Noticias del mercado

-

21:01

S&P 500 2,119.75 +21.27 +1.01 %, NASDAQ 5,043.84 +62.15 +1.25 %, Dow 18,236.36 +175.87 +0.97 %

-

20:56

WSE: Session Results

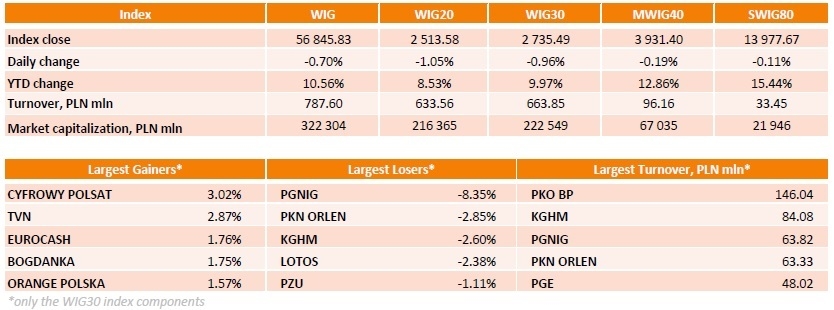

Polish equity market continued its decline on Thursday. The broad market benchmark - the WIG index declined by 0.70%, while the large liquid companies' indicator - the WIG30 index lost 0.96%.

PGNIG (WSE: PGN) posted the largest decline (8.35%), weighted down by the announcement the company failed to achieve a price cut in six months of negotiations with Russian Gazprom and filed for arbitration with the Stockholm Arbitration Tribunal concerning a long-term supply contract. Aside from that, PKN ORLEN (WSE: PKN), KGHM (WSE: KGH) and LOTOS (WSE: LTS) also saw substantial selling pressure, losing 2.85%, 2.60% and 2.38% respectively. On the contrary, CYFROWY POLSAT (WSE: CPS) gained 3.02% and topped the list of the best performers among the WIG30 index basket's components on the back of strong quarterly results. It was followed by its peer TVN (WSE: TVN), which went up 2.87%. In addition, good first-quarter earnings report uplifted quotations of TAURON PE (WSE: TPE), up 1.04%.

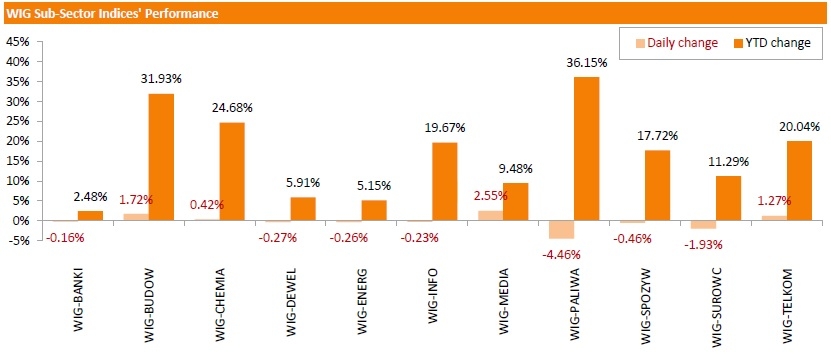

Turning to the performance of the WIG sub-sector indices, the benchmarks for the oil and gas companies (the WIG-PALIWA index) and the basic material producers (the WIG-SUROWC index) were the laggards, declining a respective 4.46% and 1.93%. At the same time, the measures for the media sector names (the WIG-MEDIA index) and the construction sector stocks (the WIG-BUDOW index) were the strongest performers, climbing up 2.55% and 1.72% respectively.

-

20:25

American focus: dollar regained lost ground

The US dollar rose against most major currencies after a decline earlier in the session. Support for US currency had data on initial applications for unemployment benefits. The number of Americans who first applied for unemployment benefits decreased last week, indicating that the labor market recovery. This was reported in the Labor Department report. The number of initial applications for unemployment benefits fell by 1,000 to a seasonally adjusted, reaching 264,000 in the week ended May 9th. Economists had expected 275,000 new claims. We also add the figure for the previous week has not been revised. Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly data, fell by 7750 - up to 271,750 (the lowest value since April 2000). Meanwhile, the number of people who continue to receive unemployment benefits has not changed and amounted to 2.229 million. For the week ended April 18. Recall data on re-treatment come with a week delay.

