Noticias del mercado

-

22:07

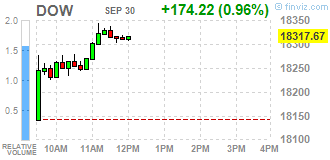

Major US stock indexes finished trading above zero

Major stock Wall Street indexes rose by about a percentage, as a rebound of shares Deutsche Bank (DB) has helped to raise the financial sector.

As it became known, the US consumer spending remained unchanged in August, but inflation has shown signs of acceleration, giving mixed signals that could affect the cautious policy of the Federal Reserve System in the issue of rising interest rates. The Commerce Department reported that consumer spending, which accounts for over two-thirds of US economic activity, has not changed in the last month, adjusted for inflation. Analysts had expected spending to increase by 0.1%.

However, the Purchasing Managers Index Chicago Purchasing rose by 2.7 points to 54.2 in September from 51.5 in August, recovering most of the lost ground in the previous month. On the basis of the trend, the report paints a slightly better picture than earlier this year with an average of 53.8 index in the 3rd quarter, compared to 52.2 in the 2nd quarter and the highest quarterly level since the 4th quarter of 2014 .

It should also be noted that the final results of the studies submitted by Thomson-Reuters and Institute of Michigan, revealed in September index of consumer sentiment rose to 91.2 points compared with a final reading of 89.8 points in August and the preliminary value of 89.8 points in September . It was predicted that the index is 90 points.

Oil prices returned to positive territory after a moderate decline previously, received support from a weaker dollar. Further increase in prices made it difficult to profit-taking by some investors after the price increase to one-month high, which contributed to the news of the agreement on the limitation of oil production. Meanwhile, experts say that the OPEC agreement may not lead to a result or even break due to disagreements between the two countries.

Almost all the components of DOW index closed in positive territory (29 of 30). Most remaining shares increased Wal-Mart Stores Inc. (WMT, + 2.11%). Cheaper shares only Verizon Communications Inc. (VZ, -0,06%).

Almost all sectors of the S & P index recorded an increase. The leader turned out to be the financial sector (+ 1.3%). Decreased only utilities sector (-0.5%).

-

21:00

DJIA +1.09% 18,341.40 +197.95 Nasdaq +0.99% 5,321.35 +52.20 S&P +1.01% 2,172.80 +21.67

-

18:09

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Friday as a bounce in Deutsche Bank's (DB) shares helped lift financial stocks amid broad gains across sectors. Deutsche Bank's U.S-listed stock surged 13,5% after French news agency AFP reported that the bank was nearing a settlement with the U.S. Department of Justice regarding mortgage bonds.

All Dow stocks in positive area (30 of 30). Top gainer - Wal-Mart Stores Inc. (WMT, +2.19%).

Most of S&P sectors also in positive area. Top gainer - Financials (+1.0%). Top loser - Utilities (-0.5%).

At the moment:

Dow 18224.00 +127.00 +0.70%

S&P 500 2161.00 +12.50 +0.58%

Nasdaq 100 4871.00 +26.75 +0.55%

Oil 47.99 +0.16 +0.33%

Gold 1322.60 -3.40 -0.26%

U.S. 10yr 1.59 +0.09

-

18:00

European stocks closed: FTSE 100 -20.09 6899.33 -0.29% DAX +105.48 10511.02 +1.01% CAC 40 +4.42 4448.26 +0.10%

