Noticias del mercado

-

21:00

S&P 500 2,119.37 -1.73 -0.08 %, NASDAQ 5,045.22 -5.58 -0.11 %, Dow 18,252.1 -0.14 0.00%

-

19:54

WSE: Session Results

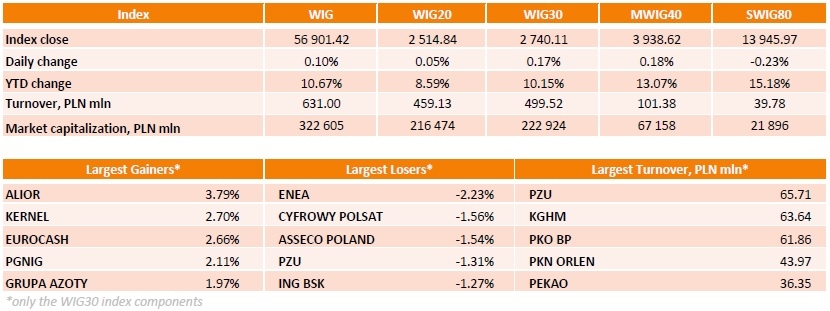

Polish equity market edged higher on Friday. The broad market benchmark - the WIG index rose 0.10%, while the large liquid companies' indicator - the WIG30 index advanced 0.17%.

In the WIG30 index, ALIOR (WSE: ALR) surged 3.79% due to announced 33% YoY rise in its first-quarter net profit. It was followed by KERNEL (WSE: KER) and EUROCASH (WSE: EUR), adding 2.70% and 2.66% respectively. On the contrary, ENEA (WSE: ENA) lagged, losing 2.23% as reported positive 1Q15 results were not enough to reverse the general unfavorable sentiment towards Polish utilities sector. CYFROWY POLSAT (WSE: CPS) and ASSECO POLAND (WSE: ACP) also posted notable declines, sliding down 1.56% and 1.54% respectively.

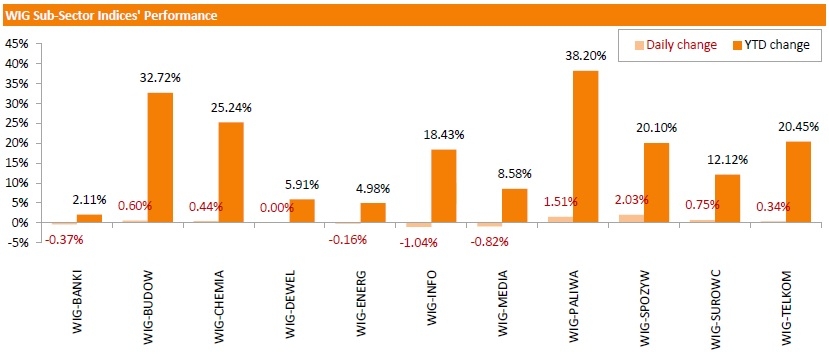

The WIG sub-sector indices' performance was mixed. The food sector benchmark - the WIG-SPOZYW index (+2.03%) added the most, while the measure for IT-sector - the WIG-INFO index (-1.04%) was weakest.

-

18:23

Wall Street. Major U.S. stock-indexes are little changed

Major U.S. stock-indexes are lower on Friday as weak economic data pointed to a lack of momentum in the economy. Industrial output slipped 0.3%, weighed down by a decline in production by mining companies and utilities. Economists had forecast a rise of 0.1%. U.S. consumer sentiment also fell more than expected in May and was at the lowest level since October.

Most of the Dow stocks are trading in negative area (18 of 30). Top looser - The Boeing Company (BA, -1.07%). Top gainer - Cisco Systems, Inc. (CSCO, +1.50%).

S&P index sectors mixed. Top gainer - Utilities (+0,4%). Top looser - Conglomerates (-0.7%).

At the moment:

Dow 18193.00 -9.00 -0.05%

S&P 500 2114.25 -3.25 -0.15%

Nasdaq 100 4483.75 -6.50 -0.14%

10-year yield 2.15% -0.09

Oil 60.24 -0.60 -0.99%

Gold 1222.40 -2.80 -0.23%

-

18:05

European stocks close: stocks closed lower on a stronger euro and on the Greek debt crisis

Stock indices closed lower on a stronger euro and on the Greek debt crisis. The U.S. industrial production dropped 0.3% in April, missing expectations for a 0.1% increase, after a 0.3% decline in March. March's figure was revised up from a 0.6% decrease.

