Noticias del mercado

-

22:07

Major US stock indexes finished trading above zero

Major stock indexes in Wall Street rose for the first time just three days, thanks to the increase in the technology sector, but the weakness in oil prices limited the growth.

Technology Sector S & P500 rose by 1.0% and gave the biggest boost underlying index on a background of growth stocks Alphabet (GOOG) and Amazon.com (AMZN).

In addition, it became known that the US single family housing prices rose slightly less than expected on an annual basis in July, and in comparison with the last year the increase was smaller than in the previous month. The composite index of house prices from S & P / Case-Shiller 20 metropolitan areas rose by 5% in July on an annual basis, departing from the rise of 5.1% in June and forecast to increase by 5.1%.

However, a preliminary index of business activity (PMI) released by the Markit in the services sector rose to 51.9 in September, compared with the final value of the previous month's 51.0. This marked the fastest monthly increase in activity since April. The pace of activity growth accelerated for the first time in three months, but remained relatively modest. At the same time, the growth of new orders fell to four-month low, and the company responded to the weak influx of new orders by reducing the rate of hiring labor. In this case there were no signs of inflationary pressure building for a month, as the purchasing and selling prices grew weaker pace than in August. Deteriorating confidence was also recorded in the last survey.

It should also be noted that the consumer confidence index from the Conference Board continued to improve in September. The index is currently 104.1 (1985 = 100) compared to 101.8 in August. the present situation index rose to 128.5 from 125.3, while the expectations index rose to 86.1 last month to 87.8.

Almost all the components of DOW index closed in positive territory (28 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.85%). Outsider were shares of The Walt Disney Company (DIS, -0.36%).

Most of the S & P sectors showed an increase. The leader turned out to be the technology sector (+ 1.0%). Most fel lutilities sector (-1.0%).

At the close:

Dow + 0.74% 18,227.89 +133.06

Nasdaq + 0.92% 5,305.71 +48.22

S & P + 0.64% 2,159.92 +13.82

-

21:01

DJIA +0.70% 18,221.66 +126.83 Nasdaq +0.83% 5,301.08 +43.59 S&P +0.57% 2,158.40 +12.30

-

18:00

European stocks closed: FTSE 100 -10.37 6807.67 -0.15% DAX -32.23 10361.48 -0.31% CAC 40 -9.17 4398.68 -0.21%

-

17:52

Oil fall more than 3% but a big announcement on production freeze could be made today

Crude-oil futures fell significantly affected by fading optimism regarding the possibility of a deal on limiting oil production. Pressure on also provided renewed strengthening of the American currency.

Iranian Oil Minister Bijan Zanganeh said that Iran expects OPEC meeting just to exchange views on the situation on the market, and not to conclude an agreement on the freezing of production. His counterpart from the United Arab Emirates Suhail Al Mazrui said that his country supports the production freeze. However, Saudi Arabia's energy minister, Khalid al-Falih described the meeting as a consultative exercise.

At the same time, Russia's oil minister said that Russia wants to freeze the oil production at the current level. It is worth emphasizing that oil production in Russia in recent years has risen to a record high of 11.75 million barrels per day.

Earlier, Wall Street Journal reported that OPEC members will discuss a proposal to limit production by about 1 million barrels a day for 1 year, but the likelihood of the deal still remained low, analysts noted. Recall, according to the September OPEC report, the total volume of oil production in the world has decreased in comparison with July by 0.14 million barrels per day in August, to 95.65 million barrels. At the same time supplies from OPEC countries decreased by 23 thousand barrels per day and other oil-producing countries -. 0.11 million barrels a day.

Investors also drew attention to the updated forecasts by Goldman Sachs. Today, the investment bank downgraded the outlook for WTI in the 4th quarter of 2016 from $ 50 to $ 43, as the supply-demand balance was weaker than expected, including due to the larger production growth in the current quarter. Meanwhile, Goldman Sachs confirmed the assessment of the average annual price of oil in 2017 at $ 52 per barrel, prices will range from $ 45 to $ 50 per barrel in the first half. The outlook for global oil demand was left unchanged: the expected growth in annual terms is1.4 million barrels a day.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 44.34 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 46.40 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:47

Wall Street. Major U.S. stock-indexes rose

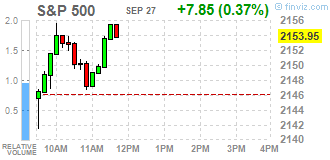

Major U.S. stock-indexes rose for the first time in three days on Tuesday, helped by technology and discretionary stocks, but weak oil prices limited gains. The S&P 500 technology sector rose 0,6% and gave the biggest boost to the benchmark index. The consumer sector also got a boost from a report that showed the consumer confidence index unexpectedly rose to 104,1, marking its highest level since August 2007. However, oil prices fell 3,5% as hopes for a deal to cut output faded.

Almost all of Dow stocks in positive area (25 of 30). Top gainer - American Express Company (AXP, +1.04%). Top loser - Exxon Mobil Corporation (XOM, -1.87%).

Almost all of S&P sectors also in positive area. Top gainer - Technology (+0.6%). Top loser - Basic Materials (-1.1%).

At the moment:

Dow 18095.00 +81.00 +0.45%

S&P 500 2147.25 +7.50 +0.35%

Nasdaq 100 4848.00 +33.00 +0.69%

Oil 44.36 -1.57 -3.42%

Gold 1329.30 -14.80 -1.10%

U.S. 10yr 1.56 -0.02

-

17:38

WSE: Session Results

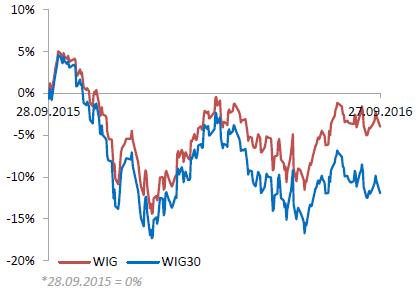

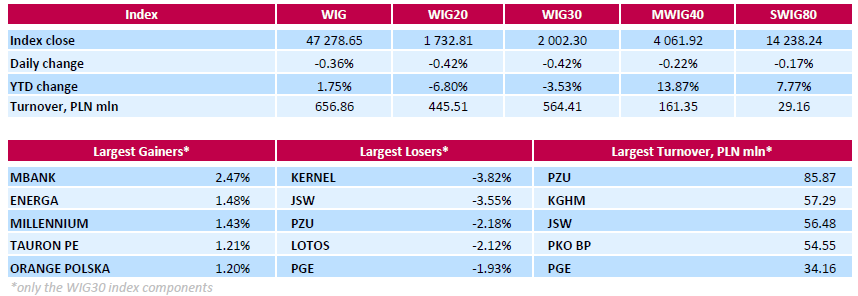

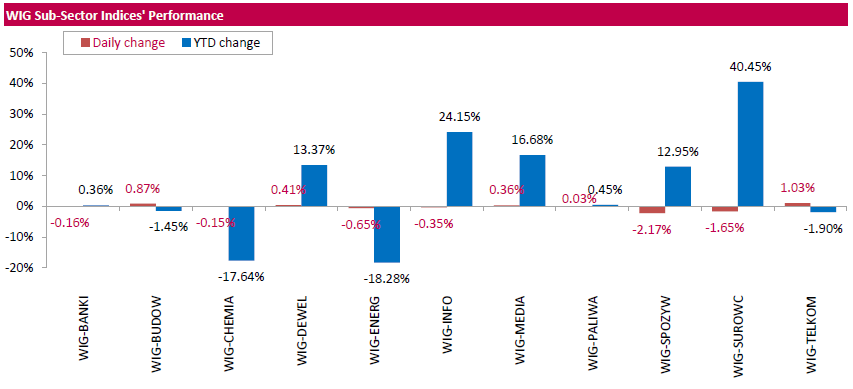

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, declined by 0.36%. Sector performance within the WIG Index was mixed. Telecoms (+1.03%) outperformed, while food sector (-2.17%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.42%. In the index basket, agricultural producer KERNEL (WSE: KER) and coking coal miner JSW (WSE: JSW) topped the decliners' list, tumbling by 3.82% and 3.55% respectively. Among other major laggards were insurer PZU (WSE: PZU), oil refiner LOTOS (WSE: LTS) and genco PGE (WSE: PGE), plunging by 2.18%, 2.12% and 1.93% respectively. On the other side of the ledger, bank MBANK (WSE: MBK) led the gainers, jumping by 2.47%. It was followed by bank MILLENNIUM (WSE: MIL), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two gencos ENERGA (WSE: ENG) and TAURON PE (WSE; TPE), advancing by 1.2%-1.48%.

-

17:22

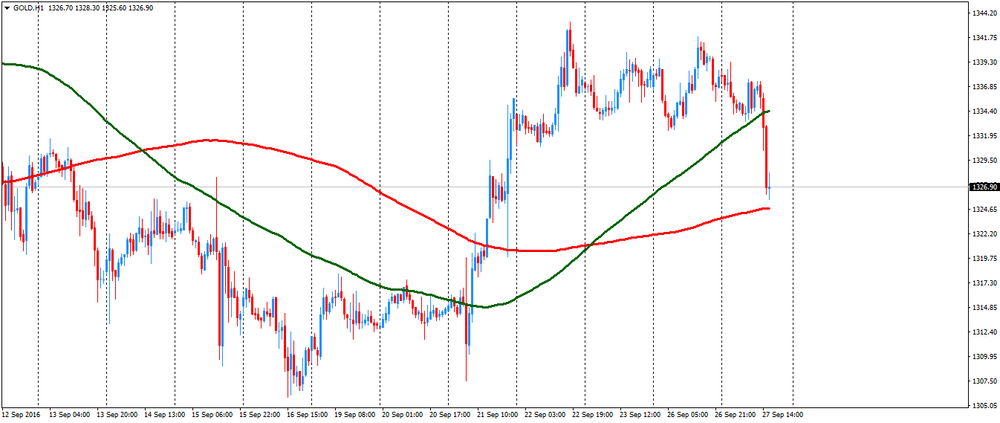

Gold was traded lower today

Gold prices dropped significantly, helped by the increase in risk appetite and strengthening of the US dollar after the first of the three TV US presidency debates.

Investors say that Democratic candidate Clinton won the debate with Republican Donald Trump. The markets believe that Clinton's victory in the elections will mean maintaining the status quo. In general, the debate have reduced the demand for gold, which is often seen as an alternative investment in times of geopolitical and financial uncertainty.

Meanwhile, the US Dollar Index, showing the US dollar against a basket of six major currencies, was up 0.35%. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

Additionally, investors await the Fed's statement hoping to hear comments about the prospects for a rate hike before the end of this year. According to the futures market, the likelihood of tighter monetary policy in December is 52.0%. Higher interest rates tend to have a downward pressure on gold.

The cost of the October futures for gold on the COMEX fell to $ 1325.9 per ounce.

-

17:19

Saudi Arabia, Iran made no proposals during meeting: Zanganeh

-

16:33

-

16:02

US consumer confidence improved further in September

The Conference Board Consumer Confidence Index®, which had increased in August, improved further in September. The Index now stands at 104.1 (1985=100), up from 101.8 in August. The Present Situation Index rose from 125.3 to 128.5, while the Expectations Index improved from 86.1 last month to 87.8.

"Consumer confidence increased in September for a second consecutive month and is now at its highest level since the recession," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers' assessment of present-day conditions improved, primarily the result of a more positive view of the labor market. Looking ahead, consumers are more upbeat about the short-term employment outlook, but somewhat neutral about business conditions and income prospects. Overall, consumers continue to rate current conditions favorably and foresee moderate economic expansion in the months ahead."

-

16:00

U.S.: Consumer confidence , September 104.1 (forecast 99)

-

16:00

U.S.: Richmond Fed Manufacturing Index, September -8 (forecast -2)

-

15:52

WSE: After start on Wall Street

The mood on the parquets in Europe confirms that more anxiety than fear of the result of the US elections begins to appear in the banking sector.

The beginning of trading on Wall Street indicates optimism and we may find that the weaker sentiment will be used as an opportunity for buyers. It does not really help for quotations in Warsaw, where the WIG20 index an hour before the close of trading loses 0,92%.

-

15:52

US: Faster rise in services activity, but new orders and jobs growth eases - Markit

The rate of expansion in business activity at U.S. service providers picked up for the first time in three months during September, but remained relatively modest. Meanwhile, growth of new orders eased to a four-month low and companies reacted to modest inflows of new work by reducing their rate of hiring. There was no sign of inflationary pressures building during the month as both input costs and output prices rose at weaker rates than in August. A dip in confidence was also registered in the latest survey period.

Adjusted for seasonal influences, the Markit Flash U.S. Services PMI™ Business Activity Index1 1 Please note that Markit's PMI data, flash and final, are derived from information collected by Markit from a different panel of companies to those that participate in the ISM Non-Manufacturing Report on Business. No information from the ISM survey is used in the production of Markit's PMI. rose to 51.9 in September from the previous month's final reading of 51.0. This signalled the fastest monthly rise in activity since April, albeit one that was still relatively modest. Activity has now increased in each of the past seven months. Where higher activity was recorded, this was widely linked by panellists to ongoing new business growth.

