Noticias del mercado

-

23:59

Schedule for today, Wednesday, May 20’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence May -3.2%

05:00 Japan Coincident Index (Finally) March 110.7 109.5

05:00 Japan Leading Economic Index (Finally) March 104.7 105.5

07:00 U.S. FOMC Member Charles Evans Speaks

08:30 United Kingdom Bank of England Minutes

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) May -23.2

12:30 Canada Wholesale Sales, m/m March -0.4% 0.7%

14:30 U.S. Crude Oil Inventories May -2.191

18:00 U.S. FOMC meeting minutes

20:45 New Zealand Visitor Arrivals April -3.6%

22:50 Australia RBA Assist Gov Edey Speaks

-

20:21

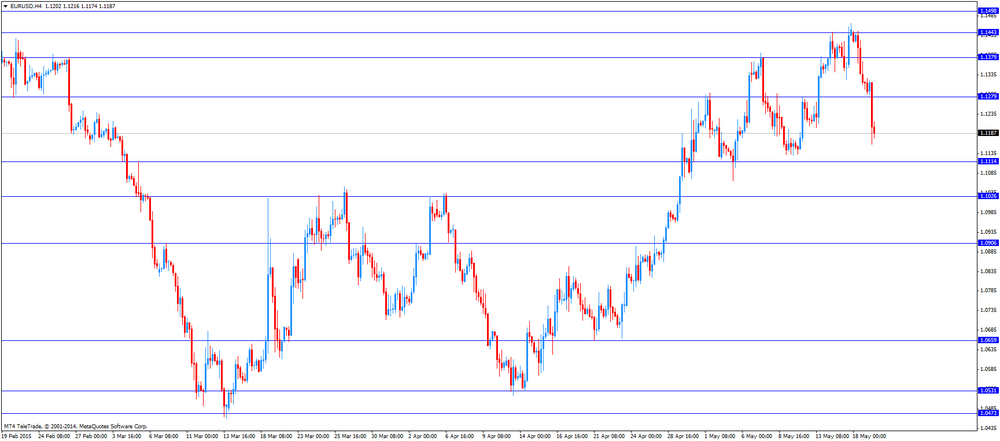

American focus: the US dollar against the euro has grown significantly

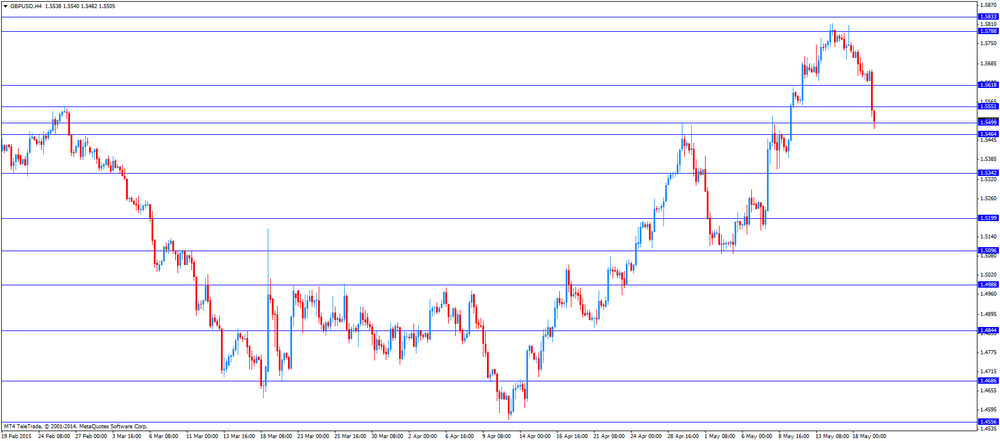

The pound weakened significantly against the dollar, having lost about 1% after UK CPI data came out weaker than expected. This has caused a revision of expectations for the Bank of England's rates. Experts note that in this regard tomorrow's publication of the minutes of the meeting of the Central Bank will be of particular interest to investors. Recall, consumer prices fell 0.1 percent in April compared to the previous year, while, according to forecasts, they were to remain unchanged, as it was in March. This was the first annual decline since the official data series began in 1996, and based on comparable estimates this was the first drop since 1960. On a monthly measurement of consumer prices rose by 0.2 percent, showing the same growth rate as in March. Core inflation fell to 0.8 percent from 1 percent in March. Economists forecast that it will remain at 1 percent. Another report from the ONS showed that producer prices continued to decline in April. Selling prices fell by 1.7 percent for the third month in a row in April. On a monthly measurement of sales prices rose by 0.1 percent. The annual decline in purchasing prices slowed to 11.7 percent from 12.8 percent in March. On a monthly basis, prices paid rose by 0.4 percent.

