Noticias del mercado

-

17:52

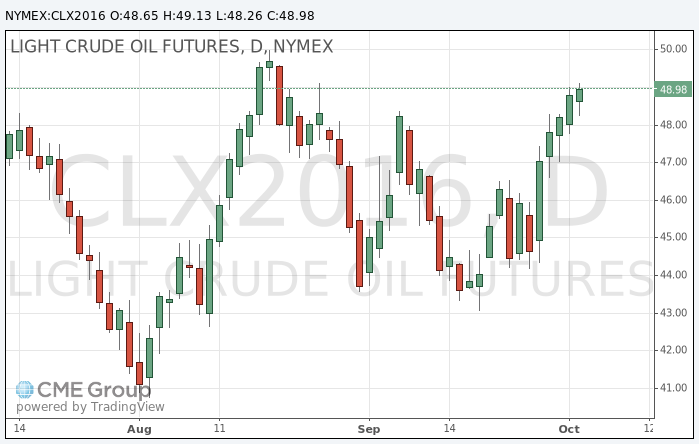

Oil prices rose today

Oil prices rose slightly, although earlier in the day they traded almost unchanged. Investors assessed the ability of OPEC to cut oil production.

Oil quotes are supported in connection with the arrangements of the Organization of Petroleum Exporting Countries (OPEC) to cut production to 33 - 32.5 million barrels per day. Oil prices are roughly 9% higher since the end of the OPEC meeting in Algeria. Opinions of investors about the prospects of a cartel deal are now a major force in the market, said Scott Shelton of ICAP PLC.

Although many investors doubt the success of the OPEC agreement, less skeptical market participants point to the increasing pressure on other members of the cartel on the part of Saudi Arabia, its actual leader.

"The economic and geopolitical issues have reached a critical point, which could lead to major geopolitical differences between the Middle East countries, - wrote in a note chief market economist at First Standard Financial Peter Cardillo -. We believe that to the news should be treated with care. "

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 49.13 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 51.37 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:41

ECB said to near consensus on need to taper QE before it concludes - Forexlive. EUR/USD up 50 pips instantly

-

17:26

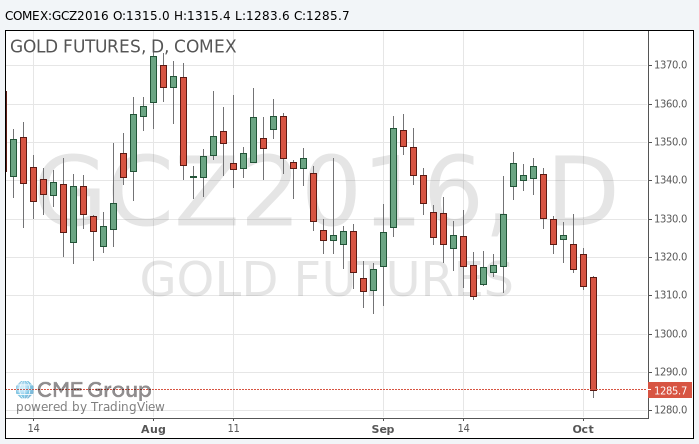

Gold fell sharply

Gold becomes cheaper breaking $ 1,300 and approaching the 24 June low, after strong manufacturing data from the United States and hawkish comments that strengthen expectations that the Fed will raise interest rates by year end.

The dollar index has nearly reached the two-week high.

Gold remained within the range of $ 1.300- $ 1.350 in the last six weeks, and traders are waiting for important US data this week.

"We are waiting for employment data on Friday, so that many will be cautious before, - said Afshin Nabavi, the MKS chief trader.

Although data on Monday showed growth in the US manufacturing activity in September, reinforced bets that the Fed will tighten at the December meeting of policy officials US central bank remained cautious.

The Fed probably will not be able to hike interest rates as aggressively as in previous times, said on Monday the president of the Federal Reserve Bank of New York William Dudley.

China's markets are closed from 1 to 9 October for holidays.

The cost of December futures on COMEX fell to $ 1283.6 per ounce.

-

16:34

NZD/USD falls after GlobalDairyTrade auction results

The cost of dairy products fell by 3.0% after it grew by 1.7% in the previous auction. It is worth emphasizing the fall in prices was recorded for the first time since August. Auction results also showed that the rate of milk powder decreased by 3.8%.

Dairy products make up a significant proportion of New Zealand's exports, so the dynamics of their prices has a direct impact on the New Zealand dollar. After the announcement of the results NZD / USD is down 0.40%.

