Noticias del mercado

-

21:00

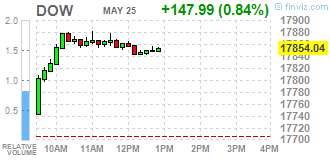

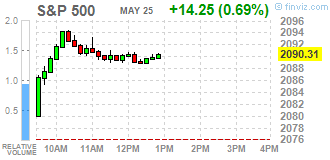

Dow +0.85% 17,857.36 +151.31 Nasdaq +0.63% 4,891.45 +30.39 S&P +0.70% 2,090.53 +14.47

-

20:03

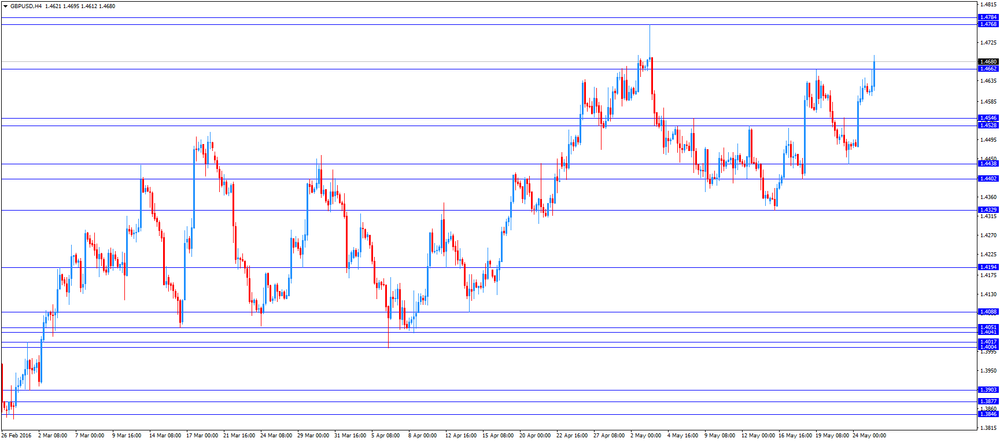

American focus: The US dollar fell markedly against the British currency

The pound rose more than 100 points against the dollar, updating the three-week high. Support currency had the results of another survey on the subject of the referendum, which confirmed once again that the number of British exit from the EU exceeds the number of opponents Brekzita supporters - 44% of respondents in favor of the preservation of the country in the EU, and 38% - against.

The growth of the pound also helped yesterday's comments head of the Bank of England Carney. Recall, Carney said that the Central Bank will provide stability and order in the markets in anticipation Brekzita, using auctions to provide liquidity. Carney said that if Britain left the EU, the next likely step will be the Central Bank interest rate rise

Later this week, investors will be watching the consumer confidence index of the UK, as well as the report on GDP. Given the economic slowdown, the rise of political uncertainty and the decline in the index GfK in the last month, experts predict that the consumer confidence index drops again. Meanwhile, the second estimate of GDP for the 1st quarter, is likely to confirm the early predictions of slowing economic growth. According to expert estimates, GDP grew by 0.4% after rising 0.6% in the 4th quarter of 2015. In annual terms, GDP growth is expected to stabilize at 2.1%.

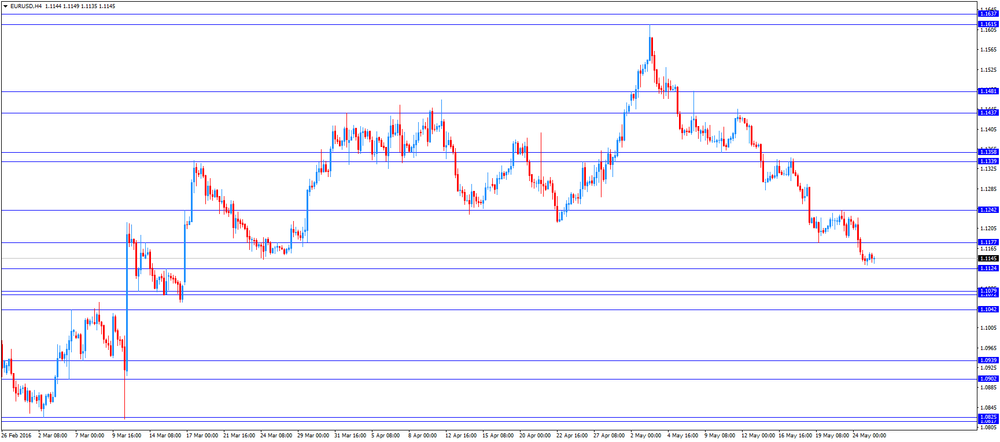

The dollar fell slightly against the euro retreated from a two-week high, which was associated with the publication of weak US economic activity data. The Markit Economics reported that activity in the US service sector continued to expand in May, but the growth rate slowed to 3-month low, which was associated with a relatively subdued demand from customers and the less favorable domestic economic conditions. Preliminary PMI index for the services sector in May fell to 51.2 points versus 52.8 points in April. Economists had expected an increase to 53.1 points. The pace of activity growth in May was much weaker than the long-term average (55.6). The Markit Economics said that new orders continued to rise in May, but the weakest pace since the end of 2009. Some firms reported a cyclical downturn in investment spending and the reluctance of clients to implement new projects. Subdued demand has also helped reduce the backlog. At the same time, hiring the services sector firms rose in May, but only slightly. Procurement inflation rose for the second time in May, recording the maximum rate since July 2015. Meanwhile, the average selling prices also increased, but only slightly.

