Noticias del mercado

-

22:07

Major US stock indices closed above zero

US stocks rose slightly today, while the S & P 500 closed near record highs. Fresh batch of disappointing economic data reinforced investors' expectations that the Federal Reserve will not raise interest rates any time soon.

As it became known today, initial applications for unemployment benefits, the gauge of layoffs throughout the economy, rose to a seasonally adjusted 10,000 to 274,000 for the week ended May 16, the Labor Department said on Thursday. Economists expected 271,000 initial claims.

In addition, a report Philadelphia Fed in May PMI deteriorated, reaching at the same level of 6.7 points compared with 7.5 points in April. It is worth noting that many economists had expected growth of this indicator to the level of 8.0 points.

However, sales in the secondary market fell in April after rising in the previous month, marking the unevenness that has been the hallmark of the recovery of the housing market. Sales in the secondary market decreased by 3.3% last month from March to a seasonally adjusted annual rate reached 5.04 million, the National Association of Realtors said Thursday. Sales in March were revised up to 5.21 million. From the originally reported 5.19 million.

Oil prices increased significantly today, adding more than 2% as disappointing manufacturing data from China and the euro zone have increased the likelihood of the adoption of measures to stimulate the economy, which could help increase the demand for energy.

Components of the index DOW closed mixed (11 against 18 in the red in the black). Outsider were shares Johnson & Johnson (JNJ, -1.05%). Most remaining shares of Caterpillar Inc. rose (CAT, + 1.56%).

Most sectors of the S & P closed in the positive zone. Most of the basic materials sector increased (+ 0.8%). Outsiders were conglomerates sector (-0.1%).

At the close:

Dow + 0.01% 18,286.40 +1.00

Nasdaq + 0.38% 5,090.79 +19.05

S & P + 0.24% 2,130.89 +5.04

-

21:00

Dow +0.09% 18,302.45 +17.05 Nasdaq +0.41% 5,092.30 +20.56 S&P +0.29% 2,131.91 +6.06

-

18:59

WSE: Session Results

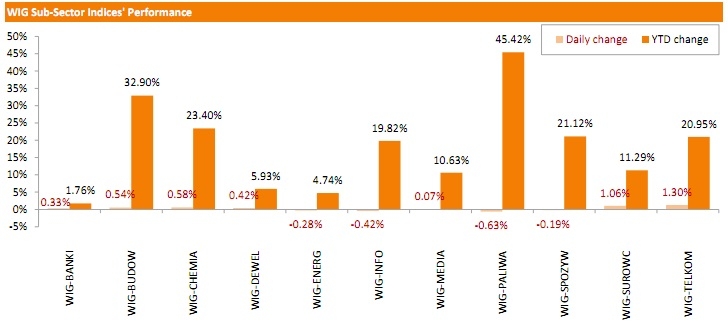

Polish equity market appreciated on Thursday. The broad market benchmark - the WIG index inched up 0.11%, while the large liquid companies measure - the WIG30 index rose 0.07%.

The outperformers of the previous session ASSECO POLAND (WSE: ACP) and JSW (WSE: JSW) were among the biggest laggards in the WIG30 index, losing a respective 1.88% and 1.15% due to profit-taking. Aside from that, oil & gas name PKN ORLEN (WSE: PKN) also suffered selling pressure, retreating by 1.36% after hitting an all-time high in the previous session. Financials name ING BSK (WSE: ING) recorded similar result, falling by 1.34%. At the same time, ORANGE POLSKA (WSE: OPL) managed to record the best daily result, advancing 1.56%. It was followed by PKO BP (WSE: PKO) and BOGDANKA (WSE: LWB), gaining 1.45% and 1.44% respectively. KGHM (WSE: KGH) added 1.11%, benefiting from a rising copper price.

The performance of the WIG sub-sector indices was mixed. The telecommunications names measure - the WIG-TELKOM index posted the biggest gain, adding 1.30%. On the contrary, oil&gas names benchmark- the WIG-PALIWA index fared the worst, losing 0.63%.

