Noticias del mercado

-

22:08

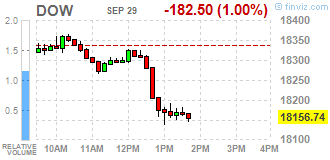

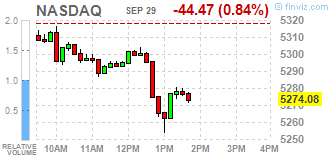

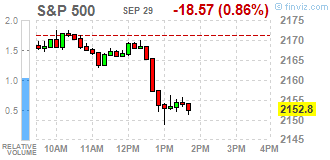

Major US stock indexes finished trading below zero

Major stock indexes in Wall Street closed in the red, breaking a two-day increase. Pressure drop in the index was the capitalization of Apple (AAPL) due to the lowering of the target value of shares Barclays experts.

In addition, it became known today, the number of Americans who applied for unemployment benefits rose less than expected last week and remained at relatively healthy levels, which could support the Federal Reserve, which plans to raise interest rates this year. Primary applications for state unemployment benefits rose by 3,000, reaching 254,000 for the week ended September 24th. Economists had expected the figure will be 260,000.

In addition, the number of signed contracts to purchase homes in the US secondary market fell in August to its lowest level since January, a warning sign for the economy at the time, as the industry is trying to increase the supply. The National Association of Realtors said its index of sales expectations houses, calculated on the basis of contracts concluded in the last month decreased by 2.4% to 108.5 in July after the jump. Index was 0.2% lower than in August 2015.

However, oil futures rose by about 1%, continuing the rally the previous session, which was caused by the news of an agreement by OPEC to curb oil production. Recall participants OPEC meeting in Algeria declared the achievement of mutual understanding, but work on the production of detail reduction plan, they have postponed until November. Production will be limited to the level of 32.50 mln. Barrels per day compared to the current 33.24 million. Barrels of oil per day.

Almost all the components of DOW index finished trading in negative territory (27 of 30). Outsider were shares of The Goldman Sachs Group, Inc. (GS, -2.78%). Most remaining shares rose Caterpillar Inc. (CAT, + 1.22%).

Most of the S & P sectors showed a decline. the health sector fell the most (-2.0%). Grown only sector conglomerates (+ 0.3%) and basic materials sector (+ 0.3%).

At the close:

Dow -1.06% 18,144.48 -194.76

Nasdaq -0.93% 5,269.15 -49.40

S & P -0.93% 2,151.11 -20.26

-

21:00

DJIA -0.74% 18,204.06 -135.18 Nasdaq -0.61% 5,286.06 -32.49 S&P -0.59% 2,158.59 -12.78

-

19:48

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower in choppy trading late Thursday morning after two straight days of gains, pulled lower by Apple (AAPL) and healthcare stocks. The S&P healthcare index dropped as shares of Merck (MRK) and Johnson & Johnson (JNJ) booked losses. Apple fell after Barclays cut its price target. The stock was the biggest drag on Wall Street.

Almost all of Dow stocks in negative area (26 of 30). Top gainer - Caterpillar Inc. (CAT, +1.52%). Top loser - Merck & Co., Inc. (MRK, -2.23%).

Almost all S&P sectors also in negative area. Top gainer - Basic Materials (+0.3%). Top loser - Healthcare (-2.0%).

At the moment:

Dow 18085.00 -153.00 -0.84%

S&P 500 2147.25 -16.00 -0.74%

Nasdaq 100 4837.75 -30.50 -0.63%

Oil 47.78 +0.73 +1.55%

Gold 1326.40 +2.70 +0.20%

U.S. 10yr 1.56 -0.01

-

18:19

WSE: Session Results

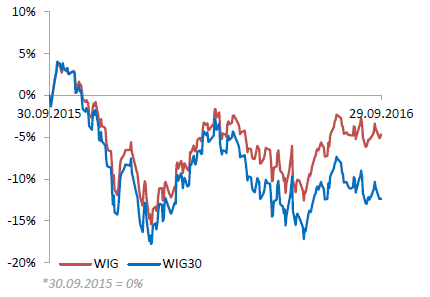

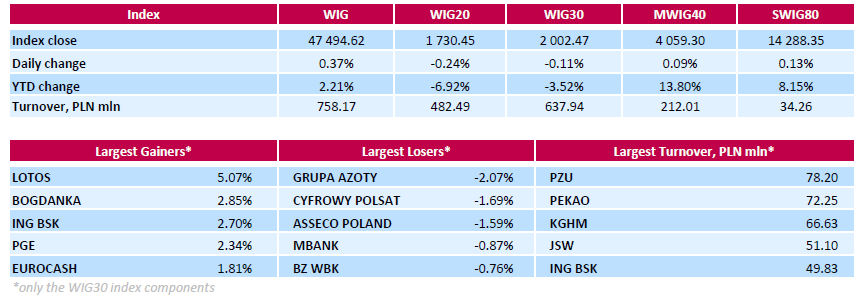

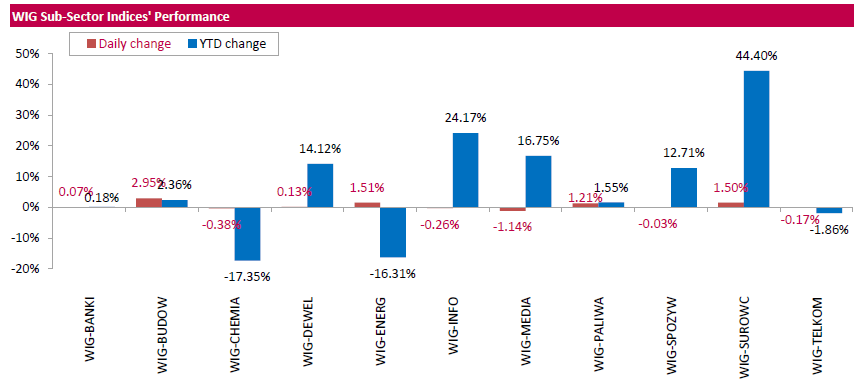

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, gained 0.37%. Sector performance within the WIG Index was mixed. Media (-1.14%) was the weakest group, while construction (+2.95%) outperformed.

Large-cap stocks measure, the WIG30 Index, underperformed the broad market, posting a 0.11% drop. In the index basket, chemical company GRUPA AZOTY (WSE: ATT) was the sharpest decliner, tumbling by 2.07%. It was followed by media group CYFROWY POLSAT (WSE: CPS) and IT-company ASSECO POLAND (WSE: ACP) plunging by 1.69% and 1.59% respectively. On the other side of the ledger, oil refiner LOTOS (WSE: LTS), thermal coal miner BOGDANKA (WSE: LWB), bank ING BSK (WSE: ING) and genco PGE (WSE: PGE) were recorded as the biggest gainers, advancing between 2.34% and 5.07%.

-

18:00

European stocks closed: FTSE 100 +70.04 6919.42 +1.02% DAX -32.80 10405.54 -0.31% CAC 40 +11.39 4443.84 +0.26%

-

15:52

WSE: After start on Wall Street

The beginning of the session on Wall Street took place in a similar style like yesterday. Contracts on the S&P500, which even in the previous phase of trade reflected the improvement in sentiment in relation to the agreement of OPEC, before the start of the spot market were around lows and the opening of the US indices was held on the red side of the market. The first transactions were carried out under the dictation of the supply side, however, declines so far are symbolic.

On European stock exchanges, including the Warsaw Stock Exchange, now we have a little peace after a previous process of descent. An hour before the end of the session the WIG20 index reached the level of 1,719 points (-0.85%).

-

15:34

U.S. Stocks open: Dow 0.00%, Nasdaq -0.10%, S&P -0.09%

-

15:28

Before the bell: S&P futures -0.18%, NASDAQ futures -0.17%

U.S. stock-index futures slipped amid data that indicated growth remains slow but steady, while remarks from policy makers signaled they're moving closer to raising interest rates.

Global Stocks:

Nikkei 16,693.71 +228.31 +1.39%

Hang Seng 23,739.47 +119.82 +0.51%

Shanghai 2,998.23 +10.38 +0.35%

FTSE 6,920.54 +71.16 +1.04%

CAC 4,467.46 +35.01 +0.79%

DAX 10,489.46 +51.12 +0.49%

Crude $46.87 (-0.38%)

Gold $1322.10 (-0.12%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.83

-0.05(-0.5061%)

8300

ALTRIA GROUP INC.

MO

63.7

-0.07(-0.1098%)

250

Amazon.com Inc., NASDAQ

AMZN

828.5

-0.22(-0.0265%)

19419

Apple Inc.