Investors also await Fed Chairman Yellen speech, scheduled for Friday, which may to some extent make it clear whether the Central Bank will raise interest rates soon. Today futures on interest rates Fed indicate that the probability of a rate hike in June is 38% versus 4% at the beginning of last week, and is estimated at 60% in July.

The Canadian dollar rose sharply against the US dollar, approaching to the maximum 19 May. The main influence on the currency have had the results of the meeting of the Central Bank of Canada. Recall, the Central Bank has left its main interest rate unchanged at 0.5%. Meanwhile, the Bank of Canada reported that economic growth in the 1st quarter of approximately corresponded to earlier forecasts. Nevertheless, the Central Bank said that GDP growth in the 2nd quarter will be lower than expected due to the forest fires in the oil-rich province of Alberta. According to estimates of the Bank of Canada, forest fires in Alberta may take 1.25 percentage points from GDP growth in the 2nd quarter. "Restoring economic growth must take place in the 3rd quarter of this year due to increased production volumes and the start of work on the restoration of the fires in the province", - reported in the Bank of Canada,.

-

18:57

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday, extending gains from Tuesday, as the possibility of the U.S. Federal Reserve raising interest rates as early as this summer boosted bank stocks.

Almost of Dow stocks in positive area (27 of 30). Top looser - NIKE, Inc. (NKE, -1,17%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,29%).

Almost all S&P sectors in positive area. Top looser - Utilities (-0,5%). Top gainer - Basic Materials (+1,6%).

At the moment:

Dow 17827.00 +140.00 +0.79%

S&P 500 2087.25 +12.25 +0.59%

Nasdaq 100 4474.75 +29.50 +0.66%

Oil 49.04 +0.42 +0.86%

Gold 1223.40 -5.80 -0.47%

U.S. 10yr 1.86 -0.00

-

18:00

European stocks close: stocks closed higher on a deal between Greece and its creditors, and on rising oil prices

Stock closed higher on news that Greece will get €10.3 billion in loans from the third bailout programme. Eurozone finance ministers agreed to unlock next tranche after talks in Brussels. Ministers also agreed to potentially offer Greece debt relief.

Oil prices also supported stock markets. Oil prices rose on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.2 million barrels to 537.1 million in the week to May 20. Analysts had expected U.S. crude oil inventories to decline by 2.5 million barrels.

Market participants also eyed the economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index rose to 107.7 in May from 106.7 in April, exceeding expectations for an increase to 106.8. April's reading was revised up from 106.6.

"Business confidence in German industry and trade has improved in all four main sectors. In construction a new record high has even been reached," Ifo President Clemens Fuest said.

"The German economy is growing at a robust pace," he added.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.8 in June from 9.7 in May. Analysts had expected the index to remain unchanged at 9.7.

"Private consumption will remain an important pillar of the German economy over the next few months. GfK therefore still stands by the forecast it made at the start of the year that real private consumer spending will climb by around 2 percent in 2016. This figure stood at 1.9 percent in 2015," Gfk noted.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,262.85 +43.59 +0.70 %

DAX 10,205.21 +147.90 +1.47 %

CAC 40 4,481.64 +50.12 +1.13 %

-

18:00

European stocks closed: FTSE 6,262.85 +43.59 +0.70% CAC 4,481.64 +50.12 +1.13% DAX 10,205.21 +147.90 +1.47%

-

17:46

World Trade Organization Director General Roberto Azevedo: Britain’s exit from the European Union (EU) would cost Britain billions

World Trade Organization (WTO) Director General Roberto Azevedo said in an interview with the Financial Times on Wednesday that Britain's exit from the European Union (EU) would cost Britain $13.2 billion in annual additional import tariffs, adding that the country's trade deals had to be renegotiated.

"Pretty much all of the UK's trade would somehow have to be negotiated," he said.

-

17:44

WSE: Session Results

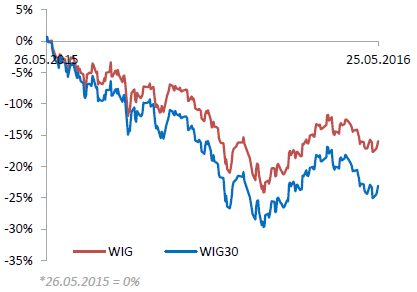

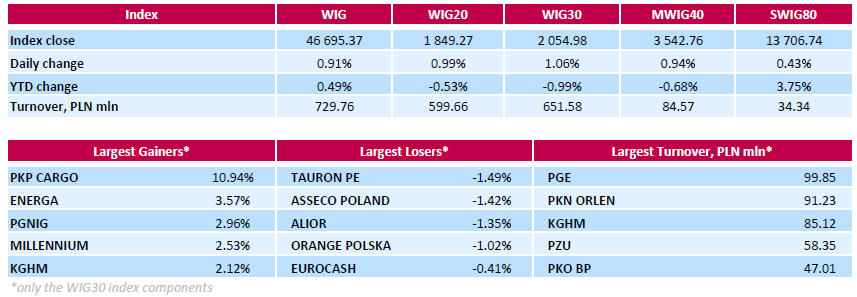

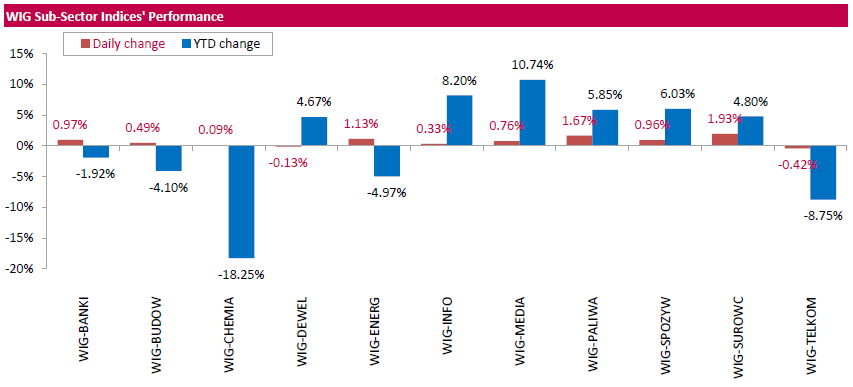

Polish equity market surged on Wednesday. The broad market measure, the WIG Index, added 0.91%. Except for developing sector (-0.13%) and telecoms (-0.42%), every sector in the WIG Index rose, with materials (+1.93%) outperforming.

