Noticias del mercado

-

21:00

S&P 500 2,098.32 -0.80 -0.04 %, NASDAQ 4,981.98 +5.79 +0.12 %, Dow 18,052.82 -15.41 -0.09 %

-

20:54

WSE: Session Results

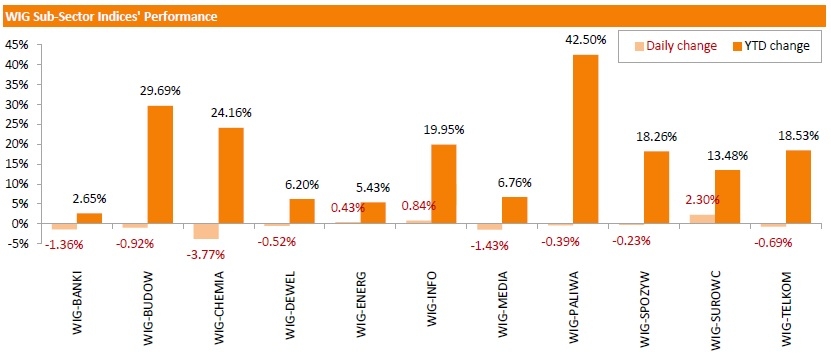

Polish equity market was modestly lower on Wednesday, with the broad market measure - the WIG index losing 0.10%. At the same time, the large liquid companies' indicator - the WIG30 index ended today's session unchanged.

Despite reported good first-quarter earnings report, GRUPA AZOTY (WSE: ATT) fared the worst among the WIG30 index components, decreasing 6.62%. The quotations of PKO BP (WSE: PKO) also fell sharply (-5.16%), weighted down by reported 19% YoY reduction in its bottom-line in 1Q15. On the plus side, LPP (WSE: LPP) became the strongest performer, climbing up 6.80% on the MSCI's decision to increase the stock weight in the MSCI Poland index. It was followed by JSW (WSE: JSW), which gained 6.54% as the company's quarterly results revealed its EBITDA reverted to positive territory in 1Q15.

The performance of the WIG sub-sector indices was mixed. The benchmark for the basic material producers - the WIG-SUROWC (+2.30%) index was the strongest performer, while the measure for the chemical industry stocks - the WIG-CHEMIA (-3.77%) index was the laggard.

-

20:21

American focus: Dollar on track for worst day in a week after disappointing data

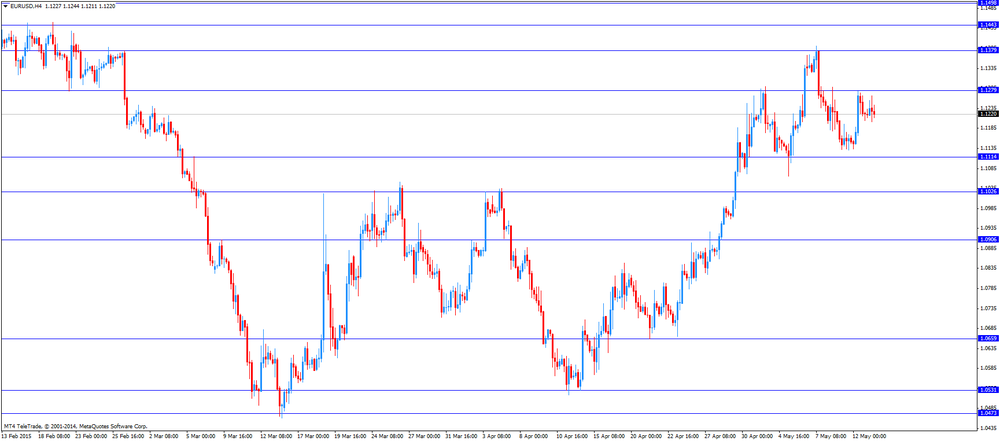

Dollar is down 1.1% against euro, on track for its largest one-day drop since March 6

The dollar was having its worst day in two weeks Wednesday, as several disappointing reports on the U.S. economy prompted investors to rethink the timing of the Federal Reserve's first interest-rate increase since 2006.

The dollar was down more than 1.1% against the euro after the data. On March 6, the dollar finished 1.2% lower against the shared currency.

Economists and analysts had expected retail sales to rebound in April after three months of declines. Instead, spending was flat, with sales excluding automobile sales increasing by a paltry 0.1%, according to the Commerce Department falling short of the consensus forecast of 0.4% from a MarketWatch survey of economists.

Prices of goods exported from the U.S. dropped 0.7% in April, missing a consensus estimate for a 0.2% and 0.3% decline.

The dollar continued to weaken after the Commerce Department announced that March business inventories rose by 0.1%, lower than the 0.2% increase that economists had expected.

Omer Esiner, chief market analyst at Commonwealth Foreign Exchange, said that the retail-sales number -- which was today's marquee data release -- was a "big disappointment," providing more evidence that the widely anticipated spring rebound for the U.S. economy has been "very lackluster."

"This is the type of number that's going to remove the possibility of a Fed rate hike in June, and it raises further doubts about the likelihood of a July or September move by the Federal Reserve," Esiner said.

The timing of the Federal Reserve's first interest-rate increase since 2006 continues to be the most significant factor driving trading in the foreign-exchange market, Esiner said. The Fed has repeatedly promised to be "data dependent" when determining the timing of the first rate increase, and any data that could give policy makers cause to delay a hike would likely weigh on the dollar.

Higher interest rates would increase the return on dollar-denominated deposits and support the currency by attracting more flows from foreign investors.

The buck retreated Tuesday after two sessions of moderate gains. The U.S. currency depreciated against the euro for a fourth consecutive week last Friday, and is down nearly 1% against the euro so far this week.

