Noticias del mercado

-

21:00

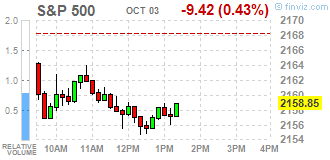

DJIA 18237.68 -70.47 -0.38%, NASDAQ 5289.79 -22.21 -0.42%, S&P 500 2158.13 -10.14 -0.47%

-

19:27

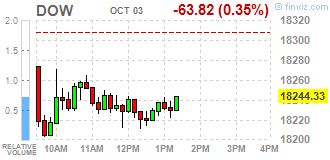

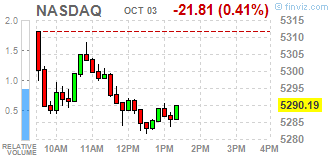

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes started the fourth quarter on a weak note as healthcare stocks fell and Deutsche Bank's (DB) travails weighed on financials. The German lender is working to reach a settlement with U.S. authorities who have demanded a fine of up to $14 billion for mis-selling mortgage-baked securities.

Most of Dow stocks in negative area (24 of 30). Top gainer - E. I. du Pont de Nemours and Company (DD, +2.36%). Top loser - The Travelers Companies, Inc. (TRV, -1.53%).

All S&P sectors also in negative area. Top loser - Utilities (-1.0%).

At the moment:

Dow 18145.00 -74.00 -0.41%

S&P 500 2150.75 -9.75 -0.45%

Nasdaq 100 4849.50 -20.75 -0.43%

Oil 48.56 +0.32 +0.66%

Gold 1313.20 -3.90 -0.30%

U.S. 10yr 1.62 +0.01

-

18:00

European stocks closed: FTSE 6984.38 85.05 1.23%, DAX 10511.02 UNCH 0%, CAC 4452.99 4.73 0.11%

-

17:37

WSE: Session Results

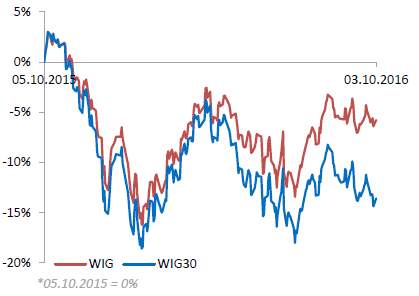

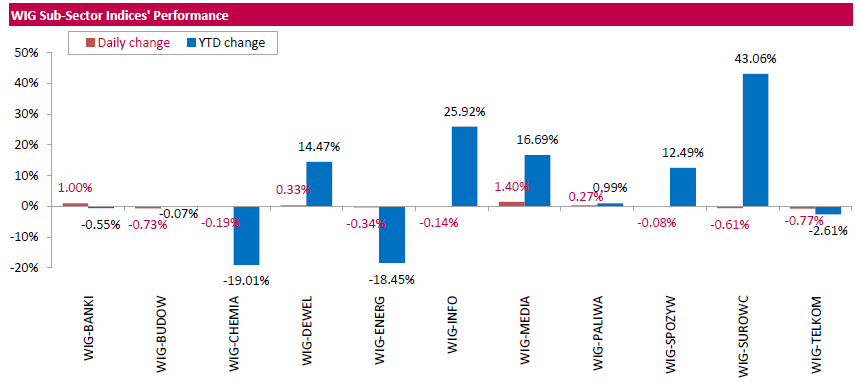

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 0.67%. Sector-wise, media (+1.40%) fared the best, while telecoms (-0.77%) fell the most.

The large-cap benchmark, the WIG30 Index, surged by 0.92%. Within the index components, clothing retailer LPP (WSE: LPP) led the gainers, skyrocketing by 14.12%, supported by the announcement the company's revenues boosted by 20% y/y to appr. PLN 457 mln in September, while its gross margin in the period edged up by 1 ppt y/y to 59%. YTD, LPP's sales increased by 17% y/y to PLN 4.16 bln. Other major advancers were railway freight transport operator PKP CARGO (WSE: PKP), footwear retailer CCC (WSE: CCC) and two banks PEKAO (WSE: PEO) and BZ WBK (WSE: BZW), climbing 9.21%, 3.47%, 2.83% and 2.59% respectively. On the other side of the ledger, IT-company ASSECO POLAND (WSE: ACP) topped the list of the decliners with a 2.17% drop, followed by two gencos TAURON PE (WSE: TPE) and ENERGA (WSE: ENG), falling by 1.92% and 1.33% respectively.

-

15:53

WSE: After start on Wall Street

On the Warsaw market it is worth to note today's pretty good behavior of the banks sector led by Pekao and BZ WBK, which supports a market that is slowly climbing up the next levels. Nevertheless we have take an amendment to the level of the turnover, which is very far from ideal. On the plus side, however, need to be considered full use of the situation in the environment of emerging markets in our region. We managed to return slightly above the level of the Friday's opening and support for both the WIG20 and the WIG was defended.

