Noticias del mercado

-

21:03

DJIA 18125.41 -128.44 -0.70%, NASDAQ 5274.12 -26.76 -0.50%, S&P 500 2144.85 -16.35 -0.76%

-

18:00

European stocks closed: FTSE 7074.34 90.82 1.30%, DAX 10619.61 108.59 1.03%, CAC 4503.09 49.53 1.11%

-

17:56

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed in choppy trading on Tuesday. The markets lost momentum after the International Monetary Fund (IMF) lowered its growth forecast for the U.S. economy to 1.6% from 2.2% this year.

Most of Dow stocks in positive area (20 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.74%). Top loser - 3M Company (MMM, -0.91%).

Most of S&P sectors also in positive area. Top gainer - Financial (+0.4%). Top loser - Utilities (-1.3%).

At the moment:

Dow 18164.00 +8.00 +0.04%

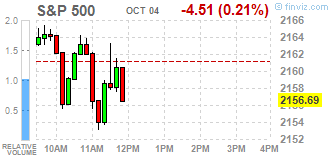

S&P 500 2151.75 -1.50 -0.07%

Nasdaq 100 4868.25 +2.50 +0.05%

Oil 48.84 +0.03 +0.06%

Gold 1279.40 -33.30 -2.54%

U.S. 10yr 1.65 +0.03

-

17:31

WSE: Session Results

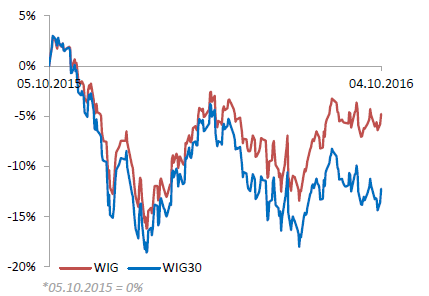

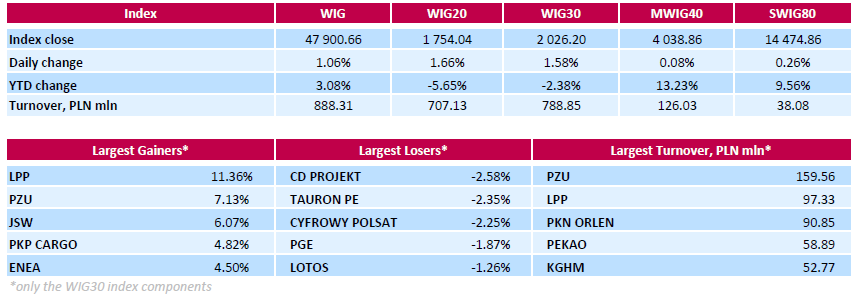

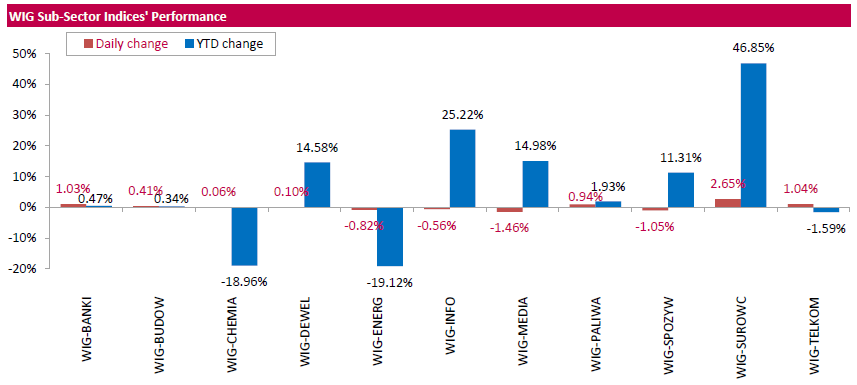

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, added 1.06%. Sector-wise, materials (+2.65%) fared the best, while media (-1.46%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, advanced 1.58%. Clothing retailer LPP (WSE: LPP) kept its position as a growth leader among the large-cap stocks, gaining a further 11.36%. Overall, the retailer added more than 27% after two consecutive days of growth, triggered by strong sales data. It was followed by insurer PZU (WSE: PZU), jumping by 7.13%. The company published its new dividend policy, assuming payouts of at least 50% of its consolidated attributable net profit in 2016-2020. Other major advancers were railway freight transport operator PKP CARGO (WSE: PKP), genco ENEA (WSE: ENA) and two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), surging by 4.19%-6.07%. On the other side of the ledger, the session's biggest laggards were videogame developer CD PROJEKT (WSE: CDR), genco TAURON PE (WSE: TPE) and media group CYFROWY POLSAT (WSE: CPS), dropping by 2.58%, 2.35% and 2.25% respectively.

