Noticias del mercado

-

21:01

S&P 500 2,119.75 +21.27 +1.01 %, NASDAQ 5,043.84 +62.15 +1.25 %, Dow 18,236.36 +175.87 +0.97 %

-

20:56

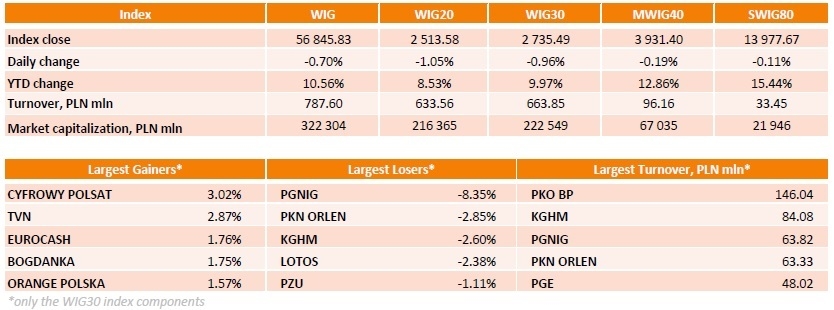

WSE: Session Results

Polish equity market continued its decline on Thursday. The broad market benchmark - the WIG index declined by 0.70%, while the large liquid companies' indicator - the WIG30 index lost 0.96%.

PGNIG (WSE: PGN) posted the largest decline (8.35%), weighted down by the announcement the company failed to achieve a price cut in six months of negotiations with Russian Gazprom and filed for arbitration with the Stockholm Arbitration Tribunal concerning a long-term supply contract. Aside from that, PKN ORLEN (WSE: PKN), KGHM (WSE: KGH) and LOTOS (WSE: LTS) also saw substantial selling pressure, losing 2.85%, 2.60% and 2.38% respectively. On the contrary, CYFROWY POLSAT (WSE: CPS) gained 3.02% and topped the list of the best performers among the WIG30 index basket's components on the back of strong quarterly results. It was followed by its peer TVN (WSE: TVN), which went up 2.87%. In addition, good first-quarter earnings report uplifted quotations of TAURON PE (WSE: TPE), up 1.04%.

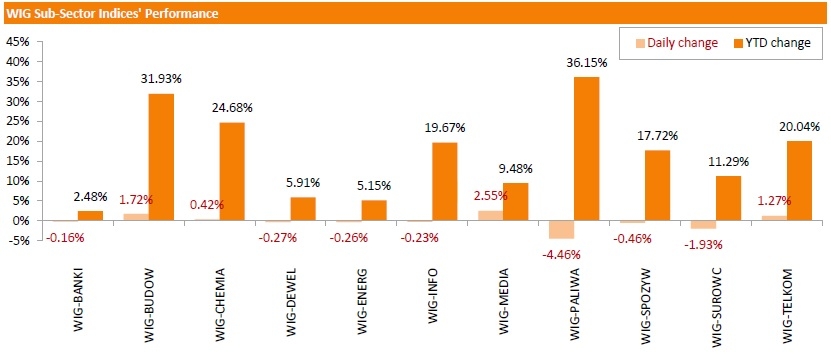

Turning to the performance of the WIG sub-sector indices, the benchmarks for the oil and gas companies (the WIG-PALIWA index) and the basic material producers (the WIG-SUROWC index) were the laggards, declining a respective 4.46% and 1.93%. At the same time, the measures for the media sector names (the WIG-MEDIA index) and the construction sector stocks (the WIG-BUDOW index) were the strongest performers, climbing up 2.55% and 1.72% respectively.

-

18:30

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday as weekly jobless claims fell and the dollar slid to its lowest in nearly four months. Initial claims for state unemployment benefits slipped by 1,000 to a seasonally adjusted 264,000 last week, while the 4-week jobless average stayed near a 15-year low. In the same time, the dollar was at its lowest since January against a basket of currencies of major U.S. trading partners.

Almost all of the Dow stocks are trading in positive area (29 of 30). Top looser - Cisco Systems, Inc. (CSCO, -0.42%) Top gainer - Microsoft Corporation (MSFT, +2.03%).

All S&P index sectors in positive area. Top gainer - Utilities (+1,5%).

At the moment:

Dow 18176.00 +161.00 +0.89%

S&P 500 2110.75 +16.25 +0.78%

Nasdaq 100 4474.75 +51.00 +1.15%

10-year yield 2.25% -0.04

Oil 59.68 -0.82 -1.36%

Gold 1222.60 +4.40 +0.36%

-

18:00

European stocks closed: FTSE 100 6,973.04 +23.41 +0.34 %, CAC 40 5,029.31 +67.45 +1.36 %, DAX 11,559.82 +208.36 +1.84 %

-

15:35

U.S. Stocks open: Dow +0.67%, Nasdaq +0.66%, S&P +0.55%

-

15:29

Before the bell: S&P futures +0.56%, NASDAQ futures +0.72%

U.S. index futures advanced, signaling the Standard & Poor's 500 Index will rise for the first time this week, as the dollar fell to a four-month low.

