Noticias del mercado

-

23:45

New Zealand: Building Permits, m/m, August -1% (forecast -4%)

-

16:48

Lockhart: November Is a 'Live Meeting'

-

16:07

US pending home sales cooled in August for the third time in four months

After bouncing back in July, pending home sales cooled in August for the third time in four months and to their lowest level since January, according to the National Association of Realtors®.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.4 percent to 108.5 in August from a downwardly revised 111.2 in July and is now slightly lower (0.2 percent) than August 2015 (108.7). With last month's decline, the index is now at its second lowest reading this year after January (105.4).

Lawrence Yun, NAR chief economist, says suffering supply levels have taken the wind out of the momentum the housing market experienced earlier this year. "Contract activity slackened throughout the country in August except for in the Northeast, where higher inventory totals are giving home shoppers greater options and better success signing a contract," he said. "In most other areas, an increased number of prospective buyers appear to be either wavering at the steeper home prices pushed up by inventory shortages or disheartened by the competition for the miniscule number of affordable listings."

-

16:00

U.S.: Pending Home Sales (MoM) , August -2.4% (forecast 0%)

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (800m) 1.1165-70 (844m) 1.1190 (589m) 1.1250 (278m) 1.1350 (346m)

USD/JPY: 100.00 (USD 786m) 102.00 (600m)

GBP/USD: 1.3100 (641m)

AUD/USD: 0.7650 (AUD 342m)

USD/CAD: 1.2990 (USD 380m) 1.3075 (260m) 1.3125 (206m) 1.3144-50 (USD 509m)

-

15:13

US trade deficit lower in August

According to Dow Jones, US trade deficit in goods was a seasonally adjusted $58.40B in August, down 0.6% from July. Goods exports rose 0.7% from July and goods imports were up a more modest 0.3%. The figures came in this morning's Advance Economic Indicators Report from the Commerce Department. The full August trade report is due out on October 5 and will include data on services as well, and it employs a somewhat different methodology. Still, the advance report has proven to be a reasonably accurate guide to the full report's broad findings.

-

15:11

Reports of multiple injuries in a train crash in Hoboken in the U.S. state of New Jersey

-

14:35

US unemployment claims continue to decline

In the week ending September 24, the advance figure for seasonally adjusted initial claims was 254,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 252,000 to 251,000. The 4-week moving average was 256,000, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised down by 250 from 258,500 to 258,250.

There were no special factors impacting this week's initial claims. This marks 82 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:34

US Q2 final GDP up 1.4% on positive contributions from personal consumption expenditures

Real gross domestic product increased at an annual rate of 1.4 percent in the second quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent.

Real gross domestic income (GDI) decreased 0.2 percent in the second quarter, in contrast to an increase of 0.8 percent in the first. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.6 percent in the second quarter, compared with an increase of 0.8 percent in the first

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), exports, and nonresidential fixed investment. These were partly offset by negative contributions from private inventory investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased

The price index for gross domestic purchases increased 2.1 percent in the second quarter, compared with an increase of 0.2 percent in the first (table 4). The PCE price index increased 2.0 percent, compared with an increase of 0.3 percent. Excluding food and energy prices, the PCE price index increased 1.8 percent, compared with an increase of 2.1 percent

-

14:30

U.S.: Initial Jobless Claims, 254 (forecast 260)

-

14:30

U.S.: GDP, q/q, Quarter II 1.4% (forecast 1.3%)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter II 1.8% (forecast 1.8%)

-

14:30

U.S.: Continuing Jobless Claims, 2062 (forecast 2130)

-

14:26

European session review: range trading as we wait for US GDP

The following data was published:

(Time / country / index / period / previous value / forecast)

7:55 Germany Change in the number of unemployed in September Revised -6 to -7 -5 1

07:55 Germany Unemployment rate seasonally adjusted September 6.1% 6.1% 6.1%

8:30 UK approved applications for mortgage loans, thousand. Revised August 60.92 to 60.91 60.15 60.06