In addition, the prices of US manufacturers decreased by the end of last month, a sign of stable low inflation in the economy. The Labor Department said the seasonally adjusted producer price index fell in April by 0.4%, offsetting an increase of 0.2% in the previous month. The main index, which excludes prices of food and energy, also fell 0.2%. Excluding food, energy, and trade services, producer price index rose 0.1%. Economists had expected an overall increase of 0.2%, while the main index - 0.1%. Compared to April last, producer prices fell by 1.3% and the core index rose by 0.8%. Recall, the producer price index, as well as most of the indicators of inflation, declining fairly steadily since the middle of last year. The drop mainly reflects cheaper oil, the cost of which exceeded $ 100 in the summer, but then fell below $ 50 earlier this year. Now oil is trading near $ 60. The report also reported that producer prices of energy decreased by 2.9% compared to March and by 24% per annum. Gasoline prices fell 4.7% last month, while the cost of food fell by 0.9% in monthly terms and by 4.2% per annum. Also, the data showed that the price index for intermediate demand, which tracks the cost of commodities used as raw materials for production, fell by 1.1% in April, recording the ninth monthly decline in a row. Compared to the previous year index decreased by 7.8% (maximum rate in September 2009).

The pound rose against the dollar earlier, approaching at the same time to a maximum of 27 November. Experts note that the pound managed to survive the dovish tone of the Quarterly inflation report the Bank of England, published yesterday, and now records the growth for the second week in a row. Investors pay attention to the statements of the Bank of England manager Mark Carney. Asked in an interview with BBC radio about changing the record low interest rates by this time next year, Carney said: "It's possible, but it depends on the evolution of the economy. We're not going to raise interest rates too early or too fast and slow down the economy" . Also, Carney said that the low productivity in the UK - one of the consequences of the financial crisis - will gradually rise. CB Chairman noted that the British economy will continue to be faced with "headwinds" from the weak global economic growth, the fiscal policy of the government and the strengthening of the pound sterling.

-

18:30

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday as weekly jobless claims fell and the dollar slid to its lowest in nearly four months. Initial claims for state unemployment benefits slipped by 1,000 to a seasonally adjusted 264,000 last week, while the 4-week jobless average stayed near a 15-year low. In the same time, the dollar was at its lowest since January against a basket of currencies of major U.S. trading partners.

Almost all of the Dow stocks are trading in positive area (29 of 30). Top looser - Cisco Systems, Inc. (CSCO, -0.42%) Top gainer - Microsoft Corporation (MSFT, +2.03%).

All S&P index sectors in positive area. Top gainer - Utilities (+1,5%).

At the moment:

Dow 18176.00 +161.00 +0.89%

S&P 500 2110.75 +16.25 +0.78%

Nasdaq 100 4474.75 +51.00 +1.15%

10-year yield 2.25% -0.04

Oil 59.68 -0.82 -1.36%

Gold 1222.60 +4.40 +0.36%

-

18:00

European stocks closed: FTSE 100 6,973.04 +23.41 +0.34 %, CAC 40 5,029.31 +67.45 +1.36 %, DAX 11,559.82 +208.36 +1.84 %

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E499mn), $1.1350(E225mn), $1.1400-10(E640mn), $1.1440-50(E650mn), $1.1500(E577mn)

USD/JPY: Y118.85($419mn), Y119.00($472mn), Y119.10($650mn), Y119.50($600mn), Y120.00($2.4bn)

GBP/USD: $1.5570(Gbp203mn)

EUR/GBP: Gbp0.7255(E200mn), Gbp0.7290(E405mn)

AUD/USD: $0.8030(A$200mn), $0.8075(A$217mn)

NZD/USD: $0.7600(NZ$267mn)

-

15:35

U.S. Stocks open: Dow +0.67%, Nasdaq +0.66%, S&P +0.55%

-

15:29

Before the bell: S&P futures +0.56%, NASDAQ futures +0.72%

U.S. index futures advanced, signaling the Standard & Poor's 500 Index will rise for the first time this week, as the dollar fell to a four-month low.

