Noticias del mercado

-

21:00

Dow +0.26% 18,320.80 +48.24 Nasdaq +0.63% 5,080.06 +31.77 S&P +0.35% 2,130.18 +7.45

-

19:51

WSE: Session Results

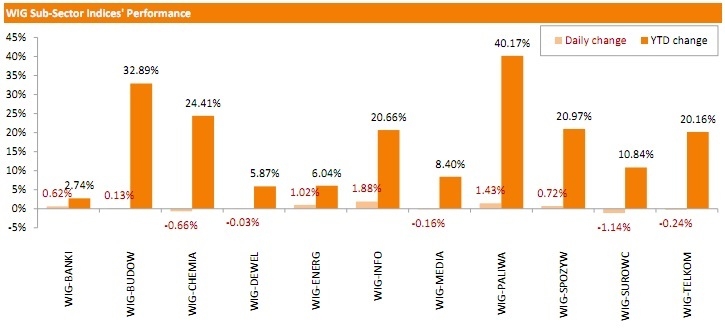

Polish equity market continued its upward trend on Monday. The broad market benchmark - the WIG index added 0.25%, while the large liquid companies' indicator - the WIG30 index gained 0.34%.

In the WIG30 index, ASSECO POLAND (WSE: ACP) led advances with a 2.31% gain, rebounding after three sessions of losses. It was followed by EUROCASH (WSE: EUR), PKN ORLEN (WSE: PKN) and PGNIG (WSE: PGN), returning 1.88%, 1.75% and 1.68%, respectively. At the same time, LPP (WSE: LPP) fared the worst, falling down 2.04%. In addition, KGHM (WSE: KGH) and GRUPA AZOTY (WSE: ATT) demonstrated notable declines, sliding down 1.51% and 1.45% respectively.

Turning to the performance of the WIG sub-sector indices, the technology-oriented WIG-INFO index outperformed, advancing 1.88%. It was followed by the oil & gas sector benchmark WIG-PALIWA and the utilities measure WIG-ENERG, adding 1.43% and 1.02%. On the contrary, the worst-performing sub-sector indices were the indicators that represented the basic material producers and the chemical companies - the WIG-SUROWC index (-1.14%) and the WIG-CHEMIA index (-0.66%).

-

19:06

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday, after the Dow Jones industrial average hit a record high, as homebuilder confidence index fell, adding to a stream of weak economic data that has muddied the outlook for interest rates. The National Association of Home Builders/Wells Fargo Housing Market index fell to 54 from 56 the month before. Economists polled by Reuters had predicted the index would rise to 57. The U.S. economy is struggling to rebound strongly enough for the Federal Reserve to raise interest rates before September, analysts have said.

Dow stocks are mixed (15 vs 15). Top looser - Chevron Corporation (CVX, -0.92%). Top gainer - Johnson & Johnson (JNJ, +1.50%).

S&P index sectors mixed. Top gainer - Healthcare (+0,5%). Top looser - Basic materials (-0.9%).

At the moment:

Dow 18249.00 +20.00 +0.11%

S&P 500 2123.25 +4.25 +0.20%

Nasdaq 100 4503.00 +14.25 +0.32%

10-year yield 2.21% +0.07

Oil 60.38 -0.16 -0.26%

Gold 1227.00 +1.70 +0.14%

-

18:00

European stocks closed: FTSE 100 6,968.87 +8.38 +0.12% CAC 40 5,012.31 +18.49 +0.37% DAX 11,594.28 +147.25 +1.29%

-

18:00

European stocks close: stocks closed higher on a weaker euro

Stock indices closed higher on a weaker euro. The euro traded lower on the Greek debt crisis.

German Bundesbank released its monthly report. The central bank expects the German economy to expand in the coming months, driven by consumption. Bundesbank also said that Greece could be bankrupt without changing its attitude in the negotiations with its creditors.

The European Central Bank Executive Board Member Yves Mersch said on Monday that the central bank should continue its quantitative easing until inflation is on track to the central bank's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,968.87 +8.38 +0.12 %

DAX 11,594.28 +147.25 +1.29 %

CAC 40 5,012.31 +18.49 +0.37 %

-

17:01

Reserve Bank of Australia Deputy Governor Philip Lowe: further interest rate cut by the RBA is possible if needed

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe said in Melbourne on Monday that low interest rate in Australia to support spending and help a transition from mining investment.

He noted that borrowers should not take too much debt.

Lowe pointed out that further interest rate cut by the RBA is possible if needed. He added that lower Australian dollar will help the Australian economy.

-

16:32

NAHB housing market index declines to 54 in May

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index declined to 54 in May from 56 in April.

Analysts had expected the index to rise to 57.

The decline was driven by lower sales and slower buyer traffic.

A level above 50.0 is considered positive, below indicates a negative outlook.

The NAHB Chairman Tom Woods said that the second quarter is expected to be solid.

"Consumers are exhibiting caution, and want to be on more stable financial footing before purchasing a home," the NAHB Chief Economist David Crowe noted.

He added that as the subindex measuring future sales expectations has been increased all year, mortgage rates remain low, and house prices are affordable, all these factors "should spur the release of pent-up demand moving forward".