The large-cap stocks' benchmark, the WIG30 Index, grew by 1.06%. There were only six decliners among the index components: genco TAURON PE (WSE: TPE), IT-company ASSECO POLAND (WSE: ACP), bank ALIOR (WSE: ALR), telecommunication services provider ORANGE POLSKA (WSE: OPL), FMCG-wholesaler EUROCASH (WSE: EUR) and property developer GTC (WSE: GTC) lost between 0.29% and 1.49%. On the plus side, railway freight transport operator PKP CARGO (WSE: PKP) continued its strong run, gaining a further 10.94%. It was followed by genco ENERGA (WSE: ENG), oil and gas producer PGNIG (WSE: PGN) and bank MILLENNIUM (WSE: MIL), advancing by 3.57%, 2.96% and 2.53% respectively.

The Warsaw Stock Exchange will be closed on Thursday, May 26, due to celebration of Corpus Christi Day in Poland.

-

17:43

Oil quotes show a positive trend

Oil prices rose by about 1 percent, approaching to the psychological mark of $ 50 per barrel, which was associated with the expectations of the publication in the US petroleum inventories report

US Department of Energy reported that in the week ended May 20, commercial crude oil inventories fell by 4.2 million barrels, while analysts had expected a decline of 2.5 million barrels. In recent weeks, stocks fell to 80-year highs, increasing expectations about what the global excess supply may decrease. However, gasoline inventories last week rose unexpectedly, as demand declined, US Department of Energy data showed. After Memorial Day in the US should begin the season of active road trips, and a relatively low consumption can put pressure on prices. Gasoline inventories in the US rose by 2.043 million barrels to 240.111 million barrels. Distillate stocks fell by 1.284 million barrels to 150.878 million barrels. Meanwhile, oil inventories in Cushing terminal fell by 0.649 million barrels to 67.624 million. Barrels. Workload refinery in the United States decreased to 89.7% from 90.5% a week earlier. Oil in the US last week fell the 11th week in a row, reaching 8.8 million barrels per day. The peak of production was recorded in April 2015 at 9.7 million barrels a day.

Recall yesterday's report from the API revealed that US crude stocks the previous week declined by 5.137 million. Barrels, while analysts expected a decrease of 3.3 million barrels. Stocks of crude oil at the terminal in Cushing fell by 0.189 million barrels, gasoline inventories rose by 3.6 million barrels, while distillate stocks - fell by 2.9 million barrels.

"Scheduled and unscheduled interruptions of oil supplies continue to affect the dynamics of the market", - noted in the Energy Aspects. "If the current level of disruption will be kept sharp drop in crude oil stocks in storage can begin sooner than expected", - analysts say the company added.

In focus were also statements by the Minister of Energy of Qatar, Mohammed bin Saleh Al-Sada, who is also the head of OPEC. He believes that at the moment is vital minimum price of $ 65 per barrel. According to estimates, there are no oil is trading at a fair price. June 2 representatives of the member countries of OPEC will convene the next meeting in Vienna. Discussion will focus on the possibilities of raising prices and stabilize the market.

WTI for delivery in July rose to $49.06 a barrel. Brent for July rose to $49.17 a barrel.

-

17:23

Gold prices continued to decline today

Gold prices declined moderately, reaching a seven-week low, the cause of which is to increase the likelihood of higher interest rates the Fed in the near future. Pressure on the quotes also provides strengthening of the American currency.

Precious metals fell more than 4 percent after it posted last week, minutes of the last Fed meeting revived expectations of further tightening of monetary policy of the Fed, that is, to increase the interest rate. Recall, higher interest rates have a downward pressure on the price of gold, which brings its holders to interest income and that is difficult to compete with the assets, bringing that income against the background of increasing interest rates. Today futures on interest rates Fed indicate that the probability of a rate hike in June is 38% versus 4% at the beginning of last week, and is estimated at 60% in July.

"US economic data point to a gradual improvement in the situation, which in turn promotes the growth of the US currency, - said Naeem Aslam, chief analyst at Think Forex -. In addition, market participants are increasingly believe that the Fed will increase rates in June."

Today, the dollar reached a two-month high against a basket of currencies on expectations that the Fed will raise rates in the near future. A stronger dollar usually puts pressure on gold, as it reduces the metal's appeal as an alternative asset and increases in the price of dollar-denominated commodities for holders of other currencies. According to analysts, gold may continue to decline to around $ 1,200 an ounce, the lowest level since early February. "This mark will soon be tested for strength," - said in Commerzbank.

In addition, it became known that the gold reserves in the largest gold ETF-fund SPDR Gold Trust fell Tuesday by 3.9 tonnes to 868.66 tonnes. It was the first decline for the month.

The cost of the June gold futures on the COMEX fell to $ 1222.2 per ounce.