-

15:53

IMF Forecasts Global Growth to Rise to 3.4% in 2017

-

Secular Stagnation Risks Dragging Down Economy

-

Rise in Protectionism Could Hurt Global Growth

-

Cuts UK 2017 Growth Forecast, Citing Brexit Headwinds

-

Raises U.K. Growth Forecast for This Year, but Lowers Outlook for 2017

-

-

15:50

Business conditions across New York City remained largely steady in September

According to Dow Jones, business conditions across New York City remained largely steady in September from August, but an employment measure dropped to a level not seen since the aftermath of the financial crisis, according to the New York chapter of the Institute for Supply Management.

The organization said its seasonally adjusted employment index fell to 33.9 in September, down from 54.9 in August and 44.9 in September of last year. Results below 50 represent contracting activity.

Its headline current business conditions index, based on a survey of companies across New York City, increased to just below break-even at 49.6 up from 47.5 in August.

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1150 (EUR 248m) 1.1170-80 (429m) 1.1325 (248m) 1.1350 (717m) 1.1485 (200m)

USDJPY: 100.00 (USD 1.64bln) 102.10 (300m) 102.20 (210m) 103.40 (400m)

GBPUSD: 1.2950 (GBP 301m)

USDCHF 0.9800 (USD 375m)

AUDUSD: 0.7450 (AUD 404m) 0.7700-01 (538m)

USDCAD: 1.2950 (USD 330m) 1.3075 (260m) 1.3095 (416m)1.3100 (792m)1.3200 (440m)

-

15:49

ECB Officials Express Concerns Over Effect of Negative Rates on Lending

-

15:23

-

14:37

FOMC, Lacker: Prudent Pre-emptive Action Can Help Avoid Troubling Situations

-

Slow Output Growth Behind Dissatisfaction

-

'Strong Case' for Raising Rates

-

-

14:23

European session review: the dollar rose significantly against the majors

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK index of business activity in the construction sector, m / m in September 49.2 49 52.3

9:00 Eurozone Producer Price Index m / m in August of 0.3% -0.1% -0.2%

9:00 Eurozone Producer Price Index y / y in August -2.6% -2.1% -2.1%

The euro depreciated strongly against the US dollar, updating Sept 30 low on high demand for the US currency. However, some influenced had the statement by the representative of the ECB Peter Praet, as well as statistical data for the euro area. During his speech, Pret noted that long-term drop in the shares of banks may begin to contain the euro zone lending to companies and individuals. In general, his statements underscore the concern of the Central Bank measures on the banking system. "It is important to continue to monitor the impact of the ECB's policy on the state and prospects of the banking system", - said Praet. - Does the ECB policy instruments correction should be aimed at supporting the economy as a whole, but not to deprive the banks incentives to lend. However, I expect that very low interest rates will persist for a long time. "

With regard to the data reported by Eurostat in August, producer prices in the euro area decreased by 0.2%. Analysts had expected a decline of 0.1%. Among the 28 EU countries was also recorded a drop of 0.2%. In July, prices rose by 0.3% in the euro area and the EU. In annual terms, the producer price index fell by 2.1% in the euro area and by 1.6% in the EU. Changes were in line with expectations. In addition, the rate of decline in prices in the euro area slowed down compared to July, when the recession was seen at 2.8%. The largest price decline compared with July was noted in the Netherlands (-1.9%), Croatia (-1.4%), Ireland (-1.1%) and Hungary (-1.0%). Prices rose in Latvia (+ 0.9%), Sweden (+ 0.4%), and Cyprus (+ 0.2%).

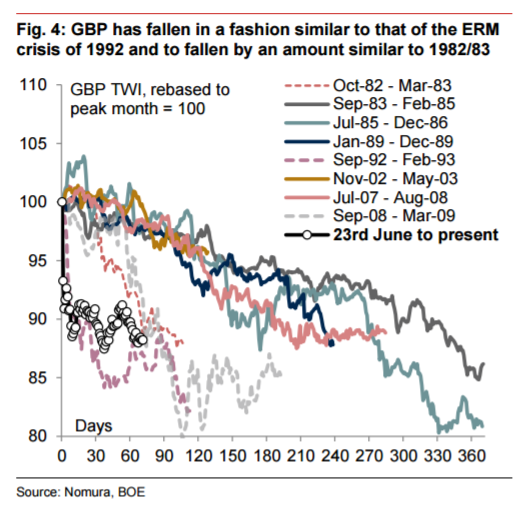

The British pound dropped significantly against the US dollar, updating the 31-years low, move caused by increasing concerns about Brexit, as well as large-scale strengthening of the American currency. Experts point out that investors continue selling the pound after the statements of UK's PM. Recall, May reported that the authorities intend to triger Article 50 of the agreement with the EU before the end of March 2017.