-

17:37

WSE: Session Results

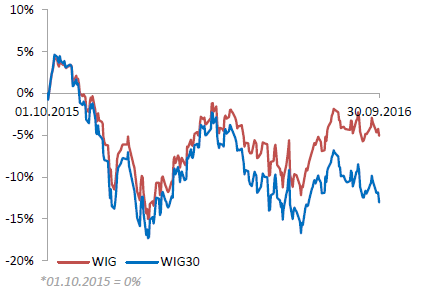

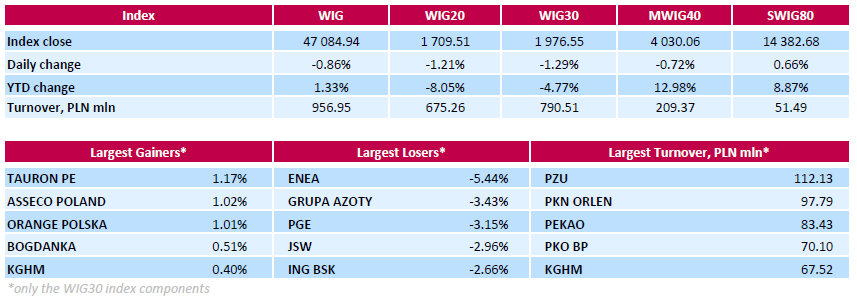

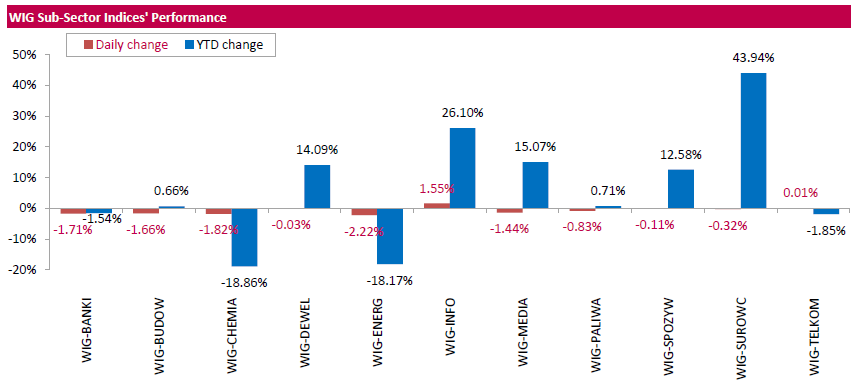

Polish equity market closed lower on Friday. The broad market measure, the WIG index, fell by 0.86 %. Most sectors dropped, with utilities (-2.22%) recording the biggest decline.

The large-cap stocks' gauge, the WIG30 Index, lost 1.29%. A majority of the index components recorded declines. Genco ENEA (WSE: ENA) posted the biggest drop, down by 5.44%. Other most prominent losers were chemical company GRUPA AZOTY (WSE: ATT), genco PGE (WSE: PGE), coking coal miner JSW (WSE: JSW), property developer GTC (WSE: GTC) and two banks ING BSK (WSE: ING) and PEKAO (WSE: PEO), plunging by 2.6%-3.43%. At the same time, genco TAURON PE (WSE: TPE), IT-company ASSECO POLAND (WSE: ACP) and telecommunication services provider ORANGE POLSKA (WSE: OPL) topped a handful of gainers, adding 1.17%, 1.02% and 1.01% respectively.

-

15:51

WSE: After start on Wall Street

Quotations on Wall Street began from a solid growth. The S&P500 index gained 0.5 percent, which helped to offset declines in Europe and the German DAX reached the equilibrium level. Thus, the index regained total of nearly 2 percent loss. In this context, the Warsaw Stock Exchange is looking to reduce the decline, but the response of the market is still pale against the previous resistance to drops in the environment.

However, on the threshold of the final hours of the session, the index still has the prospect to make up for losses due to upward pressure from core markets.

An hour before the close of trading, the WIG20 index was at 1,724 points (-0,38%).

-

15:34

U.S. Stocks open: Dow +0.71%, Nasdaq +0.45%, S&P +0.61%

-

15:29

Before the bell: S&P futures +0.12%, NASDAQ futures +0.04%

U.S. stock-index futures were little changed, as investors assessed the implications of deepening woes in Europe's banking industry.

Global Stocks:

Nikkei 16,449.84 -243.87 -1.46%

Hang Seng 23,297.15 -442.32 -1.86%

Shanghai 3,005.51 +7.03 +0.23%

FTSE 6,878.06 -41.36 -0.60%

CAC 4,398.01 -45.83 -1.03%

DAX 10,352.53 -53.01 -0.51%

Crude $47.93 (+0.21%)

Gold $1330.80 (+0.36%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.1

0.14(1.4056%)

17848

ALTRIA GROUP INC.

MO

63

0.18(0.2865%)

400

Amazon.com Inc., NASDAQ

AMZN

832.35

3.30(0.398%)

22438

AMERICAN INTERNATIONAL GROUP

AIG

58.6

0.20(0.3425%)

1100

Apple Inc.

AAPL

112.69

0.51(0.4546%)

107609

AT&T Inc

T

40.8

0.07(0.1719%)

420

Barrick Gold Corporation, NYSE

ABX

18.2

0.26(1.4493%)

63102

Boeing Co

BA

129

-2.03(-1.5493%)

312

Caterpillar Inc

CAT

87.8

0.33(0.3773%)

1690

Chevron Corp

CVX

100.81

-0.46(-0.4542%)

5703

Cisco Systems Inc

CSCO

31.5

0.11(0.3504%)

400

Citigroup Inc., NYSE

C

46.24

0.44(0.9607%)

17600

Exxon Mobil Corp

XOM

86.67

0.21(0.2429%)

100

Facebook, Inc.

FB

128.3

0.21(0.1639%)

56179

Ford Motor Co.

F

12.02

0.05(0.4177%)

7507

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.8

0.11(1.029%)

17826

General Electric Co

GE

29.58

0.05(0.1693%)

4648

General Motors Company, NYSE

GM

31.61

0.13(0.413%)

400

Goldman Sachs

GS

159.9

0.95(0.5977%)

3816

Google Inc.

GOOG

777.11

2.10(0.271%)

787

International Business Machines Co...