The market in the United States opens from decrease of approx. 0.2%, which in the first few bars slightly growing. The red color on Wall Street is part of a slightly worse afternoon mood in Europe, where cosmetic discounts were implemented.

An hour before the end of the session the WIG20 index was at the level of 1,727 points (+1,04%).

-

15:31

U.S. Stocks open: Dow -0.24%, Nasdaq -0.21%, S&P -0.22%

-

15:21

Before the bell: S&P futures -0.23%, NASDAQ futures -0.16%

U.S. stock-index futures slipped, following a rally Friday spurred by diminished concerns over the health of Deutsche Bank (DB), while investors awaited a reading on American manufacturing activity.

Global Stocks:

Nikkei 16,598.67 +148.83 +0.90%

Hang Seng 23,584.43 +287.28 +1.23%

Shanghai Closed

FTSE 6,978.50 +79.17 +1.15%

CAC 4,446.97 -1.29 -0.03%

DAX Closed

Crude $48.61 (+0.77%)

Gold $1319.60 (+0.19%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.15

0.01(0.0986%)

26466

Amazon.com Inc., NASDAQ

AMZN

836.45

-0.86(-0.1027%)

12513

Apple Inc.

AAPL

112.89

-0.16(-0.1415%)

85147

Barrick Gold Corporation, NYSE

ABX

17.77

0.05(0.2822%)

32187

Chevron Corp

CVX

102.93

0.01(0.0097%)

4418

Cisco Systems Inc

CSCO

31.56

0.10(0.3179%)

14821

Citigroup Inc., NYSE

C

47.19

-0.04(-0.0847%)

8719

E. I. du Pont de Nemours and Co

DD

67.9

0.93(1.3887%)

18470

Exxon Mobil Corp

XOM

87.55

0.27(0.3094%)

1129

Facebook, Inc.

FB

128.35

0.08(0.0624%)

41359

Ford Motor Co.

F

12.09

0.02(0.1657%)

36893

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.07

0.21(1.9337%)

62091

General Electric Co

GE

29.59

-0.03(-0.1013%)

54794

General Motors Company, NYSE

GM

31.75

-0.02(-0.063%)

354

Goldman Sachs

GS

161.05

-0.22(-0.1364%)

3222

Google Inc.

GOOG

776.95

-0.34(-0.0437%)

1143

Intel Corp

INTC

37.76

0.01(0.0265%)

14713

JPMorgan Chase and Co

JPM

66.51

-0.08(-0.1201%)

4600

McDonald's Corp

MCD

115.25

-0.11(-0.0954%)

17553

Nike

NKE

52.8

0.15(0.2849%)

7541

Procter & Gamble Co

PG

89.7

-0.05(-0.0557%)

4747

Tesla Motors, Inc., NASDAQ

TSLA

212.25

8.22(4.0288%)

102761

The Coca-Cola Co

KO

42.36

0.04(0.0945%)

641

Twitter, Inc., NYSE

TWTR

23.8

0.75(3.2538%)

598772

United Technologies Corp

UTX

101.75

0.15(0.1476%)

8629

Verizon Communications Inc

VZ

52.05

0.07(0.1347%)

20840

Walt Disney Co

DIS

92.81

-0.05(-0.0538%)

15368

Yahoo! Inc., NASDAQ

YHOO

43.18

0.08(0.1856%)

2295

Yandex N.V., NASDAQ

YNDX

21.44

0.39(1.8527%)

8687

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Freeport-McMoRan (FCX) upgraded to Buy from Hold at Deutsche Bank

Barrick Gold (ABX) upgraded to Buy from Hold at Deutsche Bank

DuPont (DD) upgraded to Buy from Neutral at Citigroup

Downgrades:

Other:

Chevron (CVX) added to US Large Cap Fundamental List at BMO Capital

Apple (AAPL) maintained with an Overweight at Piper Jaffray; target $151

-

13:11

Major stock indices in Europe show a positive trend

European stocks traded in the green zone on the rise of energy companies and financial firms. Support for indices also provides statistics for the euro area and the United Kingdom.

The final data published by Markit Economics showed that business activity in the euro zone's manufacturing sector accelerated last month, confirming preliminary estimates. The PMI for the manufacturing sector rose to 52.6 points compared with 51.7 points in the previous month. In addition, the report stated that the growth of production, new orders, new export orders and employment accelerated in September compared to August. "Today's PMI data indicate that the production, which grew at a steady pace in the second quarter (by about 2 per cent per annum), gained further momentum in September," - said Chris Williamson, chief economist at the business IHS Markit.

A separate report from Markit Economics and CIBS showed that UK's manufacturing sector expanded in September at the fastest pace since mid-2014, helped by faster growth in output and new orders. As it became known, the index of manufacturing activity improved in September to 55.4 points compared to 53.4 points in August. The last reading was the highest since June 2014. Economists had expected the index to decline moderately to 52.1 points. "The rebound in the last two months has been encouragingly strong, and puts the sector on course, which will provide an additional positive contribution to GDP in the 3rd quarter," - said Rob Dobson, senior economist at Markit.