Little support for the pound had statistics for the construction sector in Britain. The index of business activity in the construction sector rose to 52.3 points from 49.2 points in August. Experts predicted that the rate will drop to 49.0 points. The index rose above 50 points for the first time in four months. Nevertheless, the growth rates were lower than the average for the entire research history (54.6 points). "A number of respondents noted that Brexit uncertainty declined among customers, although these concerns were a factor in the continuing decline in commercial construction work", - said Tim Moore, senior economist at IHS Markit.

EUR / USD: during the European session, the pair fell to $ 1.1148

GBP / USD: during the European session, the pair fell to $ 1.2732

USD / JPY: during the European session, the pair rose to Y102.59

-

13:50

Orders

EUR/USD

Offers 1.1200 1.1220 1.1250 1.1280 1.1300 1.1320 1.1350

Bids 1.1175-80 1.1150-60 1.1125-301.1100 1.1080 1.1050

GBP/USD

Offers 1.2820 1.2850 1.2875-80 1.2900 1.2930 1.2950

Bids 1.2780 1.2750 1.2730 1.2700

EUR/GBP

Offers 0.8765 0.8780 0.8800 0.8825-30 0.8850

Bids 0.8720 0.8700 0.8685 0.8650 0.8620 0.8600

EUR/JPY

Offers 114.75-80 115.00 115.35 115.50 116.00

Bids 114.20 114.00 113.80 113.50 113.35 113.00 112.50

USD/JPY

Offers 102.50 102.80 103.00 103.30 103.50 103.75-80 104.00

Bids 102.00 101.85 100.70 100.50 100.25 100.00-05

AUD/USD

Offers 0.7700 0.7720 0.7750 0.7800

Bids 0.7635-40 0.7600 0.7585 0.7565 0.7550 0.7530 0.7500

-

13:25

India Cuts Key Rates Unexpectedly - Rttnews

Reserve Bank of India's newly appointed Governor Urjit Patel cut the key interest rates unexpectedly on Tuesday.

At the first monetary policy committee meeting of RBI, policymakers unanimously decided to reduce the benchmark lending rate, the repo, to 6.25 percent from 6.50 percent. Consequently, the reverse repo rate was adjusted to 5.75 percent.

The repo rate was previously lowered by a quarter-basis point in April. The bank has cut the rates by a cumulative 175 basis points since 2015.

The bank said the decision taken by the MPC is consistent with an accommodative monetary policy stance in consonance with the objective of achieving consumer price index inflation at 5 percent by the fourth quarter of 2016-17.

The momentum of growth is expected to quicken with a normal monsoon raising agricultural growth and rural demand, the bank said. The RBI maintained its growth outlook at 7.6 percent for 2016-17.

The MPC envisaged a trajectory taking headline CPI inflation towards a central tendency of 5 percent by March 2017, with risks tilted to the upside.

-

12:43

Major stock indices in Europe showing gains

European stocks traded higher, while Britain's FTSE 100 for the first time since June 1 2015 has reached 7000 points on the background of GBP's collapse.

Pound remains under pressure due to the statements of British Prime Minister Theresa May. On Sunday, she said that intended to triger Article 50 of the Lisbon Treaty until the end of March 2017.

Market participants also analyzed recent economic data for the euro zone and Britain. Report submitted by Markit Economics and CIBS, showed that the UK construction sector expanded, mainly due to a marked increase in activity in the residential segment. The index of business activity in the construction sector rose to 52.3 points from 49.2 points in August. Experts predicted that the rate will drop to 49.0 points. The index rose above 50 points for the first time in four months. Nevertheless, the growth rates were lower than the average for the entire research history (54.6 points). "A number of respondents noted that Brexit uncertainty declined among customers, although these concerns were a factor in the continuing decline in commercial construction work", - said Tim Moore, senior economist at IHS Markit.

