Noticias del mercado

-

22:00

U.S.: Total Net TIC Flows, March -100.9

-

22:00

U.S.: Net Long-term TIC Flows , March 17.6

-

20:20

American focus: Dollar fell

The US dollar fell against the euro and yen after the assessments are not justified US economic reports. Weak US data, which indicated, among other things, about the fall of consumer confidence led investors to revise their expectations about the timing of increases in interest rates by the central bank.

The dollar has lost those gains after the data, University of Michigan, testified about the fall of the preliminary index of consumer sentiment in May to 88.6, compared with the final value of 95.9 in April. Economists had expected the preliminary index in May was 96.0.

US industrial output in April declined for the fifth month in a row, indicating the weakness of global demand. Production in manufacturing and mining United States, as well as production in the field of public services, taking into account the correction for seasonal variations in April fell by 0.3% compared to March, the Fed said. The index is expected to increase by 0.1%.

The index of business conditions, the Federal Reserve of New York in May rose to 3.09 after falling to -1.19 in April. This is evidenced by the report of the Federal Reserve Bank of New York, published on Friday. Economists had expected the index to rise to 5.0 in May. Readings above zero indicate expanding activity.

Presented figures indicate that the economy is not recovering from weakening during the first three months of the year. Investors are betting that the strengthening of the US economy will force the Fed to raise interest rates for the first time since 2006, which would increase the attractiveness of the dollar.

The Canadian dollar traded lower against the backdrop of a strong US dollar and lower oil prices. The Canadian currency gained almost no support from the strong data on the industrial sector in March.

The US dollar weakened slightly against the Canadian dollar after the publication of the data, but quickly recovered.

The agency Statistics Canada reported that sales in the manufacturing sector in Canada in March showed the largest monthly increase in nearly four years amid strong demand for cars and parts manufacturing aerospace industry.

Shipments to Canada's industrial sector grew in March by 2.9% to 51.02 billion Canadian dollars (42.52 US dollars). Economists had forecast that the growth of the supply will be 1%.

In March, sales also grew by 2.9%.

Statistics Canada also noted that foreign investors in March bought the Canadian securities at the fastest pace in almost three years against the backdrop of bond-buying companies at the fastest pace in a month more than a decade.

Foreign investors in March bought the Canadian securities 22.47 billion Canadian dollars (18.72 billion US dollars). This volume was the highest since May 2012.

Canadian investors reduced the amount of foreign securities in their holding of 3.20 billion Canadian dollars a month.

-

16:45

Thomson Reuters/University of Michigan preliminary consumer sentiment index drops to 88.6 in May

The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 88.6 in May from a final reading of 95.9 in April, missing expectations for an increase to 96.0. It was the lowest level since October 2014.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that the decline was a result of lower optimism regarding "quick and robust rebound" in the U.S. economy.

Mr Curtin added that consumers remained optimistic about their future personal finances.

A gauge of consumers' current economic conditions dropped to 103.0 in March from 106.9 in February.

The index of consumer expectations declined to 81.5 from 88.8.

The one-year inflation expectations in May climbed to 2.9% from 2.6% in April.

-

16:14

NY Fed Empire State manufacturing index is up to 3.09 in May

The New York Federal Reserve released its survey on Friday. The NY Fed Empire State manufacturing index rose to 3.09 in May from -1.19 in April, missing expectations for an increase to 5.0.

The increase was driven by a rise in new orders. The new orders index climbed to 3.9 in May from -6.0 in April.

The price-paid index decreased to 9.38 in May from 19.15 in April.

The index for the number of employees decreased to 5.21 in May from 9.57 last month.

The general business conditions expectations index for the next six months was down to 29.81 in May from 37.06 in April.

-

16:01

U.S.: Reuters/Michigan Consumer Sentiment Index, May 88.6 (forecast 96.0)

-

15:53

U.S. industrial production declines 0.3% in April

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production dropped 0.3% in April, missing expectations for a 0.1% increase, after a 0.3% decline in March.

March's figure was revised up from a 0.6% decrease.

The decline was driven by lower mining and utilities output. Mining output dropped by 0.8% in April as oil and gas drilling plunged 14.5%, while utility output fell by 1.3%.

The U.S. manufacturing production remained unchanged in April.