-

17:23

Construction work done in Australia drops 2.6% in the first quarter

The Australian Bureau of Statistics released its construction work done figures on Wednesday. Construction work done in Australia dropped 2.6% in the first quarter, missing forecasts of a 1.5% fall, after a 2.9% decrease in the previous quarter. The fourth quarter's figure was revised up from a 3.6% decline.

The seasonally adjusted estimate of total building work done fell 1.0% in the first quarter, while engineering work slid 4.2%.

On a yearly basis, total construction work plunged 6.7% in the first quarter.

-

17:16

Philadelphia Fed President Patrick Harker: the Fed could raise its interest rate two to three times this year

Philadelphia Fed President Harker said on Wednesday that that he expected the Fed could raise its interest rate two to three times this year. He noted that U.S. presidential election would not have an impact on the Fed's monetary policy.

Philadelphia Fed president pointed out that there were no significant risks from China.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:53

U.S. crude inventories fall by 4.2 million barrels to 537.1 million in the week to May 20

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.2 million barrels to 537.1 million in the week to May 20.

Analysts had expected U.S. crude oil inventories to decline by 2.5 million barrels.

Gasoline inventories increased by 2.04 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, slid by 649,000 barrels.

U.S. crude oil imports decreased by 362,000 barrels per day.

Refineries in the U.S. were running at 89.7% of capacity, down from 90.5% the previous week.

Oil production fell to 8.767 million barrels a day last week from 8.791 million barrels a day in the previous week.

-

16:44

Bank of Canada keeps its interest rate unchanged at 0.50% in May

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was still appropriate. This decision was expected by analysts.

The BoC noted that the Canadian economic growth in the first quarter was in line with the BoC's forecasts, adding that the growth in the second quarter would be weaker than previously expected due to wildfires in Alberta. According to the central bank, the economy was expected to rebound in the third quarter due to higher oil prices.

The central bank also said that business investment and intentions remained disappointing.

According to the central bank, inflation was evolving as anticipated by the BoC, and rose due to higher oil prices.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that household vulnerabilities increased.

-

16:30

U.S.: Crude Oil Inventories, May -4.226 (forecast -2.5)

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:54

U.S. preliminary services purchasing managers' index drops to 51.2 in May

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 51.2 in May from 52.8 in April.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The decline was driven by subdued client demand and less favourable domestic economic conditions.

Job creation slowed to the weakest level since December 2014, while business optimism slid to the lowest level since October 2009.

"A deterioration in the survey data for May deal a blow to hopes that the US economy will rebound in the second quarter after the dismal start to the year," Markit Chief Economist Chris Williamson said.

"Service sector growth has slowed in May to one of the weakest rates seen since 2009, and manufacturing is already in its steepest downturn since the recession," he added.

-

15:51

Thursday 26.05.2016 - WSE will be closed

We would like to remind you that there will be no trading session on the Warsaw Stock Exchange (the Exchange will be closed) on Thursday, May 26, 2016.

-

15:48

WSE: After start on Wall Street

After yesterday's rise in the S&P500 index by 1.4 percent and finishedthe session in the region of 2,076 points all indications shows that the index performs another step north and approach to the area of 2,100 pts., which previously stopped demand and caused a correction. Investors now have to speculate about a possible continuation of the growth and return to 2100 points.

On the Warsaw market bulls do everything to get the highest possible quotations closing, which will build a margin of safety for tomorrow's day off on the Warsaw Stock Exchange. The higher today's closing on the WIG20 means more space for a potential withdrawal on Friday morning.

-

15:45

U.S.: Services PMI, May 51.2

-

15:38

NBB business climate for Belgium declines to -2.8 in May

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate declined to -2.8 in May from -2.4 in April. Analysts had expected the index to decrease to -2.6.

The business climate index for the manufacturing sector was down to -6.3 in May from -4.9 in April due to a less favourable assessments of stock levels.

The business climate index for the services sector rose to 12.7 in May from 10.8 in April due to a more favourable assessment of activity.

The business climate index for the building sector increased to -2.6 in May from-3.2 in April due to a more favourable assessment of current order books.

The business climate index for the trade sector climbed to -4.6 in May from -7.2 in April due a rise in demand.

-

15:32

U.S. Stocks open: Dow +0.34%, Nasdaq +0.36%, S&P +0.35%

-

15:31

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.00 (USD 342m)

EUR/USD: 1.1150 (EUR 367m)

USD/CHF 0.9820 (USD 200m)

AUD/USD 0.7200 (AUD 292m) 0.7300 (255m) 0.7385 (218m)

USD/CAD 1.2650 (USD 350m) 1.3050 (590m)

-

15:17

Before the bell: S&P futures +0.41%, NASDAQ futures +0.48%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,757.35 +258.59 +1.57%

Hang Seng 20,368.05 +537.62 +2.71%

Shanghai Composite 2,815.28 -6.39 -0.23%

FTSE 6,255.61 +36.35 +0.58%

CAC 4,480.55 +49.03 +1.11%

DAX 10,199.5 +142.19 +1.41%

Crude $49.17 (+1.13%)

Gold $1225.10 (-0.33%)

-

15:00

Belgium: Business Climate, May -2.8 (forecast -2.6)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.29

0.66(0.3914%)

338

ALCOA INC.

AA

9.56

0.14(1.4862%)

19949

ALTRIA GROUP INC.

MO

63.92

0.13(0.2038%)

550

Amazon.com Inc., NASDAQ

AMZN

706.99

2.79(0.3962%)

16663

American Express Co

AXP

65.26

0.39(0.6012%)

839

Apple Inc.