-

18:25

Wall Street. Major U.S. stock-indexes rose

Major U.S. indexes rose on Thursday, with the S&P 500 near record high, as a fresh batch of disappointing economic data bolstered expectations that the Federal Reserve would not raise interest rates any time soon. The central bank's officials believed it would be premature to raise rates next month even though most felt the economy was set to rebound from a dismal start to the year, according to minutes from their April policy meeting. Data on Thursday showed that jobless claims rose slightly more than expected last week, manufacturing sector growth slowed for a second straight month during May and home resales unexpectedly fell in April.

Dow stocks are mixed (14 - fell vs 16 - rose). Top looser - UnitedHealth Group Incorporated (UNH, -0.75%). Top gainer - Caterpillar Inc. (CAT, +1.34%).

Most of S&P index sectors in positive area. Top gainer - Basic Materials (+0,8%). Top looser - Financial (-0.1%).

At the moment:

Dow 18275.00 +19.00 +0.10%

S&P 500 2128.75 +6.25 +0.29%

Nasdaq 100 4529.25 +23.75 +0.53%

10-year yield 2.21% -0.04

Oil 60.67 +1.69 +2.87%

Gold 1204.60 -4.10 -0.34%

-

18:00

European stocks closed: FTSE 100 7,013.47 +6.21 +0.09% CAC 40 5,146.7 +13.40 +0.26% DAX 11,864.59 +16.12 +0.14%

-

18:00

European stocks close: stocks closed higher on mixed manufacturing PMIs from the Eurozone and after the release of the European Central Bank's monetary policy minutes

Stock indices closed higher on mixed manufacturing PMIs from the Eurozone and after the release of the European Central Bank's (ECB) monetary policy minutes. Eurozone's preliminary manufacturing PMI increased to 52.3 in May from 52.0 in April. Analysts had expected index to remain unchanged at 52.0.

Eurozone's preliminary services PMI declined to 53.3 in May from 54.1 in April. Analysts had expected the index to fall to 53.9.

Markit's Chief Economist Chris Williamson said that Eurozone's economy is expected to grow around 2.0% this year. He added that it would be the best performance since 2010.

Germany's preliminary manufacturing PMI fell to 51.4 in May from 52.1 in April, missing forecasts of an increase to 52.3.

Germany's preliminary services PMI decreased to 52.9 in May from 54.0 in April, missing expectations for a fall to 53.9.

Markit's economist Oliver Kolodseike noted that it seems that the growth of German economy will remain sluggish in the coming months.

France's preliminary manufacturing PMI rose to 49.3 in May from 48.0 in April, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.6 in May from 51.4 in April, missing expectations for a gain to 51.9.

The Senior Economist at Markit Jack Kennedy said that the French economy is expected to expand in the second quarter.

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the ECB said in its minutes that quantitative easing was working but the implementation of key reforms is needed for full benefits.

The Governing Council reiterated to keep its monetary policy "until the end of September 2016 and, in any case, until a sustained adjustment was visible in the path of inflation consistent with the Governing Council's aim of achieving inflation rates below, but close to, 2% over the medium term".

Eurozone's preliminary consumer confidence index declined to -5.5 in May from -4.6 in April.

Retail sales in the U.K. increased 1.2% in April, exceeding expectations for a 0.4% rise, after a 0.7% decline in March. March's figure was revised down from a 0.5% fall.

It was the highest increase since November 2014.

The rise was driven by higher sales of clothing, textiles and footwear, which climbed by 5.2% in April.

The ONS noted that sales were supported by warmer than average weather.

On a yearly basis, retail sales in the U.K. climbed 4.7% in April, beating forecasts of 3.8% increase, after a 4.0% rise in March. March's figure was revised down from a 4.2% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,013.47 +6.21 +0.09%

DAX 11,864.59 +16.12 +0.14%

CAC 40 5,146.7 +13.40 +0.26%

-

17:12

Eurozone’s preliminary consumer confidence index drops to -5.5 in May

The European Commission released its preliminary consumer confidence figures for the Eurozone on Thursday. Eurozone's preliminary consumer confidence index declined to -5.5 in May from -4.6 in April.

