Noticias del mercado

-

17:54

Oil little changed for the day

In today's trading, oil prices fluctuated, while investors assessed the OPEC agreement, which can interrupt the period of low oil prices.

Purchases from traders and investment managers received support due to hopes for a coordinated reduction in OPEC output to 32.5 - 33 million barrels per day. Such agreements reached by representatives of the cartel within the framework of an informal meeting in Algeria. Meanwhile, a number of market participants expect that the transaction should not be considered until the OPEC concluded.

The risk of disappointment in the OPEC agreement is great, believe Morgan Stanley, and it is unclear whether the cartel agreements aimed only at maintaining the trust of investors for an additional couple of months. The bank says that OPEC to conduct negotiations with Russia and other major oil producers outside the cartel.

Many analysts and traders expect OPEC transaction results, while the market is back under the control of one-day technical traders, said the broker.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 48.87 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 50.90 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:30

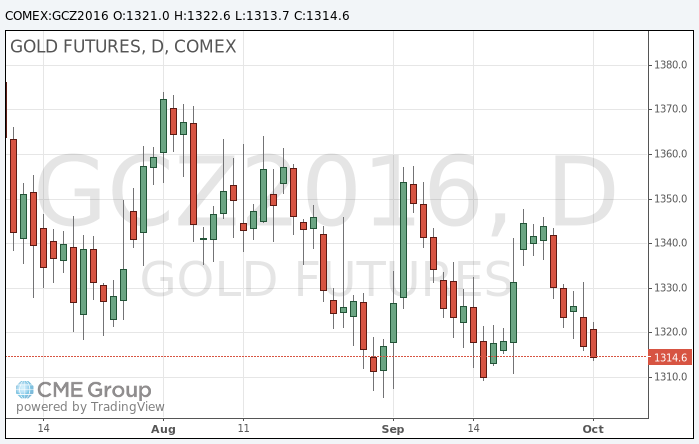

Gold trading lower

Gold fall today after stronger US data on business activity.

The US dollar rose after the manufacturing sector rebounded in September.

According to the report of the Institute for Supply Management (ISM), manufacturing PMI sector rose to 51.5 in September from 49.4 in August. Readings above 50 indicate expanding activity.

The manufacturing sector in recent years harmed the sluggish global economic growth and a strong US dollar.

"Positive news that the production index jumped after the fall, - says Brian Deyndzherfild, an analyst at RBS Securities -. Since September, the Fed signaled its intention to raise interest rates and the market, of course, will follow the economic data."

Earlier, gold prices were largely stable after the decision of the UK to triger article 50.

China's markets are closed from 1 to 9 October.

British Prime Minister Theresa May said on Sunday that the United Kingdom will start the process of exit from the EU no later than March next year, but it did not have any significant impact on the demand for gold.

Brexit calendar unlikely to have a direct impact on the gold price, says Julius Baer analyst, Carsten Menke.

Messages that Deutsche Bank is in talks with the US Justice Department to reduce the compensation designated for settlement of the dispute, also increased investors' appetite for risk.

Gold imports to India fell for the ninth straight month as weak retail demand and high prices have prompted banks and refining company to reduce foreign buying.

The cost of December futures for gold on the COMEX fell to $ 1313.7 per ounce.

-

16:27

-

16:02

US manufacturing ISM beats expectations

Economic activity in the manufacturing sector expanded in September following one month of contraction in August, and the overall economy grew for the 88th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The September PMI® registered 51.5 percent, an increase of 2.1 percentage points from the August reading of 49.4 percent. The New Orders Index registered 55.1 percent, an increase of 6 percentage points from the August reading of 49.1 percent. The Production Index registered 52.8 percent, 3.2 percentage points higher than the August reading of 49.6 percent. The Employment Index registered 49.7 percent, an increase of 1.4 percentage points from the August reading of 48.3 percent. Inventories of raw materials registered 49.5 percent, an increase of 0.5 percentage point from the August reading of 49 percent. The Prices Index registered 53 percent in September, the same reading as in August, indicating higher raw materials prices for the seventh consecutive month. Manufacturing expanded in September following one month of contraction in August, with nine of the 18 industries reporting an increase in new orders in September (up from six in August), and 10 of the 18 industries reporting an increase in production in September (up from eight in August)."

