Noticias del mercado

-

21:00

Dow -0.12% 18,263.88 -21.86 Nasdaq +0.10% 5,095.95 +5.16 S&P -0.07% 2129.36 -1.46

-

18:46

WSE: Session Results

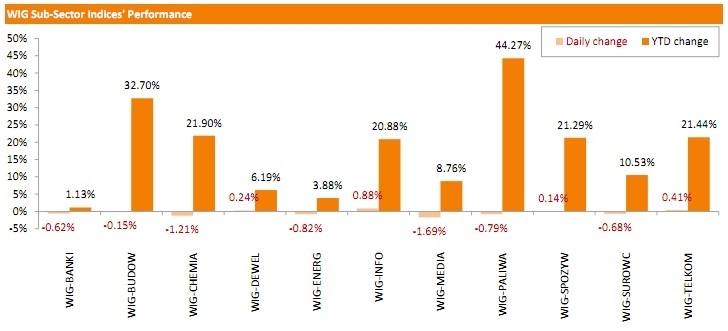

The selling moods predominated on Polish equity market on Friday. As a result, the broad market benchmark - the WIG index dropped 0.28% and the large liquid companies measure - the WIG30 index exhibited a greater decline of 0.45%.

The drops in CYFROWY POLSAT (WSE: CPS) and MBANK (WSE: MBK) were the biggest in the WIG30 index, reducing their market capitalization by a respective 2.95% and 2.35%. ING BSK (WSE: ING) and SYNTHOS (WSE: SNS) were also among top fallers, dropping more than 2% each. At the same time, a few stocks managed to hold up better, with LPP (WSE: LPP) generating the biggest gain of 2.59%.

Turning to the performance of the WIG sub-sector indices, the technology-oriented WIG-INFO index outperformed, advancing 0.88%. On the contrary, the worst-performing sub-sector indices were the media sector names' benchmark - the WIG-MEDIA index and the chemical companies' measure - the WIG-CHEMIA index, declining 1.69% and 1.21% respectively.

-

18:03

European stocks close: stocks closed mixed on the Greek debt crisis and as investors focused on the forum in Portugal

Stock indices closed mixed on the Greek debt crisis and as investors focused on the forum in Portugal. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President Francois Hollande met yesterday. The Greek spokesman, Gabriel Sakellaridis, said today that a deal between Greece and its creditors should be reached within the next 10 days.

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

German Finance Minister Wolfgang Schäuble denied reports today that he said Greece needs a parallel currency.

Earlier today, news reported that Schäuble raised the possibility that Athens may need a parallel currency alongside the euro in case its talks with creditors fail. He should have cited the example of Montenegro, which uses the euro but isn't a member of the Eurozone.

German Ifo Institute released its business confidence figures for Germany on Friday. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

The European Central Bank president Mario Draghi said in Portugal today that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,031.72 +18.25 +0.26 %

DAX 11,815.01 -49.58 -0.42 %

CAC 40 5,142.89 -3.81 -0.07 %

-

18:00

European stocks closed: FTSE 100 7,031.72 +18.25 +0.26% CAC 40 5,142.89 -3.81 -0.07% DAX 11,815.01 -49.58 -0.42%

-

17:50

Wall Street. Major U.S. stock-indexes lower

Major U.S. stock-indexes fell in late morning trading on Friday, retreating from recent record highs, as investors await Federal Reserve Chair Janet Yellen's economic outlook for clues on the timing of a rate hike after new data showed a rise in inflation. Consumer prices moderated last month, data showed, but the so-called core consumer price index, which strips out food and energy costs, posted its largest gain since January 2013.

Most of Dow stocks in negative area (25 of 30). Top looser - The Boeing Company (BA, -1.37%). Top gainer - Apple Inc. (AAPL, +0.74%).

All of S&P index sectors in negative area. Top looser - Utilities (-0.6%).

At the moment:

Dow 18205.00 -53.00 -0.29%

S&P 500 2124.25 -3.75 -0.18%

Nasdaq 100 4528.00 -0.75 -0.02%

10-year yield 2.20% +0.01

Oil 59.82 -0.90 -1.48%

Gold 1206.00 +1.90 +0.16%

-

16:42

German Finance Minister Wolfgang Schäuble denied reports that he said Greece needs a parallel currency

German Finance Minister Wolfgang Schäuble denied reports today that he said Greece needs a parallel currency.