Global markets:

Nikkei 19,570.24 -194.48 -0.98%

Hang Seng 27,286.55 +37.27 +0.14%

Shanghai Composite 4,378.93 +3.17 +0.07%

FTSE 6,960.88 +11.25 +0.16%

CAC 4,991.14 +29.28 +0.59%

DAX 11,437.69 +86.23 +0.76%

Crude oil $60.18 (-0.53%)

Gold $1216.30 (-0.17%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

American Express Co

AXP

79.95

+0.11%

1.0K

International Paper Company

IP

52.70

+0.27%

23.2K

Exxon Mobil Corp

XOM

86.81

+0.29%

6.3K

General Electric Co

GE

27.30

+0.33%

16.1K

Chevron Corp

CVX

108.08

+0.35%

0.2K

Home Depot Inc

HD

111.58

+0.35%

5.2K

Yahoo! Inc., NASDAQ

YHOO

44.55

+0.35%

1.0K

Nike

NKE

102.54

+0.37%

0.1K

Wal-Mart Stores Inc

WMT

78.45

+0.37%

3.5K

Verizon Communications Inc

VZ

49.93

+0.40%

0.2K

Boeing Co

BA

146.25

+0.43%

1.4K

International Business Machines Co...

IBM

173.02

+0.43%

1.4K

Johnson & Johnson

JNJ

101.00

+0.45%

1.0K

UnitedHealth Group Inc

UNH

116.40

+0.47%

0.7K

Citigroup Inc., NYSE

C

54.46

+0.48%

27.4K

McDonald's Corp

MCD

97.84

+0.50%

1.1K

Pfizer Inc

PFE

33.70

+0.51%

44.8K

Intel Corp

INTC

32.81

+0.52%

1.9K

Ford Motor Co.

F

15.49

+0.52%

23.5K

General Motors Company, NYSE

GM

34.98

+0.52%

6.5K

Tesla Motors, Inc., NASDAQ

TSLA

244.47

+0.53%

2.4K

Procter & Gamble Co

PG

80.13

+0.54%

0.2K

JPMorgan Chase and Co

JPM

65.88

+0.55%

31.8K

Walt Disney Co

DIS

109.80

+0.56%

0.3K

Facebook, Inc.

FB

78.88

+0.56%

31.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.74

+0.57%

11.1K

Goldman Sachs

GS

202.59

+0.58%

2.1K

AT&T Inc

T

34.10

+0.59%

0.6K

Microsoft Corp

MSFT

47.91

+0.60%

23.1K

Caterpillar Inc

CAT

89.00

+0.63%

1.0K

Starbucks Corporation, NASDAQ

SBUX

49.90

+0.63%

1.3K

Visa

V

69.10

+0.66%

2.5K

Hewlett-Packard Co.

HPQ

33.53

+0.69%

0.1K

ALTRIA GROUP INC.

MO

51.35

+0.69%

0.2K

Merck & Co Inc

MRK

59.61

+0.73%

0.9K

Amazon.com Inc., NASDAQ

AMZN

430.00

+0.73%

1.9K

Google Inc.

GOOG

533.69

+0.77%

0.2K

Twitter, Inc., NYSE

TWTR

38.02

+0.80%

33.1K

Apple Inc.

AAPL

127.09

+0.86%

342.4K

ALCOA INC.

