Noticias del mercado

-

23:59

Schedule for today, Wednesday, Apr 27’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Trimmed Mean CPI q/q March 0.6% 0.5%

01:30 Australia Trimmed Mean CPI y/y March 2.1% 2%

01:30 Australia CPI, q/q Quarter I 0.4% 0.3%

01:30 Australia CPI, y/y Quarter I 1.7% 1.8%

04:30 Japan All Industry Activity Index, m/m February 2.0% -1.3%

06:00 Germany Gfk Consumer Confidence Survey May 9.4 9.4

06:00 Switzerland UBS Consumption Indicator March 1.53

06:45 France Consumer confidence April 94 95

08:00 Eurozone Private Loans, Y/Y March 1.6% 1.7%

08:00 Eurozone M3 money supply, adjusted y/y March 5.0% 5%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 2.1% 2%

10:00 United Kingdom CBI retail sales volume balance April 7 11

11:00 U.S. MBA Mortgage Applications April 1.3%

14:00 U.S. Pending Home Sales (MoM) March 3.5% 0.5%

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Statement

21:00 New Zealand RBNZ Interest Rate Decision 2.25% 2.25%

21:00 New Zealand RBNZ Rate Statement

23:30 Japan Household spending Y/Y March 1.2% -4.2%

23:30 Japan Tokyo Consumer Price Index, y/y April -0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April -0.3% -0.3%

23:30 Japan National Consumer Price Index, y/y March 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y March 0% -0.2%

23:50 Japan Retail sales, y/y March 0.5% -1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) March -5.2% 2.9%

23:50 Japan Industrial Production (YoY) (Preliminary) March -1.2%

-

21:01

DJIA 17965.12 -12.12 -0.07%, NASDAQ 4882.85 -12.93 -0.26%, S&P 500 2088.93 1.14 0.05%

-

18:01

European stocks closed: FTSE 6284.52 23.60 0.38%, DAX 10259.59 -34.76 -0.34%, CAC 40 4533.18 -12.94 -0.28%

-

18:00

European stocks close: stocks traded mixed on rising oil prices

Stock indices traded mixed on rising oil prices. Oil prices increased on hopes that the oil market would rebalance and on a weaker U.S. dollar. The U.S. dollar declined on the weaker-than-expected U.S. economic data and ahead the release of the Fed's interest rate decision tomorrow. Analysts expect the Fed to keep it monetary policy unchanged.

No major economic reports from the Eurozone will be released today.

According to a poll by opinion poll firm ICM released on Tuesday, 46% of respondents would vote for Britain's exit from the European Union (EU), while 44% of respondents supported Britain's membership in the EU.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals declined to 45,096 in March from 45,646 in February. February's figure was revised down from 45,982.

"For households more widely, consumer credit continues to grow above real earnings growth, as improving consumer confidence and low interest rates combine to stimulate borrowing demand for personal loans, cards and overdrafts," the chief economic advisor at the BBA, Dr Rebecca Harding, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,284.52 +23.60 +0.38 %

DAX 10,259.59 -34.76 -0.34 %

CAC 40 4,533.18 -12.94 -0.28 %

-

17:40

WSE: Session Results

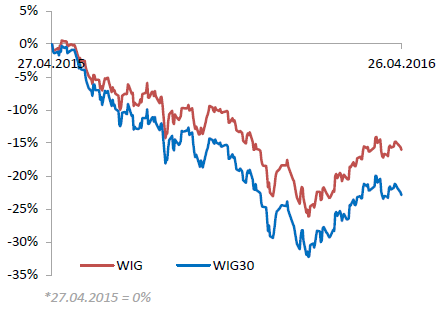

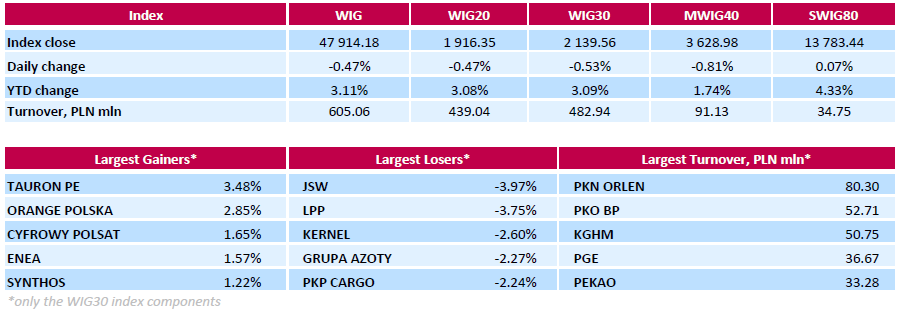

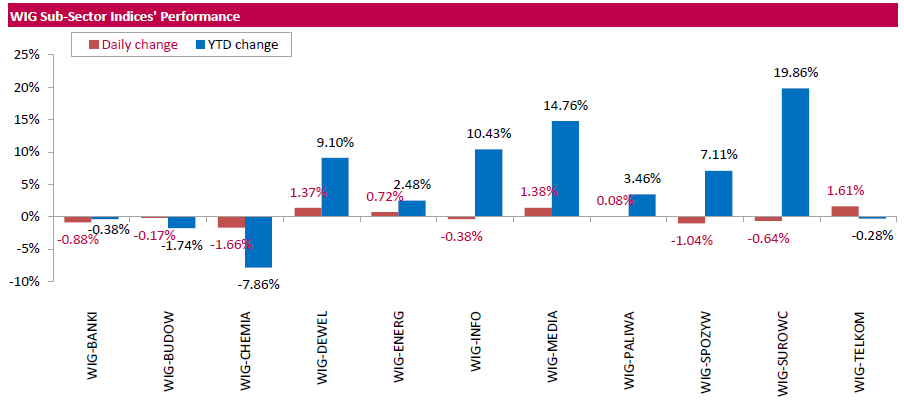

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, declined by 0.47%. Sector performance within the WIG Index was mixed. Telecommunication sector (+1.61%) was the strongest group, while chemicals (-1.66%) lagged behind.