8:30 UK Changing the volume of consumer lending million in August 1191 with the Revised 1181 1400 1574

8:30 Volume UK net lending to individuals, 3.8 billion August 4 4.5

9:00 Eurozone index of sentiment in the economy in September 103.5 103.5 104.9

9:00 Eurozone consumer confidence index (final data) September -8.5 -8.2 -8.2

9:00 Eurozone Sentiment Index in the business community in September to 0.03 Revision 0.02 0.1 0.45

9:00 Eurozone business confidence index in industry in September -4.4 -4.1 -1.7

12:00 Germany Consumer Price Index m / m (preliminary data) September 0.0% 0% 0.1%

12:00 Germany Consumer Price Index y / y (preliminary data) September 0.4% 0.6% 0.7%

The euro fell against the dollar after the release of data from the German labor market. Unemployment in Germany rose unexpectedly in September, the Federal Labor Agency reported on Thursday.

The number of people out of work increased by 1,000 to 2.68 million, confounding expectations for a decline of 5,000.

The unemployment rate remained unchanged at a seasonally adjusted 6.1 percent, the lowest level since German reunification. The figure was in line with expectations.

At the same time, Destatis data showed that the unemployment rate in Germany remained stable in August, while the number of those who remain out of work decreased.

The seasonally adjusted unemployment rate based on ILO standards was 4.2 percent, unchanged from July, showed the results of the Labour Force Survey. Index was 4.5 per cent in the same month last year.

The number of unemployed was 1.82 million, which was nearly 4,000 less than a month ago.

In unadjusted basis, the unemployment rate fell to 4.2 percent from 4.3 percent in July. A year ago, the figure was 4.5 percent.

The number of employees based on ILO standards was adjusted to 41.14 million, which was higher by 2.7 percent compared to the previous year.

The number of employed people in Germany amounted to a seasonally adjusted 43.53 million in August, roughly the same as in July, according to Destatis.

In addition, in the euro area manufacturers have ignored the concerns about the impact of the UK decision to leave the European Union, reporting an increase in export orders, which helped boost confidence in September to its highest level this year.

A more optimistic outlook shared by the euro zone consumers, as well as retailers, service providers and construction companies. And the restoration of sentiment spread outside EU, as British consumers and construction companies also gained trust during the month, although the country's manufacturers have become more pessimistic.

Eurozone politicians feared that the sharp decline in the exchange rate of the British pound against the euro after the vote in June would lead to a weakening of exports in its second largest overseas market, as well as cause damage to the economic sentiment.