Capacity utilisation rate fell to 78.2% in April from 78.6% in March. March's figure was revised up 78.4%. Analysts had expected a capacity utilisation rate of 78.4%.

These figures are pointing to a slower economic growth in the U.S.

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY: Y119.00($220mn), Y119.75($216mn), Y120.50/55($1.065bn)

EUR/JPY: Y135.35(E362mn)

GBP/USD: $1.5600(Gbp273mn), $1.5750(Gbp 224mn), $1.5850(Gbp200mn)

USD/CHF: Chf0.9000($293mn)

AUD/USD: $0.8000(A$968mn)

NZD/USD: $0.7400(NZ$200mn)

USD/CAD: C$1.1970($531mn), C$1.2050($475mn), C$1.2200($492mn)

-

15:27

Foreign securities purchases in Canada climb by C$22.47 billion in March

Statistics Canada released foreign investment figures on Friday. Foreign securities purchases in Canada rose by C$22.47 billion in March, after a drop by C$9.35 billion in February. It was the highest inflow since May 2012.

February's figure was revised up from a gain by C$9.27 billion.

Canadian investors sold C$3.2 billion of foreign securities in March.

-

15:15

U.S.: Industrial Production (MoM), April -0.3% (forecast 0.1%)

-

15:15

U.S.: Capacity Utilization, April 78.2% (forecast 78.4%)

-

15:03

Canadian manufacturing shipments rises 2.9% in March

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments climbed 2.9% in March, beating forecasts of a 1.2% increase, after a 2.2% decrease in February.

February's figure was revised down from a 1.7% decline.

The increase was driven by a rise in the production of aerospace products and parts and higher sales of motor vehicles. The production of aerospace products and parts soared 42.3% in March, after a 29.4% drop in February.

Sales of motor vehicles climbed 12.8% in March.

Sales increased in 10 of 21 categories.

-

14:43

Bank of Japan Governor Haruhiko Kuroda: that the consumer price inflation is likely to be reached 2% by September 2016

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Friday that the consumer price inflation is likely to be reached 2% by September 2016. He pointed out further monetary easing is not necessary as "underlying price trend is steadily improving and is expected to keep improving going forward".

Kuroda noted the timing for achieving 2% inflation has been delayed due to falling oil prices.

Inflation in Japan was 0.2% in March.

The BoJ governor also said that consumer spending in Japan over the year ended March was weaker than expected due to a sales tax rise in April 2014. He noted that the impact on exports was "more significant" that he expected as Japanese manufacturers shifted their production abroad.

-

14:31

Canada: Foreign Securities Purchases, March 22.47

-

14:30

Canada: Manufacturing Shipments (MoM), March 2.9% (forecast 1.2%)

-

14:30

U.S.: NY Fed Empire State manufacturing index , May 3.09 (forecast 5.0)

-

14:15

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the solid construction output data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Consumer Confidence April 41.7 41.9 41.5

07:15 Switzerland Producer & Import Prices, m/m April 0.2% -0.1% -2.1%

07:15 Switzerland Producer & Import Prices, y/y April -3.4% -5.2%

The U.S. dollar rose against the most major currencies ahead of the U.S. economic data. The NY Fed Empire State manufacturing index is expected to rise to 5.0 in May from -1.19 in April.

The U.S. industrial production is expected to climb 0.1% in April, after a 0.6% drop in March.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to rise to 96.0 in May from a final reading of 95.9 in April.

The euro traded lower against the U.S. dollar in the absence of any major economic data from the Eurozone. The Greek debt problem still weighs on the euro.

The British pound traded lower against the U.S. dollar despite the solid construction output data from the U.K. Construction output in the U.K. rose 3.9% in March, after a 0.3% decline in February.

The increase was driven by a rise in non-housing repair and maintenance work, which soared 20% in March.

On a yearly basis, construction output climbed 1.6% in March.

The Canadian dollar fell against the U.S. dollar ahead of the Canadian economic data. Canada's manufacturing shipments are expected to increase 1.2% in March, after a 1.7% drop in February.

The Swiss franc declined against the U.S. dollar after the weaker-than-expected Swiss producer and import prices data. Switzerland's producer and import prices dropped 2.1% in April, missing expectations for a 0.1% decline, after a 0.2% rise in March.

On a yearly basis, producer and import prices plunged 5.2% in April, after a 3.4% drop in March.