However, although continuing to increase during September, new business was up only modestly compared to August. In fact, the rate of growth eased to a four-month low. The pace of accumulation in backlogs of work also eased and was the slowest in the current three-month sequence of rising outstanding business.

-

15:48

Saudi Arabia and Russia to give joint briefing in Algeria today - Reuters. Oil and USD/CAD volatility expected

-

15:45

U.S.: Services PMI, September 51.9 (forecast 51.1)

-

15:37

Iran Doesn’t Want Oil Deal in Algiers, Won’t Freeze Output - Iranian Oil Minister

-

15:33

U.S. Stocks open: Dow -0.22%, Nasdaq -0.07%, S&P -0.18%

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1170 (367m) 1.1250 (224m) 1.1325 (207m)

USD/JPY: 99.00 (USD 610m) 99.80-81 (640m) 100.00 (627m) 100.50-60 (USD 220m) 101.00 (411m) 102.00 (262m) 102.21 (360m)

AUD/USD 0.7500 (AUD 610m)

NZD/USD 0.7300 (248m) 0.7335-41 (249m)

USD/CAD 1.3300 (USD 590m)

EUR/JPY 113.15 (798m)

AUD/JPY 75.50-60 (531m)

-

15:27

Before the bell: S&P futures 0%, NASDAQ futures +0.04%

U.S. stock-index futures pared advances that followed the first presidential debate, as lingering concerns about the health of European banks weighed on sentiment.

Global Stocks:

Nikkei 16,683.93 +139.37 +0.84%

Hang Seng 23,571.90 +253.98 +1.09%

Shanghai 2,997.88 +17.45 +0.59%

FTSE 6,782.18 -35.86 -0.53%

CAC 4,375.33 -32.52 -0.74%

DAX 10,297.37 -96.34 -0.93%

Crude $44.77 (-2.53%)

Gold $1335.80 (-0.62%)

-

15:10

S&P Case-Shiller U.S. National Home Prices rose 0.7% in July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.1% annual gain in July, up from 5.0% last month. The 10-City Composite posted a 4.2% annual increase, down from 4.3% the previous month.The 20-City Composite reported a year-over-year gain of 5.0%, down from 5.1% in June.

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.7% in July. The 10-City Composite recorded a 0.5% month-over-month increase while the 20-City Composite posted a 0.6% increase in July. After seasonal adjustment, the National Index recorded a 0.4% month-overmonth increase, the 10-City Composite posted a 0.1% decrease, and the 20-City Composite remains unchanged. After seasonal adjustment, 12 cities saw prices rise, two cities were unchanged, and six cities experienced negative monthly prices changes.

"Both the housing sector and the economy continue to expand with home prices continuing to rise at about a 5% annual rate," says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. "The statement issued last week by the Fed after its policy meeting confirms the central bank's view that the economy will see further gains. Most analysts now expect the Fed to raise interest rates in December. After such Fed action, mortgage rates would still be at historically low levels and would not be a major negative for house prices"

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, July 5% (forecast 5.1%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.67

-0.01(-0.1033%)

21940

Amazon.com Inc., NASDAQ

AMZN

803.5

4.34(0.5431%)

27885

American Express Co

AXP

63.5

0.08(0.1261%)

2150

Apple Inc.

AAPL

113.12

0.24(0.2126%)

138237

Barrick Gold Corporation, NYSE

ABX

17.86

-0.06(-0.3348%)

74349

Boeing Co

BA

130.8

0.23(0.1762%)

1000

Caterpillar Inc

CAT

82.2

-0.17(-0.2064%)

902

Chevron Corp

CVX

98.5

-0.28(-0.2835%)

1093

Cisco Systems Inc

CSCO

31.09

0.02(0.0644%)

200

Citigroup Inc., NYSE

C

45.82

-0.07(-0.1525%)

29325

Deere & Company, NYSE

DE

83.7

0.12(0.1436%)

200

Exxon Mobil Corp

XOM

82.7

-0.36(-0.4334%)

3938

Facebook, Inc.

FB

127.4

0.09(0.0707%)

51793

Ford Motor Co.

F

12.03

0.02(0.1665%)

16131

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.42

-0.09(-0.8563%)

81794

General Electric Co

GE

29.56

0.02(0.0677%)

4944

General Motors Company, NYSE

GM

31.7

-0.10(-0.3145%)

413

Goldman Sachs

GS

161.2

-0.28(-0.1734%)

280

Google Inc.

GOOG

775.9

1.69(0.2183%)

4254

Hewlett-Packard Co.

HPQ

15.04

0.02(0.1332%)

500

Home Depot Inc

HD

125.5

0.05(0.0399%)

800

International Business Machines Co...

IBM

153.53

-0.45(-0.2922%)

1088

JPMorgan Chase and Co

JPM

65.85

0.07(0.1064%)

692

McDonald's Corp

MCD

116.99

0.46(0.3947%)

143

Microsoft Corp

MSFT

56.98

0.08(0.1406%)

3837

Nike

NKE

54.42

0.02(0.0368%)

9763

Pfizer Inc

PFE

33.73

0.09(0.2675%)

4083

Tesla Motors, Inc., NASDAQ

TSLA

209.7

0.71(0.3397%)

10257

The Coca-Cola Co

KO

42.1

0.05(0.1189%)

6577

Twitter, Inc., NYSE

TWTR

23.26

-0.11(-0.4707%)

691548

Verizon Communications Inc

VZ

52.33

0.18(0.3452%)

189

Wal-Mart Stores Inc

WMT

71.64

0.02(0.0279%)

374

Walt Disney Co

DIS

92.15

0.19(0.2066%)

904

Yahoo! Inc., NASDAQ

YHOO

42.38

0.09(0.2128%)

2800

Yandex N.V., NASDAQ

YNDX

21.41

0.05(0.2341%)

400

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $175 from $170 at JP Morgan

Amazon (AMZN) target raised to $1000 from $925 at JP Morgan

-

14:25

European session review: the euro was down against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Changing the Eurozone private sector lending volume, y / y in August to 1.8% 2% 1.8%

8:00 Eurozone M3 Money Supply, y / y in August 4.8% 4.9% 5.1%

10:00 UK retail sales according to CBI on September 9 7 -8

The British pound came under pressure after data from the CBI. The survey of 120 companies, of which 63 were retailers showed that sales fell last month, despite the expectation that sales will be largely unchanged. However, sales are likely to rise slightly this year.

Overall, sales for this time of year were considered above seasonal norms.

The volume of orders from suppliers fell the sixth consecutive month, disappointing expectations for a rebound in the growth of orders.