AAPL

113.3

-0.65(-0.5704%)

199883

AT&T Inc

T

40.8

-0.05(-0.1224%)

1070

Barrick Gold Corporation, NYSE

ABX

17.87

-0.15(-0.8324%)

13956

Boeing Co

BA

132.22

-0.01(-0.0076%)

745

Caterpillar Inc

CAT

86.5

-0.09(-0.1039%)

7531

Chevron Corp

CVX

102.12

-0.03(-0.0294%)

3417

Exxon Mobil Corp

XOM

86.83

-0.07(-0.0806%)

5970

Facebook, Inc.

FB

129.2

-0.03(-0.0232%)

36129

Ford Motor Co.

F

12.05

-0.04(-0.3309%)

3050

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.85

-0.06(-0.55%)

71347

General Electric Co

GE

29.81

-0.09(-0.301%)

1315

Home Depot Inc

HD

129

0.73(0.5691%)

540

JPMorgan Chase and Co

JPM

66.6

-0.11(-0.1649%)

950

McDonald's Corp

MCD

115.34

0.16(0.1389%)

1030

Merck & Co Inc

MRK

63.23

-0.07(-0.1106%)

950

Microsoft Corp

MSFT

57.96

-0.07(-0.1206%)

1020

Nike

NKE

53.09

-0.16(-0.3005%)

17232

Procter & Gamble Co

PG

89.48

0.02(0.0224%)

649

Tesla Motors, Inc., NASDAQ

TSLA

206

-0.27(-0.1309%)

6775

Twitter, Inc., NYSE

TWTR

22.85

-0.11(-0.4791%)

82320

Visa

V

83.04

0.07(0.0844%)

500

Walt Disney Co

DIS

91.72

-0.48(-0.5206%)

1244

Yahoo! Inc., NASDAQ

YHOO

43.1

-0.59(-1.3504%)

700

Yandex N.V., NASDAQ

YNDX

21.5

0.05(0.2331%)

695

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) removed from Top Pick status at Barclays; Overweight, target raised to $115 from $114

-

13:37

Major European stock indices traded in the green zone

European stocks rose due to the prior agreement of OPEC to reduce oil production and encouraged the shares of commodity companies.

OPEC countries at an informal meeting in Algeria have agreed on reduction of oil production from the current 33.24 million barrels per day to 32,5-33 million barrels per day. The final written confirmation agreement to be reached on a formal meeting of the cartel on November 30 in Vienna.

"Overall, we see only the intention of the OPEC countries to agree on reduction of production. The details relating to the production cuts and to what extent, is not, and they are likely to appear only at the end of November. Is still much to be done, and they still have enough time, to upset the agreement ", - Accendo Markets analyst Mike van Dulko and Henry Croft.

The composite index of the largest companies in the region Stoxx Europe 600 rose during trading 0,8% - to 345.17 points.

Oil prices soared on Wednesday 5-6%, but little changed so far today.

Shares of oil companies sharply rise: Royal Dutch Shell securities jumped by 5,6%, Total SA - on 5,2%, BP - by 4.5%.

Metals are also rising, which pushes up the share prices of mining companies. Shares of BHP Billiton in London soared in price by 4,9%, Rio Tinto - on 2,7%, Anglo American - by 4.6%.

The cost of Lufthansa fell by 3%, Air France-KLM - on 2,5%, Ryanair - on 2,6%, IAG - on 1,4%, EasyJet - by 1.8%.

At the moment:

FTSE 6926.99 77.61 1.13%

DAX 10519.30 80.96 0.78%

CAC 4486.63 54.18 1.22%

-

13:11

WSE: Mid session comment

The first half of trading on the Warsaw market has brought slightly higher than usual turnover. However lack of fuel to growth caused the elements of impatience, which resulted in the transition to a slow subsidence of the WIG20 index.

While in earlier days the wide market was resistant for such processes, today decreases also applies to the second and third lines (the mWIG40 and sWIG80 indices).

Also clearly weakened enthusiasm showed by the demand side on the undisputed leader of activity - JSW. This course is still growing, but from 5.3 percent has got only 0.13 per cent and the rate has downward moving character.

In the middle of trading the WIG20 index reached the level of 1,722 points (-0.71%) with the turnover of PLN 210 million.

-

09:42

Major stock exchanges trading in the green zone: FTSE + 1.0%, DAX + 1.0%, CAC40 + 1.4%, FTMIB + 1.5%, IBEX + 1.2%

-

09:15

WSE: After opening

WIG20 index opened at 1730.66 points (-0.23%)*

WIG 47554.40 0.50%

WIG30 2002.00 -0.13%

mWIG40 4071.44 0.39%

*/ - change to previous close

The futures market started from increase of 0.58% (1,732 points). The contract on the DAX gained at that time on a smaller scale, because he had a chance yesterday to react to the OPEC decision.