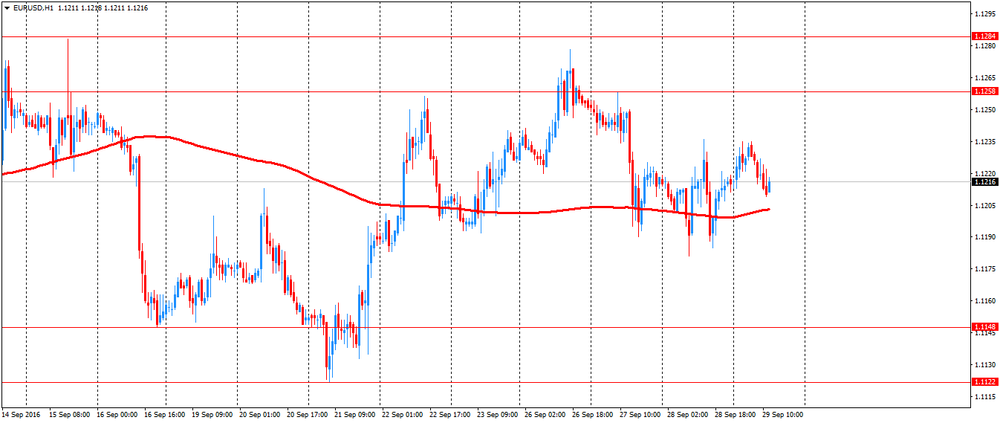

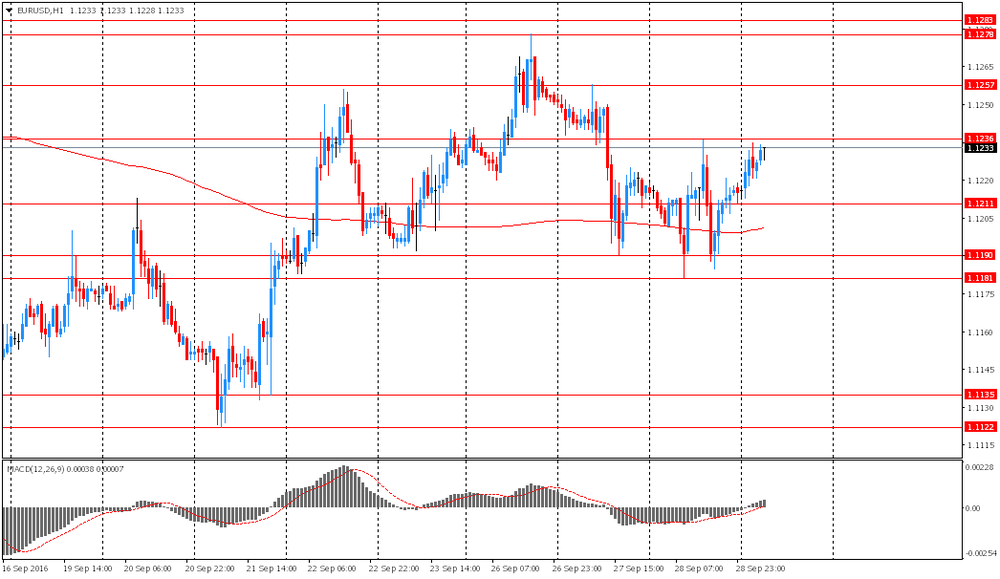

EUR / USD: during the European session, the pair fell to $ 1.1209

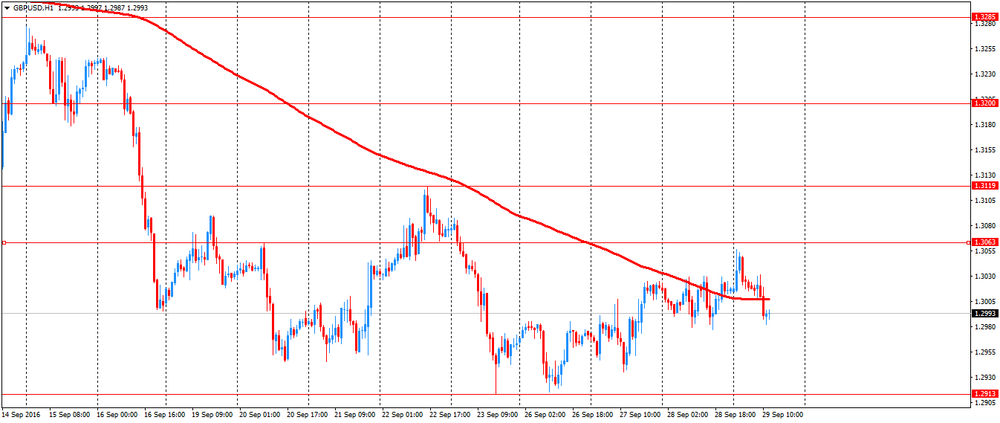

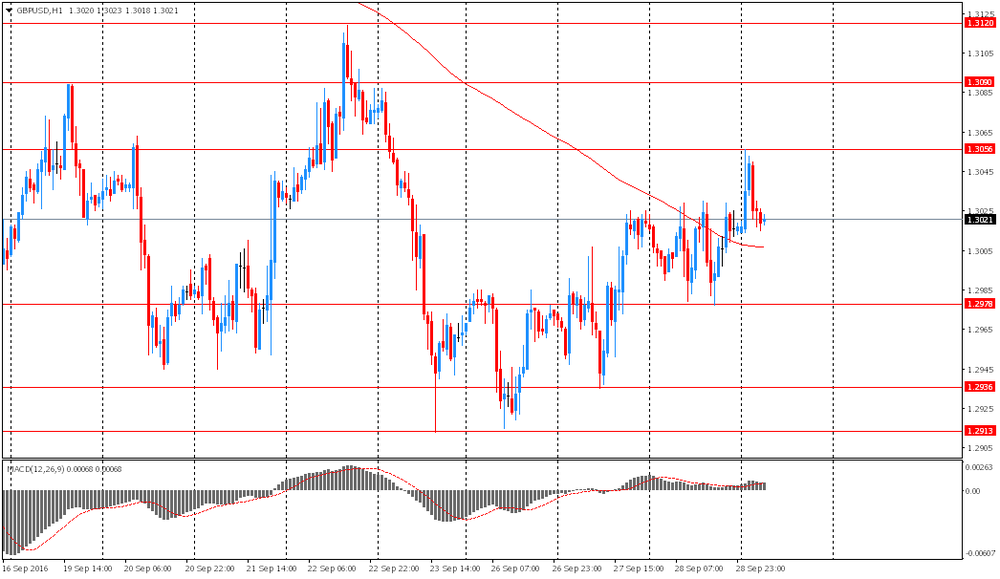

GBP / USD: during the European session, the pair fell to $ 1.2987 and retreated

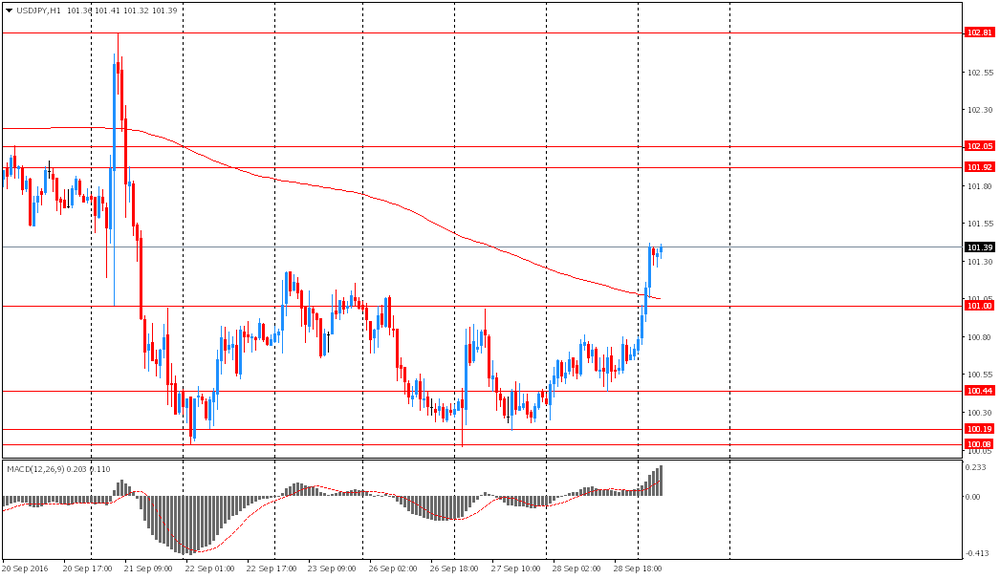

USD / JPY: during the European session, the pair rose to Y101.74 and retreated

-

14:22

A very important final US Q2 GDP in the rate hike/hold debate, up next

-

14:19

Fed's Harker Backs December Rate Rise if Growth Stays on Track

-

14:06

German preliminary inflation up 0.1% in September

The inflation rate in Germany as measured by the consumer price index is expected to be +0.7% in September 2016. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.1% on August 2016. The harmonised consumer price index for Germany calculated for European purposes is expected to be up 0.5% year on year.Compared with August 2016 it is expected to remain unchanged. The final results for September 2016 will be released on 13 October 2016.

