Noticias del mercado

-

15:49

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1100 (EUR 250m) 1.1210-20 (901m) 1.1350 (433m) 1.1400 (220m) 1.1450 (265m)

USDJPY: 101.00 (USD 456m) 101.30 (220m) 102.00 (527m) 102.30 (255m) 102.40-50 (961m) 102.80 (200m) 103.00 (210m) 103.00 (210m) 103.40-45 (446m) 103.50 (1.27bln) 105.00 (545m)

GBPUSD: 1.2500 (GBP 425m) 1.2571 (398m) 1.3000 (377m)

AUDUSD: 0.7700 (AUD 301m)

USDCAD: 1.2800 (USD 230m) 1.3140 (406m) 1.3200 (676m)

NZD/USD: 0.7270 (NZD 217m)

AUDJPY 76.00 (300m)

-

14:38

US unemployment claims continue to decline

According to Bloomberg, filings for U.S. unemployment benefits fell last week almost to the lowest level since 1973, as employers show scant willingness to fire workers amid a tightening labor market.

Jobless claims dropped by 5,000 to 249,000 in the week ended Oct. 1, a Labor Department report showed Thursday in Washington. The median forecast in a Bloomberg survey called for 256,000. Continuing claims declined to the lowest level since 2000.

-

14:34

Canadian building permits rose significantly in August

Municipalities issued $7.3 billion worth of building permits in August, up 10.4% from July. This marked the second consecutive monthly increase. The gain in August was mainly attributable to higher construction intentions in Quebec, Ontario and British Columbia.

The value of residential building permits was up 9.6% to $4.5 billion in August, following four consecutive monthly declines. Both residential components-multi-family and single-family dwellings-recorded gains. Six provinces posted increases, led by Ontario and British Columbia.

In the non-residential sector, municipalities issued $2.9 billion worth of permits in August, up 11.6% from July. The increase was mainly attributable to higher construction intentions for commercial buildings and, to a lesser extent, industrial buildings. Gains were reported in five provinces, led by Quebec, followed distantly by Manitoba.

-

14:30

Canada: Building Permits (MoM) , August 10.4% (forecast 3%)

-

14:30

U.S.: Initial Jobless Claims, 249 (forecast 257)

-

14:30

U.S.: Continuing Jobless Claims, 2058 (forecast 2090)

-

14:00

Orders

EUR/USD

Offers 1.1220 1.1235 1.1250 1.1280 1.1300 1.1320 1.1350

Ордера на покупку: 1.1175-80 1.1150-60 1.1125-30 1.1100 1.1080 1.1050

GBP/USD

Offers 1.2735 1.2750 1.2775 1.2790-1.2800 1.2820 1.2850 1.2875-80 1.2900

Bids 1.2640-50 1.2620-25 1.2600 1.2500

EUR/GBP

Offers 0.8820-25 0.8850-55 0.8885 0.8900 0.8930 0.8950

Bids 0.8785 0.8750 0.8720 0.8700 0.8685 0.8650

EUR/JPY

Offers 116.25-30 116.50 117.00 117.30 117.50 118.00 118.45-50

Bids 115.80 115.50 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers 103.65 103.80 104.00 104.30 104.50 105.00

Bids 103.25-30 103.00 102.85 102.70 102.50 102.30 102.00

AUD/USD

Offers 0.7600 0.7630 0.7650 0.7685 0.7700 0.7720

Bids 0.7565 0.7550 0.7530 0.7500 0.7485 0.7450

-

13:44

ECB: Underlying Inflation 'an Ongoing Source of Concern' -- Minutes

-

Weak Bank Profitability Poses Risk for Future Lending

-

Risk of Stronger Hit to Growth From Brexit Vote in Future

-

Too Early to Say Adverse Expectations From Brexit Were Overstated

-

ECB Saw 'Considerable Uncertainty' Around Longer-Term Economic Impact of Brexit Vote

-

Banks Face Numerous Challenges That Might Affect Lending Decisions

-

Possible Revisions to QE Parameters Must Take Account of Policy Effectiveness

-

Underlying Inflation Not Yet Showing Clear Upward Trend

-

'Increasing Challenges' to Future Implementation of QE at Sept. Meeting

-

Underlying Inflation 'an Ongoing Source of Concern'

