Noticias del mercado

-

21:00

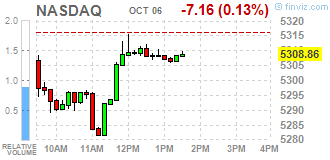

DJIA 18261.69 -19.34 -0.11%, NASDAQ 5307.55 -8.47 -0.16%, S&P 500 2160.65 0.92 0.04%

-

19:39

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday, a day ahead of a crucial employment report that would show whether the economy is strong enough to absorb an interest rate hike. A growing number of U.S. Federal Reserve officials have argued for higher rates as the labor market remains solid and inflation inches towards the central bank's 2% target.

Dow stocks mixed (15 in positive area, 15 in negative area). Top gainer - The Home Depot, Inc. (HD, +1.38%). Top loser - American Express Company (AXP, -3.76%).

S&P sectors also mixed. Top gainer - Basic Materials (+0.9%). Top loser - Healthcare (-0.7%).

At the moment:

Dow 18175.00 -25.00 -0.14%

S&P 500 2154.00 +0.75 +0.03%

Nasdaq 100 4871.50 -2.00 -0.04%

Oil 50.40 +0.57 +1.14%

Gold 1253.90 -14.70 -1.16%

U.S. 10yr 1.74 +0.02

-

18:01

European stocks closed: FTSE 6999.96 -33.29 -0.47%, DAX 10568.80 -16.98 -0.16%, CAC 4480.10 -9.85 -0.22%

-

17:35

WSE: Session Results

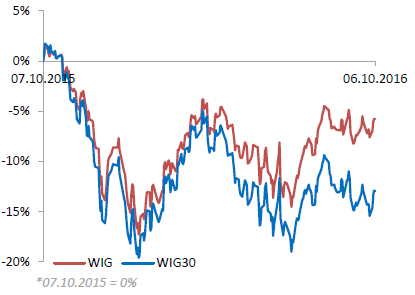

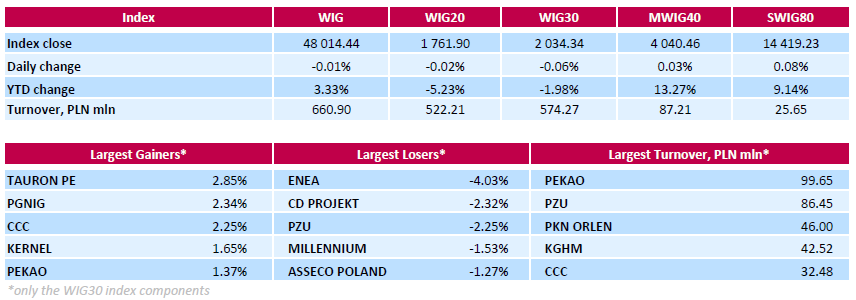

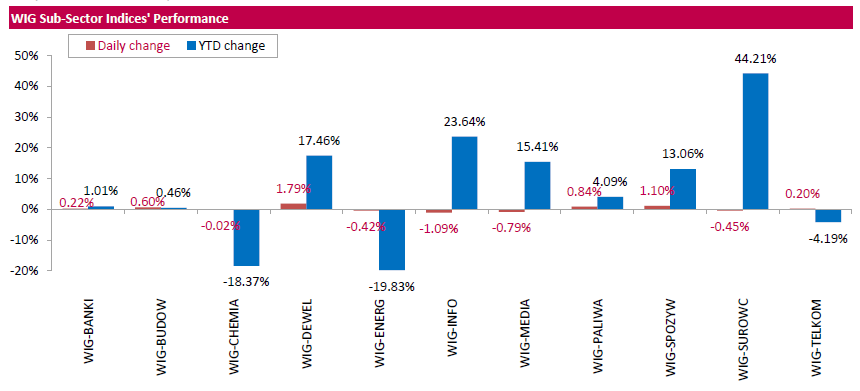

Polish equity market closed flat on Thursday. The broad market measure, the WIG Index, inched down 0.01%. Sector performance in the WIG index was mixed. Developing sector (+1.79%) outperformed, while information technology (-1.09%) lagged behind.

