Noticias del mercado

-

22:08

Major US stock indexes closed without a single dynamic

Major US stock indexes finished trading in different directions after yesterday Standard & Poor's 500 and the Dow Jones reached historic highs. "The shares are traded at a price above their historical average level, there is no doubt," - said the chief investment officer of Haverford Trust Hank Smith. The expert added that given the low levels of interest rates and inflation, the stock is fairly valued.

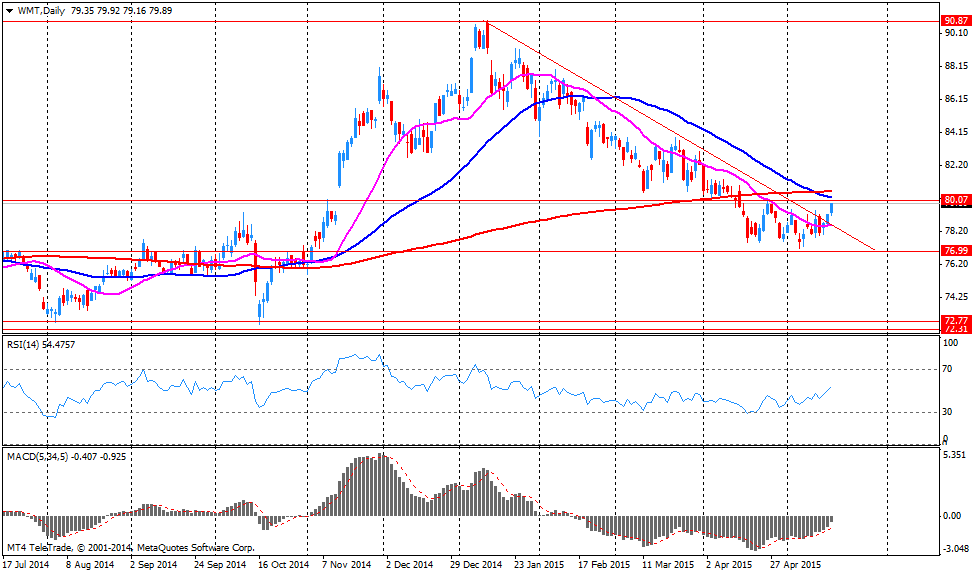

The pressure on the indices had poor results Wal-Mart, while positive data from the US housing market have increased expectations that the Fed may start raising interest rates later this year. Thus, indicators of housing starts in the US rebounded in April. It is a sign that the housing market may be restored after a sluggish winter season sales. Bookmarks new homes in the US rose by 20.2% compared to the previous month and reached a seasonally adjusted annual rate of 1135 thousand., In April, the Commerce Department reported Tuesday. This is the highest since November 2007, and the largest increase in percentage from February 1991. Share of single-family units, which exclude apartments, and represent almost two-thirds of the market, rose by 16.7%. Bookmarks multifamily units, including apartments and condominiums increased by 27.2%. New applications for building permits, which determine the volume of construction in the coming months, increased by 10.1%. Economists had expected in April bookmarks of new homes reached the level of 1019 thousand.

Prior to the publication of statistics a positive impact on the US stock market provided by the representative of the ECB Benoit Ker that the Central Bank will redeem bonds more actively in the program of quantitative easing (QE) in May and June in anticipation of summer.

Components of the index DOW closed mixed (12 against 18 in the red in the black). Outsider shares were Wal-Mart Stores Inc. (WMT, -4.52%). Most remaining shares rose McDonald's Corp. (MCD, + 2.58%).

Sector S & P index finished trading mixed. Most of the health sector increased (+ 0.3%). Outsiders were the basic materials sector (-1.5%).

At the close:

Dow + 0.07% 18,312.39 +13.51

Nasdaq -0.17% 5,070.03 -8.41

S & P -0.06% 2,127.83 -1.37

-

21:00

Dow +0.16% 18,328.08 +29.20 Nasdaq -0.09% 5,074.10 -4.34 S&P +0.00% 2,129.22 +0.02

-

18:44

WSE: Session Results

Polish equity market was lower on Tuesday, with the broad market measure - the WIG index losing 0.13%. At the same time, the large liquid companies' benchmark- the WIG30 index ended today's session with a tiny increase of 0.09%.