In the retail sector, the decline in sales of grocery food and beverages, as well as footwear and articles of leather were the main factors in the fall of the total volume. At the same time, a significant increase was recorded in sales of clothing, hardware & DIY.

The growth of online sales slowed down in September, although is expected to accelerate in October.

The euro fell against the US dollar, while investors evaluate the US presidential debate and statistical data for the euro area.

In the opinion of many market participants, Clinton seemed to win. According to a CNN poll, 62% of viewers gave the victory in the first round to her. Democratic candidate Donald Trump managed to get on the defensive during the greater part of the discussion.With regard to the statistical data, in the euro zone money supply growth accelerated in August, and the lending of households increased at a steady pace, said Tuesday the European Central Bank.

Investors also evaluated by statistical data for the euro area. Eurozone money supply growth accelerated in August, and the lending of households increased at a steady pace, said the European Central Bank.

Broad money M3 increased by 5.1 percent year on year in August, faster than the growth of 4.9 percent in July.

Economists had forecast that the growth rate will accelerate to 4.9 percent compared to the initially estimated rise in July of 4.8 percent.

Similarly, M1 aggregate, which includes cash in circulation and overnight deposits, increased by 8.9 percent in August after rising 8.4 percent in July.

Deposits placed by households increased by 5.2 per cent and deposits from non-financial corporations rose by 7.1 per cent.

The data showed that the annual rate of credit growth in the private sector amounted to 1.5 percent in August, compared with 1.4 percent in July.

Loans to the private sector increased by 1.7 percent in August, the same rate as in July. In addition, household loans grew at a steady pace of 1.8 percent, and loans to non-financial corporations rose by 1.9 per cent.