The decline was driven by lower prices for machinery, electronic and optical products, metal products, electrical equipment, motor vehicles and medical equipment.

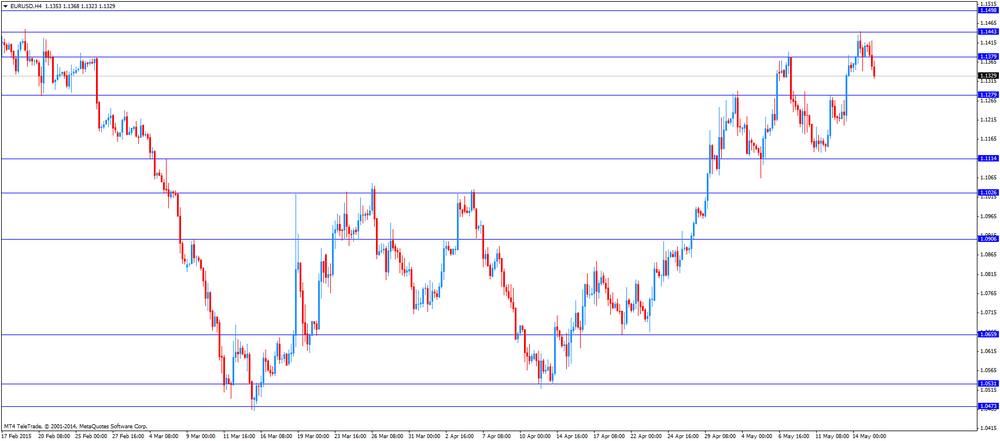

EUR/USD: the currency pair fell to $1.1323

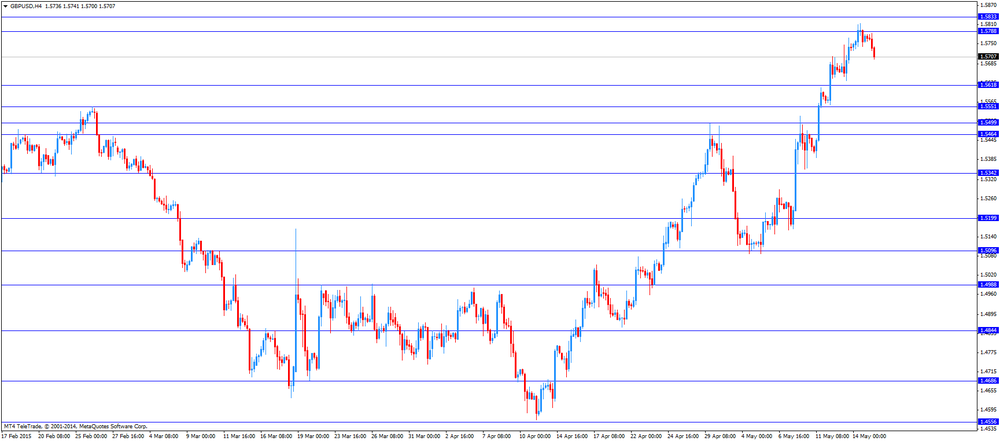

GBP/USD: the currency pair decreased to $1.5700

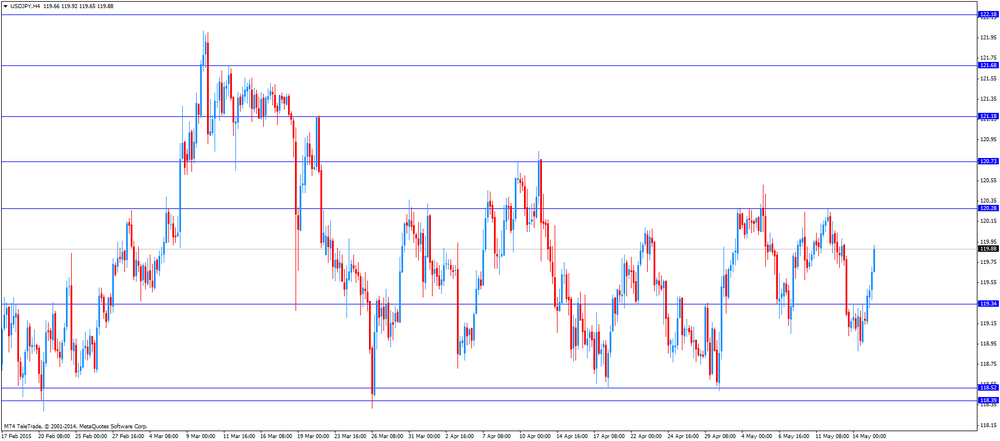

USD/JPY: the currency pair rose to Y119.92

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) March -1.7% 1.2%

12:30 U.S. NY Fed Empire State manufacturing index May -1.19 5.0

13:15 U.S. Industrial Production (MoM) April -0.6% 0.1%

13:15 U.S. Capacity Utilization April 78.4% 78.4%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) May 95.9 96.0

20:00 U.S. Net Long-term TIC Flows March 9.8

-

14:00

Orders

EUR/USD

Offers 1.1425-30 1.1450 1.1470 1.1485 1.1500 1.1550

Bids 1.1375-80 1.1360 1.1340 1.1325 1.1300 1.1280 1.1250

GBP/USD

Offers 1.5785 1.5800 1.5830 1.5850 1.5870 1.5885 1.5900

Bids 1.5730-35 1.5700 1.5680 1.5655-60 1.5630 1.5600

EUR/GBP

Offers 0.7245-50 0.7265 0.7280 0.7300 0.7325

Bids 0.7200 0.7180-85 0.7150 0.7130 0.7100

EUR/JPY

Offers 136.50 136.80 137.00 137.50

Bids 135.80 135.50 135.25 135.00 134.60 134.40

USD/JPY

Offers 119.60 119.80 120.00 120.25-30 120.50

Bids 119.30 119.00 118.85 118.65 118.50 118.35 118.00

AUD/USD

Offers 0.8060 0.8080 0.8100 0.8125 0.8150 0.8165 0.8180 0.8200

Bids 0.8025 0.8000 0.7985 0.7960 0.7930 0.7900-10

-

11:41

UK’s construction output rises 3.9% in March

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 3.9% in March, after a 0.3% decline in February.

The increase was driven by a rise in non-housing repair and maintenance work, which soared 20% in March.

On a yearly basis, construction output climbed 1.6% in March.

For the first quarter as a whole, construction output was down at an annual rate of 0.3%. It was the first annual fall since the second quarter of 2013.

