Noticias del mercado

-

21:00

Dow -0.12% 18,263.88 -21.86 Nasdaq +0.10% 5,095.95 +5.16 S&P -0.07% 2129.36 -1.46

-

20:20

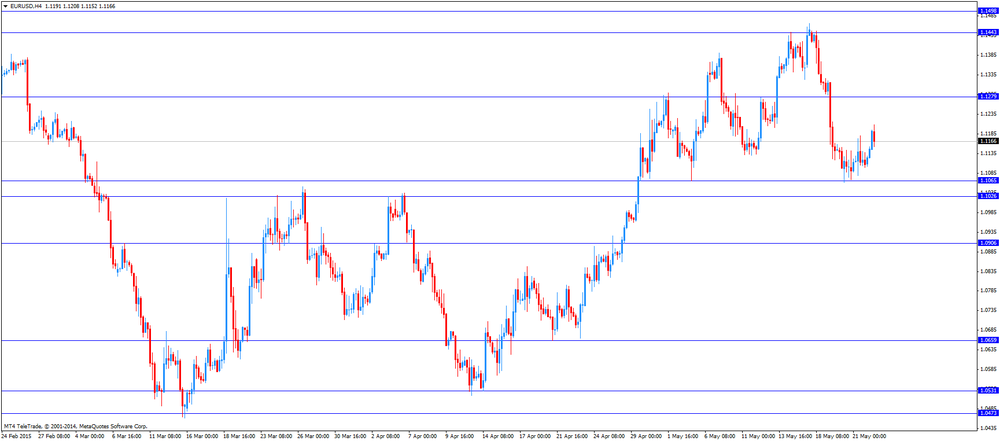

American focus: the US dollar significantly higher against most major currencies

Dollar rose significantly against the euro, reaching $ 1.1000, which was caused by the publication of data on the US CPI. Recall, the consumer price index, which reflects the fact that Americans pay for everything from breakfast cereal to medical care, increased a seasonally adjusted 0.1% in April compared with the previous month. Except for the volatile categories of food and energy, so-called core prices have risen 0.3%, the largest increase noted since January 2013. Economists had expected overall prices will rise by 0.1% and core prices to rise 0.2%. Compared with a year earlier, overall prices fell 0.2%, while core prices rose 1.8%. The Consumer Price Index, as well as most of the indicators of inflation began to fall fairly steadily in the middle of last year. The decrease mainly reflects the decline in the cost of a barrel of crude oil, which topped $ 100 in the summer, but then fell below $ 50 earlier this year. Prices since then have strengthened to about $ 60. Strengthening the dollar also affected the prices, keeping the cost of imported goods and services.

The report Friday showed that energy prices fell 1.3% from March, and gasoline prices were down 1.7%. Food prices were unchanged compared with the previous month. Changing the basic price was due to the rising cost of housing, medical care, furniture and vehicles. The prices of clothing and air tickets fell.

The Canadian dollar dropped significantly against the US dollar, approaching to the lowest since April 16 after US data were better than expected, and the statistics for Canada a little disappointed. As previously reported, Canadian consumer prices rose in April, the slowest pace in 18 months due to the largest drop in energy prices since 2009. Core inflation has expanded on an annual basis by more than 2% of the ninth month in a row, although it was slightly below the recent six-year high. The Consumer Price Index in Canada rose 0.8% in April compared with a year earlier. Expectations of economists were at the level of growth by 1%. The annual rate of core inflation, which excludes volatile components such as some food prices and energy prices, rose 2.3%. Expectations were experts at an increase of 2.4%, or unchanged compared with the previous month.

Meanwhile, another report showed that Canadian retail sales rose in March at a faster than expected pace, albeit amid disappointing volumes, led by activity in showrooms, shops and the sale of alcohol. In March, retail sales rose 0.7% to a seasonally adjusted level reached 42.47 billion. Canadian dollars ($ 34.79 billion.). Market experts expect an increase of 0.3%. The volume of retail sales rose by a more modest 0.1%. On an annual basis, retail sales increased by 3.1%.

The pound depreciated significantly against the dollar, losing more than 180 points and reached the lowest level since May 20, which was associated with the widespread growth of the dollar after strong inflation figures. Little support was provided by the statements of the Bank of England Carney, who will speak at the conference of the ECB said that Britain must reduce the fall in output over the next year, performance should gain traction, and the main cause of low inflationary pressure in recent years - cheap food and energy. ..

Also today, it was announced that the UK budget deficit narrowed in April compared with the previous year. Net public sector borrowing (PSNB) excluding banks fell by 2.5 billion pounds to 6.8 billion pounds in April. This decrease in net debt is largely due to a decrease in net borrowing of the central government by 4.1 billion pounds, partially offset by an increase to 1.8 billion pounds net borrowing of local government. Income tax rose by 0.6 billion pounds, or 11.3 percent, and payments related to income tax rose by 0.4 billion pounds, or 3.7 percent. In the fiscal year ending in 2015, PSNB decreased by 10.8 billion pounds from last year to 87.7 billion pounds.

