Noticias del mercado

-

19:58

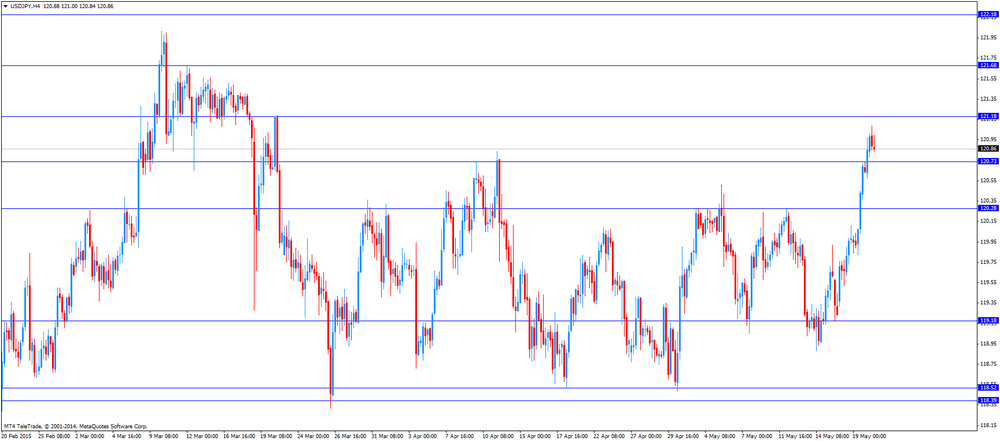

American focus: the US dollar significantly higher against the yen

The yen depreciated significantly against the US dollar, reaching a two-month low at the same time, due to the expectations of the publication of the minutes of the Fed. The minutes from the Fed is likely to weak data of recent months will be a key theme. The Fed already noted that the weakness of macroeconomic indicators in recent months due solely to temporary factors. Also, the protocol is likely to strengthen the Fed's official stance, according to which the rate can be increased at any meeting, even though the expectations of market participants regarding the first increase at the meeting in September, it will have little impact.

The pound lost previously earned positions against the dollar, returning to the level of opening of the session. Earlier, the pair rose by hawkish minutes of the Bank of England remains at high positions in anticipation of the minutes of FOMC, which may reflect a reluctance to rush to the Central Bank rate increase. With regard to the protocol of the Central Bank of England, they showed that the leaders expected to accelerate the growth of the UK economy in the 2nd quarter. From reports that in May, the nine committee members voted to leave its key interest rate at a record low 0.5%, and the volume of bond purchases - at the level of 375 billion pounds (581.20 billion US dollars). The members of the Committee expect that in the 2nd quarter of the country's economic growth accelerated after a weak start of the year, as the decline in prices for food, energy and other commodities support household incomes and stimulate consumer spending. According to the forecast of experts of the Central Bank, quarterly growth of UK GDP in the 2nd quarter accelerated to 0.7%, said in the minutes. According to official estimates, the growth in the 1st quarter was only 0.3%, but the Bank of England expects that the revision of the data rate close to 0.5%.

The dollar will continue to trade in a narrow range against the euro, expecting output protocol FOMC. RBC Experts point out that the April Fed statement did not contain any surprises. According to the central bank, the weakness of the US economy in the 1st quarter was a one-off phenomenon and not the start of a trend. As regards the situation in the labor market, the Fed did not attach particular importance to the slowdown in the number of jobs outside agriculture in March. It turned out that it was the right decision, because in April, the growth rate of the number of jobs outside agriculture accelerated. RBC Economists expect the Fed meeting minutes of April will reflect these sentiments and confirmed that the Fed is inclined to start tightening monetary policy in September. Markets take into account the likelihood of higher interest rates until January 2016, so that, if the expectations with respect to RBC hints on central bank policy tightening in September materialize, the US dollar should continue to grow.

Also worth noting that today the main negative factor for the euro was again Greece and rumors that the country might not be able to repay the debt to the IMF without the conclusion of new agreements. In addition, German Finance Minister Schaeuble did not rule out the probability of default of Greece.

-

16:57

Greek government’s parliamentary speaker Nikos Filis said on Wednesday that Greece will not repay the €305 million IMF loans unless creditors unlocked bailout funds

-

16:30

U.S.: Crude Oil Inventories, May -2.674

-

16:15

Federal Reserve Bank of Chicago President Charles Evans: U.S. unemployment rate might be lower than 5%

Federal Reserve Bank of Chicago President Charles Evans said in Munich on Wednesday that the U.S. unemployment rate might be lower than 5%. He added that it might take more time for inflation to achieve 2% target.