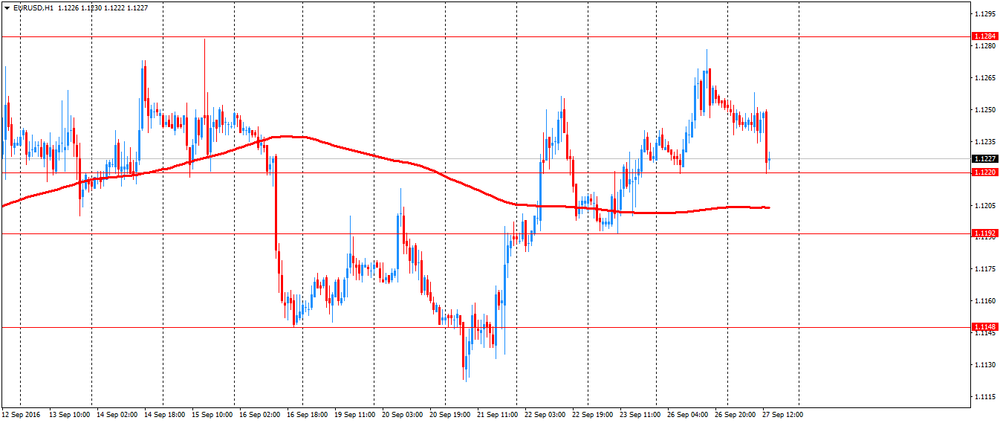

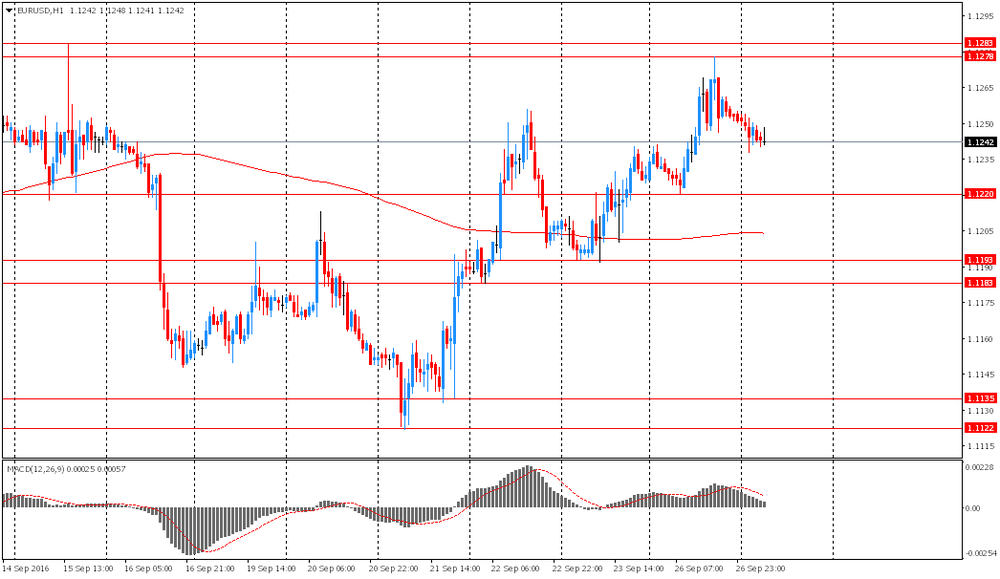

EUR / USD: during the European session, the pair fell to $ 1.1220

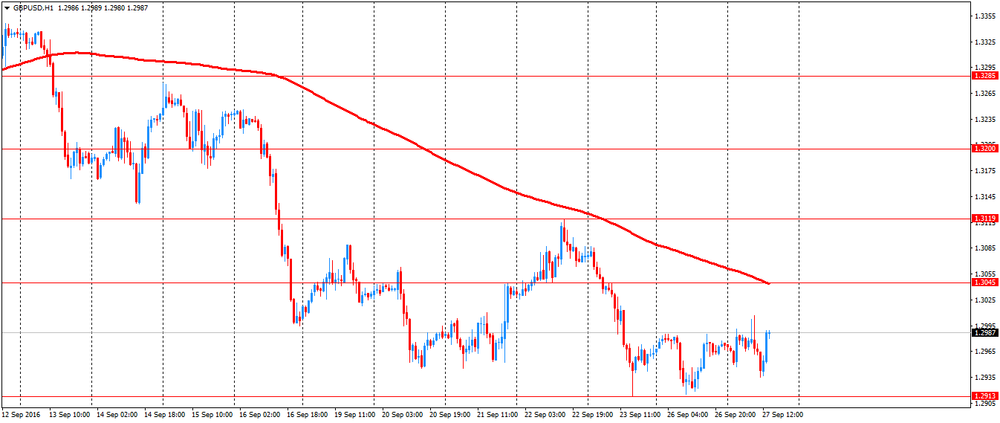

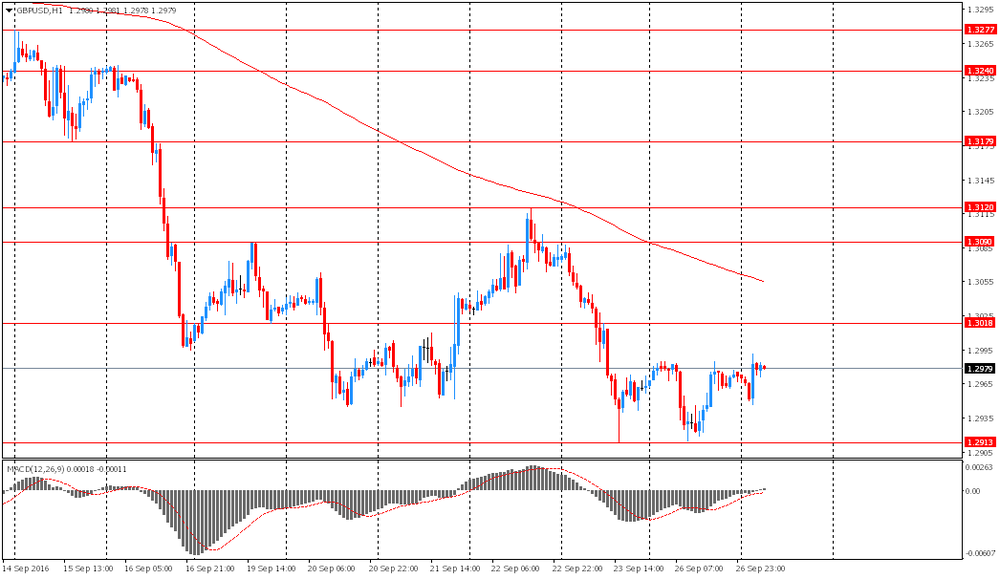

GBP / USD: during the European session, the pair fell to $ 1.2935 and retreated

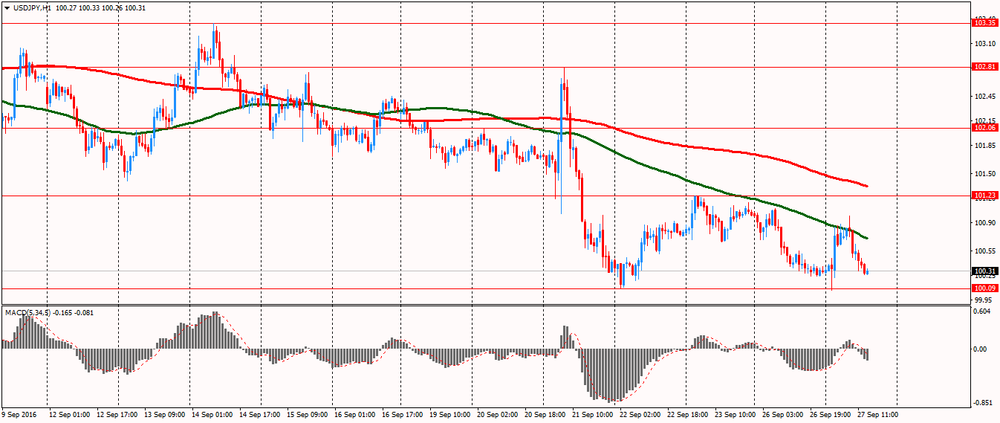

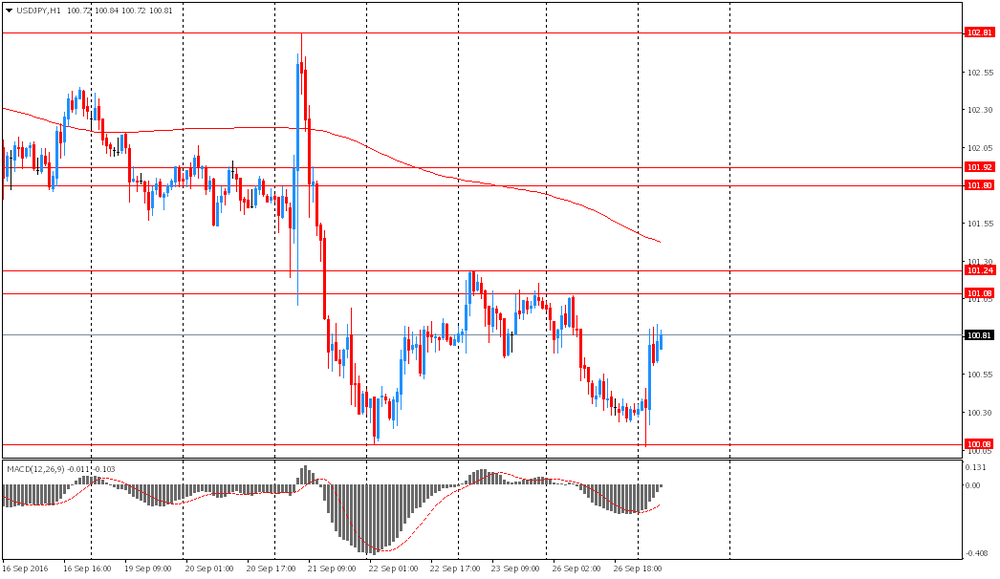

USD / JPY: during the European session, the pair fell to Y100.26

-

14:08

Novak: Oil market would balance quicker with producer cooperation

-

14:01

Orders

EUR/USD

Offers : 1.1280 1.1300 1.1320 1.1350

Bids : 1.1240 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers : 1.3020-25 1.3050-55 1.3080-85 1.3100 1.3120 1.3150

Bids : 1.2950 1.2935 1.2915 1.2900 1.2880 1.2865 1.2850

EUR/GBP

Offers : 0.8685 0.8700 0.8720-25 0.8750 0.8765 0.8785 0.8800

Bids : 0.8645-50 0.8630 0.8600 0.8580 0.8565 0.8540 0.8520 0.8500

EUR/JPY

Offers : 113.30 113.50 113.85 114.00 114.20 114.50 114.80-85 115.00

Bids : 113.00 112.80-85 112.50 112.35 112.00 111.80 111.50 111.30 111.00

USD/JPY

Offers : 100.85 101.00 101.25-30 101.50 101.80 102.00

Bids : 100.40 100.25 100.00 99.80 99.65 99.50-55 99.30 99.00

AUD/USD

Offers : 0.7700 0.7725-30 0.7750 0.7765 0.7800

Bids : 0.7650 0.7630 0.7600 0.7585 0.7565 0.7550

-

13:06

WSE: Mid session comment

The first half of today's trading on the Warsaw market did not produce a positive image. Systematic descent of the WIG20 index in response to external deterioration in sentiment was reflected also on the sector of small and medium-sized companies. Clearly, however, we have no intention to return above the level of 1,750 points in the case of the WIG20 index and the demand side, which remained passive yesterday, today does not act better. Discounted trading in Europe suggest that decline does not necessarily have a base exclusively related to the presidential debate. Contracts in the United States also gave up earlier gains and it looks like that the joy of contractual wining the debate by Clinton proved to be extremely short.