IBM

158.5

0.39(0.2467%)

271

Johnson & Johnson

JNJ

117.8

0.53(0.452%)

200

JPMorgan Chase and Co

JPM

66.04

0.39(0.5941%)

13600

Microsoft Corp

MSFT

57.45

0.05(0.0871%)

2045

Nike

NKE

52.45

0.29(0.556%)

3544

Pfizer Inc

PFE

33.39

0.07(0.2101%)

1361

Procter & Gamble Co

PG

88.25

0.02(0.0227%)

66867

Starbucks Corporation, NASDAQ

SBUX

53.22

-0.23(-0.4303%)

1035

Tesla Motors, Inc., NASDAQ

TSLA

202.2

1.50(0.7474%)

3940

The Coca-Cola Co

KO

42.23

0.20(0.4758%)

2801

Twitter, Inc., NYSE

TWTR

23.13

0.12(0.5215%)

75461

Visa

V

81.8

-0.12(-0.1465%)

3414

Wal-Mart Stores Inc

WMT

71.2

0.47(0.6645%)

750

Yandex N.V., NASDAQ

YNDX

21.38

-0.06(-0.2799%)

1500

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $130 from $120 at Citigroup; maintain Buy

Alphabet A (GOOGL) target raised to $1025 at RBC Capital Mkts

Wal-Mart (WMT) initiated with a Overweight at KeyBanc Capital Mkts; target $90

NIKE (NKE) initiated with Buy at Guggenheim

Wal-Mart (WMT) initiated with Buy at Guggenheim

Amazon (AMZN) initiated with Buy at Guggenheim -

13:06

WSE: Mid session comment

After the first half of the session on the Warsaw market appeared calm and waiting for new impetus. In Europe, after the solid morning discount, the German DAX shows attempt to stabilization, however, this did not bring new content specifically for the Warsaw Stock Exchange, which is today much stronger than the environment.

The second half of today's trading the WIG20 index welcomed at the level of 1,721 points (-0.54%). The turnover among the largest companies was amounted to PLN 245 million.

-

09:43

Major stock markets trading in the red zone: DB shares at record lows down 7.9%, DAX -1.6%, FTSE -1.2%, CAC40 -1.6%, FTMIB -1.8%, IBEX -2.1%

-

09:17

WSE: After opening

WIG20 index opened at 1723.24 points (-0.42%)*

WIG 47208.49 -0.60%

WIG30 1988.37 -0.70%

mWIG40 4041.82 -0.43%

*/ - change to previous close

Today's trading on the derivative market started from the withdrawal, which decreased the valuation of the September contract series of more than 0.9 percent.

The cash market, like other European markets, started with the rhythm of changes imposed by yesterday's declines on Wall Street. As it appeared only after the close of European parquets, today we have to make up the backlog.

After fifteen minutes of trading, the WIG20 index reached the level of 1,719 points (-0,62 %).

-

08:43

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -1.6%, CAC40 -1.4%, FTSE -1.0%

-

08:28

WSE: Before opening

Thursday on Wall Street ended with falls and investors know a number of macroeconomic data. Positively surprised reading of GDP, which showed an increase higher than forecasts. The market also heard statements by members of the Fed, who pointed to the upcoming rate hike. The Dow Jones Industrial at the end of the day lost 1.07 percent, the S&P 500 fell by 0.93 percent and the Nasdaq Composite went down about 0.93 percent.

The highest increases were recorded in the US telecommunications sector, fuel and goods of higher order, declines led by the pharmaceutical industry and energy. The financial sector was one of the weakest in the market and gave about 1.5 percent

The situation on Wall Street may be translated into a downstream opening in Europe, and may create downward pressure on the market in Warsaw. Another element of today's opening of the Warsaw market can be yesterday's jump at the fixing. Combining this fact with a worse-than-expected closure in the US may lead to greater withdrawal of the WIG20 at the opening.

Today's macro calendar is relatively rich and connects to the last session of the month and quarter, which could bring an attempt to raise the valuations of individual stocks by institutional investors (ie. "window dressing"), it may also lead to surge in valuations at the fixing.

-

07:21

Global Stocks

U.K. stocks rallied on Thursday, with resource companies leading the charge higher as investors cheered a decision by the Organization of the Petroleum Exporting Countries to cap oil output.

U.S. stocks closed lower Thursday, recovering from session lows, following a selloff fueled by investor worry about European banks and talk of a December rate increase by the Federal Reserve. Investors were following embattled giant German lender Deutsche BankAG, which has been buffeted by concerns about the health of its balance sheet, specifically its ability to withstand a potential $14 billion fine from the U.S. Justice Department. Deutsche Bank's U.S.-listed shares DB, -6.67% closed down 6.7%

Asian stocks extended losses on Friday as worries about the health of Deutsche Bank weighed on financial shares and as oil prices inched back from near-one month highs on scepticism over OPEC's new plan to curb output.

-

00:29

Stocks. Daily history for Sep 29’2016:

(index / closing price / change items /% change)

Nikkei 225 16,693.71 +228.31 +1.39%

Shanghai Composite 2,998.23 +10.38 +0.35%

S&P/ASX 200 5,471.26 +58.91 +1.09%

FTSE 100 6,919.42 +70.04 +1.02%

CAC 40 4,443.84 +11.39 +0.26%

Xetra DAX 10,405.54 -32.80 -0.31%

S&P 500 2,151.13 -20.24 -0.93%

Dow Jones Industrial Average 18,143.45 -195.79 -1.07%

S&P/TSX Composite 14,754.55 +23.12 +0.16%

-