The composite index of the largest companies in the region Stoxx Europe 600 up 0.2 percent. The trading volume today is about 15 percent lower than the average for the last 30 days, as the German stock exchange is closed for a national holiday.

FTSE 100 index in Britain rose by more than 1.1 per cent, the best result among the Western European markets. Exporting companies benefited from a significant drop in the pound after UK Prime Minister Theresa May said it will triger article 50 at the end of March 2017.

Capitalization of Royal Dutch Shell Plc rose by 3 percent, supported by rising oil prices.

Shares of Henderson Group Plc rose 12 percent after the company announced a merger with the American Janus Capital Group Inc. As a result of this transaction, the Group will be established with assets of more than $ 320 billion and a total market capitalization of more than $ 6 billion.

At the moment:

FTSE 100 +80.78 6980.11 + 1.17%

DAX Closed

CAC 40 +13.62 4461.88 + 0.31%

-

13:03

WSE: Mid session comment

The first half of today's trading brought make up for an artificial auction in the segment of blue chips from Friday's closing. In the segment of small and medium-sized companies market behaves neutrally. There is not much better In the markets in Europe.

In the middle of today's trading the WIG20 index was at the level of 1,720 points (+ 0.64%). The turnover in the segment of the largest companies was amounted to PLN 150 million.

-

09:47

Major stock exchanges trading in the green zone: FTSE 100 6,930.88 +31.55 + 0.46%, Xetra DAX 10,511.02 +105.48 + 1.01%

-

09:13

WSE: After opening

WIG20 index opened at 1713.16 points (+0.21%)*

WIG 47169.38 0.18%

WIG30 1982.01 0.28%

mWIG40 4029.85 -0.01%

*/ - change to previous close

The cash market started a new month with increase of 0.22% to 1,713 points, at usual Monday's modest turnover. The PMI index for the domestic industry was slightly better than forecasts and increased to 52.2 points from 51.5 points previously. The environment is quiet and the CAC40 lost 0.1%, so this behavior is slightly worse than might have been expected early in the morning.

-

08:43

Positive start of trading expected on the major stock exchanges in Europe: CAC40 futures flat, FTSE + 0.2%

-

08:27

WSE: Before opening

Today we begin another month and quarter in the markets. The beginning of the month means the readings of PMI and ISM in the United States, which is the most important macroeconomic publication of the day.

The markets attention, however, will focus on information relating to Deutsche Bank. On Friday, late in the evening, there were reports that the US Justice Department is negotiating with the bank decrease previously proposed penalty of up to US $ 5.4 billion from the original $ 14 billion. In response the DB shares gained 14% in United States. This information also influenced the positive sentiment on Wall Street, where major indexes rose after approx. 0.8%.

Today, because of the holidays the Frankfurt Stock Exchange will be closed, so we have to wait until tomorrow to find out the sentiment to the DB in home country.

In turn, in Asia the whole week will celebrate the Chinese, but on the weekend there were official PMI data for both the service and industry sectors, which have been well received by investors. Asian markets are dominated by noticeable increases. Also grow contracts in the United States, so in Europe, at the beginning we may expect the dominance of the green color.

On the Warsaw market another "miracle fixing" on Friday this time understated quoting, so some decline on Friday was somewhat artificial and may be made up for today.

-

07:07

Global Stocks

European stock markets on Friday erased earlier sharp losses and closed slightly higher as concerns over Deutsche Bank's financial health subsided on hopes the lender will pay a lower-than-feared fine to U.S. regulators.

U.S. stocks closed higher Friday, but off their session highs, boosted by a double-digit rally in Deutsche Bank AG shares, which were recovering from brutal losses in the previous session amid heightened concerns about the health of the German lender's balance sheet.

Asian shares got the new quarter off to a firm start on Monday, while sterling tumbled as Britain set a March deadline to start divorce proceedings from the European Union. Risk sentiment had benefited on Friday from reports Deutsche Bank was negotiating a much smaller fine with the U.S. Department of Justice, though the Wall Street Journal reported on Sunday that the talks were still in flux.

-

01:01

Stocks. Daily history for Sep 30’2016:

(index / closing price / change items /% change)

Nikkei 225 16,449.84 -243.87 -1.46%

Shanghai Composite 3,005.51 +7.03 +0.23%

S&P/ASX 200 5,435.92 -35.34 -0.65%

FTSE 100 6,899.33 -20.09 -0.29%

CAC 40 4,448.26 +4.42 +0.10%

Xetra DAX 10,511.02 +105.48 +1.01%

S&P 500 2,168.27 +17.14 +0.80%

Dow Jones Industrial Average 18,308.15 +164.70 +0.91%

S&P/TSX Composite 14,725.86 -28.69 -0.19%

-