The large-cap stocks edged down 0.06%, as measured by the WIG30 Index. Within the index components, genco ENEA (WSE: ENA), videogame developer CD PROJEKT (WSE: CDR) and insurer PZU (WSE: PZU) recorded the largest declines, tumbling by a respective 4.03%, 2.32% and 2.25%. They were followed by bank MILLENNIUM (WSE: MIL) and IT-company ASSECO POLAND (WSE: ACP), dropping by 1.53% and 1.27% respectively. At the same time, genco TAURON PE (WSE: TPE), oil and gas producer PGNIG (WSE: PGN) and footwear retailer CCC (WSE: CCC) were among growth leaders, climbing by 2.25%-2.85%.

-

15:52

WSE: After start on Wall Street

As every week, on Thursday afternoon we met weekly publication about the number of applications for unemployment benefits. It amounted to 249 thousand, what is a result of slightly better than expected and the second best in the course of this current recovery after 2008. Only tomorrow's publication of the new jobs will attract far more attention and at the same time will imprint its mark on the market. After the last series of quite good data it may be stated that the tomorrow's is not promise to be wrong.

Trading on Wall Street started from cosmetic departure down, which given the size of the changes from previous sessions can be considered as neutral. On the Warsaw market, an hour before the close of trading the WIG20 index was at the level of 1,763 points (+0,07%).

-

15:49

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1100 (EUR 250m) 1.1210-20 (901m) 1.1350 (433m) 1.1400 (220m) 1.1450 (265m)

USDJPY: 101.00 (USD 456m) 101.30 (220m) 102.00 (527m) 102.30 (255m) 102.40-50 (961m) 102.80 (200m) 103.00 (210m) 103.00 (210m) 103.40-45 (446m) 103.50 (1.27bln) 105.00 (545m)

GBPUSD: 1.2500 (GBP 425m) 1.2571 (398m) 1.3000 (377m)

AUDUSD: 0.7700 (AUD 301m)

USDCAD: 1.2800 (USD 230m) 1.3140 (406m) 1.3200 (676m)

NZD/USD: 0.7270 (NZD 217m)

AUDJPY 76.00 (300m)

-

15:31

U.S. Stocks open: Dow -0.22%, Nasdaq -0.15%, S&P -0.13%

-

15:15

Before the bell: S&P futures -0.20%, NASDAQ futures -0.18%

U.S. stock-index futures slipped as shares in Europe erased an advance, while investors awaited more evidence that the economy is strong enough to cope with higher borrowing costs.

Global Stocks:

Nikkei 16,899.10 +79.86 +0.47%

Hang Seng 23,952.50 +164.19 +0.69%

Shanghai Closed

FTSE 7,034.36 +1.11 +0.02%

CAC 4,484.40 -5.55 -0.12%

DAX 10,560.27 -25.51 -0.24%

Crude $50.13 (+0.60%)

Gold $1266.00 (-0.20%)

-

14:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

842.74

-1.62(-0.1919%)

13876

American Express Co

AXP

63.98

-0.38(-0.5904%)

2069

Apple Inc.

AAPL

113.47

0.42(0.3715%)

88591

AT&T Inc

T

39.1

-0.06(-0.1532%)

5718

Barrick Gold Corporation, NYSE

ABX

15.67

-0.31(-1.9399%)

115305

Caterpillar Inc

CAT

89.2

-0.22(-0.246%)

5017

Citigroup Inc., NYSE

C

48.6

-0.05(-0.1028%)

12300

Exxon Mobil Corp

XOM

87.5

0.50(0.5747%)

373

Facebook, Inc.

FB

128.39

-0.08(-0.0623%)

24147

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.63

-0.04(-0.3749%)

13490

General Electric Co

GE

29.45

-0.05(-0.1695%)

13773

Google Inc.