The large-cap stocks' benchmark, the WIG30 Index, fell by 0.53%. In the index basket, coking coal producer JSW (WSE: JSW) and clothing retailer LPP (WSE: LPP) recorded the biggest declines, down 3.97% and 3.75% respectively. Other major underperformers were agricultural producer KERNEL (WSE: KER), chemical producer GRUPA AZOTY (WSE: ATT) and railway freight transport operator PKP CARGO (WSE: PKP), dropping by 2.6%, 2.27% and 2.24% respectively. On the other side of the ledger, genco TAURON PE (WSE: TPE) topped the list of outperformers, climbing by 3.48%. It was followed by telecommunication services provider ORANGE POLSKA (WSE: OPL), jumping by 2.85% on better-than-expected Q1 FY2016 earnings (the company posted net profit of PLN 98 mln for Q1 versus analysts' consensus of PLN 55.2 mln). Other noticeable risers were media group CYFROWY POLSAT (WSE: CPS), genco ENEA (WSE: ENA) and chemical producer SYNTHOS (WSE: SNS), advancing 1.65%, 1.57% and 1.22% respectively.

-

17:39

ICM’s poll: 46% of respondents support Britain’s exit from the European Union

According to a poll by opinion poll firm ICM released on Tuesday, 46% of respondents would vote for Britain's exit from the European Union (EU), while 44% of respondents supported Britain's membership in the EU.

The online survey was conducted between April 22 and 24.

-

17:30

Moody's affirms Volkswagen AG’s (VW) issuer rating at ‘A3’

Moody's Investors Service Tuesday affirmed Volkswagen AG's (VW) issuer rating at 'A3'. The outlook is negative.

"VW's overall unit sales performance, particularly for its premium Audi and Porsche brands, have remained surprisingly strong and we expect the company's earnings and cash flow from operations to remain robust in 2016-17, supporting the rating," a Moody's Senior Credit Officer and lead analyst for Volkswagen, Yasmina Serghini, said.

She added that the agency expected VW to take steps to address internal control and governance issues.

-

17:15

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday as investors assess quarterly earnings and await the outcome of a two-day U.S. Federal Reserve meeting. Markets see no chance of a U.S. interest rate increase at the meeting that is set to begin on Tuesday but have priced in a one-in-five chance of a hike at the meeting on June 14-15. Fed officials have repeatedly said a hike in June is on the cards. While job growth has continues to gain strength, inflation stubbornly remains below the Fed's 2% target. Investors are also keeping a close eye on earnings reports from major players such as Apple (AAPL) and AT&T (T).

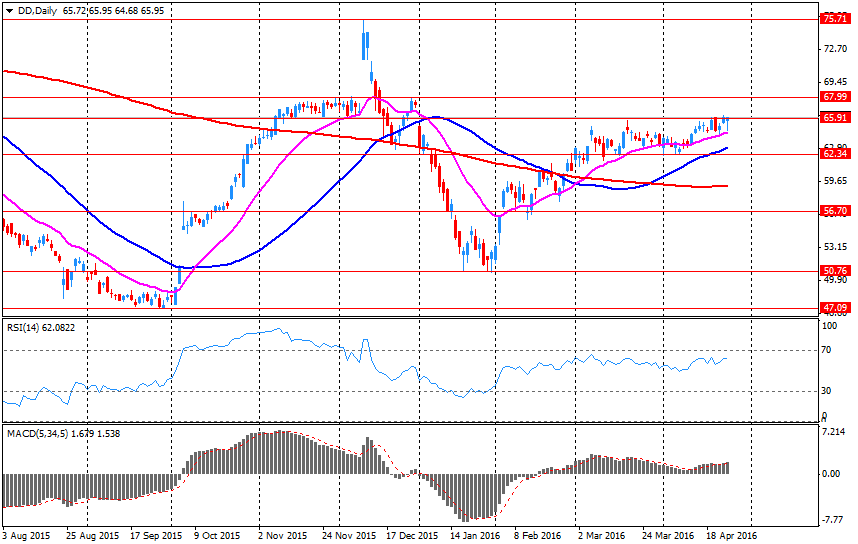

Most of Dow stocks in negative area (18 of 30). Top looser - Microsoft Corporation (MSFT, -1,21%). Top gainer - E. I. du Pont de Nemours and Company (DD, +2,40%).

Most of S&P sectors in positive area. Top looser - Healthcare (-0,8%). Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 17863.00 -39.00 -0.22%

S&P 500 2080.75 -2.50 -0.12%

Nasdaq 100 4447.00 -25.25 -0.56%

Oil 43.53 +0.89 +2.09%

Gold 1243.00 +2.80 +0.23%

U.S. 10yr 1.92 +0.02

-

17:04

Bank of Canada Governor Stephen Poloz: the global economy is recovering

The Bank of Canada (BoC) Governor Stephen Poloz said in a speech on Tuesday that the global economy was recovering.

"The global economy can continue to recover, even if global trade growth remains lower than its pre-crisis levels," he said.

Poloz pointed out that a slowdown in the global trade did not signal a recession.

"The weakness in trade we've seen is not a warning of an impending recession. Rather, I see it as a sign that trade has reached a new balance point in the global economy," the BoC governor noted.

Regarding the central bank's monetary policy, Poloz said that the central bank would continue to work on building a positive economic environment for investors, firms and consumers.