The dollar has depreciated more than 8% against the shared currency since it reached a more than 12-year high in mid- March.

-

18:47

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed in choppy trading as tepid economic data and a renewed selloff in the bond market more than offset a flurry of corporate deals on Wednesday. Import prices fell in April, weekly applications for home mortgages were down and U.S. business inventories barely rose in March. U.S. retail sales were unchanged in April as households cut back on purchases of automobiles and other big-ticket items.

Most of the Dow stocks are trading in positive area (17 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -7.12%). Top gainer - Microsoft Corporation (MSFT, +1.18%).

S&P index sectors mixed. Top gainer - Industrial goods (+0,5%). Top looser - Utilities (-0.8%).

At the moment:

Dow 18013.00 -16.00 -0.09%

S&P 500 2095.00 0.00 0.00%

Nasdaq 100 4426.25 +5.50 +0.12%

10-year yield 2.27% +0.01

Oil 61.21 +0.46 +0.76%

Gold 1215.80 +23.40 +1.96%

-

18:14

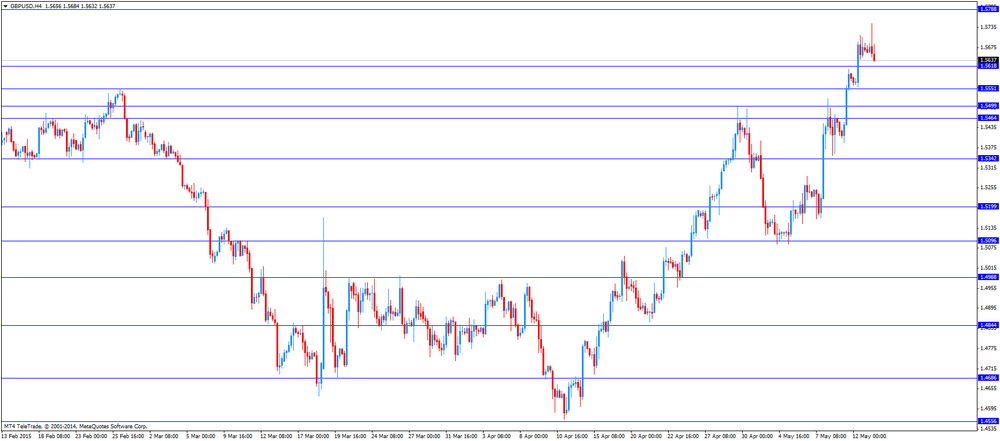

Bank of England lowers its economic growth forecasts

The Bank of England (BoE) released its Inflation Letter. The BoE lowered its economic growth forecasts. The forecast for gross domestic product (GDP) growth in 2015 was cut to 2.4%, down from 2.9% three months ago. The GDP growth forecasts for 2016 and 2017 were lowered to 2.6% and 2.4% respectively.

The BoE expects inflation to decline below zero in the coming months and to return to the BoE's 2% target within two years.

The central bank also downgraded its expectations for wage growth in 2015 to 2.5% from 3.5%.

Wage growth is a key determination in the timing of first interest rate hike by the BoE.

Britain's central bank is worried about productivity growth in the U.K.

-

18:08

European stocks close: most stocks closed lower on a stronger euro

Most stock indices closed lower on a stronger euro. The euro rose against the U.S. dollar after the U.S. retail sales. The U.S. retail sales were flat in April, missing expectations for a 0.2% increase, after a 1.1% gain in March. March's figure was revised up from a 0.9% increase.

The reading was driven by lower automobiles and gasoline purchases. Automobiles sales decreased 0.4% in April, while gasoline station sales decreased 0.7%.

Retail sales excluding automobiles increased 0.1% in April, missing forecasts for a 0.5% rise, after a 0.7% gain in March. March's figure was revised up from a 0.4% rise.

These figures are adding to concerns that U.S. economy is losing momentum, and the Fed might delay its first interest rate hike.

Eurozone's preliminary gross domestic product (GDP) increased by 0.4% in the first quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.0% in the first quarter, missing expectations for a 1.1% increase, after a 0.9% gain in the fourth quarter.

Industrial production in the Eurozone fell 0.3% in March, missing expectations for a flat reading, after a 1.0% rise in February. February's figure was revised down from a 1.1% increase.

The decline was driven by a drop in production of energy, which fell 1.7% in March.

On a yearly basis, Eurozone's industrial production gained 1.8% in March, in line with expectations, after a 1.9% increase in February. February's figure was revised up from a 1.6 gain.

The increase was driven by a rise in non-durable consumer goods and in production of energy.

The Greek debt problem still weighs on markets. Greece yesterday repaid €750 million in loans to the International Monetary Fund (IMF).

According to Reuters, the Greek government used emergency reserves in its holding account with the IMF to repay loans.

The Bank of England (BoE) released its Inflation Letter. The BoE lowered its economic growth forecasts. The forecast for gross domestic product (GDP) growth in 2015 was cut to 2.4%, down from 2.9% three months ago. The GDP growth forecasts for 2016 and 2017 were lowered to 2.6% and 2.4% respectively.

The BoE Governor Mark Carney said that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.5% in the January to March quarter from 5.7% in the October to December quarter, in line with expectations.

It was the lowest level since 2008.

The claimant count decreased by 12,600 people in April, missing expectations for a drop by 20,000, after a decrease of 16,700 people in March. It was the smallest monthly decline since March 2013.