GOOG

777.73

1.26(0.1623%)

900

Hewlett-Packard Co.

HPQ

15.6

-0.03(-0.1919%)

600

Home Depot Inc

HD

127

-0.58(-0.4546%)

5851

Intel Corp

INTC

38

0.01(0.0263%)

2580

Johnson & Johnson

JNJ

119.16

-0.02(-0.0168%)

400

JPMorgan Chase and Co

JPM

67.6

-0.09(-0.133%)

8164

Microsoft Corp

MSFT

57.6

-0.04(-0.0694%)

312

Nike

NKE

52.2

0.08(0.1535%)

590

Pfizer Inc

PFE

34

0.10(0.295%)

1200

Starbucks Corporation, NASDAQ

SBUX

53.4

0.05(0.0937%)

556

Tesla Motors, Inc., NASDAQ

TSLA

202.47

-5.99(-2.8735%)

50957

Twitter, Inc., NYSE

TWTR

20.8

-4.07(-16.3651%)

7285476

Verizon Communications Inc

VZ

50.22

-0.05(-0.0995%)

2821

Wal-Mart Stores Inc

WMT

70.4

-1.27(-1.772%)

242754

Walt Disney Co

DIS

92.39

-0.06(-0.0649%)

1200

Yahoo! Inc., NASDAQ

YHOO

43.61

-0.10(-0.2288%)

600

Yandex N.V., NASDAQ

YNDX

21.92

-0.06(-0.273%)

250

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

American Express (AXP) downgraded to Reduce from Neutral at Nomura

Tesla Motors (TSLA) downgraded to Neutral from Buy at Goldman; target lowered to $185 from $240

JPMorgan Chase (JPM) downgraded to Hold from Buy at Sandler O'Neil

Other:

Honeywell (HON) initiated with a Outperform at Robert W. Baird; target $135

United Tech (UTX) initiated with a Neutral at Robert W. Baird; target $110

Boeing (BA) initiated with a Outperform at Robert W. Baird; target $161

-

14:38

US unemployment claims continue to decline

According to Bloomberg, filings for U.S. unemployment benefits fell last week almost to the lowest level since 1973, as employers show scant willingness to fire workers amid a tightening labor market.

Jobless claims dropped by 5,000 to 249,000 in the week ended Oct. 1, a Labor Department report showed Thursday in Washington. The median forecast in a Bloomberg survey called for 256,000. Continuing claims declined to the lowest level since 2000.

-

14:34

Canadian building permits rose significantly in August

Municipalities issued $7.3 billion worth of building permits in August, up 10.4% from July. This marked the second consecutive monthly increase. The gain in August was mainly attributable to higher construction intentions in Quebec, Ontario and British Columbia.

The value of residential building permits was up 9.6% to $4.5 billion in August, following four consecutive monthly declines. Both residential components-multi-family and single-family dwellings-recorded gains. Six provinces posted increases, led by Ontario and British Columbia.

In the non-residential sector, municipalities issued $2.9 billion worth of permits in August, up 11.6% from July. The increase was mainly attributable to higher construction intentions for commercial buildings and, to a lesser extent, industrial buildings. Gains were reported in five provinces, led by Quebec, followed distantly by Manitoba.

-

14:30

Canada: Building Permits (MoM) , August 10.4% (forecast 3%)

-

14:30

U.S.: Initial Jobless Claims, 249 (forecast 257)

-

14:30

U.S.: Continuing Jobless Claims, 2058 (forecast 2090)

-

14:00

Orders

EUR/USD

Offers 1.1220 1.1235 1.1250 1.1280 1.1300 1.1320 1.1350

Ордера на покупку: 1.1175-80 1.1150-60 1.1125-30 1.1100 1.1080 1.1050

GBP/USD

Offers 1.2735 1.2750 1.2775 1.2790-1.2800 1.2820 1.2850 1.2875-80 1.2900

Bids 1.2640-50 1.2620-25 1.2600 1.2500

EUR/GBP

Offers 0.8820-25 0.8850-55 0.8885 0.8900 0.8930 0.8950

Bids 0.8785 0.8750 0.8720 0.8700 0.8685 0.8650

EUR/JPY

Offers 116.25-30 116.50 117.00 117.30 117.50 118.00 118.45-50

Bids 115.80 115.50 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers 103.65 103.80 104.00 104.30 104.50 105.00