-

11:17

Switzerland's producer and import prices drop 2.1% in April

The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices dropped 2.1% in April, missing expectations for a 0.1% decline, after a 0.2% rise in March.

On a yearly basis, producer and import prices plunged 5.2% in April, after a 3.4% drop in March.

The decline was driven by lower prices for machinery, electronic and optical products, metal products, electrical equipment, motor vehicles and medical equipment.

-

11:04

Option expiries for today's 10:00 ET NY cut

USD/JPY: Y119.00($220mn), Y119.75($216mn), Y120.50/55($1.065bn)

EUR/JPY: Y135.35(E362mn)

GBP/USD: $1.5600(Gbp273mn), $1.5750(Gbp 224mn), $1.5850(Gbp200mn)

USD/CHF: Chf0.9000($293mn)

AUD/USD: $0.8000(A$968mn)

NZD/USD: $0.7400(NZ$200mn)

USD/CAD: C$1.1970($531mn), C$1.2050($475mn), C$1.2200($492mn)

-

11:03

Bank of England Governor Mark Carney: the U.K. should hold a referendum on membership of the European Union "as soon as necessary"

The Bank of England (BoE) Governor Mark Carney said on Thursday that the U.K. should hold a referendum on membership of the European Union (EU) "as soon as necessary".

Analysts fear that businesses may delay making investments due to the uncertainty over UK's future in the EU.

Carney noted that there is no evidence yet businesses have acted on the uncertainty.

The BoE governor pointed out that Europe is important to the UK's economy.

The Conservatives have promised to hold a referendum before the end of 2017. The government in the U.K. hopes that a referendum could be held in 2016.

-

10:42

Italy’s Economy Minister Pier Carlo Padoan: the country’s economy is expected to grow stronger this year

Italy's Economy Minister Pier Carlo Padoan said on Thursday that the country's economy is expected to grow stronger this year.

Italy's economy expanded at 0.3% in the first quarter. It was the first time since the third quarter of 2013.

