Noticias del mercado

-

23:59

Schedule for today, Wednesday, Apr 27’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Trimmed Mean CPI q/q March 0.6% 0.5%

01:30 Australia Trimmed Mean CPI y/y March 2.1% 2%

01:30 Australia CPI, q/q Quarter I 0.4% 0.3%

01:30 Australia CPI, y/y Quarter I 1.7% 1.8%

04:30 Japan All Industry Activity Index, m/m February 2.0% -1.3%

06:00 Germany Gfk Consumer Confidence Survey May 9.4 9.4

06:00 Switzerland UBS Consumption Indicator March 1.53

06:45 France Consumer confidence April 94 95

08:00 Eurozone Private Loans, Y/Y March 1.6% 1.7%

08:00 Eurozone M3 money supply, adjusted y/y March 5.0% 5%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 2.1% 2%

10:00 United Kingdom CBI retail sales volume balance April 7 11

11:00 U.S. MBA Mortgage Applications April 1.3%

14:00 U.S. Pending Home Sales (MoM) March 3.5% 0.5%

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Statement

21:00 New Zealand RBNZ Interest Rate Decision 2.25% 2.25%

21:00 New Zealand RBNZ Rate Statement

23:30 Japan Household spending Y/Y March 1.2% -4.2%

23:30 Japan Tokyo Consumer Price Index, y/y April -0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April -0.3% -0.3%

23:30 Japan National Consumer Price Index, y/y March 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y March 0% -0.2%

23:50 Japan Retail sales, y/y March 0.5% -1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) March -5.2% 2.9%

23:50 Japan Industrial Production (YoY) (Preliminary) March -1.2%

-

17:39

ICM’s poll: 46% of respondents support Britain’s exit from the European Union

According to a poll by opinion poll firm ICM released on Tuesday, 46% of respondents would vote for Britain's exit from the European Union (EU), while 44% of respondents supported Britain's membership in the EU.

The online survey was conducted between April 22 and 24.

-

17:04

Bank of Canada Governor Stephen Poloz: the global economy is recovering

The Bank of Canada (BoC) Governor Stephen Poloz said in a speech on Tuesday that the global economy was recovering.

"The global economy can continue to recover, even if global trade growth remains lower than its pre-crisis levels," he said.

Poloz pointed out that a slowdown in the global trade did not signal a recession.

"The weakness in trade we've seen is not a warning of an impending recession. Rather, I see it as a sign that trade has reached a new balance point in the global economy," the BoC governor noted.

Regarding the central bank's monetary policy, Poloz said that the central bank would continue to work on building a positive economic environment for investors, firms and consumers.

-

16:27

Richmond Fed Manufacturing Index drops to 14 in April

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to 14 in April from 22 in March. Analysts had expected the index to decrease to 11.

The decrease was mainly driven by drops in shipments and new orders.

Shipments sub-index slid to 14 in April from 27 in March, while new orders sub-index was down to 18 from 24.

The employment sub-index declined to8 from 11.

"Shipments and the volume of new orders remained solid. New hiring increased modestly, while the average workweek lengthened and average wage increases moderated. Prices of raw materials and finished goods rose at a faster pace compared to last month," the survey said.

-

16:13

U.S. consumer confidence index falls to 94.2 in April

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index fell to 94.2 in April from 96.1 in March. March's figure was revised down from 96.2.

Analysts had expected the index to decline to 96.0.

The present conditions index climbed to 116.4 in April from 114.9 in March.

The Conference Board's consumer expectations index for the next six months decreased to 79.3 in April from 83.6 in March.

The percentage of consumers expecting more jobs in the coming months was down to 12.2% in April from 13.0% in March.

"Consumer confidence continued on its sideways path, posting a slight decline in April, following a modest gain in March. Consumers' assessment of current conditions improved, suggesting no slowing in economic growth. However, their expectations regarding the short-term have moderated, suggesting they do not foresee any pickup in momentum," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:00

U.S.: Consumer confidence , April 94.2 (forecast 96)

-

15:59

U.S. preliminary services purchasing managers' index rises to 52.1 in April

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) rose to 52.1 in April from 51.3 in March. Analysts had expected the index to rise to 52.3.

A reading below 50 indicates contraction in economic activity.

The increase was driven by a marginal growth in new work. Job creation slowed to the weakest level since October 2015.