-

16:27

Richmond Fed Manufacturing Index drops to 14 in April

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to 14 in April from 22 in March. Analysts had expected the index to decrease to 11.

The decrease was mainly driven by drops in shipments and new orders.

Shipments sub-index slid to 14 in April from 27 in March, while new orders sub-index was down to 18 from 24.

The employment sub-index declined to8 from 11.

"Shipments and the volume of new orders remained solid. New hiring increased modestly, while the average workweek lengthened and average wage increases moderated. Prices of raw materials and finished goods rose at a faster pace compared to last month," the survey said.

-

16:13

U.S. consumer confidence index falls to 94.2 in April

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index fell to 94.2 in April from 96.1 in March. March's figure was revised down from 96.2.

Analysts had expected the index to decline to 96.0.

The present conditions index climbed to 116.4 in April from 114.9 in March.

The Conference Board's consumer expectations index for the next six months decreased to 79.3 in April from 83.6 in March.

The percentage of consumers expecting more jobs in the coming months was down to 12.2% in April from 13.0% in March.

"Consumer confidence continued on its sideways path, posting a slight decline in April, following a modest gain in March. Consumers' assessment of current conditions improved, suggesting no slowing in economic growth. However, their expectations regarding the short-term have moderated, suggesting they do not foresee any pickup in momentum," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:00

U.S.: Consumer confidence , April 94.2 (forecast 96)

-

15:59

U.S. preliminary services purchasing managers' index rises to 52.1 in April

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) rose to 52.1 in April from 51.3 in March. Analysts had expected the index to rise to 52.3.

A reading below 50 indicates contraction in economic activity.

The increase was driven by a marginal growth in new work. Job creation slowed to the weakest level since October 2015.

"The upturn in the rate of growth of business activity and increased inflows of new orders suggest the economy should see GDP rise at an increased rate in the second quarter, but growth is clearly far more fragile than this time last year," Markit Chief Economist Chris Williamson said.

-

15:59

U.S.: Richmond Fed Manufacturing Index, April 14 (forecast 11)

-

15:50

Option expiries for today's 10:00 ET NY cut

USDJPY 109.00 (USD 243m) 110.00 (USD 991m) 111.15 (890m) 111.25 (280m) 111.35 (255m) 112.65 (315m) 112.75 (240m)

EURUSD: 1.1140 (EUR 372m)

AUDUSD 0.7570 (AUD 753m) 0.7600 (230m)

USDCAD 1.2600 (USD 215m) 1.2800 (310m)

NZDUSD 0.6890 (NZD 270m)

AUDNZD 1.1180 (AUD 347m)

-

15:45

U.S.: Services PMI, April 52.1 (forecast 52.3)

-

15:41

WSE: After start on Wall Street

Preliminary March orders for durable goods in the US were worse than expected, and no rebound took place after a weak February. The 0.2% contraction was admittedly lower that in the previous month, but still a departure from the expectation was 0.5% growth.

The statistical data have cast negative impact on the stock market and caused weakening of the USD.

Before the start of Wall Street, futures on the S&P500 grew only marginally.

U.S. Stocks open: Dow +0.21%, Nasdaq +0.16%, S&P +0.22%

The Polish market, as well as the DAX remain at the lowest levels of the session, however, under similar circumstances it often happened so that a positive first phase of the session in the US was able to reverse the lackluster sentiment in Europe. In the absence of the latter, there is an immediate possibility that the WIG20 may test the level of 1,900 points.

-

15:35

U.S. Stocks open: Dow +0.21%, Nasdaq +0.16%, S&P +0.22%

-

15:30

S&P/Case-Shiller home price index rises 5.4% in February

The S&P/Case-Shiller home price index increased 5.4% year-on-year in February, missing expectations for a 5.5% rise, after a 5.7% gain in January.

Portland, Seattle, and Denver were the largest contributors to the rise, where prices climbed by 11.9% year-on-year, 11.0% and 9.7%, respectively.

"Home prices continue to rise twice as fast as inflation, but the pace is easing off in the most recent numbers," managing director chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

"The slower growth rate is evident in the monthly seasonally adjusted numbers: six cities experienced smaller monthly gains in February compared to January, when no city saw growth," he added.

On a monthly basis, the S&P/Case-Shiller home price index rose 0.2% in February.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:30

Before the bell: S&P futures +0.17%, NASDAQ futures +0.14%

U.S. stock-index futures edged higher.

Global Stocks:

Nikkei 17,353.28 -86.02 -0.49%

Hang Seng 21,407.27 +102.83 +0.48%

Shanghai Composite 2,965.4 +18.73 +0.64%

FTSE 6,280.52 +19.60 +0.31%

CAC 4,534.34 -11.78 -0.26%

DAX 10,283.02 -11.33 -0.11%

Crude $43.22 (+1.37%)

Gold $1235.00 (-0.42%)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, February 5.4% (forecast 5.5%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

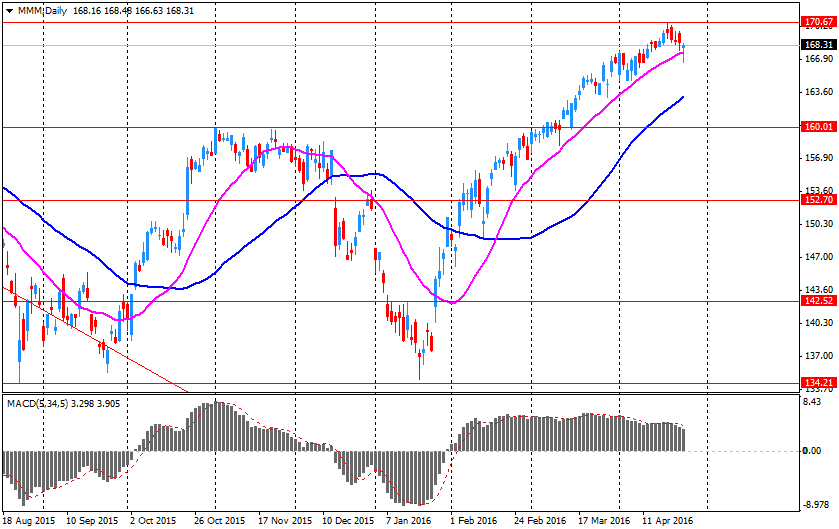

3M Co

MMM

168

-0.38(-0.2257%)

2724

ALCOA INC.