The decline was driven by lower mining and utilities output. Mining output dropped by 0.8% in April as oil and gas drilling plunged 14.5%, while utility output fell by 1.3%.

The U.S. manufacturing production remained unchanged in April.

Capacity utilisation rate fell to 78.2% in April from 78.6% in March. March's figure was revised up 78.4% Analysts had expected a capacity utilisation rate of 78.4%.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 88.6 in May from a final reading of 95.9 in April, missing expectations for an increase to 96.0. It was the lowest level since October 2014.

Earlier in the day, stocks traded higher on European Central Bank President's comments and as stability seems to return to bond markets. The European Central Bank (ECB) President Mario Draghi said in a speech at the International Monetary Fund in Washington on Thursday that the central bank will not stop its quantitative easing until there is "a sustained adjustment in the path of inflation".

Draghi noted that he wanted that quantitative easing to boost investment and price inflation.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 3.9% in March, after a 0.3% decline in February.

The increase was driven by a rise in non-housing repair and maintenance work, which soared 20% in March.

On a yearly basis, construction output climbed 1.6% in March.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,960.49 -12.55 -0.18 %

DAX 11,447.03 -112.79 -0.98 %

CAC 40 4,993.82 -35.49 -0.71 %

-

18:00

European stocks closed: FTSE 100 6,960.49 -12.55 -0.18 %, CAC 40 4,993.82 -35.49 -0.71 %, DAX 11,447.03 -112.79 -0.98 %

-

16:45

Thomson Reuters/University of Michigan preliminary consumer sentiment index drops to 88.6 in May

The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 88.6 in May from a final reading of 95.9 in April, missing expectations for an increase to 96.0. It was the lowest level since October 2014.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that the decline was a result of lower optimism regarding "quick and robust rebound" in the U.S. economy.

Mr Curtin added that consumers remained optimistic about their future personal finances.

A gauge of consumers' current economic conditions dropped to 103.0 in March from 106.9 in February.

The index of consumer expectations declined to 81.5 from 88.8.

The one-year inflation expectations in May climbed to 2.9% from 2.6% in April.

-

16:14

NY Fed Empire State manufacturing index is up to 3.09 in May

The New York Federal Reserve released its survey on Friday. The NY Fed Empire State manufacturing index rose to 3.09 in May from -1.19 in April, missing expectations for an increase to 5.0.

The increase was driven by a rise in new orders. The new orders index climbed to 3.9 in May from -6.0 in April.

The price-paid index decreased to 9.38 in May from 19.15 in April.

The index for the number of employees decreased to 5.21 in May from 9.57 last month.

The general business conditions expectations index for the next six months was down to 29.81 in May from 37.06 in April.

-

15:53

U.S. industrial production declines 0.3% in April

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production dropped 0.3% in April, missing expectations for a 0.1% increase, after a 0.3% decline in March.

March's figure was revised up from a 0.6% decrease.

The decline was driven by lower mining and utilities output. Mining output dropped by 0.8% in April as oil and gas drilling plunged 14.5%, while utility output fell by 1.3%.

The U.S. manufacturing production remained unchanged in April.

Capacity utilisation rate fell to 78.2% in April from 78.6% in March. March's figure was revised up 78.4%. Analysts had expected a capacity utilisation rate of 78.4%.

These figures are pointing to a slower economic growth in the U.S.

-

15:33

U.S. Stocks open: Dow +0.05%, Nasdaq +0.22%, S&P +0.12%

-

15:28

Before the bell: S&P futures +0.08%, NASDAQ futures +0.21%

U.S. index futures advanced as a selloff in the global bond market eased after purchases by the European Central Bank, lifting stock index futures.

Global markets:

Nikkei 19,732.92 +162.68 +0.83%

Hang Seng 27,822.28 +535.73 +1.96%

Shanghai Composite 4,309.36 -68.95-1.57 %

FTSE 6,977.37 +4.33 +0.06%

CAC 5,041.64 +12.33 +0.25%

DAX 11,557.59 -2.23 -0.02%

Crude oil $59.45 (-0.77%)

Gold $1215.80 (-0.76%)

-

15:27

Foreign securities purchases in Canada climb by C$22.47 billion in March

Statistics Canada released foreign investment figures on Friday. Foreign securities purchases in Canada rose by C$22.47 billion in March, after a drop by C$9.35 billion in February. It was the highest inflow since May 2012.