The Italian government expects the economy to grow 0.7% in 2015.

Padoan also said that Eurozone's countries want to reach a dealt with Greece.

-

10:24

European Central Bank President Mario Draghi: the ECB will not stop its quantitative easing

The European Central Bank (ECB) President Mario Draghi said in a speech at the International Monetary Fund in Washington on Thursday that the central bank will not stop its quantitative easing until there is "a sustained adjustment in the path of inflation".

Draghi noted that he wanted that quantitative easing to boost investment and price inflation.

The ECB president pointed out that "there is little indication that generalised financial imbalances are emerging".

-

09:16

Switzerland: Producer & Import Prices, m/m, April -2.1% (forecast -0.1%)

-

09:16

Switzerland: Producer & Import Prices, y/y, April -5.2%

-

08:23

Options levels on friday, May 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1491 (4865)

$1.1459 (4399)

$1.1437 (3098)

Price at time of writing this review: $1.1378

Support levels (open interest**, contracts):

$1.1312 (1597)

$1.1267 (1112)

$1.1209 (4949)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 102773 contracts, with the maximum number of contracts with strike price $1,1500 (6252);

- Overall open interest on the PUT options with the expiration date June, 5 is 123793 contracts, with the maximum number of contracts with strike price $1,0800 (7349);

- The ratio of PUT/CALL was 1.20 versus 1.17 from the previous trading day according to data from May, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.6004 (1233)

$1.5907 (1199)

$1.5811 (1233)

Price at time of writing this review: $1.5766

Support levels (open interest**, contracts):

$1.5690 (447)

$1.5593 (875)

$1.5496 (1887)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34844 contracts, with the maximum number of contracts with strike price $1,5700 (2498);

- Overall open interest on the PUT options with the expiration date June, 5 is 48535 contracts, with the maximum number of contracts with strike price $1,5000 (3314);

- The ratio of PUT/CALL was 1.39 versus 1.41 from the previous trading day according to data from May, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:59

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Japan BOJ Governor Haruhiko Kuroda Speaks

The dollar was slightly higher against the yen in Asia trade Friday, an indication that investors were avoiding leaning too much toward the downside ahead of the release of economic indicators in the U.S. In currency flows related to trade settlements early in the session, dollar buying from importers appeared to exceed selling, helping send the greenback to as high as Y119.50, but some of the gains were given back as trade become directionless.

Market participants shrugged off midday comments by Bank of Japan Gov. Haruhiko Kuroda that there was no need for the central bank to take any additional easing steps now. The BOJ is widely seen standing pat at its policy setting meeting next week, while a raft of downbeat economic indicators in the U.S. make it increasingly unlikely that the Federal Reserve will raise rates in June.

EUR/USD: during the Asian session, the pair was trading in the $1.1390-15

GBP/USD: during the Asian session, the pair was trading in the $1.5755-80

USD/JPY: during the Asian session the pair rose to Y119.50

-

07:16

Japan: Consumer Confidence, April 41.5 (forecast 41.9)

-

01:01

Currencies. Daily history for May 14’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1407 +0,51%

GBP/USD $1,5774 +0,23%

USD/CHF Chf0,9124 -0,52%

USD/JPY Y119,18 +0,01%

EUR/JPY Y135,95 +0,51%

GBP/JPY Y187,99 +0,24%

AUD/USD $0,8078 -0,30%

NZD/USD $0,7492 0,00%

USD/CAD C$1,1988 +0,26%

-

00:00

Schedule for today, Friday, May 15’2015:

(time / country / index / period / previous value / forecast)

03:40 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Consumer Confidence April 41.7 41.9

07:15 Switzerland Producer & Import Prices, m/m April 0.2% -0.1%

07:15 Switzerland Producer & Import Prices, y/y April -3.4%

12:30 Canada Foreign Securities Purchases March 9.27

12:30 Canada Manufacturing Shipments (MoM) March -1.7% 1.2%

12:30 U.S. NY Fed Empire State manufacturing index May -1.19 5.0

13:15 U.S. Industrial Production (MoM) April -0.6% 0.1%

13:15 U.S. Capacity Utilization April 78.4% 78.4%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) May 95.9 96.0

20:00 U.S. Total Net TIC Flows March 4.1

20:00 U.S. Net Long-term TIC Flows March 9.8

-