AA

10.25

0.09(0.8858%)

9095

ALTRIA GROUP INC.

MO

61.4

0.18(0.294%)

2815

Amazon.com Inc., NASDAQ

AMZN

627.98

1.78(0.2843%)

4477

American Express Co

AXP

66

0.30(0.4566%)

291

AMERICAN INTERNATIONAL GROUP

AIG

55.95

0.00(0.00%)

200

Apple Inc.

AAPL

104.49

-0.59(-0.5615%)

297812

AT&T Inc

T

38.23

0.02(0.0523%)

3751

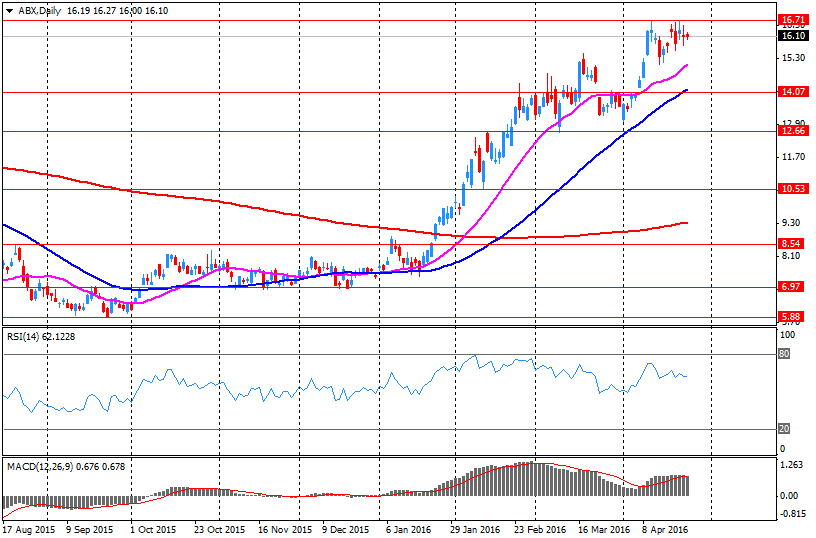

Barrick Gold Corporation, NYSE

ABX

15.81

-0.30(-1.8622%)

149509

Caterpillar Inc

CAT

77.19

0.40(0.5209%)

16468

Chevron Corp

CVX

101.89

0.38(0.3743%)

3278

Cisco Systems Inc

CSCO

28.31

0.08(0.2834%)

3595

Citigroup Inc., NYSE

C

46.8

0.11(0.2356%)

5210

E. I. du Pont de Nemours and Co

DD

67.06

1.09(1.6523%)

31134

Exxon Mobil Corp

XOM

87.55

0.22(0.2519%)

3584

Facebook, Inc.

FB

110.47

0.37(0.3361%)

68820

FedEx Corporation, NYSE

FDX

164.5

-1.06(-0.6403%)

150

Ford Motor Co.

F

13.62

0.04(0.2945%)

12260

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.27

-0.08(-0.7048%)

298607

General Electric Co

GE

30.73

0.05(0.163%)

11937

General Motors Company, NYSE

GM

32.17

0.22(0.6886%)

1100

Goldman Sachs

GS

165.38

0.29(0.1757%)

115

Google Inc.

GOOG

724.88

1.73(0.2392%)

1664

Intel Corp

INTC

31.46

0.07(0.223%)

2949

Johnson & Johnson

JNJ

113.69

0.18(0.1586%)

670

JPMorgan Chase and Co

JPM

63.64

0.04(0.0629%)

150

McDonald's Corp

MCD

127.67

0.21(0.1648%)

925

Microsoft Corp

MSFT

52.15

0.04(0.0768%)

23805

Nike

NKE

59.2

-0.01(-0.0169%)

900

Pfizer Inc

PFE

33.26

0.05(0.1506%)

782

Procter & Gamble Co

PG

81.6

0.19(0.2334%)

81573

Starbucks Corporation, NASDAQ

SBUX

57.89

0.12(0.2077%)

1136

Tesla Motors, Inc., NASDAQ

TSLA

252.35

0.53(0.2105%)

9877

The Coca-Cola Co

KO

44.74

0.03(0.0671%)

2025

Twitter, Inc., NYSE

TWTR

17.24

0.15(0.8777%)

91414

United Technologies Corp

UTX

105.5

0.30(0.2852%)

150

Verizon Communications Inc

VZ

50.75

-0.01(-0.0197%)

2610

Visa

V

78

-0.14(-0.1792%)

1520

Wal-Mart Stores Inc

WMT

69.51

0.04(0.0576%)

633

Yahoo! Inc., NASDAQ

YHOO

37.09

-0.14(-0.376%)

335

-

14:50

U.S. durable goods orders rise 0.8% in March

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders rose 0.8% in March, missing expectations for a 1.8% gain, after a 3.1% drop in February. February's figure was revised down from a 2.8% fall.

The increase was mainly driven by a strong demand for transportation equipment, which climbed by 2.9% in March.