Among the most liquid names, oil and gas names were the strongest group with PKN ORLEN (WSE: PKN) and LOTOS (WSE: LTS) advancing 5.24% and 3.36% respectively. Coal producer JSW (WSE: JSW) and media sector company TVN (WSE: TVN) also were star performers, gaining a respective 3.88% and 3.69%. At the same time, the biggest underperformer was bank ALIOR (WSE: ALR), the quotation of which went down 4.10%. It was followed by chemicals name GRUPA AZOTY (WSE: ATT) and utilities name PGE (WSE: PGE), declining 1.73% and 1.66% respectively.

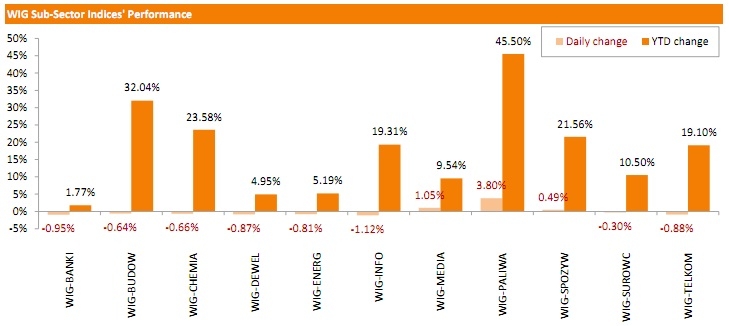

The WIG sub-sector indices were mainly lower with the technology-oriented WIG-INFO (-1.12%) suffering the most.

-

18:00

European stocks closed: FTSE 100 6,995.1 +26.23 +0.38% CAC 40 5,117.3 +104.99 +2.09% DAX 11,853.33 +259.05 +2.23%

-

18:00

European stocks close: stocks closed higher, supported by the European Central Bank (ECB) Executive Board Member Benoit Coeure’s comments

Stock indices closed higher, supported by the European Central Bank (ECB) Executive Board Member Benoit Coeure's comments. He said on Monday that the ECB plans to expand its asset purchases in May and June due to low market liquidity in July and August. He added that a selloff in the European government bond market was a normal correction, but the pace of the selloff was worrisome.

The ECB Governing Council Member and the Bank of France Governor Christian Noyer said on Tuesday that there are signs that the central bank's monetary easing had a positive effect on inflation expectations. He added that the ECB was ready to take further action if needed to achieve its inflation target.

Germany's ZEW economic sentiment index dropped to 41.9 in May from 53.3 in April, missing expectations for a decline to 49.0.

The ZEW President Clemens Fuest said that expectations were adjusted after the weak first quarter figures.

Eurozone's ZEW economic sentiment index fell to 61.1 in May from 64.8 in April.

Eurozone's consumer price index rose 0.2% in April, after a 1.1% increase in March.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.0% in April from -0.1% in March, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in April, in line with expectations.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in April from 0.0% in March. It was the lowest level since 1960, based on comparable historic estimates.

Analysts had expected the index to remain unchanged.

The fall was driven by a decline in air and sea fares.

The Bank of England Governor (BoE) Mark Carney said last Wednesday that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 0.8% in April from 1.0% the month before.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,995.1 +26.23 +0.38 %

DAX 11,853.33 +259.05 +2.23 %

CAC 40 5,117.3 +104.99 +2.09 %

-

17:07

Eurozone's final consumer price index rises 0.2% in April

Eurostat released its final inflation figures for the Eurozone. Eurozone's consumer price index rose 0.2% in April, after a 1.1% increase in March.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.0% in April from -0.1% in March, in line with expectations.

Higher costs in restaurants and cafes, higher rents and higher vegetables prices supported the annual consumer price inflation, while cheaper gas, heating oil and automotive fuel weighed on the index.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in April, in line with expectations.