-

16:00

U.S.: Construction Spending, m/m, August -0.7% (forecast 0.2%)

-

16:00

U.S.: ISM Manufacturing, September 51.5 (forecast 50.3)

-

15:54

Canadian manufacturing PMI lower than forecast

Canadian manufacturers signalled another slowdown in growth momentum during September, with production volumes expanding at the weakest pace for seven months. The latest survey also pointed to a renewed decline in overall new business volumes, partly driven by a sharper drop in export sales. Subdued demand conditions contributed a slight fall in employment numbers and a greater degree of inventory drawdown in September.

At 50.3 in September, down from 51.1 in August, the Markit Canada Manufacturing Purchasing Managers' Index™ (PMI™) pointed to only a marginal improvement in overall business conditions and the slowest pace of recovery since the upturn began in March. Lower new order volumes and reduced payroll numbers were the main negative influences on the headline index, alongside the sharpest drop in pre-production inventories since the start of 2016.

-

15:52

U.S. manufacturers signalled another moderate upturn - Markit

U.S. manufacturers signalled another moderate upturn in both production volumes and incoming new work during September, but the latest survey indicated a further loss of growth momentum from July's recent peak. Softer overall growth was attributed to generally subdued client demand, alongside a drop in new export sales for the first time in four months.

At the same time, manufacturers sought to streamline their inventories of finished goods, with the pace of stock depletion the fastest since November 2015. The latest survey also pointed to cautious staff hiring strategies, although the rate of job creation picked up from August's recent low.

The seasonally adjusted final Markit U.S. Manufacturing Purchasing Managers' Index™ (PMI™) registered 51.5 in September (flash: 51.4), down slightly from 52.0 in August, to signal the weakest improvement in overall business conditions since June. Slower rates of output and new order growth were the main factors weighing on the headline index, which more than offset a stronger contribution from the staff hiring component.

-

15:45

U.S.: Manufacturing PMI, September 51.5 (forecast 51.4)

-

15:40

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1175 (EUR 251m) 1.1200 611m) 1.1280 (334m) 1.1325 (368m)

USDJPY: 100.00 (USD 486m) 100.90 (891m) 102.05-06 (1.34bln) 102.21 (540m) 102.30-35 (800m)

GBPUSD: 1.2975 (GBP 304m) 1.3100 (246m)

AUDUSD: 0.7600 (AUD 205m) 0.7640 (815m)

USDCAD: 1.3000 (USD 301m) 1.3075 (260m) 1.3095 (416m) 1.3100 (792m) 1.3200 (440m)

NZD/USD: 0.7332 (NZD 225m)

AUD/JPY: 78.00 (AUD 460m)

-

14:35

UK corporate taxes to be cut to 17% by end of parliament - Hammond

-

14:20

European session review: the British pound dropped significantly against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany official holiday

7:15 Switzerland Retail Sales m / m in August 0.2%

07:15 Switzerland Retail sales, y / y in August -2.2%

Switzerland 7:30 PMI in the manufacturing sector in September 51 53.2

France 7:50 PMI in the manufacturing sector (the final data) September 48.3 49.5 49.7

Germany 7:55 PMI in the manufacturing sector (the final data) September 53.6 54.3 54.3

08:00 Eurozone PMI in the manufacturing sector (the final data) September 51.7 52.6 52.6

8:30 UK PMI Manufacturing Index September 53.3 52.1 55.4

The pound depreciated significantly against the US dollar, approaching July 6 low on comments by British Prime Minister on the Brexit process. However, a further currency collapse halted by extremely strong data on business activity in the manufacturing sector of the United Kingdom. Recall, in the weekend Theresa May said that the authorities intend to triger Article 50 of the Lisbon Treaty, providing for the country's right to withdraw from the EU until the end of March 2017. She stressed that Brexit is an "extremely difficult" process and the British authorities have to carry out lengthy negotiations with Brussels regarding the details of the country's exit from the union. The authorities plan to continue an active trade policy with the EU Member States.

