Noticias del mercado

-

22:16

Major US stock indexes closed without a single dynamic

US stock indexes finished trading near zero, recovering after falling earlier in the session. The main attention was focused on the minutes of the meeting FOMC, which revealed that the members of the Committee on Open Market (FOMC) Federal Reserve have expressed doubts about the readiness to increase short-term interest rates in June 2015. Earlier it was reported that the Fed rate hike wants to be sure that the economic growth rate begin to increase, the unemployment rate to fall, and inflation - is gradually approaching the mark of 2%. Only a small part of the participants of the meeting expressed confidence that by June 2015 can achieve these conditions.

"I can not imagine how the Fed will raise rates, because this would lead to further strengthening of the dollar, - said the chief investment manager at Huntington Asset Management Randy Bateman. - We had a weak first quarter. We still have to contend with a strong dollar."

Also had little impact reports that the five major international banks to pay a fine for a total of more than $ 5 billion to settle claims of American regulators in the framework of the case of manipulating exchange rates. Four banks - JPMorgan Chase & Co., Barclays Plc, Royal Bank of Scotland Group Plc and Citigroup Inc - pleaded guilty to conspiring to manipulate currency. Fifth Bank - UBS AG - avoid confession: US Justice Department gave the bank a partial immunity, since he informed the authorities about violations. Nevertheless, UBS pleads guilty in manipulating LIBOR rate and pays a fine in this case.

In addition, oil prices rose moderately after falling more than 3% at the end of yesterday's session, which is associated with the publication of government data on stocks of petroleum products in the United States. US Department of Energy reported that in the week of May 9-15, the total volume of commercial oil inventories in the US fell by 2.7 million barrels to 482.2 million barrels. Analysts had expected a decline of stocks by 1.1 million barrels per day. US crude stocks falling for three consecutive weeks after the jump to a record high in April. Oil reserves in Cushing terminal fell by 241,000 barrels to 60.4 million barrels per day. Yesterday the American Petroleum Institute (API) reported that crude oil inventories in the US fell by 5.2 million barrels for the week ended May 15th. The Institute receives information from operators refinery, oil storage and pipelines on a voluntary basis.

Components of the index DOW closed mixed (17 against 13 in the red in the black). Outsider shares were JPMorgan Chase & Co. (JPM, -0.74%). Most remaining shares rose General Electric Company (GE, + 1.13%).

Sector S & P index finished trading mixed. Most of the health sector increased (+ 0.3%). Outsiders were conglomerates sector (-0.3%).

At the close:

Dow -0.15% 18,285.40 -26.99

Nasdaq + 0.03% 5,071.74 +1.71

S & P -0.09% 2,125.85 -1.98

-

21:00

Dow +0.08% 18,327.41 +15.02 Nasdaq +0.37% 5,088.63 +18.60 S&P +0.17% 2,131.47 +3.64

-

18:34

Wall Street. Major U.S. stock-indexes are little changed

Major U.S. stock-indexes are little changed in late morning trading on Wednesday, recovering from a fall in earlier in the session, as investors await the minutes from last month's Federal Reserve meeting for clues on when interest rates will be increased. The minutes of meeting are due at 17:00 GMT0. While the central bank is broadly expected to raise rates this year, the timing of the move has kept the market on tenterhooks. The Fed has said it will raise rates only when data suggests that the economy is strengthening. Growth slowed to a crawl in the first quarter, while recent data has painted a mixed picture.

Dow stocks are mixed (15 - fell vs 15 - rose). Top looser - McDonald's Corp. (MCD, -0.79%). Top gainer - Caterpillar Inc. (CAT, +0.62%).

S&P index sectors mixed. Top gainer - Healthcare (+0,2%). Top looser - Services (-0.2%).

At the moment:

Dow 18279.00 -5.00 -0.03%

S&P 500 2124.50 0.00 0.00%

Nasdaq 100 4505.75 +4.50 +0.10%

10-year yield 2.27% +0.00

Oil 58.90 +0.91 +1.57%

Gold 1209.60 +2.90 +0.24%

-

18:17

WSE: Session Results

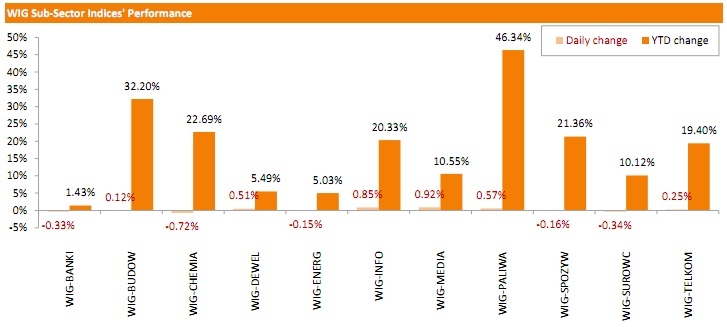

Polish equity market continued to retreat on Wednesday. The broad market benchmark - the WIG index edged down 0.07%, while the large liquid companies measure - the WIG30 index lost 0.11%.