At the halfway point of the session the WIG20 index reached the level of 1,726 points (-0,77%) with the turnover of approx. PLN 180 million.

-

12:39

Major European stock indices trading in the red zone

After rising at the opening the European stock indices decline on fears for the economy of the region and especially the banking sector.

In early trading the main positive factor for the global stock markets were the results of the first televised US presidency debate.

In the opinion of many market participants, Clinton seemed preferable. According to a CNN poll, 62% of viewers gave the victory in the first round to her. Democratic candidate Donald Trump managed to get on the defensive during the greater part of the discussion.

Investors also evaluated by statistical data for the euro area. Eurozone money supply growth accelerated in August, and the lending of households increased at a steady pace, said the European Central Bank.

Broad money M3 increased by 5.1 percent year on year in August, faster than the growth of 4.9 percent in July.

Economists had forecast that the growth rate will accelerate to 4.9 percent compared to the initially estimated rise in July of 4.8 percent.

Similarly, M1 aggregate, which includes cash in circulation and overnight deposits, increased by 8.9 percent in August after rising 8.4 percent in July.

Deposits placed by households increased by 5.2 per cent and deposits from non-financial corporations rose by 7.1 per cent.

The data showed that the annual rate of credit growth in the private sector amounted to 1.5 percent in August, compared with 1.4 percent in July.

Loans to the private sector increased by 1.7 percent in August, the same rate as in July. In addition, household loans grew at a steady pace of 1.8 percent, and loans to non-financial corporations rose by 1.9 per cent.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,6% - to 338.05 points.

The energy sector was mixed, as market participants are preparing for the informal meeting of OPEC members this week, which should be discussed a production freeze.

French oil and gas giant Total SA gained 0.5%, the Italian ENI rose 0.6%, while the Norwegian Statoil fell by 0.2%.

The financial sector as a whole grew, as French lenders BNP Paribas and Societe Generale rose 0.3% and 0.4%, while Germany's Deutsche Bank up 1.6% after the collapse of more than 6% on Monday amid reports that the German government will not provide state aid to the bank.

Shares of Commerzbank, on the other hand, fell by 0.6% on news that the lender plans to cut about 9,000 jobs in the coming years.

Shares of French telecom group Orange SA jumped 2.1% after Credit Suisse analysts raised their rating to "outperform."

Carnival shares rose 2.5% after the company raised its profit forecast and announced its increase of 17% in the last quarter.

At the moment:

FTSE 6803.48 -14.56 -0.21%

DAX 10300.42 -93.29 -0.90%

CAC 4381.89 -25.96 -0.59%

-

12:34

UK: the volume of sales fell, despite expectations - CBI

The survey of 120 firms, of which 63 were retailers, showed that the volume of sales fell, despite expectations last month that sales would be largely unchanged. However, sales volumes look set to grow slightly in the year to October.

Overall, sales volumes for the time of year were considered to be above seasonal norms.

The volume of orders placed upon suppliers fell for a sixth consecutive month, disappointing expectations of a rebound in order growth.

Within the retail sector, lower sales at grocers, specialist food & drink and footwear & leather were the main drivers of the drop in overall volumes. Meanwhile, strong growth was recorded in clothing, hardware & DIY.

Growth in internet sales volumes slowed further in the year to September, although growth is set to pick up in October.

-

12:01

Informal meeting of OPEC may be held 27 or 28 September - Novak

-

12:00

United Kingdom: CBI retail sales volume balance, September -8 (forecast 7)

-

10:59

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1170 (367m) 1.1250 (224m) 1.1325 (207m)

USD/JPY: 99.00 (USD 610m) 99.80-81 (640m) 100.00 (627m) 100.50-60 (USD 220m) 101.00 (411m) 102.00 (262m) 102.21 (360m)

AUD/USD 0.7500 (AUD 610m)

NZD/USD 0.7300 (248m) 0.7335-41 (249m)

USD/CAD 1.3300 (USD 590m)

EUR/JPY 113.15 (798m)

AUD/JPY 75.50-60 (531m)

-

10:45

AUD: Overvalued For A Reason: Where To Target? - NAB

"The Fed has come and gone and the US dollar has traded softer out of the FOMC, helping keep AUD/USD firmly ensconced within a 0.7450-0.7750 range and which has contained close to 100% of the price action since the beginning of August.

AUD/USD looks set to end the quarter not too far from our earlier 0.77 forecast and we see no compelling reason at this stage to alter our end-2016 forecast of 0.75. We're not convinced the prevailing range is under any imminent threat of breaking.

That said, post-Fed and with market volatility set to stay low at least until we get much closer to the US Presidential elections, we'd have to judge the top side as currently the weaker edge.

AUD overvalued, but so what?

AUD/USD trades slightly rich relative to our short term fair value model estimate (just over 0.74) - but has done so for about two months now. It is significantly above the RBA's own view of the (real) trade weighted AUD that would be consistent with the scale of the terms of trade decline since its 2011 peak. In a chart contained within a speech from RBA Assistant Governor Chris Kent on 13 September, the estimated overvaluations looks to be about 6% as of Q2 and more like 8% currently. This is broadly in line with NAB's own estimates using our stylised RBA real TWI model".

Copyright © 2016 NAB, eFXnews™

-

10:25

Oil fell slightly

This morning New York futures for Brent have fallen in price by -0.56% to $ 47.66 and crude oil futures WTI down 0.37% to $ 45.76 per barrel. Thus, the black gold is trading in negative territory correcting after yesterday's sharp 3% rise. The world's leading oil producers meet in Algiers for a three-day meeting, which can lead to reduction or freezing of production in order to maintain prices. Nevertheless, market participants rather skeptical about the agreement they reach.

-

10:09

Euro Zone monetary aggregate M3 increased to 5.1%

The annual growth rate of the broad monetary aggregate M3 increased to 5.1% in August 2016, from 4.9% in July, averaging 5.0% in the three months up to August. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), increased to 8.9% in August, from 8.4% in July.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) stood at -1.5% in August, compared with -1.4% in July. The annual growth rate of marketable instruments (M3-M2) decreased to 4.5% in August, from 5.0% in July. Within M3, the annual growth rate of deposits placed by households increased to 5.2% in August, from 4.8% in July, while the annual growth rate of deposits placed by non-financial corporations decreased to 7.1% in August, from 7.3% in July. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) increased to 1.5% in August, from 0.4% in July.