-

18:46

WSE: Session Results

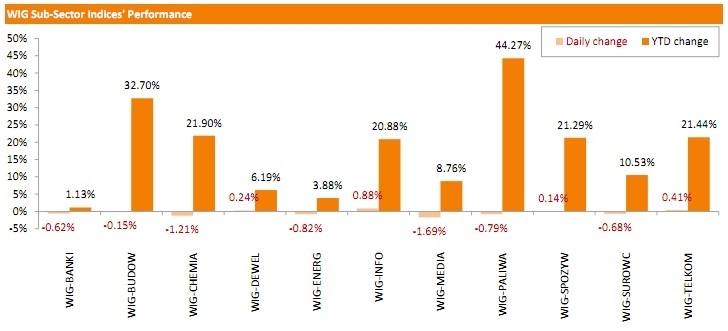

The selling moods predominated on Polish equity market on Friday. As a result, the broad market benchmark - the WIG index dropped 0.28% and the large liquid companies measure - the WIG30 index exhibited a greater decline of 0.45%.

The drops in CYFROWY POLSAT (WSE: CPS) and MBANK (WSE: MBK) were the biggest in the WIG30 index, reducing their market capitalization by a respective 2.95% and 2.35%. ING BSK (WSE: ING) and SYNTHOS (WSE: SNS) were also among top fallers, dropping more than 2% each. At the same time, a few stocks managed to hold up better, with LPP (WSE: LPP) generating the biggest gain of 2.59%.

Turning to the performance of the WIG sub-sector indices, the technology-oriented WIG-INFO index outperformed, advancing 0.88%. On the contrary, the worst-performing sub-sector indices were the media sector names' benchmark - the WIG-MEDIA index and the chemical companies' measure - the WIG-CHEMIA index, declining 1.69% and 1.21% respectively.

-

18:03

European stocks close: stocks closed mixed on the Greek debt crisis and as investors focused on the forum in Portugal

Stock indices closed mixed on the Greek debt crisis and as investors focused on the forum in Portugal. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President Francois Hollande met yesterday. The Greek spokesman, Gabriel Sakellaridis, said today that a deal between Greece and its creditors should be reached within the next 10 days.

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

German Finance Minister Wolfgang Schäuble denied reports today that he said Greece needs a parallel currency.

Earlier today, news reported that Schäuble raised the possibility that Athens may need a parallel currency alongside the euro in case its talks with creditors fail. He should have cited the example of Montenegro, which uses the euro but isn't a member of the Eurozone.

German Ifo Institute released its business confidence figures for Germany on Friday. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

The European Central Bank president Mario Draghi said in Portugal today that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,031.72 +18.25 +0.26 %

DAX 11,815.01 -49.58 -0.42 %

CAC 40 5,142.89 -3.81 -0.07 %

-

18:00

European stocks closed: FTSE 100 7,031.72 +18.25 +0.26% CAC 40 5,142.89 -3.81 -0.07% DAX 11,815.01 -49.58 -0.42%

-

17:50

Wall Street. Major U.S. stock-indexes lower

Major U.S. stock-indexes fell in late morning trading on Friday, retreating from recent record highs, as investors await Federal Reserve Chair Janet Yellen's economic outlook for clues on the timing of a rate hike after new data showed a rise in inflation. Consumer prices moderated last month, data showed, but the so-called core consumer price index, which strips out food and energy costs, posted its largest gain since January 2013.

Most of Dow stocks in negative area (25 of 30). Top looser - The Boeing Company (BA, -1.37%). Top gainer - Apple Inc. (AAPL, +0.74%).

All of S&P index sectors in negative area. Top looser - Utilities (-0.6%).

At the moment:

Dow 18205.00 -53.00 -0.29%

S&P 500 2124.25 -3.75 -0.18%

Nasdaq 100 4528.00 -0.75 -0.02%

10-year yield 2.20% +0.01

Oil 59.82 -0.90 -1.48%

Gold 1206.00 +1.90 +0.16%

-

17:42

Oil prices traded lower on the stronger U.S. dollar and due to profit-taking

Oil prices traded lower on the stronger U.S. dollar and due to profit-taking before the long weekend. U.S. markets and markets of most European countries will be closed for a public holiday on Monday.

The U.S. consumer price inflation excluding food and energy gained 0.3% in April, exceeding expectations for a 0.2% increase, after a 0.2% rise in March. It was the largest increase since January 2013.

The rise was driven by higher costs for housing, medical care, furniture and vehicles.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.8% in April, beating forecasts of a decline to 1.7%.

The core consumer inflation data indicates that the Fed might start to hike its interest rate later this year.