AAPL

98.5

0.60(0.6129%)

208668

AT&T Inc

T

38.56

0.06(0.1558%)

2553

Barrick Gold Corporation, NYSE

ABX

16.78

-0.13(-0.7688%)

167947

Boeing Co

BA

128

0.50(0.3922%)

691

Cisco Systems Inc

CSCO

28.6

0.13(0.4566%)

7156

Citigroup Inc., NYSE

C

46.23

0.37(0.8068%)

17500

Deere & Company, NYSE

DE

80

0.36(0.452%)

647

Exxon Mobil Corp

XOM

89.75

0.08(0.0892%)

10303

Facebook, Inc.

FB

118.12

0.42(0.3568%)

77114

Ford Motor Co.

F

13.35

0.06(0.4515%)

42475

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.45

0.34(3.0603%)

176329

General Electric Co

GE

29.97

0.12(0.402%)

14693

General Motors Company, NYSE

GM

31.18

0.13(0.4187%)

841

Goldman Sachs

GS

158.4

0.81(0.514%)

450

Google Inc.

GOOG

723

2.91(0.4041%)

4977

Hewlett-Packard Co.

HPQ

12.15

0.24(2.0151%)

6846

Home Depot Inc

HD

134.3

0.94(0.7049%)

1135

HONEYWELL INTERNATIONAL INC.

HON

114.76

0.39(0.341%)

100

Intel Corp

INTC

31.24

0.18(0.5795%)

8270

International Paper Company

IP

41.51

0.53(1.2933%)

227

Johnson & Johnson

JNJ

112.93

0.24(0.213%)

313

JPMorgan Chase and Co

JPM

64.83

0.29(0.4493%)

25199

Microsoft Corp

MSFT

51.96

0.37(0.7172%)

42395

Nike

NKE

57

0.41(0.7245%)

470

Pfizer Inc

PFE

34.12

0.02(0.0586%)

1538

Procter & Gamble Co

PG

81.03

0.06(0.0741%)

100

Starbucks Corporation, NASDAQ

SBUX

55.21

-0.23(-0.4149%)

13856

Tesla Motors, Inc., NASDAQ

TSLA

218.75

0.84(0.3855%)

8787

The Coca-Cola Co

KO

44.4

0.03(0.0676%)

300

Twitter, Inc., NYSE

TWTR

14.17

0.14(0.9979%)

101290

Verizon Communications Inc

VZ

49.7

0.12(0.242%)

1225

Visa

V

79.51

0.13(0.1638%)

183

Wal-Mart Stores Inc

WMT

70.42

0.18(0.2563%)

310

Walt Disney Co

DIS

99.97

0.46(0.4623%)

1183

Yahoo! Inc., NASDAQ

YHOO

36.63

-0.90(-2.3981%)

145450

Yandex N.V., NASDAQ

YNDX

19.76

0.28(1.4374%)

7400

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Hewlett Packard Enterprise (HPE) upgraded to Buy from Hold at Needham

Hewlett Packard Enterprise (HPE) upgraded to Buy from Hold at Cross Research

Downgrades:

Other:Tesla Motors (TSLA) target lowered to $242 from $252 at RBC Capital Mkt

Hewlett Packard Enterprise (HPE) target raised to $16 from $13 at Mizuho -

14:29

Company News: Hewlett Packard Enterprise (HPE) posts Q1 earnings in-line with analysts' estimates

Hewlett Packard Enterprise reported Q2 FY 2016 earnings of $0.42 per share, in-line with analysts' consensus of $0.42.

The company's quarterly revenues amounted to $12.711 bln (+1.3% y/y), beating consensus estimate of $12.336 bln.

The company also issued guidance for Q3 and FY2016, projecting Q3 EPS of $0.42-0.46 (versus analysts' consensus estimate of $0.48) and FY2016 EPS of $1.85-1.95 (versus analysts' consensus estimate of $1.88)

Hewlett Packard Enterprise also announced plans for a tax-free spin-off and merger of its Enterprise Services business with Computer Sciences (CSC).

HPE rose to $18.06 (+11.14%) in pre-market trading.

-

14:17

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the positive economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Construction Work Done Quarter I -2.9% Revised From -3.6% -1.5% -2.6%

06:00 Germany Gfk Consumer Confidence Survey June 9.7 9.7 9.8

06:00 Switzerland UBS Consumption Indicator April 1.40 Revised From 1.51 1.47

08:00 Germany IFO - Business Climate May 106.7 Revised From 106.6 106.8 107.7

08:00 Germany IFO - Expectations May 100.5 Revised From 100.4 100.8 101.6

08:00 Germany IFO - Current Assessment May 113.2 113.2 114.2

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) May 11.5 17.5

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. preliminary services PMI data.

The euro traded mixed against the U.S. dollar after the release of the positive economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index rose to 107.7 in May from 106.7 in April, exceeding expectations for an increase to 106.8. April's reading was revised up from 106.6.

"Business confidence in German industry and trade has improved in all four main sectors. In construction a new record high has even been reached," Ifo President Clemens Fuest said.

"The German economy is growing at a robust pace," he added.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.8 in June from 9.7 in May. Analysts had expected the index to remain unchanged at 9.7.

"Private consumption will remain an important pillar of the German economy over the next few months. GfK therefore still stands by the forecast it made at the start of the year that real private consumer spending will climb by around 2 percent in 2016. This figure stood at 1.9 percent in 2015," Gfk noted.

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Bank of Canada's interest rate decision. The central bank is expected to keep its interest rate unchanged.

The Swiss franc traded mixed against the U.S. dollar. ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 17.5 in May from 11.5 in April.

"Economic expectations have reached their highest assessment balance since October 2015," the ZEW said.