The reading remains above the levels in the recent years since the financial crisis, but it seems that the boost from lower energy prices is fading.

-

16:55

U.S. leading economic index climbs 0.7% in April

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index climbed by 0.7% in April, beating expectations a 0.3% gain, after a 0.4% increase in March. March's figure was revised up from a 0.2% rise.

The increase was driven by higher building permits. Seven of the ten indicators rose.

The Conference Board economist Ataman Ozyildirim said that the reading suggests that the weakness of the economy in the first quarter was temporary. But he added that the index does not suggest "a significant strengthening in the economic outlook at this time".

The improvement in building permits helped to drive the index up this month, but gains in other components, in particular the financial indicators, have been somewhat more muted," Ozyildirim noted.

-

16:44

Philadelphia Federal Reserve Bank’s manufacturing index unexpectedly falls to 6.7 in May

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index unexpectedly decreased to 6.7 in May from 7.5 in April, missing expectations for a rise to 8.0.

A reading above zero indicates expansion.

The fall was driven by decline in input prices. The prices paid index dropped to -14.2 in May from -7.5 in April, while the prices received index were down to -5.4 from -4.1.

The number of employees index declined to 6.7 in May from 11.5 last month.

The new orders index increased to 4.0 in May from 0.7 in April.

According to the report, the indicators of future activity continue to show that the manufacturing sector is expected to continue growing over the next six months.

-

16:32

U.S. existing homes sales declines 3.3% in April

The National Association of Realtors released existing homes sales figures in the U.S. on Thursday. Sales of existing homes declined 3.3% to a seasonally adjusted annual rate of 5.04 million in April from 5.21 million in March.

March's figure was revised up from 5.19 million units.

Analysts had expected an increase to 5.24 million units.

The NAR chief economist Lawrence Yun said that April's reading was "the result of lagging supply relative to demand and the upward pressure it's putting on prices".

"With low interest rates and job growth, more buyers will be encouraged to enter the market unless prices accelerate even higher in relation to incomes," he noted.

-

16:17

U.S. preliminary manufacturing purchasing managers' index (PMI) declines to 53.8 in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Thursday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.8 in May from 54.1 in April, missing expectations for a rise to 54.5. It was the lowest level since January 2014.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that export sales dropped for two straight months. That has not seen for two years, he added.

"Unless production growth revives there is a worry that payroll growth will slow as companies seek to boost productivity," Williamson pointed out.

According to the survey, manufacturers say that the stronger U.S. dollar is hurting demand for exports.

The preliminary new orders index declined to 54.2 in May from 55.3 in April.

The preliminary output index was down to 55.0 in May from 55.3 in April, the lowest level since December 2014.

-

16:01

ECB Monetary Policy Meeting Account: quantitative easing was working but the implementation of key reforms is needed for full benefits

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the ECB said in its minutes that quantitative easing was working but the implementation of key reforms is needed for full benefits.

"A strong signal needed to be sent to euro area governments to press ahead with structural reforms and to take measures to improve the business environment," the central bank noted.

The Governing Council reiterated to keep its monetary policy "until the end of September 2016 and, in any case, until a sustained adjustment was visible in the path of inflation consistent with the Governing Council's aim of achieving inflation rates below, but close to, 2% over the medium term".

The central bank ruled out that there would be difficulty meeting purchase targets.

The ECB decided on January 22 to launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

-

15:41

CBI industrial order books balance drops to -5% in May

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance dropped to -5% in May from +1% in April, missing expectations for a rise to +3%.

The decline was driven by lower exports. The export order book balance rose slightly to -7% in May from -11% in April.

The balance for output volumes for the next three months fell to +15% in May from +16% in April.

The CBI director of economics Rain Newton-Smith said that manufacturers in the U.K. expect the growth to continue and export orders to improve.

