Noticias del mercado

-

21:00

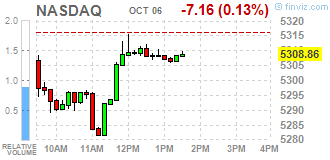

DJIA 18261.69 -19.34 -0.11%, NASDAQ 5307.55 -8.47 -0.16%, S&P 500 2160.65 0.92 0.04%

-

19:39

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday, a day ahead of a crucial employment report that would show whether the economy is strong enough to absorb an interest rate hike. A growing number of U.S. Federal Reserve officials have argued for higher rates as the labor market remains solid and inflation inches towards the central bank's 2% target.

Dow stocks mixed (15 in positive area, 15 in negative area). Top gainer - The Home Depot, Inc. (HD, +1.38%). Top loser - American Express Company (AXP, -3.76%).

S&P sectors also mixed. Top gainer - Basic Materials (+0.9%). Top loser - Healthcare (-0.7%).

At the moment:

Dow 18175.00 -25.00 -0.14%

S&P 500 2154.00 +0.75 +0.03%

Nasdaq 100 4871.50 -2.00 -0.04%

Oil 50.40 +0.57 +1.14%

Gold 1253.90 -14.70 -1.16%

U.S. 10yr 1.74 +0.02

-

18:01

European stocks closed: FTSE 6999.96 -33.29 -0.47%, DAX 10568.80 -16.98 -0.16%, CAC 4480.10 -9.85 -0.22%

-

17:35

WSE: Session Results

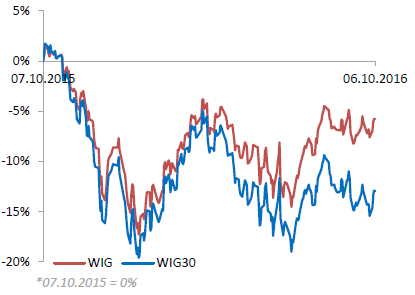

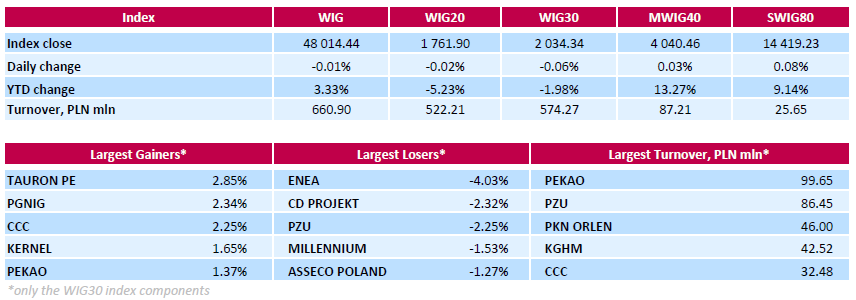

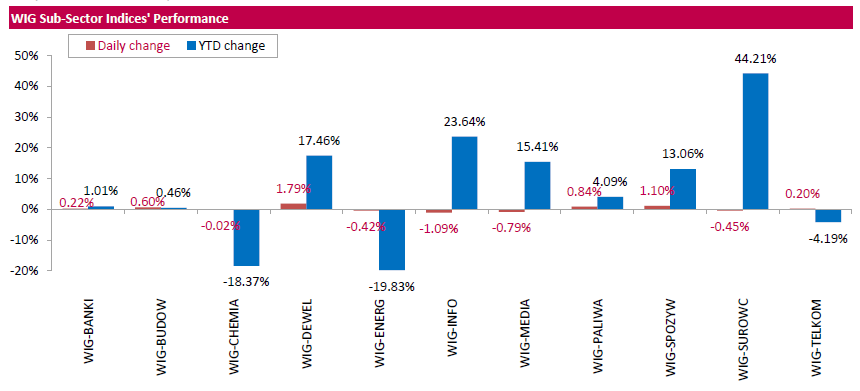

Polish equity market closed flat on Thursday. The broad market measure, the WIG Index, inched down 0.01%. Sector performance in the WIG index was mixed. Developing sector (+1.79%) outperformed, while information technology (-1.09%) lagged behind.

The large-cap stocks edged down 0.06%, as measured by the WIG30 Index. Within the index components, genco ENEA (WSE: ENA), videogame developer CD PROJEKT (WSE: CDR) and insurer PZU (WSE: PZU) recorded the largest declines, tumbling by a respective 4.03%, 2.32% and 2.25%. They were followed by bank MILLENNIUM (WSE: MIL) and IT-company ASSECO POLAND (WSE: ACP), dropping by 1.53% and 1.27% respectively. At the same time, genco TAURON PE (WSE: TPE), oil and gas producer PGNIG (WSE: PGN) and footwear retailer CCC (WSE: CCC) were among growth leaders, climbing by 2.25%-2.85%.

