Noticias del mercado

-

21:00

DJIA 18302.78 134.33 0.74%, NASDAQ 5325.02 35.36 0.67%, S&P 500 2162.56 12.07 0.56%

-

18:42

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose for the first time in three days on Wednesday, powered by gains in financial and energy shares. Activity in the U.S. services sector saw a big rebound in September, after having slowed to more than a six-year low in the previous month, a report from the Institute of Supply Management showed. The data raised the prospects of a U.S. interest rate hike in the near term and comes before a carefully watched non-farm payrolls report on Friday. Oil prices touched their highest levels since June following a bigger-than-expected draw in U.S. crude inventories.

Most of Dow stocks in positive area (28 of 30). Top gainer - Caterpillar Inc. (CAT, +2.54%). Top loser - Verizon Communications Inc. (VZ, -2.28%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.8%). Top loser - Utilities (-0.4%).

At the moment:

Dow 18212.00 +120.00 +0.66%

S&P 500 2155.00 +10.25 +0.48%

Nasdaq 100 4884.00 +26.50 +0.55%

Oil 49.81 +1.12 +2.30%

Gold 1265.90 -3.80 -0.30%

U.S. 10yr 1.72 +0.04

-

18:00

European stocks closed: FTSE 7033.25 -41.09 -0.58%, DAX 10585.78 -33.83 -0.32%, CAC 4489.95 -13.14 -0.29%

-

17:37

WSE: Session Results

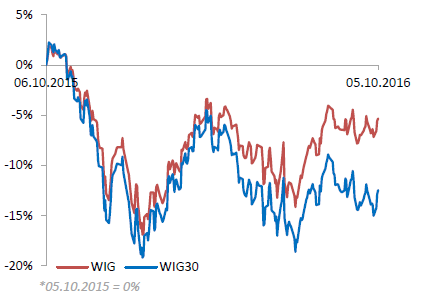

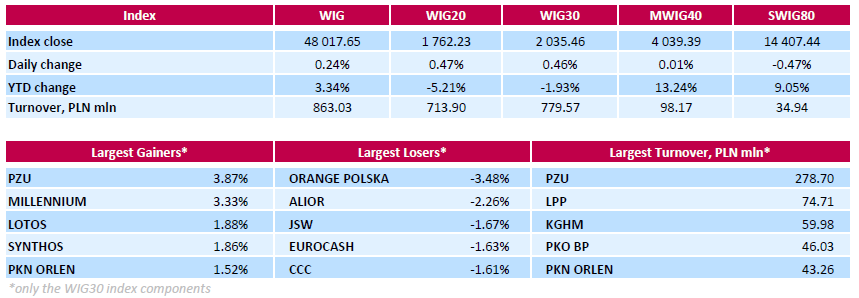

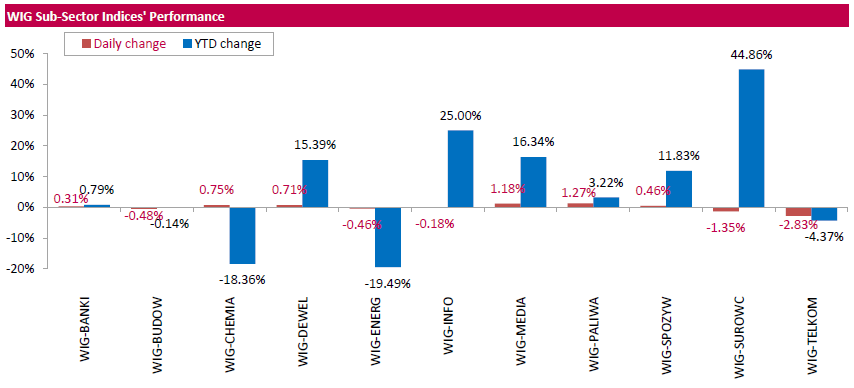

Polish equity closed higher on Wednesday. The broad market measure, the WIG Index, added 0.24%. Sector performance within the WIG Index was mixed. Oil and gas (+1.27%) outpaced, while telecoms (-2.83%) lagged behind.