March's figure was revised down from a decline of 20,700.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the January to March quarter, exceeding expectations for a rise by 2.1%, after a 1.9% gain in the October to December quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the January to March quarter, exceeding expectations for a gain of 1.7%, after a 1.7% increase in the October to December quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,949.63 +15.83 +0.23 %

DAX 11,351.46 -120.95 -1.05 %

CAC 40 4,961.86 -12.79 -0.26 %

-

18:00

European stocks closed: FTSE 100 6,941.95 +8.15 +0.1 %, CAC 40 4,954.59 -20.06 -0.4 %, DAX 11,339.5 -132.91 -1.2 %

-

17:42

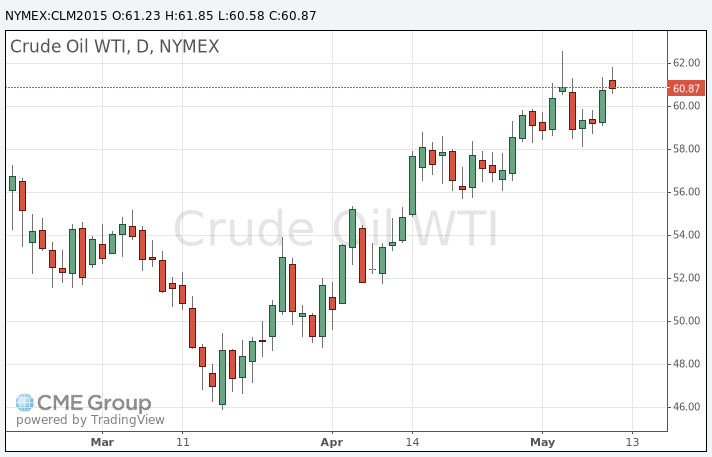

Oil prices traded slightly higher after the release of U.S. crude oil inventories

Oil prices traded slightly higher after the release of U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 2.2 million barrels to 484.08 million in the week to May 8. Analysts had expected a decline of 125,000 barrels.

Gasoline inventories were down by 1.1 million barrels last week, according to the EIA.

U.S. oil production climbed by 5,000 barrels a day to 9.37 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 990,000 barrels to 60.7 million barrels.

U.S. crude oil imports rose by 340,000 barrels per day to 6.9 million barrels per day.

Refineries in the U.S. were running at 91.2% of capacity.

The International Energy Agency (IEA) released its monthly oil market report. The agency said that global oil supply remained unchanged at 95.7 million barrels per day in April. But the IEA upgraded its forecast for non-OPEC production growth to 830,000 barrels per day of additional supply this year, up 200,000 barrels per day.

A global oil glut is growing as Saudi Arabia increased its oil production, the IEA noted.

WTI crude oil for June delivery rose to $60.58 a barrel on the New York Mercantile Exchange. Brent crude oil for June increased to $67.55 a barrel on ICE Futures Europe.

-

17:24

Gold price traded higher as the U.S. dollar declined after the weaker-than-expected U.S. retail sales

Gold price traded higher as the U.S. dollar declined after the weaker-than-expected U.S. retail sales. The U.S. retail sales were flat in April, missing expectations for a 0.2% increase, after a 1.1% gain in March. March's figure was revised up from a 0.9% increase.

The reading was driven by lower automobiles and gasoline purchases. Automobiles sales decreased 0.4% in April, while gasoline station sales decreased 0.7%.

Retail sales excluding automobiles increased 0.1% in April, missing forecasts for a 0.5% rise, after a 0.7% gain in March. March's figure was revised up from a 0.4% rise.

These figures are adding to concerns that U.S. economy is losing momentum, and the Fed might delay its first interest rate hike.

A selloff in global government bonds also supported gold price.

June futures for gold on the COMEX today rose to 1218.10 dollars per ounce.

-

16:53

Bank of England Governor Mark Carney: consumer price inflation could turn negative, but it is expected to rise towards the end of the year

The Bank of England Governor (BoE) Mark Carney said in a speech on Wednesday that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year. He noted that low inflation was driven by falling energy prices, lower food prices and strong pound.

The consumer price inflation was 0% in March, below the central bank's 2% target.

Carney pointed out that he was not worried about low inflation. "A temporary period of falling prices should not be mistaken for widespread and persistent deflation," he said. The BoE governor added that he expects inflation to return to the BoE's 2% target within two years.

"The most important legacies of the financial crisis are the persistent headwinds which continue to weigh on the U.K. economy," Carney also said. He added that it will need more gradual rises in interest rates than in previous cycles.

The BoE governor noted that interest rates will have to remain low due to weaker global demand and tighter fiscal policy.

-

16:32

U.S. business inventories rise 0.1% in March

The U.S. Commerce Department released the business inventories data on Wednesday. The U.S. business inventories rose 0.1% in March, beating expectations for a 0.2% increase, after a 0.2% gain in February. February's figure was revised up from a 0.3% rise.

The increase was driven by a rise in retail inventories. Retail inventories climbed 0.3% in March.

Business sales climbed 0.4% in March, after a 0.2% fall in February.

The business inventories/sales ratio fell to 1.36 months in March from 1.37 months in February. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:30

U.S.: Crude Oil Inventories, May -2.191 (forecast -0.125)

-

16:01

U.S. import price index declines 0.3% in April

The U.S. Labor Department released its import and export prices data on Wednesday. The U.S. import price index dropped by 0.3% in April, missing expectations for a 0.3% increase, after a 0.2% decline in March.

March's figure was revised up from a 0.3% decrease.

The decline was driven by a fall in prices for non-fuel imports. Non-fuel imports prices decreased 0.4% in April. It was the second consecutive decline.

A stronger U.S. currency lowers the price of imported goods.

Fuel import prices climbed 0.7% in April.

U.S. export prices plunged by 0.7% in April, after a 0.1% rise in March.