Also today, financial minister Hammond warned that the UK economy will face turbulence, when the government will negotiate the exit from the EU. Hammond said he would like to see a deal with the EU, which included the full access of British companies to the EU's single market, while at the same time, the government listens to the call of the voters who need to regain control over the country's borders.

Markit Economics and CIBS showed that UK's manufacturing sector expanded in September at the fastest pace since mid-2014, helped by faster growth in output and new orders. As it became known, the index of manufacturing activity improved in September to 55.4 points compared to 53.4 points in August. The last reading was the highest since June 2014. Economists had expected the index to decline moderately to 52.1 points. "The rebound in the last two months has been encouragingly strong, and puts the sector on course, which will provide an additional positive contribution to GDP in the 3rd quarter," - said Rob Dobson, senior economist at Markit.

The euro traded in a range against the US dollar, while remaining near the opening level. However, little support has provided statistics for the euro area. The final data published byMarkit Economics showed that business activity in the euro zone's manufacturing sector accelerated last month, confirming preliminary estimates. The PMI for the manufacturing sector rose to 52.6 points compared with 51.7 points in the previous month. In addition, the report stated that the growth of production, new orders, new export orders and employment accelerated in September compared to August. "Today's PMI data indicate that the production, which grew at a steady pace in the second quarter (by about 2 per cent per annum), gained further momentum in September," - said Chris Williamson, chief economist at the business IHS Markit.

Among Member States, Germany and Austria recorded the fastest growth in September. Italy has returned to expansion, while France came close to stabilizing. German Manufacturing PMI rose to a three-month high, and amounted to 54.3 points compared to 53.6 points in August. The final readings correspond to the preliminary assessment. It is worth emphasizing the expansion of activity in the sector observed during the last 22 months. Meanwhile, the French manufacturing PMI improved to 49.7 from 48.3 in August. This is the highest score in the last seven months, and only slightly below the neutral mark of 50.0. The value was also higher than the preliminary assessment of 49.5.