"The upturn in the rate of growth of business activity and increased inflows of new orders suggest the economy should see GDP rise at an increased rate in the second quarter, but growth is clearly far more fragile than this time last year," Markit Chief Economist Chris Williamson said.

-

15:59

U.S.: Richmond Fed Manufacturing Index, April 14 (forecast 11)

-

15:50

Option expiries for today's 10:00 ET NY cut

USDJPY 109.00 (USD 243m) 110.00 (USD 991m) 111.15 (890m) 111.25 (280m) 111.35 (255m) 112.65 (315m) 112.75 (240m)

EURUSD: 1.1140 (EUR 372m)

AUDUSD 0.7570 (AUD 753m) 0.7600 (230m)

USDCAD 1.2600 (USD 215m) 1.2800 (310m)

NZDUSD 0.6890 (NZD 270m)

AUDNZD 1.1180 (AUD 347m)

-

15:45

U.S.: Services PMI, April 52.1 (forecast 52.3)

-

15:30

S&P/Case-Shiller home price index rises 5.4% in February

The S&P/Case-Shiller home price index increased 5.4% year-on-year in February, missing expectations for a 5.5% rise, after a 5.7% gain in January.

Portland, Seattle, and Denver were the largest contributors to the rise, where prices climbed by 11.9% year-on-year, 11.0% and 9.7%, respectively.

"Home prices continue to rise twice as fast as inflation, but the pace is easing off in the most recent numbers," managing director chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

"The slower growth rate is evident in the monthly seasonally adjusted numbers: six cities experienced smaller monthly gains in February compared to January, when no city saw growth," he added.

On a monthly basis, the S&P/Case-Shiller home price index rose 0.2% in February.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, February 5.4% (forecast 5.5%)

-

14:50

U.S. durable goods orders rise 0.8% in March

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders rose 0.8% in March, missing expectations for a 1.8% gain, after a 3.1% drop in February. February's figure was revised down from a 2.8% fall.

The increase was mainly driven by a strong demand for transportation equipment, which climbed by 2.9% in March.

The U.S. durable goods orders excluding transportation fell 0.2% in March, missing expectations for a 0.5% increase, after a 1.3% decline in February. February's figure was revised down from a 1.0% drop.

The U.S. durable goods orders excluding defence slid 1.0 % in March, missing expectations for a 0.4% increase, after a 2.3% decline in February. February's figure was revised down from a 1.9% decrease.

-

14:30

U.S.: Durable Goods Orders , March 0.8% (forecast 1.8%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , March -0.2% (forecast 0.5%)

-

14:30

U.S.: Durable goods orders ex defense, March -1% (forecast 0.4%)

-

14:08

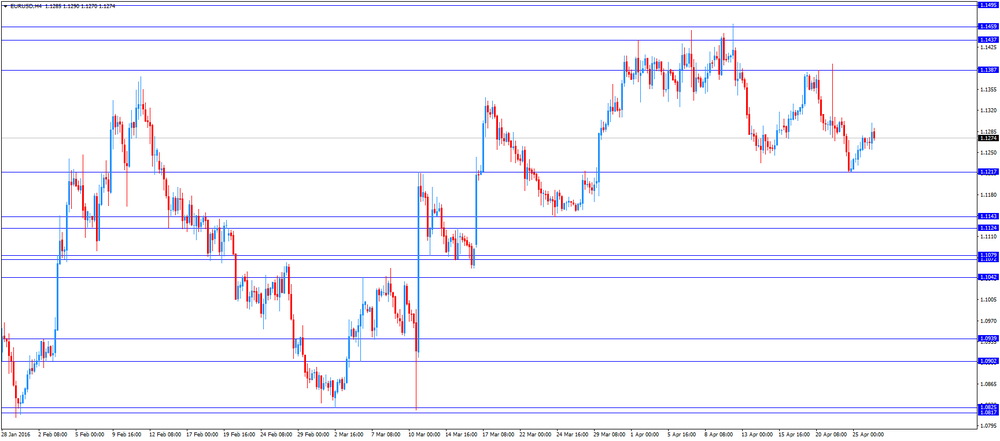

Foreign exchange market. European session: the euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:30 United Kingdom BBA Mortgage Approvals March 45.6 46 45.096

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. durable goods orders are expected to increase 1.8% in March, after a 2.8% rise in February.

The U.S. durable goods orders excluding transportation are expected to climb 0.5% in March, after a 1.0% increase in February.

The S&P/Case-Shiller home price index is expected to rise by 5.5% in February, after a 5.7% gain in January.