-

14:00

Germany: CPI, y/y , September 0.7% (forecast 0.6%)

-

14:00

Germany: CPI, m/m, September 0.1% (forecast 0%)

-

13:52

Orders

EUR/USD

Offers : 1.1235 1.1250 1.1280 1.1300 1.1320 1.1350

Bids : 1.1200 1.1180-85 1.1150 1.11301.1100 1.1080 1.1050

GBP/USD

Offers : 1.3055-60 1.3080-85 1.3100 1.3120 1.3150 1.3180 1.3200

Bids : 1.3000 1.2985 1.2950 1.2935 1.2915 1.2900 1.2880 1.2865 1.2850

EUR/GBP

Offers : 0.8625 0.8650 0.8685 0.8700 0.8720-25 0.8750

Bids : 0.8580 0.8565 0.8550 0.8520-25 0.8500

EUR/JPY

Offers : 114.20 114.50 114.70-75 115.00 115.35 115.50

Bids : 113.50 113.30 113.00 112.80 112.50 112.35 112.00 111.80 111.50

USD/JPY

Offers : 101.80 102.00 102.20 102.50 102.75-80 103.00

Bids : 101.50 101.20 101.00 100.80 100.50 100.25 100.00

AUD/USD

Offers : 0.7700 0.7720 0.7750 0.7765 0.7800

Bids : 0.7650 0.7630 0.7600 0.7585 0.7565 0.7550

-

13:40

ECB can ease again if inflation remains weak - German institutes

-

13:39

Eurozone economic sentiment rebounded

According to rttnews, Eurozone economic sentiment rebounded strongly in September to is highest level thus far this year from a five-month low in the previous month, survey data from the European Union showed Thursday.

The economic sentiment index climbed to 104.9 from 103.5 in August. Economists had forecast an unchanged reading.

The latest reading was the strongest since January, when the score was 105.1.

The consumer confidence index rose to -8.2 from -8.5, in line with the initial estimate released on September 22. The improvement was the first in four months.

The industrial confidence index rose sharply to -1.7 from -4.3, marking the strongest reading in at least the past 12 months. Economists had forecast a score of -4.2.

The services confidence measure increased to 10 from 9.9. Sentiment also improved in the construction and retail trade sectors.

The business climate indicator climbed sharply by 0.42 points to 0.45. Economists had predicted a score of 0.05.

-

11:45

JPY: Japan's MOF To Be Forced To Intervene If USD/JPY Breaks 100 - Citi

"If the BoJ had not announced the new framework last week, pressure from the market and the politics would have forced it to adopt additional easing at its next policy meeting on Oct 31/Nov 1. That would have triggered further JPY strengthening and a fall in stock prices that would most likely have completely destroyed the BoJ's credibility. As it is, because the Bank didn't exert any concrete measure such as additional interest rate cuts last week, it could save them for next year while avoiding such fatal failure.

We suspect, in doing so, the BoJ has passed the policy baton to the MoF (Ministry of Finance). In particular, when the Yen appreciates beyond 100 against the Dollar the possibility of intervention could strengthen. It goes without saying that the Japanese government would like to avoid it as much as possible amid the US-Japan relations in a particularly sensitive period ahead of the US presidential election and with TPP still up in the air. However, the Abe administration is said to be eyeing the fruits of the December visit by Russian president Vladimir Putin and an expected improvement in RussoJapan relations including on the disputed Northern Islands, as a springboard for a general election that Prime Minister Shinzo Abe is said to want to have early next year. A fall to 95 would generate new demand for hedging the past foreign investments by Japanese investors, with the resulting JPY buying spree accelerating another rise in JPY against USD, leading to a new negative downward spiral that could get USDJPY plummet toward 90. The political background described above cannot allow the monetary authority accepting such JPY strengthening without doing anything.

As such, we suspect the MoF would likely be forced to implement interventions when USDJPY breaks 100, even if it deteriorates relations with the US and other countries somewhat".