-

16:00

U.S.: Business inventories , March 0.1% (forecast 0.2%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1145(E1.6bn), $1.1205(E589mn), $1.1260(E431mn), $1.1300(E267mn)

USD/JPY: Y119.50($350mn), Y120.50($280mn)

AUD/USD: $0.8000(A$670mn)

NZD/USD: $0.7350(NZ$265mn), $0.7375(NZ$290mn), 0.7425(NZ$279mn)

USD/CAD: C$1.2200($355mn)

-

15:42

U.S. retail sales are flat in April

The U.S. Commerce Department released the retail sales data on Wednesday. The U.S. retail sales were flat in April, missing expectations for a 0.2% increase, after a 1.1% gain in March. March's figure was revised up from a 0.9% increase.

The reading was driven by lower automobiles and gasoline purchases. Automobiles sales decreased 0.4% in April, while gasoline station sales decreased 0.7%.

Retail sales excluding automobiles increased 0.1% in April, missing forecasts for a 0.5% rise, after a 0.7% gain in March. March's figure was revised up from a 0.4% rise.

Sales at clothing retailers climbed 0.2%. Sales at building material and garden equipment stores were up 0.3% and sales at restaurants and bars increased 0.7%.

Sales at electronics and appliance outlets were down 0.4% in April, whiles sales at online stores gained 0.8%.

These figures are adding to concerns that U.S. economy is losing momentum, and the Fed might delay its first interest rate hike.

-

15:33

U.S. Stocks open: Dow -0.04%, Nasdaq +0.46%, S&P +0.30%

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Verizon Communications Inc

VZ

49.65

+0.06%

1.5K

Johnson & Johnson

JNJ

100.56

+0.09%

1.2K

Citigroup Inc., NYSE

C

53.79

+0.09%

8.7K

Goldman Sachs

GS

200.75

+0.11%

1.6K

JPMorgan Chase and Co

JPM

65.45

+0.14%

2.0K

Pfizer Inc

PFE

33.83

+0.15%

23.9K

Boeing Co

BA

145.70

+0.19%

1.0K

General Electric Co

GE

27.09

+0.22%

10.7K

Apple Inc.

AAPL

126.15

+0.23%

208.4K

Ford Motor Co.

F

15.60

+0.26%

74.4K

AT&T Inc

T

33.75

+0.27%

8.6K

Intel Corp

INTC

32.34

+0.28%

0.2K

Home Depot Inc

HD

112.85

+0.29%

2.8K

ALCOA INC.

AA

13.59

+0.30%

11.7K

UnitedHealth Group Inc

UNH

114.99

+0.31%

0.4K

ALTRIA GROUP INC.

MO

51.31

+0.31%

4.7K

Nike

NKE

102.70

+0.32%

1.8K

The Coca-Cola Co

KO

40.83

+0.34%

2.3K

Google Inc.

GOOG

531.00

+0.37%

0.8K

Cisco Systems Inc

CSCO

29.34

+0.38%

29.2K

Amazon.com Inc., NASDAQ

AMZN

432.72

+0.39%

0.3K

Caterpillar Inc

CAT

88.55

+0.44%

1.0K

Facebook, Inc.

FB

77.81

+0.45%

106.5K

McDonald's Corp

MCD

98.40

+0.46%

1.1K

General Motors Company, NYSE

GM

34.90

+0.46%

21.8K

Yahoo! Inc., NASDAQ

YHOO

44.05

+0.48%

9.3K

Starbucks Corporation, NASDAQ

SBUX

49.96

+0.50%

0.4K

International Business Machines Co...

IBM

171.45

+0.53%

0.9K

Twitter, Inc., NYSE

TWTR

37.68

+0.53%

60.0K

Chevron Corp

CVX

108.15

+0.55%

1.2K

Exxon Mobil Corp

XOM

87.53

+0.59%

3.8K

Procter & Gamble Co

PG

80.43

+0.60%

1.2K

Walt Disney Co

DIS

110.00

+0.70%

1.6K

Tesla Motors, Inc., NASDAQ

TSLA

247.00

+0.92%

202.1K

Microsoft Corp

MSFT

47.94

+1.25%

198.1K

American Express Co

AXP

80.10

+1.29%

0.9K

Barrick Gold Corporation, NYSE

ABX

13.00

+1.33%

37.2K

Yandex N.V., NASDAQ

YNDX

19.50

+1.56%

14.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

22.73

0.00%

0.4K

AMERICAN INTERNATIONAL GROUP

AIG

58.74

-0.03%

4.6K

E. I. du Pont de Nemours and Co

DD

71.04

-4.46%

1.9K

-

15:07

Upgrades and downgrades before the market open

Upgrades:

Microsoft (MSFT) upgraded to Buy from Hold at Deutsche Bank, target raised to $55 from $44

Downgrades:

Other:

-

14:44

German economy grows 0.3% in the first quarter

Destatis released its gross domestic product (GDP) growth for Germany on Wednesday. Germany's preliminary GDP gained by 0.3% in the first quarter, missing expectations for a 0.5% rise, after a 0.7% increase in the fourth quarter.

The weak growth was driven by lower exports. Exports increased more slowly than imports.

Consumers remained the key driver of growth.

On a yearly basis, Germany's GDP declined to 1.1% in the first quarter from 1.6% in the fourth quarter, missing expectations for a fall to 1.2%. It was the slowest growth since the second quarter of 2014.