The cash market opens with modest discount of 0.23% to 1,730 points. It seems that the dividend of shares in PKO BP has not been cut off, and the shares of PZU this morning increase in value of more than 1% and this fact offset part of the negative impact of the dividend. However, the main index remains at levels well known from yesterday and even after taking into account dividends from PZU stands out from the DAX, which grows approx. 1%.

-

08:49

Expected positive start of trading on the major stock exchanges in Europe: DAX futures + 1.1%, CAC 40 + 1.2%, FTSE + 1.1%

-

08:28

WSE: Before opening

The main event that has affected the behavior of the market after yesterday's close of trading on the Warsaw Stock Exchange was the message that the OPEC countries reached an agreement to reduce oil production in November. As a result, oil began to be more expensive in the US market. The agreement was a big surprise, because the markets were not expecting this turn of events after previous reports.

This information was supported for oil companies in the US and later in Asia. As a result, the S&P500 index rose yesterday by 0.5%, and this morning in Asia brings the continuation of better moods with the increases exceeding 1.4% for the Japanese Nikkei. Contracts in the US in the morning continue to increase in value.

Improving of global sentiment after the OPEC decision should translate into growth in Europe, which are also expected after yesterday's calm confidence about the banking sector in the Old Continent.

On the Warsaw market may be important information on changes in the government, where the post was lost by the Finance Minister, and its powers took Mateusz Morawiecki (Deputy Prime Minister). Information slightly positive.

The more important the information is attributable today, the first day of trading without dividend for PKO BP and PZU. The negative impact on the WIG20 is respectively 0.54% and 0.75%, which in total can reduce the main index up about 1.29%.

-

08:21

European stocks look set to start strong after OPEC's surprize deal

According to rttnews, European stocks look set to start Thursday's session on a buoyant note, as a surprise OPEC deal to limit oil production helped rekindle investors' appetite for risk.

At an informal meeting in Algiers on Wednesday, the Organization of the Petroleum Exporting Countries (OPEC) agreed a preliminary deal to cut production for the first time since 2008, though the output level for each member nation must still be finalized at an OPEC meeting in Vienna in November.

Oil prices fell slightly in Asian deals after settling up nearly 6 percent overnight in reaction to the OPEC deal and the release of EIA report showing an unexpected drawdown in U.S. crude oil stocks for the fourth straight week.

Other commodities traded mostly firm and the yen weakened against the dollar, after Fed Chair Janet Yellen said she believes the U.S. economy is continuing its recovery and is ready for a rate hike by the end of the year.

Asian stocks rose across the board, with Japanese shares leading regional gains after steep losses in the previous session.

-

07:07

Global Stocks

European stocks closed fractionally higher Tuesday, rebounding at the last minute after being pressured most of the session by the energy sector after Iran poured cold water on hopes for an output cap at a meeting of major oil producers this week.

U.S. stocks swung higher Wednesday after OPEC took an important step toward a cap on crude-oil output. The Organization of the Petroleum Exporting Countries reached an "understanding" to limit crude production and is considering cutting production to between 32.5 million to 33 million barrels a day, The Wall Street Journal reported.

The overnight rally in oil prices amid reports that oil producers finally agreed to cut production levels sent Asia markets higher on Thursday. In Japan, the Nikkei 225 rallied 1.55 percent, while the Topix index was up 1.08 percent. Across the Korean Strait, the Kospi advanced 0.82 percent. Hong Kong's Hang Seng index was up 0.38 percent. Mainland Chinese markets were also higher, with the Shanghai composite up 0.22 percent and the Shenzhen composite adding 0.15 percent.

-

00:28

Stocks. Daily history for Sep 28’2016:

(index / closing price / change items /% change)

Nikkei 225 16,419.20 -264.73 -1.59%

Shanghai Composite 2,988.13 -10.05 -0.34%

S&P/ASX 200 5,412.35 +6.46 +0.12%

FTSE 100 6,849.38 +41.71 +0.61%

CAC 40 4,432.45 +33.77 +0.77%

Xetra DAX 10,438.34 +76.86 +0.74%

S&P 500 2,171.37 +11.44 +0.53%

Dow Jones Industrial Average 18,339.24 +110.94 +0.61%

S&P/TSX Composite 14,731.43 +173.39 +1.19%

-