Noticias del mercado

-

23:58

Schedule for today, Tuesday, Apr 26’2016:

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals March 45.9

12:30 U.S. Durable Goods Orders March -2.8% 1.7%

12:30 U.S. Durable Goods Orders ex Transportation March -1.0% 0.5%

12:30 U.S. Durable goods orders ex defense March -1.9%

12:55 Canada BOC Gov Stephen Poloz Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y February 5.7% 5.6%

13:45 U.S. Services PMI (Preliminary) April 51.3

14:00 U.S. Richmond Fed Manufacturing Index April 22

14:00 U.S. Consumer confidence April 96.2 95.9

22:45 New Zealand Trade Balance, mln March 339

-

17:36

European Central Bank Executive Board member Peter Praet: the economic recovery in the Eurozone is driven by domestic demand

European Central Bank (ECB) Executive Board member Peter Praet said on Monday that the economic recovery in the Eurozone was driven by domestic demand. He added that there were large imbalances in the Eurozone.

Praet pointed out that disposable income in the Eurozone was supported by recovery in labour market and lower oil prices, adding that there was gradual rise in residential investment.

-

17:27

German IW economic institute: the slowdown in emerging economies and higher energy prices are risks to the German economic growth

The German think tank IW economic institute said on Monday that the slowdown in emerging economies and higher energy prices were risks to the country's economic growth. The uncertainty in emerging economies weighs on the German export sector.

IW expects the German economy to expand 1.5% in 2016 and 1.25% in 2017.

-

17:18

People’s Bank of China injected 267 billion yuan into market

The People's Bank of China (PBoC) injected 267 billion yuan ($41 billion) into 18 financial institutions via medium-term lending facility (MLF) on Monday.

The reason for this injection could be the decision to boost liquidity.

-

17:15

Services prices in Japan rise 0.6% in March

The Bank of Japan (BoJ) released its Corporate Services Price Index (CSPI) data on late Sunday evening. Producer prices in Japan rose 0.6% in March, after a flat reading in February.

On a yearly basis, producer prices increased 0.2% in March, after a 0.2% rise in February.

The increase was driven by rises in software development, television advertising, temporary employment agency services, security services and employment services.

-

16:37

European Central Bank purchases €19.91 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €19.91 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.76 billion of covered bonds, and the value of asset-backed securities fell by €45 million.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:17

New home sales in the U.S. decrease 1.5% in March

The U.S. Commerce Department released new home sales data on Monday. New home sales decreased 1.5% to a seasonally adjusted annual rate of 511,000 units in March from 519,000 units in February. February's figure was revised up from 512,000 units.

Analysts had expected new home sales to reach 519,000 units.

The decrease was mainly driven lower sales in the West region. New home sales in the West region plunged 23.6% in March.

-

16:00

U.S.: New Home Sales, March 511 (forecast 519)

-

15:45

NBB business climate for Belgium rises to -2.4 in April

The National Bank of Belgium (NBB) released its business survey on Monday. The business climate rose to -2.4 in April from-4.2 in March. Analysts had expected the index to increase to -4.0.

2 of 4 indicators climbed in April.

The business climate index for the manufacturing sector was up to -4.9 in April from -7.9 in March due to a more favourable assessments of total order books.

The business climate index for the services sector fell to 10.8 in April from 11.2 in March due to a less favourable assessment of the current activity and a downward revision of forecasts for general market demand.

The business climate index for the building sector increased to -3.2 in April from -3.9 in March due to a more favourable assessment of current order books.

The business climate index for the trade sector dropped to -7.2 in April from -4.1 in March due to pessimism, which weighed on all components of the indicator.

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 394m) 112.70 (2.2bln) 112.85 (1.95bln) 113.00 (1.27bln)

EUR/USD:1.1295-1.1300 (EUR 1.0bln) 1.1400 (1.26bln)

GBP/USD: 1.4130 (GBP 297m) 1.4300 (401m)

USD/CHF 0.9525 (USD 200m) 0.9675 (315m) 0.9785 (335m)

EUR/GBP 0.7865-67 (EUR 1.05bln)

AUD/USD: 0.7575 (AUD245m) 0.7650 (737m) 0.7715-20 (216m) 0

USD/CAD 1.2700 (USD 335m) 1.3100 ( 420m) 1.3125 (592m)

AUD/NZD 1.0900 (AUD 1.4bln) 1.1100 (1.31bln) 1.1200 (4.61bln) 1.1400 (1.85bln)

-

15:04

Fitch affirms Cyprus’ sovereign debt rating at 'B+'

Rating agency Fitch Ratings Friday affirmed Cyprus' sovereign debt rating at 'B+'. The outlook is 'positive'.