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.47 in April from 1.40 in March. March's figure was revised down from 1.51. The increase was driven by positive trends in tourism and new car registrations.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair climbed to $1.4695

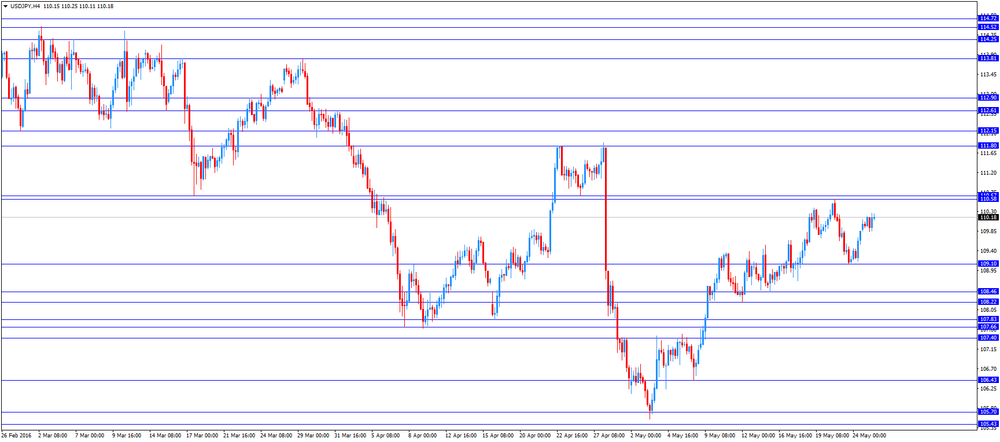

USD/JPY: the currency pair rose to Y110.27

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) May 52.8

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories May 1.31 -2.5

-

13:50

Orders

EUR/USD

Offers : 1.1160-65 1.1200 1.1230 1.1250 1.1280-85 1.1300 1.1325 1.1355-60

Bids: 1.1125-30 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.4635 1.4650 1.4670 1.4685 1.4700 1.4750

Bids: 1.4600 1.4585 1.4550 1.4500 1.4480 1.4465 1.4450 1.4420-25 1.4400

EUR/GBP

Offers : 0.7635 0.7650 0.7675-80 0.7700-05 0.7730 0.7755-60

Bids: 0.7600-10 0.7580 0.7565 0.7550 0.7530 0.7500

EUR/JPY

Offers : 122.80 123.00 123.30 123.60 123.80 124.00 124.30 124.50 124.70-75 125.00

Bids: 122.50 122.25 122.00 121.70 121.50 121.20 121.00

USD/JPY

Offers : 110.20-35 110.50 110.65 110.80 111.00 111.50

Bids: 109.85 109.65 109.50 109.20 109.00 108.75 108.50 108.30 108.20 108.00

AUD/USD

Offers : 0.7220-25 0.7250 0.7260 0.7280 0.7300 0.7325-30 0.7350

Bids: 0.7175-80 0.7155-60 0.7130 0.7100 0.7080 0.7065 0.7050

-

13:19

WSE: Mid session comment

In the mid-session the WIG20 index was at the level of 1,853 points (+1,22%) and with the turnover of PLN 280 mln. So far, many factors contribute to our success. These are mainly increases in indices of European stock exchanges. The signal a decline in risk aversion may also be a combination of a falling EUR / CHF and the continuing sell-off on gold.

-

12:00

European stock markets mid session: stocks traded higher on a deal between Greece and its creditors

Stock indices traded higher on news that Greece will get €10.3 billion in loans from the third bailout programme. Eurozone finance ministers agreed to unlock next tranche after talks in Brussels. Ministers also agreed to potentially offer Greece debt relief.

Market participants also eyed the economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index rose to 107.7 in May from 106.7 in April, exceeding expectations for an increase to 106.8. April's reading was revised up from 106.6.

"Business confidence in German industry and trade has improved in all four main sectors. In construction a new record high has even been reached," Ifo President Clemens Fuest said.

"The German economy is growing at a robust pace," he added.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.8 in June from 9.7 in May. Analysts had expected the index to remain unchanged at 9.7.

"Private consumption will remain an important pillar of the German economy over the next few months. GfK therefore still stands by the forecast it made at the start of the year that real private consumer spending will climb by around 2 percent in 2016. This figure stood at 1.9 percent in 2015," Gfk noted.

Current figures:

Name Price Change Change %

FTSE 100 6,265.75 +46.49 +0.75 %

DAX 10,204.72 +147.41 +1.47 %

CAC 40 4,481.87 +50.35 +1.14 %

-

11:50

Industrial orders in Italy drop at a seasonally adjusted rate of 3.3% in March

The Italian statistical office Istat released its industrial orders data for Italy on Wednesday. Industrial orders in Italy dropped at a seasonally adjusted rate of 3.3% in March, after a 0.7% increase in February.

Domestic orders were down 1.6% in March, while non-domestic orders declined 5.8%.

On a yearly basis, the unadjusted industrial orders in Italy increased 0.1% in March, after a 3.8% rise in February.

The seasonally adjusted industrial turnover in Italy fell 1.6% in March, after a 0.1% increase in February.

Domestic turnover decreased 2.6% in March, while non-domestic turnover rose 0.1%.

On a yearly basis, the adjusted industrial turnover in Italy declined 3.6% in March, after a 0.2% decrease in February.

-

11:44

German Gfk consumer confidence index climbs to 9.8 in June

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.8 in June from 9.7 in May. Analysts had expected the index to remain unchanged at 9.7.

The economic expectations index increased by 2.0 points to 8.3 points in May, while the willingness to buy index rose by 2.3 points to 57.7.