Bids 103.25-30 103.00 102.85 102.70 102.50 102.30 102.00

AUD/USD

Offers 0.7600 0.7630 0.7650 0.7685 0.7700 0.7720

Bids 0.7565 0.7550 0.7530 0.7500 0.7485 0.7450

-

13:44

ECB: Underlying Inflation 'an Ongoing Source of Concern' -- Minutes

-

Weak Bank Profitability Poses Risk for Future Lending

-

Risk of Stronger Hit to Growth From Brexit Vote in Future

-

Too Early to Say Adverse Expectations From Brexit Were Overstated

-

ECB Saw 'Considerable Uncertainty' Around Longer-Term Economic Impact of Brexit Vote

-

Banks Face Numerous Challenges That Might Affect Lending Decisions

-

Possible Revisions to QE Parameters Must Take Account of Policy Effectiveness

-

Underlying Inflation Not Yet Showing Clear Upward Trend

-

'Increasing Challenges' to Future Implementation of QE at Sept. Meeting

-

Underlying Inflation 'an Ongoing Source of Concern'

-

-

13:03

WSE: Mid session comment

The first part of the day in the markets brought a slight aversion to risk. European parquets appoint new session lows, also weaker present themselves contracts in the United States. Discounts on markets in Frankfurt and Paris are not any significant and amount to approx. 0.3%. Announcing by the ECB's departure from accommodative monetary policy helps today financial companies, which suffered the most on it. Everything points to the fact that Thursday's trade is marked by expectations for tomorrow's, the important data from the US Department of Labor.

The second half of the trading the WIG20 index started at the level 1,755 points (-0,39%), with the turnover of PLN 250 million

-

13:00

Major stock indices in Europe traded in the red zone

European stocks traded in the red zone, as the decline in the shares of the airlines offset the increase in the banking sector and oil companies.

Certain influence on the dynamics of trade had data for Germany. Statistical Office Destatis reported that German factory orders rose at a faster pace in August, which is mainly on high level of domestic demand in August. The volume of industrial orders rose by 1 percent compared to July, when an increase of 0.3 percent (revised from +0.2 per cent) was recorded. It was the second consecutive increase in orders. Economists had expected orders to grow by only 0.2 percent. Domestic orders increased by 2.6 percent in August, while foreign orders fell by 0.2 percent. New orders from the euro area countries increased by 4.1 percent. In contrast, demand from other countries fell by 2.8 percent.

Meanwhile, the results of Markit Economics, showed that business activity in the German construction sector has reached in September a 4-month high. The PMI for the construction sector rose to 52.4 points from 51.6 points in August. Recall index value above 50 indicates expansion. It is worth emphasizing the growth in construction activity recorded 20 consecutive months. The survey also showed that German construction companies on average believe that the volume of construction will grow over the next 12 months.

Investors also await the publication of the ECB's report on monetary policy. "Most likely, the report will give little or no support for the idea that in the near future, the ECB would be ready to taper the asset purchase program. We expect the Central Bank announcement on December meeting to extend buying period for another 6 months after the March 2017 ", -. BNPP experts said.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0.4 percent. Shares of the banking sector for the third consecutive day rise in price, which is the longest series in the past month.

UniCredit shares rose 2.5 percent after reports that Amundi SA is ready to offer 4 billion euros for Pioneer Global Management unit.

Shares of CaixaBank rose 3.1 percent. The cost of the French bank Societe Generale rose 2.9 percent, while quotations of German lender Deutsche Bank rose 0.8 percent, having recovered 16 percent from its record low reached last week.

