Noticias del mercado

-

16:45

'Far Too Soon' For ECB's Taper Tantrum; EUR To Hold Well Vs G10 Ex USD - BNPP

"We do not think the EUR should draw sustained support from headlines Tuesday indicating that the ECB governing council have agreed that asset purchases should be tapered rather than stopped abruptly when the time comes to exit QE.

The news story is more about the ECB's eventual exit strategy rather than any indication of the actual time frame for exit, and a subsequent comment from an ECB spokesman indicated the ECB has not discussed reducing bond purchases. With core inflation at only 0.8% and the ECB likely to have to revise down its inflation forecast in its December projections, we think talks of tapering are very much misplaced.

Our economists continue to expect the ECB to announce an extension of asset purchases in December, keeping any concerns about exit off the table for most of 2017.

We expect the EUR to hold up well vs. most G10 currencies this year, but lose ground vs. the USD as the Fed delivers a December rate hike".

Copyright © 2016 BNP Paribas™, eFXnews™

-

16:34

Big drop for US crude oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.0 million barrels from the previous week. At 499.7 million barrels, U.S. crude oil inventories are at historically high levels for this time of year.

Total motor gasoline inventories increased by 0.2 million barrels last week, and are above the upper limit of the average range. Finished gasoline inventories decreased slightly while blending components inventories increased last week.

Distillate fuel inventories decreased by 2.4 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.7 million barrels last week and are above the upper limit of the average range. Total commercial petroleum inventories decreased by 11.2 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, September -2.976 (forecast 2.062)

-

16:10

-

16:08

Huge US ISM non-manufacturing. USD/JPY at session highs

Economic activity in the non-manufacturing sector grew in September for the 80th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management (ISM) Non-Manufacturing Business Survey Committee. "The NMI registered 57.1 percent in September, 5.7 percentage points higher than the August reading of 51.4 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased substantially to 60.3 percent, 8.5 percentage points higher than the August reading of 51.8 percent, reflecting growth for the 86th consecutive month, at a noticeably faster rate in September. The New Orders Index registered 60 percent, 8.6 percentage points higher than the reading of 51.4 percent in August. The Employment Index increased 6.5 percentage points in September to 57.2 percent from the August reading of 50.7 percent".

-

16:05

US factory orders improves slightly

New orders for manufactured goods in August, up two consecutive months, increased $0.7 billion or 0.2 percent to $453.1 billion, the U.S. Census Bureau reported today. This followed a 1.4 percent July increase.

Shipments, up five of the last six months, increased $0.1 billion or virtually unchanged to $458.1 billion. This followed a 0.4 percent July decrease.

Unfilled orders, down three consecutive months, decreased $1.6 billion or 0.1 percent to $1,123.2 billion. This followed a 0.2 percent July decrease. The unfilled orders-to-shipments ratio was 6.81, up from 6.79 in July.

Inventories, up two consecutive months, increased $1.0 billion or 0.2 percent to $622.0 billion. This followed a 0.2 percent July increase. The inventories-toshipments ratio was 1.36, unchanged from July.

-

16:00

U.S.: Factory Orders , August 0.2% (forecast -0.1%)

-

16:00

U.S.: ISM Non-Manufacturing, September 57.1 (forecast 53)

-

15:49

U.S. service providers indicated an upturn in business activity growth - Markit

U.S. service providers indicated an upturn in business activity growth from the six-month low recorded during August. Nonetheless, the pace of expansion remained modest and softer than its post-crisis trend, largely reflecting subdued new business gains in recent months.

The latest survey highlighted that new work increased at the weakest rate since May, which contributed to another moderation in staff hiring across the service economy. The rise in payroll numbers during September was only marginal and the slowest seen for three-and-a-half years.

The seasonally adjusted final Markit U.S. Services Business Activity Index registered 52.3 in September ('flash' reading: 51.9), up from 51.0 in August, to signal the fastest upturn in service sector output since April.