The income expectations index slid by 5.7 points to 51.8 in May.

"Private consumption will remain an important pillar of the German economy over the next few months. GfK therefore still stands by the forecast it made at the start of the year that real private consumer spending will climb by around 2 percent in 2016. This figure stood at 1.9 percent in 2015," Gfk noted.

-

11:40

UBS consumption index rises to 1.47 in April

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.47 in April from 1.40 in March. March's figure was revised down from 1.51.

The increase was driven by positive trends in tourism and new car registrations.

-

11:36

Spanish producer prices decrease 0.1% in April

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Wednesday. The Spanish producer prices decreased 0.1% in April, after a 0.6% rise in March.

On a yearly basis, producer price inflation in Spain fell 6.1% in April, after a 5.4% decline in March. It was the biggest drop since July 2009

Producer prices have been declining since July 2014.

Energy prices slid 10.9% year-on-year in April, capital goods prices rose 0.7%, and consumer goods prices were flat, while intermediate goods prices declined 2.8%.

-

11:28

German Ifo business confidence index rises to 107.7 in May

German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index rose to 107.7 in May from 106.7 in April, exceeding expectations for an increase to 106.8. April's reading was revised up from 106.6.

"Business confidence in German industry and trade has improved in all four main sectors. In construction a new record high has even been reached," Ifo President Clemens Fuest said.

"The German economy is growing at a robust pace," he added.

The Ifo current conditions index increased to 114.2 from 113.2. Analysts had expected the index to remain unchanged at 113.2.

The Ifo expectations index climbed to 101.6 from 100.5, beating expectations for a rise to 100.8. April's reading was revised up from 100.4.

-

11:23

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 17.5 in May

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 17.5 in May from 11.5 in April.

"Economic expectations have reached their highest assessment balance since October 2015," the ZEW said.

The current conditions rose to 0.0 in May from -0.1 in April.

-

11:00

Bank of Japan Governor Haruhiko Kuroda: the BoJ is ready to add further stimulus measures

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that the central bank was ready to add further stimulus measures if the yen would fluctuate extremely and if there were risks for inflation outlook.

"If foreign exchange moves, as with other factors, affect our ability to meet our price target, we would take additional easing steps," he said.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), May 17.5

-

10:42

New Zealand’s trade surplus widens to NZ$292 million in April

Statistics New Zealand released its trade data on late Tuesday evening. New Zealand's trade surplus widened to NZ$292 million in April from NZ$189 million in March. March's figure was revised up from a surplus of NZ$117 million.

Analysts had expected the surplus to narrow to NZ$60 million.

Exports rose 4.0% year-on-year in April, mainly driven by fruit exports, while imports increased by 1.5%, led by consumption goods.

-

10:25

European Central Bank Vice President Vitor Constancio: there is no need to discuss further stimulus measures

The European Central Bank (ECB) Vice President Vitor Constancio said in an interview with Reuters on Tuesday that there was no need to discuss further stimulus measures as the recent measures needed more time to take effect.

"Let us see what the effects are. These sorts of measures take time and some have not even been implemented," he said.

-

10:10

Greece will get €10.3 billion in loans

Greece will get €10.3 billion in loans from the third bailout programme. Eurozone finance ministers agreed to unlock next tranche after talks in Brussels. Ministers also agreed to potentially offer Greece debt relief.

-

10:01

Germany: IFO - Expectations , May 106.6 (forecast 100.8)

-

10:00

Germany: IFO - Business Climate, May 107.7 (forecast 106.8)

-

10:00

Germany: IFO - Current Assessment , May 114.2 (forecast 113.2)

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.00 (USD 342m)

EUR/USD: 1.1150 (EUR 367m)

USD/CHF 0.9820 (USD 200m)

AUD/USD 0.7200 (AUD 292m) 0.7300 (255m) 0.7385 (218m)

USD/CAD 1.2650 (USD 350m) 1.3050 (590m)

-

09:14

WSE: After opening

Yesterday's session showed that the Warsaw Exchange has some distance to the approach of the outer improve of sentiment on the core markets, closely watching the situation in emerging markets, which have not yet got a strong impulse even from the raw materials. Despite maintaining a strong approach in the US and continuing good mood this morning, our futures market started with quite modest boast, about 0.3%.

WIG20 index opened at 1837.25 points (+0.33%)*

WIG 46447.69 0.37%

WIG30 2043.04 0.47%

mWIG40 3516.87 0.20%

*/ - change to previous close

-

08:44

Options levels on wednesday, May 25, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1319 (3473)

$1.1280 (2659)

$1.1220 (1113)

Price at time of writing this review: $1.1152

Support levels (open interest**, contracts):

$1.1105 (8208)

$1.1052 (5319)

$1.1018 (3409)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 70596 contracts, with the maximum number of contracts with strike price $1,1400 (5108);

- Overall open interest on the PUT options with the expiration date June, 3 is 87721 contracts, with the maximum number of contracts with strike price $1,1200 (8208);

- The ratio of PUT/CALL was 1.24 versus 1.27 from the previous trading day according to data from May, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.4901 (2060)

$1.4803 (1705)

$1.4706 (2259)

Price at time of writing this review: $1.4622

Support levels (open interest**, contracts):

$1.4592 (846)

$1.4496 (1251)

$1.4398 (1566)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 32869 contracts, with the maximum number of contracts with strike price $1,4600 (2464);

- Overall open interest on the PUT options with the expiration date June, 3 is 34495 contracts, with the maximum number of contracts with strike price $1,4200 (2930);

- The ratio of PUT/CALL was 1.05 versus 1.07 from the previous trading day according to data from May, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

WSE: Before opening

Tuesday's session on Wall Street ended with strong increases in the major indexes, which gained 1.2 to 2 percent. The reason for growth were both good data from the German economy and good data from the US housing market, strong gains in European stock exchanges and growing appetite for risk in global markets.