AA

13.76

+0.95%

0.1K

E. I. du Pont de Nemours and Co

DD

70.09

+1.10%

126.7K

Barrick Gold Corporation, NYSE

ABX

13.24

-0.08%

1.7K

Yandex N.V., NASDAQ

YNDX

19.25

-0.93%

18.7K

Cisco Systems Inc

CSCO

29.04

-1.06%

200.0K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded to Neutral from Underperform at BofA/Merrill

Downgrades:

Other:

-

14:30

U.S.: PPI excluding food and energy, Y/Y, April 0.8% (forecast 1.1%)

-

14:30

U.S.: Initial Jobless Claims, May 264 (forecast 275)

-

14:30

Canada: New Housing Price Index, MoM, March 0% (forecast 0.1%)

-

14:30

U.S.: PPI excluding food and energy, m/m, April -0.2% (forecast 0.1%)

-

14:30

U.S.: Continuing Jobless Claims, 2229 (forecast 2240)

-

14:30

U.S.: PPI, m/m, April -0.4% (forecast 0.2%)

-

14:30

U.S.: PPI, y/y, April -1.3% (forecast -0.8%)

-

14:11

Company News: Cisco Systems (CSCO) beats expectation

Company reported Q3 profit of $0.54 per share versus $0.53 consensus. Revenues rose 5.1% year/year to $12.14 bln versus $12.07 bln consensus.

CSCO fell to $29.10 (-0.85%) on the premarket.

-

14:00

Orders

EUR/USD

Offers 1.1435 1.1450 1.1470 1.1485 1.1500 1.1550

Bids 1.1385 1.1360 1.1340 1.1300 1.1280 1.1250

GBP/USD

Offers 1.5800 1.5830 1.5850 1.5870 1.5885 1.5900

Bids 1.5750 1.5730 1.5700 1.5680 1.5655-60 1.5630 1.5600

EUR/GBP

Offers 0.7255-60 0.7280 0.7300

Bids 0.7200 0.7150 0.7130 0.7100 0.7085 0.7060

EUR/JPY

Offers 136.50 136.80 137.00 137.50

Bids 135.50 135.25 135.00 134.60 134.40 134.20 134.00

USD/JPY

Offers 119.30 119.60 119.80 120.00 120.25-30 120.50

Bids 118.85 118.65 118.50 118.35 118.00

AUD/USD

Offers 0.8100 0.8125 0.8150 0.8165 0.8180 0.8200

Bids 0.8060 0.8040 0.8025 0.8000 0.7985 0.7960 0.7930 0.7900-10

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E499mn), $1.1350(E225mn), $1.1400-10(E640mn), $1.1440-50(E650mn), $1.1500(E577mn)

USD/JPY: Y118.85($419mn), Y119.00($472mn), Y119.10($650mn), Y119.50($600mn), Y120.00($2.4bn)

GBP/USD: $1.5570(Gbp203mn)

EUR/GBP: Gbp0.7255(E200mn), Gbp0.7290(E405mn)

AUD/USD: $0.8030(A$200mn), $0.8075(A$217mn)

NZD/USD: $0.7600(NZ$267mn)

-

10:40

Asia Pasific Stocks closed:

S&P/ASX 200 5,696.6 -18.50 -0.32%

TOPIX 1,591.49 -12.72 -0.79%

SHANGHAI COMP 4,378.93 +3.17 +0.07%

HANG SENG 27,232.52 -16.76 -0.06%

-

08:31

Japan: Prelim Machine Tool Orders, y/y , April 10.4%

-

08:27

Options levels on thursday, May 14, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1465 (4962)

$1.1430 (4491)

$1.1405 (3099)

Price at time of writing this review: $1.1382

Support levels (open interest**, contracts):

$1.1294 (1553)

$1.1254 (1023)

$1.1200 (4627)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 102555 contracts, with the maximum number of contracts with strike price $1,1500 (6249);

- Overall open interest on the PUT options with the expiration date June, 5 is 120327 contracts, with the maximum number of contracts with strike price $1,0800 (7594);

- The ratio of PUT/CALL was 1.17 versus 1.20 from the previous trading day according to data from May, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.6004 (1188)

$1.5907 (1326)

$1.5811 (1244)

Price at time of writing this review: $1.5754

Support levels (open interest**, contracts):

$1.5689 (336)

$1.5592 (905)

$1.5495 (1833)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34379 contracts, with the maximum number of contracts with strike price $1,5700 (2620);

- Overall open interest on the PUT options with the expiration date June, 5 is 48337 contracts, with the maximum number of contracts with strike price $1,5000 (3316);

- The ratio of PUT/CALL was 1.41 versus 1.39 from the previous trading day according to data from May, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

The dollar was almost flat against the yen and the euro in directionless Asia trade Thursday, with disappointing U.S. retail sales data overnight keeping a lid on any strong gains in the greenback. But the U.S. currency's downside was well supported from dip buying from Japanese corporate investors.

