Noticias del mercado

-

22:07

Major US stock indexes finished trading above zero

Major stock indexes in Wall Street rose for the first time just three days, thanks to the increase in the technology sector, but the weakness in oil prices limited the growth.

Technology Sector S & P500 rose by 1.0% and gave the biggest boost underlying index on a background of growth stocks Alphabet (GOOG) and Amazon.com (AMZN).

In addition, it became known that the US single family housing prices rose slightly less than expected on an annual basis in July, and in comparison with the last year the increase was smaller than in the previous month. The composite index of house prices from S & P / Case-Shiller 20 metropolitan areas rose by 5% in July on an annual basis, departing from the rise of 5.1% in June and forecast to increase by 5.1%.

However, a preliminary index of business activity (PMI) released by the Markit in the services sector rose to 51.9 in September, compared with the final value of the previous month's 51.0. This marked the fastest monthly increase in activity since April. The pace of activity growth accelerated for the first time in three months, but remained relatively modest. At the same time, the growth of new orders fell to four-month low, and the company responded to the weak influx of new orders by reducing the rate of hiring labor. In this case there were no signs of inflationary pressure building for a month, as the purchasing and selling prices grew weaker pace than in August. Deteriorating confidence was also recorded in the last survey.

It should also be noted that the consumer confidence index from the Conference Board continued to improve in September. The index is currently 104.1 (1985 = 100) compared to 101.8 in August. the present situation index rose to 128.5 from 125.3, while the expectations index rose to 86.1 last month to 87.8.

Almost all the components of DOW index closed in positive territory (28 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.85%). Outsider were shares of The Walt Disney Company (DIS, -0.36%).

Most of the S & P sectors showed an increase. The leader turned out to be the technology sector (+ 1.0%). Most fel lutilities sector (-1.0%).

At the close:

Dow + 0.74% 18,227.89 +133.06

Nasdaq + 0.92% 5,305.71 +48.22

S & P + 0.64% 2,159.92 +13.82

-

21:01

DJIA +0.70% 18,221.66 +126.83 Nasdaq +0.83% 5,301.08 +43.59 S&P +0.57% 2,158.40 +12.30

-

18:00

European stocks closed: FTSE 100 -10.37 6807.67 -0.15% DAX -32.23 10361.48 -0.31% CAC 40 -9.17 4398.68 -0.21%

-

17:47

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose for the first time in three days on Tuesday, helped by technology and discretionary stocks, but weak oil prices limited gains. The S&P 500 technology sector rose 0,6% and gave the biggest boost to the benchmark index. The consumer sector also got a boost from a report that showed the consumer confidence index unexpectedly rose to 104,1, marking its highest level since August 2007. However, oil prices fell 3,5% as hopes for a deal to cut output faded.

Almost all of Dow stocks in positive area (25 of 30). Top gainer - American Express Company (AXP, +1.04%). Top loser - Exxon Mobil Corporation (XOM, -1.87%).

Almost all of S&P sectors also in positive area. Top gainer - Technology (+0.6%). Top loser - Basic Materials (-1.1%).

At the moment:

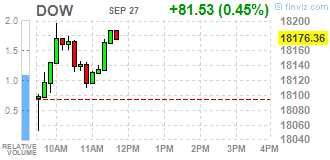

Dow 18095.00 +81.00 +0.45%

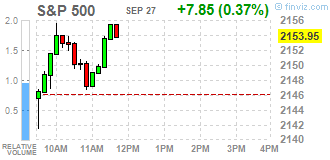

S&P 500 2147.25 +7.50 +0.35%

Nasdaq 100 4848.00 +33.00 +0.69%

Oil 44.36 -1.57 -3.42%

Gold 1329.30 -14.80 -1.10%

U.S. 10yr 1.56 -0.02

-

17:38

WSE: Session Results

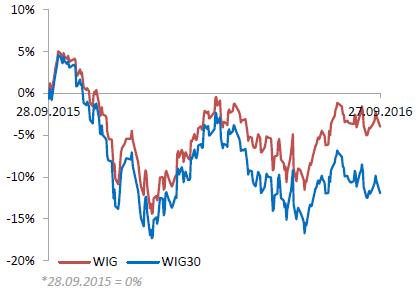

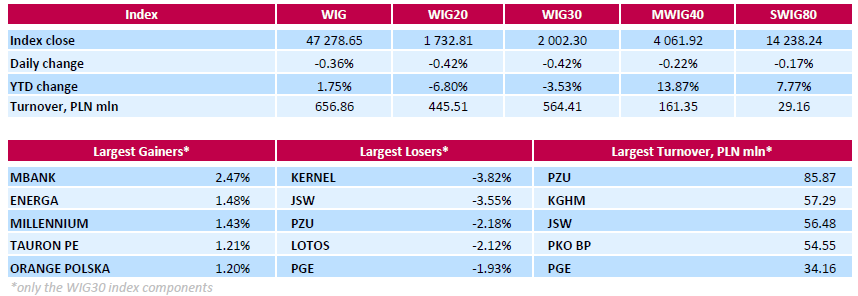

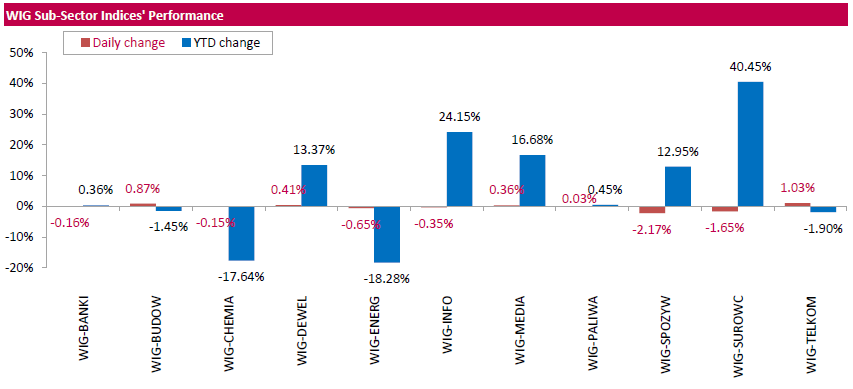

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, declined by 0.36%. Sector performance within the WIG Index was mixed. Telecoms (+1.03%) outperformed, while food sector (-2.17%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.42%. In the index basket, agricultural producer KERNEL (WSE: KER) and coking coal miner JSW (WSE: JSW) topped the decliners' list, tumbling by 3.82% and 3.55% respectively. Among other major laggards were insurer PZU (WSE: PZU), oil refiner LOTOS (WSE: LTS) and genco PGE (WSE: PGE), plunging by 2.18%, 2.12% and 1.93% respectively. On the other side of the ledger, bank MBANK (WSE: MBK) led the gainers, jumping by 2.47%. It was followed by bank MILLENNIUM (WSE: MIL), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two gencos ENERGA (WSE: ENG) and TAURON PE (WSE; TPE), advancing by 1.2%-1.48%.

-

15:52

WSE: After start on Wall Street

The mood on the parquets in Europe confirms that more anxiety than fear of the result of the US elections begins to appear in the banking sector.

The beginning of trading on Wall Street indicates optimism and we may find that the weaker sentiment will be used as an opportunity for buyers. It does not really help for quotations in Warsaw, where the WIG20 index an hour before the close of trading loses 0,92%.

-

15:33

U.S. Stocks open: Dow -0.22%, Nasdaq -0.07%, S&P -0.18%

-

15:27

Before the bell: S&P futures 0%, NASDAQ futures +0.04%

U.S. stock-index futures pared advances that followed the first presidential debate, as lingering concerns about the health of European banks weighed on sentiment.

Global Stocks:

Nikkei 16,683.93 +139.37 +0.84%

Hang Seng 23,571.90 +253.98 +1.09%

Shanghai 2,997.88 +17.45 +0.59%

FTSE 6,782.18 -35.86 -0.53%

CAC 4,375.33 -32.52 -0.74%

DAX 10,297.37 -96.34 -0.93%

Crude $44.77 (-2.53%)

Gold $1335.80 (-0.62%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.67

-0.01(-0.1033%)

21940

Amazon.com Inc., NASDAQ

AMZN

803.5

4.34(0.5431%)

27885

American Express Co

AXP

63.5

0.08(0.1261%)

2150

Apple Inc.

AAPL

113.12

0.24(0.2126%)

138237

Barrick Gold Corporation, NYSE

ABX

17.86

-0.06(-0.3348%)

74349

Boeing Co

BA

130.8

0.23(0.1762%)

1000

Caterpillar Inc

CAT

82.2

-0.17(-0.2064%)

902

Chevron Corp

CVX

98.5

-0.28(-0.2835%)

1093

Cisco Systems Inc

CSCO

31.09

0.02(0.0644%)

200

Citigroup Inc., NYSE

C

45.82

-0.07(-0.1525%)

29325

Deere & Company, NYSE

DE

83.7

0.12(0.1436%)

200

Exxon Mobil Corp

XOM

82.7

-0.36(-0.4334%)

3938

Facebook, Inc.