Copyright © 2016 CitiFX, eFXnews™

-

11:09

German unemployment increased unexpectedly in September

German unemployment increased unexpectedly in September, reports said citing the Federal Labor Agency on Thursday.

The number of people out of work increased by 1,000 to 2.68 million, confounding expectations for a decrease of 5,000.

The jobless rate remained unchanged at a seasonally adjusted 6.1 percent, the lowest since the German reunification. The rate came in line with expectations.

-

11:00

Eurozone: Business climate indicator , September 0.45 (forecast 0.1)

-

11:00

Eurozone: Industrial confidence, September -1.7 (forecast -4.1)

-

11:00

Eurozone: Consumer Confidence, September -8.2 (forecast -8.2)

-

11:00

Eurozone: Economic sentiment index , September 104.9 (forecast 103.5)

-

10:42

Mortgages approved in the U.K. for August ticked down from July

According to Dow Jones, the number of mortgages approved in the U.K. for August ticked down from July, in a further signal that the U.K. housing market has cooled since the nation voted to leave the European Union in June, figures released by the Bank of England. The number of new house loans dropped to 60,058 from 60,925 in July, constituting the lowest monthly mortgage approval figure since November 2014. Economic data releases have been somewhat mixed since the U.K.'s Brexit vote, and this trend continues, with consumer lending, consumer credit, and mortgage lending all higher on the month. Consumer credit, for instance, rises to GBP1.6 billion from July's GBP1.2 billion, outperforming the flat expectations of economists polled by the Wall Street Journal

-

10:37

UK money supply stable in August

M4 increased by £2.9 billion in August, compared to the average monthly increase of £14.1 billion over the previous six months. The three-month annualised and twelve-month growth rates were 10.9% and 7.3% respectively.

M4 lending excluding intermediate OFCs. M4Lex increased by £5.0 billion in August, compared to the average monthly increase of £12.1 billion over the previous six months. The three-month annualised and twelve-month growth rates were 7.2% and 6.6% respectively.

Households' holdings of M4 increased by £4.0 billion in August, compared to the average monthly increase of £7.9 billion over the previous six months. The three-month annualised and twelve-month growth rates were 6.1% and 6.5% respectively.

M4 lending to households increased by £3.9 billion in August, compared to the average monthly increase of £4.1 billion over the previous six months. The three-month annualised and twelve-month growth rates were 3.6% and 4.0% respectively.

Deposits from financial and non-financial businesses increased by £19.6 billion in August, compared to the average monthly increase of £12.5 billion over the previous six months. The increase was mainly in deposits from businesses in the financial services industry (£17.3 billion). The twelve-month growth rate was 5.1%. Loans to financial and non-financial businesses decreased by £0.3 billion in August, compared to the average monthly increase of £7.9 billion over the previous six months. The twelve-month growth rate was 2.0%.

Consumer credit increased by £1.6 billion in August, broadly in line with the average over the previous six months. The threemonth annualised and twelve-month growth rates were 10.4% and 10.3% respectively.

-

10:31

United Kingdom: Net Lending to Individuals, bln, August 4.5 (forecast 4)

-

10:30

United Kingdom: Consumer credit, mln, August 1574 (forecast 1400)

-

10:30

United Kingdom: Mortgage Approvals, August 60.06 (forecast 60.15)

-

10:04

Germany's Bavaria Sep CPI +0.2% On Mo; +0.8% On Year , Brandenburg Sep CPI +0.4% On Mo, +0.7% On Year

-

09:55

Germany: Unemployment Change, September 1 (forecast -5)

-

09:55

Germany: Unemployment Rate s.a. , September 6.1% (forecast 6.1%)

-

09:19

3 Reasons Why We Still Target EUR/USD At 1.15 In 3 Months - Credit Suisse

"We maintain our EURUSD 1.15 three month target. The target was based on the following rationale:

1- We do not expect the Fed to hike this year (Credit Suisse has the first hike penciled in for May 2017) despite the market still pricing in a 50% probability of this.

2- We think any US political risk elevation going into the November 8 Presidential Election would boost liquid, defensive currencies like EUR.

