Noticias del mercado

-

22:06

Major US stock indexes finished trading above zero

Major stock indexes in Wall Street rose modestly on Wednesday, helped by a rise in price of shares of basic materials sector and the scope of conglomerates.

At the same time, the pressure on the index has a decrease in the health sector and financial shares, after the chairman of the US Fed Yellen said that the Central Bank is considering the possibility of changing the annual stress testing. She also added that the US banking system is well capitalized, credit growth accelerated, and the number of bad loans is reduced. However, Yellen did not comment on the outlook for the economy or the Fed's monetary policy.

In addition, as it became known, new orders for non-military capital goods in the US, except for aircraft rose a third straight month in August, giving a positive signal for investment business prospects. The Commerce Department reported that new orders in the category, which includes items such as motor vehicles and equipment, and is carefully monitored to gauge business spending plans, rose 0.6% last month. Economists predicted that the so-called core capital goods orders to fall by 0.2%.

The cost of oil has grown amid reports that OPEC countries agreed to set a limit on the level of the average daily oil production 32.5 million barrels from the current 33.24 million barrels per day. After reaching this goal cartel to turn to other countries - oil exporters to accede to this agreement. According to the source, at the next meeting, which will take place in November, OPEC will discuss the freezing of oil each country - a member of the cartel.

DOW index components ended the session mixed (10 red, 20 black). More rest up shares Exxon Mobil Corporation (XOM, + 4.38%). Outsider were shares of NIKE, Inc. (NKE, -4.07%).

Sector S & P index also showed a mixed trend. The leader turned out to be the basic materials sector (+ 3.3%). Most utilities sector fell (-0.2%).

At the close:

Dow + 0.60% 18,338.22 +109.92

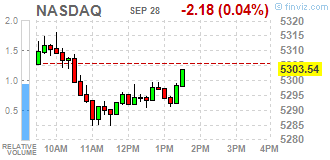

Nasdaq + 0.24% 5,318.55 +12.84

S & P + 0.53% 2,171.29 +11.36

-

21:00

DJIA +0.53% 18,325.51 +97.21 Nasdaq +0.12% 5,311.85 +6.14 S&P +0.41% 2,168.81 +8.88

-

19:42

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday as health stocks weighed and financials fell after Federal Reserve Chair Janet Yellen said the central bank was considering changes to the annual stress test. Yellen said the Fed was looking at a more risk-sensitive, firm-specific approach to the test that would raise capital requirements for big U.S. banks based on their test results. Healthcare sector weighed the most on the benchmark S&P 500 index as Bristol-Myers and Amgen fell.

Dow stocks mixed (17 in negative area, 13 in positive area). Top gainer - Caterpillar Inc. (CAT, +2.18%). Top loser - NIKE, Inc. (NKE, -1.87%).

S&P sectors also mixed. Top gainer - Basic Materials (+1.0%). Top loser - Healthcare (-0.5%).

At the moment:

Dow 18137.00 -2.00 -0.01%

S&P 500 2150.50 -2.25 -0.10%

Nasdaq 100 4857.50 -3.25 -0.07%

Oil 45.82 +1.15 +2.57%

Gold 1323.90 -6.50 -0.49%

U.S. 10yr 1.54 -0.01

-

18:00

European stocks closed: FTSE 100 +41.71 6849.38 +0.61% DAX +76.86 10438.34 +0.74% CAC 40 +33.77 4432.45 +0.77%