-

14:30

U.S.: Retail sales, April 0.0% (forecast 0.2%)

-

14:30

U.S.: Import Price Index, April -0.3% (forecast 0.3%)

-

14:30

U.S.: Retail sales excluding auto, May 0.1% (forecast 0.5%)

-

14:23

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the Bank of England’s Inflation Letter

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Wage Price Index, y/y Quarter I 2.5% 2.4% 2.3%

01:30 Australia Wage Price Index, q/q Quarter I 0.6% 0.6% 0.5%

05:00 Japan Eco Watchers Survey: Outlook March 53.2 54.2

05:00 Japan Eco Watchers Survey: Current April 52.2 52.1 53.6

05:30 China Industrial Production y/y April 5.6% 6.0% 5.9%

05:30 China Retail Sales y/y April 10.2% 10.5% 10.0%

05:30 China Fixed Asset Investment March 13.5% 13.5% 12.0%

05:30 France GDP, q/q (Preliminary) Quarter I 0.0% Revised From 0.1% 0.4% 0.6%

05:30 France GDP, Y/Y (Preliminary) Quarter I 0.2% 0.7%

06:00 Germany CPI, m/m (Finally) April -0.1% Revised From 0.5% -0.1% 0.0%

06:00 Germany CPI, y/y (Finally) April 0.3% 0.4% 0.5%

06:00 Germany GDP (YoY) (Preliminary) Quarter I 1.6% 1.2% 1.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter I 0.7% 0.5% 0.3%

06:45 France CPI, m/m April 0.7% 0.2% 0.1%

06:45 France CPI, y/y April -0.1% 0.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y March 1.9% Revised From 1.8% 2.1% 2.2%

08:30 United Kingdom Average Earnings, 3m/y March 1.7% 1.7% 1.9%

08:30 United Kingdom Claimant count April -16.7 Revised From -20.7 -20.0 -12.6

08:30 United Kingdom ILO Unemployment Rate March 5.6% 5.5% 5.5%

09:00 Eurozone Industrial Production (YoY) March 1.9% Revised From 1.6% 1.8% 1.8%

09:00 Eurozone Industrial production, (MoM) March 1.0% Revised From 1.1% 0.0% -0.3%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter I 0.3% 0.5% 0.4%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter I 0.9% 1.1% 1.0%

09:30 United Kingdom BOE Inflation Letter

09:30 United Kingdom BOE Gov Mark Carney Speaks

11:00 U.S. MBA Mortgage Applications May -4.6% -3.5%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. retail sales data. The U.S. retail sales are expected to rise 0.2% in April, after a 0.9% gain in March.

Retail sales excluding automobiles are expected to climb 0.5% in April, after a 0.4% increase in March.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. Eurozone's preliminary gross domestic product (GDP) increased by 0.4% in the first quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.0% in the first quarter, missing expectations for a 1.1% increase, after a 0.9% gain in the fourth quarter.

Industrial production in the Eurozone fell 0.3% in March, missing expectations for a flat reading, after a 1.0% rise in February. February's figure was revised down from a 1.1% increase.

The decline was driven by a drop in production of energy, which fell 1.7% in March.

On a yearly basis, Eurozone's industrial production gained 1.8% in March, in line with expectations, after a 1.9% increase in February. February's figure was revised up from a 1.6 gain.

The increase was driven by a rise in non-durable consumer goods and in production of energy.

Germany's preliminary GDP gained by 0.3% in the first quarter, missing expectations for a 0.5% rise, after a 0.7% increase in the fourth quarter. The weak growth was driven by lower exports.

France's preliminary GDP increased by 0.6% in the first quarter, beating forecasts of a 0.4% rise, after a flat reading in the previous quarter.

The Greek debt problem still weighs on markets. Greece yesterday repaid €750 million in loans to the International Monetary Fund (IMF).

According to Reuters, the Greek government used emergency reserves in its holding account with the IMF to repay loans.

The British pound traded lower against the U.S. dollar after the release of the Bank of England's (BoE) Inflation Letter. The BoE lowered its economic growth forecasts. The forecast for gross domestic product (GDP) growth in 2015 was cut to 2.4%, down from 2.9% three months ago. The GDP growth forecasts for 2016 and 2017 were lowered to 2.6% and 2.4% respectively.

The BoE Governor Mark Carney said that the consumer price inflation could turn negative, but it is expected to rise towards the end of the year.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.5% in the January to March quarter from 5.7% in the October to December quarter, in line with expectations.

It was the lowest level since 2008.

The claimant count decreased by 12,600 people in April, missing expectations for a drop by 20,000, after a decrease of 16,700 people in March. It was the smallest monthly decline since March 2013.

March's figure was revised down from a decline of 20,700.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the January to March quarter, exceeding expectations for a rise by 2.1%, after a 1.9% gain in the October to December quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the January to March quarter, exceeding expectations for a gain of 1.7%, after a 1.7% increase in the October to December quarter.

EUR/USD: the currency pair fell to $1.1201

GBP/USD: the currency pair decreased to $1.5632

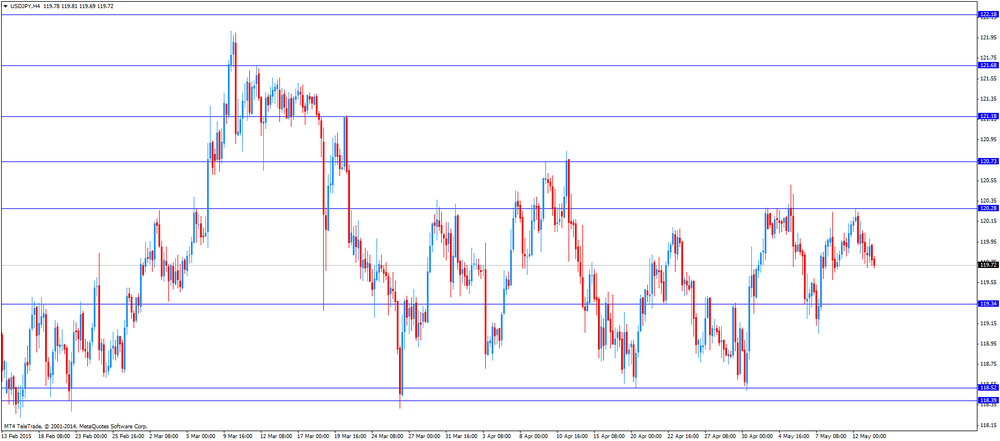

USD/JPY: the currency pair declined to Y119.69

The most important news that are expected (GMT0):