The dollar rose substantially against the euro, updating the maximum on May 11 due to the publication of positive statistics on the US housing market and the ECB's comments with regard to the scope of QE. It is learned that the establishment of new homes in the US rose by 20.2% compared to the previous month and reached a seasonally adjusted annual rate of 1135 thousand. In April. This is the highest since November 2007, and the largest increase in percentage from February 1991. Share of single-family units, which exclude apartments, and represent almost two-thirds of the market, rose by 16.7%. Bookmarks multifamily units, including apartments and condominiums increased by 27.2%. New applications for building permits, which determine the volume of construction in the coming months, increased by 10.1%. Economists had expected in April bookmarks of new homes reached the level of 1019 thousand. Compared with a year earlier bookmarks of new homes rose 9.2% in April, while building permits rose 6.4%.

The Canadian dollar fell against the US dollar, reaching a month low after the release of positive statistics on the US housing market. However, the currency was able to regain some lost ground against the background of the head of the Central Bank of Canada runners, who noted that the Canadian economy is moving in the right direction, increasing the momentum of growth, and that the January reduction in operating rates. Poloz also said that the Central Bank expects partial recovery in the 2nd quarter and reaching its full capacity by the end of 2016. However, he warned that there are many uncertainties in the current economic environment. As for inflation, Poloz said that it will steadily move towards the target level of 2% towards the end of 2016. Investors watched this performance to see whether Poloz is less optimistic about the economy in Canada, but there were no major changes, despite the recent weak data in Canada.

-

17:07

Eurozone's final consumer price index rises 0.2% in April

Eurostat released its final inflation figures for the Eurozone. Eurozone's consumer price index rose 0.2% in April, after a 1.1% increase in March.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.0% in April from -0.1% in March, in line with expectations.

Higher costs in restaurants and cafes, higher rents and higher vegetables prices supported the annual consumer price inflation, while cheaper gas, heating oil and automotive fuel weighed on the index.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in April, in line with expectations.

The lowest annual inflation was reported in Greece. The consumer price inflation was down 1.8%.

-

16:57

Number of employed persons in Germany climbs by 0.7% in the first quarter

Destatis released its number of persons in employment in Germany on Tuesday. The number of employed persons climbed by 0.7% in the first quarter from the corresponding period last year, after a 0.9% rise in the fourth quarter.

The increase was driven by the growth in the service sector.

-

16:28

European Central Bank Governing Council Member Christian Noyer: the ECB was ready to take further action if needed to achieve its inflation target

The European Central Bank (ECB) Governing Council Member and the Bank of France Governor Christian Noyer said on Tuesday that there are signs that the central bank's monetary easing had a positive effect on inflation expectations. He added that the ECB was ready to take further action if needed to achieve its inflation target.

"The Eurosystem is ready to go further if necessary to deliver on its mandate of maintaining inflation close to but below 2 percent," Noyer noted.

-

16:01

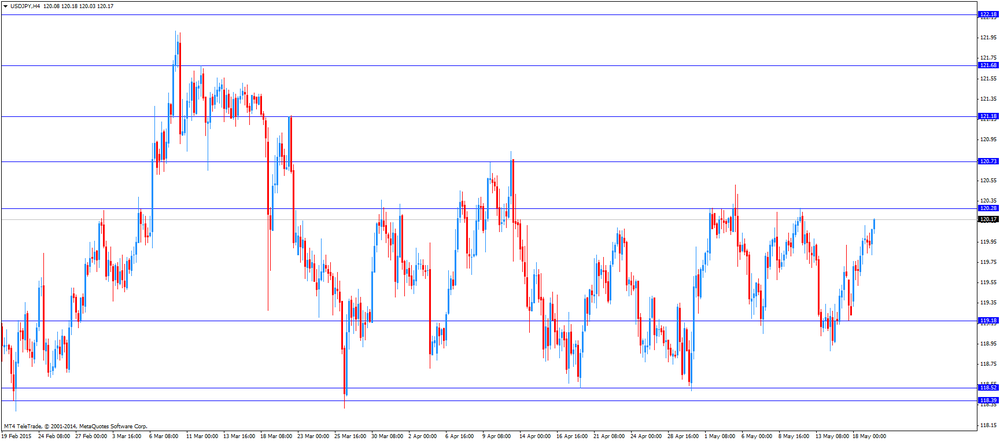

Bank of Japan Deputy Governor Kikuo Iwata: inflation will likely rise late this year

The Bank of Japan (BoJ) Deputy Governor Kikuo Iwata said on Tuesday that inflation will likely rise late this year as consumers are expected to start to feel the benefit from lower fuel prices.