-

-

12:39

USD/JPY: A Bottom Now In Place: What's Next? - Morgan Stanley

"The BoJ and the JPY. Yesterday USDJPY broke out of an upper channel resistance at 102.50, which for us confirms that a bottom is now in place. Beyond current momentum, the major catalysts for JPY weakness are found within the newly designed BoJ monetary policy. Here the BoJ no longer aims to lower bond yields across the curve, but instead to manage a generally positively sloped curve aiming to keep 10-year yields near zero even in the case of inflation overshooting the 2% target. Rightly, investors cited the dilemma that you can either control quantity or price, but you cannot control both. Hence, investors were convinced the BoJ's 0% yield target would lead to an implicit tapering, specifically since the country has a current account surplus, generating an excess of savings which push down yields. Investors assumed that the BoJ's monetary base would grow less than suggested by the JPY80trn QE promise provided earlier and that this implicit decline in the monetary base growth rate would lead to a lower USDJPY. A race of USDJPY downside projections peaked with ex MOF's Sakakibara calling USDJPY to reach 90. We believe this assessment is wrong for several reasons.

Our reasons for further JPY weakness. Firstly, the assessment above does not take into account the potential for an increase in monetary velocity from the changing environment for commercial banks. In particular the potential for bank profitability to rise and hence increase their risk taking capacity when yield curves stay positively sloped and while the back end trades near predictable levels. Soon we will dive deeper into this theme. Secondly, the steeper international yield curve environment will push the JGB curve up too. With JGB long end yields rising, the BoJ can execute bigger QE purchase operations which will support its monetary base growth. JPY weakness will be the result".

Copyright © 2016 Morgan Stanley, eFXnews

-

12:05

British households' equity injections reached its highest level since December 2014

According to rttnews, british households' equity injections reached its highest level since December 2014, the Bank of England said Thursday.

Households injected GBP 12.57 billion in the second quarter versus GBP 5.09 billion in the prior quarter. This was the highest since the fourth quarter of 2014, when injection totaled GBP 12.69 billion.

HEW occurs when withdrawals of housing equity by the household sector are larger than injections of equity.

When households, in aggregate, are withdrawing more equity than they are injecting, HEW is positive. When they are injecting more than they are withdrawing, HEW is negative.

-

11:53

UK Government will buy homes developers can’t sell in £2bn housebuilding drive

-

11:00

Merkel: Brexit talks will not be easy

-

UK must first trigger Article 50

-

talks will tackle how much single-market access can be given to UK

-

full freedom of movement tied to full access to market

-

ignoring those rules would damage EU

-

there will be no EU market access without freedom of movement

*via forexlive -

-

10:23

The end of the third quarter saw a slight drop in retail sales in the euro area - Markit

The end of the third quarter saw a slight drop in retail sales in the euro area, meaning that sales have now fallen in three of the past four months. Italy remained the weakest performer of the 'big-three', although France saw a renewed downturn and growth slowed in Germany.

The headline Markit Eurozone Retail PMI - which tracks month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - dipped to 49.6 in September, down from August's ten-month high of 51.0. Retailers also reported that sales were lower than during same month one year earlier, with the rate of decline on an annual basis being the fastest seen since April.

Phil Smith, economist at IHS Markit which compiles the Eurozone Retail PMI survey, said: "The headline Eurozone Retail PMI moved back into contraction territory in September, meaning that the sector has gone at least a full calendar year without successive increases in sales. A relapse in French retail sales following four months of growth was the main factor behind the downturn at the end of the third quarter, though the worst overall performance was again seen Italy. The picture in Germany remained one of moderate growth, albeit with some sales coming at the expense of lower margins."