12:30 U.S. Retail sales excluding auto May 0.4% 0.5%

12:30 U.S. Retail sales April 0.9% 0.2%

22:45 New Zealand Retail Sales, q/q Quarter I 1.4% 1.5%

22:45 New Zealand Retail Sales YoY Quarter I 5.9% 4.9%

23:50 Japan GDP, y/y (Preliminary) Quarter I 1.5%

23:50 Japan GDP, q/q (Preliminary) Quarter I 0.4%

-

14:00

Orders

EUR/USD

Offers 1.1280 1.1300 1.1330 1.1360-65 1.1385 1.1400

Bids 1.1225 1.1200 1.1180 1.1160 1.1135 1.1120 1.1100 1.1085 1.1050-60

GBP/USD

Offers 1.5700-10 1.5725 1.5750 1.5775-80 1.5800 1.5830 1.5850

Bids 1.5655-60 1.5630 1.5600 1.5585 1.5570 1.5550 1.5250 1.5500

EUR/GBP

Offers 0.7185 200 0.7225-30 0.7255-60 0.7280 0.7300

Bids 0.7150 0.7130 0.7100 0.7085 0.7060

EUR/JPY

Offers 135.30 135.50 135.85 136.00 136.50

Bids 134.20 134.00 133.70 133.50

USD/JPY

Offers 120.00 120.25-30 120.50 120.80 121.00

Bids 119.65-70 119.50 119.35 119.25 119.00

AUD/USD

Offers 0.8050-60 0.8085 0.8100

Bids 0.7960 0.7900-10 0.7885-90 0.7850-55 0.7820-25 0.7800 0.7780

-

13:01

U.S.: MBA Mortgage Applications, May -3.5%

-

12:07

European stock markets mid session: stocks traded higher as Eurozone’s economy expanded in the first quarter

Stock indices traded higher as Eurozone's economy expanded in the first quarter. Eurozone's preliminary gross domestic product (GDP) increased by 0.4% in the first quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.0% in the first quarter, missing expectations for a 1.1% increase, after a 0.9% gain in the fourth quarter.

Industrial production in the Eurozone fell 0.3% in March, missing expectations for a flat reading, after a 1.0% rise in February. February's figure was revised down from a 1.1% increase.

The decline was driven by a drop in production of energy, which fell 1.7% in March.

On a yearly basis, Eurozone's industrial production gained 1.8% in March, in line with expectations, after a 1.9% increase in February. February's figure was revised up from a 1.6 gain.

The increase was driven by a rise in non-durable consumer goods and in production of energy.

The Greek debt problem still weighs on markets. Greece yesterday repaid €750 million in loans to the International Monetary Fund (IMF).

According to Reuters, the Greek government used emergency reserves in its holding account with the IMF to repay loans.

The U.K. unemployment rate fell to 5.5% in the January to March quarter from 5.7% in the October to December quarter, in line with expectations.

It was the lowest level since 2008.

The claimant count decreased by 12,600 people in April, missing expectations for a drop by 20,000, after a decrease of 16,700 people in March. It was the smallest monthly decline since March 2013.

March's figure was revised down from a decline of 20,700.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the January to March quarter, exceeding expectations for a rise by 2.1%, after a 1.9% gain in the October to December quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the January to March quarter, exceeding expectations for a gain of 1.7%, after a 1.7% increase in the October to December quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,979.75 +45.95 +0.66 %

DAX 11,553.65 +81.24 +0.71 %

CAC 40 5,035.28 +60.63 +1.22 %

-

11:41

Eurozone’s industrial production declines 0.3% in March

Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.3% in March, missing expectations for a flat reading, after a 1.0% rise in February. February's figure was revised down from a 1.1% increase.

The decline was driven by a drop in production of energy, which fell 1.7% in March.

Durable consumer goods were down 0.9%, while non-durable consumer goods rose by 2.3%.

On a yearly basis, Eurozone's industrial production gained 1.8% in March, in line with expectations, after a 1.9% increase in February. February's figure was revised up from a 1.6 gain.

The increase was driven by a rise in non-durable consumer goods and in production of energy. Non-durable consumer goods climbed by 5.7% in March from a year ago, while production of energy rose by 3.9%.

Durable consumer goods dropped by 1.7%.

-

11:25

Eurozone’s economy expands at 0.4% in the first quarter

Eurostat released its GDP growth figures for the Eurozone on Wednesday. Eurozone's preliminary gross domestic product (GDP) increased by 0.4% in the first quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.0% in the first quarter, missing expectations for a 1.1% increase, after a 0.9% gain in the fourth quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.1% in the first quarter, after 0.5% in fourth quarter. On a yearly basis, the U.S. economy expanded at 2.4% in first quarter, after a 3.0% increase in the fourth quarter.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1145(E1.6bn), $1.1205(E589mn), $1.1260(E431mn), $1.1300(E267mn)

USD/JPY: Y119.50($350mn), Y120.50($280mn)

AUD/USD: $0.8000(A$670mn)

NZD/USD: $0.7350(NZ$265mn), $0.7375(NZ$290mn), 0.7425(NZ$279mn)

USD/CAD: C$1.2200($355mn)

-

11:05

U.K. unemployment rate is down to 5.5% in the first quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.5% in the January to March quarter from 5.7% in the October to December quarter, in line with expectations.