"The underlying trend of inflation is improving steadily," he noted.

Iwata also said that Japan's economy continued to recover moderately, and inflation expectations were increasing in a longer view.

The BoJ deputy governor pointed out that monetary easing had intended effects.

-

15:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: Y120.00($553mn)

USD/CAD: C$1.2125($240mn)

EUR/USD: Weds $1.1450(E1.07bn), Thu $1.1500(E3.2bn). Fri $1.1400(E1.22bn)

USD/JPY: Y120.00 Tues($542mn), Wed($700mn), Fri(1.48bn) - Fri Y122.00($1.63bn)

GBP/USD: Wed $1.5600(Gbp501m), $1.5690(Gbp413mn)

AUD/USD: Fri $0.8000 in A$1.2bn, Fri $0.7920(A$1.2bn)

-

15:44

May’s Reserve Bank of Australia monetary policy meeting: further interest rate cut is possible

The Reserve Bank of Australia (RBA) released its minutes from May monetary policy meeting on Tuesday. The RBA said that it will not release any guidance on the future path of monetary policy in its statement, but the interest rate cut at future meetings is possible if needed.

Board members pointed out that further depreciation of the Australian dollar "seemed to be both likely and necessary".

Board members discussed the timing of the interest rate cut. The interest rate cut at the June meeting was also possible. But the RBA decided to lower its interest rate in May because of the release the same week of its quarterly statement on monetary policy.

The central bank noted that Australia's terms of trade were expected to decline more than forecasted due to the weakness in the Chinese property market.

According to the RBA, the economic growth in Australia was expected to need more time to strengthen and "the unemployment rate was likely to remain elevated for longer".

The RBA cut its interest rate to 2.00% from 2.25% on May 05.

-

15:17

Japan’s Finance Minister Taro Aso: fiscal policy and growth strategies are needed in addition to monetary easing to end deflation

Japan's Finance Minister Taro Aso said on Tuesday that monetary easing is not enough to end deflation.

"The deflationary mindset that has beset Japan for such a long time won't change suddenly. But we've seen some changes in the past two years, which is significant," he noted.

Aso added that fiscal policy and growth strategies are needed in addition to monetary easing to end deflation.

-

15:07

U.S. housing starts soar 20.2% in April

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. soared 20.2% to 1,135 million annualized rate in April from a 944,000 pace in March, exceeding expectations for a rise to 1.019 million. It was the highest level since November 2007.

March's figure was revised up from 926,000 units.

The increase was driven by a gain in starts of single-family homes, which jumped to their highest level since January 2008.

Building permits in the U.S. climbed 10.1% to 1.143 million annualized rate in April from a 1.038 million pace in March. March's figure was revised down from 1,042 million units.

Analysts had expected building permits to increase to 1.064 million units.

Starts of single-family homes jumped 16.7% in April. Building permits for single-family homes rose 3.7%.

Starts of multifamily buildings rose 27.2% in April. Permits for multi-family housing jumped 20.5%.

Housing market seems to pick up as the weakness in first quarter of 2015 seems to be due to harsh weather. But housing market figures are in stark contrast with weakness in consumption, business spending and manufacturing.

-

14:41

European Central Bank Executive Board Member Benoit Coeure: the central bank plans to expand its asset purchases in May and June

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Tuesday that the ECB plans to expand its asset purchases in May and June due to low market liquidity in July and August.

"If need be, the frontloading may be complemented by some backloading in September when market liquidity is expected to improve again", he added.

Coeure noted that a selloff in the European government bond market was a normal correction, but the pace of the selloff was worrisome.