The U.S. consumer confidence is expected to decrease to 96.0 in April from 96.2 in March.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

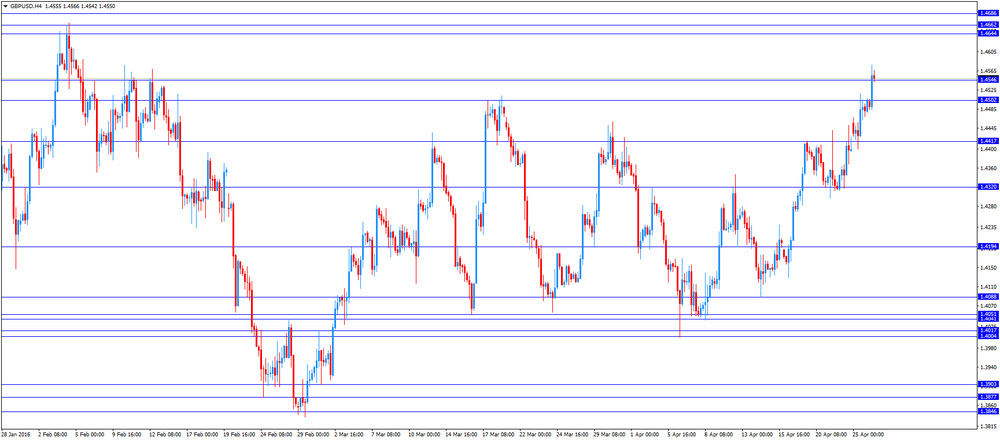

The British pound traded higher against the U.S. dollar. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals declined to 45,096 in March from 45,646 in February. February's figure was revised down from 45,982.

"For households more widely, consumer credit continues to grow above real earnings growth, as improving consumer confidence and low interest rates combine to stimulate borrowing demand for personal loans, cards and overdrafts," the chief economic advisor at the BBA, Dr Rebecca Harding, said.

The Canadian dollar traded higher against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz.

EUR/USD: the currency pair rose to $1.1299

GBP/USD: the currency pair increased to $1.4577

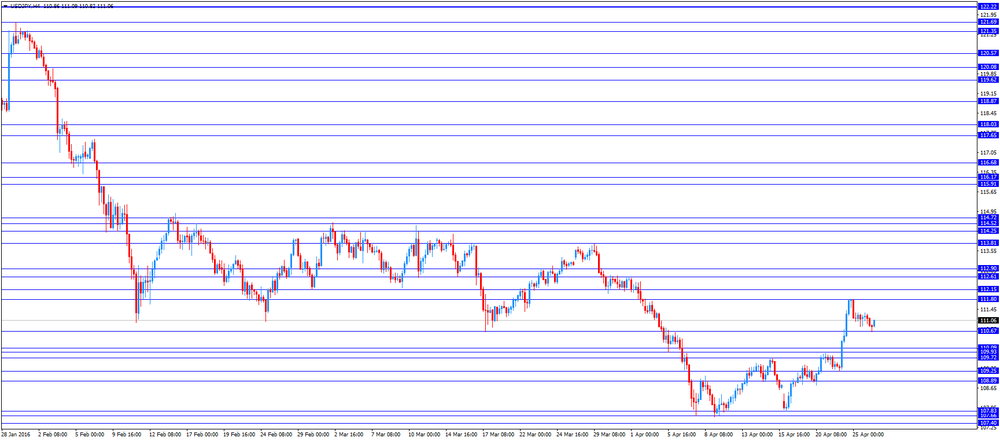

USD/JPY: the currency pair climbed to Y111.09

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders March -2.8% 1.8%

12:30 U.S. Durable Goods Orders ex Transportation March -1.0% 0.5%

12:30 U.S. Durable goods orders ex defense March -1.9% 0.4%

12:55 Canada BOC Gov Stephen Poloz Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y February 5.7% 5.5%

13:45 U.S. Services PMI (Preliminary) April 51.3 52.3

14:00 U.S. Richmond Fed Manufacturing Index April 22 11

14:00 U.S. Consumer confidence April 96.2 96

22:45 New Zealand Trade Balance, mln March 339 405

-

13:45

Orders

EUR/USD

Offers 1.1280 1.1300 1.1320 1.1335 1.1350 1.1385 1.1400 1.1420 1.1450

Bids 1.1250 1.1220-25 1.1200 1.1180 1.1160 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers 1.4550-55 1.4575 1.4600 1.4630 1.4650 1.4680 1.4700