-

15:49

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.100 (EUR 253m) 1.1350 (350m) 1.1400 (220m) 1.1450 (265m)

USDJPY: 100.00 (USD 743m) 101.50 215m) 103.00 (203m) 103.45 (270m) 104.00 (511m)

GBPUSD: 1.2500 (GBP 425m) 1.2571 (398m) 1.3000 (377m)

AUDUSD: 0.7450-55 (AUD 275m) 0.7493 (200m) 0.7515 (450m) 0.7850 (225m)

USDCAD: 1.3100 (USD 413m) 1.3150 (260m)

NZD/USD: 0.7270 (NZD 217m)

-

15:45

U.S.: Services PMI, September 52.3

-

14:36

Better Canadian trade balance pushes CAD higher

Canada's exports increased 0.6% to $43.4 billion in August. Exports volumes rose 0.4% and prices edged up 0.2%. Imports were largely unchanged at $45.3 billion in August, as a 0.8% increase in volumes was offset by a 0.7% decrease in prices. Consequently, Canada's merchandise trade deficit with the world narrowed from $2.2 billion in July to $1.9 billion in August.

-

14:32

US trade balance deficit rose in August

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $40.7 billion in August, up $1.2 billion from $39.5 billion in July, revised. August exports were $187.9 billion, $1.5 billion more than July exports. August imports were $228.6 billion, $2.6 billion more than July imports.

The August increase in the goods and services deficit reflected a decrease in the goods deficit of less than $0.1 billion to $60.3 billion and a decrease in the services surplus of $1.2 billion to $19.6 billion.

-

14:30

Canada: Trade balance, billions, August -1.94 (forecast -2.6)

-

14:30

U.S.: International Trade, bln, August -40.73 (forecast -39.3)

-

14:20

September US ADP employment lower than forecast

Private sector employment increased by 154,000 jobs from August to September according to the September ADP National Employment Report.

Payrolls for businesses with 49 or fewer employees increased by 34,000 jobs in September, down from 68,000 in August. Employment at companies with 50-499 employees increased by 56,000 jobs, up from last month's 40,000. Employment at large companies - those with 500 or more employees - increased by 64,000, down from 67,000 in the prior month. Companies with 500-999 employees added 8,000 and companies with more than 1,000 employees added 56,000 in September.

Goods-producing employment was up by 3,000 jobs in September, following August losses of 9,000. The construction industry added 11,000 jobs, following August losses of 2,000 jobs. Meanwhile, manufacturing jobs were down 6,000 in September, after losing 4,000 in the previous month. Service-providing employment rose by 151,000 jobs in September. The ADP National Employment Report indicates that professional/business services contributed 45,000 jobs, down from 53,000 in August. Trade/transportation/utilities increased by 15,000 jobs in September, down from 26,000 jobs added the previous month. Financial activities added 11,000 jobs, down from last month's gain of 15,000 jobs.

"Job gains in September eased a bit when compared to the past 12-month average," said Ahu Yildirmaz, vice president and head of the ADP Research Institute. "We also observed softening this month in trade/transportation/utilities, possibly due to a continued tightening U.S. labor market and lackluster consumer spending.

-

14:15

U.S.: ADP Employment Report, September 154 (forecast 169)