-

14:30

U.S.: Building Permits, mln, April 1143 (forecast 1065)

-

14:30

U.S.: Housing Starts, mln, April 1135 (forecast 1019)

-

14:22

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected inflation data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand PPI Output (QoQ) Quarter I -0.1% 0.0% -0.9%

00:45 New Zealand PPI Input (QoQ) Quarter I -0.4% -0.7% -1.1%

02:00 Australia Conference Board Australia Leading Index March 0.5% -0.1%

03:30 Australia RBA Meeting's Minutes

05:00 New Zealand Expected Annual Inflation 2y from now Quarter II 1.8% 1.85%

10:30 United Kingdom Producer Price Index - Input (MoM) April 0.4% Revised From 0.3% 0.8% 0.4%

10:30 United Kingdom Producer Price Index - Input (YoY) April -12.8% Revised From -13.0% -11.5% -11.7%

10:30 United Kingdom Producer Price Index - Output (MoM) April 0.1% Revised From 0.2% 0.2% 0.1%

10:30 United Kingdom Producer Price Index - Output (YoY) April -1.7% -1.6% -1.7%

10:30 United Kingdom Retail Price Index, m/m April 0.2% 0.4% 0.4%

10:30 United Kingdom Retail prices, Y/Y April 0.9% 1.0% 0.9%

10:30 United Kingdom HICP, m/m April 0.2% 0.4% 0.2%

10:30 United Kingdom HICP, Y/Y April 0.0% 0.0% -0.1%

10:30 United Kingdom HICP ex EFAT, Y/Y April 1.0% 0.8%

11:00 Eurozone ZEW Economic Sentiment May 64.8 61.2

11:00 Eurozone Trade balance unadjusted March 20.3 22.3 23.4

11:00 Eurozone Harmonized CPI April 1.1% 0.2%

11:00 Eurozone Harmonized CPI, Y/Y (Finally) April -0.1% 0.0% 0.0%

11:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) April 0.6% 0.6% 0.6%

11:00 Germany ZEW Survey - Economic Sentiment May 53.3 49 41.9

The U.S. dollar higher against the most major currencies ahead of the U.S. housing market data. Housing starts in the U.S. are expected to climb to 1.019 million units in April from 0.926 million units in March.

The number of building permits is expected to rise to 1.065 million units in April from 1.042 million units in March.

The euro traded lower against the U.S. dollar after comments by the European Central Bank (ECB) Executive Board Member Benoit Coeure. He said on Monday that the ECB plans to expand its asset purchases in May and June due to low market liquidity in July and August. He added that a selloff in the European government bond market was a normal correction, but the pace of the selloff was worrisome.

Germany's ZEW economic sentiment index dropped to 41.9 in May from 53.3 in April, missing expectations for a decline to 49.0.

The ZEW President Clemens Fuest said that expectations were adjusted after the weak first quarter figures.

Eurozone's ZEW economic sentiment index fell to 61.1 in May from 64.8 in April.

Eurozone's consumer price index rose 0.2% in April, after a 1.1% increase in March.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.0% in April from -0.1% in March, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.6% in April, in line with expectations.

The British pound traded lower against the U.S. dollar after the weaker-than-expected inflation data from the U.K. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in April from 0.0% in March. It was the lowest level since 1960, based on comparable historic estimates.

Analysts had expected the index to remain unchanged.

The fall was driven by a decline in air and sea fares.

The Bank of England Governor (BoE) Mark Carney said last Wednesday that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 0.8% in April from 1.0% the month before.

The Swiss franc traded lower against the U.S. dollar ahead of a speech by the Swiss National Bank Vice President Jean-Pierre Danthine.

The Canadian dollar traded lower against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

EUR/USD: the currency pair fell to $1.1159

GBP/USD: the currency pair decreased to $1.5482

USD/JPY: the currency pair rose to Y120.18

The most important news that are expected (GMT0):

14:30 U.S. Building Permits, mln April 1042 1065

14:30 U.S. Housing Starts, mln April 926 1019

17:45 Canada BOC Gov Stephen Poloz Speaks

18:00 Switzerland Gov Board Member Danthine Speaks

-

14:00

Orders

EUR/USD

Offers 1.1200 1.1230 1.1250 1.1280 1.1300 1.1320 1.1350-60 1.1380 1.1400 1.1425

Bids 1.1150-60 1.1130 1.1100 1.1080 1.1050 1.1025-40 1.1000 1.0985

GBP/USD

Offers 1.5630 1.5650 1.5670 1.5700 1.5720 1.5740 1.5765 1.5780 1.5800 1.5830

Bids 1.5585 1.5560 1.5525-30 1.5500 1.5485 1.5465 1.5450

EUR/GBP

Offers 0.7185 0.7200 0.7225-30 0.7250 0.7285 0.7300 0.7325 0.7350

Bids 0.7150 0.7130 0.7100 0.7085 0.7065 0.7050

EUR/JPY

Offers 134.40 134.80 135.00 135.40 136.00 136.50

Bids 133.80 133.50 133.00 132.80 132.50

USD/JPY

Offers 120.25-30 120.50 120.80 121.00

Bids 119.80 119.60 119.45 119.30 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.8000 0.8025 0.8040 0.8060 0.8080 0.8100 0.8125 0.8150

Bids 0.7955-60 0.7930 0.7900-05 0.7885 0.7865 0.7850

-

11:38

Eurozone's unadjusted trade surplus rises to €23.4 billion in March

Eurostat released its trade data for the Eurozone on Tuesday. Eurozone's unadjusted trade surplus rose to €23.4 billion in March from €20.3 billion in February, exceeding expectations for an increase to €22.3 billion.