"There's a lot of uncertainty about that. As unemployment goes down, I'm also going to be looking to see what inflation is doing. Because if we've got a natural rate below 5%, we might not see inflation pick up until we go even further," the Federal Reserve Bank of Chicago president.

Evans repeated that the Fed should delay its interest rate hike until early 2016 as inflation in the U.S. is still low.

Evans is a voting member of the Federal Open Market Committee this year.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E386mn), $1.1200(E380mn), $1.1450(E1.07bn)

USD/JPY: Y119.75($840mn), Y120.00($730mn)

GBP/USD: $1.5450(Gbp273mn), $1.5600(Gbp501mn), $1.5690(Gbp597mn)

AUD/USD: $0.7900(A$363n).

NZD/USD: $0.7250(NZ$523mn)

USD/CAD: C$1.2185($445mn), C$1.2205-10($400mn)

-

15:42

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to -0.1 points in April

A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index rose to -0.1 points in April from -23.2 points in March.

The current conditions index was 0 points in May.

Both the economic expectations indicator and the measure for the current economic activity were zero in May.

About 50% of the respondents expect unchanged economic conditions in the coming months.

-

15:11

Canada’s wholesale sales rise 0.8% in March

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales increased 0.8% in March, missing expectations for a 0.9% rise, after a 0.4% decline in February.

The increase was driven by higher sales in the building material and supplies subsector. Sales in the building material and supplies subsector climbed 2.8%.

Sales rose in five of the seven subsectors.

Sales of automobiles and parts were up 0.7% in March.

Inventories climbed by 1.0% in March. It was the 15th consecutive increase.

-

14:42

Japan’s preliminary GDP climbs 0.6% in the first quarter

The Cabinet Office released its gross domestic product (GDP) figures for Japan on late Tuesday. Japan's preliminary GDP climbed 0.6% in the first quarter, exceeding expectations for a 0.4% rise, after a 0.3% gain in the fourth quarter. The fourth quarter was revised down from a 0.4% rise.

Business spending climbed by 0.4% in the first quarter, while private consumption rose 0.4%.

Inventories were up 0.5% in the first quarter. Residential housing investments increased 1.8%.

On a yearly basis, Japan's preliminary GDP was up 2.4% in the first quarter, beating forecasts of a 1.5% increase, after a 1.1% in the fourth quarter. The fourth quarter was revised down from a 1.5% gain.

-

14:30

Canada: Wholesale Sales, m/m, March 0.8% (forecast 0.9%)

-

14:24

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the Bank of England's May meeting minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence May -3.2% 6.4%

05:00 Japan Coincident Index (Finally) March 110.7 109.5 109.2

05:00 Japan Leading Economic Index (Finally) March 105.3 Revised From 104.7 105.5 106.0

07:00 U.S. FOMC Member Charles Evans Speaks

08:30 United Kingdom Bank of England Minutes

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) May -23.2 -0.1

The U.S. dollar mixed to lower against the most major currencies ahead of the Fed's April meeting minutes.

The euro traded higher against the U.S. dollar in the absence of any major reports from the Eurozone. The Greek debt crisis still weighs on the euro.

The British pound traded higher against the U.S. dollar after the Bank of England's (BoE) May meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

MPC members noted that rising house prices in the U.K. posed renewed risks due to a shortage of new homes.

The Bank of England still expects the consumer inflation close to zero due to lower oil and commodity prices, but inflation should pick up by the end of this year.

The Swiss franc traded mixed against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index rose to -0.1 points in April from -23.2 points in March.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian wholesale sales data. Canadian wholesale sales are expected to climbed 0.9% in March, after a 0.4% drop in February.