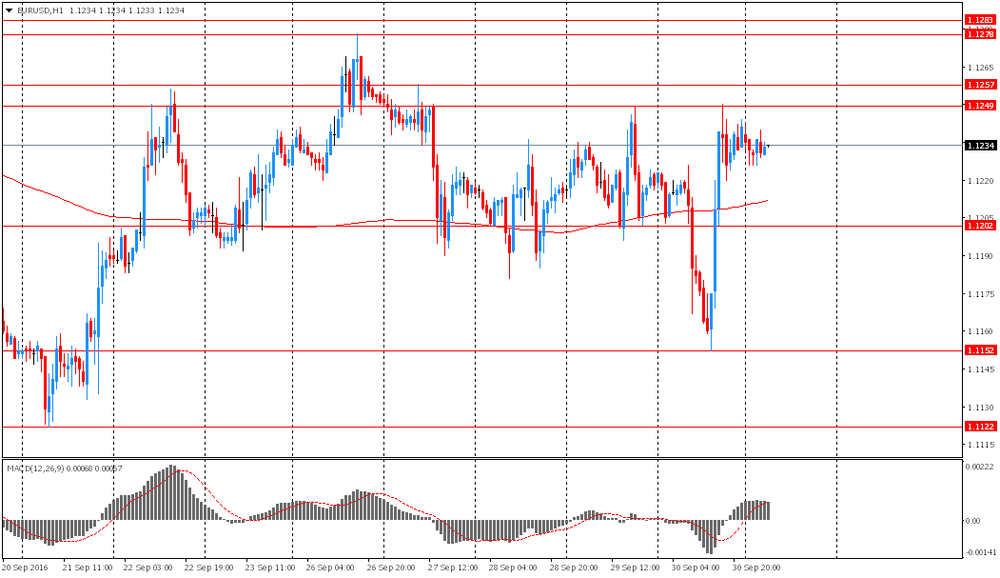

EUR / USD: during the European session, the pair traded in a narrow range

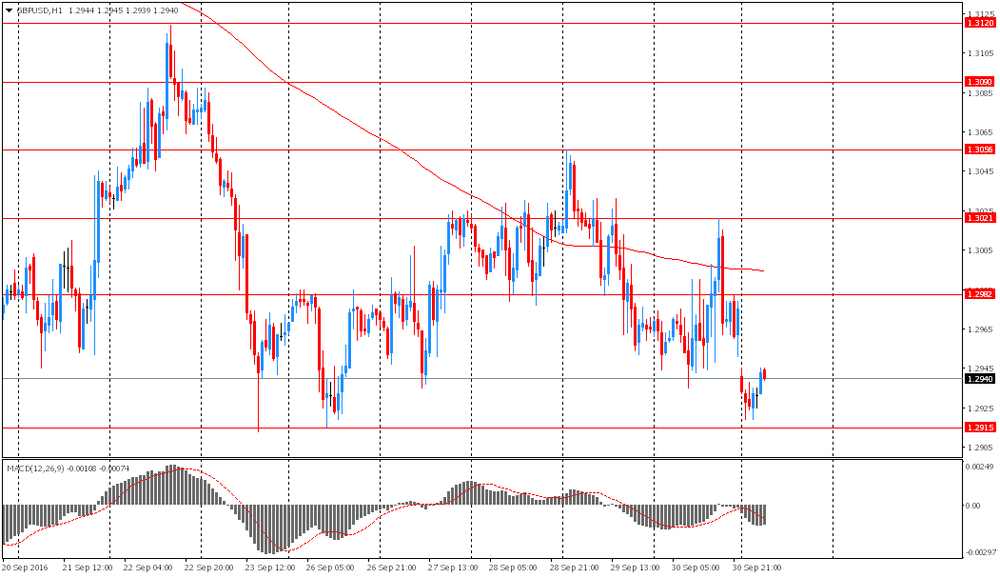

GBP / USD: during the European session, the pair fell to $ 1.2844

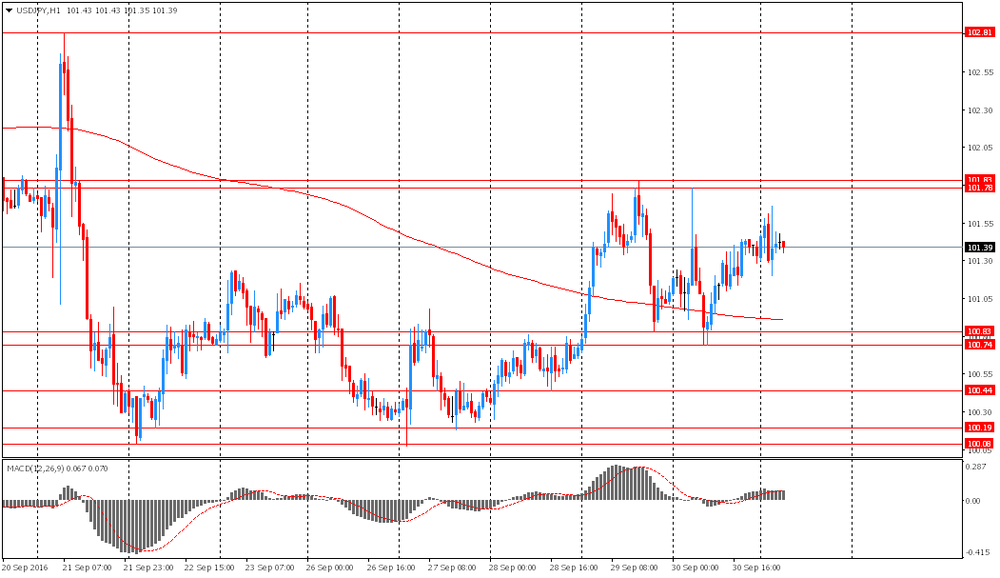

USD / JPY: during the European session, the pair traded in a narrow range

-

13:50

Orders

EUR/USD

Offers 1.1250 1.1280 1.1300 1.1320 1.1350

Bids 1.1220 1.1200 1.1185 1.1150-60 1.1125-301.1100 1.1080 1.1050

GBP/USD

Offers 1.2875-80 1.2900 1.2930 1.2950 1.2980 1.3000

Bids 1.2820-1.2800 1.2785 1.2750 1.2730 1.2700

EUR/GBP

Offers 0.8750 0.8765 0.8780 0.8800

Bids 0.8720 0.8700 0.8685 0.8650 0.8620 0.8600

EUR/JPY

Offers 114.20 114.50 114.75-80 115.00 115.35 115.50 116.00

Bids 113.50 113.35 113.00 112.50 112.25 112.00 111.85 111.50 111.00

USD/JPY

Offers 101.80 102.00 102.20 102.50 102.80 103.00

Bids 101.00 101.85 100.70 100.50 100.25 100.00-05

AUD/USD

Offers 0.7680 0.7700 0.7720 0.7750 0.7800

Bids 0.7635-40 0.7600 0.7585 0.7565 0.7550 0.7530 0.7500

-

12:57

UK financial minister Hammond: No ifs, no buts, no second referendum, we are leaving the EU

-

Brexit process will be complex

-

We have the skills and ingenuity to make an exit a success

-

Brexit will need meticulous planning and steely determination

-

We are entering EU negotiations with the economy fundamentally robust

*via forexlive

-

-

11:37

Bank of England Sees Risks of 'Sharp Adjustment' in U.K.Commercial Real Estate

-

11:15

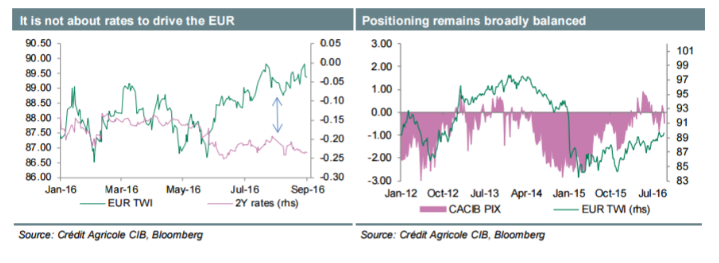

EUR: Stable This Week On Empty Calendar & Balanced Positioning - Credit Agricole