The U.S. durable goods orders excluding transportation fell 0.2% in March, missing expectations for a 0.5% increase, after a 1.3% decline in February. February's figure was revised down from a 1.0% drop.

The U.S. durable goods orders excluding defence slid 1.0 % in March, missing expectations for a 0.4% increase, after a 2.3% decline in February. February's figure was revised down from a 1.9% decrease.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Buy from Hold at Argus

Downgrades:

Other:

General Electric (GE) target lowered to $34 from $36 at Stifel

Verizon (VZ) target lowered to $56 from $58 at RBC Capital Mkts

-

14:33

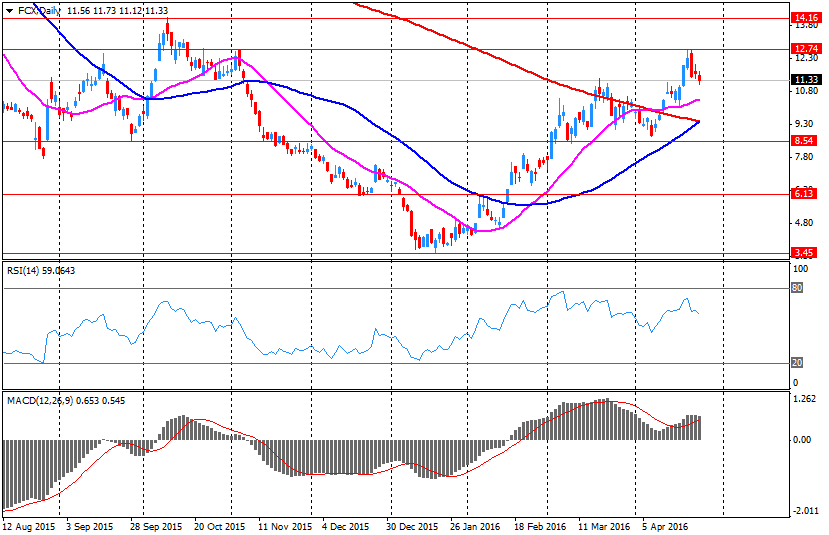

Company News: Freeport-McMoRan (FCX) Posts Q1 Results in Line With Analysts' Estimates

Freeport-McMoRan reported Q1 FY 2016 net losses of $0.16 per share (versus net losses of $0.06 in Q1 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $3.527 bln (-15.1% y/y), generally in-line with consensus estimate of $3.524 bln.

FCX rose to $11.44 (+0.79%) in pre-market trading.

-

14:30

U.S.: Durable Goods Orders , March 0.8% (forecast 1.8%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , March -0.2% (forecast 0.5%)

-

14:30

U.S.: Durable goods orders ex defense, March -1% (forecast 0.4%)

-

14:24

-

14:16

Company News: 3M Co. (MMM) Quarterly Results Beat Analysts’ Estimates

3M Co. reported Q1 FY 2016 earnings of $1.95 per share (versus $1.85 in Q1 FY 2015), beating analysts' consensus of $1.92.

The company's quarterly revenues amounted to $7.409 bln (-2.2% y/y), beating consensus estimate of $7.326. bln.

3M Co. reaffirmed guidance for FY 2016, projecting EPS of $8.10-8.45 versus analysts' consensus estimates of $8.24

MMM fell to $167.00 (-0.82%) in pre-market trading.

-

14:08

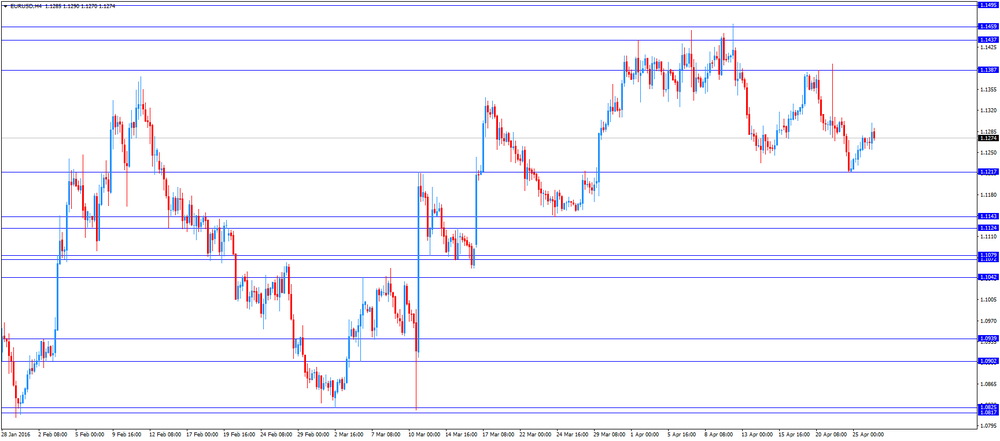

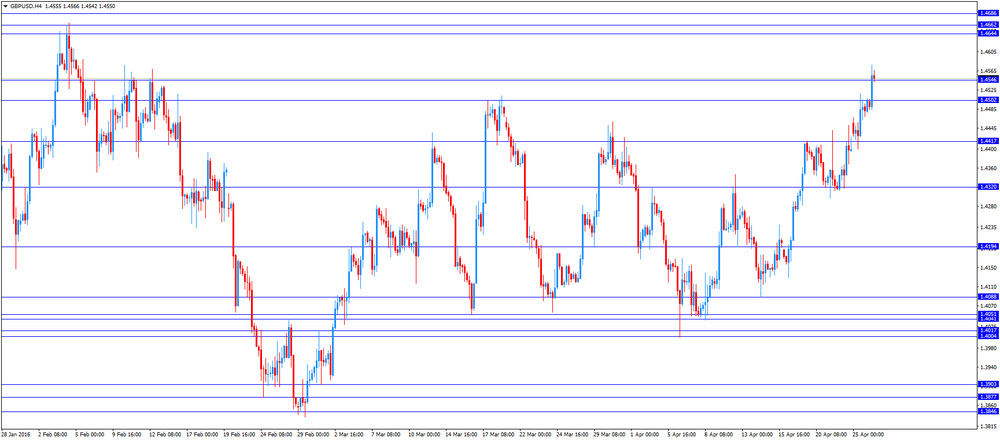

Foreign exchange market. European session: the euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:30 United Kingdom BBA Mortgage Approvals March 45.6 46 45.096

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. durable goods orders are expected to increase 1.8% in March, after a 2.8% rise in February.