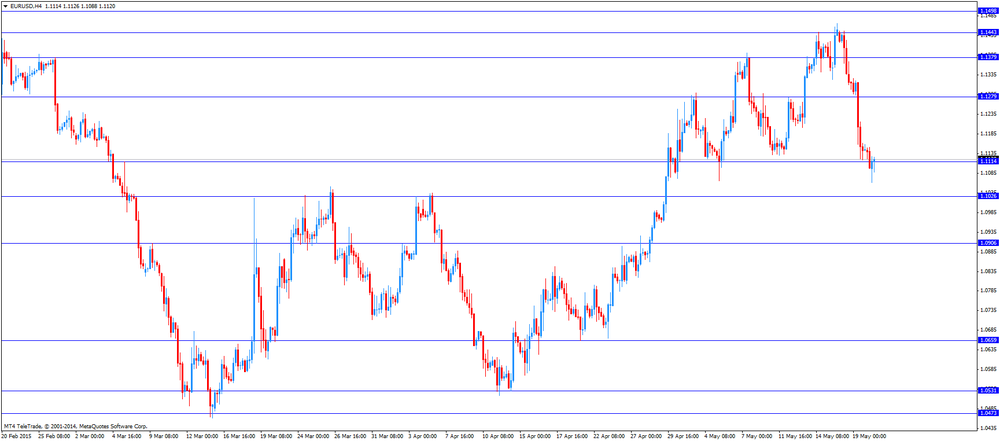

EUR/USD: the currency pair increased to $1.1127

GBP/USD: the currency pair climbed to $1.5557

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m March -0.4% 0.9%

18:00 U.S. FOMC meeting minutes

22:50 Australia RBA Assist Gov Edey Speaks

-

13:50

Orders

EUR/USD

Offers 1.1100 1.1120 1.1140 1.1165 1.1180 1.1200 1.1230 1.1250

Bids 1.1055-60 1.1025-40 1.1000 1.0985 1.0965 1.0950 1.0930 1.0900

GBP/USD

Offers 1.5500 1.5520 1.5550 1.5585 1.5600 1.5630 1.5650 1.5670 1.5700

Bids 1.5465 1.5450 1.5430 1.5400 1.5380 1.5360

EUR/GBP

Offers 0.7185 0.7200 0.7225-30 0.7250 0.7285 0.7300

Bids 0.7130 0.7100 0.7085 0.7065 0.7050

EUR/JPY

Offers 134.40 134.75 135.00 135.40 136.00136.50

Bids 133.80 133.50 133.00 132.80 132.50

USD/JPY

Offers 121.20 121.50 121.80 122.00 122.30 122.50

Bids 120.80 120.60 120.45 120.20 120.00 119.80 119.60 119.45

AUD/USD

Offers 0.7925 0.7940-45 0.7965 0.7980 0.8000 0.8025 0.8040 0.8060 0.8080 0.8100

Bids 0.7880 0.7865 0.7850 0.7835 0.7800 0.7785 0.7750

-

11:47

German producer prices rise 0.1% in April

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices rose 0.1% in April, after a 0.1% gain in March. It was the third consecutive monthly increase.

PPI excluding energy sector climbed by 0.2% in April.

On a yearly basis, German PPI dropped 1.5% in April, after a 1.7% fall in March.

Energy prices plunged 4.4% in April.

Consumer goods sector prices fell 1.4% in April from the previous year, intermediate goods sector prices decreased by 0.7%, while consumer goods sector prices rose 1.3%.

-

11:33

Bank of England's Monetary Policy Committee minutes: inflation should pick up by the end of this year

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced," repeating comments from the last minutes.

MPC members noted that rising house prices in the U.K. posed renewed risks due to a shortage of new homes.

The Bank of England still expects the consumer inflation close to zero due to lower oil and commodity prices, but inflation should pick up by the end of this year.

Policymakers said that the economy will pick up in the second quarter after the weak first quarter due to higher household incomes and consumer spending as prices for food, energy and other goods declined.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E386mn), $1.1200(E380mn), $1.1450(E1.07bn)

USD/JPY: Y119.75($840mn), Y120.00($730mn)

GBP/USD: $1.5450(Gbp273mn), $1.5600(Gbp501mn), $1.5690(Gbp597mn)

AUD/USD: $0.7900(A$363n).

NZD/USD: $0.7250(NZ$523mn)

USD/CAD: C$1.2185($445mn), C$1.2205-10($400mn)

-

11:13

Bank of Canada Governor Stephen Poloz hopes Canada’s economy bounce back in the second quarter

The Bank of Canada (BoC) Governor Stephen Poloz said on Tuesday that he hopes Canada's economy bounce back in the second quarter. The central bank forecasted a zero growth in the first quarter.

"The Canadian rebound hasn't been as quick as we'd like, but recent data have been encouraging," Poloz said.

He noted that there is uncertainty about the country`s outlook due to recent increase in oil prices and the strong Canadian dollar. But he added that the Canadian economy is on track to return to full capacity around the end of 2016.

The BoC governor hopes to see more business investment.

Poloz pointed out that the January interest rate cut is working.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), May -0.1

-

10:52

Swiss National Bank (SNB) Vice President Jean-Pierre Danthine: that negative interest rates will help weaken the strong Swiss franc

The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said on Tuesday that negative interest rates will help weaken the strong Swiss franc. He added that this measure is only temporary.