-

14:10

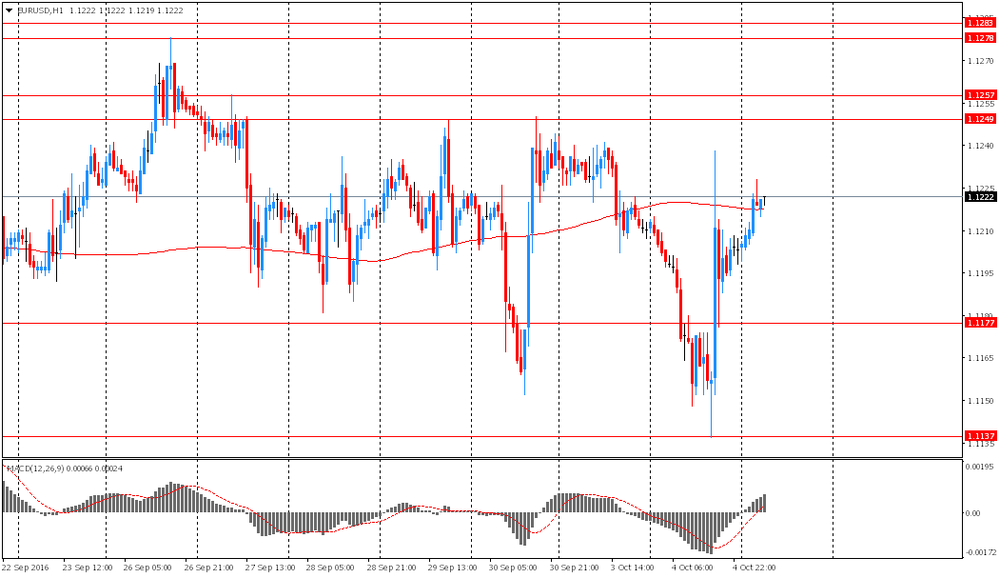

European session review: EUR/USD accumulates

The following data was published:

(Time / country / index / period / previous value / forecast)

7:50 France Business activity index in the services sector (final data) September 52.3 54.1 53.3

7:55 Germany Index of business activity in the services sector (final data) September 51.7 50.6 50.9

8:00 Eurozone business activity index in the services sector (final data) September 52.8 52.1 52.2

8:30 UK PMI index for the services sector in September 52.9 52 52.6

9:00 Eurozone Retail Sales m / m in August of 0.3% -0.3% -0.1%

9:00 Eurozone Retail sales, y / y in August 1.8% 1.5% 0.6%

The euro strengthened slightly against the US dollar, approaching yesterday's session high. Against the background of the lack of new significant catalysts investors continue to back yesterday's rumors that the European Central Bank may begin to taper QE before the scheduled time.Bloomberg, citing unnamed sources in the Central Bank, said that the ECB will gradually reduce the monthly purchase of assets in the amount of 80 billion euros before March 2017. The agency said that the ECB could begin a steady decline in the volume of purchase of assets of 10 billion euros per month.

"The central bank may try to test the market and see how reacts to this kind of news and thus reduce the pressure on the banking sector, - said William Hobbs, head of Barclays Plc investment unit -. ECB officials may come to the realization that the current monetary policy does not help the banking sector, which could eventually make it counter-productive. "

Markit Economics reported that the eurozone economy is losing momentum, as the looming political uncertainty facing the region. The final composite index, covering manufacturing and service industries fell in September to a level of 52.6 points compared with 52.9 points. The indicator has coincided with a preliminary estimate, however, it was at its lowest level since January 2015. "The slowdown in growth in the region partly reflects growing caution among business, - said Chris Williamson, chief economist at IHS Markit -. We believe that this trend will continue into next year, as Brexit compounded by uncertainty ahead of elections in France and Germany, along with the ongoing political instability in Italy and Spain. " In addition, the report stated that the index of business activity in the services sector fell to 52.2 points from 52.8 points in August.

A separate report showed that business activity in the UK's services sector grew more than expected, casting doubt on the need for another interest rate cut by the Bank of England next month. The index fell slightly in September - to 52.6 points from 52.9 points in August, when was noticed the biggest monthly increase for the entire 20-year history of the research. Nevertheless, the last value was significantly higher than the average forecast of 52.0 points. The report stated that the overall performance of the economy in the past month was the highest since January. Recall, Markit research on activity in the manufacturing sector and the construction sector, published earlier this week, were also better than expected