The global oil glut also weighed on oil prices. Investors expect that OPEC will maintain its strategy at it next meeting in June 05.

Geopolitical tensions in the Middle East support oil prices.

Investors are awaiting the release of the number of the U.S. oil rigs later in the day.

WTI crude oil for June delivery decreased to $59.84 a barrel on the New York Mercantile Exchange.

Brent crude oil for June fell to $65.45 a barrel on ICE Futures Europe.

-

17:22

Gold price traded lower on U.S. inflation data

Gold price traded lower on U.S. inflation data. Gold price declined by 1.6% since the beginning of this week. It was the largest drop since April 20-24.

The U.S. consumer price inflation rose 0.1% in April, in line with expectations, after a 0.2% gain in March.

On a yearly basis, the U.S. consumer price index fell to -0.2% in April from -0.1% in March. It was the lowest level since October 2009. Analysts had expected the index to remain unchanged at -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.3% in April, exceeding expectations for a 0.2% increase, after a 0.2% rise in March. It was the largest increase since January 2013.

The rise was driven by higher costs for housing, medical care, furniture and vehicles.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.8% in April, beating forecasts of a decline to 1.7%.

The core consumer inflation data indicates that the Fed might start to hike its interest rate later this year.

Investors are awaiting a speech by the Fed Chair Janet Yellen, which is scheduled to be at 17:00 GMT. Yellen will speak about the prospects of the U.S. economy.

July futures for gold on the COMEX today decreased to 1205.00 dollars per ounce.

-

16:42

German Finance Minister Wolfgang Schäuble denied reports that he said Greece needs a parallel currency

German Finance Minister Wolfgang Schäuble denied reports today that he said Greece needs a parallel currency.

Earlier today, news reported that Schäuble raised the possibility that Athens may need a parallel currency alongside the euro in case its talks with creditors fail. He should have cited the example of Montenegro, which uses the euro but isn't a member of the Eurozone.

-

16:09

Bank of England Deputy Governor Minouche Shafik: outlook have not deteriorated despite low long-term interest rates

Bank of England Deputy Governor Minouche Shafik said on Friday that the Britain's outlook have not deteriorated despite low long-term interest rates. She added that she expects wage growth and productivity growth to pick up in the U.K.

"I think it is reasonable to expect that resumption in productivity growth to come over the next year or so as the continued narrowing of slack in the labour market raises the incentive to increase output by increasing output per worker," she noted.

Shafik also expects inflation to pick up as oil prices will stabilize.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E1.7bn), $1.1000(E1.9bn), $1.1050(E563mn), $1.1100(E807mn), $1.1200(E1.4bn), $1.1250(E636mn), $1.1300(E945mn)$1.1400(E1.22bn)

USD/JPY: Y120.00($2.05bn), Y121.00($1.4bn), Y122.00($1.97bn)

GBP/USD: $1.5650(Gbp405mn)

AUD/USD: $0.7800(A$582mn), $0.7850(A$543mn), $0.7920(A$1.32bn), $0.8000 in (A$1.17bn)

USD/CAD: C$1.2265($790mn)

-

15:33

U.S. Stocks open: Dow 0.00%, Nasdaq +0.05%, S&P -0.10%

-

15:24

Before the bell: S&P futures -0.15%, NASDAQ futures -0.03%

U.S. stock-index futures fell after data showing the fastest rise in consumer prices in two years bolstered speculation the Federal Reserve will be forced to raise interest rates soon.

Global markets:

Nikkei 20,264.41 +61.54 +0.30%

Hang Seng 27,992.83 +469.11 +1.70%

Shanghai Composite 4,657.6 +128.17 +2.83%

FTSE 7,060.07 +46.60 +0.66%

CAC 5,149.79 +3.09 +0.06%

DAX 11,842.33 -22.26 -0.19%

Crude oil $60.07 (-1.09%)

Gold $1205.20 (+0.07%)

-

15:21

Canadian retail sales increase by 0.7% in March

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 0.7% in March, exceeding expectations for a 0.3% gain, after a 1.5% rise in February. February's figure was revised down from a 1.7% increase.

It was the second consecutive increase.

The rise was driven by higher cars, food and alcohol sales. Motor vehicle and parts sales gained 1.5% in March, while sales at food and beverage stores rose 1.3%.

Sales at gasoline stations were down 0.5% in March.

Canadian retail sales excluding automobiles were up 0.5% in March, exceeding expectations for a 0.4% increase, after a 1.8% rise in February. February's figure was revised down from a 2.0% increase.

-

15:10

U.S. consumer price inflation rises 0.1% in April

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation rose 0.1% in April, in line with expectations, after a 0.2% gain in March.