The large-cap stocks' benchmark, the WIG30 Index, grew by 0.46%. In the index basket, insurer PZU (WSE: PZU) continued its strong run on higher dividend prospects, gaining a further 3.87%. It was followed by bank MILLENNIUM (WSE: MIL), chemical producer SYNTHOS (WSE: SNS) and two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN), gaining between 1.52% and 3.33%. At the same time, telecommunication services provider ORANGE POLSKA (WSE: OPL) and bank ALIOR (WSE: ALR) recorded the sharpest declines of a respective 3.48% and 2.26%.

-

15:53

WSE: After start on Wall Street

Today's readings of ADP in the US brought a slight surprise on the negative and should lower slightly market expectations that Friday's data will show growth in jobs outside the agricultural sector by about 175 thousand. As a result, the dollar slightly weakened and the stock exchanges reaction was rather calm.

The US market started from the increases. On the Warsaw Stock Exchange the leader of turnover and growth among the biggest companies remains today PZU (+6,2%).

An hour before the close of trading the WIG20 index was at the level of 1,762 point (+0,50%)

-

15:31

U.S. Stocks open: Dow +0.34%, Nasdaq +0.30%, S&P +0.30%

-

15:19

Before the bell: S&P futures +0.24%, NASDAQ futures +0.19%

U.S. stock-index futures rose as European shares pared losses and oil prices rallied, while investors assessed the prospects for tighter monetary policy.

Global Stocks:

Nikkei 16,819.24 +83.59 +0.50%

Hang Seng 23,788.31 +98.87 +0.42%

Shanghai Closed

FTSE 7,050.08 -24.26 -0.34%

CAC 4,488.69 -14.40 -0.32%

DAX 10,588.79 -30.82 -0.29%

Crude $49.55 за баррель (+1.77%)

Gold $1278.00 (+0.65%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.26

0.06(0.5882%)

123109

ALTRIA GROUP INC.

MO

61.9

0.12(0.1942%)

610

Amazon.com Inc., NASDAQ

AMZN

837.45

3.42(0.4101%)

10498

American Express Co

AXP

63.89

0.30(0.4718%)

1300

AMERICAN INTERNATIONAL GROUP

AIG

59.05

-0.03(-0.0508%)

633

Apple Inc.

AAPL

113.3

0.30(0.2655%)

39529

AT&T Inc

T

39.57

0.15(0.3805%)

25390

Barrick Gold Corporation, NYSE

ABX

15.75

0.30(1.9417%)

187943

Boeing Co

BA

132.75

0.50(0.3781%)

6165

Caterpillar Inc

CAT

88

0.49(0.5599%)

997

Chevron Corp

CVX

102

0.73(0.7208%)

6375

Citigroup Inc., NYSE

C

47.92

0.17(0.356%)

1038

Exxon Mobil Corp

XOM

86.65

0.40(0.4638%)

2871

Facebook, Inc.

FB

128.36

0.17(0.1326%)

30276

Ford Motor Co.

F

12.24

0.04(0.3279%)

9200

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.58

0.19(1.8287%)

105099

General Electric Co

GE

29.59

0.09(0.3051%)

12880

General Motors Company, NYSE

GM

32.16

-0.01(-0.0311%)

574

Goldman Sachs

GS

163.25

0.98(0.6039%)

100

Google Inc.