"Cyprus is undergoing a major financial sector, fiscal, and economic adjustment following the 2013 banking sector crisis and the ensuing EU/IMF bail-out programme. The country's early exit from the macroeconomic adjustment programme in March 2016 reflects a track record of fiscal consolidation, progress in financial sector restructuring and economic recovery," Fitch said.

The agency also said that the country's economic recovery was underway.

The economy is expected to expand around 2.0% in 2016-17, driven by household consumption, according to Fitch's forecasts.

-

14:59

Belgium: Business Climate, April -2.4 (forecast -4)

-

14:51

Fitch affirms Italia’s sovereign debt rating at 'BBB+'

Rating agency Fitch Ratings Friday affirmed Italia's sovereign debt rating at 'BBB+'. The outlook is 'stable'.

The agency noted that Australia's rating was supported by "a large, high value-added and diversified economy, with moderate levels of private sector indebtedness and a sustainable pension system".

"The ratings balance these structural strengths against high public debt and weak growth performance and outlook," Fitch added.

The agency also said that Italia's economic recovery was supported by the European Central Bank's (ECB) quantitative easing and low oil prices.

The economy is expected to expand 1.0% this year and 1.3% next year, according to Fitch's forecasts.

-

14:25

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weaker-than-expected Ifo data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index (Finally) February 101.2 Revised From 101.8 99.8 96.8

05:00 Japan Coincident Index (Finally) February 112.3 Revised From 102.3 110.3 110.7

08:00 Germany IFO - Business Climate April 106.7 107 106.6

08:00 Germany IFO - Current Assessment April 113.8 113.8 113.2

08:00 Germany IFO - Expectations April 100 100.8 100.4

10:00 United Kingdom CBI industrial order books balance April -14 -15 -11

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. new home sales data. New home sales in the U.S. are expected to rise to 519,000 units in March from 512,000 units in February.

The euro traded higher against the U.S. dollar despite the weaker-than-expected Ifo data from Germany. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index fell to 106.6 in April from 106.7 in March, missing expectations for an increase to 107.0.

"Although companies were somewhat less satisfied with their current situation, their business expectations brightened once again. The moderate upturn in the German economy continues," Ifo President Clemens Fuest said.

The Ifo current conditions index decreased to 113.2 from 113.8. Analysts had expected the index to remain unchanged at 113.8.

The Ifo expectations index climbed to 100.4 from 100.0, missing expectations for a rise to 100.8.

The British pound traded higher against the U.S. dollar. The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to -11 in April from -14 in March, beating expectations for a decline to -15.

"Manufacturing has yet to pick-up after a flat start to the year, with falling orders providing little impetus for production. While expectations for the upcoming quarter are encouraging, manufacturers are still facing sizeable external headwinds," the CBI director of economics Rain Newton-Smith said.