-

15:52

WSE: After start on Wall Street

As every week, on Thursday afternoon we met weekly publication about the number of applications for unemployment benefits. It amounted to 249 thousand, what is a result of slightly better than expected and the second best in the course of this current recovery after 2008. Only tomorrow's publication of the new jobs will attract far more attention and at the same time will imprint its mark on the market. After the last series of quite good data it may be stated that the tomorrow's is not promise to be wrong.

Trading on Wall Street started from cosmetic departure down, which given the size of the changes from previous sessions can be considered as neutral. On the Warsaw market, an hour before the close of trading the WIG20 index was at the level of 1,763 points (+0,07%).

-

15:31

U.S. Stocks open: Dow -0.22%, Nasdaq -0.15%, S&P -0.13%

-

15:15

Before the bell: S&P futures -0.20%, NASDAQ futures -0.18%

U.S. stock-index futures slipped as shares in Europe erased an advance, while investors awaited more evidence that the economy is strong enough to cope with higher borrowing costs.

Global Stocks:

Nikkei 16,899.10 +79.86 +0.47%

Hang Seng 23,952.50 +164.19 +0.69%

Shanghai Closed

FTSE 7,034.36 +1.11 +0.02%

CAC 4,484.40 -5.55 -0.12%

DAX 10,560.27 -25.51 -0.24%

Crude $50.13 (+0.60%)

Gold $1266.00 (-0.20%)

-

14:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

842.74

-1.62(-0.1919%)

13876

American Express Co

AXP

63.98

-0.38(-0.5904%)

2069

Apple Inc.

AAPL

113.47

0.42(0.3715%)

88591

AT&T Inc

T

39.1

-0.06(-0.1532%)

5718

Barrick Gold Corporation, NYSE

ABX

15.67

-0.31(-1.9399%)

115305

Caterpillar Inc

CAT

89.2

-0.22(-0.246%)

5017

Citigroup Inc., NYSE

C

48.6

-0.05(-0.1028%)

12300

Exxon Mobil Corp

XOM

87.5

0.50(0.5747%)

373

Facebook, Inc.

FB

128.39

-0.08(-0.0623%)

24147

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.63

-0.04(-0.3749%)

13490

General Electric Co

GE

29.45

-0.05(-0.1695%)

13773

Google Inc.

GOOG

777.73

1.26(0.1623%)

900

Hewlett-Packard Co.

HPQ

15.6

-0.03(-0.1919%)

600

Home Depot Inc

HD

127

-0.58(-0.4546%)

5851

Intel Corp

INTC

38

0.01(0.0263%)

2580

Johnson & Johnson

JNJ

119.16

-0.02(-0.0168%)

400

JPMorgan Chase and Co

JPM

67.6

-0.09(-0.133%)

8164

Microsoft Corp

MSFT

57.6

-0.04(-0.0694%)

312

Nike

NKE

52.2

0.08(0.1535%)

590

Pfizer Inc

PFE

34

0.10(0.295%)

1200

Starbucks Corporation, NASDAQ

SBUX

53.4

0.05(0.0937%)

556

Tesla Motors, Inc., NASDAQ

TSLA

202.47

-5.99(-2.8735%)

50957

Twitter, Inc., NYSE

TWTR

20.8

-4.07(-16.3651%)

7285476

Verizon Communications Inc

VZ

50.22

-0.05(-0.0995%)

2821

Wal-Mart Stores Inc

WMT

70.4

-1.27(-1.772%)

242754

Walt Disney Co

DIS

92.39

-0.06(-0.0649%)

1200

Yahoo! Inc., NASDAQ

YHOO

43.61

-0.10(-0.2288%)

600

Yandex N.V., NASDAQ

YNDX

21.92

-0.06(-0.273%)

250

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

American Express (AXP) downgraded to Reduce from Neutral at Nomura

Tesla Motors (TSLA) downgraded to Neutral from Buy at Goldman; target lowered to $185 from $240

JPMorgan Chase (JPM) downgraded to Hold from Buy at Sandler O'Neil

Other:

Honeywell (HON) initiated with a Outperform at Robert W. Baird; target $135

United Tech (UTX) initiated with a Neutral at Robert W. Baird; target $110

Boeing (BA) initiated with a Outperform at Robert W. Baird; target $161

-

13:03

WSE: Mid session comment

The first part of the day in the markets brought a slight aversion to risk. European parquets appoint new session lows, also weaker present themselves contracts in the United States. Discounts on markets in Frankfurt and Paris are not any significant and amount to approx. 0.3%. Announcing by the ECB's departure from accommodative monetary policy helps today financial companies, which suffered the most on it. Everything points to the fact that Thursday's trade is marked by expectations for tomorrow's, the important data from the US Department of Labor.

The second half of the trading the WIG20 index started at the level 1,755 points (-0,39%), with the turnover of PLN 250 million

-

13:00

Major stock indices in Europe traded in the red zone

European stocks traded in the red zone, as the decline in the shares of the airlines offset the increase in the banking sector and oil companies.