Among the WIG30 index components, financials name BZ WBK (WSE: BZW) lagged, declining 4.33% on news the EBRD sold its 0.5%-stake in the bank with a discount to the market price. It was followed by GRUPA AZOTY (WSE: ATT) and ENERGA (WSE: ENG), sliding 3.10% and 2.72% respectively. On the contrary, JSW (WSE: JSW) became the biggest gainer, posting a 5% growth. SYNTHOS (WSE: SNS), CYFROWY POLSAT (WSE: CPS) and ASSECO POLAND (WSE: ACP) also were on upstream, advancing 2.55%, 1.94% and 1.90% respectively.

The WIG sub-sector indices were mixed. The chemicals names measure - the WIG-CHEMIA index (-0.72%) was the worst performer, while the media companies benchmark - the WIG-MEDIA index (+0.92%) added the most.

-

18:02

European stocks close: stocks closed mixed as investors are awaiting the Fed’s April meeting minutes

Stock indices closed mixed as investors are awaiting the Fed's April meeting minutes. Minutes are scheduled to be released later in the day. Investors expect to find some signals when the Fed will start its interest rates, which have been near zero since December 2008.

The Greek debt crisis is still in focus. Greece is running out of cash. Greek government's parliamentary speaker Nikos Filis said on Wednesday that Greece will not repay the €305 million IMF loans unless creditors unlocked bailout funds.

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

MPC members noted that rising house prices in the U.K. posed renewed risks due to a shortage of new homes.

The Bank of England still expects the consumer inflation close to zero due to lower oil and commodity prices, but inflation should pick up by the end of this year.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,007.26 +12.16 +0.17 %

DAX 11,848.47 -4.86 -0.04 %

CAC 40 5,133.3 +16.00 +0.31 %

-

18:00

European stocks closed: FTSE 100 7,007.26 +12.16 +0.17% CAC 40 5,133.3 +16.00 +0.31% DAX 11,848.47 -4.86 -0.04%

-

16:57

Greek government’s parliamentary speaker Nikos Filis said on Wednesday that Greece will not repay the €305 million IMF loans unless creditors unlocked bailout funds

-

16:15

Federal Reserve Bank of Chicago President Charles Evans: U.S. unemployment rate might be lower than 5%

Federal Reserve Bank of Chicago President Charles Evans said in Munich on Wednesday that the U.S. unemployment rate might be lower than 5%. He added that it might take more time for inflation to achieve 2% target.

"There's a lot of uncertainty about that. As unemployment goes down, I'm also going to be looking to see what inflation is doing. Because if we've got a natural rate below 5%, we might not see inflation pick up until we go even further," the Federal Reserve Bank of Chicago president.

Evans repeated that the Fed should delay its interest rate hike until early 2016 as inflation in the U.S. is still low.

Evans is a voting member of the Federal Open Market Committee this year.

-

15:42

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to -0.1 points in April

A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index rose to -0.1 points in April from -23.2 points in March.

The current conditions index was 0 points in May.

Both the economic expectations indicator and the measure for the current economic activity were zero in May.

About 50% of the respondents expect unchanged economic conditions in the coming months.

-

15:32

U.S. Stocks open: Dow -0.01%, Nasdaq -0.01%, S&P -0.02%

-

15:25

Before the bell: S&P futures +0.05%, NASDAQ futures +0.12%

U.S. stock futures traded in tight ranges on Wednesday ahead of closely watched Federal Reserve minutes that could give clues to the timing of a first interest-rate hike.

Global markets:

Nikkei 20,196.56 +170.18 +0.85%

Hang Seng 27,585.05 -108.49 -0.39%

Shanghai Composite 4,448.29 +30.74 +0.70%

FTSE 7,001.28 +6.18 +0.09%

CAC 5,104.94 -12.36 -0.24%

DAX 11,813.74 -39.59 -0.33%

Crude oil $58.50 (+0.90%)

Gold $1209.00 (+0.18%)

-

15:16

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Verizon Communications Inc

VZ

49.57

+0.04%

0.9K

Amazon.com Inc., NASDAQ

AMZN

422.00

+0.07%

14.9K

Cisco Systems Inc

CSCO

29.76

+0.08%

4.1K

Wal-Mart Stores Inc

WMT

76.51

+0.10%

6.1K

Facebook, Inc.