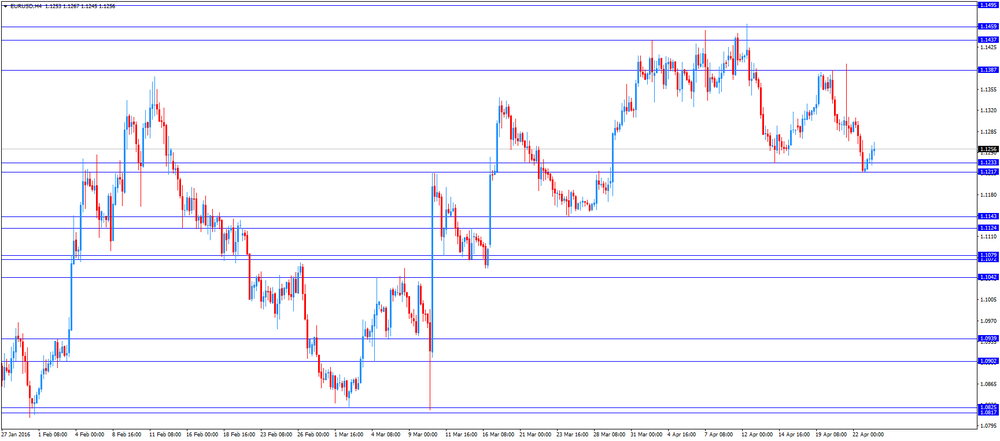

EUR/USD: the currency pair rose to $1.1267

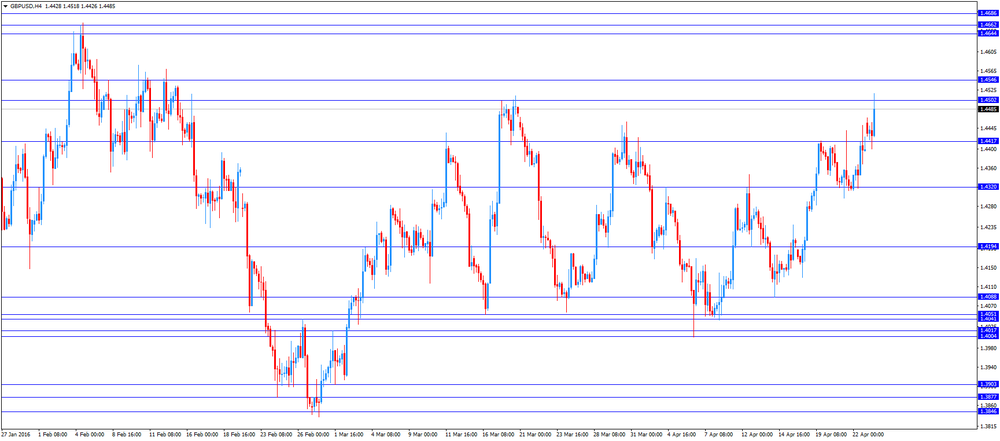

GBP/USD: the currency pair increased to $1.4518

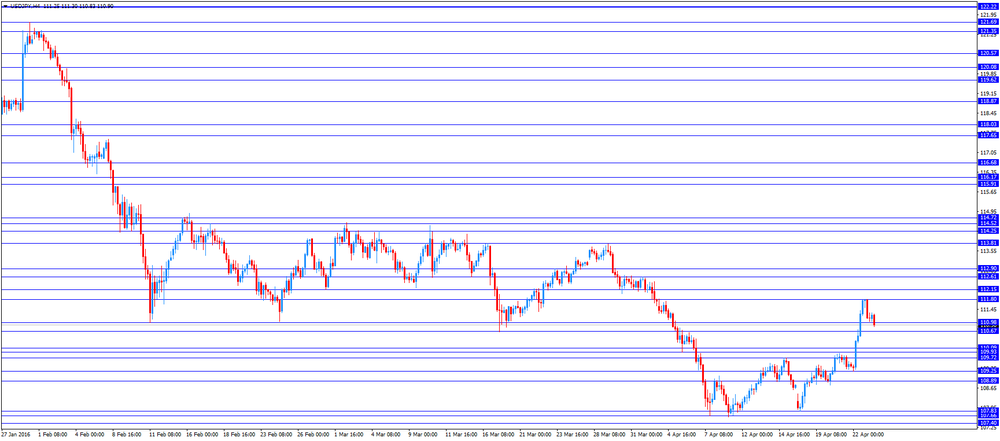

USD/JPY: the currency pair fell to Y110.83

The most important news that are expected (GMT0):

13:00 Belgium Business Climate April -4.2 -4

14:00 U.S. New Home Sales March 512 519

-

14:20

Orders

EUR/USD

Offers 1.1265 1.1280 1.1300 1.1320 1.1335 1.1350 1.1385 1.1400 1.1420 1.1450

Bids 1.1220-25 1.1200 1.1180 1.1160 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers 1.4450 1.4465 1.4480 1.4500 1.4525-30 1.4550 1.4575 1.4600