Earlier today, news reported that Schäuble raised the possibility that Athens may need a parallel currency alongside the euro in case its talks with creditors fail. He should have cited the example of Montenegro, which uses the euro but isn't a member of the Eurozone.

-

16:09

Bank of England Deputy Governor Minouche Shafik: outlook have not deteriorated despite low long-term interest rates

Bank of England Deputy Governor Minouche Shafik said on Friday that the Britain's outlook have not deteriorated despite low long-term interest rates. She added that she expects wage growth and productivity growth to pick up in the U.K.

"I think it is reasonable to expect that resumption in productivity growth to come over the next year or so as the continued narrowing of slack in the labour market raises the incentive to increase output by increasing output per worker," she noted.

Shafik also expects inflation to pick up as oil prices will stabilize.

-

15:33

U.S. Stocks open: Dow 0.00%, Nasdaq +0.05%, S&P -0.10%

-

15:24

Before the bell: S&P futures -0.15%, NASDAQ futures -0.03%

U.S. stock-index futures fell after data showing the fastest rise in consumer prices in two years bolstered speculation the Federal Reserve will be forced to raise interest rates soon.

Global markets:

Nikkei 20,264.41 +61.54 +0.30%

Hang Seng 27,992.83 +469.11 +1.70%

Shanghai Composite 4,657.6 +128.17 +2.83%

FTSE 7,060.07 +46.60 +0.66%

CAC 5,149.79 +3.09 +0.06%

DAX 11,842.33 -22.26 -0.19%

Crude oil $60.07 (-1.09%)

Gold $1205.20 (+0.07%)

-

15:21

Canadian retail sales increase by 0.7% in March

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 0.7% in March, exceeding expectations for a 0.3% gain, after a 1.5% rise in February. February's figure was revised down from a 1.7% increase.

It was the second consecutive increase.

The rise was driven by higher cars, food and alcohol sales. Motor vehicle and parts sales gained 1.5% in March, while sales at food and beverage stores rose 1.3%.

Sales at gasoline stations were down 0.5% in March.

Canadian retail sales excluding automobiles were up 0.5% in March, exceeding expectations for a 0.4% increase, after a 1.8% rise in February. February's figure was revised down from a 2.0% increase.

-

15:10

U.S. consumer price inflation rises 0.1% in April

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation rose 0.1% in April, in line with expectations, after a 0.2% gain in March.

On a yearly basis, the U.S. consumer price index fell to -0.2% in April from -0.1% in March. It was the lowest level since October 2009. Analysts had expected the index to remain unchanged at -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.3% in April, exceeding expectations for a 0.2% increase, after a 0.2% rise in March. It was the largest increase since January 2013.

The rise was driven by higher costs for housing, medical care, furniture and vehicles.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.8% in April, beating forecasts of a decline to 1.7%.

The core consumer inflation data indicates that the Fed might start to hike its interest rate later this year.

Gasoline prices decreased 1.7% in April, food prices remained unchanged, while shelter costs rose 0.3%.

The medical care index climbed 0.7% in April, the largest gain since January 2007.

Energy costs declined 1.3% in April.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

104.41

+0.01%

3.4K

Johnson & Johnson

JNJ

102.44

+0.02%

0.1K

Facebook, Inc.

FB

80.50

+0.02%

10.8K

Tesla Motors, Inc., NASDAQ

TSLA

245.70

+0.03%

1.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.36

+0.05%

3.6K

Boeing Co

BA

147.50

+0.10%

0.2K

Barrick Gold Corporation, NYSE

ABX

12.47

+0.24%

17.0K

Starbucks Corporation, NASDAQ

SBUX

51.47

+0.27%

0.3K

Apple Inc.

AAPL

131.80

+0.31%

292.0K

Hewlett-Packard Co.