Price Osram Licht AG shares rose 10 percent after news that the Chinese company plans to bid the German manufacturer of light bulbs and LEDs in the middle of October.

Capitalization of EasyJet Plc fell 5.7 percent, as the airline announced its first annual profit decline since 2009, referring to the drop in demand due to the terrorist attacks and a weak pound, which inflated costs in foreign currency.

At the moment:

FTSE 100 7008.24 -25.01 -0.36%

DAX -42.69 10543.09 -0.40%

CAC 40 4471.59 -18.36 -0.41%

-

12:39

USD/JPY: A Bottom Now In Place: What's Next? - Morgan Stanley

"The BoJ and the JPY. Yesterday USDJPY broke out of an upper channel resistance at 102.50, which for us confirms that a bottom is now in place. Beyond current momentum, the major catalysts for JPY weakness are found within the newly designed BoJ monetary policy. Here the BoJ no longer aims to lower bond yields across the curve, but instead to manage a generally positively sloped curve aiming to keep 10-year yields near zero even in the case of inflation overshooting the 2% target. Rightly, investors cited the dilemma that you can either control quantity or price, but you cannot control both. Hence, investors were convinced the BoJ's 0% yield target would lead to an implicit tapering, specifically since the country has a current account surplus, generating an excess of savings which push down yields. Investors assumed that the BoJ's monetary base would grow less than suggested by the JPY80trn QE promise provided earlier and that this implicit decline in the monetary base growth rate would lead to a lower USDJPY. A race of USDJPY downside projections peaked with ex MOF's Sakakibara calling USDJPY to reach 90. We believe this assessment is wrong for several reasons.

Our reasons for further JPY weakness. Firstly, the assessment above does not take into account the potential for an increase in monetary velocity from the changing environment for commercial banks. In particular the potential for bank profitability to rise and hence increase their risk taking capacity when yield curves stay positively sloped and while the back end trades near predictable levels. Soon we will dive deeper into this theme. Secondly, the steeper international yield curve environment will push the JGB curve up too. With JGB long end yields rising, the BoJ can execute bigger QE purchase operations which will support its monetary base growth. JPY weakness will be the result".

Copyright © 2016 Morgan Stanley, eFXnews

-

12:05

British households' equity injections reached its highest level since December 2014

According to rttnews, british households' equity injections reached its highest level since December 2014, the Bank of England said Thursday.

Households injected GBP 12.57 billion in the second quarter versus GBP 5.09 billion in the prior quarter. This was the highest since the fourth quarter of 2014, when injection totaled GBP 12.69 billion.

HEW occurs when withdrawals of housing equity by the household sector are larger than injections of equity.

When households, in aggregate, are withdrawing more equity than they are injecting, HEW is positive. When they are injecting more than they are withdrawing, HEW is negative.

-

11:53

UK Government will buy homes developers can’t sell in £2bn housebuilding drive

-

11:00

Merkel: Brexit talks will not be easy

-

UK must first trigger Article 50

-

talks will tackle how much single-market access can be given to UK

-

full freedom of movement tied to full access to market

-

ignoring those rules would damage EU

-

there will be no EU market access without freedom of movement

*via forexlive -

-

10:41

Oil is trading lower

This morning, the New York futures for Brent have fallen in price by 0.50% to $ 49.57 and crude oil futures for WTI have fallen in price by 0.48% to $ 51.62 per barrel. Thus, the black gold is traded in the red zone, correcting down after recent gains, amid US Department of Energy data oil reserves. Traders, however, does not believe in the continued steady rise in prices, given the high supply of raw materials in the market, writes "Interfax".

-

10:23

The end of the third quarter saw a slight drop in retail sales in the euro area - Markit

The end of the third quarter saw a slight drop in retail sales in the euro area, meaning that sales have now fallen in three of the past four months. Italy remained the weakest performer of the 'big-three', although France saw a renewed downturn and growth slowed in Germany.