Exports soared by 11% due to a weaker euro, while imports climbed by 7%.

-

11:28

Germany's ZEW economic sentiment index drops to 41.9 in May

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index dropped to 41.9 in May from 53.3 in April, missing expectations for a decline to 49.0.

The ZEW President Clemens Fuest said that expectations were adjusted after the weak first quarter figures.

"Financial market experts have adjusted their optimistic expectations downward in May due to unexpectedly poor growth figures in the first quarter of 2015 and turmoil on the stock and bond markets. However, only a small number of survey participants actually expect a deterioration of the economic situation," Fuest noted.

Eurozone's ZEW economic sentiment index fell to 61.1 in May from 64.8 in April.

-

11:24

Option expiries for today's 10:00 ET NY cut

USD/JPY: Y120.00($553mn)

USD/CAD: C$1.2125($240mn)

EUR/USD: Weds $1.1450(E1.07bn), Thu $1.1500(E3.2bn). Fri $1.1400(E1.22bn)

USD/JPY: Y120.00 Tues($542mn), Wed($700mn), Fri(1.48bn) - Fri Y122.00($1.63bn)

GBP/USD: Wed $1.5600(Gbp501m), $1.5690(Gbp413mn)

AUD/USD: Fri $0.8000 in A$1.2bn, Fri $0.7920(A$1.2bn) -

11:10

UK consumer price inflation declines to the lowest level since 1960

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in April from 0.0% in March. It was the lowest level since 1960, based on comparable historic estimates.

Analysts had expected the index to remain unchanged.

The fall was driven by a decline in air and sea fares.

The Bank of England Governor (BoE) Mark Carney said last Wednesday that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 0.8% in April from 1.0% the month before.

The Retail Prices Index remained unchanged at 0.9% in April.

The consumer price inflation is below the Bank of England's 2% target.

-

11:00

Eurozone: Harmonized CPI, Y/Y, April 0.0% (forecast 0.0%)

-

11:00

Eurozone: Trade balance unadjusted, March 23.4 (forecast 22.3)

-

11:00

Eurozone: ZEW Economic Sentiment, May 61.2

-

11:00

Germany: ZEW Survey - Economic Sentiment, May 41.9 (forecast 49)

-

10:57

Moody's launches the first credit rating agency dedicated to the growing European public sector debt market

Moody's has launched a new credit rating agency Moody's Public Sector Europe (MPSE) on Monday. The new credit rating agency is the first agency, which dedicated to the growing European public sector debt market.

MPSE should help European public service providers such as regional and local governments, universities, hospitals and housing associations expand their financing options and to get greater access to international debt capital markets.

According to Eurostat, the public sector outstanding debt in the EU (excluding central government debt) totalled €1.8 trillion in 2014, increasing at an annual rate of 2.6%. Moody's expects this trend to continue over the longer period.

-

10:33

Asia Pasific Stocks closed:

HANG SENG 27,688.14 +96.89 +0.35%

S&P/ASX 200 5,615.5 -43.70 -0.77%

TOPIX 1,633.33 +6.67 +0.41%

SHANGHAI COMP 4,409.95 +126.46 +2.95%

-

10:31

United Kingdom: Retail prices, Y/Y, April 0.9% (forecast 1.0%)

-

10:31

United Kingdom: HICP ex EFAT, Y/Y, April 0.8%

-

10:31

United Kingdom: Retail Price Index, m/m, April 0.4% (forecast 0.4%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , April -11.7% (forecast -11.5%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), April 0.1% (forecast 0.2%)

-

10:30

United Kingdom: HICP, m/m, April 0.2% (forecast 0.4%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , April -1.7% (forecast -1.6%)

-

10:30

United Kingdom: HICP, Y/Y, April -0.1% (forecast 0.0%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), April 0.4% (forecast 0.8%)