"Stabilising ECB rate expectations have been keeping the single currency broadly stable of late. Given an empty calendar when it comes to market moving data releases this is unlikely to change this week.

If anything there may be some focus on September PMI readings, which are likely to confirm moderately expanding business activity. However, considering it will be final readings, there is only limited surprise potential. In terms of speeches, ECB Governing Council Knot will be in focus. He is unlikely to make a case of changing monetary policy expectations. This in turn should leave the single currency driven by external factors such as global risk sentiment and Fed rate expectations.

Still, the main domestic risk may be related to the ongoing woes in the banking sector, including woes related to Deutsche Bank".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1175 (EUR 251m) 1.1200 611m) 1.1280 (334m) 1.1325 (368m)

USD/JPY: 100.00 (USD 486m) 100.90 (891m) 102.05-06 (1.34bln) 102.21 (540m) 102.30-35 (800m)

GBP/USD: 1.2975 (GBP 304m) 1.3100 (246m)

AUD/USD: 0.7600 (AUD 205m) 0.7640 (815m)

USD/CAD: 1.3000 (USD 301m) 1.3075 (260m) 1.3095 (416m) 1.3100 (792m) 1.3200 (440m)

NZD/USD: 0.7332 (NZD 225m)

AUD/JPY: 78.00 (AUD 460m)

-

10:37

UK manufacturing PMI better than forecast. Can it support the pound?

Conditions in the UK manufacturing sector continued to improve at the end of the third quarter. Rates of expansion in output and new orders accelerated further, rising at rates rarely achieved since the middle of 2014. The domestic market remained a prime driver of new business wins, while the weaker sterling exchange rate drove up new orders from abroad.