Certain influence on the dynamics of trade had data for Germany. Statistical Office Destatis reported that German factory orders rose at a faster pace in August, which is mainly on high level of domestic demand in August. The volume of industrial orders rose by 1 percent compared to July, when an increase of 0.3 percent (revised from +0.2 per cent) was recorded. It was the second consecutive increase in orders. Economists had expected orders to grow by only 0.2 percent. Domestic orders increased by 2.6 percent in August, while foreign orders fell by 0.2 percent. New orders from the euro area countries increased by 4.1 percent. In contrast, demand from other countries fell by 2.8 percent.

Meanwhile, the results of Markit Economics, showed that business activity in the German construction sector has reached in September a 4-month high. The PMI for the construction sector rose to 52.4 points from 51.6 points in August. Recall index value above 50 indicates expansion. It is worth emphasizing the growth in construction activity recorded 20 consecutive months. The survey also showed that German construction companies on average believe that the volume of construction will grow over the next 12 months.

Investors also await the publication of the ECB's report on monetary policy. "Most likely, the report will give little or no support for the idea that in the near future, the ECB would be ready to taper the asset purchase program. We expect the Central Bank announcement on December meeting to extend buying period for another 6 months after the March 2017 ", -. BNPP experts said.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0.4 percent. Shares of the banking sector for the third consecutive day rise in price, which is the longest series in the past month.

UniCredit shares rose 2.5 percent after reports that Amundi SA is ready to offer 4 billion euros for Pioneer Global Management unit.

Shares of CaixaBank rose 3.1 percent. The cost of the French bank Societe Generale rose 2.9 percent, while quotations of German lender Deutsche Bank rose 0.8 percent, having recovered 16 percent from its record low reached last week.

Price Osram Licht AG shares rose 10 percent after news that the Chinese company plans to bid the German manufacturer of light bulbs and LEDs in the middle of October.

Capitalization of EasyJet Plc fell 5.7 percent, as the airline announced its first annual profit decline since 2009, referring to the drop in demand due to the terrorist attacks and a weak pound, which inflated costs in foreign currency.

At the moment:

FTSE 100 7008.24 -25.01 -0.36%

DAX -42.69 10543.09 -0.40%

CAC 40 4471.59 -18.36 -0.41%

-

09:52

Major stock exchanges trading in the green zone: FTSE + 0.2%, DAX + 0.5%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX + 0.3%

-

09:12

WSE: After opening

WIG20 index opened at 1762.95 points (+0.04%)*

WIG 48006.01 -0.02%

WIG30 2033.05 -0.12%

mWIG40 4052.71 0.33%

*/ - change to previous close

The WIG20 futures December series began the day with 4 points more than yesterday's closing level. After three consecutive sessions of growth good run allow to extend the positive sentiment in Euroland.

The cash market opens up with a modest increase of 0.04% to 1,762 points at low turnover, focused on smaller companies..

-

08:44

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.2%, CAC40 + 0.2%, FTSE + 0.2%

-

08:27

WSE: Before opening

Stock exchanges in the United States ended Wednesday's session with increases, which leaders were financial and fuel companies. The Dow Jones Industrial at the end of the day gained 0.62 per cent and the S&P500 rose by 0.43 per cent.

Once better ISM data for both industry and services sectors, increases the probability of the December interest rate hike in the US. There are also speculations that the ECB may intend to reduce and end the asset purchase program. Such a tightening of monetary policy in Euroland would be a big surprise. Hence, probably yesterday's weaker performance of European indices, although not as weak as we would expect.

The macro calendar does not contain today's important information and investors already are waiting for tomorrow's monthly data from the US labor market.

In the morning Asian markets are dominated by small increases but contracts in the US cosmetically go down. This may mean a neutral sentiment in early European trading.

Also on the Warsaw Stock Exchange this week so far recorded positive, although largely due to the force of the specific entities (PZU and LPP) and not the market as a whole. Yesterday the WIG20 index even managed to go beyond the level of 1,750 points, but the proximity of the maximum from September 22 reduced the scale of increases

-

00:29

Stocks. Daily history for Oct 05’2016:

(index / closing price / change items /% change)

Nikkei 225 16,830.22 +94.57 +0.57%

Shanghai Composite 3,005.51 +7.03 +0.23%

S&P/ASX 200 5,452.93 -31.08 -0.57%

FTSE 100 7,033.25 -41.09 -0.58%

CAC 40 4,489.95 -13.14 -0.29%

Xetra DAX 10,585.78 -33.83 -0.32%

S&P 500 2,159.73 +9.24 +0.43%

Dow Jones Industrial Average 18,281.03 +112.58 +0.62%

S&P/TSX Composite 14,610.58 +89.57 +0.62%

-