Meanwhile, Eurostat reported that in August producer prices in the euro area decreased by 0.2%. Analysts had expected a decline of 0.1%. Among the 28 EU countries was also recorded a drop of 0.2%. In July, prices rose by 0.3% in the euro area and the EU. In annual terms, the producer price index fell by 2.1% in the euro area and by 1.6% in the EU. Changes were in line with expectations. In addition, the rate of decline in prices in the euro area slowed down compared to July, when the recession was seen at 2.8%. The largest price decline compared with July was noted in the Netherlands (-1.9%), Croatia (-1.4%), Ireland (-1.1%) and Hungary (-1.0%). Prices rose in Latvia (+ 0.9%), Sweden (+ 0.4%), and Cyprus (+ 0.2%).

The composite index of the largest companies in the region Stoxx Europe 600 up by 0.8 percent. German markets, which were closed yesterday for a national holiday, reopened today, and Deutsche Bank was again in the center of attention.

Shares of Deutsche Bank rose 0.6 percent. Recall, on Friday, stock fell to a record low, but then partially recovered amid expectations of a deal with the US authorities. However, negotiations are ongoing, and no agreement has been reached. However, today HSBC experts have lowered target price Deutsche Bank shares.

Quotes of ABB rose 0.5 percent, as the company announced a share buy-back scheme, totaling $ 3 billion in the period from 2017 to 2019.

Vivendi shares rose 2.1 percent, as Deutsche Bank raised the target price for the stock.

At the moment:

FTSE 100 +113.05 7096.57 + 1.62%

DAX +58.13 10569.15 + 0.55%

CAC 40 +38.65 4492.21 + 0.87%

-

12:13

ECB Praet: The banking system of the euro area is stronger than before the financial crisis

-

Eurozone banks are facing serious challenges in regard to profitability

-

further consolidation of banks in the euro zone needed

-

i would like to see more international bank mergers

-

interest rates will remain low for an extended period

-

there is no clear evidence that the profitability of the banks affected by the ECB's measures

-

sustainable drop in shares of banks may restrict lending

-

it is important to monitor the impact of the ECB's measures on banks

-

-

12:10

-

11:11

Industrial producer prices down 0.2% in Euro Zone

In August 2016, compared with July 2016, industrial producer prices fell by 0.2% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In July 2016 prices increased by 0.3% in both zones. In August 2016, compared with August 2015, industrial producer prices decreased by 2.1% in the euro area and by 1.6% in the EU28.

The 0.2% decrease in industrial producer prices in total industry in the euro area in August 2016, compared with July 2016, is due to price falls of 0.8% in the energy sector and of 0.1% for intermediate goods, while prices remained stable for both capital goods and durable consumer goods and increased by 0.1% for non-durable consumer goods. Prices in total industry excluding energy remained stable.

-

11:00

Eurozone: Producer Price Index, MoM , August -0.2% (forecast -0.1%)

-

11:00

Eurozone: Producer Price Index (YoY), August -2.1% (forecast -2.1%)

-

10:52

Oil is trading lower

This morning, the New York futures for Brent have fallen 0.53% to $ 48.55 and crude oil futures for WTI down 0.35% to $ 50.71 per barrel. Thus, the black gold is traded in the red zone because traders are awaiting the release of data on oil reserves in the key US markets as Chinese markets are closed due to holidays.

Today, the American Petroleum Institute will publish the assessment of stocks of crude oil and petroleum products in the United States, and on Wednesday we have data from the US Department of Energy, for which traders are watching with great interest.

Yesterday the price of oil hovered near its highest level in three months, as OPEC continues to provide optimism in the market.

-

10:33

UK’s construction sector rebounds strongly in September - Markit

September data highlighted an upturn in business activity across the UK construction sector for the first time since May, primarily driven by a recovery in residential building. New orders also rebounded during September, which ended a four-month period of sustained decline.

Survey respondents cited improving confidence among clients and a reduced drag on demand from Brexit-related uncertainty. Reflecting this, construction firms indicated a further recovery in their business expectations for the next 12 months, with optimism the strongest since May. Just under half of the survey panel (45%) forecast a rise in output over the year ahead, while only 9% anticipate a reduction. However, the degree of confidence remained softer than that seen at the start of 2016.

Adjusted for seasonal influences, the Markit/CIPS UK Construction Purchasing Managers' Index® (PMI® ) registered 52.3 in September, up from 49.2 in August and above the 50.0 no-change value for the first time in four months. The latest reading was well above July's seven-year low and indicated the fastest rise in construction output since March. The pace of expansion was nonetheless still softer than the long-run survey average (54.6).

-

10:30

United Kingdom: PMI Construction, September 52.3 (forecast 49)

-

10:13

GBP: A Strategy For A 'Big If' Trade - Nomura

"Reminded that the single market access is important, but not on top.