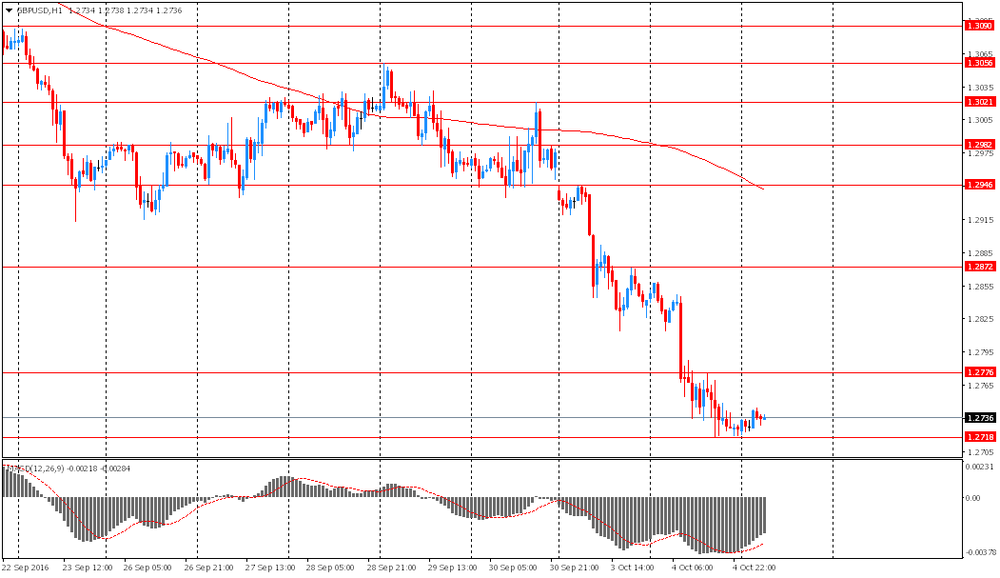

The pound fell moderately against the US dollar, falling below $ 1.2700, but soon recovering to the opening level.

EUR / USD: during the European session, the pair rose to $ 1.1232

GBP / USD: during the European session, the pair fell to $ 1.2684, but then went back up to $ 1.2740

USD / JPY: during the European session, the pair rose to Y103.16

-

13:46

Orders

EUR/USD

Offers 1.1250 1.1280 1.1300 1.1320 1.1350

Bids 1.1200 1.1175-801.1150-60 1.1125-301.1100 1.1080 1.1050

GBP/USD

Offers 1.2750 1.2780-85 1.2800 1.2820 1.2850 1.2875-80 1.2900

Bids 1.2700 1,2680-85 1.2650 1.2620-25 1.2600 1.2500

EUR/GBP

Offers 0.8850-55 0.8885 0.8900 0.8930 0.8950

Bids 0.8800 0.8785 0.8750 0.8720 0.8700 0.8685 0.8650

EUR/JPY

Offers 115.75 116.00-05 116.35 116.50 117.00 117.50

Bids 115.00 114.80 114.50 114.20 114.00 113.80 113.50 113.35 113.00

USD/JPY

Offers 103.00-05 103.30 103.50 103.75-80 104.00 104.30 104.50

Bids 102.70 102.50 102.30 102.00 101.85 101.65 101.50 101.00

AUD/USD

Offers 0.7630 0.7650 0.7685 0.7700 0.7720 0.7750

Bids 0.7585 0.7565 0.7550 0.7530 0.7500

-

11:49

BOE's Broadbent: Brexit Uncertainty to Weigh on Demand, Investment

-

Fall in Sterling Supporting Economy

-

Slowdown More Moderate Than We Feared

-

Economy Has Performed Better Than Surveys Signaled

-

Too Early to Judge Referendum Impact With Certainty

-

GDP Growth Strongly Correlated With Uncertainty

-

-

11:06

EuroZone retail sales decline in August

In August 2016 compared with July 2016, the seasonally adjusted volume of retail trade fell by 0.1% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In July the retail trade volume increased by 0.3% in the euro area and by 0.5% in the EU28.

In August 2016 compared with August 2015, the calendar adjusted retail sales index increased by 0.6% in the euro area and by 2.1% in the EU28.

-

11:00

Eurozone: Retail Sales (MoM), August -0.1% (forecast -0.3%)

-

11:00

Eurozone: Retail Sales (YoY), August 0.6% (forecast 1.5%)

-

10:33

UK's services sector continue to recover. Time to buy the pound?

The UK service sector continued to recover from July's EU referendum-induced shock, according to PMI® survey data for September from IHS Markit and CIPS.

Business activity rose for the second month running, following a sharp drop in July linked to uncertainty surrounding the UK's vote to leave the European Union. Moreover, new business rose at the fastest pace since February and the rate of job creation picked up.

However, future expectations remained very low by historical standards and the survey recorded the sharpest increase in service sector input prices in over three-and-a-half years.