On a yearly basis, the U.S. consumer price index fell to -0.2% in April from -0.1% in March. It was the lowest level since October 2009. Analysts had expected the index to remain unchanged at -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.3% in April, exceeding expectations for a 0.2% increase, after a 0.2% rise in March. It was the largest increase since January 2013.

The rise was driven by higher costs for housing, medical care, furniture and vehicles.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.8% in April, beating forecasts of a decline to 1.7%.

The core consumer inflation data indicates that the Fed might start to hike its interest rate later this year.

Gasoline prices decreased 1.7% in April, food prices remained unchanged, while shelter costs rose 0.3%.

The medical care index climbed 0.7% in April, the largest gain since January 2007.

Energy costs declined 1.3% in April.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

104.41

+0.01%

3.4K

Johnson & Johnson

JNJ

102.44

+0.02%

0.1K

Facebook, Inc.

FB

80.50

+0.02%

10.8K

Tesla Motors, Inc., NASDAQ

TSLA

245.70

+0.03%

1.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.36

+0.05%

3.6K

Boeing Co

BA

147.50

+0.10%

0.2K

Barrick Gold Corporation, NYSE

ABX

12.47

+0.24%

17.0K

Starbucks Corporation, NASDAQ

SBUX

51.47

+0.27%

0.3K

Apple Inc.

AAPL

131.80

+0.31%

292.0K

Hewlett-Packard Co.

HPQ

34.00

+0.50%

36.5K

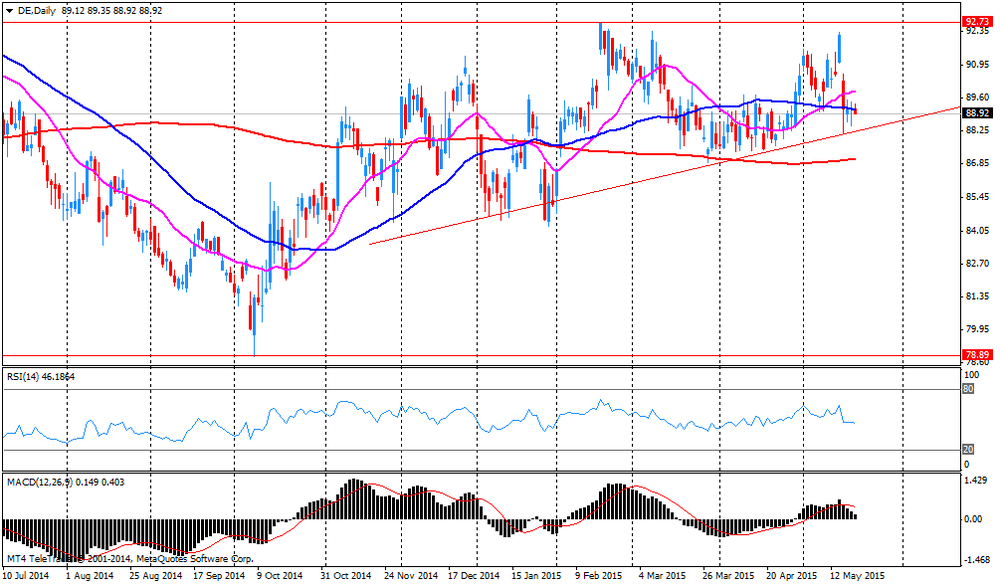

Deere & Company, NYSE

DE

92.01

+2.85%

50.6K

American Express Co

AXP

80.76

0.00%

0.5K

ALCOA INC.

AA

13.00

0.00%

3.9K

Ford Motor Co.

F

15.51

0.00%

10.2K

International Paper Company

IP

53.10

0.00%

0.5K

Home Depot Inc

HD

112.00

-0.01%

0.4K

Twitter, Inc., NYSE

TWTR

36.66

-0.05%

49.9K

Procter & Gamble Co

PG

80.35

-0.07%

2.1K

Caterpillar Inc

CAT

89.26

-0.08%

5.4K

Yahoo! Inc., NASDAQ

YHOO

43.64

-0.08%

15.6K

Visa

V

69.30

-0.10%

5.4K

Yandex N.V., NASDAQ

YNDX

18.59

-0.11%

2.8K

Wal-Mart Stores Inc

WMT

76.02

-0.12%

1.8K

Walt Disney Co

DIS

110.23

-0.14%

2.2K

Amazon.com Inc., NASDAQ

AMZN

430.96

-0.16%

2.0K

AT&T Inc

T

35.01

-0.17%

4.7K

UnitedHealth Group Inc

UNH

120.25

-0.17%

0.1K

Pfizer Inc

PFE

34.30

-0.17%

16.6K

Citigroup Inc., NYSE

C

54.74

-0.18%

58.2K

Cisco Systems Inc

CSCO

29.37

-0.20%

1.1K

Verizon Communications Inc

VZ

49.80

-0.20%

17.6K

General Motors Company, NYSE

GM

35.51

-0.20%

7.9K

Goldman Sachs

GS

204.50

-0.22%

0.3K

The Coca-Cola Co

KO

41.14

-0.22%

10.0K

Intel Corp

INTC

33.47

-0.24%

3.6K

General Electric Co

GE

27.65

-0.25%

3.6K

Merck & Co Inc

MRK

59.95

-0.25%

8.0K

Exxon Mobil Corp

XOM

86.96

-0.29%

0.7K

E. I. du Pont de Nemours and Co

DD

70.77

-0.30%

5.4K

Microsoft Corp

MSFT

47.28

-0.30%

6.4K

International Business Machines Co...