We also see this morning the rising valuation of contract for the S&P500 and the contract for the DAX, which promises a continuation of yesterday's gains.

Please, remember that tomorrow there is no session in Warsaw, so the market can today look for tranquility, which will extend also to the Friday's session. Many investors probably wish to make use of the calendar, which invites to take a break from the market for a few days. On Monday, there will be holiday in London and New York, which will reduce the activity of foreign players on the Warsaw Stock Exchange.

-

08:20

Asian session: The Aussie was hit

The dollar stood near a two-month peak against a basket of currencies on Wednesday after robust U.S. housing data supported the case for the Federal Reserve to raise interest rates in the near term. The U.S. currency also gained on the safe-haven yen as investor risk aversion ebbed on the back of a bounce in European and U.S. equities. The upbeat housing numbers backed the Fed's April policy meeting minutes, released last week, which hinted that the central bank may raise rates soon if the economy appeared strong enough.

Fed Chair Janet Yellen is also due to speak on Friday, which is also the concluding day for the Ise-Shima G7 Summit being held in Japan. Once the G7 summit is out of the way, markets will be focusing whether Tokyo may look to postpone a sales tax hike and implement fiscal stimulus steps.

The Aussie was hit after the market took comments by Reserve Bank of Australia Governor Glenn Stevens to mean the central bank could further ease monetary policy in coming months. Surprisingly low inflation prompted the RBA to cut the cash rate to a record low 1.75 percent earlier this month and has investors betting on at least another easing this year.

EUR/USD: during the Asian session the pair rose to $1.1160

GBP/USD: during the Asian session the pair traded in the range of $1.4600-20

USD/JPY: during the Asian session the pair dropped to Y109.85

Based on Reuters materials

-

08:16

Germany: Gfk Consumer Confidence Survey, June 9.8 (forecast 9.7)

-

08:00

Switzerland: UBS Consumption Indicator, April 1.47

-

07:00

Global Stocks

European stocks closed lower Monday as shares in Bayer AG and Fiat Chrysler Automobiles NV struggled and Deutsche Bank sounded downbeat on the market. Markit said its eurozone composite purchasing managers index fell to 52.9. Economists surveyed by The Wall Street Journal last week had expected a rise to 53.2.

U.S. stocks surged to close higher Tuesday as a rally in financial and technology shares underpinned a sharp, broadly based stock-market advance. Similarly, Tuesday's gain was the largest percentage gain for the index since March 11. Among the S&P 500 shares, nearly a fifth were up more than 2%, another 40% were up more than 1%, while less than 10% were in negative territory.

Asian stocks rose, with the regional equities benchmark gauge rebounding from a seven-week low, after a surge in U.S. home sales fueled speculation the world's biggest economy can withstand higher interest rates. A report showed U.S. new-home sales in April surged to the highest level in more than eight years. Odds for a Federal Reserve rate increase in June rose to 34 percent from 4 percent last Monday, with traders now expecting a better-than-even chance of an increase by July.

Based on MarketWatch materials

-

04:04

Nikkei 225 16,768.8 +270.04 +1.64 %, Hang Seng 20,231.26 +400.83 +2.02 %, Shanghai Composite 2,835.79 +14.12 +0.50 %

-

03:30

Australia: Construction Work Done, Quarter I -2.6% (forecast -1.5%)

-

01:03

Commodities. Daily history for May 24’2016:

(raw materials / closing price /% change)

Oil 49.10 +0.99%

Gold 1,227.20 -0.16%

-

01:02

Stocks. Daily history for Sep Apr May 24’2016:

(index / closing price / change items /% change)

Nikkei 225 16,498.76 -155.84 -0.94 %

Hang Seng 19,830.43 +21.40 +0.11 %

S&P/ASX 200 5,295.57 -23.37 -0.44 %

Shanghai Composite 2,822.04 -21.60 -0.76 %

FTSE 100 6,219.26 +82.83 +1.35 %

CAC 40 4,431.52 +106.42 +2.46 %

Xetra DAX 10,057.31 +215.02 +2.18 %

S&P 500 2,076.06 +28.02 +1.37 %

NASDAQ Composite 4,861.06 +95.27 +2.00 %

Dow Jones 17,706.05 +213.12 +1.22 %

-

01:01

Currencies. Daily history for May 24’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1139 -0,72%

GBP/USD $1,4621 +0,95%

USD/CHF Chf0,9932 +0,38%

USD/JPY Y109,97 +0,69%

EUR/JPY Y122,50 -0,01%

GBP/JPY Y160,8 +1,64%

AUD/USD $0,7184 -0,52%

NZD/USD $0,6736 -0,34%

USD/CAD C$1,3129 -0,11%

-

00:45

New Zealand: Trade Balance, mln, April 292 (forecast 60)

-

00:01

Schedule for today, Wednesday, May 25’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Construction Work Done Quarter I -3.6% -1.5%

06:00 Germany Gfk Consumer Confidence Survey June 9.7 9.7

06:00 Switzerland UBS Consumption Indicator April 1.51

08:00 Germany IFO - Business Climate May 106.6 106.8

08:00 Germany IFO - Expectations May 100.4 100.8

08:00 Germany IFO - Current Assessment May 113.2 113.2

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) May 11.5

13:00 Belgium Business Climate May -2.4 -2.6

13:45 U.S. Services PMI (Preliminary) May 52.8

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories May 1.31

-