-

10:07

Saudi Oil Min: Market Recovery Slower Than Hoped, Algiers Meeting In Consultative -- RTRS

-

10:00

Eurozone: M3 money supply, adjusted y/y, August 5.1% (forecast 4.9%)

-

10:00

Eurozone: Private Loans, Y/Y, August 1.8% (forecast 2%)

-

09:45

Major stock exchanges trading mixed: the FTSE 100 6,845.21 -64.22 -0.93%, Xetra DAX 10,444.25 +50.54 + 0.49%

-

09:34

Today’s events

At 13:00 GMT house price index S & P / Case-Shiller July 5.1% y / y 5.0% y / y

At 14:00 GMT Richmond Fed Index September -11 -2

At 15:15 GMT the Federal Reserve Vice Chairman Stanley Fischer will deliver a speech

-

09:16

WSE: After opening

WIG20 index opened at 1741.68 points (+0.09%)*

WIG 47458.49 0.02%

WIG30 2011.28 0.03%

mWIG40 4060.95 -0.25%

*/ - change to previous close

The futures market opened with increase by 0.4% to 1,738 points. Surrounded contract for DAX gained 0.6% at the opening which was not particularly high achievements as the scale of the recent decline.

The cash market started the day from a modest increase of 0.09%. The German DAX rises at the same time by 0.55%. The Warsaw market does not open clearly above and the turnover does not stand out of any above-average activity. It is not an encouraging picture of the morning.

-

08:44

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.7%, CAC40 +0.85, FTSE + 0.7%

-

08:38

A “big short” for USD/CAD? Will OPEC support the oil market?

-

08:36

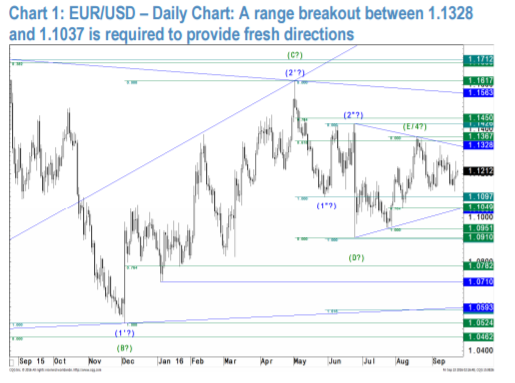

EUR/USD: Struggle Between Bulls And Bears Drags On: Levels & Targets - JP Morgan

"Since EUR/USD bottomed at 1.0462 in March 2015 it formed a broad consolidation triangle (A-B-C-D-E, green) which could be complete as the market stalled right around its projected E-wave target at 1.1347 (int. 61.8 %) five weeks ago.

Following this view, any bounce should now be capped at 1.1309/28 (minor 76.4 %/daily triangle).

Only a break above the latter would re-open the upside for an extension to the next higher T-junction at 1.1426/50 (pivot/int. 76.4 % on higher scale).

Below 1.1309/28 though, we see a negative bias prevailing and the market at risk of at least testing key-support at 1.1049/37 (int. 76.4 %/daily trend).

A break below the latter would finally challenge the key-T-zone on big scale at 1.0782/10 (int. 76.4 %/pivot).

A break below the latter would resume the long-term downtrend in favor of an extension to 1.0072 and possibly to 0.9652 and 0.9298 (wave 3 projections)".

Copyright © 2016 eFXplus™

-

08:33

Asian session review: Euro under preasure

The euro is under pressure against the background of yesterday's statement by European Central Bank President Mario Draghi, who once again invited Governments to help the eurozone and the ECB carrying out reforms aimed at growth. Thus, he stressed that the possibility of measures by central banks are close to the limits. Draghi warned of the negative side effects of prolonged interest rates at a low level and said that the measures applied by the European Central Bank "are not sufficient to ensure real, sustainable and long-term growth." He stressed that the stimulus measures taken by the ECB yield results, and the euro zone economy is still coping with the effects of the British decision to withdraw from the EU. He said the ECB will continue to "play its role", providing extra stimulation of economic growth if necessary.

The dollar rose against the yen after the end of the first of three US presidential debate between Hillary Clinton and Donald Trump. Investors felt that the Democratic candidate Hillary Clinton looks more confident than the Republican Donald Trump. According to a survey conducted by ABC and the newspaper Washington Post, Clinton is ahead in popularity by 2%. Studies have shown that if you had to choose between two candidates, 46% of respondents would vote for Clinton and 44% for Trump. Meanwhile, the latest Reuters / Ipsos poll indicated 41%% of voters supported Clinton against 37% for Trump.

Richard Grace of CBA said that the debate will cause volatility in the market, a small but real impact on the currency can only have the election on November 8. "If Trump wins the election, then, in our opinion, the US currency will rise 10%, and AUD / USD will fall by the same amount for 12 months," - Grace said.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1240-55 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2945-90 rabge

USD / JPY: rose to Y100.85 in the Asian session

-

08:26

Corporate service prices in Japan were up 0.2 percent on year

According to rttnews, corporate service prices in Japan were up 0.2 percent on year in August, the Bank of Japan said on Tuesday.

That was shy of forecasts for 0.3 percent, which would have been unchanged following the downward revision from 0.4 percent.

On a monthly basis, prices were down 0.3 percent after climbing 0.4 percent in the previous month.

Individually, prices were down for advertising, leasing and real estate, and they were up for transportation and postal activities.

-

08:24

Prime Minister of Japan, Shinzo Abe: I believe in what Kuroda and his team do

The prime minister expressed his full support for the actions of Governor of the Bank of Japan, Mr. Kuroda. "The government supports the monetary policy of the Central Bank and is ready to help in achieving the 2% inflation target and high rates of economic growth" - said Abe. At the same time, the politician said that it was too early to talk about the termination of such measures.

-

08:24

Options levels on tuesday, September 27, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1381 (4266)

$1.1331 (2238)

$1.1298 (425)

Price at time of writing this review: $1.1244

Support levels (open interest**, contracts):

$1.1179 (4181)

$1.1138 (3253)

$1.1093 (7037)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 37912 contracts, with the maximum number of contracts with strike price $1,1500 (5460);

- Overall open interest on the PUT options with the expiration date October, 7 is 39704 contracts, with the maximum number of contracts with strike price $1,1100 (7037);

- The ratio of PUT/CALL was 1.05 versus 1.07 from the previous trading day according to data from September, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3301 (2603)

$1.3202 (1415)

$1.3105 (1010)

Price at time of writing this review: $1.2993

Support levels (open interest**, contracts):

$1.2894 (915)

$1.2797 (1801)

$1.2698 (1424)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 26749 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22490 contracts, with the maximum number of contracts with strike price $1,3000 (3589);

- The ratio of PUT/CALL was 0.84 versus 0.84 from the previous trading day according to data from September, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

WSE: Before opening

This morning the market is most likely to response to the US debate. As to who won the debate Clinton - Trump probably every viewer has their own opinion, but the message given by the media is that Trump little disappointed, at least not shine enough - and that's why in the polls most people (even more than 60 percent) claims that Clinton won. It does not mean, however, that Clinton wins the election. Much can happen to Nov. 8.