At 55.4 in September, up from 53.4 in August, the seasonally adjusted Markit/CIPS Purchasing Managers' Index® (PMI® ) rose to its highest level since June 2014. Furthermore, the rebound in the PMI level since its EU-referendum related low in July has been sufficient to make the third quarter average (52.3) the best during the year-to-date.

September saw manufacturing production expand at the quickest pace since May 2014. Growth was led by the consumer goods sector, where output rose at the quickest pace in one-and-a-half years. There were also substantial and accelerated increases at intermediate (11-month high) and investment (eight-month high) goods producers.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , September 55.4 (forecast 52.1)

-

10:00

Eurozone: Manufacturing PMI, September 52.6 (forecast 52.6)

-

09:57

German mafacturing activity stable compared to last month

September data signalled ongoing growth of German manufacturing, with the rate of improvement in the sector reaching a three-month high. This was highlighted by the final seasonally adjusted Markit/BME Germany Manufacturing Purchasing Managers' Index® (PMI® ) - a singlefigure snapshot of the performance of the manufacturing economy - rising from August's 53.6 to 54.3. The PMI has signalled growth in each of the past 22 months.

In response to rising demand, manufacturers scaled up their production volumes in September. The rate of increase was unchanged from August and solid overall. Survey data signalled that output expanded at consumer, intermediate and investment goods producers.

Some companies used existing stock in order to satisfy higher demand. This was signalled by a reduction in post-production inventories. Moreover, the rate at which stocks of finished goods fell was the most marked in over six-and-a-half years.

-

09:55

Germany: Manufacturing PMI, September 54.3 (forecast 54.3)

-

09:50

September saw an improved performance among Italy’s manufacturers - Markit

September saw an improved performance among Italy's manufacturers, although the overall picture remained one of only modest growth. Output rose at a slightly quicker rate than in August as new orders returned to expansion, led by a stronger increase in new business from abroad. The pace of job creation also quickened, though remained only moderate overall. Elsewhere, input price inflation was at a 14-month high but still muted by historical standards.

The headline Markit Italy Manufacturing Purchasing Managers' Index® (PMI® ) - a single-figure measure of developments in overall business conditions - moved to 51.0 September, improving on August's 49.8, which was the first sub-50 reading in over one-and-a-half years.

-

09:50

France: Manufacturing PMI, September 49.7 (forecast 49.5)

-

09:34

September saw growth momentum in the Spanish manufacturing sector - Markit

September saw growth momentum in the Spanish manufacturing sector recover somewhat as output, new orders and employment all rose at sharper rates than in August. Firms continued to display a preference for stock reduction, however. On the price front, the rate of cost inflation picked up but competitive pressures meant that output prices were reduced marginally.

The PMI rose to 52.3 in September, up from 51.0 in August and the highest since April. The reading signalled a solid monthly improvement in the health of the sector. Business conditions have now strengthened in each of the past 34 months.

-

09:30

Switzerland: Manufacturing PMI, September 53.2

-

09:14

Sterling Falls to 7-Week Low of 0.8720 Per Euro

-

08:45

Get Ready For Another Big Slide In Cable: Where To Target - CIBC

"Despite the fact that economic indicators have shown less of a slowdown than had been expected, the post-Brexit vote environment hasn't been particularly positive for sterling. The recent short-covering rally in sterling ran out of steam just shy of 1.35, with the currency retreating thereafter. With some of the more pessimistic forecasts calling for an outright recession in 2017, investors are still wary of the spectre of additional policy stimulus from the Bank of England. Despite criticism from a number of politicians, Governor Carney could still ease policy further should data disappoint.

As time has progressed, the likelihood of a so-called 'hard-Brexit' has increased. That situation would involve giving up single market access for control over immigration. While the Bank of England can't offset the long-term growth implications of such a scenario, it is increasing the chances that the MPC decides to take rates down to its effective lower bound of 0.10% in the coming months.

Markets are currently pricing in only a 25% chance of rate cut by year-end, leaving room for another cut to depress the currency. With the Chancellor giving a fiscal update on November 23rd, the precise timing of an interest rate cut is difficult to pin down. But whether the central bank eases ahead of that November fiscal update or waits until December, either outcome would see sterling weakening in the coming months".