3- We see the ECB as likely to deliver only marginal new easing measures in December.

What would make us revise our view?

Firstly, it is still possible that the political environment in Germany is slow enough to respond to further banking stress that a still fragile European banking system reacts badly, leading to a loss of confidence and a funding squeeze. We have attributed a low probability to this as the Italian banking prob

Secondly, the Italian Constitutional referendum date has been set for December 4. If this leads to i) defeat for PM Renzi and ii) his subsequent resignation, the resulting political upheaval could be problematic for EURlems over the summer were in some ways even more problematic yet did not cause overall deposit flight But we flag the risk nonetheless".

Copyright © 2016 Credit Suisse, eFXnews™

-

09:17

Germany's Saxony Sep CPI +0.1% On Mo, +0.7% On Year

-

09:16

India confirms it has carried out surgical strikes on Pakistan launch pads

-

09:15

Spanish CPI up 0.3% y/y

The estimated CPI in September 2016 annual inflation is 0.3%, according to the leading indicator compiled by the INE. This indicator provides a preview of IPC that, if confirmed, would imply a increase of four tenths in the annual rate, since in August this change was -0.1%. This increase is mainly explained by rising fuel prices (Oil and gas) and electricity, compared to the drop experienced in 2015. Meanwhile, the annual change in the HICP flash is in September 0.1%. If this information is confirmed, the annual rate of HICP increase four tenths from the previous month.

-

09:10

USD/CAD set to continue the decline?

-

08:58

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (800m) 1.1165-70 (844m) 1.1190 (589m) 1.1250 (278m) 1.1350 (346m)

USD/JPY: 100.00 (USD 786m) 102.00 (600m)

GBP/USD: 1.3100 (641m)

AUD/USD: 0.7650 (AUD 342m)

USD/CAD: 1.2990 (USD 380m) 1.3075 (260m) 1.3125 (206m) 1.3144-50 (USD 509m)

-

08:37

Japan’s Retail sales fell in August

Retail sales fell by 1.1% after rising 1.5% in July. In annual terms, this indicator decreased 2.1% compared to the same period of the previous year and the sixth consecutive month of decline.

Retail sales - a figure published by the Ministry of Economy, Trade and Industry evaluates the total sales through specialized outlets involved in the sale of goods and related services to the population, households as well as for personal use. Consumer spending - an important indicator of the state of the Japanese economy. The decline is negative for the Japanese currency and led to the fall of the yen.

The report of the Ministry of Economy, Trade and Industry of Japan said that sales of almost all goods except automobiles and cosmetics, decreased compared to the same period of the previous year.

-

08:34

Options levels on thursday, September 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1330 (3058)

$1.1302 (1995)

$1.1270 (1073)

Price at time of writing this review: $1.1218

Support levels (open interest**, contracts):

$1.1172 (3895)

$1.1134 (3286)

$1.1091 (7034)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 38425 contracts, with the maximum number of contracts with strike price $1,1500 (5774);

- Overall open interest on the PUT options with the expiration date October, 7 is 39165 contracts, with the maximum number of contracts with strike price $1,1100 (7034);

- The ratio of PUT/CALL was 1.02 versus 1.01 from the previous trading day according to data from September, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.3301 (2603)

$1.3203 (1435)

$1.3106 (1262)

Price at time of writing this review: $1.3016

Support levels (open interest**, contracts):

$1.2897 (1056)

$1.2799 (1746)

$1.2699 (1424)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 27086 contracts, with the maximum number of contracts with strike price $1,3500 (3374);

- Overall open interest on the PUT options with the expiration date October, 7 is 22587 contracts, with the maximum number of contracts with strike price $1,3000 (3542);

- The ratio of PUT/CALL was 0.83 versus 0.84 from the previous trading day according to data from September, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:34

RBNZ says NZD exchange rate is too high

-

08:28

Asian session review: OPEC deal spice things up

The Australian dollar rose sharply in the early Asian session on news that OPEC members agreed to limit oil production the first time in 8 years. Yesterday, the country's oil exporters said that they came to a consensus on the need to reduce the level of production. Negotiations in Algeria lasted six hours and the measures will be implemented in November. OPEC decided to create a committee that will determine how much each country is ready to cut. OPEC intends to reduce total production to 32,5-33 million barrels a day. In August, production amounted to 33.2 million barrels. Also it contributes to the growth of the Australian dollar and global stock markets.