-

08:26

Options levels on tuesday, May 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1428 (4209)

$1.1387 (4216)

$1.1347 (2067)

Price at time of writing this review: $1.1285

Support levels (open interest**, contracts):

$1.1225 (2333)

$1.1180 (4050)

$1.1121 (4432)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 102502 contracts, with the maximum number of contracts with strike price $1,1500 (4721);

- Overall open interest on the PUT options with the expiration date June, 5 is 129607 contracts, with the maximum number of contracts with strike price $1,1000 (8428)

- The ratio of PUT/CALL was 1.26 versus 1.24 from the previous trading day according to data from May, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1201)

$1.5806 (1200)

$1.5709 (2375)

Price at time of writing this review: $1.5644

Support levels (open interest**, contracts):

$1.5591 (792)

$1.5494 (1900)

$1.5397 (2893)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34755 contracts, with the maximum number of contracts with strike price $1,5600 (2463);

- Overall open interest on the PUT options with the expiration date June, 5 is 49681 contracts, with the maximum number of contracts with strike price $1,5000 (3294);

- The ratio of PUT/CALL was 1.43 versus 1.42 from the previous trading day according to data from May, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index March 0.5% -0.1%

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II 1.8% 1.85%

The dollar index, a gauge of the greenback versus 10 major peers, was little changed. The measure rallied 0.9 percent Monday, snapping a four-day slump.

The Australian dollar was little changed after the Reserve Bank of Australia said the lack of guidance at its meeting this month doesn't limit the scope for further rate moves.

New Zealand's dollar jumped on increased inflation expectations, and silver retreated.

The euro was little changed at $1.1311. Greek Finance Minister Yanis Varoufakis said in an interview late Monday with Greece's Star TV Channel that the country is "very close" to a deal with creditors.

EUR / USD: during the Asian session the pair fell to $ 1.1285

GBP / USD: during the Asian session the pair fell to $ 1.5630

USD / JPY: during the Asian session the pair traded in the range Y119.85-05

-

05:01

New Zealand: Expected Annual Inflation 2y from now, Quarter II 1.85%

-

02:01

Australia: Conference Board Australia Leading Index, March -0.1%

-

00:45

New Zealand: PPI Input (QoQ), Quarter I -1.1% (forecast -0.7%)

-

00:45

New Zealand: PPI Output (QoQ) , Quarter I -0.9% (forecast 0.0%)

-

00:30

Currencies. Daily history for May 18’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1314 -1,20%

GBP/USD $1,5652 -0,48%

USD/CHF Chf0,926 +1,09%

USD/JPY Y119,98 +0,63%

EUR/JPY Y135,74 -0,55%

GBP/JPY Y187,78 +0,14%

AUD/USD $0,7990 -0,53%

NZD/USD $0,7396 -1,03%

USD/CAD C$1,2154 +1,17%

-

00:00

Schedule for today, Tuesday, May 19’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Conference Board Australia Leading Index March 0.5%

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II 1.8%

08:30 United Kingdom Producer Price Index - Input (MoM) April 0.3% 0.8%

08:30 United Kingdom Producer Price Index - Input (YoY) April -13.0% -11.5%

08:30 United Kingdom Producer Price Index - Output (MoM) April 0.2% 0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) April -1.7% -1.6%

08:30 United Kingdom Retail Price Index, m/m April 0.2% 0.4%

08:30 United Kingdom Retail prices, Y/Y April 0.9% 1.0%

08:30 United Kingdom HICP, m/m April 0.2% 0.4%

08:30 United Kingdom HICP, Y/Y April 0.0% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y April 1.0%

09:00 Eurozone ZEW Economic Sentiment May 64.8

09:00 Eurozone Trade balance unadjusted March 20.3 22.3

09:00 Eurozone Harmonized CPI April 1.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April -0.1% 0.0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) April 0.6% 0.6%

09:00 Germany ZEW Survey - Economic Sentiment May 53.3 49

12:30 U.S. Building Permits, mln April 1042 1060

12:30 U.S. Housing Starts, mln April 926 1020

15:45 Canada BOC Gov Stephen Poloz Speaks

16:00 Switzerland Gov Board Member Danthine Speaks

20:30 U.S. API Crude Oil Inventories May -2.0

23:15 Australia RBA Assist Gov Lowe Speaks

23:50 Japan GDP, y/y (Preliminary) Quarter I 1.5% 1.5%

23:50 Japan GDP, q/q (Preliminary) Quarter I 0.4% 0.4%

-