-

17:37

WSE: Session Results

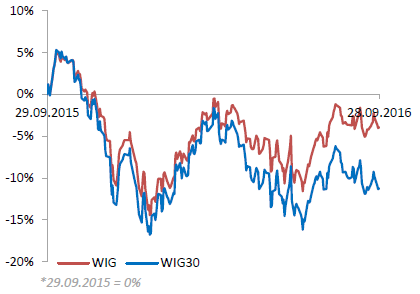

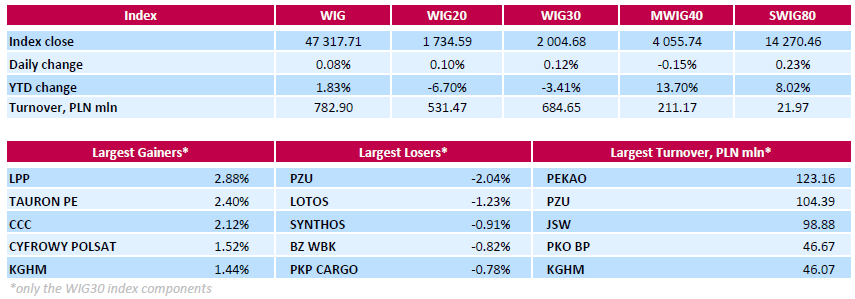

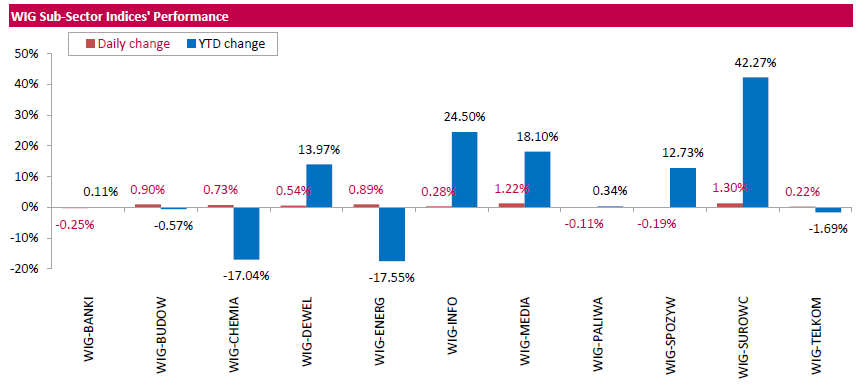

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index, edged up 0.08%. Most sectors rose, with materials (+1.30%) recording the biggest advance.

The large-cap stocks gained 0.12%, as measured by the WIG30 Index, with the way up led by clothing retailer LPP (WSE: LPP), gaining 2.88%. It was followed by genco TAURON PE (WSE: TPE) and footwear retailer CCC (WSE: CCC), adding 2.4% and 2.12% respectively. On the other side of the ledger, insurer PZU (WSE: PZU) demonstrated the biggest slump, down 2.04%. Other largest decliners were oil refiner LOTOS (WSE: LTS), chemical producer SYNTHOS (WSE: SNS) and bank BZ WBK (WSE: BZW), losing 1.23%, 0.91% and 0.82% respectively.

-

15:33

U.S. Stocks open: Dow +0.21%, Nasdaq +0.09%, S&P +0.13%

-

15:28

Before the bell: S&P futures +0.12%, NASDAQ futures +0.13%

U.S. stock-index futures were little changed, while oil prices rose before a meeting of OPEC members.

Global Stocks:

Nikkei 16,465.40 -218.53 -1.31%

Hang Seng 23,619.65 +47.75 +0.20%

Shanghai 2,988.13 -10.05 -0.34%

FTSE 6,870.50 +62.83 +0.92%

CAC 4,446.61 +47.93 +1.09%

DAX 10,482.90 +121.42 +1.17%

Crude $44.94 (+0.63%)

Gold $1328.30 (-0.16%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.72

0.07(0.7254%)

2023

ALTRIA GROUP INC.

MO

63.87

0.55(0.8686%)

2900

Amazon.com Inc., NASDAQ

AMZN

815.65

-0.46(-0.0564%)

27339

Apple Inc.

AAPL

113.58

0.49(0.4333%)

114892

AT&T Inc

T

41.07

-0.39(-0.9407%)

100958

Barrick Gold Corporation, NYSE

ABX

17.61

0.01(0.0568%)

32982

Boeing Co

BA

131.25

-0.07(-0.0533%)

250

Citigroup Inc., NYSE

C

46.46

0.09(0.1941%)

8760

Deere & Company, NYSE

DE

82.85

0.40(0.4851%)

500

Exxon Mobil Corp

XOM

83.39

0.15(0.1802%)

747

Facebook, Inc.

FB

128.85

0.16(0.1243%)

24364

Ford Motor Co.

F

12.04

0.06(0.5008%)

12528

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.28

0.07(0.6856%)

28526

General Electric Co

GE

29.86

-0.02(-0.0669%)

1675

Google Inc.

GOOG

777.26

-5.75(-0.7343%)

10258

Hewlett-Packard Co.

