the previous trading day according to data from September, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3301 (2603)

$1.3202 (1415)

$1.3105 (1010)

Price at time of writing this review: $1.2993

Support levels (open interest**, contracts):

$1.2894 (915)

$1.2797 (1801)

$1.2698 (1424)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 26749 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22490 contracts, with the maximum number of contracts with strike price $1,3000 (3589);

- The ratio of PUT/CALL was 0.84 versus 0.84 from the previous trading day according to data from September, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Deputy Governor of the Bank of Japan, Nakas: Monetary easing is not enough to eradicate deflation

-

Economic measures and structural reforms do not replace, but complement each other

-

US presidential debate signaled the growth of protectionism

-

The mood of anti-globalization - a risk factor for the global economy

-

-

08:17

Bank of Japan Meeting minutes

"The Bank, in accordance with the guideline decided at the previous meeting on June 15 and 16, 2016, had been providing funds through purchases of Japanese government bonds (JGBs) and other measures. 6 In this situation, the amount outstanding of the monetary base had been in the range of 394-406 trillion yen.

B. Recent Developments in Financial Markets In the money market, interest rates on both overnight and term instruments had generally been in negative territory. The uncollateralized overnight call rate had been in the range of around minus 0.03 to minus 0.06 percent. As for interest rates on term instruments, yields on three-month treasury discount bills (T-Bills) had been at around minus 0.3 percent.

The Nikkei 225 Stock Average had increased, reflecting the rise in U.S. and European stock prices and speculation about the direction of fiscal and monetary policy in Japan, and was moving at around 16,500 yen recently. In the foreign exchange market, the yen had appreciated temporarily against the U.S. dollar following the United Kingdom's referendum, but had depreciated thereafter, partly due to speculation about the direction of fiscal and monetary policy in Japan, while investors' risk aversion had moderated. Meanwhile, the yen had appreciated against the euro. Yields on 10-year JGBs had moved further into negative territory under a tight supply-demand balance, due in part to anticipation of additional monetary easing by the Bank. C. Overseas Economic and Financial Developments Overseas economies continued to grow at a moderate pace, but the pace of growth had somewhat decelerated, mainly in emerging economies.

The U.S. economy had been on a recovery trend, assisted by firmness in the employment and income situation and in household spending, although the industrial sector had lacked momentum, mainly against the background of the slowdown in emerging 5 Reports were made based on information available at the time of the meeting. 6 The guideline was as follows: The Bank of Japan will conduct money market operations so that the monetary base will increase at an annual pace of about 80 trillion yen. 4 economies".

-

08:10

German import prices decreased by 2.6% in August

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 2.6% in August 2016 compared with the corresponding month of the preceding year. In July and in June 2016 the annual rates of change were -3.8% and -4.6%, respectively. From July to August 2016 the index fell by 0.2%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 1.9% compared with the level of a year earlier.

The index of export prices decreased by 0.9% in August 2016 compared with the corresponding month of the preceding year. In July and in June 2016 the annual rates of change were -1.2% and -1.3%, respectively. From July to August 2016 the index fell slightly by 0.1%.

-

00:28

Currencies. Daily history for Sep 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1251 +0,20%

GBP/USD $1,2972 +0,07%

USD/CHF Chf0,969 -0,13%

USD/JPY Y100,30 -0,69%

EUR/JPY Y112,85 -0,49%

GBP/JPY Y130,1 -0,63%

AUD/USD $0,7635 +0,18%

NZD/USD $0,7269 +0,36%

USD/CAD C$1,3222 +0,43%

-

00:00

Schedule for today,Tuesday, Sep 27’2016

08:00 Eurozone Private Loans, Y/Y August 1.8%

08:00 Eurozone M3 money supply, adjusted y/y August 4.8% 4.9%

10:00 United Kingdom CBI retail sales volume balance September 9 7

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July 5.1% 5.1%

13:45 U.S. Services PMI (Preliminary) September 51 51.2

14:00 U.S. Richmond Fed Manufacturing Index September -11

14:00 U.S. Consumer confidence September 101.1 99

15:15 U.S. FED Vice Chairman Stanley Fischer Speaks

-