-

15:53

WSE: After start on Wall Street

Into the final phase of the session we enter with an interesting picture of a fairly active trading as at the last standards and overcoming barriers of 1,750 points in the case of the WIG20 index.

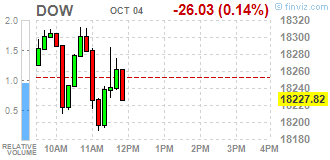

The market in the United States opened with a slight increase of 0.14%, which changes little in the consolidation scheme on the main chart of Wall Street. At the same time it is difficult to assume that there will be more changes today. Stronger than yesterday dollar may slightly cool the ardor of buyers. At the same time tomorrow will begin a play under Friday's data. Quite better looks European market, where indexes in the afternoon phase came to new highs of the session.

An hour before the close of trading, the WIG20 index was at the level of 1,754 points (+1,67%) and with impressive turnover of PLN 525 mln.

-

15:34

U.S. Stocks open: Dow +0.18%, Nasdaq +0.30%, S&P +0.15%

-

15:27

Before the bell: S&P futures +0.01%, NASDAQ futures +0.11%

U.S. stock-index futures were little changed as investors weighed hawkish comments from Federal Reserve officials against muted prospects for growth in the world's largest economy.

Global Stocks:

Nikkei 16,735.65 +136.98 +0.83%

Hang Seng 23,689.44 +105.01 +0.45%

Shanghai Closed

FTSE 7,105.12 +121.60 +1.74%

CAC 4,504.71 +51.15 +1.15%

DAX 10,591.78 +80.76 +0.77%

Crude $448.63 (+0.37%)

Gold $1296.90 (-1.20%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.06

-0.06(-0.5929%)

7867

Amazon.com Inc., NASDAQ

AMZN

839.5

2.76(0.3299%)

20154

Apple Inc.

AAPL

112.6

0.08(0.0711%)

46624

AT&T Inc

T

40.82

0.05(0.1226%)

1842

Barrick Gold Corporation, NYSE

ABX

16.9

-0.49(-2.8177%)

184425

Chevron Corp

CVX

102.99

0.54(0.5271%)

1419

Facebook, Inc.

FB

129.01

0.24(0.1864%)

34909

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.62

-0.07(-0.6548%)

60307

General Electric Co

GE

29.66

0.02(0.0675%)

10023

Goldman Sachs

GS

161.21

0.14(0.0869%)

200

Google Inc.

GOOG

774.8

2.24(0.2899%)

2709

Home Depot Inc

HD

128.8

0.30(0.2335%)

277

JPMorgan Chase and Co

JPM

66.13

0.10(0.1514%)

3800

Microsoft Corp

MSFT

57.43

0.01(0.0174%)

2812

Nike

NKE

52.98

0.31(0.5886%)

2010

Starbucks Corporation, NASDAQ

SBUX

53.9

0.06(0.1114%)

1501

Tesla Motors, Inc., NASDAQ

TSLA

212.78

-0.92(-0.4305%)

15959

The Coca-Cola Co

KO

42.09

0.06(0.1428%)

5463

Twitter, Inc., NYSE

TWTR

23.77

-0.23(-0.9583%)

175637

Verizon Communications Inc

VZ

51.92

0.04(0.0771%)

2461

Wal-Mart Stores Inc

WMT

72.2

0.19(0.2638%)

300

Yahoo! Inc., NASDAQ

YHOO

43.33

0.20(0.4637%)

249

Yandex N.V., NASDAQ

YNDX

21.61

-0.12(-0.5522%)

1178

-

13:08

WSE: Mid session comment

The first half of today's trading brought activity back to levels adequate for our market. In the segment of blue chips in the middle of trading we have approx. PLN 320 mln of turnover, and on the whole market PLN 400 million.