The speech by Theresa May over the weekend told us that the timing of Article 50 is to be "no later than the end of March next year." This provided clarity as to when, but was not much of a surprise given several reports that alluded to that possibility in the weeks prior. The market view this morning was that the big themes of Brexit were touched on and offered little hope of a single market access outcome, given the emphasis on immigration and sovereignty controls used.

GBP continues to be a difficult market to trade, with political headlines causing the recent fall but also a deterioration of wider market risk sentiment perhaps playing part of the trend lower.

If the negative European financial developments continue, this could accelerate GBP weakness, especially against USD, while the US political risk declined somewhat after the first debate (still uncertain, though).

Assuming a widespread market tail risk event doesn't materialize (also a big IF), given these low levels the value trade remains to hold Long GBP in the medium term; however, timing remains important, as we remain in a range-bound environment whilst the Tory party conference is not yet over, so we would wait for the dust to settle before doing so and look to see how Services PMI is on Wednesday".

Copyright © 2016 Nomura, eFXnews™

-

10:01

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1150 (EUR 248m) 1.1170-80 (429m) 1.1325 (248m) 1.1350 (717m) 1.1485 (200m)

USD/JPY: 100.00 (USD 1.64bln) 102.10 (300m) 102.20 (210m) 103.40 (400m)

GBP/USD: 1.2950 (GBP 301m)

USD/CHF 0.9800 (USD 375m)

AUD/USD: 0.7450 (AUD 404m) 0.7700-01 (538m)

USD/CAD: 1.2950 (USD 330m) 1.3075 (260m) 1.3095 (416m)1.3100 (792m)1.3200 (440m)

-

09:49

UK Prime Minister, May: government will be ambitious in Brexit negotiations with EU

-

important to set out timing for Article 50 to reassure business

-

Brexit process will not be plain sailing for the economy

-

business wants a smooth transition out of EU

-

number of countries saying they want a trade deal with UK post-Brexit

-

wants to see "special relationship" with the US continuing

*via forexlive

-

-

09:45

Major stock exchanges began trading in the green zone: FTSE + 0.65% near session highs as GBP falls. Exporters finding favour, DAX + 0.55%, CAC40 + 0.45%, FTMIB + 0.5%, IBEX + 0.5%

-

09:28

Spanish unemployment increased in September

The number of unemployed registered at the offices of the Public Employment Services has increased by 22,801 people in September over the previous month. In the last 8 years in this month registered unemployment increased by an average of 58,835 people Thus, the total number of registered unemployed stood at 3,720,297, and continues at lower levels of the last 7 years. In seasonally adjusted terms, unemployment is reduced by 16,906 people in September. The monthly variation of the seasonally adjusted unemployment has fallen in 40 of the last 41 months. In the last year unemployment has fallen by 373,745 people.

-

08:49

New multi-year low for GBP/USD (31 years low)

-

08:37

Gold Longs At Risk Of Pending Breakdown: Levels & Targets - BofA Merrill

"Spot gold prices continue to consolidate after an impressive 30% rally from the December 2015 lows. Chart 4 shows price is sitting on support at a year to date trend line. A close below this suggests a correction to follow. However the last few corrective moves have been bought at 1300. And so 1300, in our view, must break to have a higher conviction of a decline and may be where the stops are.

Longs have long been stretched - it could be fast A break below 1300 is tactically bearish and implies a correction to the 38.2% retracement of 1250. A larger shift in positioning could lead to 1210. This year dips in gold have been bought. Near term macro events in Q4 could continue to result in buyers of gold on the dip.

Gold Q4 seasonals weak in short term, sideways long term Gold prices have had a tough time during Q4 for the past five years. However during the prior 10 and past 30 yearsl, the trend is range bound and choppy".

Copyright © 2016 BofAML, eFXnews™

-

08:31

Options levels on tuesday, October 4, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1320 (3307)

$1.1292 (2179)

$1.1265 (1020)

Price at time of writing this review: $1.1186

Support levels (open interest**, contracts):

$1.1140 (4503)

$1.1095 (5012)

$1.1047 (4720)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 38944 contracts, with the maximum number of contracts with strike price $1,1500 (6175);

- Overall open interest on the PUT options with the expiration date October, 7 is 39181 contracts, with the maximum number of contracts with strike price $1,1100 (5012);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from October, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.3101 (1431)

$1.3002 (1173)

$1.2905 (718)

Price at time of writing this review: $1.2819

Support levels (open interest**, contracts):

$1.2797 (1175)

$1.2699 (1421)

$1.2599 (710)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 29396 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 21867 contracts, with the maximum number of contracts with strike price $1,3000 (3285);

- The ratio of PUT/CALL was 0.74 versus 0.82 from the previous trading day according to data from October, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:28

New Zeeland: 26% of firms expecting improved economic conditions over the coming months

The latest NZIER Quarterly Survey of Business Opinion shows a further strengthening in business confidence over the September quarter, with a net 26 percent of firms expecting improved economic conditions over the coming months.