"Some of this could be down to an improvement in the Eurozone's momentum - but the strengthening pound is still proving quite a challenge," he noted.

-

15:32

U.S. Stocks open: Dow -0.15%, Nasdaq -0.15%, S&P -0.14%

-

15:29

Before the bell: S&P futures -0.15%, NASDAQ futures -0.26%

U.S. stock-index futures fluctuated amid mixed earnings reports and signs the labor market continues to strengthen.

Global markets:

Nikkei 20,202.87 +6.31 +0.03%

Hang Seng 27,523.72 -61.33 -0.22%

Shanghai Composite 4,530.16 +83.88 +1.89%

FTSE 7,007.17 -0.09 0.00%

CAC 5,122.52 -10.78 -0.21%

DAX 11,826.5 -21.97 -0.19%

Crude oil $59.39 (+0.68%)

Gold $1202.40 (-0.52%)

-

15:24

Initial jobless claims rise by 10,000 to 274,000 in the week ending May 16

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 16 in the U.S. climbed by 10,000 to 274,000 from 264,000 in the previous week, missing expectations for a rise by 7,000.

Low jobless claims could be interpreted as the strengthening of the labour market.

Continuing jobless claims declined by 12,000 to 2,211,000 in the week ended May 9, the lowest level since November 11, 2000.

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.09

+0.05%

7.9K

Yandex N.V., NASDAQ

YNDX

18.60

+0.05%

14.6K

Johnson & Johnson

JNJ

102.91

+0.06%

1.1K

ALTRIA GROUP INC.

MO

51.83

+0.06%

0.5K

Walt Disney Co

DIS

110.33

+0.12%

1.0K

Twitter, Inc., NYSE

TWTR

36.85

+0.19%

2.3K

Chevron Corp

CVX

105.50

+0.24%

5.6K

Nike

NKE

105.00

+0.37%

0.2K

ALCOA INC.

AA

13.12

+0.38%

14.3K

Yahoo! Inc., NASDAQ

YHOO

43.15

+0.84%

100.9K

Amazon.com Inc., NASDAQ

AMZN

427.58

+0.88%

11.8K

Hewlett-Packard Co.

HPQ

33.39

+0.97%

1.5K

Visa

V

69.78

0.00%

0.5K

Exxon Mobil Corp

XOM

87.13

0.00%

12.4K

General Electric Co

GE

27.64

0.00%

6.1K

Pfizer Inc

PFE

34.30

0.00%

1.9K

Wal-Mart Stores Inc

WMT

75.88

-0.03%

0.3K

Procter & Gamble Co

PG

80.43

-0.06%

0.2K

United Technologies Corp

UTX

118.80

-0.06%

0.1K

Ford Motor Co.

F

15.29

-0.07%

4.4K

Apple Inc.

AAPL

129.95

-0.08%

95.6K

Boeing Co

BA

146.25

-0.12%

0.1K

Home Depot Inc

HD

111.97

-0.12%

0.7K

E. I. du Pont de Nemours and Co

DD

70.56

-0.14%

3.7K

Facebook, Inc.

FB

80.44

-0.14%

20.7K

Starbucks Corporation, NASDAQ

SBUX

50.95

-0.16%

0.6K

Cisco Systems Inc

CSCO

29.57

-0.17%

2.3K

AT&T Inc

T

34.55

-0.20%

0.9K

Caterpillar Inc

CAT

87.75

-0.20%

3.3K

Intel Corp

INTC

33.30

-0.21%

0.6K

Microsoft Corp

MSFT

47.47

-0.23%

14.4K

International Business Machines Co...

IBM

173.34

-0.24%

0.6K

Verizon Communications Inc

VZ

49.56

-0.26%

6.7K

Citigroup Inc., NYSE

C

54.75

-0.26%

2.0K

JPMorgan Chase and Co

JPM

66.30

-0.27%

9.8K

McDonald's Corp

MCD

99.83

-0.28%

2.2K

Google Inc.