IBM

172.75

-0.34%

7.4K

JPMorgan Chase and Co

JPM

66.42

-0.35%

0.3K

Chevron Corp

CVX

105.00

-0.46%

0.9K

-

14:53

Canadian consumer price inflation declines 0.1% in April

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation decreased 0.1% in April, missing expectations for a 0.1% rise, after a 0.7% increase in March.

On a yearly basis, the consumer price index fell to 0.8% in April from 1.2% in March. That was the lowest level since April 2013.

The consumer price index was driven by lower energy prices. The energy index plunged 13.5% in April from the same month a year earlier.

Gasoline price dropped 21.0% in April from the same month a year earlier.

Canadian core consumer price index, which excludes some volatile goods, increased 0.1% in April, after a 0.6% gain in March.

On a yearly basis, core consumer price index in Canada fell to 2.3% in April from 2.4% in March. Analysts had expected the index to remain unchanged at 2.4%.

The Bank of Canada's inflation target is 2.0%.

-

14:45

-

14:32

Canada: Retail Sales YoY, March 3.1%

-

14:30

U.S.: CPI excluding food and energy, Y/Y, April 1.8% (forecast 1.7%)

-

14:30

Canada: Consumer price index, y/y, April 0.8% (forecast 1.0%)

-

14:30

U.S.: CPI excluding food and energy, m/m, April 0.3% (forecast 0.2%)

-

14:30

Canada: Retail Sales, m/m, March 0.7% (forecast 0.3%)

-

14:30

U.S.: CPI, Y/Y, April -0.2% (forecast -0.1%)

-

14:30

Canada: Consumer Price Index m / m, April -0.1% (forecast 0.1%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, April 2.3% (forecast 2.4%)

-

14:30

U.S.: CPI, m/m , April 0.1% (forecast 0.1%)

-

14:30

Canada: Retail Sales ex Autos, m/m, March 0.5% (forecast 0.4%)

-

14:28

European Central Bank President Mario Draghi: Eurozone's is brighter today than it has been for seven long years"

The European Central Bank (ECB) President Mario Draghi said at the forum in Portugal on Friday that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

But the ECB president warned that structural reforms are needed.

"Being in the early phases of a cyclical recovery is not a reason to postpone structural reforms; it is in fact an opportunity to accelerate them," Draghi said.

-

14:11

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after German Ifo business climate data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany GDP (YoY) (Finally) Quarter I 1.6% 1.0% 1.1%

06:00 Germany GDP (QoQ) (Finally) Quarter I 0.7% 0.3% 0.3%

06:30 Japan BOJ Press Conference

08:00 Eurozone ECB President Mario Draghi Speaks

08:00 Germany IFO - Business Climate May 108.6 108.3 108.5

08:00 Germany IFO - Current Assessment May 114 Revised From 113.9 113.5 114.3

08:00 Germany IFO - Expectations May 103.4 Revised From 103.5 103.1 103.0

08:30 United Kingdom PSNB, bln April -6.06 Revised From -6.74 -8.1 -6.04

11:00 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The U.S. consumer price inflation is expected to remain unchanged at -0.1% in April.

The U.S. consumer price index excluding food and energy is expected to fall to 1.7% in April from 1.8% in March.

Yesterday's mostly weaker-than-expected U.S. economic data weighed on the greenback.

The euro traded higher against the U.S. dollar after German Ifo business climate data. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

The European Central Bank president Mario Draghi said in Portugal today that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

The Greek debt problem continues to weigh on the euro. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President Francois Hollande met yesterday. The Greek spokesman, Gabriel Sakellaridis, said today that a deal between Greece and its creditors should be reached within the next 10 days.

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

The British pound traded lower against the U.S. dollar after the public sector net borrowing data from the U.K. The public sector net borrowing in the U.K. fell to £6.04 billion in April from £6.06 billion in March, missing expectations for a rise to £8.1 billion. March's figure was revised down from £6.74 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian economic data. The consumer price index in Canada is expected to decline to 1.0% in April from 1.2% in March.

The core consumer price index in Canada is expected to remain unchanged 2.4% in April.

Canadian retail sales are expected to increase 0.3% in March, after a 1.7% rise in February.