The New Zealand dollar was sharply higher after getting an overnight lift from a weaker U.S. dollar and after strong domestic retail sales numbers. It got another good boost from New Zealand's first-quarter retail sales data, he said. Retail spending beat expectations to rise strongly in the first quarter, driven by a sharp increase in sales of electrical and electronic goods retailing. The volume of real retail sales in the first quarter rose 2.7% from the prior quarter. When the effect of price changes is included, adjusted retail sales rose 1.7% in the first quarter, according to Statistics New Zealand on Thursday. The median forecasts in a Wall Street Journal poll of 10 economists was for rises of 1.6% and 1.0%, respectively.

EUR / USD: during the Asian session the pair rose to $ 1.1375

GBP / USD: during the Asian session, the pair was trading in the $ 1.5725-55

USD / JPY: during the Asian session the pair traded in the range Y119.10-35

-

04:01

Nikkei 225 19,643.9 -120.82 -0.61 %, Hang Seng 27,266.13 +16.85 +0.06 %, Shanghai Composite 4,369.69 -6.07 -0.14 %

-

01:34

Commodities. Daily history for May 13’2015:

(raw materials / closing price /% change)

Oil 60.50 -0.41%

Gold 1,214.60 -0.30%

-

01:30

Stocks. Daily history for Apr May 13’2015:

(index / closing price / change items /% change)

Nikkei 225 19,764.72 +139.88 +0.71 %

Hang Seng 27,249.28 -157.90 -0.58 %

Shanghai Composite 4,376.71 -24.51 -0.56 %

FTSE 100 6,949.63 +15.83 +0.23 %

CAC 40 4,961.86 -12.79 -0.26 %

Xetra DAX 11,351.46 -120.95 -1.05 %

S&P 500 2,098.48 -0.64 -0.03 %

NASDAQ Composite 4,981.69 +5.50 +0.11 %

Dow Jones 18,060.49 -7.74 -0.04 %

-

01:28

Currencies. Daily history for May 13’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1349 +1,13%

GBP/USD $1,5738 +0,44%

USD/CHF Chf0,9171 -1,24%

USD/JPY Y119,17 -0,55%

EUR/JPY Y135,25 +0,58%

GBP/JPY Y187,54 -0,11%

AUD/USD $0,8102 +1,46%

NZD/USD $0,7492 +1,13%

USD/CAD C$1,1957 -0,37%

-

00:46

New Zealand: Retail Sales YoY, Quarter I 5.1% (forecast 4.9%)

-

00:45

New Zealand: Retail Sales, q/q, Quarter I 2.7% (forecast 1.5%)

-

00:32

New Zealand: Business NZ PMI, April 51.8

-

00:00

Schedule for today, Thursday, May 14’2015:

(time / country / index / period / previous value / forecast)

06:00 France Bank holiday

06:00 Germany Bank Holiday

06:00 Japan Prelim Machine Tool Orders, y/y April 14.6%

06:00 Switzerland Bank holiday

12:30 Canada New Housing Price Index, MoM March 0.2% 0.1%

12:30 U.S. PPI, y/y April -0.8% -0.8%

12:30 U.S. PPI excluding food and energy, Y/Y April 0.9% 1.1%

12:30 U.S. Initial Jobless Claims May 265 275

12:30 U.S. Continuing Jobless Claims 2228 2240

12:30 U.S. PPI, m/m April 0.2% 0.2%

12:30 U.S. PPI excluding food and energy, m/m April 0.2% 0.1%

14:30 Canada Bank of Canada Review

-