February's figure was revised up from a gain by C$9.27 billion.

Canadian investors sold C$3.2 billion of foreign securities in March.

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Verizon Communications Inc

VZ

49.98

+0.02%

0.6K

Pfizer Inc

PFE

33.95

+0.03%

5.8K

Caterpillar Inc

CAT

88.80

+0.07%

1.8K

The Coca-Cola Co

KO

41.53

+0.07%

13.6K

ALCOA INC.

AA

13.65

+0.07%

0.1K

JPMorgan Chase and Co

JPM

66.10

+0.08%

14.6K

ALTRIA GROUP INC.

MO

52.64

+0.08%

0.8K

Amazon.com Inc., NASDAQ

AMZN

432.65

+0.09%

3.1K

Chevron Corp

CVX

107.49

+0.10%

2.6K

Goldman Sachs

GS

202.84

+0.11%

0.7K

General Electric Co

GE

27.44

+0.11%

3.1K

Walt Disney Co

DIS

110.06

+0.12%

1.1K

International Business Machines Co...

IBM

174.30

+0.14%

1.4K

AT&T Inc

T

34.18

+0.15%

3.7K

Citigroup Inc., NYSE

C

54.69

+0.16%

0.6K

Ford Motor Co.

F

15.30

+0.20%

4.9K

Intel Corp

INTC

33.05

+0.24%

27.2K

Boeing Co

BA

148.33

+0.25%

1K

Facebook, Inc.

FB

81.60

+0.28%

104.0K

Microsoft Corp

MSFT

48.86

+0.29%

165.9K

General Motors Company, NYSE

GM

34.75

+0.29%

3.3K

Starbucks Corporation, NASDAQ

SBUX

50.70

+0.29%

1.0K

UnitedHealth Group Inc

UNH

118.89

+0.30%

0.4K

Cisco Systems Inc

CSCO

29.14

+0.31%

24.5K

Yahoo! Inc., NASDAQ

YHOO

45.10

+0.33%

4.9K

Visa

V

70.27

+0.39%

8.2K

3M Co

MMM

163.84

+0.42%

0.1K

Twitter, Inc., NYSE

TWTR

37.50

+0.46%

19.4K

E. I. du Pont de Nemours and Co

DD

70.00

+0.47%

7.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.80

0.00%

0.7K

Hewlett-Packard Co.

HPQ

33.70

0.00%

15.0K

Google Inc.

GOOG

538.27

-0.02%

1.4K

Exxon Mobil Corp

XOM

86.90

-0.08%

1.8K

Apple Inc.

AAPL

128.84

-0.09%

335.6K

Merck & Co Inc

MRK

59.71

-0.12%

126.6K

Tesla Motors, Inc., NASDAQ

TSLA

243.00

-0.45%

4.3K

Barrick Gold Corporation, NYSE

ABX

13.11

-0.53%

10.1K

Deere & Company, NYSE

DE

90.40

-1.96%

18.6K

-

15:03

Canadian manufacturing shipments rises 2.9% in March

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments climbed 2.9% in March, beating forecasts of a 1.2% increase, after a 2.2% decrease in February.

February's figure was revised down from a 1.7% decline.

The increase was driven by a rise in the production of aerospace products and parts and higher sales of motor vehicles. The production of aerospace products and parts soared 42.3% in March, after a 29.4% drop in February.

Sales of motor vehicles climbed 12.8% in March.

Sales increased in 10 of 21 categories.

-

15:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Deere (DE) downgraded to Underweight from Neutral at JP Morgan

Other:

Honeywell (HON) reiterated at Outperform at Cowen, target raised from $112 to $116

-

14:43

Bank of Japan Governor Haruhiko Kuroda: that the consumer price inflation is likely to be reached 2% by September 2016

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Friday that the consumer price inflation is likely to be reached 2% by September 2016. He pointed out further monetary easing is not necessary as "underlying price trend is steadily improving and is expected to keep improving going forward".

Kuroda noted the timing for achieving 2% inflation has been delayed due to falling oil prices.

Inflation in Japan was 0.2% in March.

The BoJ governor also said that consumer spending in Japan over the year ended March was weaker than expected due to a sales tax rise in April 2014. He noted that the impact on exports was "more significant" that he expected as Japanese manufacturers shifted their production abroad.