Canadian retail sales excluding automobiles are expected to rise 0.4% in March, after a 2.0% gain in February.

EUR/USD: the currency pair increased to $1.1208

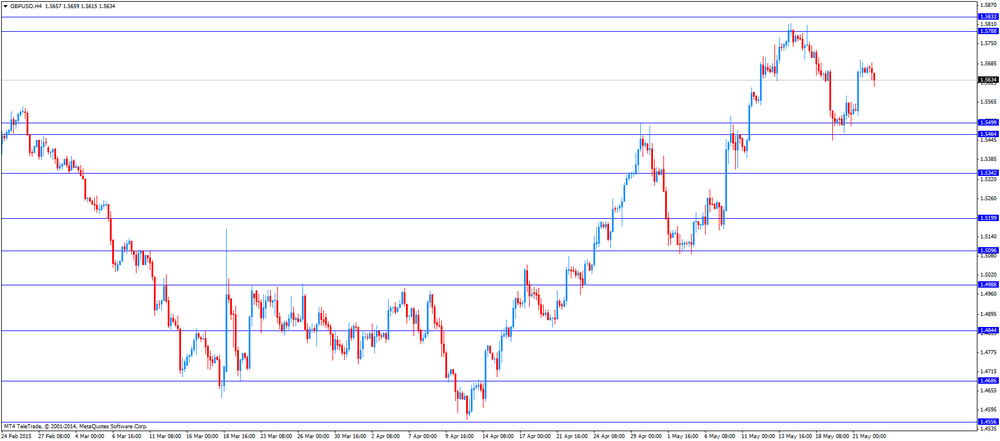

GBP/USD: the currency pair fell to $1.5615

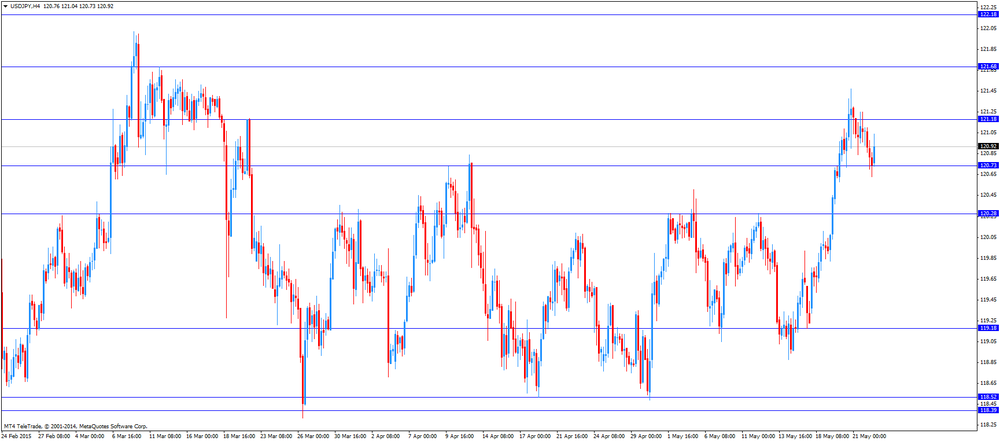

USD/JPY: the currency pair rose to Y121.04

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m March 1.7% 0.3%

12:30 Canada Retail Sales YoY March 2.5%

12:30 Canada Retail Sales ex Autos, m/m March 2.0% 0.4%

12:30 Canada Consumer Price Index m / m April 0.7% 0.1%

12:30 Canada Consumer price index, y/y April 1.2% 1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April 2.4% 2.4%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April 0.6%

12:30 U.S. CPI, m/m April 0.2% 0.1%

12:30 U.S. CPI, Y/Y April -0.1% -0.1%

12:30 U.S. CPI excluding food and energy, m/m April 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y April 1.8% 1.7%

13:30 Eurozone ECB President Mario Draghi Speaks

13:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Japan BOJ Governor Haruhiko Kuroda Speaks

17:00 U.S. Fed Chairman Janet Yellen Speaks

-

14:00

Orders

EUR/USD

Offers 1.1180 1.1200 1.1230 1.1250 1.1280 1.1300

Bids 1.1140 1.1120 1.1100 1.1080-85 1.1055-60 1.1025-40 1.1000 1.0985 1.0965

GBP/USD

Offers 1.5685 1.5700 1.5725 1.5740 1.5780 1.5800 1.5830

Bids 1.5650 1.5625 1.5600 1.5580 1.5560 1.5535 1.5520 1.5500 1.5480 1.5465 1.5450