In the morning, futures contracts for the S&P500 gain up to 0.6%, while the Nikkei index rising 0.8%. At first glance, the changes may not be spectacular, but they are strong enough that markets could make up most of yesterday's losses. This means that we need to prepare for the growth gaps in Europe, and all of today's session should have a positive coloration.

Today's macro calendar is almost empty and we may only pay attention to the consumer confidence index - the Conference Board. It is difficult to expect that investors have turned more attention to this data, as of yesterday are focused on American election politics.

-

08:20

Deputy Governor of the Bank of Japan, Nakas: Monetary easing is not enough to eradicate deflation

-

Economic measures and structural reforms do not replace, but complement each other

-

US presidential debate signaled the growth of protectionism

-

The mood of anti-globalization - a risk factor for the global economy

-

-

08:17

Bank of Japan Meeting minutes

"The Bank, in accordance with the guideline decided at the previous meeting on June 15 and 16, 2016, had been providing funds through purchases of Japanese government bonds (JGBs) and other measures. 6 In this situation, the amount outstanding of the monetary base had been in the range of 394-406 trillion yen.

B. Recent Developments in Financial Markets In the money market, interest rates on both overnight and term instruments had generally been in negative territory. The uncollateralized overnight call rate had been in the range of around minus 0.03 to minus 0.06 percent. As for interest rates on term instruments, yields on three-month treasury discount bills (T-Bills) had been at around minus 0.3 percent.

The Nikkei 225 Stock Average had increased, reflecting the rise in U.S. and European stock prices and speculation about the direction of fiscal and monetary policy in Japan, and was moving at around 16,500 yen recently. In the foreign exchange market, the yen had appreciated temporarily against the U.S. dollar following the United Kingdom's referendum, but had depreciated thereafter, partly due to speculation about the direction of fiscal and monetary policy in Japan, while investors' risk aversion had moderated. Meanwhile, the yen had appreciated against the euro. Yields on 10-year JGBs had moved further into negative territory under a tight supply-demand balance, due in part to anticipation of additional monetary easing by the Bank. C. Overseas Economic and Financial Developments Overseas economies continued to grow at a moderate pace, but the pace of growth had somewhat decelerated, mainly in emerging economies.

The U.S. economy had been on a recovery trend, assisted by firmness in the employment and income situation and in household spending, although the industrial sector had lacked momentum, mainly against the background of the slowdown in emerging 5 Reports were made based on information available at the time of the meeting. 6 The guideline was as follows: The Bank of Japan will conduct money market operations so that the monetary base will increase at an annual pace of about 80 trillion yen. 4 economies".

-

08:10

German import prices decreased by 2.6% in August

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 2.6% in August 2016 compared with the corresponding month of the preceding year. In July and in June 2016 the annual rates of change were -3.8% and -4.6%, respectively. From July to August 2016 the index fell by 0.2%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 1.9% compared with the level of a year earlier.

The index of export prices decreased by 0.9% in August 2016 compared with the corresponding month of the preceding year. In July and in June 2016 the annual rates of change were -1.2% and -1.3%, respectively. From July to August 2016 the index fell slightly by 0.1%.

-

06:51

Global Stocks

U.K. stocks dropped Monday, with the week starting off on risk-averse footing with energy shares under pressure as oil producers gather for industry talks. Oil shares were in the red Monday, as both members in and outside of the Organization of the Petroleum Exporting Countries were meeting this week in Algiers at the International Energy Forum. Investors will watch for any news that producers will agree to curb oil output at a time the market is grappling with an oil glut.

U.S. stocks extended losses Monday as worries about Germany's Deutsche Bank weighed on the financial sector while the upcoming U.S. presidential debate also contributed to jittery sentiment. Heavy losses for Deutsche Bank took a toll on European markets and pressured U.S. financial shares. U.S.-listed shares of Deutsche Bank DB, -7.06% DBK, -7.49% sank 7.1%, after Germany's Focus magazine reported over the weekend that Chancellor Angela Merkel wouldn't support state aid for the bank.

Declines in financial and commodities stocks sent Asian share markets broadly lower Tuesday, as markets eyed the first U.S. presidential debate for hints of future economic policy. Banks, insurers and other financial stocks in Japan opened lower, following a global fall in the sector overnight as concerns intensified over the health of Deutsche Bank AG DB1, -1.12% , after its shares slid 7.5% Monday to their lowest in decades.

-

00:29

Commodities. Daily history for Sep 26’2016:

(raw materials / closing price /% change)

Oil 45.62 -0.67%

Gold 1,341.90 -0.16%

-

00:28

Stocks. Daily history for Sep 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,544.56 -209.46 -1.25%

Shanghai Composite 2,981.25 -52.65 -1.74%

S&P/ASX 200 5,431.42 +0.123 0.00%

FTSE 100 6,818.04 -91.39 -1.32%

CAC 40 4,407.85 -80.84 -1.80%

Xetra DAX 10,393.71 -233.26 -2.19%

S&P 500 2,146.10 -18.59 -0.86%

Dow Jones Industrial Average 18,094.83 -166.62 -0.91%

S&P/TSX Composite 14,619.46 -78.47 -0.53%

-

00:28

Currencies. Daily history for Sep 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1251 +0,20%

GBP/USD $1,2972 +0,07%

USD/CHF Chf0,969 -0,13%

USD/JPY Y100,30 -0,69%

EUR/JPY Y112,85 -0,49%

GBP/JPY Y130,1 -0,63%

AUD/USD $0,7635 +0,18%

NZD/USD $0,7269 +0,36%

USD/CAD C$1,3222 +0,43%

-

00:00

Schedule for today,Tuesday, Sep 27’2016

08:00 Eurozone Private Loans, Y/Y August 1.8%

08:00 Eurozone M3 money supply, adjusted y/y August 4.8% 4.9%

10:00 United Kingdom CBI retail sales volume balance September 9 7

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July 5.1% 5.1%

13:45 U.S. Services PMI (Preliminary) September 51 51.2

14:00 U.S. Richmond Fed Manufacturing Index September -11

14:00 U.S. Consumer confidence September 101.1 99

15:15 U.S. FED Vice Chairman Stanley Fischer Speaks

-