HPQ

15.39

0.05(0.3259%)

365

JPMorgan Chase and Co

JPM

66.5

0.14(0.211%)

5415

McDonald's Corp

MCD

116.77

-0.11(-0.0941%)

500

Merck & Co Inc

MRK

63.45

0.88(1.4064%)

11818

Nike

NKE

53.91

-1.43(-2.584%)

158377

Procter & Gamble Co

PG

88.65

0.29(0.3282%)

19795

Starbucks Corporation, NASDAQ

SBUX

53.89

-0.30(-0.5536%)

20108

Tesla Motors, Inc., NASDAQ

TSLA

206.5

0.69(0.3353%)

4580

Twitter, Inc., NYSE

TWTR

23.45

-0.27(-1.1383%)

365309

Verizon Communications Inc

VZ

52.42

-0.07(-0.1334%)

1560

Walt Disney Co

DIS

91.97

0.25(0.2726%)

915

Yahoo! Inc., NASDAQ

YHOO

43.35

-0.02(-0.0461%)

1970

Yandex N.V., NASDAQ

YNDX

21.24

-0.07(-0.3285%)

900

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

AT&T (T) downgraded to Neutral from Buy at UBS

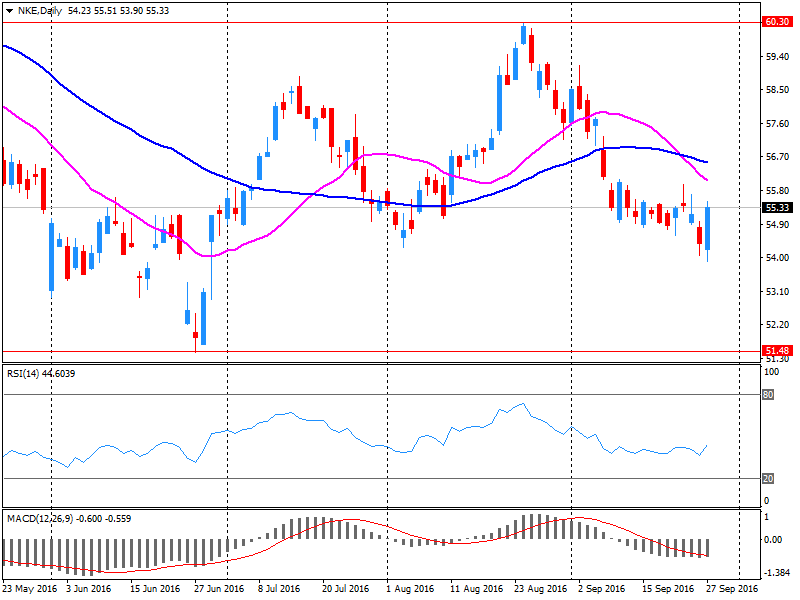

NIKE (NKE) downgraded to Hold from Buy at Brean Capital

Twitter (TWTR) downgraded to Underperform from Neutral at Mizuho; target $15

Twitter (TWTR) downgraded to Sell from Hold at Loop Capital

Alphabet A (GOOGL) downgraded to Underperform from Neutral at Wedbush; target $700

Other:

Starbucks (SBUX) target lowered to $65 from $70 at Wedbush

NIKE (NKE) target lowered to $67 from $69 at Telsey Advisory Group

NIKE (NKE) target lowered to $55 from $63 at FBR & Co

Amazon (AMZN) resumed with a Buy at Nomura; target $950

-

13:52

Company News: Nike’s (NKE) quarterly results beat analysts’ expectations

Nike (NKE) reported Q1 FY 2017 earnings of $0.73 per share (versus $1.34 in Q1 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $9.061 bln (+7.7% y/y), beating analysts' consensus estimate of $8.865 bln.

However, Nike's FY 2017 outlook remained unchanged, with revenue projected to grow at a high-single-digit rate.

NKE fell to $54.00 (-2.42%) in pre-market trading.

-

12:43

Major European stock indices traded in the green zone

European stocks rise amid rising mining and energy companies.

The composite index of the largest companies in the region Stoxx Europe 600 rose during trading 1,1% - to 343.81 points, and nearly leveled the decline since the beginning of the month.

Yesterday, the Stoxx 600 increased slightly due to better than expected data from the US. The consumer confidence index in September, jumped to 104.1 points, the highest level since August 2007, from a revised 101.8 points in August. Analysts on average expected a decline to 99.3 points.

World stock markets also strengthened due to improved sentiment because analysts believed that Hillary Clinton proved to have an edge on Donald Trump during a presidential debate on Monday.

Prices for most metals are rising today, so capitalization of Anglo American Plc and Rio Tinto Group increased by more than 2%.

In addition, the oil becomes more expensive on signals that Saudi Arabia is ready to compromise with Iran on the signing of production freeze.

Total SA shares rose in price by 1,2%, BP Plc by 1.1%.