The survey's headline figure is the seasonally adjusted Markit/CIPS Services Business Activity PMI, a single-figure measure designed to track changes in total activity. Readings above 50.0 signal growth compared with the previous month, and below 50.0 contraction.

The Business Activity Index remained above the no-change mark of 50.0 in September, at 52.6, signalling growth of UK services output. Down slightly from 52.9 in August, the latest figure Markit / CIPS UK Services PMI indicated a further moderate rate of expansion at the end of the third quarter, following a contraction in July in the wake of the EU referendum. The rate of expansion in the latest period was weak in the context of historical data, however, with the Index below its long-run level of 55.1. The Index averaged 50.9 over Q3 as a whole, the lowest since Q4 2012.

-

10:30

United Kingdom: Purchasing Manager Index Services, September 52.6 (forecast 52)

-

10:10

The rate of economic expansion across the eurozone eased to a 20-month low in September

The rate of economic expansion across the eurozone eased to a 20-month low in September. Growth slowed in Germany, Italy, Spain and Ireland to offset a mild acceleration in France.

The final Markit Eurozone PMI® Composite Output Index posted 52.6 in September, down from 52.9 in August and matching the earlier flash estimate. The average index reading during the third quarter as a whole (52.9) was the weakest since the final quarter of 2014.

By sector, output rose at manufacturers and service providers. The rate of expansion in manufacturing production ticked higher and remained above that for service sector business activity for the fourth straight month. Services output growth dipped to a 21-month low.

-

10:00

Eurozone: Services PMI, September 52.2 (forecast 52.1)

-

09:57

The upturn in Germany’s service sector slowed further during September - Markit

The upturn in Germany's service sector slowed further during September, with output and new business rising only slightly. The rate of employment growth remained solid by historical standards, but was nonetheless the weakest since April. Despite this, companies were able to further work through their backlogs. Moreover, despite subdued demand, service providers raised their charges to the greatest extent since February, partly as a result of rising input costs. Meanwhile, the degree of optimism towards activity growth improved.

September data signalled a further slowdown in activity growth at German service providers, with the final seasonally adjusted Markit Germany Services PMI Business Activity Index falling from August's 51.7 to a 39-month low of 50.9. Moreover, the average PMI reading for the quarter as a whole was the worst in over three years.

-

09:56

French Activity rises at strongest rate in 15 months

Service providers in France reported a third successive increase in business activity during September. The rate of expansion was solid, having quickened to the fastest since June 2015. Supporting stronger activity growth was a sharper rise in incoming new business. Backlogs of work also increased at a faster pace, while staffing levels rose slightly. Input costs increased, but prices charged by service providers were cut further. Business expectations meanwhile improved in the latest survey period.

The seasonally adjusted headline Markit France Business Activity Index - which is based on a single question asking respondents to report on the actual change in business activity at their companies compared with one month ago - posted 53.3 in September. Up from 52.3 in August, the latest index reading pointed to a solid rate of growth that was the fastest in 15 months.

The final seasonally adjusted Markit France Composite Output Index - which covers the combined manufacturing and service sectors - climbed to 52.7 in September from 51.9 in August. That signalled the fastest rate of growth since June 2015

-

09:55

Germany: Services PMI, September 50.9 (forecast 50.6)

-

09:50

France: Services PMI, September 53.3 (forecast 54.1)

-

09:25

Spanish services activity continued to grow at a solid pace - Markit

Spanish services activity continued to grow at a solid pace during September, supported by a faster increase in new business. Companies also remained optimistic of further rises in activity over the coming year. That said, the rate of job creation eased for the third consecutive month. Meanwhile, rates of inflation of both input costs and output prices eased from those seen in August.

The headline seasonally adjusted Business Activity Index posted 54.7 in September, down slightly from 56.0 in August but continuing to signal solid monthly growth of services activity. Output has now increased in each of the past 35 months, with the latest rise mainly linked to higher new orders.