-

16:01

Bank of Japan's Chief Economist Eiji Maeda: Japan’s economy “to move from recovery to an expansionary phase”

The Bank of Japan's Chief Economist Eiji Maeda expects that Japan's economy "to move from recovery to an expansionary phase" this fiscal year due to improvements in domestic demand, exports and falling oil prices.

Maeda pointed out that the country is near full employment, which will put upward pressure on wages.

The Bank of Japan's chief economist noted that the central bank will adjust its monetary policy if needed. He added that there is no need adjustments as inflation expectations remain firm.

-

15:33

European Economic and Monetary Affairs Commissioner Pierre Moscovici: Greece and its creditors has been made some progress

European Economic and Monetary Affairs Commissioner Pierre Moscovici said on Monday that Greece and its creditors has been made some progress.

"We have moved closer to common understanding on reforms to be adopted in a number of areas," he noted. He added that Greece agreed to engage "more constructively on the issue of privatizations" and that there are also some progress regarding the reform of the gas market.

Moscovici pointed out that talks are needed to speed up.

He noted that there are no talks about a third aid package for Greece.

-

15:32

U.S. Stocks open: Dow -0.02%, Nasdaq -0.20%, S&P -0.08%

-

15:20

Before the bell: S&P futures -0.17%, NASDAQ futures -0.26%

U.S. stock-index futures were little changed.

Global markets:

Nikkei 19,890.27 +157.35 +0.80%

Hang Seng 27,591.25 -231.03 -0.83%

Shanghai Composite 4,283.23 -25.46 -0.59%

FTSE 6,952.73 -7.76 -0.11%

CAC 4,966.92 -26.90 -0.54%

DAX 11,475.59 +28.56 +0.25%

Crude oil $60.42 (+1.21%)

Gold $1225.20 (-0.01%)

-

15:06

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

105.00

+0.02%

0.6K

Deere & Company, NYSE

DE

89.27

+0.16%

0.2K

Intel Corp

INTC

33.07

+0.24%

12.0K

Twitter, Inc., NYSE

TWTR

37.19

+0.24%

27.9K

General Motors Company, NYSE

GM

35.00

+0.26%

2.5K

Wal-Mart Stores Inc

WMT

79.45

+0.27%

1.5K

Home Depot Inc

HD

113.70

+0.31%

16.4K

Yandex N.V., NASDAQ

YNDX

19.09

+0.42%

2.3K

Barrick Gold Corporation, NYSE

ABX

13.18

+0.46%

4.5K

3M Co

MMM

163.30

0.00%

0.2K

Pfizer Inc

PFE

33.99

0.00%

16.3K

Goldman Sachs

GS

202.95

-0.01%

2.4K

Visa

V

69.55

-0.03%

0.5K

Merck & Co Inc

MRK

60.21

-0.03%

137.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.82

-0.04%

26.8K

Starbucks Corporation, NASDAQ

SBUX

50.77

-0.06%

0.7K

Exxon Mobil Corp

XOM

87.27

-0.09%

1.7K

Procter & Gamble Co

PG

80.98

-0.09%

3.6K

Boeing Co

BA

146.74

-0.10%

0.1K

Ford Motor Co.

F

15.46

-0.13%

27.8K

The Coca-Cola Co

KO

41.46

-0.14%

1.3K

International Business Machines Co...

IBM

173.00

-0.15%

0.2K

ALCOA INC.

AA

13.52

-0.15%

1.8K

Verizon Communications Inc

VZ

49.70

-0.18%

1.4K

Facebook, Inc.

FB

80.27

-0.19%

52.6K

General Electric Co

GE

27.21

-0.22%

4.0K

AMERICAN INTERNATIONAL GROUP

AIG

58.21

-0.26%

1.2K

Apple Inc.

AAPL

128.38

-0.30%

120.7K

Amazon.com Inc., NASDAQ

AMZN

424.64

-0.32%

1.1K

Tesla Motors, Inc., NASDAQ

TSLA

248.05

-0.32%

22.0K

Cisco Systems Inc

CSCO

29.45

-0.34%

0.3K

Walt Disney Co

DIS

109.91

-0.35%

0.5K

Microsoft Corp

MSFT

48.11

-0.38%

5.6K

E. I. du Pont de Nemours and Co

DD

69.80

-0.64%

2.0K

Yahoo! Inc., NASDAQ

YHOO

44.46

-0.65%

6.4K

Chevron Corp

CVX

107.26

-0.71%

7.3K

-

15:00

Federal Reserve Bank of Chicago President Charles Evans: the Fed should delay its interest rate hike until early 2016

Federal Reserve Bank of Chicago President Charles Evans said in Stockholm on Monday that the Fed should delay its interest rate hike until early 2016 as inflation in the U.S. is still low.

Evans noted that the Fed could raise its interest rate in every monetary policy meeting, depending on the incoming data. He added that he projects the U.S. economy need more time to recover from the first-quarter weakness.

The Federal Reserve Bank of Chicago president doesn't believe that inflation will increase to 2% target until 2018. He also said that the Fed should allow inflation to rise above its 2% target.