If we look at the behavior of the German Dax (+0.4 %) in recent quarters, it has nothing to do with the scheme and the behavior of the WIG20, what is a very big plus for our bulls. Finally, we may see an image of independence and the relative strength of our market.

Positively stand out quotation of earlier mentioned PZU (+4.83%) and LPP (+12.4%), which continues its spectacular rally. Also joined them Alior (WSE: ALR), which shares gain nearly 3%. As a result, the WIG20 index surprised positively and in the mid-session reached the level of 1,746 points (+ 1.20%).

-

09:15

WSE: After opening

WIG20 index opened at 1728.57 points (+0.18%)*

WIG 47524.09 0.26%

WIG30 1999.99 0.26%

mWIG40 4046.81 0.27%

*/ - change to previous close

Trading on the Warsaw market starting from a green color on all major indexes. Compared to a neutral environment is obviously a plus. Today, with the morning activity and an increase in the valuation stands values PZU.

The German DAX cosmetically loses its value, which as yet brings little new to the situation. The WIG20 index returned to the area in 1730 pts., which recently attracted like a magnet.

-

08:42

Mixed start of trading expected on the major stock exchanges in Europe: DAX futures flat, CAC 40 + 0.3%, FTSE down -0.1%

-

08:26

WSE: Before opening

Monday's session on the New York stock markets ended with slight declines in the major indexes. At the end of the day the Dow Jones Industrial fell by 0.30 percent and the S&P500 lost 0.33 percent. The investors' attention was yesterday turned on data from the US industrial sector. The final reading of the indicator of activity in the US industry (the ISM) surprised on the plus. The US data strengthened the dollar and weakened the yen. As a result, Tokyo index stands positively on the far east with an increase of almost 1%. The parquet in China is still closed, and other markets are gaining more cosmetically. So if nothing special happens around European banks, it promises to be a quiet day

Today, back in the game are German investors, which is so important that the local Deutsche Bank continues to be mentioned as one of the main factors influencing the mood.

The macro calendar remains empty today and this week the most important will be Thursday's data from the US labor market about the number of new jobs created in non-agricultural sectors in September. The upcoming week, like the previous one, will be also abound in statements by members of the Fed.

On the Warsaw market today it is worth to pay attention to the behavior of PZU shares, the Supervisory Board of PZU Group approved the capital and dividends policy for the years 2016-2020, which provides, inter alia, to allocate the dividend not less than 50 per cent of profit. This is a good signal because of earlier concerns of investors that the dividend could even be suspended.

-

07:04

Global Stocks

U.S. stocks closed lower Monday as concerns over Deutsche Bank's financial condition and the U.K.'s plan for exiting the European Union outweighed stronger-than-expected manufacturing data. Some analysts said that a report on U.S. manufacturing activity, which showed a shift back into expansion territory, might have heightened concerns that the Federal Reserve might raise interest rates sooner rather than later. "The ISM number was good but it's only one data point among many to consider and investors are eager to see September's employment report due on Friday," said Eric Wiegand, senior portfolio manager at U.S. Bank's Private Client Reserve.

Asian stock markets were mostly higher Tuesday as concerns about Deutsche Bank's financial health eased and Japan's quarterly survey showed companies lowered their inflation outlook. The Bank of Japan's quarterly Tankan business sentiment survey showed that Japanese companies expect consumer prices to rise 0.6 percent in the next year, lowering their inflation outlook, according to Kyodo News. That means that the central bank would have to do more to achieve its 2 percent inflation goal.

-

00:29

Stocks. Daily history for Oct 03’2016:

(index / closing price / change items /% change)

Nikkei 225 16,598.67 +148.83 +0.90%

Shanghai Composite 3,005.51 +7.03 +0.23%

S&P/ASX 200 5,478.51 +42.59 +0.78%

FTSE 100 6,983.52 +84.19 +1.22%

CAC 40 4,453.56 +5.30 +0.12%

Xetra DAX 10,511.02 +105.48 +1.01%

S&P 500 2,161.20 -7.07 -0.33%

Dow Jones Industrial Average 18,253.85 -54.30 -0.30%

S&P/TSX Composite 14,689.04 -36.82 -0.25%

-