CIBC targets GBP/USD at 1.25 by year-end.

Copyright © 2016 CIBC, eFXnews™

-

08:42

Asian session review: the yen little changed

The yen was trading subdued amid statistics published today. As it became known, the Tankan large manufacturers index, published by the Bank of Japan, and reflecting general business conditions for large Japanese manufacturing companies amounted to 6, which coincided with the value in the first quarter, but was lower than economists' forecast of 7. Tankan services sector fell to 18 from the previous value of 19. This index is an indicator of the growth of domestic demand and the health of non-tradable sector. Also,the all industries index grew by 6.3%, which is higher than the previous value of 6.2%, but below economists' forecast of 6.8%.

The pound has dropped significantly since the beginning of the session, after the British prime minister Theresa May said that Britain will begin the process of exit from the European Union no later than March 2017. The Prime Minister said that the exit from the EU is quite complex, and expressed the need to begin preparatory work with the remaining countries in the EU, so that when the time comes, the negotiation process will be smoother. "This is important not only for the UK, it is important for the whole of Europe, so we made the best of it, with the least problems for business", - she said.

In addition, this week, traders will be waiting for official data on the UK's service sector, industrial production and production in the manufacturing industry, which will be released on Friday. Economists polled by Wall Street Journal, expected that production in the manufacturing industry of Great Britain grew by 0.5% in August, after unchanged in July.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1225-40 range

GBP / USD: during the Asian session the pair fell to $ 1.2920

USD / JPY: during the Asian session, the pair was trading in the Y101.20-65 range

-

08:34

Moody's: Japan policy stimulus will support growth, medium-term challenges remain

Moody's Japan K.K. has released its latest issue of Inside Japan, which says that persistent low economic growth and inflation in Japan (A1 stable) has prompted a shift toward greater monetary and fiscal accommodation, and led the rating agency to raise its forecasts for real GDP growth to 0.7% this year and 0.9% in 2017, following a 0.5% increase in 2015.

Moody's says the delay in the consumption tax hike and the implementation of additional fiscal stimulus, alongside the Bank of Japan's new monetary framework unveiled on 21 September, are the latest policy measures aimed at reviving economic growth and inflation, while providing room for structural reforms, such as increasing labor force participation.

But the positive impact of these structural reforms will be set against intensifying pressures on growth and fiscal expenditure from an aging population.

In the absence of a marked boost to growth from structural reform, we estimate that Japan's already high debt burden will further edge up over the next decade.

Moody's conclusions are contained in the latest edition of its "Inside Japan" publication. Moody's bi-annual compendium includes recent key research and commentaries published, as well as a list of recent rating actions across all sectors in Japan.

Moody's report also includes the press release on its affirmation of Japan's A1 sovereign rating on 30 August, which reflected (1) the slow but continuing progress in developing a policy and reform framework which could ultimately reflate the Japanese economy and reverse the rise in government debt and (2) its expectation that funding costs for the government will remain low and stable.

In addition to the sovereign update, Moody's compendium aggregates a selection of recently published sovereign, corporate finance, financial institution and structured finance key research pieces.

-

08:32

Former Bank of Japan board member, Nobiyuki Nakahara: the control of bond yields is a mistake

Today, a former BoJ's board member and part-time assistant to Prime Minister Abe, Mr. Nakahara Nobiyuki stated his disagreement with the changes made at the last meeting of the Bank of Japan. The official spoke out against the fact that the central element of the easing policy was to control bond yields.

-

08:28

German minister accuses Deutsche Bank of making speculation its business - Reuters

-

08:23

Australian manufacturing stabilises in September

-

After a sharp drop in August, the Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI® ) increased by 2.9 points to a broadly stable 49.8 points in September (results below 50 indicate contraction, the distance from 50 points indicates the strength of contraction).