Bids 1.4420 1.4400 1.4385 1.4350 1.4320-25 1.4300 1.4280 1.4250 1.4230 1.4200

EUR/JPY

Offers 125.30 125.50 125.75 126.00 126.50 126.85 127.00

Bids 124.80 124.50 124.30 124.00 123.50 123.20 123.00

EUR/GBP

Offers 0.7825-30 07850 0.7880-85 0.7900 0.7920-25 0.7950 0.7980 0.8000

Bids 0.7750 0.7730 0.7700 0.7685 0.7650 0.7630 0.7600

USD/JPY

Offers 111.35 111.50 111.75-80 112.00 112.30 112.50 112.65 112.80 113.00

Bids 111.00 110.80 110.50 110.20 110.00 109.80 109.50 109.30 109.00 108.75 108.50

AUD/USD

Offers 0.7735 0.7750 0.7780 0.7800 0.7825-30 0.7850 0.7880 0.7900

Bids 0.7700 0.7680 0.7650 0.7620-25 0.7600 0.7585 0.7550 0.7530 0.7500

-

14:14

CBI industrial order books balance rises to -11 in April

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance rose to -11 in April from -14 in March, beating expectations for a decline to -15.

"Manufacturing has yet to pick-up after a flat start to the year, with falling orders providing little impetus for production. While expectations for the upcoming quarter are encouraging, manufacturers are still facing sizeable external headwinds," the CBI director of economics Rain Newton-Smith said.

"The falling exchange rate should give some support to manufacturers, and investment intentions are strong," she added.

-

12:00

United Kingdom: CBI industrial order books balance, April -11 (forecast -15)

-

11:44

European Central Bank Vice President Vitor Constancio: financial integration in the Eurozone slowed recently

European Central Bank (ECB) Vice President Vitor Constancio said on Monday that financial integration in the Eurozone slowed recently. He pointed out that he banking union should be completed.

-

11:34

Japan's final leading index declines to 96.8 in February, the lowest level since February 2010

Japan's Cabinet Office released its final leading index data on Monday. The leading index decreased to 96.8 in February from 101.2 in January, down from the preliminary estimate of 99.8. It was the lowest level since February 2010.

January's figure was revised down from 101.8.

Japan's coincident index was down to 110.7 in February from 112.3 in January, up from the preliminary reading of 110.3.

-

11:28

Spanish producer prices increase 0.7% in March

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Monday. The Spanish producer prices increased 0.7% in March, after a 1.3% fall in February.

On a yearly basis, producer price inflation in Spain fell 5.4% in March, after a 5.7% decline in February. Producer prices have been declining since July 2014.

Energy prices slid 17.7% year-on-year in March, capital goods prices rose 0.7%, and consumer goods prices were flat, while intermediate goods prices declined 2.7%.

-

11:06

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.50 (USD 394m) 112.70 (2.2bln) 112.85 (1.95bln) 113.00 (1.27bln)

EUR/USD:1.1295-1.1300 (EUR 1.0bln) 1.1400 (1.26bln)

GBP/USD: 1.4130 (GBP 297m) 1.4300 (401m)

USD/CHF 0.9525 (USD 200m) 0.9675 (315m) 0.9785 (335m)

EUR/GBP 0.7865-67 (EUR 1.05bln)

AUD/USD: 0.7575 (AUD245m) 0.7650 (737m) 0.7715-20 (216m) 0

USD/CAD 1.2700 (USD 335m) 1.3100 ( 420m) 1.3125 (592m)

AUD/NZD 1.0900 (AUD 1.4bln) 1.1100 (1.31bln) 1.1200 (4.61bln) 1.1400 (1.85bln)

-

10:55

German Ifo business confidence index falls to 106.6 in April

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index fell to 106.6 in April from 106.7 in March, missing expectations for an increase to 107.0.

"Although companies were somewhat less satisfied with their current situation, their business expectations brightened once again. The moderate upturn in the German economy continues," Ifo President Clemens Fuest said.

The Ifo current conditions index decreased to 113.2 from 113.8. Analysts had expected the index to remain unchanged at 113.8.

The Ifo expectations index climbed to 100.4 from 100.0, missing expectations for a rise to 100.8.