Bids 1.4520 1.4500 1.4485 1.4465 1.4450 1.4420 1.4400 1.4385 1.4350 1.4320-25 1.4300

EUR/JPY

Offers 125.30 125.50 125.75 126.00 126.50 126.85 127.00

Bids 124.65 124.50 124.30 124.00 123.50 123.20 123.00

EUR/GBP

Offers 0.7780-85 0.7800 0.7825-30 07850 0.7880-85 0.7900

Bids 0.7735 0.7720 0.7700 0.7685 0.7650 0.7630 0.7600

USD/JPY

Offers 111.00 111.35 111.50 111.75-80 112.00 112.30 112.50

Bids 110.65 110.50 110.20 110.00 109.80 109.50 109.30 109.00 108.75 108.50

AUD/USD

Offers 0.7730 0.7750 0.7780 0.7800 0.7825-30 0.7850 0.7880 0.7900

Bids 0.7700 0.7680-85 0.7650 0.7620-25 0.7600 0.7585 0.7550 0.7530 0.7500

-

11:38

Reuters: the German parliament plans to invite the European Central Bank President Mario Draghi

Reuters reported on Tuesday that the German parliament planned to invite the European Central Bank (ECB) President Mario Draghi, according to sources familiar with the matter. Draghi should explain the ECB's monetary policy.

-

11:20

Bank of Japan Governor Haruhiko Kuroda: there is no need in exemption from negative interest rates

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Tuesday that there was no need in exemption from negative interest rates.

"Negative interest rates apply to only a small portion of financial institutions' excess reserves, so most of them receive a net interest rate payment from the central bank," he said.

-

11:03

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00 (USD 243m) 110.00 (USD 991m) 111.15 (890m) 111.25 (280m) 111.35 (255m) 112.65 (315m) 112.75 (240m)

EUR/USD: 1.1140 (EUR 372m)

AUD/USD 0.7570 (AUD 753m) 0.7600 (230m)

USD/CAD 1.2600 (USD 215m) 1.2800 (310m)

NZD/USD 0.6890 (NZD 270m)

AUD/NZD 1.1180 (AUD 347m)

-

10:55

Number of mortgage approvals in the U.K. declines to 45,096 in March

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals declined to 45,096 in March from 45,646 in February. February's figure was revised down from 45,982.

"For households more widely, consumer credit continues to grow above real earnings growth, as improving consumer confidence and low interest rates combine to stimulate borrowing demand for personal loans, cards and overdrafts," the chief economic advisor at the BBA, Dr Rebecca Harding, said.

"Business borrowing is moderating within distribution, manufacturing, food and accommodation sectors, as large corporates use capital markets for their funding and both large and small businesses continue to build up deposits," she added.

-

10:30

United Kingdom: BBA Mortgage Approvals, March 45.096 (forecast 46)

-

08:36

Options levels on tuesday, April 26, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1391 (2474)

$1.1360 (2406)

$1.1314 (578)

Price at time of writing this review: $1.1268

Support levels (open interest**, contracts):

$1.1216 (3211)

$1.1192 (4432)

$1.1162 (3407)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 37686 contracts, with the maximum number of contracts with strike price $1,1400 (4573);

- Overall open interest on the PUT options with the expiration date May, 6 is 59563 contracts, with the maximum number of contracts with strike price $1,0900 (4685);

- The ratio of PUT/CALL was 1.58 versus 1.34 from the previous trading day according to data from April, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.4801 (961)

$1.4703 (1152)

$1.4605 (1472)

Price at time of writing this review: $1.4491

Support levels (open interest**, contracts):

$1.4393 (1380)

$1.4296 (750)

$1.4198 (1158)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24498 contracts, with the maximum number of contracts with strike price $1,4400 (2064);

- Overall open interest on the PUT options with the expiration date May, 6 is 31585 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.29 versus 1.27 from the previous trading day according to data from April, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:33

Currencies. Daily history for Apr 25’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1267 +0,39%

GBP/USD $1,4481 +0,57%

USD/CHF Chf0,9751 -0,33%

USD/JPY Y111,22 -0,50%

EUR/JPY Y125,31 -0,13%

GBP/JPY Y161,05 +0,07%

AUD/USD $0,7712 +0,05%

NZD/USD $0,6856 +0,09%

USD/CAD C$1,2676 +0,08%

-