The lowest annual inflation was reported in Greece. The consumer price inflation was down 1.8%.

-

16:57

Number of employed persons in Germany climbs by 0.7% in the first quarter

Destatis released its number of persons in employment in Germany on Tuesday. The number of employed persons climbed by 0.7% in the first quarter from the corresponding period last year, after a 0.9% rise in the fourth quarter.

The increase was driven by the growth in the service sector.

-

16:49

Wall Street. Major U.S. stock-indexes are little changed

Major U.S. stock-indexes are little changed by Wal-Mart's weak results and after a rally that took the Dow Jones industrial average and the S&P 500 to record closing highs. Strong housing data also suggested that the Federal Reserve could have room to raise interest rates sooner rather than later. U.S. housing starts jumped to their highest level in nearly 7-1/2 years in April and permits soared.

Dow stocks are mixed (14 - fell vs 15 - rose). Top looser - Wal-Mart Stores Inc. (WMT, -3.63%). Top gainer - American Express Company (AXP, +1.15%).

S&P index sectors mixed. Top gainer - Healthcare (+0,3%). Top loser - Basic Materials (-1.3%).

At the moment:

Dow 18281.00 +22.00 +0.12%

S&P 500 2127.00 +1.00 +0.05%

Nasdaq 100 4513.75 +6.50 +0.14%

10-year yield 2.28% +0.05

Oil 58.63 -1.61 -2.67%

Gold 1207.20 -20.40 -1.66%

-

16:28

European Central Bank Governing Council Member Christian Noyer: the ECB was ready to take further action if needed to achieve its inflation target

The European Central Bank (ECB) Governing Council Member and the Bank of France Governor Christian Noyer said on Tuesday that there are signs that the central bank's monetary easing had a positive effect on inflation expectations. He added that the ECB was ready to take further action if needed to achieve its inflation target.

"The Eurosystem is ready to go further if necessary to deliver on its mandate of maintaining inflation close to but below 2 percent," Noyer noted.

-

16:01

Bank of Japan Deputy Governor Kikuo Iwata: inflation will likely rise late this year

The Bank of Japan (BoJ) Deputy Governor Kikuo Iwata said on Tuesday that inflation will likely rise late this year as consumers are expected to start to feel the benefit from lower fuel prices.

"The underlying trend of inflation is improving steadily," he noted.

Iwata also said that Japan's economy continued to recover moderately, and inflation expectations were increasing in a longer view.

The BoJ deputy governor pointed out that monetary easing had intended effects.

-

15:44

May’s Reserve Bank of Australia monetary policy meeting: further interest rate cut is possible

The Reserve Bank of Australia (RBA) released its minutes from May monetary policy meeting on Tuesday. The RBA said that it will not release any guidance on the future path of monetary policy in its statement, but the interest rate cut at future meetings is possible if needed.

Board members pointed out that further depreciation of the Australian dollar "seemed to be both likely and necessary".

Board members discussed the timing of the interest rate cut. The interest rate cut at the June meeting was also possible. But the RBA decided to lower its interest rate in May because of the release the same week of its quarterly statement on monetary policy.

The central bank noted that Australia's terms of trade were expected to decline more than forecasted due to the weakness in the Chinese property market.

According to the RBA, the economic growth in Australia was expected to need more time to strengthen and "the unemployment rate was likely to remain elevated for longer".

The RBA cut its interest rate to 2.00% from 2.25% on May 05.

-

15:33

U.S. Stocks open: Dow +0.04%, Nasdaq +0.17%, S&P +0.06%

-

15:26

Before the bell: S&P futures +0.08%, NASDAQ futures +0.21%

U.S. stock-index futures rose after data showing housing starts surged to a seven-year high.