FB

80.72

+0.11%

2.6K

3M Co

MMM

162.29

+0.12%

0.2K

Google Inc.

GOOG

538.00

+0.12%

0.3K

AT&T Inc

T

34.43

+0.17%

0.6K

Apple Inc.

AAPL

130.29

+0.17%

79.2K

Procter & Gamble Co

PG

80.99

+0.20%

0.2K

International Paper Company

IP

53.80

+0.34%

0.5K

Chevron Corp

CVX

105.40

+0.36%

0.7K

Exxon Mobil Corp

XOM

87.30

+0.36%

6.5K

Pfizer Inc

PFE

34.34

+0.38%

1.8K

Johnson & Johnson

JNJ

104.38

+0.40%

14.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.41

+0.56%

5.5K

United Technologies Corp

UTX

119.80

+0.61%

2.2K

General Motors Company, NYSE

GM

35.34

+0.63%

4.0K

Visa

V

70.84

+0.97%

1.1K

Barrick Gold Corporation, NYSE

ABX

12.61

+1.12%

13.5K

Yahoo! Inc., NASDAQ

YHOO

42.25

+3.10%

2.6M

Goldman Sachs

GS

205.40

0.00%

0.1K

Home Depot Inc

HD

112.33

-0.01%

24.7K

Citigroup Inc., NYSE

C

55.30

-0.05%

10.0K

The Coca-Cola Co

KO

41.28

-0.07%

2.6K

McDonald's Corp

MCD

100.60

-0.08%

7.3K

JPMorgan Chase and Co

JPM

66.95

-0.09%

1.7K

Tesla Motors, Inc., NASDAQ

TSLA

246.80

-0.14%

6.0K

Twitter, Inc., NYSE

TWTR

37.44

-0.16%

54.7K

General Electric Co

GE

27.30

-0.18%

30.2K

Microsoft Corp

MSFT

47.49

-0.19%

59.3K

Ford Motor Co.

F

15.47

-0.19%

1.4K

Intel Corp

INTC

33.08

-0.21%

15.6K

Starbucks Corporation, NASDAQ

SBUX

51.31

-0.21%

1.7K

ALCOA INC.

AA

13.05

-0.23%

13.2K

Caterpillar Inc

CAT

87.00

-0.28%

3.8K

FedEx Corporation, NYSE

FDX

177.40

-0.33%

0.2K

Yandex N.V., NASDAQ

YNDX

18.67

-0.43%

10.3K

-

15:11

Canada’s wholesale sales rise 0.8% in March

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales increased 0.8% in March, missing expectations for a 0.9% rise, after a 0.4% decline in February.

The increase was driven by higher sales in the building material and supplies subsector. Sales in the building material and supplies subsector climbed 2.8%.

Sales rose in five of the seven subsectors.

Sales of automobiles and parts were up 0.7% in March.

Inventories climbed by 1.0% in March. It was the 15th consecutive increase.

-

15:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Home Depot (HD) reiterated at Outperformat RBC Capital Mkts, target raised to $132 from $127

Visa (V) initiated at Outperform at Credit Agricole, target $77

Wal-Mart (WMT) reiterated at Market Perform at Telsey Advisory Group, target lowered from $87 to $83

-

14:42

Japan’s preliminary GDP climbs 0.6% in the first quarter

The Cabinet Office released its gross domestic product (GDP) figures for Japan on late Tuesday. Japan's preliminary GDP climbed 0.6% in the first quarter, exceeding expectations for a 0.4% rise, after a 0.3% gain in the fourth quarter. The fourth quarter was revised down from a 0.4% rise.

Business spending climbed by 0.4% in the first quarter, while private consumption rose 0.4%.

Inventories were up 0.5% in the first quarter. Residential housing investments increased 1.8%.

On a yearly basis, Japan's preliminary GDP was up 2.4% in the first quarter, beating forecasts of a 1.5% increase, after a 1.1% in the fourth quarter. The fourth quarter was revised down from a 1.5% gain.

-

12:00

European stock markets mid session: most stocks traded lower after yesterday’s rally

Most stock indices traded lower after yesterday's rally. Stocks Tuesday rose on comments by the European Central Bank (ECB) Executive Board Member Benoit Coeure. He said on Monday that the ECB plans to expand its asset purchases in May and June due to low market liquidity in July and August.

Investors monitor closely the debt talks between Greece and its creditors. German Chancellor Angela Merkel and French President Francois Hollande Tuesday urged that the debt talks between Greece and its creditors should be accelerated. Merkel said that Greece and its creditors should reach a deal until the end of May. Hollande noted that Greece must stay in the Eurozone.