FB

127.4

0.09(0.0707%)

51793

Ford Motor Co.

F

12.03

0.02(0.1665%)

16131

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.42

-0.09(-0.8563%)

81794

General Electric Co

GE

29.56

0.02(0.0677%)

4944

General Motors Company, NYSE

GM

31.7

-0.10(-0.3145%)

413

Goldman Sachs

GS

161.2

-0.28(-0.1734%)

280

Google Inc.

GOOG

775.9

1.69(0.2183%)

4254

Hewlett-Packard Co.

HPQ

15.04

0.02(0.1332%)

500

Home Depot Inc

HD

125.5

0.05(0.0399%)

800

International Business Machines Co...

IBM

153.53

-0.45(-0.2922%)

1088

JPMorgan Chase and Co

JPM

65.85

0.07(0.1064%)

692

McDonald's Corp

MCD

116.99

0.46(0.3947%)

143

Microsoft Corp

MSFT

56.98

0.08(0.1406%)

3837

Nike

NKE

54.42

0.02(0.0368%)

9763

Pfizer Inc

PFE

33.73

0.09(0.2675%)

4083

Tesla Motors, Inc., NASDAQ

TSLA

209.7

0.71(0.3397%)

10257

The Coca-Cola Co

KO

42.1

0.05(0.1189%)

6577

Twitter, Inc., NYSE

TWTR

23.26

-0.11(-0.4707%)

691548

Verizon Communications Inc

VZ

52.33

0.18(0.3452%)

189

Wal-Mart Stores Inc

WMT

71.64

0.02(0.0279%)

374

Walt Disney Co

DIS

92.15

0.19(0.2066%)

904

Yahoo! Inc., NASDAQ

YHOO

42.38

0.09(0.2128%)

2800

Yandex N.V., NASDAQ

YNDX

21.41

0.05(0.2341%)

400

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $175 from $170 at JP Morgan

Amazon (AMZN) target raised to $1000 from $925 at JP Morgan

-

14:25

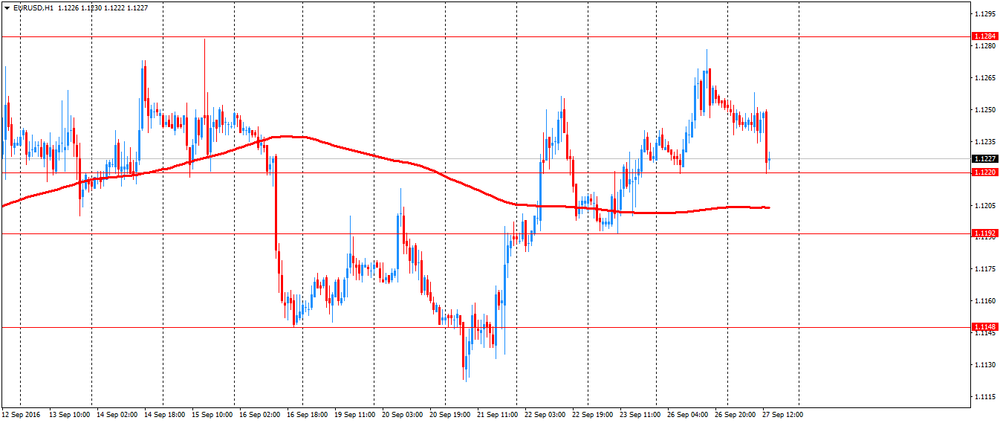

European session review: the euro was down against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Changing the Eurozone private sector lending volume, y / y in August to 1.8% 2% 1.8%

8:00 Eurozone M3 Money Supply, y / y in August 4.8% 4.9% 5.1%

10:00 UK retail sales according to CBI on September 9 7 -8

The British pound came under pressure after data from the CBI. The survey of 120 companies, of which 63 were retailers showed that sales fell last month, despite the expectation that sales will be largely unchanged. However, sales are likely to rise slightly this year.

Overall, sales for this time of year were considered above seasonal norms.

The volume of orders from suppliers fell the sixth consecutive month, disappointing expectations for a rebound in the growth of orders.

In the retail sector, the decline in sales of grocery food and beverages, as well as footwear and articles of leather were the main factors in the fall of the total volume. At the same time, a significant increase was recorded in sales of clothing, hardware & DIY.