Global markets:

Nikkei 20,026.38 +136.11 +0.68%

Hang Seng 27,693.54 +102.29 +0.37%

Shanghai Composite 4,418.38 +134.89 +3.15%

FTSE 7,003.31 +34.44 +0.49%

CAC 5,107.07 +94.76 +1.89%

DAX 11,820.47 +226.19 +1.95%

Crude oil $58.47 (-1.62%)

Gold $1214.80 (-1.03%)

-

15:17

Japan’s Finance Minister Taro Aso: fiscal policy and growth strategies are needed in addition to monetary easing to end deflation

Japan's Finance Minister Taro Aso said on Tuesday that monetary easing is not enough to end deflation.

"The deflationary mindset that has beset Japan for such a long time won't change suddenly. But we've seen some changes in the past two years, which is significant," he noted.

Aso added that fiscal policy and growth strategies are needed in addition to monetary easing to end deflation.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Pfizer Inc

PFE

33.99

+0.03%

4.2K

Nike

NKE

104.80

+0.05%

1.6K

Ford Motor Co.

F

15.59

+0.06%

0.1K

General Electric Co

GE

27.33

+0.07%

15.1K

Johnson & Johnson

JNJ

103.51

+0.09%

2.7K

Twitter, Inc., NYSE

TWTR

37.33

+0.13%

34.4K

Intel Corp

INTC

33.46

+0.15%

1K

Verizon Communications Inc

VZ

49.70

+0.20%

2.2K

Amazon.com Inc., NASDAQ

AMZN

426.20

+0.23%

8.8K

Citigroup Inc., NYSE

C

54.80

+0.24%

7.3K

McDonald's Corp

MCD

98.27

+0.26%

0.3K

Microsoft Corp

MSFT

47.83

+0.27%

10.3K

ALTRIA GROUP INC.

MO

52.09

+0.27%

0.5K

Merck & Co Inc

MRK

60.18

+0.28%

2.4K

Visa

V

70.20

+0.29%

9.2K

Cisco Systems Inc

CSCO

29.85

+0.30%

5.0K

Facebook, Inc.

FB

81.12

+0.30%

16.2K

JPMorgan Chase and Co

JPM

66.63

+0.32%

2.1K

3M Co

MMM

163.41

+0.33%

1.1K

Apple Inc.

AAPL

130.62

+0.33%

380.0K

Walt Disney Co

DIS

110.73

+0.36%

0.1K

Yahoo! Inc., NASDAQ

YHOO

44.52

+0.36%

1.5K

E. I. du Pont de Nemours and Co

DD

70.28

+0.41%

0.7K

General Motors Company, NYSE

GM

35.20

+0.43%

2.8K

AMERICAN INTERNATIONAL GROUP

AIG

59.16

+0.46%

1.6K

Boeing Co

BA

147.40

+0.47%

0.6K

Google Inc.

GOOG

534.95

+0.50%

0.4K

Goldman Sachs

GS

205.75

+0.53%

0.4K

Starbucks Corporation, NASDAQ

SBUX

51.56

+0.74%

5.3K

Home Depot Inc

HD

116.41

+1.82%

193.2K

AT&T Inc

T

34.85

-0.06%

6.4K

International Business Machines Co...

IBM

172.91

-0.09%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

248.38

-0.15%

12.0K

Caterpillar Inc

CAT

88.15

-0.16%

1.7K

The Coca-Cola Co

KO

41.25

-0.17%

1.1K

Exxon Mobil Corp

XOM

86.65

-0.23%

15.1K

Chevron Corp

CVX

106.27

-0.36%

5.1K

ALCOA INC.

AA

13.34

-0.45%

21.5K

Yandex N.V., NASDAQ

YNDX

19.20

-0.78%

2.0K

Barrick Gold Corporation, NYSE

ABX

13.01

-1.36%

0.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.75

-1.72%

23.7K

Wal-Mart Stores Inc

WMT

77.98

-2.43%

329.6K

-

15:07

U.S. housing starts soar 20.2% in April

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. soared 20.2% to 1,135 million annualized rate in April from a 944,000 pace in March, exceeding expectations for a rise to 1.019 million. It was the highest level since November 2007.

March's figure was revised up from 926,000 units.

The increase was driven by a gain in starts of single-family homes, which jumped to their highest level since January 2008.