HPQ

34.00

+0.50%

36.5K

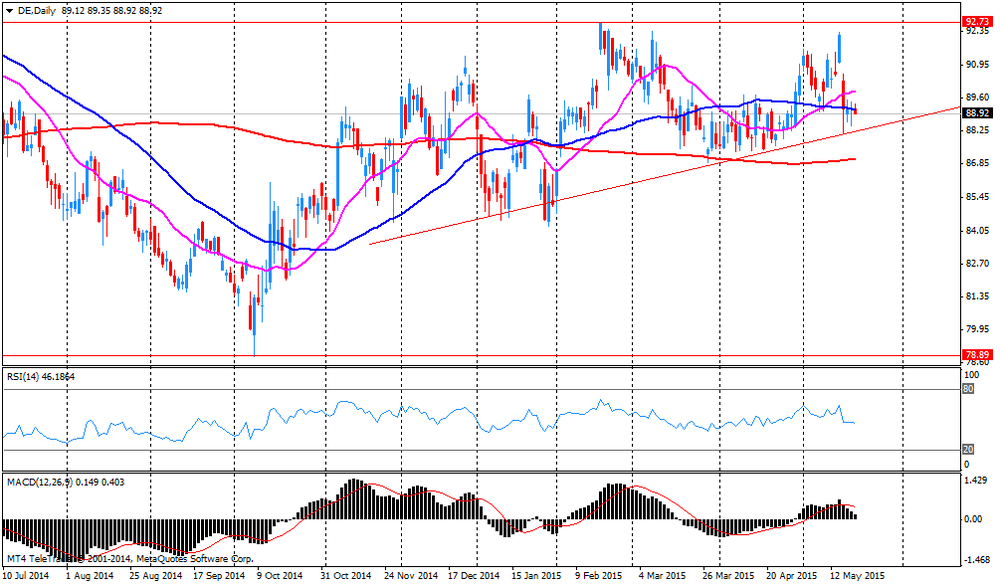

Deere & Company, NYSE

DE

92.01

+2.85%

50.6K

American Express Co

AXP

80.76

0.00%

0.5K

ALCOA INC.

AA

13.00

0.00%

3.9K

Ford Motor Co.

F

15.51

0.00%

10.2K

International Paper Company

IP

53.10

0.00%

0.5K

Home Depot Inc

HD

112.00

-0.01%

0.4K

Twitter, Inc., NYSE

TWTR

36.66

-0.05%

49.9K

Procter & Gamble Co

PG

80.35

-0.07%

2.1K

Caterpillar Inc

CAT

89.26

-0.08%

5.4K

Yahoo! Inc., NASDAQ

YHOO

43.64

-0.08%

15.6K

Visa

V

69.30

-0.10%

5.4K

Yandex N.V., NASDAQ

YNDX

18.59

-0.11%

2.8K

Wal-Mart Stores Inc

WMT

76.02

-0.12%

1.8K

Walt Disney Co

DIS

110.23

-0.14%

2.2K

Amazon.com Inc., NASDAQ

AMZN

430.96

-0.16%

2.0K

AT&T Inc

T

35.01

-0.17%

4.7K

UnitedHealth Group Inc

UNH

120.25

-0.17%

0.1K

Pfizer Inc

PFE

34.30

-0.17%

16.6K

Citigroup Inc., NYSE

C

54.74

-0.18%

58.2K

Cisco Systems Inc

CSCO

29.37

-0.20%

1.1K

Verizon Communications Inc

VZ

49.80

-0.20%

17.6K

General Motors Company, NYSE

GM

35.51

-0.20%

7.9K

Goldman Sachs

GS

204.50

-0.22%

0.3K

The Coca-Cola Co

KO

41.14

-0.22%

10.0K

Intel Corp

INTC

33.47

-0.24%

3.6K

General Electric Co

GE

27.65

-0.25%

3.6K

Merck & Co Inc

MRK

59.95

-0.25%

8.0K

Exxon Mobil Corp

XOM

86.96

-0.29%

0.7K

E. I. du Pont de Nemours and Co

DD

70.77

-0.30%

5.4K

Microsoft Corp

MSFT

47.28

-0.30%

6.4K

International Business Machines Co...

IBM

172.75

-0.34%

7.4K

JPMorgan Chase and Co

JPM

66.42

-0.35%

0.3K

Chevron Corp

CVX

105.00

-0.46%

0.9K

-

14:53

Canadian consumer price inflation declines 0.1% in April

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation decreased 0.1% in April, missing expectations for a 0.1% rise, after a 0.7% increase in March.

On a yearly basis, the consumer price index fell to 0.8% in April from 1.2% in March. That was the lowest level since April 2013.

The consumer price index was driven by lower energy prices. The energy index plunged 13.5% in April from the same month a year earlier.

Gasoline price dropped 21.0% in April from the same month a year earlier.

Canadian core consumer price index, which excludes some volatile goods, increased 0.1% in April, after a 0.6% gain in March.