EUR/GBP

Offers 0.7130 0.7165 0.7185 0.7200 0.7225-30 0.7250 0.7285 0.7300

Bids 0.7100 0.7085-90 0.7065 0.7050 0.7030 0.7015 0.7000

EUR/JPY

Offers 135.00 135.40 136.00 136.50

Bids 134.40 134.00 133.80 133.50 133.00

USD/JPY

Offers 121.00 121.20 121.50 121.80 122.00 122.30 122.50

Bids 120.60 120.45 120.20 120.00 119.80 119.60 119.45

AUD/USD

Offers 0.7920-30 0.7945 0.7965 0.7980 0.8000 0.8025 0.8040 0.8060

Bids 0.7900 0.7880 0.7865 0.7850 0.7835 0.7800 0.7785 0.7750

-

12:02

European stock markets mid session: most stocks traded mixed on the Greek debt crisis and on German Ifo business climate data

Most stock indices traded mixed on the Greek debt crisis and on German Ifo business climate data. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President Francois Hollande met yesterday. The Greek spokesman, Gabriel Sakellaridis, said today that a deal between Greece and its creditors should be reached within the next 10 days.

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

German Ifo Institute released its business confidence figures for Germany on Friday. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

The European Central Bank president Mario Draghi said in Portugal today that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

Current figures:

Name Price Change Change %

FTSE 100 7,043.63 +30.16 +0.43 %

DAX 11,808.91 -55.68 -0.47 %

CAC 40 5,123.05 -23.65 -0.46 %

-

11:43

Bank of Japan Governor Haruhiko Kuroda: the 2% inflation target is expected to be achieved around the first half of fiscal 2016

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a post-meeting press conference on Friday that the 2% inflation target is expected to be achieved around the first half of fiscal 2016.

Kuroda also noted that capital spending and private consumption were improving, while exports increased.

The BoJ governor reiterated that there is no need to change the monetary policy. But he added that the central bank will adjust its monetary policy to achieve its 2% inflation target if needed.

-

11:20

Bank of Japan keeps its monetary policy unchanged, the economy continues to recover moderately

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged. The BoJ board member, Takahide Kiuchi, said again that the central bank should cut its asset purchases to 45 trillion yen annually.

The BoJ noted that the country's economy continued to recover moderately. It pointed out that household spending and housing investment were showing signs of improvement.

Private consumption was resilient, the central bank said.

Inflation expectations are expected to rise.

-

11:08

Public sector net borrowing in the U.K. declines to £6.04 billion in April

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. fell to £6.04 billion in April from £6.06 billion in March, missing expectations for a rise to £8.1 billion.

March's figure was revised down from £6.74 billion.

-

11:05

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E1.7bn), $1.1000(E1.9bn), $1.1050(E563mn), $1.1100(E807mn), $1.1200(E1.4bn), $1.1250(E636mn), $1.1300(E945mn)$1.1400(E1.22bn)

USD/JPY: Y120.00($2.05bn), Y121.00($1.4bn), Y122.00($1.97bn)

GBP/USD: $1.5650(Gbp405mn)

AUD/USD: $0.7800(A$582mn), $0.7850(A$543mn), $0.7920(A$1.32bn), $0.8000 in (A$1.17bn)

USD/CAD: C$1.2265($790mn)

-

10:54

German business confidence index slightly declines in May

German Ifo Institute released its business confidence figures for Germany on Friday. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

-

10:40

Analysts and traders expect OPEC to maintain its strategy at its meeting in June

According to the Bloomberg survey, 33 of 34 analysts and traders pointed out that the Organization of Petroleum Exporting Countries (OPEC) will stick with the strategy of favouring market share over oil prices at the next meeting in June 05. They expect that OPEC will maintain its daily production target of 30 million barrels.

Saudi Arabia said at the last meeting in November that cutting oil production to boost prices would not address the threat from shale and other higher-cost oil suppliers.

Oil prices climbed 46% since mid-January as oil producers lowered spending plans and the number of active U.S. drilling rigs declined.

-

10:30

United Kingdom: PSNB, bln, April -6.04 (forecast -8.1)

-

10:17

Eurozone officials are considering to extend the current bailout until the end of October

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

This decision could allow Athens access to around €4 billion. Greece should reform its value-added tax system in exchange for this financial help. Reforms of the pension system and labour market will be postponed until the autumn.

-

10:01

Germany: IFO - Current Assessment , May 114.3 (forecast 113.5)

-

10:00

Germany: IFO - Expectations , May 103.0 (forecast 103.1)

-

10:00

Germany: IFO - Business Climate, May 108.5 (forecast 108.3)

-

08:24

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

The yen climbed 0.2 percent to 120.82 per dollar after snapping a five-day slump Thursday. The BOJ said it will continue its easing efforts until inflation hits 2 percent. The central bank said the consumer-price index will probably remain flat due to the effects of lower energy prices.

The euro strengthened 0.2 percent to $1.1132. Minutes of the Fed's April meeting published Wednesday showed many officials expected June would probably be too soon to boost borrowing costs, while they remain open to tightening later this year. They indicated a first-quarter slowdown in the economy was probably temporary.