Building permits in the U.S. climbed 10.1% to 1.143 million annualized rate in April from a 1.038 million pace in March. March's figure was revised down from 1,042 million units.

Analysts had expected building permits to increase to 1.064 million units.

Starts of single-family homes jumped 16.7% in April. Building permits for single-family homes rose 3.7%.

Starts of multifamily buildings rose 27.2% in April. Permits for multi-family housing jumped 20.5%.

Housing market seems to pick up as the weakness in first quarter of 2015 seems to be due to harsh weather. But housing market figures are in stark contrast with weakness in consumption, business spending and manufacturing.

-

14:41

European Central Bank Executive Board Member Benoit Coeure: the central bank plans to expand its asset purchases in May and June

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Tuesday that the ECB plans to expand its asset purchases in May and June due to low market liquidity in July and August.

"If need be, the frontloading may be complemented by some backloading in September when market liquidity is expected to improve again", he added.

Coeure noted that a selloff in the European government bond market was a normal correction, but the pace of the selloff was worrisome.

-

14:39

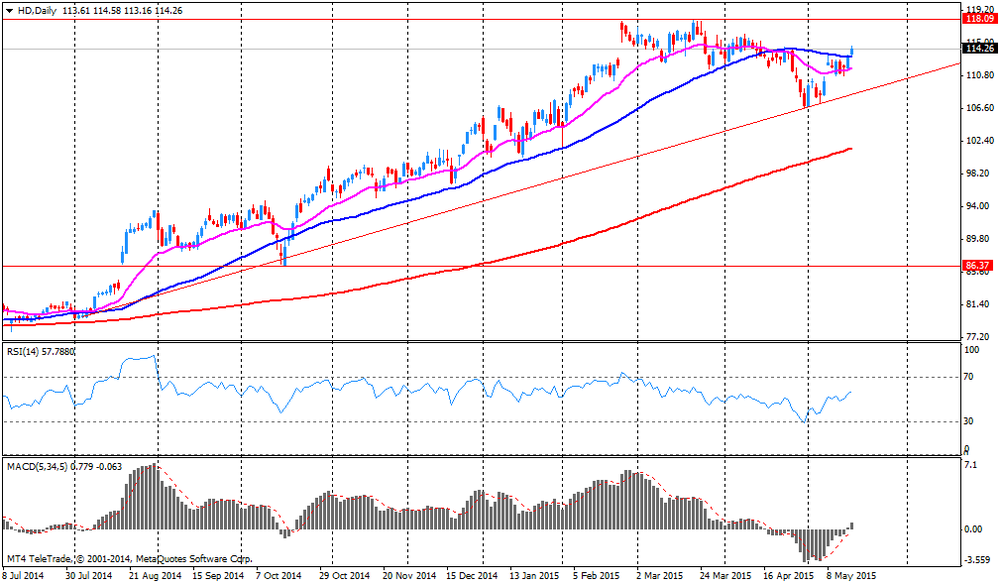

Company News: Home Depot (HD) reported better then expected EPS and revenue

Company reported Q1 profit of $1.16 per share versus $1.15 consensus. Revenues rose 6.1% year/year to $20.89 bln versus $20.81 bln consensus.

Company reised guidance for FY16, sees EPS of $5.24-$5.27 from $5.11-$5.17 versus $5.23 consensus; FY16 revenue raised to $86.67-$87.1 bln versus $86.8 bln consensus.

HD rose to $115.77 (+1.26%) on the premarket.

-

14:27

-

12:00

European stock markets mid session: stocks traded higher on comments by the European Central Bank Executive Board Member Benoit Coeure

Stock indices traded higher on comments by the European Central Bank (ECB) Executive Board Member Benoit Coeure. He said on Monday that the ECB plans to expand its asset purchases in May and June due to low market liquidity in July and August. He added that a selloff in the European government bond market was a normal correction, but the pace of the selloff was worrisome.

The euro dropped against the U.S. dollar after Coere's comments.