The headline Markit Eurozone Retail PMI - which tracks month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - dipped to 49.6 in September, down from August's ten-month high of 51.0. Retailers also reported that sales were lower than during same month one year earlier, with the rate of decline on an annual basis being the fastest seen since April.

Phil Smith, economist at IHS Markit which compiles the Eurozone Retail PMI survey, said: "The headline Eurozone Retail PMI moved back into contraction territory in September, meaning that the sector has gone at least a full calendar year without successive increases in sales. A relapse in French retail sales following four months of growth was the main factor behind the downturn at the end of the third quarter, though the worst overall performance was again seen Italy. The picture in Germany remained one of moderate growth, albeit with some sales coming at the expense of lower margins."

-

10:03

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 250m) 1.1210-20 (901m) 1.1350 (433m) 1.1400 (220m) 1.1450 (265m)

USD/JPY: 101.00 (USD 456m) 101.30 (220m) 102.00 (527m) 102.30 (255m) 102.40-50 (961m) 102.80 (200m) 103.00 (210m) 103.00 (210m) 103.40-45 (446m) 103.50 (1.27bln) 105.00 (545m)

GBP/USD: 1.2500 (GBP 425m) 1.2571 (398m) 1.3000 (377m)

AUD/USD: 0.7700 (AUD 301m)

USD/CAD: 1.2800 (USD 230m) 1.3140 (406m) 1.3200 (676m)

NZD/USD: 0.7270 (NZD 217m)

AUD/JPY 76.00 (300m)

-

09:52

Major stock exchanges trading in the green zone: FTSE + 0.2%, DAX + 0.5%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX + 0.3%

-

09:31

Swiss CPI inflation lower than expected

The Swiss Consumer Price Index (CPI) increased by 0.1% in September 2016 compared with the previous month, reaching 100.2 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO).

-

09:15

Switzerland: Consumer Price Index (YoY), September -0.2% (forecast -0.1%)

-

09:15

Switzerland: Consumer Price Index (MoM) , September 0.1% (forecast 0.2%)

-

09:12

WSE: After opening

WIG20 index opened at 1762.95 points (+0.04%)*

WIG 48006.01 -0.02%

WIG30 2033.05 -0.12%

mWIG40 4052.71 0.33%

*/ - change to previous close

The WIG20 futures December series began the day with 4 points more than yesterday's closing level. After three consecutive sessions of growth good run allow to extend the positive sentiment in Euroland.

The cash market opens up with a modest increase of 0.04% to 1,762 points at low turnover, focused on smaller companies..

-

08:44

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.2%, CAC40 + 0.2%, FTSE + 0.2%

-

08:27

WSE: Before opening

Stock exchanges in the United States ended Wednesday's session with increases, which leaders were financial and fuel companies. The Dow Jones Industrial at the end of the day gained 0.62 per cent and the S&P500 rose by 0.43 per cent.

Once better ISM data for both industry and services sectors, increases the probability of the December interest rate hike in the US. There are also speculations that the ECB may intend to reduce and end the asset purchase program. Such a tightening of monetary policy in Euroland would be a big surprise. Hence, probably yesterday's weaker performance of European indices, although not as weak as we would expect.

The macro calendar does not contain today's important information and investors already are waiting for tomorrow's monthly data from the US labor market.

In the morning Asian markets are dominated by small increases but contracts in the US cosmetically go down. This may mean a neutral sentiment in early European trading.