EUR / USD: during the Asian session the pair rose to $ 1.1145

GBP / USD: during the Asian session the pair rose to $ 1.5680

USD / JPY: during the Asian session the pair fell to Y120.70

-

08:24

Options levels on friday, May 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1318 (3147)

$1.1260 (2460)

$1.1216 (2154)

Price at time of writing this review: $1.1158

Support levels (open interest**, contracts):

$1.1094 (1129)

$1.1066 (2226)

$1.1024 (3714)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 105882 contracts, with the maximum number of contracts with strike price $1,1500 (4872);

- Overall open interest on the PUT options with the expiration date June, 5 is 132193 contracts, with the maximum number of contracts with strike price $1,0800 (10360);

- The ratio of PUT/CALL was 1.25 versus 1.24 from the previous trading day according to data from May, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1174)

$1.5805 (1232)

$1.5709 (2575)

Price at time of writing this review: $1.5679

Support levels (open interest**, contracts):

$1.5593 (847)

$1.5496 (1960)

$1.5398 (2751)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34599 contracts, with the maximum number of contracts with strike price $1,5700 (2575);

- Overall open interest on the PUT options with the expiration date June, 5 is 51063 contracts, with the maximum number of contracts with strike price $1,5000 (3235);

- The ratio of PUT/CALL was 1.48 versus 1.47 from the previous trading day according to data from May, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Germany: GDP (QoQ), Quarter I 0.3% (forecast 0.3%)

-

08:01

Germany: GDP (YoY), Quarter I 1.1% (forecast 1.0%)

-

05:18

Japan: Bank of Japan Monetary Base Target, 275

-

05:16

Japan: BoJ Interest Rate Decision, 0%

-

04:04

Nikkei 225 20,179.23 -23.64 -0.12 %, Hang Seng 27,803.49 +279.77 +1.02 %, Shanghai Composite 4,605.43 +76.01 +1.68 %

-

00:32

Commodities. Daily history for May 21’2015:

(raw materials / closing price /% change)

Oil 60.72 +2.95%

Gold 1,206.30 +0.18%

-

00:29

Stocks. Daily history for Apr May 21’2015:

(index / closing price / change items /% change)

Nikkei 225 20,202.87 +6.31 +0.03 %

Hang Seng 27,523.72 -61.33 -0.22 %

S&P/ASX 200 5,662.3 +51.97 +0.93 %

Shanghai Composite 4,530.16 +83.88 +1.89 %

FTSE 100 7,013.47 +6.21 +0.09 %

CAC 40 5,146.7 +13.40 +0.26 %

Xetra DAX 11,864.59 +16.12 +0.14 %

S&P 500 2,130.82 +4.97 +0.23 %

NASDAQ Composite 5,090.79 +19.05 +0.38 %

Dow Jones 18,285.74 +0.34 0.00%

-

00:28

Currencies. Daily history for May 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1107 +0,14%

GBP/USD $1,5639 +0,70%

USD/CHF Chf0,9369 0,00%

USD/JPY Y121,06 -0,18%

EUR/JPY Y134,47 -0,04%

GBP/JPY Y189,58 +0,66%

AUD/USD $0,7893 +0,28%

NZD/USD $0,7343 +0,61%

USD/CAD C$1,2200 -0,04%

-

00:01

Schedule for today, Friday, May 22’2015:

(time / country / index / period / previous value / forecast)

03:00 Japan BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany GDP (YoY) (Finally) Quarter I 1.6% 1.0%

06:00 Germany GDP (QoQ) (Finally) Quarter I 0.7% 0.3%

06:30 Japan BOJ Press Conference

08:00 Eurozone ECB President Mario Draghi Speaks

08:00 Germany IFO - Business Climate May 108.6 108.3

08:00 Germany IFO - Current Assessment May 113.9 113.5

08:00 Germany IFO - Expectations May 103.5 103.1

08:30 United Kingdom PSNB, bln April -6.74 -8.1

11:00 United Kingdom BOE Gov Mark Carney Speaks

12:30 Canada Retail Sales, m/m March 1.7% 0.3%

12:30 Canada Retail Sales YoY March 2.5%

12:30 Canada Retail Sales ex Autos, m/m March 2.0% 0.4%

12:30 Canada Consumer Price Index m / m April 0.7% 0.1%

12:30 Canada Consumer price index, y/y April 1.2% 1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April 2.4% 2.4%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m April 0.6%

12:30 U.S. CPI, m/m April 0.2% 0.1%

12:30 U.S. CPI, Y/Y April -0.1% -0.1%

12:30 U.S. CPI excluding food and energy, m/m April 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y April 1.8% 1.7%

13:30 Eurozone ECB President Mario Draghi Speaks

13:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Japan BOJ Governor Haruhiko Kuroda Speaks

-