The SNB has implemented negative interest rates as it removed the 1.20 per euro exchange rate floor.

Danthine defended this decision and noted that it was necessary to avoid an uncontrolled expansion of the central bank's balance sheet.

-

10:39

BofA Merrill Lynch Fund Manager Survey: investors lost interest in higher risk assets

According to the BofA Merrill Lynch Fund Manager Survey for May, global investors lost interest in higher risk assets. While 47% of respondents continue to increase investment in shares, this index decreased by seven percentage points since last month.

Interest in U.S. shares fell: 19% of respondents are now reducing investments in this asset class, although there was an increase in investment in the first quarter.

Investors also lost confidence in corporate profitability. At the same time, cash positions sharply increased. This month's reading was 23%, the highest since December 2014. These shifts follow the recent selloff in bond markets.

The survey's results showed that an increase in respondents' assessment of bonds as the most volatile asset class in 2015.

-

10:17

Merkel and Hollande urged the debt talks between Greece and its creditors should be accelerated

German Chancellor Angela Merkel and French President Francois Hollande Tuesday urged that the debt talks between Greece and its creditors should be accelerated. Merkel said that Greece and its creditors should reach a deal until the end of May. Hollande noted that Greece must stay in the Eurozone.

-

08:26

Options levels on wednesday, May 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1266 (3086)

$1.1217 (1912)

$1.1187 (1963)

Price at time of writing this review: $1.1099

Support levels (open interest**, contracts):

$1.1046 (4498)

$1.0993 (7244)

$1.0928 (9881)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 106736 contracts, with the maximum number of contracts with strike price $1,1500 (5273);

- Overall open interest on the PUT options with the expiration date June, 5 is 131556 contracts, with the maximum number of contracts with strike price $1,1000 (9881);

- The ratio of PUT/CALL was 1.23 versus 1.26 from the previous trading day according to data from May, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1241)

$1.5704 (2617)

$1.5607 (2431)

Price at time of writing this review: $1.5480

Support levels (open interest**, contracts):

$1.5392 (2836)

$1.5295 (1595)

$1.5197 (2168)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 35020 contracts, with the maximum number of contracts with strike price $1,5700 (2617);

- Overall open interest on the PUT options with the expiration date June, 5 is 51349 contracts, with the maximum number of contracts with strike price $1,5000 (3244);

- The ratio of PUT/CALL was 1.47 versus 1.43 from the previous trading day according to data from May, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence May -3.2% 6.4%

05:00 Japan Coincident Index (Finally) March 110.7 109.5 109.2

05:00 Japan Leading Economic Index (Finally) March 105.3 Revised From 104.7 105.5 106.0

The U.S. dollar rose across the board after the euro was hit with a double whammy: the European Central Bank signaled it would step up bond buying in the coming weeks and investors got positive economic news out of the U.S.

Instead, the key to currency movements will be the release of the Federal Reserve meeting minutes late in the global day with markets looking for any indication of when the Fed might raise short-term benchmark interest rates.

The New Zealand dollar is trading lower late Wednesday driven primarily by moves in the U.S. dollar and the euro in overnight trading. ANZ added that the 20% lift in U.S. housing starts and 10% lift in building permits added some confidence to U.S. dollar bulls while the lack of bounce in the GlobalDairyTrade auction saw investors hold their New Zealand dollar positions.

EUR / USD: during the Asian session, the pair was trading in the $1.1120-50

GBP / USD: during the Asian session, the pair was trading in the $1.5495-25

USD / JPY: during the Asian session the pair rose to Y120.95

BOE MPC Minutes released at 0830GMT though most not expecting any major surprises, with last week's BOE QIR still fresh in traders' minds.

-

07:02

Japan: Leading Economic Index , March 106 (forecast 105.5)

-

07:02

Japan: Coincident Index, March 109.2 (forecast 109.5)

-

02:31

Australia: Westpac Consumer Confidence, May 6.4%

-

01:52

Japan: GDP, q/q, Quarter I 0.6% (forecast 0.4%)

-

01:51

Japan: GDP, y/y, Quarter I 2.4% (forecast 1.5%)

-

00:29

Currencies. Daily history for May 19’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1145 -1,52%

GBP/USD $1,5511 -0,91%

USD/CHF Chf0,9368 +1,15%

USD/JPY Y120,65 +0,56%

EUR/JPY Y134,45 -0,96%

GBP/JPY Y187,13 -0,35%

AUD/USD $0,7918 -0,91%

NZD/USD $0,7346 -0,68%

USD/CAD C$1,2227 +0,60%

-