On a yearly basis, core consumer price index in Canada fell to 2.3% in April from 2.4% in March. Analysts had expected the index to remain unchanged at 2.4%.

The Bank of Canada's inflation target is 2.0%.

-

14:45

-

14:28

European Central Bank President Mario Draghi: Eurozone's is brighter today than it has been for seven long years"

The European Central Bank (ECB) President Mario Draghi said at the forum in Portugal on Friday that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

But the ECB president warned that structural reforms are needed.

"Being in the early phases of a cyclical recovery is not a reason to postpone structural reforms; it is in fact an opportunity to accelerate them," Draghi said.

-

12:02

European stock markets mid session: most stocks traded mixed on the Greek debt crisis and on German Ifo business climate data

Most stock indices traded mixed on the Greek debt crisis and on German Ifo business climate data. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President Francois Hollande met yesterday. The Greek spokesman, Gabriel Sakellaridis, said today that a deal between Greece and its creditors should be reached within the next 10 days.

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

German Ifo Institute released its business confidence figures for Germany on Friday. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

The European Central Bank president Mario Draghi said in Portugal today that Eurozone's is brighter today than it has been for seven long years".

"Monetary policy is working its way through the economy. Growth is picking up. And inflation expectations have recovered from their trough," he noted.

Current figures:

Name Price Change Change %

FTSE 100 7,043.63 +30.16 +0.43 %

DAX 11,808.91 -55.68 -0.47 %

CAC 40 5,123.05 -23.65 -0.46 %

-

11:43

Bank of Japan Governor Haruhiko Kuroda: the 2% inflation target is expected to be achieved around the first half of fiscal 2016

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a post-meeting press conference on Friday that the 2% inflation target is expected to be achieved around the first half of fiscal 2016.

Kuroda also noted that capital spending and private consumption were improving, while exports increased.

The BoJ governor reiterated that there is no need to change the monetary policy. But he added that the central bank will adjust its monetary policy to achieve its 2% inflation target if needed.

-

11:20

Bank of Japan keeps its monetary policy unchanged, the economy continues to recover moderately

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged. The BoJ board member, Takahide Kiuchi, said again that the central bank should cut its asset purchases to 45 trillion yen annually.

The BoJ noted that the country's economy continued to recover moderately. It pointed out that household spending and housing investment were showing signs of improvement.

Private consumption was resilient, the central bank said.

Inflation expectations are expected to rise.

-

11:08

Public sector net borrowing in the U.K. declines to £6.04 billion in April

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. fell to £6.04 billion in April from £6.06 billion in March, missing expectations for a rise to £8.1 billion.

March's figure was revised down from £6.74 billion.

-

10:54

German business confidence index slightly declines in May

German Ifo Institute released its business confidence figures for Germany on Friday. German business confidence index slightly fell to 108.5 in May from 108.6 in April, beating expectations for a decline to 108.3. It was the first decline since October 2014.

"The German economy remains on track," Ifo President Hans-Werner Sinn said.

-

10:17

Eurozone officials are considering to extend the current bailout until the end of October

According to German newspaper Süddeutsche Zeitung, Eurozone officials are considering to extend the current bailout until the end of October. A decision on this matter will be taken at the beginning of next month.

This decision could allow Athens access to around €4 billion. Greece should reform its value-added tax system in exchange for this financial help. Reforms of the pension system and labour market will be postponed until the autumn.

-

04:04

Nikkei 225 20,179.23 -23.64 -0.12 %, Hang Seng 27,803.49 +279.77 +1.02 %, Shanghai Composite 4,605.43 +76.01 +1.68 %

-

00:29

Stocks. Daily history for Apr May 21’2015:

(index / closing price / change items /% change)

Nikkei 225 20,202.87 +6.31 +0.03 %

Hang Seng 27,523.72 -61.33 -0.22 %

S&P/ASX 200 5,662.3 +51.97 +0.93 %

Shanghai Composite 4,530.16 +83.88 +1.89 %

FTSE 100 7,013.47 +6.21 +0.09 %

CAC 40 5,146.7 +13.40 +0.26 %

Xetra DAX 11,864.59 +16.12 +0.14 %

S&P 500 2,130.82 +4.97 +0.23 %

NASDAQ Composite 5,090.79 +19.05 +0.38 %

Dow Jones 18,285.74 +0.34 0.00%

-