Deutsche Post shares rose 0.3% on news that the German postal service takes on British rival UK Mail Group for $ 316 million. The price of UK Mail shares soared by 43%.

The market value of Deutsche Bank rose 2.1%. Having problems with capitalization the bank agreed to sell British insurance division of Abbey Life Assurance for $ 1.2 billion.

Meanwhile, the value of Royal Bank of Scotland rose 1.2%. The bank agreed to pay a fine of $ 1.1 billion to settle claims relating to the sale of mortgage securities to US financial companies.

Price of tour operator TUI AG rose 2.5% after the company raised its forecast for annual profit growth from 10% to 12-13%.

Meanwhile, shares of Allianz rose 1.1% on reports that the German insurer is considering options for a partial or complete sale of the regional private bank Oldenburgische Luesbank AG.

Smiths Group shares rose 2.9% after the group reported an increase in profit before tax by 6.5% for the year to the end of July.

At the moment:

FTSE 6851.62 43.95 0.65%

DAX 10452.22 90.74 0.88%

CAC 4431.87 33.19 0.75%

-

09:15

WSE: After opening

WIG20 index opened at 1734.12 points (+0.08%)*

WIG 47310.88 0.07%

WIG30 2003.15 0.04%

mWIG40 4059.39 -0.06%

*/ - change to previous close

The WIG20 futures took off 5 points below yesterday's close, but the first transactions quickly led to make up for losses from the opening, and even the transition to the light pros. The inspiration for the bulls is probably the yesterday's attitude of the Americans.

Europe started much better than expected and creates upward pressure on the market in Warsaw. However, after the first transactions the WIG20 rises by barely 0.3 percent and with the meager turnover. It should be noted that the shares of Deutsche Bank are rising by 2.6 percent, which relieves yesterday's tension regarding the banking sector.

-

08:53

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.4%, CAC40 + 0.2%, FTSE + 0.2%

-

08:25

WSE: Before opening

Tuesday's closing of trading on Wall Street did not bring any surprises and the S&P500 index gained 0.64 percent. It should be noted that the shape of Wall Street is closely linked to the US presidential election and Fed policy. Trading in Europe takes place in the context of the confusion about the banking sector, with a focus on uncertainty about the condition of Italian banks and Deutsche Bank. Therefore, the potential impact of good session on Wall Street must be taken into account, but local variables can quickly turn out to be stronger.

In the morning, we see a slight withdrawal of the contract on the S&P500, and discount on the Japanese Nikkei index, which lost 1.40%. The contracts for the German DAX are traded below the level at which the base index closed yesterday's session and therefore we may expect a withdraw on the beginning of trading in Europe.

The WIG20 index recently showed a significant correlation with the German DAX and there is also noticeable correlation between banks listed in Warsaw and the banks listed on the European markets. It all should have an impact on today's trading on the Warsaw Stock Exchange.

-

07:04

Global Stocks

European stocks closed fractionally higher Tuesday, rebounding at the last minute after being pressured most of the session by the energy sector after Iran poured cold water on hopes for an output cap at a meeting of major oil producers this week.

U.S. stocks closed higher Tuesday, with the Dow industrials rising more than 100 points after the first presidential debate between Democratic candidate Hillary Clinton and Republican contender Donald Trump and a number of stronger-than-expected economic reports. The advance in stocks suggests that U.S. equity markets are betting that Clinton benefited the most from Monday's presidential debate. Stocks are rising on the prospect of a Clinton presidency because the Democrat is viewed as a known quantity while some view Trump as being more unpredictable-a bad thing for stock investors.

Asian stocks were mostly lower on Wednesday, with European banking sector concerns and lower crude oil prices dulling investors' appetite for riskier assets. Equities in Asia had gained the previous day on a perceived win by Democrat Hillary Clinton at the first presidential debate over Republican Donald Trump, who is seen as creating greater uncertainty for the U.S. and global economies.

-

00:29

Stocks. Daily history for Sep 27’2016:

(index / closing price / change items /% change)

Nikkei 225 16,683.93 +139.37 +0.84%

Shanghai Composite 2,997.88 +17.45 +0.59%

S&P/ASX 200 5,405.89 -25.53 -0.47%

FTSE 100 6,807.67 -10.37 -0.15%

CAC 40 4,398.68 -9.17 -0.21%

Xetra DAX 10,361.48 -32.23 -0.31%

S&P 500 2,159.93 +13.83 +0.64%

Dow Jones Industrial Average 18,228.30 +133.47 +0.74%

S&P/TSX Composite 14,558.04 -61.42 -0.42%

-