Evans is a voting member of the Federal Open Market Committee this year.

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Chevron (CVX) downgraded from Neutral to Sell Goldman

Other:

Procter & Gamble (PG) removed from US and Global Focus List at Credit Suisse

-

14:42

Bundesbank’s monthly report: the German economy is expected to expand in the coming months

German Bundesbank released its monthly report. The central bank expects the German economy to expand in the coming months, driven by consumption.

German industry is expected to grow at a "sluggish" pace, according to the report.

Bundesbank also said that Greece could be bankrupt without changing its attitude in the negotiations with its creditors.

"The current Greek government is obliged to make appropriate proposals, to implement those agreements that have been reached and thereby do their part to avoid the insolvency of the state, with strong repercussions for Greece," Bundesbank noted.

The central bank added that financial help for Greece "should be linked to the relevant preconditions".

-

12:00

European stock markets mid session: stocks traded higher on a weaker euro

Stock indices traded higher on a weaker euro. The euro declined against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The euro rose against the U.S. dollar on Friday after weaker-than-expected U.S. economic data. The U.S. industrial production dropped 0.3% in April, missing expectations for a 0.1% increase, after a 0.3% decline in March. Capacity utilisation rate fell to 78.2% in April from 78.6% in March. The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 88.6 in May from a final reading of 95.9 in April, missing expectations for an increase to 96.0. It was the lowest level since October 2014.

The European Central Bank Executive Board Member Yves Mersch said on Monday that the central bank should continue its quantitative easing until inflation is on track to the central bank's 2% target.

Markets were also supported by gains in the automobile and mining sector.

Current figures:

Name Price Change Change %

FTSE 100 6,985.26 +24.77 +0.36 %

DAX 11,551.64 +104.61 +0.91 %

CAC 40 5,006.31 +12.49 +0.25 %

-

11:45

Italy’s trade surplus declines to €3.89 billion in March

Istat released its trade data for Italy on Monday. Italy's trade surplus declined to a seasonally adjusted €3.89 billion in March from €4.46 billion in February.

The decline was driven by higher imports. Imports climbed 4.0% in March, while exports rose 1.8%.

The trade surplus on EU trade was down to €686 million, while the surplus on non-EU trade fell to €3.2 billion.

-

11:34

European Central Bank Executive Board Member: the ECB should continue its quantitative easing

The European Central Bank (ECB) Executive Board Member Yves Mersch said on Monday that the central bank should continue its quantitative easing until inflation is on track to the central bank's 2% target.

"We need to maintain the pace and volume of our interventions, as we have communicated, so that inflation rises back towards 2% as quickly as possible and that monetary policy can begin once more to normalize," he said.

Mersch pointed out that unconventional monetary policy should be temporary.

-

11:11

Swiss retail sales drop 2.8% in March

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland dropped at an annual rate of 2.8% in March, after a 3.1% decline in February.

February's figure was revised down from a 2.7% decrease.

Retail sales excluding petrol prices fell 2.3%.

Sales of food, beverages and tobacco plunged 2.6%, while non-food sales were down 2.3%.

-

11:01

Asia Pasific Stocks closed:

S&P/ASX 200 5,659.2 -76.30 -1.33%

TOPIX 1,626.66 +19.55 +1.22%

SHANGHAI COMP 4,287.83 -20.86 -0.48%

HANG SENG 27,477.79 -344.49 -1.24%

-

10:57

U.S. economy is expected to grow 2.5% in the second quarter

According to the Philadelphia Federal Reserve's quarterly survey, the U.S. economy is expected to expand at an annual rate of 2.5% in the second quarter, down from its February forecast of 3.0%.

Economists expect the economy to grow 3.1% in the third quarter of 2015, up from the previous estimate of 2.8%.

For 2015 as whole, the economic growth is expected to be 2.4%, down from 3.2% in February.

-

10:14

UK’s leading economic index rises 0.2% in March

The Conference Board released its leading economic index for the U.K. The leading economic index increased 0.2% in March, after a 0.6% rise in February. It was the consecutive increase.

The coincident index was up 0.2% in March, after a 0.2% in February.

-

04:01

Nikkei 225 19,818.05 +85.13 +0.43 %, Hang Seng 27,675.08 -147.20 -0.53 %, Shanghai Composite 4,289.28 -19.41 -0.45 %

-

00:30

Stocks. Daily history for Apr May 15’2015:

(index / closing price / change items /% change)

Nikkei 225 19,732.92 +162.68 +0.83 %

Hang Seng 27,822.28 +535.73 +1.96 %

S&P/ASX 200 5,735.5 +38.93 +0.68 %

Shanghai Composite 4,309.36 -68.95 -1.57 %

FTSE 100 6,960.49 -12.55 -0.18 %

CAC 40 4,993.82 -35.49 -0.71 %

Xetra DAX 11,447.03 -112.79 -0.98 %

S&P 500 2,122.73 +1.63 +0.08 %

NASDAQ Composite 5,048.29 -2.50 -0.05 %

Dow Jones 18,272.56 +20.32 +0.11 %

-