-

10:33

Head of the Eurogroup Jeroen Dijsselbloem: Greece should prepare additional measures to guarantee to be able to reach fiscal targets

Head of the Eurogroup Jeroen Dijsselbloem said on Friday that Greece should prepare additional measures to guarantee to be able to reach fiscal targets.

"We came to the conclusion that the policy package should include a contingent package of additional measures that would be implemented only if necessary to reach the primary surplus target for 2018," he said.

-

10:20

U.S. President Barack Obama: it could take 10 years to reach a trade deal with the U.S. if Britain would leave the European Union

U.S. President Barack Obama said in an interview with BBC that it could take 10 years to reach a trade deal with the U.S. if Britain would leave the European Union (EU).

"It could be five years from now, 10 years from now before we're actually able to get something done," he said.

Obama noted that Britain would not reach a trade deal with the U.S. faster that the EU. He added that the EU was the largest trading partner of the U.S.

-

10:00

Germany: IFO - Business Climate, April 106.6 (forecast 107)

-

10:00

Germany: IFO - Current Assessment , April 113.2 (forecast 113.8)

-

10:00

Germany: IFO - Expectations , April 100.4 (forecast 100.8)

-

08:23

Asian session: The yen hit a three-week low

The yen hit a three-week low on Monday on expectations the Bank of Japan could start lending to banks at negative rates, while sterling hit a five-week high in reaction to President Barack Obama urging Britons to stay in the European Union. On Friday, the yen fell 2.1 percent - its biggest fall since the day BOJ Governor Haruhiko Kuroda unleashed his second easing in October 2014 - after Bloomberg reported that the Bank of Japan is considering applying negative rates to its lending program for financial institutions.

But traders are also wary that further BOJ easing may have limited impact in weakening the yen, as did the introduction of negative interest rates in January. With much of any further easing already priced in, the yen may have limited room to fall further after the BOJ's policy meeting on April 27-28, some analysts also said.

EUR/USD: during the Asian session the pair rose to $1.1245

GBP/USD: during the Asian session the pair rose to $1.4465

USD/JPY: during the Asian session the pair dropped to Y111.00

Based on Reuters materials

-

07:08

Options levels on mondat, April 25, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1352 (2328)

$1.1300 (1021)

$1.1269 (452)

Price at time of writing this review: $1.1240

Support levels (open interest**, contracts):

$1.1193 (3210)

$1.1145 (3384)

$1.1112 (3718)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 37758 contracts, with the maximum number of contracts with strike price $1,1400 (4725);

- Overall open interest on the PUT options with the expiration date May, 6 is 50583 contracts, with the maximum number of contracts with strike price $1,0900 (4685);

- The ratio of PUT/CALL was 1.34 versus 1.31 from the previous trading day according to data from April, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.4702 (1171)

$1.4604 (1535)

$1.4507 (2025)

Price at time of writing this review: $1.4426

Support levels (open interest**, contracts):

$1.4294 (559)

$1.4196 (1102)

$1.4098 (1991)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24567 contracts, with the maximum number of contracts with strike price $1,4400 (2042);

- Overall open interest on the PUT options with the expiration date May, 6 is 31279 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.27 versus 1.24 from the previous trading day according to data from April, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:02

Japan: Leading Economic Index , February 96.8 (forecast 99.8)

-

07:02

Japan: Coincident Index, February 110.7 (forecast 110.3)

-

01:03

Currencies. Daily history for Apr 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1223 -0,54%

GBP/USD $1,4399 +0,57%

USD/CHF Chf0,9783 +0,38%

USD/JPY Y111,78 +2,11%

EUR/JPY Y125,47 +1,59%

GBP/JPY Y160,93 +2,67%

AUD/USD $0,7708 -0,38%

NZD/USD $0,6850 -0,91%

USD/CAD C$1,2666 -0,48%

-

00:00

Schedule for today, Monday, Apr 25’2016:

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index February 101.8 99.8

05:00 Japan Coincident Index February 113.5 110.3

08:00 Germany IFO - Business Climate April 106.7 107

08:00 IFO - Current Assessment April 113.8 113.8

08:00 Germany IFO - Expectations April 100 100.8

10:00 United Kingdom CBI industrial order books balance April -14 -15

13:00 Belgium Business Climate April -4.2 -4

14:00 U.S. New Home Sales March 512 519

-