Germany's ZEW economic sentiment index dropped to 41.9 in May from 53.3 in April, missing expectations for a decline to 49.0.

The ZEW President Clemens Fuest said that expectations were adjusted after the weak first quarter figures.

Eurozone's ZEW economic sentiment index fell to 61.1 in May from 64.8 in April.

Eurozone's consumer price index rose 0.2% in April, after a 1.1% increase in March.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.0% in April from -0.1% in March, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in April, in line with expectations.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in April from 0.0% in March. It was the lowest level since 1960, based on comparable historic estimates.

Analysts had expected the index to remain unchanged.

The fall was driven by a decline in air and sea fares.

The Bank of England Governor (BoE) Mark Carney said last Wednesday that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 0.8% in April from 1.0% the month before.

Current figures:

Name Price Change Change %

FTSE 100 6,990.79 +21.92 +0.31 %

DAX 11,790.09 +195.81 +1.69 %

CAC 40 5,100.09 +87.78 +1.75 %

-

11:38

Eurozone's unadjusted trade surplus rises to €23.4 billion in March

Eurostat released its trade data for the Eurozone on Tuesday. Eurozone's unadjusted trade surplus rose to €23.4 billion in March from €20.3 billion in February, exceeding expectations for an increase to €22.3 billion.

Exports soared by 11% due to a weaker euro, while imports climbed by 7%.

-

11:28

Germany's ZEW economic sentiment index drops to 41.9 in May

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index dropped to 41.9 in May from 53.3 in April, missing expectations for a decline to 49.0.

The ZEW President Clemens Fuest said that expectations were adjusted after the weak first quarter figures.

"Financial market experts have adjusted their optimistic expectations downward in May due to unexpectedly poor growth figures in the first quarter of 2015 and turmoil on the stock and bond markets. However, only a small number of survey participants actually expect a deterioration of the economic situation," Fuest noted.

Eurozone's ZEW economic sentiment index fell to 61.1 in May from 64.8 in April.

-

11:10

UK consumer price inflation declines to the lowest level since 1960

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in April from 0.0% in March. It was the lowest level since 1960, based on comparable historic estimates.

Analysts had expected the index to remain unchanged.

The fall was driven by a decline in air and sea fares.

The Bank of England Governor (BoE) Mark Carney said last Wednesday that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 0.8% in April from 1.0% the month before.

The Retail Prices Index remained unchanged at 0.9% in April.

The consumer price inflation is below the Bank of England's 2% target.

-

10:57

Moody's launches the first credit rating agency dedicated to the growing European public sector debt market

Moody's has launched a new credit rating agency Moody's Public Sector Europe (MPSE) on Monday. The new credit rating agency is the first agency, which dedicated to the growing European public sector debt market.

MPSE should help European public service providers such as regional and local governments, universities, hospitals and housing associations expand their financing options and to get greater access to international debt capital markets.

According to Eurostat, the public sector outstanding debt in the EU (excluding central government debt) totalled €1.8 trillion in 2014, increasing at an annual rate of 2.6%. Moody's expects this trend to continue over the longer period.

-

03:59

Nikkei 225 20,016.04 +125.77 +0.63 %, Hang Seng 27,524.02 -67.23 -0.24 %, Shanghai Composite 4,285.78 +2.29 +0.05 %

-

00:31

Stocks. Daily history for Apr May 18’2015:

(index / closing price / change items /% change)

Nikkei 225 19,890.27 +157.35 +0.80 %

Hang Seng 27,591.25 -231.03 -0.83 %

S&P/ASX 200 5,659.2 -76.33 -1.33 %

Shanghai Composite 4,283.23 -25.46 -0.59 %

FTSE 100 6,968.87 +8.38 +0.12 %

CAC 40 5,012.31 +18.49 +0.37 %

Xetra DAX 11,594.28 +147.25 +1.29 %

S&P 500 2,129.2 +6.47 +0.30 %

NASDAQ Composite 5,078.44 +30.15 +0.60 %

Dow Jones 18,298.88 +26.32 +0.14 %

-