The U.S. durable goods orders excluding transportation are expected to climb 0.5% in March, after a 1.0% increase in February.

The S&P/Case-Shiller home price index is expected to rise by 5.5% in February, after a 5.7% gain in January.

The U.S. consumer confidence is expected to decrease to 96.0 in April from 96.2 in March.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded higher against the U.S. dollar. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals declined to 45,096 in March from 45,646 in February. February's figure was revised down from 45,982.

"For households more widely, consumer credit continues to grow above real earnings growth, as improving consumer confidence and low interest rates combine to stimulate borrowing demand for personal loans, cards and overdrafts," the chief economic advisor at the BBA, Dr Rebecca Harding, said.

The Canadian dollar traded higher against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

EUR/USD: the currency pair rose to $1.1299

GBP/USD: the currency pair increased to $1.4577

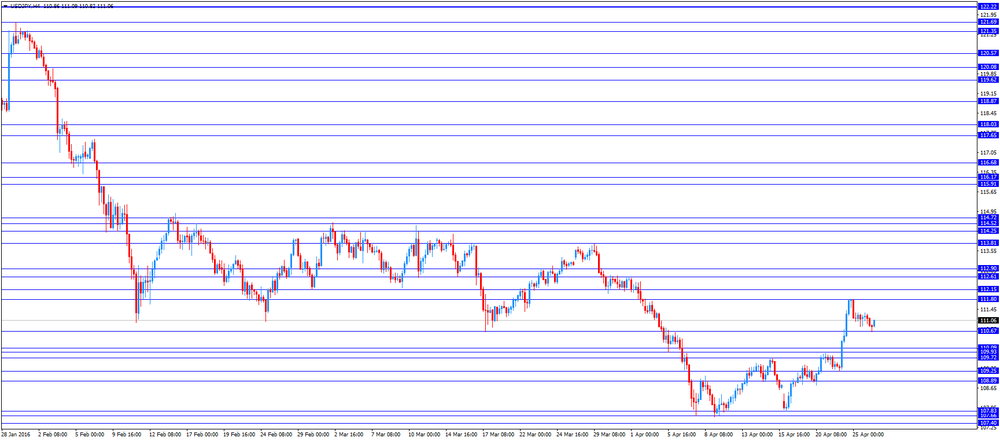

USD/JPY: the currency pair climbed to Y111.09

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders March -2.8% 1.8%

12:30 U.S. Durable Goods Orders ex Transportation March -1.0% 0.5%

12:30 U.S. Durable goods orders ex defense March -1.9% 0.4%

12:55 Canada BOC Gov Stephen Poloz Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y February 5.7% 5.5%

13:45 U.S. Services PMI (Preliminary) April 51.3 52.3

14:00 U.S. Richmond Fed Manufacturing Index April 22 11

14:00 U.S. Consumer confidence April 96.2 96

22:45 New Zealand Trade Balance, mln March 339 405

-

14:05

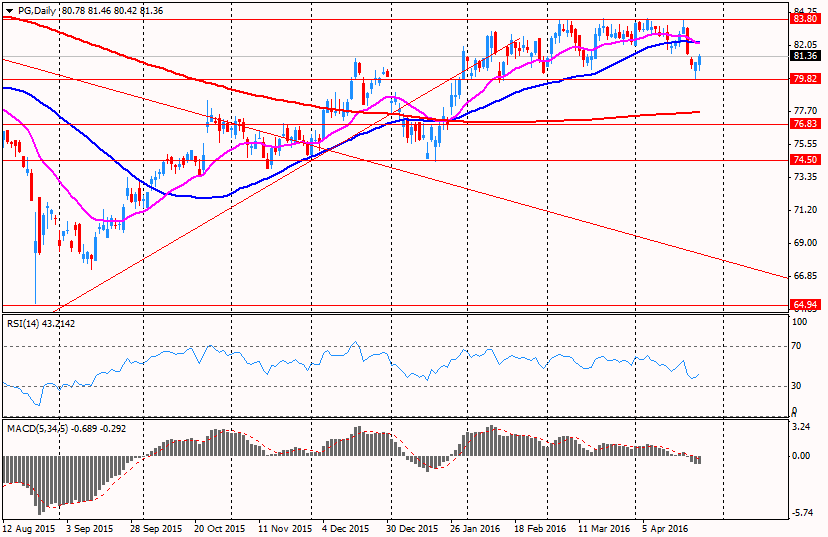

Company News: Procter & Gamble (PG) Quarterly Earnings Beat Analysts’ Estimates

Procter & Gamble reported Q3 FY 2016 earnings of $0.86 per share (versus $0.92 in Q3 FY 2015), beating analysts' consensus of $0.82.

The company's quarterly revenues amounted to $15.755 bln (-6.9% y/y), generally in-line with analysts' consensus estimate of $15.809 bln.

Procter & Gamble also issued in-line guidance for Q4 FY 2016 and for the full FY 2016, projecting Q4 EPS lower than $1.00 (versus analysts' consensus estimate of $0.78) and 2016 EPS of $3.53-3.65 (versus analysts' consensus estimate of $3.63.