Also on the Warsaw Stock Exchange this week so far recorded positive, although largely due to the force of the specific entities (PZU and LPP) and not the market as a whole. Yesterday the WIG20 index even managed to go beyond the level of 1,750 points, but the proximity of the maximum from September 22 reduced the scale of increases

-

08:26

Options levels on thursday, October 6, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1314 (3381)

$1.1283 (2370)

$1.1255 (1046)

Price at time of writing this review: $1.1193

Support levels (open interest**, contracts):

$1.1142 (6016)

$1.1096 (5030)

$1.1048 (4825)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 39298 contracts, with the maximum number of contracts with strike price $1,1500 (6400);

- Overall open interest on the PUT options with the expiration date October, 7 is 41303 contracts, with the maximum number of contracts with strike price $1,1150 (6016);

- The ratio of PUT/CALL was 1.05 versus 1.03 from the previous trading day according to data from October, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.3000 (1161)

$1.2901 (1141)

$1.2803 (804)

Price at time of writing this review: $1.2710

Support levels (open interest**, contracts):

$1.2599 (698)

$1.2500 (489)

$1.2400 (221)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 31317 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22429 contracts, with the maximum number of contracts with strike price $1,3000 (3221);

- The ratio of PUT/CALL was 0.72 versus 0.76 from the previous trading day according to data from October, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

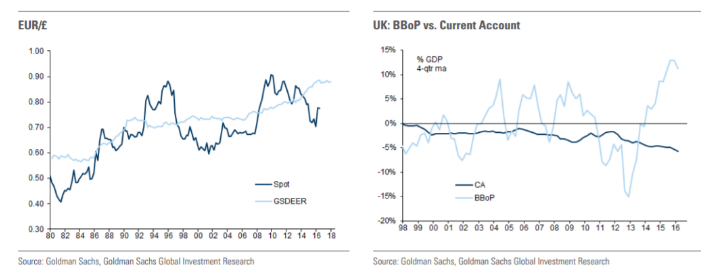

GBP Will Remain A Sell Over The Next 12 Months Targeting 1.20 - Goldman Sachs

"Sterling fell by about 11% in trade-weighted terms right after the vote on EU membership. But the Pound has mostly traded in a narrow range since Theresa May took over as Prime Minister before breaking lower this week.

The Bank of England delivered a sizeable monetary policy stimulus on August 4 and also left the door open for further easing in the near future. That said, activity data have, on average, surprised on the upside over the past month, making that less likely. Short positioning in GBP remains large and, in the absence of a clear catalyst for further action from the BoE, that goes against our view of a weaker currency.

That said, we think it is too soon to think that Sterling has found its post-Brexit low. Not much data have been released to assess fully the size of the slowdown. More importantly, negotiations with the European Union have not even started and a date has not been set for Article 50 to be triggered. When negotiations do start, business confidence will also likely be eroded further if, as we expect, European leaders take a tough negotiating stance.

Against this backdrop, it may take longer for Sterling to reach the lows we are forecasting, but we still think the currency is a sell over the next 12 months.

FX Targets:

We set our current forecast for EUR/GBP at 0.90, 0.86 and 0.80 in 3, 6 and 12 months. This implies GBP/$ at 1.20, 1.21 and 1.25 in 3, 6 and 12 months.

Things to Watch:

Exact timing for triggering Article 50, which will mark the beginning of the negotiations on the UK's exit from the European Union, remains a key factor. Until then, it is difficult to have any clarity on the type of trade and immigration agreements the UK is likely to strike with its European partners".

Copyright © 2016 Goldman Sachs, eFXnews™

-

08:10

Dutch consumer price inflation slowed slightly in September

According to rttnews, dutch consumer price inflation slowed slightly in September, figures from the Central Bureau of Statistics showed Thursday.

Consumer prices advanced 0.1 percent annually in September, following a 0.2 percent rise in August. Nonetheless, this was the second consecutive rise in consumer prices.

Core inflation that excludes energy, food, alcohol and tobacco, halved to 0.4 percent from 0.8 percent.

At the same time, EU harmonized consumer prices dropped 0.1 percent, offsetting August's 0.1 percent increase.