-

09:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.100 (EUR 253m) 1.1350 (350m) 1.1400 (220m) 1.1450 (265m)

USD/JPY: 100.00 (USD 743m) 101.50 215m) 103.00 (203m) 103.45 (270m) 104.00 (511m)

GBP/USD: 1.2500 (GBP 425m) 1.2571 (398m) 1.3000 (377m)

AUD/USD: 0.7450-55 (AUD 275m) 0.7493 (200m) 0.7515 (450m) 0.7850 (225m)

USD/CAD: 1.3100 (USD 413m) 1.3150 (260m)

NZD/USD: 0.7270 (NZD 217m)

-

09:09

Today’s events

-

At 11:30 GMT the Bank of England Deputy Governor for Monetary Policy Ben Broadbent will deliver a speech

-

At 12:30 GMT Germany will hold an auction of 10-year bonds

-

At 14:00 GMT the Bank of England Member of the Commission Michael Saunders will make a speech

-

China celebrates the founding of the People's Republic

-

-

08:38

Asian session review: NZD under pressure

The New Zealand dollar was under pressure amid weak GlobalDairyTrade auction results. Prices for whole milk powder fell 3.8%, despite the fact that market participants expected a decline by 2%. It should be noted that milk is the largest export item in New Zealand and has an impact on the New Zealand dollar.

The Australian dollar rose on more positive than expected retail sales data. Retail sales in Australia rose 0.4% in August, above economists' forecast of 0.2% and is much higher than July (0.0%). This was reported today by the Australian Bureau of Statistics. The volume of retail sales in September supported by steady growth in employment and an improvement in consumer confidence. Retail trade turnover grew by 0.1% in August 2016 after the 0.1% rise in July 2016. Compared with August 2015 trends grew by 2.6%

The euro rose against the dollar on controversial news that ECB may be gradually reduce the QE program. The paper, citing unnamed sources in the leadership of the ECB said that the central bank "emerging consensus" on the taper of quantitative easing.

During the Asian session, the dollar has stabilized a bit after yesterday's growth against the more optimistic prospects of higher interest rates in the US. Yesterday the president of the Federal Reserve Bank of Cleveland, Loretta Mester called for higher interest rates. "A slight increase in rates is justified, taking into account the progress in creating jobs and increasing inflation", - said Mester, adding that rates could be increased at any of the two remaining Fed meetings.

EUR / USD: during the Asian session, the pair rose to $ 1.1230

GBP / USD: during the Asian session, the pair was trading in the $ 1.2720-40 range

USD / JPY: during the Asian session, the pair was trading in Y102.65-90 range

-

08:30

Options levels on wednesday, October 5, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1316 (3390)

$1.1284 (2357)

$1.1261 (2126)

Price at time of writing this review: $1.1220

Support levels (open interest**, contracts):

$1.1171 (4001)

$1.1135 (4938)

$1.1093 (5051)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 39511 contracts, with the maximum number of contracts with strike price $1,1500 (6471);

- Overall open interest on the PUT options with the expiration date October, 7 is 40723 contracts, with the maximum number of contracts with strike price $1,1150 (5938);

- The ratio of PUT/CALL was 1.03 versus 1.01 from the previous trading day according to data from October, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.3000 (1219)

$1.2901 (767)

$1.2804 (301)

Price at time of writing this review: $1.2704

Support levels (open interest**, contracts):

$1.2598 (752)

$1.2499 (676)

$1.2400 (221)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 29962 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22635 contracts, with the maximum number of contracts with strike price $1,3000 (3241);

- The ratio of PUT/CALL was 0.76 versus 0.74 from the previous trading day according to data from October, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Attractive Risk-Reward In Long USD Vs High-Beta; Staying Short NZD/USD - Credit Agricole

"The USD is unlikely to lose sight of the opinion polls and candidates' rhetoric going into the second presidential debate on 9 October, especially as the first debate has now put pressure on Donald Trump to come up with a more forceful performance.

For the September non-farm payrolls we expect an improvement from the August reading with a gain of 175K. Given Fed Chair Yellen's message in September suggesting that there was more room for labour market improvement without creating excessive inflationary pressures, measures of broader labour market slack and wages should be particularly in focus this time.

We still believe the more attractive short-term risk-reward is for USD longs against the G10 commodity bloc currencies and remain short NZD/USD* in our portfolio.

Credit Agricole maintains a short NZD/USD from 0.7292 targeting 0.70".