PG rose to $81.70 (+0.36%) in pre-market trading.

-

13:47

Company News: DuPont (DD) Q1 Results Beat Analysts’ Expectations

DuPont reported Q1 FY 2016 earnings of $1.26 per share (versus $1.34 in Q1 FY 2015), beating analysts' consensus of $1.04.

The company's quarterly revenues amounted to $7.405 bln (-19.3% y/y), beating consensus estimate of $7.097 bln.

DuPont issues upside guidance for FY 2016, projecting EPS of $3.05-3.20 (versus analysts' consensus estimate of. $3.02), up from prior guidance of $2.95-3.10 per share.

DD closed Monday's trading session at $65.97 (0%).

-

13:45

Orders

EUR/USD

Offers 1.1280 1.1300 1.1320 1.1335 1.1350 1.1385 1.1400 1.1420 1.1450

Bids 1.1250 1.1220-25 1.1200 1.1180 1.1160 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers 1.4550-55 1.4575 1.4600 1.4630 1.4650 1.4680 1.4700

Bids 1.4520 1.4500 1.4485 1.4465 1.4450 1.4420 1.4400 1.4385 1.4350 1.4320-25 1.4300

EUR/JPY

Offers 125.30 125.50 125.75 126.00 126.50 126.85 127.00

Bids 124.65 124.50 124.30 124.00 123.50 123.20 123.00

EUR/GBP

Offers 0.7780-85 0.7800 0.7825-30 07850 0.7880-85 0.7900

Bids 0.7735 0.7720 0.7700 0.7685 0.7650 0.7630 0.7600

USD/JPY

Offers 111.00 111.35 111.50 111.75-80 112.00 112.30 112.50

Bids 110.65 110.50 110.20 110.00 109.80 109.50 109.30 109.00 108.75 108.50

AUD/USD

Offers 0.7730 0.7750 0.7780 0.7800 0.7825-30 0.7850 0.7880 0.7900

Bids 0.7700 0.7680-85 0.7650 0.7620-25 0.7600 0.7585 0.7550 0.7530 0.7500

-

13:05

WSE: Mid session comment

The midday phase of trade has brought new lows in Euroland, where the CAC40 turned into decreases, and the German DAX surrendered all of the initial increases.

This had put pressure on the Warsaw Stock Exchange, which has already shown its weakness in the morning. Subsequent defense worked for a short time and now capital again must be involved in the face of difficulties in the environment.

WIG20 index is approaching a key support level of 1,900 points, and the slowly becoming problem is not only the condition of the Warsaw Stock Exchange, but also the possibility of correction in the environment.

At the halfway point of the session the WIG20 reached the level of 1911 points.

-

12:01

European stock markets mid session: stocks traded higher on a rise in oil prices

Stock indices traded higher on rising oil prices. Oil prices increased on hopes that the oil market would rebalance and on a weaker U.S. dollar. The U.S. dollar declined ahead the release of the Fed's interest rate decision tomorrow. Analysts expect the Fed to keep it monetary policy unchanged.

No major economic reports from the Eurozone will be released today.

Current figures:

Name Price Change Change %

FTSE 100 6,286.92 +26.00 +0.42 %

DAX 10,326.92 +32.57 +0.32 %

CAC 40 4,552.11 +5.99 +0.13 %

-

11:38

Reuters: the German parliament plans to invite the European Central Bank President Mario Draghi

Reuters reported on Tuesday that the German parliament planned to invite the European Central Bank (ECB) President Mario Draghi, according to sources familiar with the matter. Draghi should explain the ECB's monetary policy.

-

11:20

Bank of Japan Governor Haruhiko Kuroda: there is no need in exemption from negative interest rates

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Tuesday that there was no need in exemption from negative interest rates.

"Negative interest rates apply to only a small portion of financial institutions' excess reserves, so most of them receive a net interest rate payment from the central bank," he said.

-

11:03

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00 (USD 243m) 110.00 (USD 991m) 111.15 (890m) 111.25 (280m) 111.35 (255m) 112.65 (315m) 112.75 (240m)

EUR/USD: 1.1140 (EUR 372m)

AUD/USD 0.7570 (AUD 753m) 0.7600 (230m)

USD/CAD 1.2600 (USD 215m) 1.2800 (310m)

NZD/USD 0.6890 (NZD 270m)

AUD/NZD 1.1180 (AUD 347m)

-

10:55

Number of mortgage approvals in the U.K. declines to 45,096 in March

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals declined to 45,096 in March from 45,646 in February. February's figure was revised down from 45,982.

"For households more widely, consumer credit continues to grow above real earnings growth, as improving consumer confidence and low interest rates combine to stimulate borrowing demand for personal loans, cards and overdrafts," the chief economic advisor at the BBA, Dr Rebecca Harding, said.

"Business borrowing is moderating within distribution, manufacturing, food and accommodation sectors, as large corporates use capital markets for their funding and both large and small businesses continue to build up deposits," she added.

-

10:38

Budimex S.A.

Budimex S.A. (WSE: BDX) shareholders approve allocation of PLN 207.8 mln of its 2015 net profit to dividend, which translates into PLN 8.14 per share.

The proposal translates into a dividend yield of 4.2% as calculated against the Tuesday morning price of PLN 196.1.

The dividend day is May 6 and the payout day - May 24.

Last year Budimex paid PLN 6.11 DPS from its 2014 profit.

Budimex S.A. is known to be one of the largest construction companies in Poland. The company has existed for over 40 years, and its implementation can be found in dozens of countries on three continents. Currently, the company focuses on the Polish market. As a general contractor works in the sectors of infrastructure: road, rail, airport; building construction, energy, industrial and environmental.