-

10:03

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 250m) 1.1210-20 (901m) 1.1350 (433m) 1.1400 (220m) 1.1450 (265m)

USD/JPY: 101.00 (USD 456m) 101.30 (220m) 102.00 (527m) 102.30 (255m) 102.40-50 (961m) 102.80 (200m) 103.00 (210m) 103.00 (210m) 103.40-45 (446m) 103.50 (1.27bln) 105.00 (545m)

GBP/USD: 1.2500 (GBP 425m) 1.2571 (398m) 1.3000 (377m)

AUD/USD: 0.7700 (AUD 301m)

USD/CAD: 1.2800 (USD 230m) 1.3140 (406m) 1.3200 (676m)

NZD/USD: 0.7270 (NZD 217m)

AUD/JPY 76.00 (300m)

-

09:31

Swiss CPI inflation lower than expected

The Swiss Consumer Price Index (CPI) increased by 0.1% in September 2016 compared with the previous month, reaching 100.2 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO).

-

09:15

Switzerland: Consumer Price Index (YoY), September -0.2% (forecast -0.1%)

-

09:15

Switzerland: Consumer Price Index (MoM) , September 0.1% (forecast 0.2%)

-

08:26

Options levels on thursday, October 6, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1314 (3381)

$1.1283 (2370)

$1.1255 (1046)

Price at time of writing this review: $1.1193

Support levels (open interest**, contracts):

$1.1142 (6016)

$1.1096 (5030)

$1.1048 (4825)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 39298 contracts, with the maximum number of contracts with strike price $1,1500 (6400);

- Overall open interest on the PUT options with the expiration date October, 7 is 41303 contracts, with the maximum number of contracts with strike price $1,1150 (6016);

- The ratio of PUT/CALL was 1.05 versus 1.03 from the previous trading day according to data from October, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.3000 (1161)

$1.2901 (1141)

$1.2803 (804)

Price at time of writing this review: $1.2710

Support levels (open interest**, contracts):

$1.2599 (698)

$1.2500 (489)

$1.2400 (221)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 31317 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22429 contracts, with the maximum number of contracts with strike price $1,3000 (3221);

- The ratio of PUT/CALL was 0.72 versus 0.76 from the previous trading day according to data from October, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

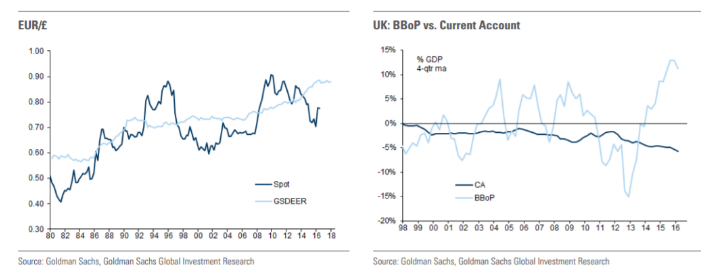

GBP Will Remain A Sell Over The Next 12 Months Targeting 1.20 - Goldman Sachs

"Sterling fell by about 11% in trade-weighted terms right after the vote on EU membership. But the Pound has mostly traded in a narrow range since Theresa May took over as Prime Minister before breaking lower this week.

The Bank of England delivered a sizeable monetary policy stimulus on August 4 and also left the door open for further easing in the near future. That said, activity data have, on average, surprised on the upside over the past month, making that less likely. Short positioning in GBP remains large and, in the absence of a clear catalyst for further action from the BoE, that goes against our view of a weaker currency.

That said, we think it is too soon to think that Sterling has found its post-Brexit low. Not much data have been released to assess fully the size of the slowdown. More importantly, negotiations with the European Union have not even started and a date has not been set for Article 50 to be triggered. When negotiations do start, business confidence will also likely be eroded further if, as we expect, European leaders take a tough negotiating stance.

Against this backdrop, it may take longer for Sterling to reach the lows we are forecasting, but we still think the currency is a sell over the next 12 months.

FX Targets:

We set our current forecast for EUR/GBP at 0.90, 0.86 and 0.80 in 3, 6 and 12 months. This implies GBP/$ at 1.20, 1.21 and 1.25 in 3, 6 and 12 months.

Things to Watch:

Exact timing for triggering Article 50, which will mark the beginning of the negotiations on the UK's exit from the European Union, remains a key factor. Until then, it is difficult to have any clarity on the type of trade and immigration agreements the UK is likely to strike with its European partners".