GOOG

537.72

-0.29%

0.4K

Merck & Co Inc

MRK

60.28

-0.30%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

243.50

-0.35%

3.5K

The Coca-Cola Co

KO

41.20

-0.36%

1.4K

Barrick Gold Corporation, NYSE

ABX

12.35

-0.64%

24.9K

-

15:05

Chinese preliminary HSBC PMI rises to 49.1 in May, but remains below 50

The Chinese preliminary HSBC manufacturing Purchasing Managers' Index (PMI) increased to 49.1 in May from 48.9 in April, missing expectations for a rise to 49.3.

A reading below 50 indicates contraction of activity.

The output index dropped to 48.4 in May from 50.0 in April. It was a 13-month low. New export orders also declined.

"Softer client demand, both at home and abroad, along with further job cuts indicate that the sector may find it difficult to expand, at least in the near-term, as companies tempered production plans in line with weaker demand conditions," Markit economist Annabel Fiddes said.

This reading puts more pressure on the Chinese government to implement further stimulus measures.

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) reiterated at Overweight at Morgan Stanley, target raised to $520 from $450

-

14:44

Japan’s manufacturing PMI climbs to 50.3 in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Japan on Thursday. The index rose to 50.3 in May from 49.9 in April.

A reading above 50 indicates expansion.

The increase was driven by higher output and new orders. The output index increased to 51.7 in May from 49.3 in April, while new orders climbed to 51.2 from 48.8 in April.

"Reflective of an overall improvement in operating conditions at Japanese manufacturers was a return to growth of both production and new orders in May," said Markit economist Amy Brownbill.

-

14:02

FOMC’s April minutes: many Fed officials noted the economic data would not strong enough to start raise interest rates in June

The Federal Reserve released its April monetary policy meeting minutes on Wednesday. Some policymakers expect that the Fed may raise its interest rates in June. Members noted that the Fed was on track to hike its interest rates in June. Many policymakers said that it unlikely that the economic data available in June would provide sufficient confirmation that the conditions for hiking interest rate had been met.

-

12:00

European stock markets mid session: most stocks traded lower after mixed manufacturing PMIs from the Eurozone

Most stock indices traded lower after mixed manufacturing PMIs from the Eurozone. Eurozone's preliminary manufacturing PMI increased to 52.3 in May from 52.0 in April. Analysts had expected index to remain unchanged at 52.0.

Eurozone's preliminary services PMI declined to 53.3 in May from 54.1 in April. Analysts had expected the index to fall to 53.9.

Markit's Chief Economist Chris Williamson said that Eurozone's economy is expected to grow around 2.0% this year. He added that it would be the best performance since 2010.

Germany's preliminary manufacturing PMI fell to 51.4 in May from 52.1 in April, missing forecasts of an increase to 52.3.

Germany's preliminary services PMI decreased to 52.9 in May from 54.0 in April, missing expectations for a fall to 53.9.

Markit's economist Oliver Kolodseike noted that it seems that the growth of German economy will remain sluggish in the coming months.

France's preliminary manufacturing PMI rose to 49.3 in May from 48.0 in April, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.6 in May from 51.4 in April, missing expectations for a gain to 51.9.

The Senior Economist at Markit Jack Kennedy said that the French economy is expected to expand in the second quarter.

Retail sales in the U.K. increased 1.2% in April, exceeding expectations for a 0.4% rise, after a 0.7% decline in March. March's figure was revised down from a 0.5% fall.

It was the highest increase since November 2014.

The rise was driven by higher sales of clothing, textiles and footwear, which climbed by 5.2% in April.

The ONS noted that sales were supported by warmer than average weather.

On a yearly basis, retail sales in the U.K. climbed 4.7% in April, beating forecasts of 3.8% increase, after a 4.0% rise in March. March's figure was revised down from a 4.2% gain.