It was the lowest level since 2008.

The claimant count decreased by 12,600 people in April, missing expectations for a drop by 20,000, after a decrease of 16,700 people in March. It was the smallest monthly decline since March 2013.

March's figure was revised down from a decline of 20,700.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the January to March quarter, exceeding expectations for a rise by 2.1%, after a 1.9% gain in the October to December quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the January to March quarter, exceeding expectations for a gain of 1.7%, after a 1.7% increase in the October to December quarter.

-

11:00

Eurozone: Industrial Production (YoY), March 1.8% (forecast 1.8%)

-

11:00

Eurozone: GDP (QoQ), Quarter I 0.4% (forecast 0.5%)

-

11:00

Eurozone: Industrial production, (MoM), March -0.3% (forecast 0.0%)

-

11:00

Eurozone: GDP (YoY), Quarter I 1.0% (forecast 1.1%)

-

10:46

Asia Pasific Stocks closed:

HANG SENG 27,265.67 -141.51 -0.52%

S&P/ASX 200 5,715.1 +40.40 +0.71%

TOPIX 1,604.21 +1.94 +0.12%

SHANGHAI COMP 4,376.71 -24.51 -0.56%

-

10:42

Reserve Bank of New Zealand Governor Graeme Wheeler: the New Zealand dollar is still "unjustified and unsustainable" despite the recent depreciation

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler reiterated on late Tuesday that the New Zealand dollar is still "unjustified and unsustainable" despite the recent depreciation. He added that the central bank would like to see further depreciation of the New Zealand dollar.

Earlier on Tuesday, the RBNZ released its Financial Stability Report. The central bank removed unexpectedly the word "unjustified" from its report. Wheeler declined to comment why the word "unjustified" had been removed.

-

10:31

United Kingdom: Average Earnings, 3m/y , March 1.9% (forecast 1.7%)

-

10:31

United Kingdom: Average earnings ex bonuses, 3 m/y, March 2.2% (forecast 2.1%)

-

10:30

United Kingdom: ILO Unemployment Rate, March 5.5% (forecast 5.5%)

-

10:30

United Kingdom: Claimant count , April -12.6 (forecast -20.0)

-

10:24

Japan’s current account surplus hits the highest level since March 2008

Japan's finance ministry released its current account figures on late Tuesday. The non-seasonally adjusted current account surplus rose to 2,795 billion yen in March from 1,440.1 billion yen in February, exceeding expectations for an increase to 2,060 billion yen.

It was the highest current account surplus since March 2008.

The increase was driven by higher overseas investment and by lower imports.

Current account figures are usually higher in March due to seasonal factors.

The current account measures trade in goods, services, tourism and investment.

-

10:11

European Central Bank raised the amount the Greek central bank can lend its banks to €80 billion

The European Central Bank (ECB) raised the amount the Greek central bank can lend its banks by €1.1 billion to €80 billion. This decision was made during an ECB board teleconference on Tuesday.

-

08:46

France: CPI, y/y, April 0.1%

-

08:45

France: CPI, m/m, April 0.1% (forecast 0.2%)

-

08:25

Options levels on wednesday, May 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1399 (5196)

$1.1347 (4471)

$1.1307 (3123)

Price at time of writing this review: $1.1231

Support levels (open interest**, contracts):

$1.1162 (1016)

$1.1126 (1321)

$1.1078 (6372)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 99427 contracts, with the maximum number of contracts with strike price $1,1300 (5196);

- Overall open interest on the PUT options with the expiration date June, 5 is 119504 contracts, with the maximum number of contracts with strike price $1,0800 (7483);

- The ratio of PUT/CALL was 1.20 versus 1.18 from the previous trading day according to data from May, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.5906 (1352)

$1.5809 (1241)

$1.5713 (2975)

Price at time of writing this review: $1.5674

Support levels (open interest**, contracts):

$1.5589 (737)

$1.5492 (1687)

$1.5395 (2654)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34621 contracts, with the maximum number of contracts with strike price $1,5700 (2975);

- Overall open interest on the PUT options with the expiration date June, 5 is 48094 contracts, with the maximum number of contracts with strike price $1,5000 (3316);

- The ratio of PUT/CALL was 1.39 versus 1.37 from the previous trading day according to data from May, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Wage Price Index, y/y Quarter I 2.5% 2.4% 2.3%

01:30 Australia Wage Price Index, q/q Quarter I 0.6% 0.6% 0.5%

The dollar was almost flat against the yen in Asian trade Wednesday, with investors awaiting a key U.S. economic indicator later the day for fresh cues to scrutinize to see if the U.S. economy is stepping out of its doldrums in the first quarter of 2015. But the U.S. currency managed to bounce back with investors covering their short positions. Following that, investors were reluctant to make any major moves ahead of the release of the U.S. retail sales for April, which is crucial to gauge if a soft patch since earlier this year was driven by temporary factors such as bad weather. Lackluster U.S. data have raised questions about when the Federal Reserve would increase short-term rates, a move that would help lift the dollar. In addition, investors were avoiding taking strong position ahead of the issuance of new U.S. debt.

EUR / USD: during the Asian session the pair rose to $ 1.1250

GBP / USD: during the Asian session, the pair traded in the range $ 1.5655-85

USD / JPY: during the Asian session the pair traded in the range Y119.70-00

UK employment/earnings data due at 0830GMT provides the early interest though more focus seen on the BOE Quarterly Inflation forecast at 0930GMT and indications for timing of the next rate move. Apart from this domestic interest EZ GDP due from France, Germany and the EZ with key US retail sales providing the interest into the afternoon.