The improvement in confidence was broad-based across most regions, with optimists outnumbering pessimists in dairy-intensive regions such as Taranaki and Southland. The recent increase in global dairy prices and subsequent upward revision by Fonterra to its dairy payout forecast have reduced the risks to the dairy sector and boosted confidence. Nonetheless, confidence remains strongest in tourism-intensive regions such as Auckland, Otago and the Bay of Plenty.

Firms are also expecting a strong lift in demand in their own business, with a net 32 percent expecting an improvement in own trading activity over the next quarter - the highest level since mid-2014.

-

08:24

Aussie building approvals index improves in August

The number of dwellings approved, in trend terms, rose 0.6 per cent in August 2016 and has risen for nine months, according to data released by the Australian Bureau of Statistics (ABS) today.

Dwelling approvals, in trend terms, increased in New South Wales (1.9 per cent), Victoria (1.2 per cent) and Queensland (0.3 per cent). They decreased in the Northern Territory (14.9 per cent), South Australia (4.3 per cent), Tasmania (4.1 per cent) and Western Australia (1.2 per cent), and were flat in the Australian Capital Territory.

In trend terms, approvals for private sector houses fell 1.0 per cent in August. Private sector house approvals fell in South Australia (3.0 per cent), New South Wales (1.4 per cent), Western Australia (1.2 per cent), Queensland (1.1 per cent) and Victoria (0.4 per cent).

In seasonally adjusted terms, dwelling approvals decreased 1.8 per cent in August, driven by a fall in total other residential dwellings (2.5 per cent). Total house approvals fell 0.9 per cent.

The value of total building approved fell 0.1 per cent in August, in trend terms, after rising for eight months. The value of residential building rose 0.7 per cent while non-residential building fell 1.8 per cent.

-

08:19

RBA holds rates at +1.50%. AUD unchanged

According to rttnews, Australia maintained its record-low interest rate as policymakers await to see the impact of previous reductions.

The board of the Reserve Bank of Australia led by new governor Philip Lowe decided to keep the benchmark rate unchanged at a record low of 1.50 percent.

The outcome of the meeting came in line with expectations. The bank had reduced the rate by 25-basis points each in August and May.

"Taking account of the available information, and having eased monetary policy at its May and August meetings, the Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time," the bank said.

Since the move in August the only real candidate for another move was going to be November when fresh information on inflation would be available and the Bank would have the opportunity to justify any move with its revised forecasts, Bill Evans, chief economist at Westpac Institutional Bank, said.

The economist see no significant change in the outlook for inflation. Consequently, Evans said prospects for a rate cut at the November Board meeting is remote.

-

07:16

Japan: Consumer Confidence, September 43.0 (forecast 41.8)

-

05:30

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-

02:31

Australia: Building Permits, m/m, August -1.8% (forecast -7%)

-

02:30

Australia: ANZ Job Advertisements (MoM), September -0.3%

-

00:28

Currencies. Daily history for Oct 03’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1241 +0,20%

GBP/USD $1,2975 +0,08%

USD/CHF Chf0,9713 +0,56%

USD/JPY Y101,33 +0,24%

EUR/JPY Y113,91 +0,45%

GBP/JPY Y131,48 +0,31%

AUD/USD $0,7658 +0,35%

NZD/USD $0,7283 +0,41%

USD/CAD C$1,3127 -0,16%

-

00:00

Schedule for today,Tuesday, Oct 04’2016

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) September 1.8%

00:30 Australia Building Permits, m/m August 11.3% -7%

01:30 New Zealand RBNZ Governor Graeme Wheeler Speaks

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

03:30 Australia RBA Rate Statement

05:00 Japan Consumer Confidence September 42

08:30 United Kingdom PMI Construction September 49.2

09:00 Eurozone Producer Price Index, MoM August 0.1%

09:00 Eurozone Producer Price Index (YoY) August -2.8%

22:30 Australia AIG Services Index September 45

-