Copyright © 2016 Goldman Sachs, eFXnews™

-

08:10

Dutch consumer price inflation slowed slightly in September

According to rttnews, dutch consumer price inflation slowed slightly in September, figures from the Central Bureau of Statistics showed Thursday.

Consumer prices advanced 0.1 percent annually in September, following a 0.2 percent rise in August. Nonetheless, this was the second consecutive rise in consumer prices.

Core inflation that excludes energy, food, alcohol and tobacco, halved to 0.4 percent from 0.8 percent.

At the same time, EU harmonized consumer prices dropped 0.1 percent, offsetting August's 0.1 percent increase.

-

08:07

Fed's Fischer Concerned About Low Natural Interest Rate

-

Made No Comments on Timing of Future Interest Rate Increases

-

Fiscal Policies More Likely to Promote Faster Growth, Boost Productivity, Than Monetary Policy

-

Increased Saving, Reduced Investment May Have Driven 'Sizeable Decline' in Natural Rate

-

Low Natural Rate May Reflect Deeper Economic Problems, Including Lower Growth Potential

-

Shocks Might Render Conventional Monetary Policy Ineffective

-

Ultralow Rates May Reflect More Than Just Cyclical Forces

-

-

08:04

Fed's Lacker Says 100K Payroll Growth Would Bolster Rate-Hike Case

-

08:02

German factory orders up 1%

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in August 2016 a seasonally and working-day adjusted 1.0% on July 2016. For July 2016, revision of the preliminary outcome resulted in an increase of 0.3% compared with June 2016 (primary +0.2%). Price-adjusted new orders without major orders in manufacturing had increased in August 2016 a seasonally and working-day adjusted 1.6% on July 2016.

In August 2016, domestic orders increased by 2.6%, while foreign orders decreased by 0.2% on the previous month. New orders from the euro area were up 4.1% on the previous month, while new orders from other countries decreased by 2.8% compared to July 2016.

In August 2016 the manufacturers of intermediate goods saw new rise 1.7% compared with July 2016. The manufacturers of capital goods showed increases of 0.3% on the previous month. For consumer goods, an increase in new orders of 2.9% was recorded.

-

08:01

Aussie trade balance deficit decline in August

In trend terms, the balance on goods and services was a deficit of $2,239m in August 2016, an increase of $8m on the deficit in July 2016.

In seasonally adjusted terms, the balance on goods and services was a deficit of $2,010m in August 2016, a decrease of $111m (5%) on the deficit in July 2016.

In seasonally adjusted terms, goods and services credits rose $10m to $26,856m. Non-rural goods rose $406m (3%) and rural goods rose $36m (1%). Non-monetary gold fell $521m (22%). Net exports of goods under merchanting remained steady at $47m. Services credits rose $90m (1%).

-

08:00

Germany: Factory Orders s.a. (MoM), August 1.0% (forecast 0.2%)

-

02:30

Australia: Trade Balance , August -2.01 (forecast -2.3)

-

00:28

Currencies. Daily history for Oct 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1206 +0,03%

GBP/USD $1,2744 +0,15%

USD/CHF Chf0,9743 -0,46%

USD/JPY Y103,51 +0,60%

EUR/JPY Y116,00 +0,62%

GBP/JPY Y131,47 +0,41%

AUD/USD $0,7611 0,00%

NZD/USD $0,7166 -0,28%

USD/CAD C$1,3181 -0,05%

-

00:00

Schedule for today,Thursday, Oct 06’2016

00:30 Australia Trade Balance August -2.41 -2.3

06:00 Germany Factory Orders s.a. (MoM) August 0.2% 0.2%

07:15 Switzerland Consumer Price Index (MoM) September -0.1% 0.2%

07:15 Switzerland Consumer Price Index (YoY) September -0.1% 0%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Building Permits (MoM) August 0.8% 3%

12:30 U.S. Continuing Jobless Claims 2062

12:30 U.S. Initial Jobless Claims 254 256

15:35 Canada Gov Council Member Wilkins Speaks

22:30 Australia AiG Performance of Construction Index September 46.6

-