The growth of online sales slowed down in September, although is expected to accelerate in October.

The euro fell against the US dollar, while investors evaluate the US presidential debate and statistical data for the euro area.

In the opinion of many market participants, Clinton seemed to win. According to a CNN poll, 62% of viewers gave the victory in the first round to her. Democratic candidate Donald Trump managed to get on the defensive during the greater part of the discussion.With regard to the statistical data, in the euro zone money supply growth accelerated in August, and the lending of households increased at a steady pace, said Tuesday the European Central Bank.

Investors also evaluated by statistical data for the euro area. Eurozone money supply growth accelerated in August, and the lending of households increased at a steady pace, said the European Central Bank.

Broad money M3 increased by 5.1 percent year on year in August, faster than the growth of 4.9 percent in July.

Economists had forecast that the growth rate will accelerate to 4.9 percent compared to the initially estimated rise in July of 4.8 percent.

Similarly, M1 aggregate, which includes cash in circulation and overnight deposits, increased by 8.9 percent in August after rising 8.4 percent in July.

Deposits placed by households increased by 5.2 per cent and deposits from non-financial corporations rose by 7.1 per cent.

The data showed that the annual rate of credit growth in the private sector amounted to 1.5 percent in August, compared with 1.4 percent in July.

Loans to the private sector increased by 1.7 percent in August, the same rate as in July. In addition, household loans grew at a steady pace of 1.8 percent, and loans to non-financial corporations rose by 1.9 per cent.