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

MPC members noted that rising house prices in the U.K. posed renewed risks due to a shortage of new homes.

The Bank of England still expects the consumer inflation close to zero due to lower oil and commodity prices, but inflation should pick up by the end of this year.

Current figures:

Name Price Change Change %

FTSE 100 6,998.04 +2.94 +0.04 %

DAX 11,810.5 -42.83 -0.36 %

CAC 40 5,098.18 -19.12 -0.37 %

-

11:47

German producer prices rise 0.1% in April

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices rose 0.1% in April, after a 0.1% gain in March. It was the third consecutive monthly increase.

PPI excluding energy sector climbed by 0.2% in April.

On a yearly basis, German PPI dropped 1.5% in April, after a 1.7% fall in March.

Energy prices plunged 4.4% in April.

Consumer goods sector prices fell 1.4% in April from the previous year, intermediate goods sector prices decreased by 0.7%, while consumer goods sector prices rose 1.3%.

-

11:33

Bank of England's Monetary Policy Committee minutes: inflation should pick up by the end of this year

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced," repeating comments from the last minutes.

MPC members noted that rising house prices in the U.K. posed renewed risks due to a shortage of new homes.

The Bank of England still expects the consumer inflation close to zero due to lower oil and commodity prices, but inflation should pick up by the end of this year.

Policymakers said that the economy will pick up in the second quarter after the weak first quarter due to higher household incomes and consumer spending as prices for food, energy and other goods declined.

-

11:13

Bank of Canada Governor Stephen Poloz hopes Canada’s economy bounce back in the second quarter

The Bank of Canada (BoC) Governor Stephen Poloz said on Tuesday that he hopes Canada's economy bounce back in the second quarter. The central bank forecasted a zero growth in the first quarter.

"The Canadian rebound hasn't been as quick as we'd like, but recent data have been encouraging," Poloz said.

He noted that there is uncertainty about the country`s outlook due to recent increase in oil prices and the strong Canadian dollar. But he added that the Canadian economy is on track to return to full capacity around the end of 2016.

The BoC governor hopes to see more business investment.

Poloz pointed out that the January interest rate cut is working.

-

10:52

Swiss National Bank (SNB) Vice President Jean-Pierre Danthine: that negative interest rates will help weaken the strong Swiss franc

The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said on Tuesday that negative interest rates will help weaken the strong Swiss franc. He added that this measure is only temporary.

The SNB has implemented negative interest rates as it removed the 1.20 per euro exchange rate floor.

Danthine defended this decision and noted that it was necessary to avoid an uncontrolled expansion of the central bank's balance sheet.

-

10:39

BofA Merrill Lynch Fund Manager Survey: investors lost interest in higher risk assets

According to the BofA Merrill Lynch Fund Manager Survey for May, global investors lost interest in higher risk assets. While 47% of respondents continue to increase investment in shares, this index decreased by seven percentage points since last month.

Interest in U.S. shares fell: 19% of respondents are now reducing investments in this asset class, although there was an increase in investment in the first quarter.

Investors also lost confidence in corporate profitability. At the same time, cash positions sharply increased. This month's reading was 23%, the highest since December 2014. These shifts follow the recent selloff in bond markets.

The survey's results showed that an increase in respondents' assessment of bonds as the most volatile asset class in 2015.

-

10:17

Merkel and Hollande urged the debt talks between Greece and its creditors should be accelerated

German Chancellor Angela Merkel and French President Francois Hollande Tuesday urged that the debt talks between Greece and its creditors should be accelerated. Merkel said that Greece and its creditors should reach a deal until the end of May. Hollande noted that Greece must stay in the Eurozone.

-

04:02

Nikkei 225 20,149.22 +122.84 +0.61 %, Hang Seng 27,610.57 -82.97 -0.30 %, Shanghai Composite 4,441.76 +24.20 +0.55 %

-

00:31

Stocks. Daily history for Apr May 19’2015:

(index / closing price / change items /% change)

Nikkei 225 20,026.38 +136.11 +0.68 %

Hang Seng 27,693.54 +102.29 +0.37 %

S&P/ASX 200 5,615.5 -43.67 -0.77 %

Shanghai Composite 4,418.38 +134.89 +3.15 %

FTSE 100 6,995.1 +26.23 +0.38 %

CAC 40 5,117.3 +104.99 +2.09 %

Xetra DAX 11,853.33 +259.05 +2.23 %

S&P 500 2,127.83 -1.37 -0.06 %

NASDAQ Composite 5,070.03 -8.40 -0.17 %

Dow Jones 18,312.39 +13.51 +0.07 %

-