-

10:30

United Kingdom: BBA Mortgage Approvals, March 45.096 (forecast 46)

-

10:10

Indonesia’s governor to OPEC Widhyawan Prawiraatmadja: oil price at $45 a barrel is “not so bad”

Indonesia's governor to the Organization of the Petroleum Exporting Countries (OPEC), Widhyawan Prawiraatmadja, said on Monday that oil price at $45 a barrel was "not so bad". He added that there would be no need in the freeze of the oil output if the oil price remains at $45 a barrel.

Prawiraatmadja noted that oil price at $50 - $60 was ideal, but still too cheap.

-

09:12

WSE: After opening

The futures market (WSE: FW20M16) opened with increase by 0.31% to 1,921 points.

WIG20 index opened at 1925.44 points (+0.01%)*

WIG 48123.60 -0.03%

WIG30 2149.26 -0.08%

mWIG40 3658.62 0.00%

*/ - change to previous close

Spot market began the day at the neutral level of 1,925 points with modest turnover. The German DAX gained more than 0.6%, which serve as reference point for the WSE, but it can also underline the weakness of the latter, whereby the WIG20 has not recovered from yesterday's lows. The beginning of the session is not encouraging for the bullish participants, and confirms that bears are becoming the majority for the time being.

-

08:36

Options levels on tuesday, April 26, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1391 (2474)

$1.1360 (2406)

$1.1314 (578)

Price at time of writing this review: $1.1268

Support levels (open interest**, contracts):

$1.1216 (3211)

$1.1192 (4432)

$1.1162 (3407)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 37686 contracts, with the maximum number of contracts with strike price $1,1400 (4573);

- Overall open interest on the PUT options with the expiration date May, 6 is 59563 contracts, with the maximum number of contracts with strike price $1,0900 (4685);

- The ratio of PUT/CALL was 1.58 versus 1.34 from the previous trading day according to data from April, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.4801 (961)

$1.4703 (1152)

$1.4605 (1472)

Price at time of writing this review: $1.4491

Support levels (open interest**, contracts):

$1.4393 (1380)

$1.4296 (750)

$1.4198 (1158)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24498 contracts, with the maximum number of contracts with strike price $1,4400 (2064);

- Overall open interest on the PUT options with the expiration date May, 6 is 31585 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.29 versus 1.27 from the previous trading day according to data from April, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

WSE: Before opening

Yesterday's trading in the US, as well as on the WSE, was not very active, but in contrast to the Polish market, managed to recover most of the setbacks by the end of the session.

Before the start of today's session, we may see that all the concerns reflected in the course of yesterday's trading today are present and even more articulated. In addition, Asia is dominated by selling, although they are not significant and, for example, the declines of the Nikkei index were not as substantial as the session's lows.

Today's calendar will be slightly richer than yesterday, and the most important information will be the consumer confidence index (the Conference Board index).

After yesterday's session on the Warsaw Stock Exchange we met the results of Orange Polska S.A. (WSE: OPL), which surprised positively. The Warsaw market declined yesterday and closed below 1,930 points, which gives an invitation to continue the discounts. On the other hand, low turnover undermined the credibility of yesterday's motion, and the wait for the outcome of the meeting of the FOMC may limit volatility.

-

07:03

Global Stocks

European stocks dropped Monday, with German shares falling on the back of downbeat data from the region's largest economy. The oil-price losses followed gains logged last week, supported by expectations of continued declines in U.S. crude production.

U.S. stocks finished lower Monday, but pared their declines heading into the close, as investors weighed a round of lackluster earnings and awaited the conclusion of a Federal Reserve policy meeting later in the week. Central bank policy is expected to remain a prominent theme this week. Signs of rising inflation in the U.S. might influence the Fed to adopt slightly more hawkish language in its monetary policy statement, analysts said.

Asian stocks fell for a third day as raw-materials shares declined and Tokyo equities slumped before this week's central-bank meetings in the U.S. and Japan. The Bank of Japan's meeting concludes the following day and most economists predict monetary stimulus will be stepped up in Asia's second-biggest economy.

Based on MarketWatch materials

-

04:06

Nikkei 225 17,219.44 -219.86 -1.26 %, Hang Seng 21,189.49 -114.95 -0.54 %, Shanghai Composite 2,948.85 +2.18 +0.07 %

-

00:35

Commodities. Daily history for Apr 25'2016:

(raw materials / closing price /% change)

Oil 42.99 +0.82%

Gold 1,239.40 -0.06%

-

00:34

Stocks. Daily history for Sep Apr 25’2016:

(index / closing price / change items /% change)

Nikkei 225 17,439.3 -133.19 -0.76 %

Hang Seng 21,304.44 -162.60 -0.76 %

Shanghai Composite 2,946.96 -12.28 -0.41 %

FTSE 100 6,260.92 -49.52 -0.78 %

CAC 40 4,546.12 -23.54 -0.52 %

Xetra DAX 10,294.35 -79.14 -0.76 %

S&P 500 2,087.79 -3.79 -0.18 %

NASDAQ Composite 4,895.79 -10.44 -0.21 %

Dow Jones 17,977.24 -26.51 -0.15 %

-

00:33

Currencies. Daily history for Apr 25’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1267 +0,39%

GBP/USD $1,4481 +0,57%

USD/CHF Chf0,9751 -0,33%

USD/JPY Y111,22 -0,50%

EUR/JPY Y125,31 -0,13%

GBP/JPY Y161,05 +0,07%

AUD/USD $0,7712 +0,05%

NZD/USD $0,6856 +0,09%

USD/CAD C$1,2676 +0,08%

-