-

08:07

Fed's Fischer Concerned About Low Natural Interest Rate

-

Made No Comments on Timing of Future Interest Rate Increases

-

Fiscal Policies More Likely to Promote Faster Growth, Boost Productivity, Than Monetary Policy

-

Increased Saving, Reduced Investment May Have Driven 'Sizeable Decline' in Natural Rate

-

Low Natural Rate May Reflect Deeper Economic Problems, Including Lower Growth Potential

-

Shocks Might Render Conventional Monetary Policy Ineffective

-

Ultralow Rates May Reflect More Than Just Cyclical Forces

-

-

08:04

Fed's Lacker Says 100K Payroll Growth Would Bolster Rate-Hike Case

-

08:02

German factory orders up 1%

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in August 2016 a seasonally and working-day adjusted 1.0% on July 2016. For July 2016, revision of the preliminary outcome resulted in an increase of 0.3% compared with June 2016 (primary +0.2%). Price-adjusted new orders without major orders in manufacturing had increased in August 2016 a seasonally and working-day adjusted 1.6% on July 2016.

In August 2016, domestic orders increased by 2.6%, while foreign orders decreased by 0.2% on the previous month. New orders from the euro area were up 4.1% on the previous month, while new orders from other countries decreased by 2.8% compared to July 2016.

In August 2016 the manufacturers of intermediate goods saw new rise 1.7% compared with July 2016. The manufacturers of capital goods showed increases of 0.3% on the previous month. For consumer goods, an increase in new orders of 2.9% was recorded.

-

08:01

Aussie trade balance deficit decline in August

In trend terms, the balance on goods and services was a deficit of $2,239m in August 2016, an increase of $8m on the deficit in July 2016.

In seasonally adjusted terms, the balance on goods and services was a deficit of $2,010m in August 2016, a decrease of $111m (5%) on the deficit in July 2016.

In seasonally adjusted terms, goods and services credits rose $10m to $26,856m. Non-rural goods rose $406m (3%) and rural goods rose $36m (1%). Non-monetary gold fell $521m (22%). Net exports of goods under merchanting remained steady at $47m. Services credits rose $90m (1%).

-

08:00

Germany: Factory Orders s.a. (MoM), August 1.0% (forecast 0.2%)

-

02:30

Australia: Trade Balance , August -2.01 (forecast -2.3)

-

00:30

Commodities. Daily history for Oct 05’2016:

(raw materials / closing price /% change)

Oil 49.70 -0.26%

Gold 1,269.00 +0.03%

-

00:29

Stocks. Daily history for Oct 05’2016:

(index / closing price / change items /% change)

Nikkei 225 16,830.22 +94.57 +0.57%

Shanghai Composite 3,005.51 +7.03 +0.23%

S&P/ASX 200 5,452.93 -31.08 -0.57%

FTSE 100 7,033.25 -41.09 -0.58%

CAC 40 4,489.95 -13.14 -0.29%

Xetra DAX 10,585.78 -33.83 -0.32%

S&P 500 2,159.73 +9.24 +0.43%

Dow Jones Industrial Average 18,281.03 +112.58 +0.62%

S&P/TSX Composite 14,610.58 +89.57 +0.62%

-

00:28

Currencies. Daily history for Oct 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1206 +0,03%

GBP/USD $1,2744 +0,15%

USD/CHF Chf0,9743 -0,46%

USD/JPY Y103,51 +0,60%

EUR/JPY Y116,00 +0,62%

GBP/JPY Y131,47 +0,41%

AUD/USD $0,7611 0,00%

NZD/USD $0,7166 -0,28%

USD/CAD C$1,3181 -0,05%

-

00:00

Schedule for today,Thursday, Oct 06’2016

00:30 Australia Trade Balance August -2.41 -2.3

06:00 Germany Factory Orders s.a. (MoM) August 0.2% 0.2%

07:15 Switzerland Consumer Price Index (MoM) September -0.1% 0.2%

07:15 Switzerland Consumer Price Index (YoY) September -0.1% 0%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Building Permits (MoM) August 0.8% 3%

12:30 U.S. Continuing Jobless Claims 2062

12:30 U.S. Initial Jobless Claims 254 256

15:35 Canada Gov Council Member Wilkins Speaks

22:30 Australia AiG Performance of Construction Index September 46.6

-