-

12:05

European stock markets mid session: stocks traded higher as markets remained supported by the European Central Bank President’s comments and as stability seems to return to bond markets

Stock indices traded higher as markets remained supported by the European Central Bank President's comments and as stability seems to return to bond markets. The European Central Bank (ECB) President Mario Draghi said in a speech at the International Monetary Fund in Washington on Thursday that the central bank will not stop its quantitative easing until there is "a sustained adjustment in the path of inflation".

Draghi noted that he wanted that quantitative easing to boost investment and price inflation.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 3.9% in March, after a 0.3% decline in February.

The increase was driven by a rise in non-housing repair and maintenance work, which soared 20% in March.

On a yearly basis, construction output climbed 1.6% in March.

Current figures:

Name Price Change Change %

FTSE 100 7,001.37 +28.33 +0.41 %

DAX 11,600.21 +40.39 +0.35 %

CAC 40 5,055.02 +25.71 +0.51 %

-

11:41

UK’s construction output rises 3.9% in March

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 3.9% in March, after a 0.3% decline in February.

The increase was driven by a rise in non-housing repair and maintenance work, which soared 20% in March.

On a yearly basis, construction output climbed 1.6% in March.

For the first quarter as a whole, construction output was down at an annual rate of 0.3%. It was the first annual fall since the second quarter of 2013.

-

11:17

Switzerland's producer and import prices drop 2.1% in April

The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices dropped 2.1% in April, missing expectations for a 0.1% decline, after a 0.2% rise in March.

On a yearly basis, producer and import prices plunged 5.2% in April, after a 3.4% drop in March.

The decline was driven by lower prices for machinery, electronic and optical products, metal products, electrical equipment, motor vehicles and medical equipment.

-

11:03

Bank of England Governor Mark Carney: the U.K. should hold a referendum on membership of the European Union "as soon as necessary"

The Bank of England (BoE) Governor Mark Carney said on Thursday that the U.K. should hold a referendum on membership of the European Union (EU) "as soon as necessary".

Analysts fear that businesses may delay making investments due to the uncertainty over UK's future in the EU.

Carney noted that there is no evidence yet businesses have acted on the uncertainty.

The BoE governor pointed out that Europe is important to the UK's economy.

The Conservatives have promised to hold a referendum before the end of 2017. The government in the U.K. hopes that a referendum could be held in 2016.

-

10:42

Italy’s Economy Minister Pier Carlo Padoan: the country’s economy is expected to grow stronger this year

Italy's Economy Minister Pier Carlo Padoan said on Thursday that the country's economy is expected to grow stronger this year.

Italy's economy expanded at 0.3% in the first quarter. It was the first time since the third quarter of 2013.

The Italian government expects the economy to grow 0.7% in 2015.

Padoan also said that Eurozone's countries want to reach a dealt with Greece.

-

10:41

Asia Pasific Stocks closed:

HANG SENG 27,709.78 +423.23 +1.55%

S&P/ASX 200 5,735.5 +39.00 +0.68%

TOPIX 1,607.11 +15.62 +0.98%

SHANGHAI COMP 4,330.97 -47.34 -1.08%

-

10:24

European Central Bank President Mario Draghi: the ECB will not stop its quantitative easing

The European Central Bank (ECB) President Mario Draghi said in a speech at the International Monetary Fund in Washington on Thursday that the central bank will not stop its quantitative easing until there is "a sustained adjustment in the path of inflation".

Draghi noted that he wanted that quantitative easing to boost investment and price inflation.

The ECB president pointed out that "there is little indication that generalised financial imbalances are emerging".

-

04:01

Nikkei 225 19,658.32 +88.08 +0.45 %, Hang Seng 27,385.74 +99.19 +0.36 %, Shanghai Composite 4,346.91 -31.40 -0.72 %

-

01:03

Stocks. Daily history for Apr May 14’2015:

(index / closing price / change items /% change)

Hang Seng 27,286.55 +37.27 +0.14 %

S&P/ASX 200 5,696.5 -18.58 -0.33 %

Shanghai Composite 4,378.93 +3.17 +0.07 %

FTSE 100 6,973.04 +23.41 +0.34 %

CAC 40 5,029.31 +67.45 +1.36 %

Xetra DAX 11,559.82 +208.36 +1.84 %

S&P 500 2,121.1 +22.62 +1.08 %

NASDAQ Composite 5,050.8 +69.10 +1.39 %

Dow Jones 18,252.24 +191.75 +1.06 %

-