*This trade is recorded and tracked in eFXplus Orders.

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

08:16

Fed's Evans Sees Weak Case for Raising Rates

-

U.S. Likely to Grow by Just Over 2% for Next Three Years

-

Jobless Rate Down to 4.25% by 2019

-

Likely to Hit 2% Inflation in Next Three Years

-

-

08:13

Bank of Japan Governor, Kuroda: rate cut is necessary for further easing of monetary policy

Today the head of the Bank of Japan said that the decline in interest rates rates is necessary for further easing of monetary policy. It is worth noting that many traders around the world were waiting for Kuroda for clarity on this issue. "Moreover, if the inflation target is reached then the interest rates will rise. Long-term rates will not stay at 0% after the achievement of the inflation target of 2% "- said Kuroda.

Since no significant improvement towards achieving the 2% target has yet seen, market participants have concluded that negative interest rates will continue to worsen.

-

08:09

The ANZ Commodity Price Index rose 5.1% m/m

The ANZ Commodity Price Index rose 5.1% m/m in September (+11% y/y). This was the fifth lift in a row, with the index now at a 17- month high. That said, the lift in September was almost entirely driven by dairy, with prices elsewhere looking rather ho-hum. Ten of 12 non-dairy categories experienced a price decline, which saw the non-dairy index drop 1.3% m/m in the month (+2.0% y/y).

The NZD remains a thorn in the side of all commodity exporters. While the NZD commodity price index rose 3.9% m/m in September, prices are running 5% behind where they were at the same time last year. This has been a consistent theme throughout the winter with the NZD/USD and TWI both appreciating 7% since May (and both have increased even more in comparison to the same time last year).

-

08:07

Australian retail sales up 0.4% in August

Australian retail turnover rose 0.4 per cent in August 2016, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a relatively unchanged (0.0 per cent) July 2016.

In seasonally adjusted terms, the largest rise was in department stores (3.5 per cent), which followed a fall in July of 5.8 per cent. There were also seasonally adjusted rises in cafes, restaurants and takeaway food services (1.2 per cent), food retailing (0.3 per cent) and household goods retailing (0.2 per cent). There were falls in other retailing (-0.6 per cent) and clothing, footwear and personal accessory retailing (-0.4 per cent).

In seasonally adjusted terms, there were rises in Victoria (0.7 per cent), New South Wales (0.5 per cent), Queensland (0.7 per cent), South Australia (0.4 per cent) and the Australian Capital Territory (0.7 per cent). There were falls in Western Australia (-0.5 per cent), Northern Territory (-0.5 per cent) and Tasmania (-0.1 per cent).

-

02:30

Australia: Retail Sales, M/M, August 0.4% (forecast 0.2%)

-

00:58

Currencies. Daily history for Oct 04’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1203 -0,06%

GBP/USD $1,2725 -0,92%

USD/CHF Chf0,9788 +0,55%

USD/JPY Y102,89 +1,22%

EUR/JPY Y115,28 +1,16%

GBP/JPY Y130,93 +0,33%

AUD/USD $0,7611 -0,85%

NZD/USD $0,7186 -1,22%

USD/CAD C$1,3188 +0,55%

-

00:31

Australia: AIG Services Index, September 48.9

-

00:01

Schedule for today,Wednesday, Oct 05’2016

00:30 Australia Retail Sales, M/M August 0.0% 0.2%

07:50 France Services PMI (Finally) September 52.3 54.1

07:55 Germany Services PMI (Finally) September 51.7 50.6

08:00 Eurozone Services PMI (Finally) September 52.8 52.1

08:30 United Kingdom Purchasing Manager Index Services September 52.9 52

09:00 Eurozone Retail Sales (MoM) August 1.1% -0.3%

09:00 Eurozone Retail Sales (YoY) August 2.9% 1.5%

12:15 U.S. ADP Employment Report September 168 169

12:30 Canada Trade balance, billions August -2.49 -2.6

12:30 U.S. International Trade, bln August -39.47 -39.3

13:45 U.S. Services PMI (Finally) September 51

14:00 U.S. Factory Orders August 1.9% -0.1%

14:30 U.S. Crude Oil Inventories September -1.882

-