Noticias del mercado

-

17:52

Oil fall more than 3% but a big announcement on production freeze could be made today

Crude-oil futures fell significantly affected by fading optimism regarding the possibility of a deal on limiting oil production. Pressure on also provided renewed strengthening of the American currency.

Iranian Oil Minister Bijan Zanganeh said that Iran expects OPEC meeting just to exchange views on the situation on the market, and not to conclude an agreement on the freezing of production. His counterpart from the United Arab Emirates Suhail Al Mazrui said that his country supports the production freeze. However, Saudi Arabia's energy minister, Khalid al-Falih described the meeting as a consultative exercise.

At the same time, Russia's oil minister said that Russia wants to freeze the oil production at the current level. It is worth emphasizing that oil production in Russia in recent years has risen to a record high of 11.75 million barrels per day.

Earlier, Wall Street Journal reported that OPEC members will discuss a proposal to limit production by about 1 million barrels a day for 1 year, but the likelihood of the deal still remained low, analysts noted. Recall, according to the September OPEC report, the total volume of oil production in the world has decreased in comparison with July by 0.14 million barrels per day in August, to 95.65 million barrels. At the same time supplies from OPEC countries decreased by 23 thousand barrels per day and other oil-producing countries -. 0.11 million barrels a day.

Investors also drew attention to the updated forecasts by Goldman Sachs. Today, the investment bank downgraded the outlook for WTI in the 4th quarter of 2016 from $ 50 to $ 43, as the supply-demand balance was weaker than expected, including due to the larger production growth in the current quarter. Meanwhile, Goldman Sachs confirmed the assessment of the average annual price of oil in 2017 at $ 52 per barrel, prices will range from $ 45 to $ 50 per barrel in the first half. The outlook for global oil demand was left unchanged: the expected growth in annual terms is1.4 million barrels a day.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 44.34 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 46.40 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:22

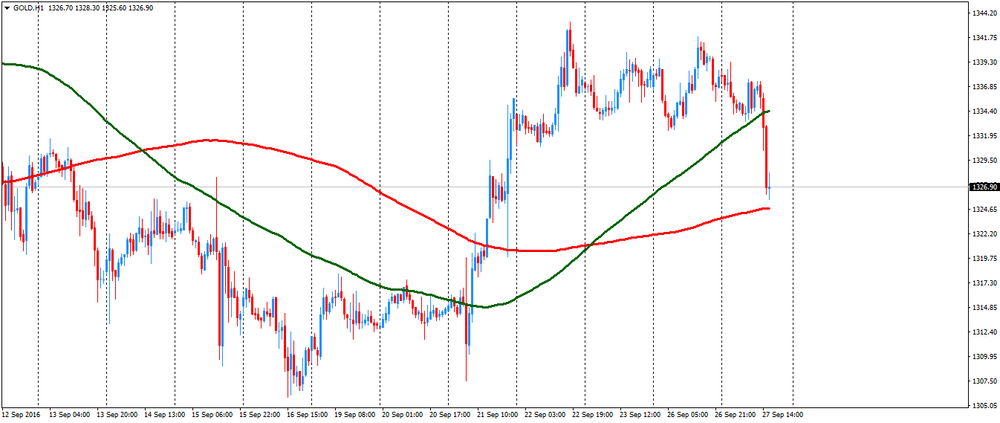

Gold was traded lower today

Gold prices dropped significantly, helped by the increase in risk appetite and strengthening of the US dollar after the first of the three TV US presidency debates.

Investors say that Democratic candidate Clinton won the debate with Republican Donald Trump. The markets believe that Clinton's victory in the elections will mean maintaining the status quo. In general, the debate have reduced the demand for gold, which is often seen as an alternative investment in times of geopolitical and financial uncertainty.

Meanwhile, the US Dollar Index, showing the US dollar against a basket of six major currencies, was up 0.35%. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

Additionally, investors await the Fed's statement hoping to hear comments about the prospects for a rate hike before the end of this year. According to the futures market, the likelihood of tighter monetary policy in December is 52.0%. Higher interest rates tend to have a downward pressure on gold.

The cost of the October futures for gold on the COMEX fell to $ 1325.9 per ounce.

-

17:19

Saudi Arabia, Iran made no proposals during meeting: Zanganeh

-

16:33

-

15:48

Saudi Arabia and Russia to give joint briefing in Algeria today - Reuters. Oil and USD/CAD volatility expected

-

15:37

Iran Doesn’t Want Oil Deal in Algiers, Won’t Freeze Output - Iranian Oil Minister

-

10:25

Oil fell slightly

This morning New York futures for Brent have fallen in price by -0.56% to $ 47.66 and crude oil futures WTI down 0.37% to $ 45.76 per barrel. Thus, the black gold is trading in negative territory correcting after yesterday's sharp 3% rise. The world's leading oil producers meet in Algiers for a three-day meeting, which can lead to reduction or freezing of production in order to maintain prices. Nevertheless, market participants rather skeptical about the agreement they reach.

-

10:07

Saudi Oil Min: Market Recovery Slower Than Hoped, Algiers Meeting In Consultative -- RTRS

-

00:29

Commodities. Daily history for Sep 26’2016:

(raw materials / closing price /% change)

Oil 45.62 -0.67%

Gold 1,341.90 -0.16%

-