-

The stabilisation in the Australian PMI® in September was heavily influenced by activity in the food & beverages sub-sector which recovered after contracting in August. This key sector (now contributing around 28% of all manufacturing output) appears to have addressed the factors that drove a contraction in production and sales in August.

-

Three of the seven activity sub-indexes in the Australian PMI® expanded in September after contracting in August. Production (52.6 points), deliveries (56.4 points) and sales (51.4 points) expanded and exports stabilised (50.0 points). Employment (46.7 points) and stocks (44.3 points) contracted again. New orders slipped into contraction (48.3 points).

-

-

08:20

UK to trigger Article 50 by end-March 2017. GBP/USD gaps down after opening. Sell the rumors, buy the facts?

-

08:16

Japan's manufacturing activity expanded for the first time in seven months

According to rttnews, Japan's factory activity expanded for the first time in seven months in September, though marginally, survey figures from Markit Economics showed Monday.

The Nikkei Manufacturing Purchasing Managers' Index rose to 50.4 in September from 49.5 in August. Any reading above 50 indicates expansion in the sector, while a score below 50 suggests contraction.

Output grew for the second consecutive month in September, while new orders declined at a slower pace. As a result, firms raised their staffing levels during the month, with the rate of job creation picking up slightly.

On the price front, both input and output prices decreased further in September.

-

07:09

Options levels on monday, October 3, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1367 (4464)

$1.1334 (3055)

$1.1287 (1020)

Price at time of writing this review: $1.1234

Support levels (open interest**, contracts):

$1.1181 (3907)

$1.1140 (4461)

$1.1094 (5082)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 38847 contracts, with the maximum number of contracts with strike price $1,1500 (6175);

- Overall open interest on the PUT options with the expiration date October, 7 is 39189 contracts, with the maximum number of contracts with strike price $1,1100 (5082);

- The ratio of PUT/CALL was 1.01 versus 1.03 from the previous trading day according to data from September, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.3201 (1441)

$1.3103 (1458)

$1.3006 (801)

Price at time of writing this review: $1.2939

Support levels (open interest**, contracts):

$1.2897 (1410)

$1.2799 (1731)

$1.2700 (1425)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 27990 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22994 contracts, with the maximum number of contracts with strike price $1,3000 (3363);

- The ratio of PUT/CALL was 0.82 versus 0.84 from the previous trading day according to data from September, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Japan: Manufacturing PMI, September 50.4 (forecast 50.3)

-

01:50

Japan: BoJ Tankan. Non-Manufacturing Index, Quarter III 18 (forecast 18)

-

01:50

Japan: BoJ Tankan. Manufacturing Index, Quarter III 6 (forecast 7)

-

00:59

Currencies. Daily history for Sep 30’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1210 -0,28%

GBP/USD $1,2842 -1,04%

USD/CHF Chf0,9734 +0,22%

USD/JPY Y101,63 +0,30%

EUR/JPY Y113,94 +0,03%

GBP/JPY Y130,5 -0,75%

AUD/USD $0,7676 +0,23%

NZD/USD $0,7274 -0,12%

USD/CAD C$1,3115 -0,09%

-

00:30

Australia: AIG Manufacturing Index, September 49.8

-

00:04

Schedule for today,Monday, Oct 03’2016

00:30 Japan Manufacturing PMI (Finally) September 49.5 50.3

07:15 Switzerland Retail Sales (MoM) August 0.2%

07:15 Switzerland Retail Sales Y/Y August -2.2%

07:30 Switzerland Manufacturing PMI September 51

07:50 France Manufacturing PMI (Finally) September 48.3 49.5

07:55 Germany Manufacturing PMI (Finally) September 53.6 54.3

08:00 Eurozone Manufacturing PMI (Finally) September 51.7 52.6

08:30 United Kingdom Purchasing Manager Index Manufacturing September 53.3 52.1

13:45 U.S. Manufacturing PMI (Finally) September 52 51.4

14:00 U.S. Construction Spending, m/m August 0% 0.2%

14:00 U.S. ISM Manufacturing September 49.4 50.3

20:00 U.S. Total Vehicle Sales, mln September 16.98 17.3

-