Global markets:

Nikkei 19,570.24 -194.48 -0.98%

Hang Seng 27,286.55 +37.27 +0.14%

Shanghai Composite 4,378.93 +3.17 +0.07%

FTSE 6,960.88 +11.25 +0.16%

CAC 4,991.14 +29.28 +0.59%

DAX 11,437.69 +86.23 +0.76%

Crude oil $60.18 (-0.53%)

Gold $1216.30 (-0.17%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

American Express Co

AXP

79.95

+0.11%

1.0K

International Paper Company

IP

52.70

+0.27%

23.2K

Exxon Mobil Corp

XOM

86.81

+0.29%

6.3K

General Electric Co

GE

27.30

+0.33%

16.1K

Chevron Corp

CVX

108.08

+0.35%

0.2K

Home Depot Inc

HD

111.58

+0.35%

5.2K

Yahoo! Inc., NASDAQ

YHOO

44.55

+0.35%

1.0K

Nike

NKE

102.54

+0.37%

0.1K

Wal-Mart Stores Inc

WMT

78.45

+0.37%

3.5K

Verizon Communications Inc

VZ

49.93

+0.40%

0.2K

Boeing Co

BA

146.25

+0.43%

1.4K

International Business Machines Co...

IBM

173.02

+0.43%

1.4K

Johnson & Johnson

JNJ

101.00

+0.45%

1.0K

UnitedHealth Group Inc

UNH

116.40

+0.47%

0.7K

Citigroup Inc., NYSE

C

54.46

+0.48%

27.4K

McDonald's Corp

MCD

97.84

+0.50%

1.1K

Pfizer Inc

PFE

33.70

+0.51%

44.8K

Intel Corp

INTC

32.81

+0.52%

1.9K

Ford Motor Co.

F

15.49

+0.52%

23.5K

General Motors Company, NYSE

GM

34.98

+0.52%

6.5K

Tesla Motors, Inc., NASDAQ

TSLA

244.47

+0.53%

2.4K

Procter & Gamble Co

PG

80.13

+0.54%

0.2K

JPMorgan Chase and Co

JPM

65.88

+0.55%

31.8K

Walt Disney Co

DIS

109.80

+0.56%

0.3K

Facebook, Inc.

FB

78.88

+0.56%

31.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.74

+0.57%

11.1K

Goldman Sachs

GS

202.59

+0.58%

2.1K

AT&T Inc

T

34.10

+0.59%

0.6K

Microsoft Corp

MSFT

47.91

+0.60%

23.1K

Caterpillar Inc

CAT

89.00

+0.63%

1.0K

Starbucks Corporation, NASDAQ

SBUX

49.90

+0.63%

1.3K

Visa

V

69.10

+0.66%

2.5K

Hewlett-Packard Co.

HPQ

33.53

+0.69%

0.1K

ALTRIA GROUP INC.

MO

51.35

+0.69%

0.2K

Merck & Co Inc

MRK

59.61

+0.73%

0.9K

Amazon.com Inc., NASDAQ

AMZN

430.00

+0.73%

1.9K

Google Inc.

GOOG

533.69

+0.77%

0.2K

Twitter, Inc., NYSE

TWTR

38.02

+0.80%

33.1K

Apple Inc.

AAPL

127.09

+0.86%

342.4K

ALCOA INC.

AA

13.76

+0.95%

0.1K

E. I. du Pont de Nemours and Co

DD

70.09

+1.10%

126.7K

Barrick Gold Corporation, NYSE

ABX

13.24

-0.08%

1.7K

Yandex N.V., NASDAQ

YNDX

19.25

-0.93%

18.7K

Cisco Systems Inc

CSCO

29.04

-1.06%

200.0K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded to Neutral from Underperform at BofA/Merrill

Downgrades:

Other:

-

14:11

Company News: Cisco Systems (CSCO) beats expectation

Company reported Q3 profit of $0.54 per share versus $0.53 consensus. Revenues rose 5.1% year/year to $12.14 bln versus $12.07 bln consensus.

CSCO fell to $29.10 (-0.85%) on the premarket.

-

10:40

Asia Pasific Stocks closed:

S&P/ASX 200 5,696.6 -18.50 -0.32%

TOPIX 1,591.49 -12.72 -0.79%

SHANGHAI COMP 4,378.93 +3.17 +0.07%

HANG SENG 27,232.52 -16.76 -0.06%

-

04:01

Nikkei 225 19,643.9 -120.82 -0.61 %, Hang Seng 27,266.13 +16.85 +0.06 %, Shanghai Composite 4,369.69 -6.07 -0.14 %

-

01:30

Stocks. Daily history for Apr May 13’2015:

(index / closing price / change items /% change)

Nikkei 225 19,764.72 +139.88 +0.71 %

Hang Seng 27,249.28 -157.90 -0.58 %

Shanghai Composite 4,376.71 -24.51 -0.56 %

FTSE 100 6,949.63 +15.83 +0.23 %

CAC 40 4,961.86 -12.79 -0.26 %

Xetra DAX 11,351.46 -120.95 -1.05 %

S&P 500 2,098.48 -0.64 -0.03 %

NASDAQ Composite 4,981.69 +5.50 +0.11 %

Dow Jones 18,060.49 -7.74 -0.04 %

-