-

08:00

Germany: GDP (YoY), Quarter I 1.1% (forecast 1.2%)

-

08:00

Germany: CPI, m/m, April 0.0% (forecast -0.1%)

-

08:00

Germany: CPI, y/y , April 0.5% (forecast 0.4%)

-

08:00

Germany: GDP (QoQ), Quarter I 0.3% (forecast 0.5%)

-

07:31

France: GDP, Y/Y, Quarter I 5.9%

-

07:30

China: Fixed Asset Investment, March 12.0% (forecast 13.5%)

-

07:30

France: GDP, q/q, Quarter I 0.6% (forecast 0.4%)

-

07:30

China: Industrial Production y/y, April 5.9% (forecast 6.0%)

-

07:30

China: Retail Sales y/y, April 10.0% (forecast 10.5%)

-

07:02

Japan: Eco Watchers Survey: Current , April 53.6 (forecast 52.1)

-

07:01

Japan: Eco Watchers Survey: Outlook, March 54.2

-

04:01

Nikkei 225 19,599.35 -25.49 -0.1 %, Hang Seng 27,411.92 +4.74 0.0%, Shanghai Composite 4,390.81 -10.40 -0.2 %

-

03:30

Australia: Wage Price Index, q/q, Quarter I 0.5% (forecast 0.6%)

-

03:30

Australia: Wage Price Index, y/y, Quarter I 2.3% (forecast 2.4%)

-

01:52

Japan: Current Account, bln, March 2795 (forecast 2060)

-

01:04

Commodities. Daily history for May 12’2015:

(raw materials / closing price /% change)

Oil 60.75 +2.53%

Gold 1,191.90 -0.04%

-

01:03

Stocks. Daily history for Apr May 12’2015:

(index / closing price / change items /% change)

Nikkei 225 19,624.84 +3.93 +0.02 %

Hang Seng 27,407.18 -311.02 -1.12 %

S&P/ASX 200 5,674.7 +49.50 +0.88 %

Shanghai Composite 4,401.98 +68.39 +1.58 %

FTSE 100 6,933.8 -96.05 -1.37 %

CAC 40 4,974.65 -53.22 -1.06 %

Xetra DAX 11,472.41 -200.94 -1.72 %

S&P 500 2,099.12 -6.21 -0.29 %

NASDAQ Composite 4,976.19 -17.38 -0.35 %

Dow Jones 18,068.23 -36.94 -0.20 %

-

01:02

Currencies. Daily history for May 12’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1221 +0,62%

GBP/USD $1,5668 +0,54%

USD/CHF Chf0,9285 -0,60%

USD/JPY Y119,83 -0,24%

EUR/JPY Y134,46 +0,39%

GBP/JPY Y187,74 +0,30%

AUD/USD $0,7984 +1,15%

NZD/USD $0,7407 +0,89%

USD/CAD C$1,2001 -0,79%

-

00:48

New Zealand: Food Prices Index, m/m, April -0.3%

-

00:00

Schedule for today, Wednesday, May 13’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Wage Price Index, y/y Quarter I 2.5% 2.4%

01:30 Australia Wage Price Index, q/q Quarter I 0.6% 0.6%

05:00 Japan Eco Watchers Survey: Outlook March 53.2

05:00 Japan Eco Watchers Survey: Current April 52.2 52.1

05:30 China Industrial Production y/y April 5.6% 6.0%

05:30 China Retail Sales y/y April 10.2% 10.5%

05:30 China Fixed Asset Investment March 13.5% 13.5%

05:30 France GDP, q/q (Preliminary) Quarter I 0.1% 0.4%

05:30 France GDP, Y/Y (Preliminary) Quarter I 0.2%

06:00 Germany CPI, m/m (Finally) April 0.5% -0.1%

06:00 Germany CPI, y/y (Finally) April 0.3% 0.4%

06:00 Germany GDP (YoY) (Preliminary) Quarter I 1.6% 1.2%

06:00 Germany GDP (QoQ) (Preliminary) Quarter I 0.7% 0.5%

06:45 France CPI, m/m April 0.7% 0.2%

06:45 France CPI, y/y April -0.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y March 1.8% 2.1%

08:30 United Kingdom Average Earnings, 3m/y March 1.7% 1.7%

08:30 United Kingdom Claimant count April -20.7 -20.0

08:30 United Kingdom ILO Unemployment Rate March 5.6% 5.5%

09:00 Eurozone Industrial Production (YoY) March 1.6% 1.8%

09:00 Eurozone Industrial production, (MoM) March 1.1% 0.0%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter I 0.3% 0.5%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter I 0.9% 1.1%

09:30 United Kingdom BOE Inflation Letter

09:30 United Kingdom BOE Gov Mark Carney Speaks

11:00 U.S. MBA Mortgage Applications May -4.6%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 U.S. Import Price Index April -0.3% 0.3%

12:30 U.S. Retail sales excluding auto May 0.4% 0.5%

12:30 U.S. Retail sales April 0.9% 0.2%

14:00 U.S. Business inventories March 0.3% 0.2%

14:30 U.S. Crude Oil Inventories May -3.882

22:30 New Zealand Business NZ PMI April 54.5

22:45New Zealand Retail Sales, q/q Quarter I 1.4% 1.5%

22:45 New Zealand Retail Sales YoY Quarter I 5.9% 4.9%

23:50 Japan GDP, y/y (Preliminary) Quarter I 1.5%

23:50 Japan GDP, q/q (Preliminary) Quarter I 0.4%

-