GOOG

779.5

3.07(0.3954%)

2633

Home Depot Inc

HD

129.25

1.05(0.819%)

1250

Intel Corp

INTC

37.63

0.09(0.2397%)

115864

Johnson & Johnson

JNJ

118.98

0.16(0.1347%)

386

JPMorgan Chase and Co

JPM

66.94

0.34(0.5105%)

2000

Merck & Co Inc

MRK

62.5

0.04(0.064%)

407

Microsoft Corp

MSFT

57.1

-0.14(-0.2446%)

1344

Nike

NKE

52.2

0.06(0.1151%)

8425

Tesla Motors, Inc., NASDAQ

TSLA

212.47

1.06(0.5014%)

6053

Twitter, Inc., NYSE

TWTR

24.35

0.83(3.5289%)

754058

Verizon Communications Inc

VZ

50.95

0.2675(0.5278%)

2318

Visa

V

83

0.27(0.3264%)

264

Yahoo! Inc., NASDAQ

YHOO

43.29

0.11(0.2547%)

344

Yandex N.V., NASDAQ

YNDX

21.37

-0.07(-0.3265%)

3667

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) target raised to $950 from $800 at Morgan Stanley

Barrick Gold (ABX) removed from Conviction Buy List at Goldman; maintain Buy

-

13:07

WSE: Mid session comment

The first half of today's trading ended with the output of the WIG20 index on the green side and the drawing of the daily maximum. The next day our market behaves without looking at the surroundings. One problem may be the level of turnover, which indicates that the market is closer to stability than a serious commitment of capital into growth. It is also worth noting that the positive sentiment is limited to a few companies - like PZU or LPP - and the discounts we see in qualities of such companies as Tauron (WSE: TPE), Orange (WSE: OPL) and Pekao (WSE: PEO). At the halfway point of the session the WIG20 index was at the level of 1,761 points (+ 0.41%) and with the turnover of PLN 340 million.

-

12:56

Major stock indices in Europe trading in the red zone

European stock indices show a moderate decline as investors' fears that the European Central Bank is moving in the direction of tightening monetary policy. However, a further decline of indices hinder positive corporate news, as well as statistics on the UK and the eurozone.

Yesterday, Bloomberg, citing unnamed sources in the Central Bank, said that the ECB will gradually reduce the monthly purchase of assets in the amount of 80 billion euros before March 2017. The agency said that the ECB could begin a steady decline in the volume of purchase of assets of 10 billion euros per month.

"The central bank may try to test the market and see how reacts to this kind of news and thus reduce the pressure on the banking sector, - said William Hobbs, head of Barclays Plc investment unit -. ECB officials may come to the realization that the current monetary policy does not help the banking sector, which could eventually make it counter-productive. "

In terms of data, Markit Economics reported that the eurozone economy is losing momentum, as the looming political uncertainty facing the region. The final composite index, covering manufacturing and service industries fell in September to a level of 52.6 points compared with 52.9 points. The indicator has coincided with a preliminary estimate, however, it was at its lowest level since January 2015. "The slowdown in growth in the region partly reflects growing caution among business, - said Chris Williamson, chief economist at IHS Markit -. We believe that this trend will continue into next year, as Brexit compounded by uncertainty ahead of elections in France and Germany, along with the ongoing political instability in Italy and Spain. " In addition, the report stated that the index of business activity in the services sector fell to 52.2 points from 52.8 points in August.

A separate report showed that business activity in the UK's services sector grew more than expected, casting doubt on the need for another interest rate cut by the Bank of England next month. The index fell slightly in September - to 52.6 points from 52.9 points in August, when was noticed the biggest monthly increase for the entire 20-year history of the research. Nevertheless, the last value was significantly higher than the average forecast of 52.0 points. The report stated that the overall performance of the economy in the past month was the highest since January. Recall, Markit research on activity in the manufacturing sector and the construction sector, published earlier this week, were also better than expected

The composite index of the largest companies in the region Stoxx Europe 600 was down 0.9 percent.

Capitalization of German bank Deutsche Bank, which has lost nearly 50 percent of its value this year, increasing the fifth day in a row, which is the longest series in eight weeks. Shares rose 0.2 percent, due to the gradual reduction of concerns about the fact that the bank may need to increase the amount of capital.

The cost of SFR Group fell by 4.2 percent, as Altice NV dropped its offer to purchase the rest of the telecom unit after the French financial regulator advised against such a move.