Current figures:

Name Price Change Change %

FTSE 100 7,009.31 +2.05 +0.03 %

DAX 11,808.27 -40.20 -0.34 %

CAC 40 5,114.04 -19.26 -0.38 %

-

11:32

Eurozone’s PMIs are mixed in May

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's preliminary manufacturing PMI increased to 52.3 in May from 52.0 in April. Analysts had expected index to remain unchanged at 52.0.

Eurozone's preliminary services PMI declined to 53.3 in May from 54.1 in April. Analysts had expected the index to fall to 53.9.

Markit's Chief Economist Chris Williamson said that Eurozone's economy is expected to grow around 2.0% this year. He added that it would be the best performance since 2010.

Germany's preliminary manufacturing PMI fell to 51.4 in May from 52.1 in April, missing forecasts of an increase to 52.3.

Germany's preliminary services PMI decreased to 52.9 in May from 54.0 in April, missing expectations for a fall to 53.9.

Markit's economist Oliver Kolodseike noted that it seems that the growth of German economy will remain sluggish in the coming months.

France's preliminary manufacturing PMI rose to 49.3 in May from 48.0 in April, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.6 in May from 51.4 in April, missing expectations for a gain to 51.9.

The Senior Economist at Markit Jack Kennedy said that the French economy is expected to expand in the second quarter.

-

11:09

UK retail sales rise 1.2% in April

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 1.2% in April, exceeding expectations for a 0.4% rise, after a 0.7% decline in March. March's figure was revised down from a 0.5% fall.

It was the highest increase since November 2014.

The rise was driven by higher sales of clothing, textiles and footwear, which climbed by 5.2% in April.

The ONS noted that sales were supported by warmer than average weather.

Fuel sales increased 2.0% in April, while food sales fell 0.1% in April.

On a yearly basis, retail sales in the U.K. climbed 4.7% in April, beating forecasts of 3.8% increase, after a 4.0% rise in March. March's figure was revised down from a 4.2% gain.

-

10:57

Germany’s Finance Minister Wolfgang Schäuble couldn’t rule out a Greek default

Germany's Finance Minister Wolfgang Schäuble said in an interview to The Wall Street Journal and Les Echos that he couldn't rule out a Greek default. Schäuble showed no willingness to compromise in the debt talks between Greece and its creditors to unlock the €245 billion bailout.

He also said that he was ready to talk with the U.K. about its demand to rewrite the rules of its European Union membership.

-

10:17

Five banks agreeto plead guilty to market manipulation

Five banks (Barclays, UBS, Citigroup, J.P. Morgan Chase и Royal Bank of Scotland) agreed on Wednesday to plead guilty to market manipulation. Barclays, Citigroup, J.P. Morgan and the Royal Bank of Scotland admitted to illegally distorting foreign exchange prices of U.S. dollars and euros from December 2007 to January 2013. Banks will pay fines in total of more than $5.5 billion.

Barclays, Citigroup, J.P. Morgan and the Royal Bank of Scotland used an electronic chat room and coded language to manipulate exchange rates.

UBS AG pleaded guilty to manipulating the London Interbank Offered Rate (Libor). UBS will pay $545 million in fines.

-

04:01

Nikkei 225 20,281.99 +85.43 +0.42 %, Hang Seng 27,540.26 -44.79 -0.16 %, Shanghai Composite 4,476.21 +29.92 +0.67 %

-

00:36

Stocks. Daily history for Apr May 20’2015:

(index / closing price / change items /% change)

Nikkei 225 20,196.56 +170.18 +0.85 %

Hang Seng 27,585.05 -108.49 -0.39 %

S&P/ASX 200 5,610.3 -5.20 -0.09 %

Shanghai Composite 4,448.29 +30.74 +0.70 %

FTSE 100 7,007.26 +12.16 +0.17 %

CAC 40 5,133.3 +16.00 +0.31 %

Xetra DAX 11,848.47 -4.86 -0.04 %

S&P 500 2,125.85 -1.98 -0.09 %

NASDAQ Composite 5,071.74 +1.71 +0.03 %

Dow Jones 18,285.4 -26.99 -0.15 %

-