EUR / USD: during the European session, the pair fell to $ 1.1220

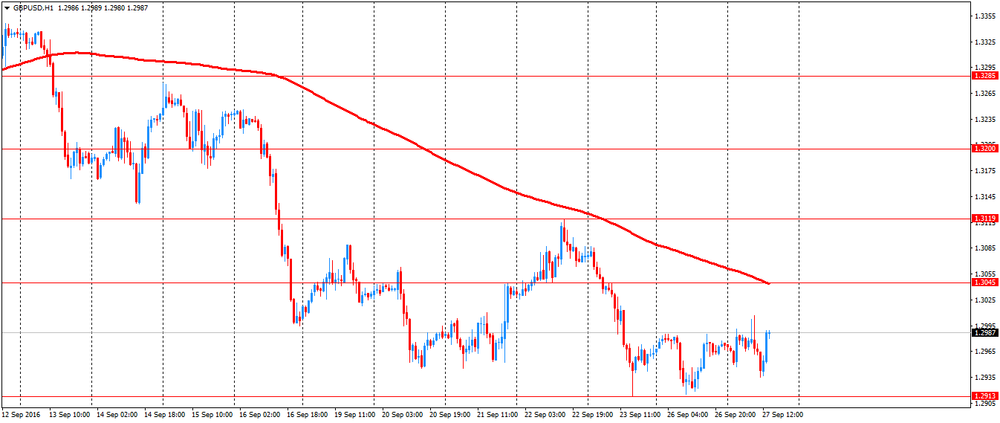

GBP / USD: during the European session, the pair fell to $ 1.2935 and retreated

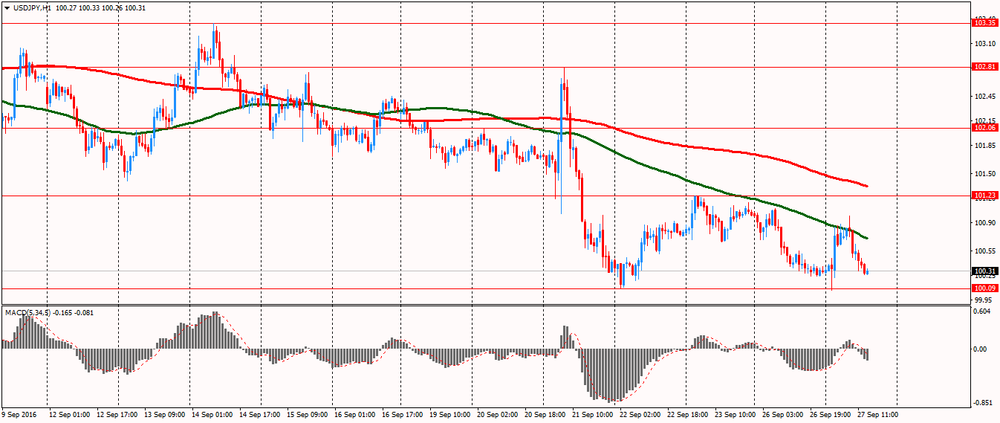

USD / JPY: during the European session, the pair fell to Y100.26

-

13:06

WSE: Mid session comment

The first half of today's trading on the Warsaw market did not produce a positive image. Systematic descent of the WIG20 index in response to external deterioration in sentiment was reflected also on the sector of small and medium-sized companies. Clearly, however, we have no intention to return above the level of 1,750 points in the case of the WIG20 index and the demand side, which remained passive yesterday, today does not act better. Discounted trading in Europe suggest that decline does not necessarily have a base exclusively related to the presidential debate. Contracts in the United States also gave up earlier gains and it looks like that the joy of contractual wining the debate by Clinton proved to be extremely short.

At the halfway point of the session the WIG20 index reached the level of 1,726 points (-0,77%) with the turnover of approx. PLN 180 million.

-

09:45

Major stock exchanges trading mixed: the FTSE 100 6,845.21 -64.22 -0.93%, Xetra DAX 10,444.25 +50.54 + 0.49%

-

09:16

WSE: After opening

WIG20 index opened at 1741.68 points (+0.09%)*

WIG 47458.49 0.02%

WIG30 2011.28 0.03%

mWIG40 4060.95 -0.25%

*/ - change to previous close

The futures market opened with increase by 0.4% to 1,738 points. Surrounded contract for DAX gained 0.6% at the opening which was not particularly high achievements as the scale of the recent decline.

The cash market started the day from a modest increase of 0.09%. The German DAX rises at the same time by 0.55%. The Warsaw market does not open clearly above and the turnover does not stand out of any above-average activity. It is not an encouraging picture of the morning.

-

08:44

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.7%, CAC40 +0.85, FTSE + 0.7%

-

08:23

WSE: Before opening

This morning the market is most likely to response to the US debate. As to who won the debate Clinton - Trump probably every viewer has their own opinion, but the message given by the media is that Trump little disappointed, at least not shine enough - and that's why in the polls most people (even more than 60 percent) claims that Clinton won. It does not mean, however, that Clinton wins the election. Much can happen to Nov. 8.

In the morning, futures contracts for the S&P500 gain up to 0.6%, while the Nikkei index rising 0.8%. At first glance, the changes may not be spectacular, but they are strong enough that markets could make up most of yesterday's losses. This means that we need to prepare for the growth gaps in Europe, and all of today's session should have a positive coloration.

Today's macro calendar is almost empty and we may only pay attention to the consumer confidence index - the Conference Board. It is difficult to expect that investors have turned more attention to this data, as of yesterday are focused on American election politics.

-

06:51

Global Stocks

U.K. stocks dropped Monday, with the week starting off on risk-averse footing with energy shares under pressure as oil producers gather for industry talks. Oil shares were in the red Monday, as both members in and outside of the Organization of the Petroleum Exporting Countries were meeting this week in Algiers at the International Energy Forum. Investors will watch for any news that producers will agree to curb oil output at a time the market is grappling with an oil glut.

U.S. stocks extended losses Monday as worries about Germany's Deutsche Bank weighed on the financial sector while the upcoming U.S. presidential debate also contributed to jittery sentiment. Heavy losses for Deutsche Bank took a toll on European markets and pressured U.S. financial shares. U.S.-listed shares of Deutsche Bank DB, -7.06% DBK, -7.49% sank 7.1%, after Germany's Focus magazine reported over the weekend that Chancellor Angela Merkel wouldn't support state aid for the bank.

Declines in financial and commodities stocks sent Asian share markets broadly lower Tuesday, as markets eyed the first U.S. presidential debate for hints of future economic policy. Banks, insurers and other financial stocks in Japan opened lower, following a global fall in the sector overnight as concerns intensified over the health of Deutsche Bank AG DB1, -1.12% , after its shares slid 7.5% Monday to their lowest in decades.

-

00:28

Stocks. Daily history for Sep 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,544.56 -209.46 -1.25%

Shanghai Composite 2,981.25 -52.65 -1.74%

S&P/ASX 200 5,431.42 +0.123 0.00%

FTSE 100 6,818.04 -91.39 -1.32%

CAC 40 4,407.85 -80.84 -1.80%

Xetra DAX 10,393.71 -233.26 -2.19%

S&P 500 2,146.10 -18.59 -0.86%

Dow Jones Industrial Average 18,094.83 -166.62 -0.91%

S&P/TSX Composite 14,619.46 -78.47 -0.53%

-