Noticias del mercado

-

17:42

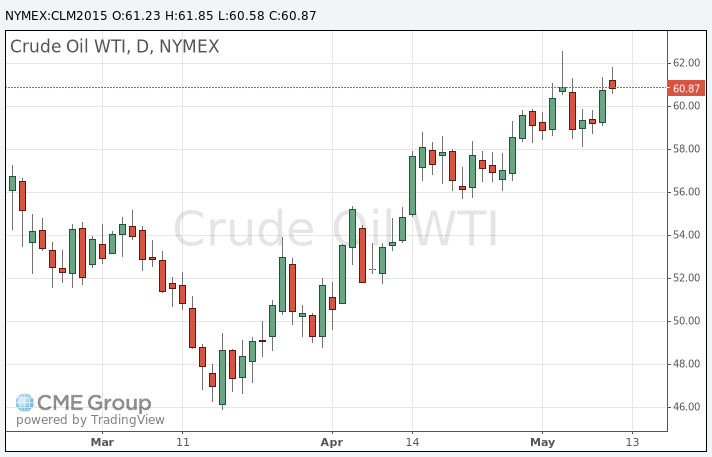

Oil prices traded slightly higher after the release of U.S. crude oil inventories

Oil prices traded slightly higher after the release of U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 2.2 million barrels to 484.08 million in the week to May 8. Analysts had expected a decline of 125,000 barrels.

Gasoline inventories were down by 1.1 million barrels last week, according to the EIA.

U.S. oil production climbed by 5,000 barrels a day to 9.37 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 990,000 barrels to 60.7 million barrels.

U.S. crude oil imports rose by 340,000 barrels per day to 6.9 million barrels per day.

Refineries in the U.S. were running at 91.2% of capacity.

The International Energy Agency (IEA) released its monthly oil market report. The agency said that global oil supply remained unchanged at 95.7 million barrels per day in April. But the IEA upgraded its forecast for non-OPEC production growth to 830,000 barrels per day of additional supply this year, up 200,000 barrels per day.

A global oil glut is growing as Saudi Arabia increased its oil production, the IEA noted.

WTI crude oil for June delivery rose to $60.58 a barrel on the New York Mercantile Exchange. Brent crude oil for June increased to $67.55 a barrel on ICE Futures Europe.

-

17:24

Gold price traded higher as the U.S. dollar declined after the weaker-than-expected U.S. retail sales

Gold price traded higher as the U.S. dollar declined after the weaker-than-expected U.S. retail sales. The U.S. retail sales were flat in April, missing expectations for a 0.2% increase, after a 1.1% gain in March. March's figure was revised up from a 0.9% increase.

The reading was driven by lower automobiles and gasoline purchases. Automobiles sales decreased 0.4% in April, while gasoline station sales decreased 0.7%.

Retail sales excluding automobiles increased 0.1% in April, missing forecasts for a 0.5% rise, after a 0.7% gain in March. March's figure was revised up from a 0.4% rise.

These figures are adding to concerns that U.S. economy is losing momentum, and the Fed might delay its first interest rate hike.

A selloff in global government bonds also supported gold price.

June futures for gold on the COMEX today rose to 1218.10 dollars per ounce.

-

01:04

Commodities. Daily history for May 12’2015:

(raw materials / closing price /% change)

Oil 60.75 +2.53%

Gold 1,191.90 -0.04%

-