The US dollar rose against the yen, after negative data on retail sales in Japan. As reported today by the Ministry of Economy, Trade and Industry, retail sales in August fell by 1.1% after rising 1.5% in July. In annual terms, this indicator decreased by -2.1% compared to the same period of the previous year and a decrease was recorded the sixth consecutive month.

Euro slightly increased since investors continue to analyze statements by ECB President Draghi and Federal Reserve Chairman Yellen. ECB President Draghi said that the loose monetary policy of the Central Bank to prevent a new "Great Depression" in Europe. Draghi also called on the government to assist the central bank in the implementation of economic reforms. "I want to show how our monetary policy maintain price stability and counter the threat of a new" Great Depression ". According to Draghi, the ECB's measures have been effective and have helped to support the economic recovery, promoting job creation.

EUR / USD: during the Asian session, the pair rose to $ 1.1235

GBP / USD: during the Asian session, the pair was trading in the $ 1.3015-35 range

USD / JPY: rose to Y101.55

-

01:50

Japan: Retail sales, y/y, August -2.1% (forecast -1.8%)

-

00:28

Currencies. Daily history for Sep 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1215 -0,03%

GBP/USD $1,3017 -0,02%

USD/CHF Chf0,9711 +0,05%

USD/JPY Y100,72 +0,32%

EUR/JPY Y112,96 +0,30%

GBP/JPY Y131,09 +0,31%

AUD/USD $0,7685 +0,27%

NZD/USD $0,7271 -0,34%

USD/CAD C$1,309 -0,83%

-

00:05

Schedule for today,Thursday, Sep 29’2016

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:55 Germany Unemployment Change September -7 -5

07:55 Germany Unemployment Rate s.a. September 6.1% 6.1%

08:30 United Kingdom Mortgage Approvals August 60.91 60.15

08:30 United Kingdom Consumer credit, mln August 1181 1400

08:30 United Kingdom Net Lending to Individuals, bln August 3.8 4

09:00 Eurozone Economic sentiment index September 103.5 103.5

09:00 Eurozone Consumer Confidence (Finally) September -8.5 -8.2

09:00 Eurozone Business climate indicator September 0.02 0.1

09:00 Eurozone Industrial confidence September -4.4 -4.1

12:00 Germany CPI, m/m (Preliminary) September 0.0% 0%

12:00 Germany CPI, y/y (Preliminary) September 0.4% 0.6%

12:30 U.S. Continuing Jobless Claims 2113 2130

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter II 2.1% 1.8%

12:30 U.S. Initial Jobless Claims 252 260

12:30 U.S. GDP, q/q (Finally) Quarter II 0.8% 1.3%

14:00 U.S. Pending Home Sales (MoM) August 1.3% 0%

14:00 U.S. FOMC Member Jerome Powell Speaks

20:00 U.S. Fed Chairman Janet Yellen Speaks

21:45 New Zealand Building Permits, m/m August -10.5% -4%

23:05 United Kingdom Gfk Consumer Confidence September -7 -5

23:30 Japan Household spending Y/Y August -0.5% -2.5%

23:30 Japan Tokyo Consumer Price Index, y/y September -0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.4% -0.4%

23:30 Japan Unemployment Rate August 3.0% 3%

23:30 Japan National Consumer Price Index, y/y August -0.4% -0.5%

23:30 Japan National CPI Ex-Fresh Food, y/y August -0.5% -0.4%

23:50 Japan Industrial Production (MoM) (Preliminary) August -0.4% 0.5%

23:50 Japan Industrial Production (YoY) (Preliminary) August -4.2%

-