Tesco shares jumped 9.9 percent after reporting that first-half profit exceeded analysts' expectations. The company also said it will increase investment in order to contribute to profitable growth in the next three years.

Delta Lloyd shares rose 28 percent after the NN Group offered to buy the company for 2.4 billion euros to increase coverage in the pension and insurance sectors.

At the moment:

FTSE 100 7044.20 -30.14 -0.43%

DAX -64.05 10555.56 -0.60%

CAC 40 4475.04 -28.05 -0.62%

-

09:23

WSE: After opening

WIG20 index opened at 1755.28 points (+0.07%)*

WIG 47927.81 0.06%

WIG30 2027.49 0.06%

mWIG40 4041.35 0.06%

*/ - change to previous close

At the opening of trading the Warsaw market was looking for a way to sustain yesterday's atmosphere. Unfortunately, we are dealing with downward pressure from environment where the German DAX fell at the opening by 0.8 percent. Two locomotives of yesterday's session (PZU and LPP) are trying to continue a good run. Unfortunately, in the power is the line of local downward trend, defeat of which is a prerequisite for overcoming technical change and success. After fifteen minutes of the session the WIG20 index was at the level 1,749 points (-0.29%).

-

08:56

Major stock exchanges in Europe trading higher: FTSE + 0.65% near session highs as GBP falls, DAX + 0.55%, CAC40 + 0.45%, FTMIB + 0.5%, IBEX + 0.5%

-

08:26

WSE: Before opening

Tuesday's session on Wall Street ended with declines in major indices of 0.2 to 0.5 percent.

It is worth to note the yesterday's relatively weaker posture of Wall Street against a strong Europe, where the DAX ended the day with an increase of more than 1 percent.

Current trading of futures on the DAX and an increase in futures on the S&P500 shows that this morning Europe will not want strongly react to the weaker end of the US.

Today's macro calendar will bring readings of PMI for the services sector in Europe and the US ADP reading, reminding of the most important event of the week - Friday's report from the US Department of Labor.

On the Warsaw market, yesterday's good attitude of bulls indicates that a good mood on the market appeared. Defense the area of 1,710 points in case of the WIG20 index and good opening of the new month and the quarter are conducive to the watching the future with optimism.

-

07:52

Global Stocks

European stocks on Tuesday leapt to their highest level in nearly two weeks, as Deutsche Bank AG shares resumed their recovery, while British blue-chips got a boost from the pound's drop. Deutsche's stock was dragged sharply lower last week on concerns the lender will face a $14 billion settlement with the U.S. Department of Justice over claims it sold toxic mortgage-backed securities. But shares have recovered somewhat in the wake of reports that the actual penalty won't be as severe.

U.S. stocks on Tuesday finished in the red in the wake of a report that the European Central Bank could start winding down its quantitative-easing program ahead of schedule. The ECB may gradually scale back its bond purchases of 80 billion euros ($89.7 billion) a month before the program's scheduled March 2017 conclusion, Bloomberg reported, citing anonymous eurozone central-bank officials.

Asian shares were mixed on Wednesday, reflecting renewed investor concerns the U.S. Federal Reserve would raise interest rates by the year's end. The weakness in other Asian markets followed comments overnight by a Fed official stating that the central bank should pre-emptively raise short-term interest rates to stave off accelerating inflation.

-

00:59

Stocks. Daily history for Oct 04’2016:

(index / closing price / change items /% change)

Nikkei 225 16,735.65 +136.98 +0.83%

S&P/ASX 200 5,484.00 +5.49 +0.10%

FTSE 100 7,074.34 +90.82 +1.30%

CAC 40 4,503.09 +49.53 +1.11%

Xetra DAX 10,619.61 +108.59 +1.03%

S&P 500 2,150.49 -10.71 -0.50%

Dow Jones Industrial Average 18,168.45 -85.40 -0.47%

S&P/TSX Composite 14,521.01 -168.03 -1.14%

-